false000152402500015240252024-01-212024-01-21

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

_______________________________________________

FORM 8-K

_______________________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of Earliest Event Reported): January 21, 2024

_______________________________________________

TILLY’S, INC.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| | | | |

Delaware | | 1-35535 | | 45-2164791 |

(State of Incorporation) | | (Commission File Number) | | (IRS Employer

Identification Number) |

10 Whatney

Irvine, California 92618

(Address of Principal Executive Offices) (Zip Code)

(949) 609-5599

(Registrant’s Telephone Number, Including Area Code)

______________________________________________

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions: | | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Class A Common Stock, $0.001 par value per share | TLYS | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Explanatory Note

This Amendment No. 1 on Form 8-K/A (this “Amendment”) amends Item 5.02 of the Current Report on Form 8-K filed by Tilly’s, Inc. (the “Company”) on January 22, 2024 (the “Original Report”), in which the Company reported, among other things, that Edmond Thomas retired from his position as the President and Chief Executive Officer of the Company and as a director of the board of directors (the “Board”) of the Company, effective as of January 21, 2024 (the “Separation Date”). This Amendment is being filed solely to provide additional information regarding compensation as required under Item 5.02. Except as set forth herein, no other changes have been made to the Original Report

| | | | | |

Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On February 15, 2024, the Company entered into an employment separation and release agreement (the “Separation Agreement”) with Edmond Thomas. Pursuant to the Separation Agreement, Mr. Thomas will be entitled to the following separation payments and benefits, provided he executes and does not revoke a general release of claims against the Company and its affiliates: (i) $667,000, payable in substantially equal monthly installments for the 12-month period following the Separation Date; (ii) all Company equity awards held by Mr. Thomas that are outstanding as of the Separation Date will vest in full and will remain exercisable in accordance with the award agreements pursuant to which such awards were granted; and (iii) Company-subsidized COBRA coverage for up to 12 months following the Separation Date. The foregoing separation payments and benefits also are subject to Mr. Thomas’s continued compliance with the restrictive covenants set forth in the Separation Agreement.

The foregoing description of the Separation Agreement does not purport to be complete and is qualified in its entirety by the text of the agreement, which is attached hereto as Exhibit 10.1 and incorporated herein by reference.

| | | | | |

Item 9.01 | Financial Statements and Exhibits. |

(d) Exhibits.

| | | | | |

Exhibit No. | Exhibit Title or Description |

| 10.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | |

| TILLY’S, INC. |

| | |

| Date: February 15, 2024 | By: | /s/ Michael L. Henry |

| Name: | Michael L. Henry |

| Title: | Executive Vice President, Chief Financial Officer |

EMPLOYMENT SEPARATION AND RELEASE AGREEMENT

This Employment Separation and Release Agreement (the “Agreement”) is entered into by and between Edmond Thomas (“Employee”) and Tilly’s, Inc. (the “Company”) as of February 15, 2024 (the “Effective Date”). The purpose of this Agreement is to ease Employee’s separation from the Company and to settle and resolve any and all disputes and controversies of any nature existing between Employee and the Company, including, but not limited to, any claims arising out of Employee’s employment with, and separation from, the Company.

1.Separation of Employment; Termination of Directorship.

(a) Employment Separation. Employee’s last day of employment with the Company was January 21, 2024 (the “Separation Date”). Effective as of the Separation Date, Employee retired as the President, Chief Executive Officer and director of the Company and resigned from such positions and all other offices, directorships or equivalent positions held at the Company and its subsidiaries. Effective as of the Separation Date, Employee’s employment with the Company and all of its affiliates terminated and Employee ceased to be an employee of all of the foregoing.

(b) Return of Company Property. As of the Separation Date, Employee confirms that he returned to the Company any and all property and equipment of the Company, including (i) all keys, files, lists, books and records (and copies thereof) of, or in connection with, the Company’s business, equipment (including, but not limited to, computer hardware, software and printers, wireless handheld devices, cellular phones and pagers), access or credit cards, Company identification, and all other property belonging to the Company in Employee’s possession or control, and (ii) all documents and copies, including hard and electronic copies, of documents in Employee’s possession relating to any Confidential Information (as defined below), including without limitation, internal and external business forms, manuals, correspondence, notes and computer programs, and Employee has not made or retained, and shall not make or retain, any copy or extract of any of the foregoing; provided, however, that Employee may retain Employee’s telephone and address book and copies of Employee’s own personnel, payroll and benefit documents (provided that such documents do not contain any Confidential Information and that the Company has the prior opportunity to review, redact and/or retain any such documents containing Confidential Information), as well as documents distributed to all shareholders.

(1)The term “Confidential Information”, as used herein, means all information or material (A) which gives the Company a competitive business advantage or the opportunity of obtaining such advantage, (B) the disclosure of which could be detrimental to the interests of the Company and/or its affiliates, (C) which is owned by the Company and/or its affiliates, in which the Company and/or its affiliates has an interest, or which is valuable or unique, (D) which is developed or used by the Company or any of its affiliates and which relates to the business, operations, employees, customers and/or clients of the Company or any of its affiliates, or (E) which is either (x) marked “Confidential Information”, “Proprietary Information” or with another similar marking, or (y) from all the relevant circumstances should reasonably be assumed by Employee to be confidential and proprietary to the Company. Confidential Information may include, but is not limited to, trade secrets, inventions, drawings, file data, documentation, diagrams, specifications, know-how, ideas, processes, formulas, models, flow charts, software in various stages of development, source codes, object codes, research and development procedures, research or development and test results, marketing techniques and materials, marketing and development plans, price lists, pricing policies, business plans, information relating to the Company and its customers and/or producers or other suppliers’ identities, characteristics and agreements, financial information and projections, and employee files, in each case, whether disclosed or made available to Employee in writing, orally or by drawings or observation, or whether intangible or embodied in documentation, software, hardware or other tangible form. Confidential Information also includes any information described above which the Company obtains from another party and which the Company treats as proprietary or designates as Confidential Information, whether or not owned or developed by the Company. Notwithstanding the foregoing, Confidential Information shall not include any information which is (w) known by Employee as a result of Employee’s extensive experience in the Company’s industry generally and not specific to the Company, (x) known to the public or becomes known to the public through no fault of Employee, (y) received by Employee on a non-confidential basis from a person that is not bound by an obligation of confidentiality to the Company or its affiliates, or (z) in Employee possession prior to receipt from the Company or its affiliates, as evidenced by Employee’s written records.

2.Accrued Obligations; Legal Expenses.

Employee acknowledges that as of the Separation Date, Employee received (i) all accrued salary and all accrued, unused vacation / paid time off through the Separation Date, and (ii) any unreimbursed business expenses incurred by Employee, in accordance with Company policy, prior to the Separation Date (collectively, the “Accrued Obligations”). Employee’s legal fees and expenses actually incurred in connection with the drafting, review and negotiation of this Agreement shall

be paid directly by the Company to Employee’s legal counsel within no later than 45 days after the Release Effective Date (as defined below), subject to Employee’s delivery to the Company of documentation evidencing such fees and expenses within 30 days after he executes this Agreement; provided, however, that such Company payment or reimbursement shall not exceed $7,500.

3.Withholdings and Other Deductions.

All compensation payable to Employee hereunder shall be subject to such withholdings and deductions as the Company is from time to time required to make pursuant to law, governmental regulation or order.

4.Warranty.

Employee acknowledges that the payments and benefits provided pursuant to Section 5 of this Agreement constitute additional compensation to which Employee would not be entitled except for Employee’s decision to sign this Agreement and the Release and to abide by the terms of this Agreement. Employee acknowledges that Employee has (i) received all monies and other benefits due to Employee as a result of his employment with and separation from the Company, including the Accrued Obligations, and (ii) no right, title, or interest in or entitlement to any other payments or benefits other than as set forth in this Agreement (including with respect to an annual bonus for the Company’s 2024 fiscal year). Employee further represents that he has not sustained a work-related injury or illness which he has not previously reported to the Company.

5.Separation Benefits.

In consideration of, subject to and conditioned upon (i) Employee’s timely execution of the release attached hereto as Exhibit A (the “Release”) on or within 21 days following the Effective Date and non-revocation of the Release (in accordance with Exhibit A) thereafter (the effective date of such Release, the “Release Effective Date”), and (ii) Employee’s continued compliance with the terms and conditions of Sections 1(b), 7, 8, 9 and 11 of this Agreement, the Release and the Restrictive Covenant Arrangements (as defined below):

(1)The Company shall pay Employee an amount in cash equal to $667,000, payable in substantially equal monthly installments over the 12-month period following the Separation Date, but commencing on the first payroll date following the Release Effective Date, and amounts otherwise payable prior to such first payroll date shall be paid on such date without interest thereon;

(2)In addition, all Company equity awards (or portions thereof) previously granted to Employee that are outstanding as of the Separation Date (the “Company Equity Awards”) shall vest in full on the Release Effective Date and shall remain exercisable in accordance with the award agreements pursuant to which such awards were granted; and

(3)During the period commencing on the Separation Date and ending on the earlier of the 12-month anniversary of the Separation Date and the date on which Employee becomes eligible for substantially similar coverage under a subsequent employer’s group health plan (in either case, the “COBRA Period”), subject to Employee’s valid election to continue healthcare coverage under Section 4980B of the Internal Revenue Code of 1986, as amended (the “Code”) and the regulations thereunder, the Company shall reimburse Employee and Employee’s dependents, with respect to each month during the COBRA Period, an amount equal to the monthly premiums for coverage under its group health plan at the same or reasonably equivalent levels in effect on the Separation Date and at the same cost to Employee that would have applied had Employee’s employment not terminated based on Employee’s elections in effect on the Separation Date (the “COBRA Benefits”); provided, however, that if (A) any plan pursuant to which such benefits are provided is not, or ceases prior to the expiration of the COBRA Period to be, exempt from the application of Section 409A (as defined below) under Treasury Regulation Section 1.409A-1(a)(5), (B) the Company is otherwise unable to continue to cover Employee or Employee’s dependents under its group health plans, or (C) the Company cannot provide the benefit without violating applicable law (including, without limitation, Section 2716 of the Public Health Service Act), then, in any such case, an amount equal to each remaining Company subsidy shall thereafter be paid to Employee in substantially equal monthly installments over the remaining portion of the COBRA Period.

6.Release of Known and Unknown Claims.

Exhibit A sets forth the release of claims that forms part of the conditions of the payments and benefits provided under Section 5 hereof, which shall not be executed prior to the Effective Date.

7.Reaffirmation of Restrictive Covenants.

Subject to Sections 10 and 20, Employee acknowledges that Employee previously agreed to certain restrictive covenants in a confidentiality, inventions assignment or similar agreement by and between Employee and the Company (the “Restrictive Covenant Arrangements”), and Employee hereby acknowledges and agrees that such provisions shall remain in full force and effect in accordance with their terms and that Employee shall be bound by their terms and conditions.

8.Non-Solicitation.

Employee agrees that at no time during the three-year period immediately following the Separation Date will Employee directly or indirectly, on behalf of Employee or any other person or entity, solicit, recruit or encourage any employee to leave the employ of the Company.

9.Non-Disparagement.

Subject to Section 10, Employee agrees not to publish or disseminate, directly or indirectly, any statements, whether written or oral, that are or could be harmful to or reflect negatively on any of the Company or any of its affiliates, or that are otherwise disparaging of the Company, its affiliates or any of their past or present officers, directors, employees, advisors, agents, policies, procedures, practices, decision-making, conduct, professionalism or compliance with standards. The Company will use reasonable efforts to direct its executive officers to abide by these same restrictions with regard to Employee.

10.Exceptions.

Notwithstanding anything in this Agreement or the Restrictive Covenant Arrangements to the contrary, nothing contained in this Agreement or the Restrictive Covenant Arrangements shall prohibit either party (or either party’s attorney(s)) from (i) communicating directly with, filing a charge with, reporting possible violations of federal law or regulation to, participating in any investigation by, or cooperating with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority, the Equal Employment Opportunity Commission, the National Labor Relations Board (the “NLRB”), the Occupational Safety and Health Administration, the U.S. Commodity Futures Trading Commission, the U.S. Department of Justice or any other securities regulatory agency, self-regulatory authority or federal, state or local regulatory authority (collectively, “Government Agencies”), or making other disclosures that are protected under the whistleblower provisions of applicable law or regulation, (ii) communicating directly with, cooperating with, or providing information (including trade secrets) in confidence to any Government Agencies for the purpose of reporting or investigating a suspected violation of law, or from providing such information to such party’s attorney(s) or in a sealed complaint or other document filed in a lawsuit or other governmental proceeding, and/or (iii) receiving an award for information provided to any Government Agency. Further, nothing herein will prevent Employee from participating in activity permitted by Section 7 of the National Labor Relations Act or from filing an unfair labor practice charge with the NLRB. Pursuant to 18 USC Section 1833(b), Employee will not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that is made: (A) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney, and solely for the purpose of reporting or investigating a suspected violation of law; or (B) in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. Further, nothing in this Agreement is intended to or shall preclude either party from providing truthful testimony in response to a valid subpoena, court order, regulatory request or other judicial, administrative or legal process or otherwise as required by law. If Employee is required to provide testimony, then unless otherwise directed or requested by a Government Agency or law enforcement, Employee shall notify the Company as soon as reasonably practicable after receiving any such request of the anticipated testimony. Further, nothing in this Agreement of the Restrictive Covenant Arrangements prevents Employee from discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that Employee has reason to believe is unlawful.

11.Ongoing Cooperation.

Subject to Section 10, Employee agrees to reasonably cooperate with and make himself available to the Company and its representatives and legal advisors in connection with any matters in which Employee is or was involved or any existing or future claims, investigations, administrative proceedings, lawsuits and other legal matters, as reasonably requested by the Company. Employee also agrees that within five business days of receipt (or more promptly if reasonably required by the circumstances) Employee will send to the Company, attention General Counsel, copies of all correspondence (for example, but not limited to, subpoenas) received by Employee in connection with any legal proceedings involving or relating to the Company, unless Employee is expressly prohibited by law from so doing. Employee agrees that Employee will not voluntarily cooperate with any third party in any actual or threatened claim, charge, or cause of action of any

nature whatsoever against the Company or affiliates. Employee understands that nothing in this Agreement prevents Employee from cooperating with any government investigation.

12.Code Section 409A.

To the extent applicable, this Agreement shall be interpreted in accordance with Section 409A of the Code and Department of Treasury regulations and other interpretive guidance issued thereunder, including without limitation any such regulations or other such guidance that may be issued after the Separation Date (collectively, “Section 409A”). Notwithstanding any provision of this Agreement to the contrary, in the event that following the Separation Date, the Company determines that any compensation or benefits payable under this Agreement may be subject to Section 409A, the Company shall adopt such amendments to this Agreement or adopt other policies or procedures (including amendments, policies and procedures with retroactive effect), or take any other actions that the Company determines are necessary or appropriate to preserve the intended tax treatment of the compensation and benefits payable hereunder, including without limitation actions intended to (i) exempt the compensation and benefits payable under this Agreement from Section 409A, and/or (ii) comply with the requirements of Section 409A, provided, however, that this Section 12 does not, and shall not be construed so as to, create any obligation on the part of the Company to adopt any such amendments, policies or procedures or to take any other such actions. In no event shall the Company, its affiliates or any of their respective officers, directors or advisors be liable for any taxes, interest or penalties imposed under Section 409A or any corresponding provision of state or local law.

13.Breach.

In the event Employee breaches any of Sections 7, 8, 9 or 11, the Company’s covenants hereunder shall be deemed null and void in their entirety.

14.Governing Law.

This Agreement shall be construed under the laws of the State of California, both procedural and substantive.

15.Waiver.

The failure to enforce any provision of this Agreement shall not be construed to be a waiver of such provision or to affect the validity of this Agreement or the right of any party to enforce this Agreement.

16.Headings.

The headings in this Agreement are provided solely for convenience, and are not intended to be part of, nor to affect or alter the interpretation or meaning of, this Agreement.

17.Severability.

If any sentence, phrase, section, subsection or portion of this Agreement is found to be illegal or unenforceable, such action shall not affect the validity or enforceability of the remaining sentences, phrases, sections, subsections or portions of this Agreement, which shall remain fully valid and enforceable.

18.Assignment.

This Agreement is personal to Employee and shall not be assignable by Employee. The rights of the Company under this Agreement may be assigned by the Company, in its sole discretion, including to any of its affiliates or any person, firm, corporation or other business entity which at any time, whether by purchase, merger or otherwise, directly or indirectly, acquires all or substantially all of the assets or business of the Company. This Agreement shall inure to the benefit of, and be binding on, the Company and its successors and assigns.

19.Ambiguities.

Both parties have participated in the negotiation of this Agreement and, thus, it is understood and agreed that the general rule that ambiguities are to be construed against the drafter shall not apply to this Agreement. In the event that any language of this Agreement is found to be ambiguous, each party shall have an opportunity to present evidence as to the actual intent of the parties with respect to any such ambiguous language.

20.Entire Agreement / Amendments.

Except as provided in this Section 20, as of the Effective Date, this Agreement, together with the Release and the Restrictive Covenant Arrangements, constitute the entire agreement between Employee and the Company concerning the subject matter hereof; provided, however, that Section 8 of the Offer Letter, by and between Employee and the Company, dated October 7, 2015 (the “Offer Letter”), shall remain in full force and effect. No covenants, agreements, representations, or warranties of any kind, other than those set forth herein, have been made to any party hereto with respect to this Agreement. Except as set forth in the proviso of the first sentence of this Section 20, as of the Effective Date, all prior discussions and negotiations (including the Offer Letter) have been and are merged and integrated into, and are superseded by, this Agreement. No amendments to this Agreement will be valid unless written and signed by Employee and an authorized representative of the Company.

21.Counterparts.

This Agreement may be executed in several counterparts, each of which shall be deemed to be an original, but all of which together will constitute one and the same Agreement.

22.Consultation with Counsel.

Employee acknowledges (i) that Employee has thoroughly read and considered all aspects of this Agreement, that Employee understands all its provisions and that Employee is voluntarily entering into this Agreement, (ii) that he has been represented by, or had the opportunity to be represented by independent counsel of his own choice in connection with the negotiation and execution of this Agreement and has been advised to do so by the Company, and (iii) that he has read and understands the Agreement, is fully aware of its legal effect, and has entered into it freely based on his own judgment. Without limiting the generality of the foregoing, Employee acknowledges that he has had the opportunity to consult with his own independent tax advisors with respect to the tax consequences to him of this Agreement, and that he is relying solely on the advice of his independent advisors for such purposes. Any rule of construction to the effect that ambiguities are to be resolved against the drafting party shall not be applied in the construction or interpretation of this Agreement.

23.Notices.

All notices, requests and other communications hereunder shall be in writing and shall be delivered by courier or other means of personal service (including by means of a nationally recognized courier service or professional messenger service), or sent by email or facsimile and also mailed first class, postage prepaid, by certified mail, return receipt requested, in all cases addressed to:

If to Employee:

At Employee’s last known address evidenced on the Company’s payroll records.

If to the Company:

Tilly’s, Inc.

10 Whatney

Irvine, CA 92618

Attention: Sonya Attal

Email: sattal@tillys.com

With a copy to (which shall not constitute notice):

Tilly’s, Inc.

10 Whatney

Irvine, CA 92618

Attention: Legal Department

legal@tillys.com

All notices, requests and other communications shall be deemed given on the date of actual receipt or delivery as evidenced by written receipt, acknowledgement or other evidence of actual receipt or delivery to the address. In case of service by telecopy, a copy of such notice shall be personally delivered or sent by registered or certified mail, in the manner set forth above, within three business days thereafter. Any party hereto may from time to time by notice in

writing served as set forth above designate a different address or a different or additional person to which all such notices or communications thereafter are to be given.

PLEASE READ CAREFULLY. THIS AGREEMENT IS SUBJECT TO A RELEASE OF ALL KNOWN AND UNKNOWN CLAIMS. EMPLOYEE AGREES TO THE TERMS OF THIS AGREEMENT AND VOLUNTARILY ENTERS INTO IT WITH THE INTENT TO BE BOUND HEREBY.

If the above accurately reflects Employee’s understanding, please date and sign the enclosed copy of this Agreement in the places indicated below and return that copy to Sonya Attal, General Counsel.

| | | | | | | | |

| Date: February 15, 2024 | By: | /s/ Edmond Thomas |

| | Edmond Thomas |

| | | | | | | | |

| Date: February 13, 2024 | By: | /s/ Hezy Shaked |

| | Hezy Shaked |

| | Tillys, Inc. |

EXHIBIT A

GENERAL RELEASE

Capitalized terms used but not defined in this Release shall have the meanings set forth in that certain Employment Separation and Release Agreement, by and between the Company and Employee, dated as of February 15, 2024 (the “Agreement”) to which this Release is attached.

(a) General Release. In exchange for the consideration set forth in the Agreement (including as set forth in Section 5 thereof), and for other good and valuable consideration, the receipt and adequacy of which are hereby acknowledged, Employee agrees unconditionally and forever to release and discharge the Company and the Company’s affiliated, related, parent and subsidiary corporations, as well as their respective past and present parents, subsidiaries, affiliates, associates, members, stockholders, employee benefit plans, attorneys, agents, representatives, partners, joint ventures, predecessors, successors, assigns, insurers, owners, employees, officers, directors and all persons acting by, through, under, or in concert with them, or any of them (hereinafter the “Releasees”) from any and all manner of claims, actions, causes of action, in law or in equity, demands, rights, or damages of any kind or nature which he may now have, or ever have, whether known or unknown, fixed or contingent, including any claims, causes of action or demands of any nature (hereinafter called “Claims”), that Employee now has or may hereafter have against the Releasees by reason of any and all acts, omissions, events or facts occurring or existing prior to Employee’s execution of this Release. The Claims released hereunder specifically include, but are not limited to, any claims for fraud; breach of contract; breach of implied covenant of good faith and fair dealing; inducement of breach; interference with contract; wrongful or unlawful discharge or demotion; violation of public policy; sexual or any other type of assault and battery; invasion of privacy; intentional or negligent infliction of emotional distress; intentional or negligent misrepresentation; conspiracy; failure to pay wages, benefits, vacation pay, severance pay, commissions, equity, attorneys’ fees, or other compensation of any sort; failure to accommodate disability, including pregnancy; discrimination or harassment on the basis of age, pregnancy, race, color, sex, gender, national origin, ancestry, religion, disability, handicap, medical condition, marital status, sexual orientation or any other protected category; any claim under the Age Discrimination in Employment Act, as amended, 29 U.S.C. § 621 et seq. (“ADEA”); the Older Workers’ Protection Benefit Act of 1990; Title VII of the Civil Rights Act of 1964, as amended, by the Civil Rights Act of 1991, 42 U.S.C. § 2000 et seq.; Equal Pay Act, as amended, 29 U.S.C. § 206(d); the Civil Rights Act of 1866, 42 U.S.C. § 1981; the Family and Medical Leave Act of 1993, 29 U.S.C. § 2601 et seq.; the Americans with Disabilities Act of 1990, 42 U.S.C. § 12101 et seq.; the False Claims Act, 31 U.S.C. § 3729 et seq.; the Employee Retirement Income Security Act, as amended, 29 U.S.C. § 1001 et seq.; the Worker Adjustment and Retraining Notification Act (“WARN”), as amended, 29 U.S.C. § 2101 et seq.; the Fair Labor Standards Act, 29 U.S.C. § 215 et seq.; the California Fair Employment and Housing Act, as amended, Cal. Lab. Code § 12940 et seq.; the California Equal Pay Law, as amended, Cal. Lab. Code §§ 1197.5(a),1199.5; the Moore-Brown-Roberti Family Rights Act of 1991, as amended, Cal. Gov’t Code §§12945.2, 19702.3; the California WARN Act, Cal. Lab. Code § 1400 et seq.; the California False Claims Act, Cal. Gov’t Code § 12650 et seq.; the California Corporate Criminal Liability Act, Cal. Penal Code § 387; the California Labor Code; and any federal, state or local laws of similar effect.

(b) Claims Not Released. This Release shall not apply to: the Company’s obligations to provide the payments and benefits under Section 5 of the Agreement; Employee’s right to indemnification under any applicable indemnification agreement with the Company, the Company’s governing documents, any applicable D&O insurance policy maintained by the Company, or applicable law; Employee’s right to assert claims for workers’ compensation or unemployment benefits; Employee’s right to bring to the attention of the Equal Employment Opportunity Commission (“EEOC”) claims of discrimination (provided, however, that Employee releases his right to secure any damages for alleged discriminatory treatment); any right to communicate directly with, cooperate with, or provide information to, any federal, state or local government regulator; any right to file an unfair labor practice charge under the National Labor Relations Act; Employee’s vested rights under any retirement or welfare benefit plan of the Company; Employee’s rights in his capacity as an equityholder of the Company; or any other rights that may not be waived by an employee under applicable law.

(c) Unknown Claims. Employee acknowledges that Employee has been advised of and is familiar with the provisions of California Civil Code section 1542, which provides as follows:

“A GENERAL RELEASE DOES NOT EXTEND TO CLAIMS WHICH THE CREDITOR OR RELEASING PARTY DOES NOT KNOW OR SUSPECT TO EXIST IN HIS OR HER FAVOR AT THE TIME OF EXECUTING THE RELEASE, WHICH IF KNOWN BY HIM OR HER, WOULD HAVE MATERIALLY AFFECTED HIS OR HER SETTLEMENT WITH THE DEBTOR OR RELEASED PARTY.”

Employee, being aware of said Code section, hereby expressly waives any rights he may have thereunder, as well as under any other statutes or common law principles of similar effect.

(d) Review and Revocation. Employee understands that under the Older Workers Benefit Protection Act, Employee has a right to review and revoke this Release as follows. Employee agrees and acknowledges that this Release includes a waiver and release of all claims that he has or may have under the ADEA. The following terms and conditions apply to and are part of the waiver and release of the ADEA claims under this general release:

(i) This Release is written in a manner calculated to be understood by Employee, and Employee understands it.

(ii) The waiver and release of claims under the ADEA contained in this Release does not cover rights or claims that may arise after the date on which Employee signs this Release.

(iii) This Release provides for consideration in addition to anything of value to which Employee is already entitled.

(iv) Employee is hereby advised to consult an attorney before signing this Release.

(v) Employee has been granted 21 days after receiving this Release to decide whether to sign this Release. If Employee signs this Release prior to the expiration of the 21-day period, Employee does so voluntarily and after having had the opportunity to consult with an attorney, and waives the remainder of the 21-day period.

(vi) Employee has the right to revoke this Release within seven days of signing this Release, and this Release shall not be enforceable or effective until the expiration of that period. In the event this Release is revoked, this Release will be null and void in its entirety, and Employee will not be entitled to the payment and benefits as provided in Section 5 of the Agreement. If Employee wishes to revoke this Release, Employee must deliver written notice stating Employee’s intent to revoke this Release to the General Counsel, Sonya Attal, on or before 11:59 p.m. PT on the seventh day after the date on which Employee signed this Release.

(e) Representations. Employee represents and warrants that there has been no assignment or other transfer of any interest in any Claim which he may have against Releasees, or any of them, and Employee agrees to indemnify and hold Releasees, and each of them, harmless from any liability, Claims, demands, damages, costs, expenses and attorneys’ fees incurred by Releasees, or any of them, as the result of any such assignment or transfer or any rights or Claims under any such assignment or transfer. It is the intention of the parties that this indemnity does not require payment as a condition precedent to recovery by the Releasees against Employee under this indemnity.

(f) No Actions. Employee represents and warrants to the Company that Employee has no pending actions, Claims or charges of any kind. Employee agrees that if Employee hereafter commences, joins in, or in any manner seeks relief through any suit arising out of, based upon, or relating to any of the Claims released hereunder or in any manner asserts against the Releasees any of the Claims released hereunder, then Employee will pay to the Releasees against whom such Claim(s) is asserted, in addition to any other damages caused thereby, all attorneys’ fees incurred by such Releasees in defending or otherwise responding to said suit or Claim; provided, however, that Employee shall not be obligated to pay the Releasees’ attorneys’ fees to the extent such fees are attributable to: (i) claims under the ADEA or a challenge to the validity of the release of claims under the ADEA; or (ii) Employee’s right to file a charge with the EEOC; however, Employee hereby waives any right to any damages or individual relief resulting from any such charge.

(g) No Admission. Employee understands and agrees that neither the payment of money nor the execution of this Release shall constitute or be construed as an admission of any liability whatsoever by the Releasees.

(h) Exceptions. Notwithstanding anything in this Release to the contrary, nothing contained in this Release shall prohibit either party (or either party’s attorney(s)) from (i) communicating directly with, filing a charge with, reporting possible violations of federal law or regulation to, participating in any investigation by, or cooperating with any Government Agency, or making other disclosures that are protected under the whistleblower provisions of applicable law or regulation, (ii) communicating directly with, cooperating with, or providing information (including trade secrets) in confidence to any Government Agencies for the purpose of reporting or investigating a suspected violation of law, or from providing such information to such party’s attorney(s) or in a sealed complaint or other document filed in a lawsuit or other governmental proceeding, and/or (iii) receiving an award for information provided to any Government Agency. Further, nothing herein will prevent Employee from participating in activity permitted by Section 7 of the National Labor Relations Act or from filing an unfair labor practice charge with the NLRB. Pursuant to 18 USC Section 1833(b), Employee will not be held criminally or civilly liable under any federal or state trade secret law for the disclosure of a trade secret that is made: (A) in confidence to a federal, state, or local government official, either directly or indirectly, or to an attorney, and solely for the purpose of reporting or investigating a suspected violation of law; or (B) in a complaint or other document filed in a lawsuit or other proceeding, if such filing is made under seal. Further, nothing in this Release is intended to or shall preclude either party from providing truthful testimony in response to a valid subpoena, court order, regulatory request or

other judicial, administrative or legal process or otherwise as required by law. If Employee is required to provide testimony, then unless otherwise directed or requested by a Government Agency or law enforcement, Employee shall notify the Company as soon as reasonably practicable after receiving any such request of the anticipated testimony. Further, nothing in this Release prevents Employee from discussing or disclosing information about unlawful acts in the workplace, such as harassment or discrimination or any other conduct that Employee has reason to believe is unlawful.

(i) Severability. The provisions of this Release are severable, and if any part of this Release is found to be unenforceable, the other paragraphs (or portions thereof) shall remain fully valid and enforceable.

IN WITNESS WHEREOF, Employee has executed this Release as of this 15th day of February, 2024.

| | | | | |

| By: | /s/ Edmond Thomas |

| Edmond Thomas |

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

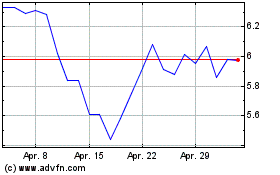

Tillys (NYSE:TLYS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

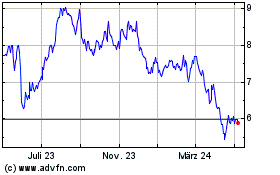

Tillys (NYSE:TLYS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024