Reports full year GAAP and adjusted earnings

from continuing operations of $1.43 and $1.38 per diluted share,

respectively

Lease fleet utilization of 97.5% and Future

Lease Rate Differential ("FLRD") of positive 23.7% at

quarter-end

Generates full year operating and adjusted

free cash flow of $309 million and $29 million,

respectively

Delivered 17,355 railcars in the year;

backlog of $3.2 billion at year-end

Trinity Industries, Inc. (NYSE:TRN) today announced earnings

results for the fourth quarter and year end ended December 31,

2023.

Financial and Operational Highlights –

Fourth Quarter

- Quarterly total company revenues of $798 million; 35%

improvement year over year

- Quarterly income from continuing operations per common diluted

share ("EPS") of $0.81 and quarterly adjusted EPS of $0.82

- Results include tax benefits related to state apportionment and

tax law changes

- Lease fleet utilization of 97.5% and FLRD of positive 23.7% at

quarter-end

- Quarterly railcar deliveries of 4,000 and new railcar orders of

840

Financial and Operational Highlights –

Full Year

- Full year total company revenues of $3.0 billion

- Full year reported EPS of $1.43 and adjusted EPS of $1.38

- Full year cash flow from continuing operations and adjusted

free cash flow after investments and dividends ("Adjusted Free Cash

Flow") were $309 million and $29 million, respectively

- Full year railcar deliveries of 17,355 and new railcar orders

of 11,500

2024 Guidance

- Industry deliveries of approximately 40,000 railcars

- Net investment in the lease fleet of $300 million to $400

million

- Manufacturing capital expenditures of $50 million to $60

million

- EPS of $1.30 to $1.50

- Excludes items outside of our core business operations

Management Commentary

“Trinity Industries ended the year with revenue up 51% over

2022, a backlog of $3.2 billion, and adjusted EPS of $1.38, up 47%

year over year,” stated Trinity’s Chief Executive Officer and

President, Jean Savage.

“In our Railcar Leasing and Management Services Group, we

maintained an impressive Future Lease Rate Differential through the

year, and rising lease rates drove our revenue up 13% over 2022.

Fleet utilization remains favorable at 97.5%,” Ms. Savage

continued. “The Rail Products Group faced challenges in the fourth

quarter with the border closure and related congestion impacting

deliveries and margins in the segment. Despite unexpected headwinds

through the year, this segment reported operating profit up 119%

over 2022.”

“In 2024, we expect to see continued improvement in our

business. We are introducing 2024 EPS annual guidance of $1.30 to

$1.50, which reflects improving margins in both our segments. This

is offset by significantly lower planned railcar sales, higher

elimination of profit from intercompany railcar sales, and a

normalized tax provision as compared to 2023.”

Ms. Savage concluded, “We view ourselves as a leasing company

that is enabled by our manufacturing and services businesses. As a

result, we are re-aligning our segments starting in 2024 and moving

our maintenance business into the Railcar Leasing & Services

segment. This allows us to better leverage our maintenance

capabilities to support lease fleet optimization and growth in our

services business.”

Consolidated Financial

Summary

Three Months Ended

December 31,

2023

2022

Year over Year – Comparison

($ in millions, except per

share amounts)

Revenues

$

797.9

$

591.2

Higher external deliveries and favorable

pricing in the Rail Products Group

Operating profit

$

148.7

$

113.5

Higher external deliveries in the Rail

Products Group, partially offset by lower lease portfolio sales

volume

Interest expense, net

$

67.7

$

59.4

Higher interest rates and higher overall

average debt during 2023

Net income from continuing operations

attributable to Trinity Industries, Inc.

$

68.1

$

37.9

EBITDA (1)

$

225.2

$

185.0

Effective tax expense rate

8.8

%

19.2

%

State apportionment and tax law changes

enacted in 2023

Diluted EPS – GAAP

$

0.81

$

0.46

Diluted EPS – Adjusted (1)

$

0.82

$

0.44

Year Ended

December 31,

2023

2022

Year over Year – Comparison

($ in millions, except per

share amounts)

Revenues

$

2,983.3

$

1,977.3

Higher external deliveries in the Rail

Products Group

Operating profit

$

417.0

$

334.0

Higher external deliveries in the Rail

Products Group and improved lease rates in the Leasing Group,

partially offset by lower lease portfolio sales volume and the

impact of foreign currency fluctuations in the Rail Products

Group

Interest expense, net

$

265.5

$

207.6

Higher interest rates and higher overall

average debt during 2023

Net income from continuing operations

attributable to Trinity Industries, Inc.

$

119.4

$

86.1

EBITDA (1)

$

720.1

$

616.8

Effective tax expense rate

6.0

%

21.8

%

2023 tax rate includes benefits related to

the release of residual taxes out of AOCI, changes in state

apportionment and tax law changes, and changes in valuation

allowances

Diluted EPS – GAAP

$

1.43

$

1.02

Diluted EPS – Adjusted (1)

$

1.38

$

0.94

Year Ended

December 31,

2023

2022

Year over Year – Comparison

(in millions)

Net cash provided by operating activities

– continuing operations

$

309.0

$

9.2

Higher external deliveries and

stabilization of working capital levels relative to prior year

Adjusted Free Cash Flow (1)

$

28.5

$

138.3

Higher cash from operations offset by

lower lease portfolio sales and the timing of railcar financing

Net lease fleet investment

$

287.0

$

178.1

Returns of capital to stockholders

$

86.0

$

153.7

2022 included $77 million of share

repurchase activity

(1) Non-GAAP financial measure. See the

Reconciliations of Non-GAAP Measures section within this Press

Release for a reconciliation to the most directly comparable GAAP

measure and why management believes this measure is useful to

management and investors.

Additional Business

Items

- Total committed liquidity of $906.3 million as of December 31,

2023.

- In December 2023, our Board of Directors declared an increase

of approximately 8% to our quarterly dividend from $0.26 per share

to $0.28 per share.

- Effective January 1, 2024, the Company modified its

organizational structure to better leverage our maintenance

services capabilities to support lease fleet optimization and to

grow our services and parts businesses. In connection with this

organizational update, we will align the maintenance services

business, which is currently reported in the Rail Products Group,

to be presented within our leasing business. Consequently,

beginning January 1, 2024, we will report our operating results in

two reportable segments: (1) Railcar Leasing and Services Group,

formerly the Railcar Leasing and Management Services Group, and (2)

Rail Products Group. These changes will have no impact to our

previously reported consolidated results of operations, financial

position, or cash flows. All prior period segment results will be

recast to reflect these changes and present results on a comparable

basis in future filings, beginning with our Quarterly Report on

Form 10-Q for the three months ended March 31, 2024.

Business Group Summary

Three Months Ended

December 31,

2023

2022

Year over Year – Comparison

($ in millions)

Railcar Leasing and Management Services

Group

Leasing and management revenues

$

221.6

$

197.4

Improved lease rates and net additions to

the lease fleet, as well as acquisition-related revenues included

in the current year period

Leasing and management operating

profit

$

99.5

$

75.6

Improved lease rates and net additions to

the lease fleet

Operating profit on lease portfolio

sales

$

36.4

$

54.5

Lower lease fleet portfolio sales

volume

Fleet utilization (1)

97.5

%

97.9

%

Future Lease Rate Differential (2)

+23.7

%

+25.1

%

Continued strength in current lease

rates

Owned lease fleet (in units) (1)

109,295

108,440

Investor-owned lease fleet (in units)

33,005

33,235

Rail Products Group

Revenues

$

674.0

$

655.7

Favorable pricing, partially offset by

lower deliveries

Operating profit

$

41.2

$

18.6

Favorable pricing and improved

efficiencies, partially offset by lower deliveries and foreign

currency fluctuations. Includes insurance recoveries of $1.4

million in the current year period.

Operating profit margin

6.1

%

2.8

%

Revenues eliminations – Lease

subsidiary

$

(97.5

)

$

(261.7

)

Operating profit eliminations – Lease

subsidiary

$

(3.8

)

$

(16.5

)

New railcars:

Deliveries (in units)

4,000

4,400

Q4 2023 unfavorably impacted by

approximately 1,300 deliveries due to the U.S.-Mexico border

closure and congestion

Orders (in units)

840

3,015

Order value

$

156.1

$

350.8

Backlog value

$

3,200.9

$

3,903.0

Sustainable railcar conversions:

Deliveries (in units)

520

495

Backlog (in units)

1,015

1,965

Backlog value

$

81.9

$

166.5

Corporate and other

Selling, engineering, and administrative

expenses

$

26.6

$

24.5

$2.0 million from the change in estimated

fair value of additional contingent consideration associated with

an acquisition

Gains on dispositions of property

$

(1.1

)

$

(5.9

)

December 31, 2023

December 31, 2022

Loan-to-value ratio

Wholly-owned subsidiaries, excluding

corporate revolving credit facility

64.3

%

65.7

%

(1) Includes wholly-owned railcars,

partially-owned railcars, and railcars under leased-in

arrangements.

(2) FLRD calculates the implied change in

lease rates for railcar leases expiring over the next four

quarters. The FLRD assumes that these expiring leases will be

renewed at the most recent quarterly transacted lease rates for

each railcar type. We believe the FLRD is useful to both management

and investors as it provides insight into the near-term trend in

lease rates.

Conference Call

Trinity will hold a conference call at 8:00 a.m. Eastern on

February 22, 2024 to discuss its fourth quarter and full year

results. To listen to the call, please visit the Investor Relations

section of the Company's website at www.trin.net and access the

Events & Presentations webpage, or the live call can be

accessed at 1-888-317-6003 with the conference passcode "7787991".

Please call at least 10 minutes in advance to ensure a timely

connection. An audio replay may be accessed through the Company’s

website or by dialing 1-877-344-7529 with passcode "2184903" until

11:59 p.m. Eastern on February 29, 2024.

Additionally, the Company will provide Supplemental Materials to

accompany the earnings conference call. The materials will be

accessible both within the webcast and on Trinity's Investor

Relations website under the Events and Presentations portion of the

site along with the Fourth Quarter Earnings Call event weblink.

Non-GAAP Financial

Measures

We have included financial measures compiled in accordance with

generally accepted accounting principles ("GAAP") and certain

non-GAAP measures in this earnings press release to provide

management and investors with additional information regarding our

financial results. Non-GAAP measures should not be considered in

isolation or as a substitute for our reported results prepared in

accordance with GAAP and, as calculated, may not be comparable to

other similarly titled measures for other companies. For each

non-GAAP financial measure, a reconciliation to the most comparable

GAAP measure has been included in the accompanying tables. When

forward-looking non-GAAP measures are provided, quantitative

reconciliations to the most directly comparable GAAP measures are

not provided because management cannot, without unreasonable

effort, predict the timing and amounts of certain items included in

the computations of each of these measures. These factors include,

but are not limited to: the product mix of expected railcar

deliveries; the timing and amount of significant transactions and

investments, such as lease portfolio sales, capital expenditures,

and returns of capital to stockholders; and the amount and timing

of certain other items outside the normal course of our core

business operations.

About Trinity Industries

Trinity Industries, Inc., headquartered in Dallas, Texas, owns

businesses that are leading providers of rail transportation

products and services in North America. Our businesses market their

railcar products and services under the trade name TrinityRail®.

The TrinityRail platform provides railcar leasing and management

services; railcar manufacturing, maintenance and modifications; and

other railcar logistics products and services. Trinity reports its

financial results in two reportable segments: the Railcar Leasing

and Management Services Group and the Rail Products Group. For more

information, visit: www.trin.net.

Some statements in this release, which are not historical facts,

are “forward-looking statements” as defined by the Private

Securities Litigation Reform Act of 1995. Forward-looking

statements include statements about Trinity's estimates,

expectations, beliefs, intentions or strategies for the future, and

the assumptions underlying these forward-looking statements,

including, but not limited to, future financial and operating

performance, future opportunities and any other statements

regarding events or developments that Trinity believes or

anticipates will or may occur in the future. Trinity uses the words

“anticipates,” “assumes,” “believes,” “estimates,” “expects,”

“intends,” “forecasts,” “may,” “will,” “should,” “guidance,”

“projected,” “outlook,” and similar expressions to identify these

forward-looking statements. Forward-looking statements speak only

as of the date of this release, and Trinity expressly disclaims any

obligation or undertaking to disseminate any updates or revisions

to any forward-looking statement contained herein to reflect any

change in Trinity’s expectations with regard thereto or any change

in events, conditions or circumstances on which any such statement

is based, except as required by federal securities laws.

Forward-looking statements involve risks and uncertainties that

could cause actual results to differ materially from historical

experience or our present expectations, including but not limited

to risks and uncertainties regarding economic, competitive,

governmental, and technological factors affecting Trinity’s

operations, markets, products, services and prices, and such

forward-looking statements are not guarantees of future

performance. For a discussion of such risks and uncertainties,

which could cause actual results to differ from those contained in

the forward-looking statements, see “Risk Factors” and

“Forward-Looking Statements” in Trinity’s Annual Report on Form

10-K for the most recent fiscal year, as may be revised and updated

by Trinity’s Quarterly Reports on Form 10-Q, and Trinity’s Current

Reports on Form 8-K.

- TABLES TO FOLLOW -

Trinity Industries, Inc.

Condensed Consolidated Statements of

Operations

(in millions, except per share

amounts)

(unaudited)

Three Months Ended

December 31,

Year Ended

December 31,

2023

2022

2023

2022

Revenues

$

797.9

$

591.2

$

2,983.3

$

1,977.3

Operating costs:

Cost of revenues

637.0

490.2

2,456.2

1,609.6

Selling, engineering, and administrative

expenses

48.6

47.7

201.9

185.4

Gains on dispositions of property:

Lease portfolio sales

36.4

54.5

82.8

127.5

Other

—

5.7

6.8

25.2

Restructuring activities, net

—

—

(2.2

)

1.0

649.2

477.7

2,566.3

1,643.3

Operating profit

148.7

113.5

417.0

334.0

Interest expense, net

67.7

59.4

265.5

207.6

Loss on extinguishment of debt

—

—

—

1.5

Other, net

0.5

1.1

2.5

(1.6

)

Income from continuing operations before

income taxes

80.5

53.0

149.0

126.5

Provision (benefit) for income taxes:

Current

24.3

11.7

50.5

12.9

Deferred

(17.2

)

(1.5

)

(41.5

)

14.7

7.1

10.2

9.0

27.6

Income from continuing operations

73.4

42.8

140.0

98.9

Loss from discontinued operations, net of

income taxes

(5.3

)

(6.6

)

(13.4

)

(20.3

)

Loss on sale of discontinued operations,

net of income taxes

—

—

—

(5.7

)

Net income

68.1

36.2

126.6

72.9

Net income attributable to noncontrolling

interest

5.3

4.9

20.6

12.8

Net income attributable to Trinity

Industries, Inc.

$

62.8

$

31.3

$

106.0

$

60.1

Basic earnings per common share:

Income from continuing operations

$

0.83

$

0.47

$

1.47

$

1.05

Loss from discontinued operations

(0.06

)

(0.08

)

(0.16

)

(0.32

)

Basic net income attributable to Trinity

Industries, Inc.

$

0.77

$

0.39

$

1.31

$

0.73

Diluted earnings per common share:

Income from continuing operations

$

0.81

$

0.46

$

1.43

$

1.02

Loss from discontinued operations

(0.06

)

(0.08

)

(0.16

)

(0.31

)

Diluted net income attributable to Trinity

Industries, Inc.

$

0.75

$

0.38

$

1.27

$

0.71

Weighted average number of shares

outstanding:

Basic

81.6

80.9

81.2

81.9

Diluted

83.5

83.1

83.4

84.2

Trinity has certain unvested restricted stock awards that

participate in dividends on a nonforfeitable basis and are

therefore considered to be participating securities. Consequently,

diluted net income attributable to Trinity Industries, Inc. per

common share is calculated under both the two-class method and the

treasury stock method, and the more dilutive of the two

calculations is presented.

Trinity Industries, Inc.

Condensed Consolidated Balance

Sheets

(in millions)

(unaudited)

December 31, 2023

December 31, 2022

ASSETS

Cash and cash equivalents

$

105.7

$

79.6

Receivables, net of allowance

363.5

323.5

Income tax receivable

5.2

7.8

Inventories

684.3

629.4

Restricted cash

129.4

214.7

Property, plant, and equipment, net:

Manufacturing/Corporate

341.1

340.7

Leasing:

Wholly-owned subsidiaries

5,940.7

5,788.1

Partially-owned subsidiaries

1,473.2

1,521.3

Deferred profit on railcars sold to the

Leasing Group

(750.2

)

(763.3

)

7,004.8

6,886.8

Goodwill

221.5

195.9

Other assets

392.1

386.6

Total assets

$

8,906.5

$

8,724.3

LIABILITIES AND STOCKHOLDERS'

EQUITY

Accounts payable

$

305.3

$

287.5

Accrued liabilities

302.3

261.0

Debt:

Recourse

794.6

624.1

Non-recourse:

Wholly-owned subsidiaries

3,819.2

3,800.7

Partially-owned subsidiaries

1,140.4

1,182.8

5,754.2

5,607.6

Deferred income taxes

1,103.5

1,134.7

Other liabilities

165.7

163.9

Stockholders' equity:

Trinity Industries, Inc.

1,037.1

1,012.4

Noncontrolling interest

238.4

257.2

1,275.5

1,269.6

Total liabilities and stockholders'

equity

$

8,906.5

$

8,724.3

Trinity Industries, Inc.

Condensed Consolidated Statements of

Cash Flows

(in millions)

(unaudited)

Year Ended

December 31,

2023

2022

Operating activities:

Net cash provided by operating activities

– continuing operations

$

309.0

$

9.2

Net cash used in operating activities –

discontinued operations

(13.4

)

(22.0

)

Net cash provided by (used in) operating

activities

295.6

(12.8

)

Investing activities:

Proceeds from lease portfolio sales

381.8

750.7

Proceeds from dispositions of property and

other assets

19.9

44.0

Capital expenditures – lease fleet

(668.8

)

(928.8

)

Capital expenditures – manufacturing and

other

(41.3

)

(38.0

)

Acquisitions, net of cash acquired

(62.2

)

(80.4

)

Proceeds from insurance recoveries

5.1

10.0

Equity investments

(1.1

)

(15.5

)

Other

3.6

—

Net cash used in investing activities –

continuing operations

(363.0

)

(258.0

)

Payments related to sale of discontinued

operations

—

(2.7

)

Net cash used in investing activities

(363.0

)

(260.7

)

Financing activities:

Net proceeds from (repayments of) debt

133.8

422.1

Shares repurchased

—

(51.8

)

Dividends paid to common shareholders

(86.0

)

(76.9

)

Other financing activities

(39.6

)

(28.0

)

Net cash provided by financing

activities

8.2

265.4

Net decrease in cash, cash equivalents,

and restricted cash

(59.2

)

(8.1

)

Cash, cash equivalents, and restricted

cash at beginning of period

294.3

302.4

Cash, cash equivalents, and restricted

cash at end of period

$

235.1

$

294.3

Trinity Industries, Inc. Reconciliations of Non-GAAP

Measures (in millions, except per share amounts)

(unaudited)

Adjusted Operating Results

We have supplemented the presentation of our reported GAAP

operating profit, income from continuing operations before income

taxes, provision (benefit) for income taxes, income from continuing

operations, net income from continuing operations attributable to

Trinity Industries, Inc., and diluted income from continuing

operations per common share attributable to Trinity Industries,

Inc. with non-GAAP measures that adjust the GAAP measures to

exclude the impact of certain selling, engineering, and

administrative expenses; gains on dispositions of other property;

restructuring activities, net; interest expense, net; the income

tax effects of the CARES Act; and certain other transactions or

events (as applicable), described in the footnotes to the table

below. These non-GAAP measures are derived from amounts included in

our GAAP financial statements and are reconciled to the most

directly comparable GAAP financial measures in the tables below.

Management believes that these measures are useful to both

management and investors for analyzing the performance of our

business without the impact of certain items that are not

indicative of our normal business operations. Non-GAAP measures

should not be considered in isolation or as a substitute for our

reported results prepared in accordance with GAAP and, as

calculated, may not be comparable to other similarly titled

measures for other companies.

Three Months Ended December

31, 2023

GAAP

Selling, engineering, and

administrative expenses (1)

Gains on dispositions of

property – other (2)

Interest expense, net

(3)

Adjusted

Operating profit

$

148.7

$

2.0

$

(1.4

)

$

—

$

149.3

Income from continuing operations before

income taxes

$

80.5

$

2.0

$

(1.4

)

$

(0.4

)

$

80.7

Provision (benefit) for income taxes

$

7.1

$

0.5

$

(0.4

)

$

(0.1

)

$

7.1

Income from continuing operations

$

73.4

$

1.5

$

(1.0

)

$

(0.3

)

$

73.6

Net income from continuing operations

attributable to Trinity Industries, Inc.

$

68.1

$

1.5

$

(1.0

)

$

(0.3

)

$

68.3

Diluted weighted average shares

outstanding

83.5

83.5

Diluted income from continuing operations

per common share attributable to Trinity Industries, Inc.

$

0.81

$

0.82

Year Ended December 31,

2023

GAAP

Selling, engineering, and

administrative expenses (1)

Gains on dispositions of

property – other (2)

Restructuring activities,

net

Interest expense, net

(3)

Adjusted

Operating profit

$

417.0

$

4.0

$

(6.3

)

$

(2.2

)

$

—

$

412.5

Income from continuing operations before

income taxes

$

149.0

$

4.0

$

(6.3

)

$

(2.2

)

$

(1.5

)

$

143.0

Provision (benefit) for income taxes

$

9.0

$

1.0

$

(1.6

)

$

(0.6

)

$

(0.4

)

$

7.4

Income from continuing operations

$

140.0

$

3.0

$

(4.7

)

$

(1.6

)

$

(1.1

)

$

135.6

Net income from continuing operations

attributable to Trinity Industries, Inc.

$

119.4

$

3.0

$

(4.7

)

$

(1.6

)

$

(1.1

)

$

115.0

Diluted weighted average shares

outstanding

83.4

83.4

Diluted income from continuing operations

per common share attributable to Trinity Industries, Inc.

$

1.43

$

1.38

Three Months Ended December

31, 2022

GAAP

Interest expense, net

(3)(4)

Income tax effect of CARES

Act

Adjusted

Operating profit

$

113.5

$

—

$

—

$

113.5

Income from continuing operations before

income taxes

$

53.0

$

(0.4

)

$

—

$

52.6

Provision (benefit) for income taxes

$

10.2

$

—

$

0.6

$

10.8

Income from continuing operations

$

42.8

$

(0.4

)

$

(0.6

)

$

41.8

Net income from continuing operations

attributable to Trinity Industries, Inc.

$

37.9

$

(0.4

)

$

(0.6

)

$

36.9

Diluted weighted average shares

outstanding

83.1

83.1

Diluted income from continuing operations

per common share attributable to Trinity Industries, Inc.

$

0.46

$

0.44

Year Ended December 31,

2022

GAAP

Gains on dispositions of

property – other (2)(4)

Restructuring activities, net

(4)

Interest expense, net

(3)(4)

Income tax effect of CARES

Act

Adjusted

Operating profit

$

334.0

$

(7.5

)

$

1.0

$

—

$

—

$

327.5

Income from continuing operations before

income taxes

$

126.5

$

(7.5

)

$

1.0

$

(1.4

)

$

—

$

118.6

Provision (benefit) for income taxes

$

27.6

$

(1.9

)

$

0.3

$

(0.3

)

$

0.6

$

26.3

Income from continuing operations

$

98.9

$

(5.6

)

$

0.7

$

(1.1

)

$

(0.6

)

$

92.3

Net income from continuing operations

attributable to Trinity Industries, Inc.

$

86.1

$

(5.6

)

$

0.7

$

(1.1

)

$

(0.6

)

$

79.5

Diluted weighted average shares

outstanding

84.2

84.2

Diluted income from continuing operations

per common share attributable to Trinity Industries, Inc.

$

1.02

$

0.94

(1) Represents the change in estimated

fair value of additional contingent consideration associated with

an acquisition.

(2) Represents insurance recoveries in

excess of net book value for assets damaged by a tornado at the

Company’s rail maintenance facility in Cartersville, Georgia in the

first quarter of 2021.

(3) Represents interest income accretion

related to a seller-financing agreement associated with the sale of

certain non-operating assets.

(4) The effective tax rate for gains on

dispositions of other property; restructuring activities, net; and

interest expense, net is before consideration of the CARES Act.

Pre-Tax Return on Equity

Pre-Tax Return on Equity (“Pre-Tax ROE”) is defined as a ratio

for which (i) the numerator is calculated as income or loss from

continuing operations, adjusted to exclude the effects of the

provision or benefit for income taxes, net income or loss

attributable to noncontrolling interest, and certain other

adjustments, described in the footnotes to the table below, which

include certain selling, engineering, and administrative expenses;

gains on dispositions of other property; restructuring activities,

net; and interest expense, net; and (ii) the denominator is

calculated as average stockholders’ equity (which excludes

noncontrolling interest), adjusted to exclude accumulated other

comprehensive income or loss. In the following table, the numerator

and denominator of our Pre-Tax ROE calculation are reconciled to

income from continuing operations and total stockholders’ equity,

respectively, which are the most directly comparable GAAP financial

measures. Management believes that Pre-Tax ROE is a useful measure

to both management and investors as it provides an indication of

the economic return on the Company’s investments over time. Pre-Tax

ROE is used in consideration of the Company’s expected tax position

in the near-term. Non-GAAP measures should not be considered in

isolation or as a substitute for our reported results prepared in

accordance with GAAP and, as calculated, may not be comparable to

other similarly titled measures for other companies.

December 31, 2023

December 31, 2022

December 31, 2021

($ in millions)

Numerator:

Income from continuing operations

$

140.0

$

98.9

Provision (benefit) for income taxes

9.0

27.6

Income from continuing operations before

income taxes

149.0

126.5

Net income attributable to noncontrolling

interest

(20.6

)

(12.8

)

Adjustments:

Selling, engineering, and administrative

expenses (1)

4.0

—

Gains on dispositions of property – other

(2)

(6.3

)

(7.5

)

Restructuring activities, net

(2.2

)

1.0

Interest expense, net (3)

(1.5

)

(1.4

)

Adjusted Profit Before Tax

$

122.4

$

105.8

Denominator:

Total stockholders' equity

$

1,275.5

$

1,269.6

$

1,296.8

Noncontrolling interest

(238.4

)

(257.2

)

(267.0

)

Accumulated other comprehensive (income)

loss

(11.0

)

(19.7

)

17.0

Adjusted Stockholders' Equity

$

1,026.1

$

992.7

$

1,046.8

Average total stockholders' equity

$

1,272.6

$

1,283.2

Return on Equity (4)

11.0

%

7.7

%

Average Adjusted Stockholders' Equity

$

1,009.4

$

1,019.8

Pre-Tax Return on Equity (5)

12.1

%

10.4

%

(1) Represents the change in estimated

fair value of additional contingent consideration associated with

an acquisition.

(2) Represents insurance recoveries in

excess of net book value for assets damaged by a tornado at the

Company’s rail maintenance facility in Cartersville, Georgia in the

first quarter of 2021.

(3) Represents interest income accretion

related to a seller-financing agreement associated with the sale of

certain non-operating assets.

(4) Return on Equity is calculated as

income from continuing operations divided by average total

stockholders' equity.

(5) Pre-Tax Return on Equity is calculated

as adjusted profit before tax divided by average adjusted

stockholders' equity, each as defined and reconciled above.

Adjusted Free Cash Flow

Adjusted Free Cash Flow After Investments and Dividends

("Adjusted Free Cash Flow") is a non-GAAP financial measure. We

believe Adjusted Free Cash Flow is useful to both management and

investors as it provides a relevant measure of liquidity and a

useful basis for assessing our ability to fund our operations and

repay our debt. Adjusted Free Cash Flow is reconciled to net cash

provided by operating activities from continuing operations, the

most directly comparable GAAP financial measure, in the following

table. Adjusted Free Cash Flow is defined as net cash provided by

operating activities from continuing operations as computed in

accordance with GAAP, plus cash proceeds from lease portfolio

sales, less capital expenditures for manufacturing, dividends paid,

and Equity CapEx for leased railcars. Equity CapEx for leased

railcars is defined as capital expenditures for our lease fleet,

adjusted to exclude net proceeds from (repayments of) recourse and

non-recourse debt. Non-GAAP measures should not be considered in

isolation or as a substitute for our reported results prepared in

accordance with GAAP and, as calculated, may not be comparable to

other similarly titled measures for other companies.

Year Ended

December 31,

2023

2022

Net cash provided by operating activities

– continuing operations

$

309.0

$

9.2

Proceeds from lease portfolio sales

381.8

750.7

Capital expenditures – manufacturing and

other

(41.3

)

(38.0

)

Dividends paid to common stockholders

(86.0

)

(76.9

)

Equity CapEx for leased railcars

(535.0

)

(506.7

)

Adjusted Free Cash Flow After Investments

and Dividends

$

28.5

$

138.3

Capital expenditures – lease fleet

$

668.8

$

928.8

Less:

Payments to retire debt

(1,518.9

)

(1,578.5

)

Proceeds from issuance of debt

1,652.7

2,000.6

Net proceeds from (repayments of) debt

133.8

422.1

Equity CapEx for leased railcars

$

535.0

$

506.7

EBITDA and Adjusted EBITDA

“EBITDA” is defined as income from continuing operations plus

interest expense, income taxes, and depreciation and amortization

expense. Adjusted EBITDA is defined as EBITDA plus certain selling,

engineering, and administrative expenses; gains on dispositions of

other property; restructuring activities, net; and interest income.

EBITDA and Adjusted EBITDA are non-GAAP financial measures;

however, the amounts included in these calculations are derived

from amounts included in our GAAP financial statements. EBITDA and

Adjusted EBITDA are reconciled to net income, the most directly

comparable GAAP financial measure, in the following table. This

information is provided to assist management and investors in

making meaningful comparisons of our operating performance between

periods. We believe EBITDA is a useful measure for analyzing the

performance of our business. We also believe that EBITDA is

commonly reported and widely used by investors and other interested

parties as a measure of a company’s operating performance and debt

servicing ability because it assists in comparing performance on a

consistent basis without regard to capital structure, depreciation

or amortization (which can vary significantly depending on many

factors). EBITDA and Adjusted EBITDA should not be considered as

alternatives to net income as indicators of our operating

performance, or as alternatives to operating cash flows as measures

of liquidity. Non-GAAP measures should not be considered in

isolation or as a substitute for our reported results prepared in

accordance with GAAP and, as calculated, may not be comparable to

other similarly titled measures for other companies.

Three Months Ended

December 31,

Year Ended

December 31,

2023

2022

2023

2022

Net income

$

68.1

$

36.2

$

126.6

$

72.9

Less: Loss from discontinued operations,

net of income taxes

(5.3

)

(6.6

)

(13.4

)

(20.3

)

Less: Loss on sale of discontinued

operations, net of income taxes

—

—

—

(5.7

)

Income from continuing operations

$

73.4

$

42.8

$

140.0

$

98.9

Interest expense

71.4

61.6

277.9

213.9

Provision (benefit) for income taxes

7.1

10.2

9.0

27.6

Depreciation and amortization expense

73.3

70.4

293.2

276.4

EBITDA

$

225.2

$

185.0

$

720.1

$

616.8

Selling, engineering, and administrative

expenses

2.0

—

4.0

—

Gains on dispositions of property –

other

(1.4

)

—

(6.3

)

(7.5

)

Restructuring activities, net

—

—

(2.2

)

1.0

Interest income

(0.4

)

(0.4

)

(1.5

)

(1.4

)

Adjusted EBITDA

$

225.4

$

184.6

$

714.1

$

608.9

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240222259728/en/

Investor Contact: Leigh Anne Mann Vice President,

Investor Relations Trinity Industries, Inc. (Investors)

214/631-4420 Media Contact: Jack L. Todd Vice President,

Public Affairs Trinity Industries, Inc. (Media Line)

214/589-8909

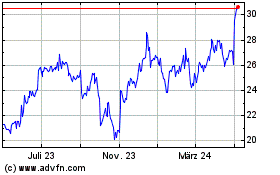

Trinity Industries (NYSE:TRN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Trinity Industries (NYSE:TRN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025