UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM

N-CSRS

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number

811-07866

Templeton

Emerging Markets Income Fund

(Exact name of registrant as specified in charter)

300 S.E. 2nd Street, Fort Lauderdale,

FL 33301-1923

(Address of principal executive offices)(Zip code)

Alison Baur,

One Franklin Parkway,

San Mateo,

CA 94403-1906

(Name and address of agent for service)

Registrant’s telephone number, including area

code:

(954) 527-7500

Date of fiscal year end: 12/31

Date of reporting period: 6/30/24

Item 1. Reports to Stockholders.

|

a.) |

The following is a copy of the report transmitted to shareholders pursuant to Rule 30e-1

under the Investment Company Act of 1940, as amended (the “1940 Act”) (17 CFR 270.30e-1).

|

|

b.) |

Include a copy of each notice transmitted to stockholders in reliance on Rule 30e-3 under

the Act (17 CFR 270.30e-3) that contains disclosures specified by paragraph (c)(3) of that rule. |

Not Applicable.

Templeton

Emerging

Markets

Income

Fund

June

30,

2024

Not

FDIC

Insured

No

Bank

Guarantee

May

Lose

Value

Managed

Distribution

Policy

:

Until

December

31,

2023,

the

Fund

employed

a

managed

distribution

policy

whereby

the

Fund

made

distributions

to

common

shareholders

at

an

annual

minimum

fixed

rate

of

10%,

based

on

the

average

monthly

net

asset

value

(NAV)

of

the

Fund's

common

shares.

Effective

January

1,

2024,

the

Board

has

implemented

a

new

managed

distribution

plan

where

the

Fund

will

distribute

a

level

distribution

amount

to

shareholders.

The

Fund

intends

to

make

monthly

distributions

to

shareholders

at

the

fixed

rate

of

$0.0475

per

share.

Management

will

generally

distribute

amounts

necessary

to

satisfy

the

Fund's

plan

and

the

requirements

prescribed

by

excise

tax

rules

and

Subchapter

M

of

the

Internal

Revenue

Code.

The

plan

is

intended

to

provide

shareholders

with

a

consistent

distribution

each

month

and

is

intended

to

narrow

the

discount

between

the

market

price

and

the

NAV

of

the

Fund's

common

shares,

but

there

is

no

assurance

that

the

plan

will

be

successful

in

doing

so.

Under

the

managed

distribution

plan,

to

the

extent

that

sufficient

investment

income

is

not

available

on

a

monthly

basis,

the

Fund

will

distribute

long-term

capital

gains

and/or

return

of

capital

in

order

to

maintain

its

managed

distribution

rate.

No

conclusions

should

be

drawn

about

the

Fund's

investment

performance

from

the

amount

of

the

Fund's

distributions

or

from

the

terms

of

the

Fund's

managed

distribution

plan.

The

Board

may

amend

the

terms

of

the

Plan

or

terminate

the

Plan

at

any

time

without

prior

notice

to

the

Fund’s

shareholders,

however,

at

this

time

there

are

no

reasonably

foreseeable

circumstances

that

might

cause

the

termination

of

the

Plan.

The

amendment

or

termination

of

the

Plan

could

have

an

adverse

effect

on

the

market

price

of

the

Fund’s

common

shares.

The

Plan

will

be

subject

to

the

periodic

review

by

the

Board,

including

a

yearly

review

of

the

annual

minimum

fixed

rate

to

determine

if

an

adjustment

should

be

made.

Shareholders

should

not

draw

any

conclusions

about

the

Fund’s

investment

performance

from

the

amount

of

this

distribution

or

from

the

terms

of

the

Plan.

The

Fund

will

send

a

Form

1099-DIV

to

shareholders

for

the

calendar

year

that

will

describe

how

to

report

the

Fund’s

distributions

for

federal

income

tax

purposes.

Please

see

the

"Important

Information

to

Shareholders"

section

for

additional

information.

Contents

Fund

Overview

2

Performance

Summary

4

Financial

Highlights

and

Schedule

of

Investments

6

Financial

Statements

15

Notes

to

Financial

Statements

19

Important

Information

to

Shareholders

32

Annual

Meeting

of

Shareholders

34

Dividend

Reinvestment

and

Cash

Purchase

Plan

35

Shareholder

Information

37

Visit

franklintempleton.com

for

fund

updates,

to

access

your

account,

or

to

find

helpful

financial

planning

tools.

Templeton

Emerging

Markets

Income

Fund

Dear

Shareholder,

This

semiannual

report

for

Templeton

Emerging

Markets

Income

Fund

covers

the

period

ended

June

30,

2024.

Fund

Overview

Your

Fund’s

Goal

and

Main

Investments

The

Fund

seeks

high,

current

income,

with

a

secondary

goal

of

capital

appreciation,

by

investing,

under

normal

market

conditions,

at

least

80%

of

its

net

assets

in

income-

producing

securities

of

sovereign

or

sovereign-related

entities

and

private

sector

companies

in

emerging

market

countries.

For

purposes

of

the

Fund’s

80%

policy,

income-

producing

securities

of

entities

in

emerging

markets

include

derivative

instruments

or

other

investments

that

have

economic

characteristics

similar

to

such

securities.

We

invest

selectively

in

bonds

from

emerging

markets

around

the

world

to

generate

income

for

the

Fund,

seeking

opportunities

while

monitoring

changes

in

interest

rates,

currency

exchange

rates

and

credit

risk.

We

seek

to

manage

the

Fund’s

exposure

to

various

currencies

and

may

use

currency

forward

contracts.

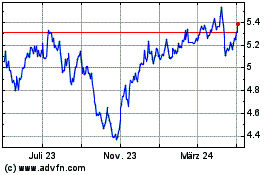

Performance

Overview

For

the

six

months

under

review,

the

Fund

posted

cumulative

total

returns

of

+10.23%

based

on

market

price

and

+3.29%

based

on

net

asset

value.

In

comparison,

U.S.

dollar-

denominated

emerging

market

bonds,

as

measured

by

the

J.P.

Morgan

(JPM)

Emerging

Markets

Bond

Index

(EMBI)

Global

Index,

posted

a

+1.84%

cumulative

total

return

in

U.S.

dollar

terms

for

the

same

period.

1

You

can

find

the

Fund’s

long-term

performance

data

in

the

Performance

Summary

on

page

4

.

Until

December

31,

2023,

the

Fund

employed

a

managed

distribution

policy

whereby

the

Fund

made

distributions

to

common

shareholders

at

an

annual

minimum

fixed

rate

of

10%,

based

on

the

average

monthly

net

asset

value

(NAV)

of

the

Fund’s

common

shares.

Effective

January

1,

2024,

the

Board

has

implemented

a

new

managed

distribution

plan

where

the

Fund

will

distribute

a

level

distribution

amount

to

shareholders.

The

Fund

intends

to

make

monthly

distributions

to

shareholders

at

the

fixed

rate

of

$0.0475

per

share.

Management

will

generally

distribute

amounts

necessary

to

satisfy

the

Fund’s

plan

and

the

requirements

prescribed

by

excise

tax

rules

and

Subchapter

M

of

the

Internal

Revenue

Code.

The

plan

is

intended

to

provide

shareholders

with

a

consistent

distribution

each

month

and

is

intended

to

narrow

the

discount

between

the

market

price

and

the

NAV

of

the

Fund’s

common

shares,

but

there

is

no

assurance

that

the

plan

will

be

successful

in

doing

so.

Please

see

“Important

Information

to

Shareholders”

section

for

additional

information.

Performance

data

represent

past

performance,

which

does

not

guarantee

future

results.

Investment

return

and

principal

value

will

fluctuate,

and

you

may

have

a

gain

or

loss

when

you

sell

your

shares.

Current

performance

may

differ

from

figures

shown.

Portfolio

Composition

6/30/24

%

of

Total

Net

Assets

Foreign

Government

and

Agency

Securities

95.3%

Corporate

Bonds

5.8%

Common

Stocks

1.8%

Other

*,†

0.0%

Short-Term

Investments

&

Other

Net

Assets

‡

-2.9%

*

Rounds

to

less

than

0.1%.

†

Categories

within

the

Other

category

are

listed

in

full

in

the

Fund’s

Schedule

of

Investments

(SOI),

which

can

be

found

later

in

this

report.

‡

Includes

U.S.

and

foreign

government

and

agency

securities,

money

market

funds

and

other

net

assets

(including

derivatives).

Geographic

Composition

6/30/24

%

of

Total

Net

Assets

Americas

37.1%

Middle

East

&

Africa

36.3%

Asia

Pacific

21.2%

Other

Europe

4.5%

Supranational

3.8%

Short-Term

Investments

&

Other

Net

Assets

-2.9%

1.

Source:

Morningstar.

The

index

is

unmanaged

and

includes

reinvestment

of

any

income

or

distributions.

It

does

not

reflect

any

fees,

expenses

or

sales

charges.

One

cannot

invest

directly

in

an

index,

and

an

index

is

not

representative

of

the

Fund’s

portfolio.

Important

data

provider

notices

and

terms

available

at

www.franklintempletondatasources.com.

The

dollar

value,

number

of

shares

or

principal

amount,

and

names

of

all

portfolio

holdings

are

listed

in

the

Fund’s

Schedule

of

Investments

(SOI).

The

SOI

begins

on

page

7

.

Templeton

Emerging

Markets

Income

Fund

Thank

you

for

your

continued

participation

in

Templeton

Emerging

Markets

Income

Fund.

We

look

forward

to

serving

your

future

investment

needs.

Sincerely,

Michael

Hasenstab,

Ph.D.

Lead

Portfolio

Manager

Calvin

Ho,

Ph.D.

Portfolio

Manager

Top

10

Countries*

6/30/24

a

%

of

Total

Net

Assets

a

a

Ecuador

8.9%

South

Africa

7.8%

Mexico

7.7%

Kazakhstan

5.7%

Oman

5.7%

India

5.2%

Dominican

Republic

5.1%

Brazil

4.7%

Uzbekistan

4.2%

Ivory

Coast

3.9%

*

Does

not

include

cash

and

cash

equivalents.

Performance

Summary

as

of

June

30,

2024

Templeton

Emerging

Markets

Income

Fund

Total

return

reflects

reinvestment

of

the

Fund’s

dividends

and

capital

gain

distributions,

if

any,

and

any

unrealized

gains

or

losses.

Total

returns

do

not

reflect

any

sales

charges

paid

at

inception

or

brokerage

commissions

paid

on

secondary

market

purchases.

The

performance

tables

and

graph

do

not

reflect

any

taxes

that

a

shareholder

would

pay

on

Fund

dividends,

capital

gain

distributions,

if

any,

or

any

realized

gains

on

the

sale

of

Fund

shares.

Your

dividend

income

will

vary

depending

on

dividends

or

interest

paid

by

securities

in

the

Fund’s

portfolio,

adjusted

for

operating

expenses.

Capital

gain

distributions

are

net

profits

realized

from

the

sale

of

portfolio

securities.

Performance

as

of

6/30/24

1

Performance

data

represent

past

performance,

which

does

not

guarantee

future

results.

Investment

return

and

principal

value

will

fluctuate,

and

you

may

have

a

gain

or

loss

when

you

sell

your

shares.

Current

performance

may

differ

from

figures

shown.

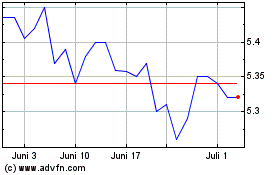

Share

Prices

Cumulative

Total

Return

2

Average

Annual

Total

Return

2

Based

on

NAV

3

Based

on

market

price

4

Based

on

NAV

3

Based

on

market

price

4

6-Month

+3.29%

+10.23%

+3.29%

+10.23%

1-Year

+11.75%

+15.53%

+11.75%

+15.53%

5-Year

-17.34%

-14.81%

-3.74%

-3.16%

10-Year

-10.47%

-6.43%

-1.10%

-0.66%

Symbol:

TEI

6/30/24

12/31/23

Change

Net

Asset

Value

(NAV)

$5.81

$5.90

-$0.09

Market

Price

(NYSE)

$5.33

$5.10

$0.23

Distributions

Per

Share

(1/1/24–6/30/24)

Net

Investment

Income

$0.2850

See

page

5

for

Performance

Summary

footnotes.

Templeton

Emerging

Markets

Income

Fund

Performance

Summary

Events

such

as

the

spread

of

deadly

diseases,

disasters,

and

financial,

political

or

social

disruptions,

may

heighten

risks

and

adversely

affect

performance.

The

Fund

is

actively

managed

but

there

is

no

guarantee

that

the

manager’s

investment

decisions

will

produce

the

desired

results.

All

investments

involve

risks,

including

possible

loss

of

principal.

Fixed

income

securities

involve

interest

rate,

credit,

inflation

and

reinvestment

risks,

and

possible

loss

of

principal.

As

interest

rates

rise,

the

value

of

fixed

income

securities

falls.

International

investments

are

subject

to

special

risks,

including

currency

fluctuations

and

social,

economic

and

political

uncertainties,

which

could

increase

volatility.

These

risks

are

magnified

in

emerging

markets.

Liquidity

risk

exists

when

securities

or

other

investments

become

more

difficult

to

sell,

or

are

unable

to

be

sold,

at

the

price

at

which

they

have

been

valued.

Derivative

instruments

can

be

illiquid,

may

disproportionate-

ly

increase

losses,

and

have

a

potentially

large

impact

on

performance.

The

manager

may

consider

environmental,

social

and

governance

(ESG)

criteria

in

the

research

or

investment

process;

however,

ESG

considerations

may

not

be

a

determinative

factor

in

security

selection.

In

addition,

the

manager

may

not

assess

every

investment

for

ESG

criteria,

and

not

every

ESG

factor

may

be

identified

or

evaluated.

The

Fund

may

invest

in

China

Interbank

bonds

traded

on

the

China

Interbank

Bond

Market

(“CIBM”)

through

the

China

–

Hong

Kong

Bond

Connect

program

(“Bond

Con-

nect”).

In

China,

the

Hong

Kong

Monetary

Authority

Central

Money

Markets

Unit

holds

Bond

Connect

securities

on

behalf

of

ultimate

investors

(such

as

the

Fund)

in

accounts

maintained

with

a

China-based

custodian

(either

the

China

Central

Depository

&

Clearing

Co.

or

the

Shanghai

Clearing

House).

This

recordkeeping

system

subjects

the

Fund

to

various

risks,

including

the

risk

that

the

Fund

may

have

a

limited

ability

to

enforce

rights

as

a

bondholder

and

the

risks

of

settlement

delays

and

counterparty

default

of

the

Hong

Kong

sub-custodian.

In

addition,

enforcing

the

ownership

rights

of

a

beneficial

holder

of

Bond

Connect

securities

is

untested

and

courts

in

China

have

limited

experi-

ence

in

applying

the

concept

of

beneficial

ownership.

Bond

Connect

uses

the

trading

infrastructure

of

both

Hong

Kong

and

China

and

is

not

available

on

trading

holidays

in

Hong

Kong.

As

a

result,

prices

of

securities

purchased

through

Bond

Connect

may

fluctuate

at

times

when

a

Fund

is

unable

to

add

to

or

exit

its

position.

Securities

offered

through

Bond

Connect

may

lose

their

eligibility

for

trading

through

the

program

at

any

time.

If

Bond

Connect

securities

lose

their

eligibility

for

trading

through

the

program,

they

may

be

sold

but

can

no

longer

be

purchased

through

Bond

Connect.

Bond

Connect

is

subject

to

regulation

by

both

Hong

Kong

and

China

and

there

can

be

no

assurance

that

further

regulations

will

not

affect

the

availability

of

securities

in

the

program,

the

frequency

of

redemptions

or

other

limitations.

Bond

Connect

trades

are

settled

in

Chinese

currency,

the

renminbi

(“RMB”).

It

cannot

be

guaranteed

that

inves-

tors

will

have

timely

access

to

a

reliable

supply

of

RMB

in

Hong

Kong.

Bond

Connect

is

relatively

new

and

its

effects

on

the

Chinese

interbank

bond

market

are

uncertain.

In

addition,

the

trading,

settlement

and

IT

systems

required

for

non-Chinese

investors

in

Bond

Connect

are

relatively

new.

In

the

event

of

systems

malfunctions,

trading

via

Bond

Connect

could

be

disrupted.

In

addition,

the

Bond

Connect

program

may

be

subject

to

further

interpretation

and

guidance.

There

can

be

no

assurance

as

to

the

program’s

continued

existence

or

whether

future

developments

regarding

the

program

may

restrict

or

adversely

affect

the

Fund’s

investments

or

returns.

Finally,

uncertainties

in

China

tax

rules

governing

taxation

of

income

and

gains

from

investments

via

Bond

Connect

could

result

in

unexpected

tax

liabilities

for

a

Fund.

The

application

and

interpretation

of

the

laws

and

regulations

of

Hong

Kong

and

China,

and

the

rules,

policies

or

guidelines

published

or

applied

by

relevant

regulators

and

exchanges

in

respect

of

the

Bond

Connect

program,

are

uncertain,

and

may

have

a

detrimental

effect

on

the

Fund’s

investments

and

returns.

1.

Gross

expenses

are

the

Fund’s

total

annual

operating

expenses

as

of

the

Fund's

annual

report

available

at

the

time

of

publication.

Actual

expenses

may

be

higher

and

may

impact

portfolio

returns.

Net

expenses

reflect

voluntary

fee

waivers,

expense

caps

and/or

reimbursements.

Voluntary

waivers

may

be

modified

or

discontinued

at

any

time

without

notice.

2.

Total

return

calculations

represent

the

cumulative

and

average

annual

changes

in

value

of

an

investment

over

the

periods

indicated.

Return

for

less

than

one

year,

if

any,

has

not

been

annualized.

3.

Assumes

reinvestment

of

distributions

based

on

net

asset

value.

4.

Assumes

reinvestment

of

distributions

based

on

the

dividend

reinvestment

and

cash

purchase

plan.

Important

data

provider

notices

and

terms

available

at

www.franklintempletondatasources.com.

Templeton

Emerging

Markets

Income

Fund

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

Six

Months

Ended

June

30,

2024

(unaudited)

Year

Ended

December

31,

2023

2022

2021

2020

2019

Per

share

operating

performance

(for

a

share

outstanding

throughout

the

period)

Net

asset

value,

beginning

of

period

.....

$5.90

$5.72

$7.58

$8.92

$9.95

$10.93

Income

from

investment

operations:

Net

investment

income

a

.............

0.29

0.43

0.45

0.55

0.38

0.66

Net

realized

and

unrealized

gains

(losses)

(0.09)

0.32

(1.67)

(1.13)

(0.84)

(0.86)

Total

from

investment

operations

........

0.20

0.75

(1.22)

(0.58)

(0.46)

(0.20)

Less

distributions

from:

Net

investment

income

and

net

foreign

currency

gains

....................

(0.29)

(0.28)

—

—

(0.37)

(0.78)

Tax

return

of

capital

................

—

(0.29)

(0.65)

(0.76)

(0.20)

—

Total

distributions

...................

(0.29)

(0.57)

(0.65)

(0.76)

(0.57)

(0.78)

Repurchase

of

shares

..............

—

—

b

0.01

—

—

—

Net

asset

value,

end

of

period

..........

$5.81

$5.90

$5.72

$7.58

$8.92

$9.95

Market

value,

end

of

period

c

...........

$5.33

$5.10

$5.49

$7.29

$7.77

$9.19

Total

return

(based

on

net

asset

value

per

share)

d

...........................

3.29%

13.95%

(16.19)%

(6.78)%

(6.14)%

(0.33)%

Total

return

(based

on

market

value

per

share)

d

...........................

10.23%

3.82%

(15.55)%

3.59%

(9.08)%

3.48%

Ratios

to

average

net

assets

e

Expenses

before

waiver

and

payments

by

affiliates

..........................

2.39%

2.32%

1.40%

1.23%

1.17%

1.17%

Expenses

net

of

waiver

and

payments

by

affiliates

..........................

2.37%

2.30%

1.38%

1.22%

1.14%

1.06%

Net

investment

income

...............

9.75%

7.65%

7.11%

6.68%

4.22%

6.20%

Supplemental

data

Net

assets,

end

of

period

(000’s)

........

$274,399

$278,680

$272,330

$363,759

$428,098

$477,471

Portfolio

turnover

rate

................

27.19%

48.95%

35.83%

70.97%

56.68%

27.69%

Total

credit

facility

and

reverse

repurchase

agreements

outstanding

at

end

of

period

(000’s)

...........................

$50,000

$50,000

$36,000

$36,000

$—

$—

Asset

coverage

per

$1,000

of

debt

......

$6,488

$6,574

$8,565

$11,133

$—

$—

a

Based

on

average

daily

shares

outstanding.

b

Amount

rounds

to

less

than

$0.01

per

share.

c

Based

on

the

last

sale

on

the

New

York

Stock

Exchange.

d

The

Market

Value

Total

Return

is

calculated

assuming

a

purchase

of

common

shares

on

the

opening

of

the

first

business

day

and

a

sale

on

the

closing

of

the

last

business

day

of

each

period.

Dividends

and

distributions

are

assumed

for

the

purposes

of

this

calculation

to

be

reinvested

at

prices

obtained

under

the

Fund's

Dividend

Reinvestment

and

Cash

Purchase

Plan.

Net

Asset

Value

Total

Return

is

calculated

on

the

same

basis,

except

that

the

Fund's

net

asset

value

is

used

on

the

purchase,

sale

and

dividend

reinvestment

dates

instead

of

market

value.

Total

return

does

not

reflect

brokerage

commissions

or

sales

charges

in

connection

with

the

purchase

or

sale

of

Fund

shares.

Total

return

is

not

annualized

for

periods

less

than

one

year.

e

Ratios

are

annualized

for

periods

less

than

one

year.

Templeton

Emerging

Markets

Income

Fund

Schedule

of

Investments

(unaudited),

June

30,

2024

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

a

a

Industry

Shares

a

Value

a

Common

Stocks

1.8%

South

Africa

1.8%

a,b,c

K2016470219

South

Africa

Ltd.,

A

....

Broadline

Retail

93,760,463

$

—

a,b,c

K2016470219

South

Africa

Ltd.,

B

....

Broadline

Retail

161,018,517

—

b

Platinum

Group

Metals

Ltd.,

(CAD

Traded)

......................

Metals

&

Mining

2,359,882

3,949,810

b

Platinum

Group

Metals

Ltd.,

(USD

Traded)

......................

Metals

&

Mining

469,750

798,575

b,d

Platinum

Group

Metals

Ltd.,

(USD

Traded),

144A

.................

Metals

&

Mining

48,837

81,740

4,830,125

Total

Common

Stocks

(Cost

$5,513,828)

.......................................

4,830,125

Principal

Amount

*

a

a

a

a

a

Corporate

Bonds

5.8%

Bermuda

0.0%

†

Digicel

Group

Holdings

Ltd.

,

Zero

Cpn

.,

11/17/33

.............

Wireless

Telecommunication

Services

589,385

31,052

Zero

Cpn

.,

11/17/33

.............

Wireless

Telecommunication

Services

231,230

67,402

98,454

Costa

Rica

3.8%

a,c

Reventazon

Finance

Trust

,

Senior

Secured

Bond

,

144A,

8

%

,

11/15/33

.

Financial

Services

10,467,360

10,494,731

South

Africa

0.0%

a,d,e,f

K2016470219

South

Africa

Ltd.

,

Senior

Secured

Note,

144A,

PIK,

3%,

12/31/22

.....................

Broadline

Retail

8,125,247

—

Senior

Secured

Note,

144A,

PIK,

8%,

12/31/22

.....................

Broadline

Retail

2,886,099

EUR

—

a,d,e,f

K2016470260

South

Africa

Ltd.

,

Senior

Secured

Note

,

144A,

PIK,

25

%

,

12/31/22

.....................

Broadline

Retail

61,769,102

—

—

United

Kingdom

2.0%

a,d

ICBC

Standard

Bank

plc

,

Note

,

144A,

Reg

S,

15

%

,

4/15/26

............

Banks

68,200,000,000

UZS

5,393,199

Total

Corporate

Bonds

(Cost

$50,387,197)

......................................

15,986,384

a

a

Industry

Principal

Amount

*

a

Value

Foreign

Government

and

Agency

Securities

95.3%

Argentina

2.8%

Argentina

Government

Bond

,

Senior

Bond,

3.625%,

7/09/35

.....

16,852,222

7,099,617

Senior

Note,

0.75%,

7/09/30

......

967,775

547,286

7,646,903

Benin

2.8%

d

Benin

Government

Bond

,

Senior

Bond,

144A,

4.875%,

1/19/32

5,340,000

EUR

4,805,799

Senior

Bond,

144A,

4.95%,

1/22/35

.

1,410,000

EUR

1,197,931

Templeton

Emerging

Markets

Income

Fund

Schedule

of

Investments

(unaudited)

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Industry

Principal

Amount

*

a

Value

a

a

a

a

a

a

Foreign

Government

and

Agency

Securities

(continued)

Benin

(continued)

d

Benin

Government

Bond,

(continued)

Senior

Bond,

144A,

6.875%,

1/19/52

2,070,000

EUR

$

1,753,704

7,757,434

Brazil

4.7%

Brazil

Notas

do

Tesouro

Nacional

,

10%,

1/01/31

..................

62,380,000

BRL

10,098,733

F,

10%,

1/01/29

................

16,530,000

BRL

2,757,620

12,856,353

Colombia

1.0%

Colombia

Titulos

de

Tesoreria

,

B,

7.25%,

10/18/34

.............

4,572,000,000

COP

866,446

B,

6.25%,

7/09/36

..............

1,386,000,000

COP

230,593

B,

9.25%,

5/28/42

..............

8,661,000,000

COP

1,741,154

2,838,193

Dominican

Republic

5.1%

d

Dominican

Republic

Government

Bond,

Senior

Bond,

Reg

S,

6.85%,

1/27/45

14,000,000

13,832,922

Ecuador

8.9%

d

Ecuador

Government

Bond

,

Senior

Bond,

144A,

3.5%,

7/31/35

..

30,733,500

15,371,432

Senior

Note,

144A,

6%,

7/31/30

....

14,039,700

8,927,817

24,299,249

Egypt

2.7%

Egypt

Government

Bond

,

25.151%,

4/16/27

...............

213,900,000

EGP

4,425,834

d

Senior

Bond,

144A,

8.75%,

9/30/51

.

2,960,000

2,236,187

d

Senior

Bond,

144A,

7.5%,

2/16/61

..

1,130,000

760,083

7,422,104

El

Salvador

0.7%

d

El

Salvador

Government

Bond,

Senior

Bond,

144A,

7.65%,

6/15/35

.......

2,650,000

1,928,683

Gabon

2.3%

d

Gabon

Government

Bond

,

Senior

Bond,

144A,

6.95%,

6/16/25

.

1,070,000

983,323

Senior

Bond,

144A,

6.625%,

2/06/31

3,650,000

2,756,227

Senior

Bond,

144A,

7%,

11/24/31

...

3,480,000

2,627,270

6,366,820

Ghana

1.6%

e

Ghana

Government

Bond

,

PIK,

8.35%,

2/16/27

.............

16,469,012

GHS

681,744

PIK,

8.5%,

2/15/28

..............

16,493,318

GHS

591,666

PIK,

8.65%,

2/13/29

.............

16,031,176

GHS

509,595

PIK,

5%,

2/12/30

...............

16,054,800

GHS

468,278

PIK,

8.95%,

2/11/31

.............

15,050,905

GHS

405,170

PIK,

9.1%,

2/10/32

..............

15,073,052

GHS

382,664

PIK,

9.25%,

2/08/33

.............

15,095,216

GHS

366,246

PIK,

9.4%,

2/07/34

..............

8,256,612

GHS

193,917

Templeton

Emerging

Markets

Income

Fund

Schedule

of

Investments

(unaudited)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

a

a

Industry

Principal

Amount

*

a

Value

a

a

a

a

a

a

Foreign

Government

and

Agency

Securities

(continued)

Ghana

(continued)

e

Ghana

Government

Bond,

(continued)

PIK,

9.55%,

2/06/35

.............

8,268,735

GHS

$

189,947

PIK,

9.7%,

2/05/36

..............

8,280,866

GHS

187,596

PIK,

9.85%,

2/03/37

.............

8,293,007

GHS

186,464

PIK,

10%,

2/02/38

..............

8,305,156

GHS

186,263

4,349,550

India

5.2%

India

Government

Bond

,

7.26%,

1/14/29

................

778,000,000

INR

9,426,143

Senior

Bond,

7.18%,

8/14/33

......

399,000,000

INR

4,829,872

14,256,015

Indonesia

3.3%

Indonesia

Government

Bond

,

FR59,

7%,

5/15/27

..............

1,445,000,000

IDR

89,151

FR73,

8.75%,

5/15/31

...........

3,985,000,000

IDR

266,062

FR82,

7%,

9/15/30

..............

4,047,000,000

IDR

247,288

FR87,

6.5%,

2/15/31

............

6,848,000,000

IDR

405,316

FR91,

6.375%,

4/15/32

..........

19,224,000,000

IDR

1,130,847

FR96,

7%,

2/15/33

..............

113,576,000,000

IDR

6,906,808

9,045,472

Ivory

Coast

3.9%

d

Ivory

Coast

Government

Bond

,

Senior

Bond,

144A,

5.25%,

3/22/30

.

2,500,000

EUR

2,442,777

Senior

Bond,

144A,

5.875%,

10/17/31

4,000,000

EUR

3,873,312

Senior

Bond,

144A,

4.875%,

1/30/32

5,000,000

EUR

4,496,424

10,812,513

Kazakhstan

5.7%

Kazakhstan

MEOKAM

,

10.67%,

1/21/26

................

123,900,000

KZT

252,303

15.35%,

11/18/27

...............

21,000,000

KZT

47,134

Kazakhstan

MEUKAM

,

9%,

7/03/27

...................

283,500,000

KZT

545,681

10.4%,

4/12/28

................

738,400,000

KZT

1,455,203

15.3%,

3/03/29

................

1,819,600,000

KZT

4,170,654

10.55%,

7/28/29

................

771,400,000

KZT

1,498,820

11%,

2/04/30

..................

523,000,000

KZT

1,032,680

12%,

3/07/30

..................

889,500,000

KZT

1,820,027

10.3%,

3/17/31

................

570,900,000

KZT

1,078,006

14%,

5/12/31

..................

582,100,000

KZT

1,302,662

Senior

Bond,

5.49%,

3/27/27

......

706,000,000

KZT

1,253,758

Senior

Bond,

5.5%,

9/20/28

.......

301,700,000

KZT

495,268

Senior

Bond,

7.68%,

8/13/29

......

438,100,000

KZT

760,570

15,712,766

Kenya

3.0%

d

Kenya

Government

Bond,

Senior

Note,

144A,

9.75%,

2/16/31

............

8,540,000

8,203,311

Mexico

7.7%

Mexican

Bonos

,

M,

10%,

11/20/36

...............

17,130,000

MXN

943,450

Templeton

Emerging

Markets

Income

Fund

Schedule

of

Investments

(unaudited)

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

a

a

Industry

Principal

Amount

*

a

Value

a

a

a

a

a

a

Foreign

Government

and

Agency

Securities

(continued)

Mexico

(continued)

Mexican

Bonos,

(continued)

M,

Senior

Bond,

7.75%,

11/23/34

...

53,170,000

MXN

$

2,503,470

Mexican

Bonos

Desarr

Fixed

Rate

,

M,

7.5%,

5/26/33

...............

85,760,000

MXN

4,038,040

M,

Senior

Bond,

8.5%,

5/31/29

.....

8,900,000

MXN

458,264

M,

Senior

Bond,

8.5%,

11/18/38

....

31,390,000

MXN

1,522,006

M,

Senior

Bond,

7.75%,

11/13/42

...

67,590,000

MXN

2,979,429

Petroleos

Mexicanos

,

Senior

Note,

6.84%,

1/23/30

................

9,790,000

8,624,461

21,069,120

Mongolia

2.2%

d

Mongolia

Government

Bond

,

Senior

Bond,

144A,

4.45%,

7/07/31

.

5,570,000

4,703,865

Senior

Note,

144A,

5.125%,

4/07/26

.

200,000

194,200

Senior

Note,

144A,

3.5%,

7/07/27

..

1,380,000

1,244,070

6,142,135

Oman

5.7%

d

Oman

Government

Bond,

Senior

Bond,

144A,

4.75%,

6/15/26

............

15,970,000

15,676,412

Panama

2.4%

Panama

Government

Bond

,

Senior

Bond,

6.4%,

2/14/35

.......

920,000

873,891

Senior

Bond,

6.7%,

1/26/36

.......

4,030,000

3,920,700

Senior

Bond,

6.875%,

1/31/36

.....

1,770,000

1,732,816

6,527,407

Romania

2.5%

d

Romania

Government

Bond

,

144A,

1.75%,

7/13/30

............

950,000

EUR

832,481

144A,

2.75%,

4/14/41

............

1,420,000

EUR

990,374

144A,

2.875%,

4/13/42

...........

7,350,000

EUR

5,133,831

6,956,686

Seychelles

1.0%

d

Seychelles

International

Bond,

Senior

Bond,

Reg

S,

8%,

1/01/26

........

2,620,680

2,643,123

South

Africa

6.0%

South

Africa

Government

Bond

,

Senior

Bond,

8.875%,

2/28/35

.....

142,300,000

ZAR

6,622,197

Senior

Bond,

8.5%,

1/31/37

.......

83,390,000

ZAR

3,607,559

Senior

Bond,

9%,

1/31/40

........

146,300,000

ZAR

6,341,589

16,571,345

Sri

Lanka

0.6%

d,f

Sri

Lanka

Government

Bond

,

Senior

Bond,

144A,

6.2%,

5/11/27

..

2,420,000

1,426,455

Senior

Bond,

144A,

6.75%,

4/18/28

.

200,000

118,090

Senior

Bond,

144A,

7.85%,

3/14/29

.

291,000

173,290

1,717,835

Templeton

Emerging

Markets

Income

Fund

Schedule

of

Investments

(unaudited)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

a

a

Industry

Principal

Amount

*

a

Value

a

a

a

a

a

a

Foreign

Government

and

Agency

Securities

(continued)

Supranational

3.8%

g

Asian

Development

Bank,

Senior

Note,

11.75%,

7/24/24

................

43,233,000,000

COP

$

10,419,291

Uganda

3.2%

Uganda

Government

Bond

,

14.25%,

8/23/29

................

229,000,000

UGX

59,709

16%,

11/14/30

.................

2,987,000,000

UGX

822,929

17%,

4/03/31

..................

248,000,000

UGX

71,094

14.375%,

2/03/33

...............

8,797,000,000

UGX

2,208,338

16%,

5/14/37

..................

21,232,000,000

UGX

5,561,336

8,723,406

Uzbekistan

4.2%

d

Uzbekistan

Government

Bond

,

Senior

Note,

144A,

14%,

7/19/24

...

107,400,000,000

UZS

8,616,392

Senior

Note,

144A,

16.25%,

10/12/26

34,790,000,000

UZS

2,818,567

11,434,959

Zambia

2.3%

Zambia

Government

Bond,

14%,

11/23/27

.....................

182,000,000

ZMW

6,276,338

Total

Foreign

Government

and

Agency

Securities

(Cost

$283,489,210)

............

261,486,345

Shares

Escrows

and

Litigation

Trusts

0.0%

a,b

K2016470219

South

Africa

Ltd.,

Escrow

Account

......................

1,140,749

—

Total

Escrows

and

Litigation

Trusts

(Cost

$–)

...................................

—

Total

Long

Term

Investments

(Cost

$339,390,235)

...............................

282,302,854

Short

Term

Investments

11.8%

a

a

Industry

Principal

Amount

*

a

Value

a

a

a

a

a

a

Foreign

Government

and

Agency

Securities

9.9%

Egypt

9.9%

h

Egypt

Treasury

Bills

,

3/04/25

......................

647,200,000

EGP

11,513,373

3/18/25

......................

884,475,000

EGP

15,602,246

27,115,619

Total

Foreign

Government

and

Agency

Securities

(Cost

$26,771,599)

..............

27,115,619

Templeton

Emerging

Markets

Income

Fund

Schedule

of

Investments

(unaudited)

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Short

Term

Investments

(continued)

a

a

Industry

Shares

a

Value

a

a

a

a

a

a

Money

Market

Funds

1.9%

United

States

1.9%

i,j

Institutional

Fiduciary

Trust

-

Money

Market

Portfolio,

4.972%

.........

5,304,129

$

5,304,129

Total

Money

Market

Funds

(Cost

$5,304,129)

...................................

5,304,129

a

a

a

a

a

Total

Short

Term

Investments

(Cost

$32,075,728

)

................................

32,419,748

a

a

a

Total

Investments

(Cost

$371,465,963)

114.7%

..................................

$314,722,602

k

Credit

Facility

(18.2)%

........................................................

(50,000,000)

Other

Assets,

less

Liabilities

3.5%

.............................................

9,676,089

Net

Assets

100.0%

...........................................................

$274,398,691

a

a

a

*

The

principal

amount

is

stated

in

U.S.

dollars

unless

otherwise

indicated.

†

Rounds

to

less

than

0.1%

of

net

assets.

a

Fair

valued

using

significant

unobservable

inputs.

See

Note

11

regarding

fair

value

measurements.

b

Non-income

producing.

c

See

Note

8

regarding

restricted

securities.

d

Security

was

purchased

pursuant

to

Rule

144A

or

Regulation

S

under

the

Securities

Act

of

1933.

144A

securities

may

be

sold

in

transactions

exempt

from

registration

only

to

qualified

institutional

buyers

or

in

a

public

offering

registered

under

the

Securities

Act

of

1933.

Regulation

S

securities

cannot

be

sold

in

the

United

States

without

either

an

effective

registration

statement

filed

pursuant

to

the

Securities

Act

of

1933,

or

pursuant

to

an

exemption

from

registration.

At

June

30,

2024,

the

aggregate

value

of

these

securities

was

$126,243,291,

representing

46.0%

of

net

assets.

e

Income

may

be

received

in

additional

securities

and/or

cash.

f

Defaulted

security

or

security

for

which

income

has

been

deemed

uncollectible.

See

Note

6.

g

A

supranational

organization

is

an

entity

formed

by

two

or

more

central

governments

through

international

treaties.

h

The

security

was

issued

on

a

discount

basis

with

no

stated

coupon

rate.

i

See

Note

3(c)

regarding

investments

in

affiliated

management

investment

companies.

j

The

rate

shown

is

the

annualized

seven-day

effective

yield

at

period

end.

k

See

Note

10

regarding

Credit

Facility.

Templeton

Emerging

Markets

Income

Fund

Schedule

of

Investments

(unaudited)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

At

June

30,

2024,

the

Fund

had

the

following

forward

exchange

contracts

outstanding.

See

Note

1(c).

Forward

Exchange

Contracts

Currency

Counter-

party

a

Type

Quantity

Contract

Amount

*

Settlement

Date

Unrealized

Appreciation

Unrealized

Depreciation

a

a

a

a

a

a

a

a

OTC

Forward

Exchange

Contracts

Indian

Rupee

......

HSBK

Buy

1,382,976,200

16,539,414

7/05/24

$

49,013

$

—

Indian

Rupee

......

HSBK

Sell

1,382,976,200

16,580,460

7/05/24

—

(7,967)

Chilean

Peso

......

HSBK

Buy

1,845,200,000

2,044,022

7/08/24

—

(82,973)

Malaysian

Ringgit

...

GSCO

Buy

51,620,000

11,002,878

7/11/24

—

(59,249)

Thai

Baht

.........

DBAB

Buy

465,792,000

12,766,181

7/11/24

—

(77,961)

Hungarian

Forint

....

BNDP

Buy

6,043,670,000

16,696,517

7/15/24

—

(317,537)

Chilean

Peso

......

HSBK

Buy

1,499,500,000

1,616,363

7/18/24

—

(22,365)

Chilean

Peso

......

JPHQ

Buy

1,695,700,000

1,827,952

7/18/24

—

(25,389)

Chilean

Peso

......

JPHQ

Buy

2,227,600,000

2,380,678

7/24/24

—

(12,380)

Columbian

Peso

....

GSCO

Buy

31,120,000,000

7,994,862

7/30/24

—

(532,130)

Columbian

Peso

....

JPHQ

Buy

20,699,500,000

5,316,493

7/30/24

—

(352,649)

Columbian

Peso

....

MSCO

Buy

45,760,000,000

11,758,962

7/30/24

—

(785,485)

Brazilian

Real

......

JPHQ

Buy

15,260,000

2,956,241

8/02/24

—

(236,550)

Brazilian

Real

......

MSCO

Buy

44,800,000

8,676,201

8/02/24

—

(691,785)

Indian

Rupee

......

HSBK

Buy

356,808,577

4,262,131

8/06/24

12,605

—

Indian

Rupee

......

CITI

Buy

837,760,460

10,003,110

9/18/24

19,390

—

Malaysian

Ringgit

...

GSCO

Buy

43,100,000

9,161,636

9/18/24

—

(5,831)

Thai

Baht

.........

HSBK

Buy

11,500,000

325,006

9/18/24

—

(10,420)

South

Korean

Won

..

DBAB

Buy

17,292,000,000

12,600,743

9/19/24

—

(16,093)

South

Korean

Won

..

HSBK

Buy

526,000,000

403,805

9/19/24

—

(20,996)

Indian

Rupee

......

HSBK

Buy

1,382,976,200

16,535,855

10/03/24

963

—

Uruguayan

Peso

....

HSBK

Buy

565,240,000

14,472,923

10/25/24

—

(292,814)

Total

Forward

Exchange

Contracts

...................................................

$81,971

$(3,550,574)

Net

unrealized

appreciation

(depreciation)

............................................

$(3,468,603)

*

In

U.S.

dollars

unless

otherwise

indicated.

a

May

be

comprised

of

multiple

contracts

with

the

same

counterparty,

currency

and

settlement

date.

Templeton

Emerging

Markets

Income

Fund

Schedule

of

Investments

(unaudited)

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

At

June

30,

2024,

the

Fund

had

the

following

interest

rate

swap

contracts

outstanding.

See

Note

1(c).

See

Abbreviations

on

page

31

.

See

Not

e

9

re

garding

other

derivative

information.

Interest

Rate

Swap

Contracts

Description

Payment

Frequency

Counter-

party

Maturity

Date

Notional

Amount

*

Value

Upfront

Payments

(Receipts)

Unrealized

Appreciation

(Depreciation)

aa

aa

aa

aa

Centrally

Cleared

Swap

Contracts

Receive

Fixed

7.565%

.

At

Maturity

Pay

Floating

1-day

BRL

CDI

..............

At

Maturity

1/02/25

8,093,521

BRL

$

(211,520)

$

—

$

(211,520)

Receive

Fixed

7.62%

..

At

Maturity

Pay

Floating

1-day

BRL

CDI

..............

At

Maturity

1/02/25

7,983,000

BRL

(204,648)

—

(204,648)

Receive

Fixed

7.625%

.

At

Maturity

Pay

Floating

1-day

BRL

CDI

..............

At

Maturity

1/02/25

9,180,972

BRL

(236,091)

—

(236,091)

Receive

Fixed

8.19%

..

At

Maturity

Pay

Floating

1-day

BRL

CDI

..............

At

Maturity

1/04/27

900,000

BRL

(34,362)

—

(34,362)

Receive

Fixed

8.675%

.

Quarterly

Pay

Floating

1-day

IBR

Quarterly

9/25/28

130,500,000,000

COP

535,522

—

535,522

Receive

Fixed

8.37%

..

At

Maturity

Pay

Floating

1-day

BRL

CDI

..............

At

Maturity

1/02/29

1,443,981

BRL

(77,105)

—

(77,105)

Receive

Fixed

8.405%

.

At

Maturity

Pay

Floating

1-day

BRL

CDI

..............

At

Maturity

1/02/29

2,006,000

BRL

(105,999)

—

(105,999)

Receive

Fixed

8.45%

..

At

Maturity

Pay

Floating

1-day

BRL

CDI

..............

At

Maturity

1/02/29

1,795,371

BRL

(93,817)

—

(93,817)

Receive

Fixed

8.485%

.

At

Maturity

Pay

Floating

1-day

BRL

CDI

..............

At

Maturity

1/02/29

955,784

BRL

(49,526)

—

(49,526)

Total

Interest

Rate

Swap

Contracts

....................................

$(477,546)

$

—

$(477,546)

*

In

U.S.

dollars

unless

otherwise

indicated.

Templeton

Emerging

Markets

Income

Fund

Financial

Statements

Statement

of

Assets

and

Liabilities

June

30,

2024

(unaudited)

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Semiannual

Report

Templeton

Emerging

Markets

Income

Fund

Assets:

Investments

in

securities:

Cost

-

Unaffiliated

issuers

...................................................................

$366,161,834

Cost

-

Non-controlled

affiliates

(Note

3

c

)

........................................................

5,304,129

Value

-

Unaffiliated

issuers

..................................................................

$309,418,473

Value

-

Non-controlled

affiliates

(Note

3

c

)

.......................................................

5,304,129

Foreign

currency,

at

value

(cost

$969,150)

........................................................

912,845

Receivables:

Interest

.................................................................................

8,991,007

Deposits

with

brokers

for:

OTC

derivative

contracts

..................................................................

3,190,308

Centrally

cleared

swap

contracts

............................................................

994,408

Unrealized

appreciation

on

OTC

forward

exchange

contracts

..........................................

81,971

Total

assets

..........................................................................

328,893,141

Liabilities:

Payables:

Investment

securities

purchased

..............................................................

258

Credit

facility

(Note

10

)

.....................................................................

50,000,000

Management

fees

.........................................................................

226,987

Trustees'

fees

and

expenses

.................................................................

6

Accrued

interest

(Note

10)

..................................................................

52,897

Variation

margin

on

centrally

cleared

swap

contracts

...............................................

17,376

Funds

advanced

by

custodian

.................................................................

31

Unrealized

depreciation

on

OTC

forward

exchange

contracts

..........................................

3,550,574

Deferred

tax

...............................................................................

361,170

Accrued

expenses

and

other

liabilities

...........................................................

285,151

Total

liabilities

.........................................................................

54,494,450

Net

assets,

at

value

.................................................................

$274,398,691

Net

assets

consist

of:

Paid-in

capital

.............................................................................

$505,681,237

Total

distributable

earnings

(losses)

.............................................................

(231,282,546)

Net

assets,

at

value

.................................................................

$274,398,691

Shares

outstanding

.........................................................................

47,228,418

Net

asset

value

per

share

a

....................................................................

$5.81

a

Net

asset

value

per

share

may

not

recalculate

due

to

rounding.

Templeton

Emerging

Markets

Income

Fund

Financial

Statements

Statement

of

Operations

for

the

six

months

ended

June

30,

2024

(unaudited)

Semiannual

Report

The

accompanying

notes

are

an

integral

part

of

these

financial

statements.

Templeton

Emerging

Markets

Income

Fund

Investment

income:

Dividends:

Non-controlled

affiliates

(Note

3

c

)

.............................................................

$341,368

Interest:

(net

of

foreign

taxes

of

$391,857)

Unaffiliated

issuers

........................................................................

16,621,616

Total

investment

income

...................................................................

16,962,984

Expenses:

Management

fees

(Note

3

a

)

...................................................................

1,400,113

Transfer

agent

fees

.........................................................................

38,617

Custodian

fees

.............................................................................

47,891

Reports

to

shareholders

fees

..................................................................

74,459

Registration

and

filing

fees

....................................................................

62,690

Professional

fees

...........................................................................

66,507

Trustees'

fees

and

expenses

..................................................................

15,591

Interest

expense

(Note

10)

...................................................................

1,600,541

Other

....................................................................................

34,903

Total

expenses

.........................................................................

3,341,312

Expenses

waived/paid

by

affiliates

(Note

3c)

...................................................

(24,814)

Net

expenses

.........................................................................

3,316,498

Net

investment

income

................................................................

13,646,486

Realized

and

unrealized

gains

(losses):

Net

realized

gain

(loss)

from:

Investments:

(net

of

foreign

taxes

of

$2,629)

Unaffiliated

issuers

......................................................................

(1,589,716)

Written

options

...........................................................................

182,524

Foreign

currency

transactions

................................................................

(212,853)

Forward

exchange

contracts

.................................................................

832,977

Swap

contracts

...........................................................................

(572,146)

Net

realized

gain

(loss)

..................................................................

(1,359,214)

Net

change

in

unrealized

appreciation

(depreciation)

on:

Investments:

Unaffiliated

issuers

......................................................................

4,398,634

Translation

of

other

assets

and

liabilities

denominated

in

foreign

currencies

..............................

(131,269)

Written

options

...........................................................................

50,953

Forward

exchange

contracts

.................................................................

(6,040,343)

Swap

contracts

...........................................................................

(1,043,012)

Change

in

deferred

taxes

on

unrealized

appreciation

...............................................

(342,951)

Net

change

in

unrealized

appreciation