0000077543false00000775432023-12-202023-12-20

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of The

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 20, 2023

Tutor Perini Corporation

(Exact name of registrant as specified in its charter)

| | | | | | | | |

| Massachusetts | 1-6314 | 04-1717070 |

(State or Other Jurisdiction

of Incorporation) | (Commission

File Number) | (IRS Employer

Identification No.) |

15901 Olden Street, Sylmar, California 91342-1093

(Address of Principal Executive Offices, and Zip Code)

(818) 362-8391

(Registrant’s Telephone Number, Including Area Code)

None

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock, $1.00 par value | TPC | The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

| | | | | | | | |

| Emerging growth company | | ☐ |

| | |

| If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. | | ☐ |

Item 8.01. Other Events.

On December 20, 2023 (the “Fourth Amendment Effective Date”), Tutor Perini Corporation (the “Company”) entered into the Fourth Amendment to Credit Agreement (the “Amendment”), which amends the Credit Agreement, dated August 18, 2020 (as amended, restated, supplemented or otherwise modified from time to time prior to the Fourth Amendment Effective Date, the “Existing Credit Agreement”; the Existing Credit Agreement, as amended by the Amendment, the “Credit Agreement”), by and among the Company, the guarantors from time to time party thereto, the lenders from time to time party thereto and BMO Harris Bank N.A., as administrative agent. As previously disclosed, under the terms of the Existing Credit Agreement, if any of the Company’s 6.875% Senior Notes due May 1, 2025 (the “Senior Notes”) are outstanding on January 30, 2025 (which is 91 days prior to the maturity of the Senior Notes), the maturity of both the term loan B facility (the “Term Loan B”) and the revolving credit facility (the “Revolver”) under the Existing Credit Agreement will accelerate to January 30, 2025, subject to certain further exceptions. We refer to this as the “spring-forward maturity” provision of the Credit Agreement. Absent the applicability of the spring-forward maturity provision, the maturity date of the Term Loan B is August 18, 2027 and of the Revolver is August 18, 2025.

The Amendment modifies the spring-forward maturity provision solely in respect of those Term Loan B lenders that, immediately prior to the Fourth Amendment Effective Date, consented to the Amendment (the “Consenting Lenders”). The Amendment extends the spring-forward maturity provision applicable to such Consenting Lenders’ portion of the Term Loan B to April 21, 2025 (which is 10 days prior to the maturity of the Senior Notes), so that if any of the Senior Notes are outstanding on April 21, 2025, that will be the maturity date of the portion of the Term Loan B held by the Consenting Lenders. The portion of the Term Loan B held by any non-Consenting Lender and the Revolver remain unchanged and retain the spring-forward maturity of January 30, 2025 as described above. The portion of the Term Loan B held by the non-Consenting Lenders will be classified as “Tranche A Term Loans” and the portion of the Term Loan B held by the Consenting Lenders will be classified as “Tranche B Term Loans”, in each case, as of the Fourth Amendment Effective Date. Other than in respect of the spring-forward maturity provision described in this paragraph, the terms of the Tranche A Term Loans and Tranche B Term Loans are identical, and the Amendment makes no modifications to the terms of the Revolver.

Lenders holding 89.8% of the aggregate principal amount of the Term Loan B consented to the Amendment. Consenting Lenders were paid a fee of 0.50% of the aggregate principal amount of the portion of the Term Loan B held by such Consenting Lenders.

A copy of the Company’s press release announcing the Amendment is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

Note Regarding Forward-Looking Statements

The statements contained in this Form 8-K that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including without limitation, statements regarding the Company’s expectations, hopes, beliefs, intentions or strategies regarding the future and statements regarding non-historical performance. These forward-looking statements are based on the Company’s current expectations and beliefs concerning future developments and their potential effects on the Company. While the Company’s expectations, beliefs and projections are expressed in good faith and the Company believes there is a reasonable basis for them, there can be no assurance that future developments affecting the Company will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the control of the Company) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to: unfavorable outcomes of existing or future litigation or dispute resolution proceedings against us or customers (project owners, developers, general contractors, etc.), subcontractors or suppliers, as well as failure to promptly recover significant working capital invested in projects subject to such matters; revisions of estimates of contract risks, revenue or costs, economic factors such as inflation, the timing of new awards, or the pace of project execution, which has resulted and may continue to result in losses or lower than anticipated profit; increased competition and failure to secure new contracts; contract requirements to perform extra work beyond the initial project scope, which has and in the future could result in disputes or claims and adversely affect our working capital, profits and cash flows; risks and other uncertainties associated with assumptions and estimates used to prepare our financial statements; a significant slowdown or decline in economic conditions, such as those presented during a recession; failure to meet contractual schedule requirements, which could result in higher costs and reduced profits or, in some cases, exposure to financial liability for liquidated damages and/or damages to customers, as well as damage to our reputation; failure to meet our obligations under our debt agreements (especially in a high interest rate environment), including as a result of the spring-forward maturity provision in the Credit Agreement, should it become applicable; our ability to refinance the Senior Notes, including the timing and terms of a refinancing process, is subject to market and other conditions; inability to attract and retain our key officers, and to adequately plan for their succession, and hire and retain personnel required to execute and perform on our contracts; possible systems and information technology interruptions and breaches in data security and/or privacy; an inability to obtain bonding could have a negative impact on our operations and results; risks related to our international operations, such as uncertainty of U.S. government funding, as well as economic, political, regulatory and other

risks, including risks of loss due to acts of war, labor conditions, and other unforeseeable events in countries where we do business, which could adversely affect our revenue and earnings; decreases in the level of government spending for infrastructure and other public projects; downgrades in our credit ratings; failure of our joint venture partners to perform their venture obligations, which could impose additional financial and performance obligations on us, resulting in reduced profits or losses and/or reputational harm; the impact of inclement weather conditions on projects; risks related to government contracts and related procurement regulations; significant fluctuations in the market price of our common stock, which could result in substantial losses for stockholders and potentially subject us to securities litigation; client cancellations of, or reductions in scope under, contracts reported in our backlog; violations of the U.S. Foreign Corrupt Practices Act and similar worldwide anti-bribery laws; public health crises, such as COVID-19, have adversely impacted, and could in the future adversely impact, our business, financial condition and results of operations by, among other things, delaying the timing of project bids and/or awards and the timing of dispute resolutions and associated collections; physical and regulatory risks related to climate change; impairment of our goodwill or other indefinite-lived intangible assets; the exertion of influence over the Company by our chairman and chief executive officer due to his position and significant ownership interest; and other risks and uncertainties discussed under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 filed on March 15, 2023 and in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 filed on November 9, 2023, and in other reports that we file with the Securities and Exchange Commission from time to time. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit Number | Description |

| |

| |

| 104 | The cover page from this Current Report on Form 8-K formatted in Inline XBRL (included as Exhibit 101). |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | |

| | TUTOR PERINI CORPORATION |

| | |

| Date: | December 20, 2023 | By: | /s/ Ryan J. Soroka |

| | Ryan J. Soroka |

| | Senior Vice President & Chief Financial Officer |

News Release

Tutor Perini Announces Amendment of 2020 Credit Agreement

•Extends spring-forward maturity provision on 89.8% of the Term Loan B Facility to April 21, 2025

•Entered into agreement with Goldman Sachs & Co. as lead advisor for Senior Notes refinancing

LOS ANGELES - (BUSINESS WIRE) - December 20, 2023 - Tutor Perini Corporation (NYSE: TPC) (the “Company”), a leading civil, building and specialty construction company, announced today the amendment of its Credit Agreement, dated August 18, 2020, to modify the spring-forward maturity provision and provide the Company with additional financial flexibility.

As previously disclosed by the Company, if any of the Company’s 6.875% Senior Notes due May 1, 2025 (the “Senior Notes”) are outstanding on January 30, 2025, the spring-forward maturity provision of the Credit Agreement would have caused the maturity dates of both the Term Loan B Facility and the Revolver to accelerate from August 18, 2025 (for the Revolver) and August 18, 2027 (for the Term Loan B Facility) to January 30, 2025. As of December 20, 2023, the Company had $368.2 million outstanding under the Term Loan B Facility, no balance outstanding under the Revolver and $500 million of Senior Notes outstanding.

The amendment, which became effective on December 20, 2023, modifies this spring-forward maturity provision in respect of the portion of the Term Loan B Facility held by lenders that consented to the amendment. As modified, the spring-forward maturity date for the portion of the Term Loan B Facility held by consenting lenders will not occur until April 21, 2025, if any of the Senior Notes are outstanding on that date.

Lenders holding approximately 89.8% of the aggregate principal amount outstanding under the Term Loan B Facility have consented to the amendment. Under the amendment, each consenting lender was paid a fee of 0.50% of the aggregate principal amount of the portion of the Term Loan B Facility that it holds.

Perella Weinberg Partners LP led the amendment process for the Company.

The Company also announced today that it has entered into an agreement with Goldman Sachs & Co. LLC to assist with the refinancing of the Senior Notes in early 2024. The Company is considering using a portion of its current and expected cash balances to repay debt or assist in the refinancing efforts.

Gary Smalley, President of the Company, commented, “We are pleased to have completed this amendment, which provides us with additional flexibility to collect significant cash that we can apply toward a refinancing transaction. We wish to express our gratitude to Perella Weinberg Partners for their efforts in helping us secure the amendment. We also look forward to working with Goldman Sachs on the refinancing in early 2024.”

About Tutor Perini Corporation

Tutor Perini Corporation is a leading civil, building and specialty construction company offering diversified general contracting and design-build services to private customers and public agencies throughout the world. We have provided construction services since 1894 and have established a strong reputation within our markets by executing large, complex projects on time and within budget, while adhering to strict quality control measures. We offer general contracting, pre-construction planning and comprehensive project management services, including planning and scheduling of manpower,

equipment, materials and subcontractors required for a project. We also offer self-performed construction services including site work, concrete forming and placement, steel erection, electrical, mechanical, plumbing and heating, ventilation and air conditioning (HVAC). We are known for our major complex building project commitments, as well as our capacity to perform large and complex transportation and heavy civil construction for government agencies and private customers throughout the world.

Forward-Looking Statements

The statements contained in this release that are not purely historical are forward-looking statements within the meaning of Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended, including without limitation, statements regarding the Company’s expectations, hopes, beliefs, intentions or strategies regarding the future and statements regarding non-historical performance. These forward-looking statements are based on the Company’s current expectations and beliefs concerning future developments and their potential effects on the Company. While the Company’s expectations, beliefs and projections are expressed in good faith and the Company believes there is a reasonable basis for them, there can be no assurance that future developments affecting the Company will be those that we have anticipated. These forward-looking statements involve a number of risks, uncertainties (some of which are beyond the control of the Company) or other assumptions that may cause actual results or performance to be materially different from those expressed or implied by such forward-looking statements. These risks and uncertainties include, but are not limited to: unfavorable outcomes of existing or future litigation or dispute resolution proceedings against us or customers (project owners, developers, general contractors, etc.), subcontractors or suppliers, as well as failure to promptly recover significant working capital invested in projects subject to such matters; revisions of estimates of contract risks, revenue or costs, economic factors such as inflation, the timing of new awards, or the pace of project execution, which has resulted and may continue to result in losses or lower than anticipated profit; increased competition and failure to secure new contracts; contract requirements to perform extra work beyond the initial project scope, which has and in the future could result in disputes or claims and adversely affect our working capital, profits and cash flows; risks and other uncertainties associated with assumptions and estimates used to prepare our financial statements; a significant slowdown or decline in economic conditions, such as those presented during a recession; failure to meet contractual schedule requirements, which could result in higher costs and reduced profits or, in some cases, exposure to financial liability for liquidated damages and/or damages to customers, as well as damage to our reputation; failure to meet our obligations under our debt agreements (especially in a high interest rate environment), including as a result of the spring-forward maturity provision in the Credit Agreement, should it become applicable; our ability to refinance the Senior Notes, including the timing and terms of a refinancing process, is subject to market and other conditions; inability to attract and retain our key officers, and to adequately plan for their succession, and hire and retain personnel required to execute and perform on our contracts; possible systems and information technology interruptions and breaches in data security and/or privacy; an inability to obtain bonding could have a negative impact on our operations and results; risks related to our international operations, such as uncertainty of U.S. government funding, as well as economic, political, regulatory and other risks, including risks of loss due to acts of war, labor conditions, and other unforeseeable events in countries where we do business, which could adversely affect our revenue and earnings; decreases in the level of government spending for infrastructure and other public projects; downgrades in our credit ratings; failure of our joint venture partners to perform their venture obligations, which could impose additional financial and performance obligations on us, resulting in reduced profits or losses and/or reputational harm; the impact of inclement weather conditions on projects; risks related to government contracts and related procurement regulations; significant fluctuations in the market price of our common stock, which could result in substantial losses for stockholders and potentially subject us to securities litigation; client cancellations of, or reductions in scope under, contracts reported in our backlog; violations of the U.S. Foreign Corrupt Practices Act and similar worldwide anti-bribery laws; public health crises, such as COVID-19, have adversely impacted, and could in the future adversely impact, our business, financial condition and results of operations by, among other things, delaying the timing of project bids and/or awards and the timing of dispute resolutions and associated collections; physical and regulatory risks related to climate change; impairment of our goodwill or other indefinite-lived intangible assets; the exertion of influence over the Company by our chairman and chief executive officer due to his position and significant ownership

interest; and other risks and uncertainties discussed under the heading “Risk Factors” in our Annual Report on Form 10-K for the year ended December 31, 2022 filed on March 15, 2023 and in our Quarterly Report on Form 10-Q for the quarter ended September 30, 2023 filed on November 9, 2023, and in other reports that we file with the Securities and Exchange Commission from time to time. The Company undertakes no obligation to publicly update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as may be required under applicable securities laws.

Contact:

Tutor Perini Corporation

Jorge Casado, 818-362-8391

Vice President, Investor Relations & Corporate Communications

www.tutorperini.com

v3.23.4

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

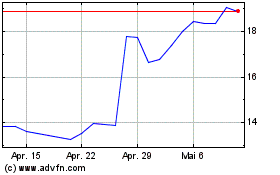

Tutor Perini (NYSE:TPC)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Tutor Perini (NYSE:TPC)

Historical Stock Chart

Von Mai 2023 bis Mai 2024