UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED

MANAGEMENT

INVESTMENT COMPANIES

Investment Company Act file number 811-23248

Ecofin Sustainable and Social Impact Term Fund

(Exact name of registrant as specified in charter)

6363 College Boulevard, Suite 100A, Overland

Park, KS 66211

(Address of principal executive offices) (Zip code)

Matthew G.P. Sallee

Diane Bono

6363 College Boulevard, Suite 100A, Overland

Park, KS 66211

(Name and address of agent for service)

913-981-1020

Registrant’s telephone number, including area code

Date of fiscal year end: November 30

Date of reporting period: May 31, 2024

Item 1. Report to Stockholders.

(a) Report pursuant to Rule 30e-1

Semi-Annual Report | May

31, 2024

2024 Semi-Annual Report

Closed-End Funds

Tortoise

2024 Semi-Annual Report to Stockholders

This combined report provides you

with a comprehensive review of our funds that span essential assets.

TTP and TPZ distribution policies

Tortoise Pipeline & Energy Fund, Inc. (“TTP”)

and Tortoise Power and Energy Infrastructure Fund, Inc. (“TPZ”) are relying on exemptive relief permitting them to make long-term

capital gain distributions throughout the year. Each of TTP and TPZ, with approval of its Board of Directors (the “Board”),

has adopted a managed distribution policy (the “Policy”). Annual distribution amounts are expected to fall in the range of

7% to 10% of the average week-ending net asset value (“NAV”) per share for the prior fiscal semi-annual period. In accordance

with its Policy, TTP distributes a fixed amount per common share, currently $0.59, each quarter to its common shareholders. TPZ distributes

a fixed amount per common share, currently $0.105, each month to its common shareholders. These amounts are subject to change from time

to time at the discretion of the Board. Although the level of distributions is independent of TTP’s and TPZ’s performance,

TTP and TPZ expect such distributions to correlate with its performance over time. Each quarterly and monthly distribution to shareholders

is expected to be at the fixed amount established by the Board, except for extraordinary distributions in light of TTP’s and TPZ’s

performance for the entire calendar year and to enable TTP and TPZ to comply with the distribution requirements imposed by the Internal

Revenue Code. The Board may amend, suspend or terminate the Policy without prior notice to shareholders if it deems such action to be

in the best interests of TTP, TPZ and their respective shareholders. For example, the Board might take such action if the Policy had the

effect of shrinking TTP’s or TPZ’s assets to a level that was determined to be detrimental to TTP or TPZ shareholders. The

suspension or termination of the Policy could have the effect of creating a trading discount (if TTP’s or TPZ’s stock is trading

at or above net asset value), widening an existing trading discount, or decreasing an existing premium. You should not draw any conclusions

about TTP’s or TPZ’s investment performance from the amount of the distribution or from the terms of TTP’s or TPZ’s

distribution policy. Each of TTP and TPZ estimates that it has distributed more than its income and net realized capital gains; therefore,

a portion of your distribution may be a return of capital. A return of capital may occur, for example, when some or all of the money that

you invested in TTP or TPZ is paid back to you. A return of capital distribution does not necessarily reflect TTP’s or TPZ’s

investment performance and should not be confused with “yield” or “income.” The amounts and sources of distributions

reported are only estimates and are not being provided for tax reporting purposes. The actual amounts and sources of the amounts for tax

reporting purposes will depend upon TTP’s and TPZ’s investment experience during their fiscal year and may be subject to changes

based on tax regulations. TTP and TPZ will send you a Form 1099-DIV for the calendar year that will tell you how to report these distributions

for federal income tax purposes.

2024 Semi-Annual Report | May 31, 2024

| Closed-end Fund Comparison |

| |

Name/Ticker |

Primary

focus |

Structure |

Total

Assets

($ millions)(1) |

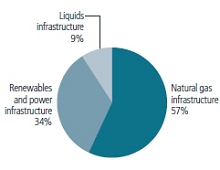

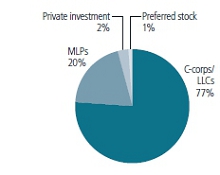

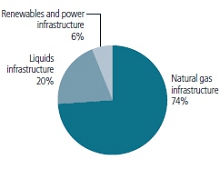

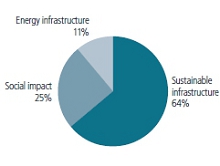

Portfolio mix

by asset type(1) |

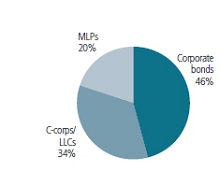

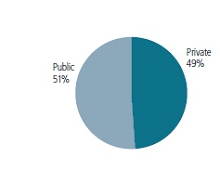

Portfolio mix

by structure(1) |

|

Tortoise Energy Infrastructure Corp.

NYSE: TYG

Inception: 2/2004 |

Energy Infrastructure |

Regulated investment company |

$563.9 |

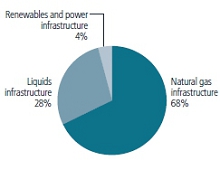

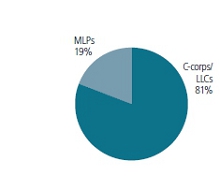

|

|

|

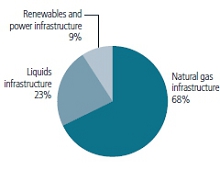

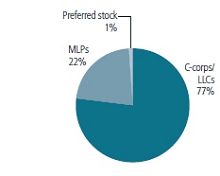

Tortoise Midstream Energy Fund, Inc.

NYSE: NTG

Inception: 7/2010 |

Natural Gas Infrastructure |

Regulated investment company |

$310.1 |

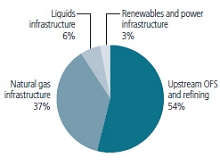

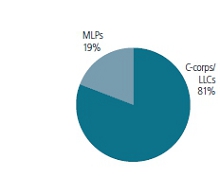

|

|

|

Tortoise Pipeline

& Energy Fund, Inc.

NYSE: TTP

Inception: 10/2011 |

North

American

pipeline

companies |

Regulated investment company |

$96.6 |

|

|

|

Tortoise Energy Independence

Fund, Inc.

NYSE: NDP

Inception: 7/2012 |

North

American

oil & gas

producers |

Regulated investment company |

$76.6 |

|

|

|

Tortoise Power

and Energy Infrastructure

Fund, Inc.

NYSE: TPZ

Inception: 7/2009 |

Power

& energy infrastructure companies

(Fixed income

& equity) |

Regulated investment company |

$129.2 |

|

|

|

Ecofin Sustainable and Social Impact Term Fund

NYSE: TEAF

Inception: 3/2019 |

Essential

assets |

Regulated investment company |

$221.8 |

|

|

(1) As of 5/31/2024

(unaudited)

Tortoise

2024 Semi-Annual Report to closed-end fund stockholders

Dear stockholder,

The fiscal semi-annual period that included the start

of 2024 for the energy sector was a good one. Overall performance was positive, and it offered a constructive supply and demand environment,

capital allocation discipline, and negligible policy implications. While geopolitical turmoil continued in both Ukraine and Israel, the

energy sector sustained flows from areas of supply to demand centers. The Organization of the Petroleum Exporting Countries Plus (OPEC+)

remained constant in their goal to balance crude oil markets. And providing a boost to visibility on longer-term crude oil and natural

gas demand, electric vehicle sales slowed, and artificial intelligence’s (AI) energy demand needs became clearer. The sector’s

essentialness to global economic growth stayed ever apparent.

Energy and power infrastructure

The broad energy sector, as represented by the S&P

Energy Select Sector Index®, returned 12.2% for the first half of the 2024 fiscal year. Energy company management teams

by and large remain committed to returning cash flow to shareholders in the form of higher dividends and share buybacks, while maintaining

strong balance sheets. Along those same lines, mergers and acquisitions (M&A), while elevated, remained disciplined in terms of price

paid and the complementary nature of assets acquired. Further aiding the sector were constructive crude oil prices, gross domestic product

(GDP) growth leading to more energy demand, softness in electric vehicle sales, and AI related data centers hunger for more energy. Less

helpful for the sector were low natural gas prices due to warm winter weather and concerns about a slowing economy.

OPEC+ continued to balance global crude oil supply

with demand by extending two million barrels per day (bpd) of production curtailments through September of 2024, before gradually phasing

them out. This discipline led to modest oil inventory draws and a constructive crude oil price near $80 and $85 per barrel for West Texas

Intermediate (WTI) and Brent at the end of May, respectively. That said, tensions in the Middle East stemming from the Israeli and Hamas

conflict along with the war between Russia and Ukraine kept concerns about a supply shock top of mind. Oil transport was disrupted, yet

oil continued to find a home even if routes were not the most efficient. Oil demand continued to grow due to a resilient global economy.

Average 2024 demand growth over 2023 using forecasts from the International Energy Agency (IEA), Energy Information Administration (EIA)

and OPEC is 1.5 million barrels per day (bpd), with 2025 levels also higher by over 1 million bpd. Over the longer-term, less optimism

over electric vehicle (EV) penetration following slower sales in the U.S., Europe, and China is leading to a view that gasoline and diesel

demand will not peak before 2030. Petrochemical and jet products that make up over 50% of crude oil demand have even firmer growth prospects

over the next 20 years.

U.S. crude oil production growth carries on. According

to the EIA, U.S. crude oil production rebounded in the second quarter to 13.2 million bpd from the first quarter when harsh winter weather

reduced levels to 12.9 million bpd. For the year, the EIA forecasts crude oil production to be 2% better than 2023 levels, and to grow

4% in 2025, averaging 13.7 million bpd. The increased production is largely from the Permian basin, the source of nearly 50% of all domestic

crude oil production. This growth is anticipated despite the lower rig count and fewer frac crews as producers are doing more with less.

Drilling laterals lengthened and completion times shortened

again. The application of AI is even resulting in improved efficiencies. And aside from labor, oilfield service and material cost inflation

are in the past.

U.S. natural gas production declined from 105.6 billion

cubic feet per day (bcf/d) in the fourth quarter of 2023 to 100.4 bcf/d in the second quarter of 2024. The reason? Relatively mild winter

weather reduced the need for natural gas to heat homes and offices, leaving supply well ahead of demand. Inventories ended the winter

withdrawal season above the five-year high. Consequently, producers reduced production to better balance supply and demand. That action

is part of the reason natural gas prices improved in May to average $2.40 per million British thermal units (mmbtu) from the March low

of $1.58 per mmbtu. The EIA forecasts that second quarter production will be the trough for 2024, with volumes improving every quarter

through year-end 2025. Weather will remain a factor, yet new U.S. liquified natural gas (LNG) export facilities are set to start coming

on-line later this year that we expect to result in more supply to meet higher natural gas demand. In fact, more LNG export facilities

will continue to come on-line in the U.S. through 2027, resulting in an almost doubling of U.S. LNG export capacity. We expect production

to keep up with these adds. This increased LNG export will meet both new Asian demand tied to economic growth and European demand as the

continent looks for more secure supplies in the face of Russia’s continuing war with Ukraine.

Natural gas liquids (NGLs) are a source of heat and

the key components in making plastics. The U.S. is the world’s largest producer of NGLs with production just under 7 million bpd,

and the largest exporter at 2.7 million bpd. A unique aspect of Permian basin oil production is that the percent of production that is

NGLs increases over time as a well depletes over time. Consequently, NGL supply is sure to grow if crude oil production increases. We

expect this increased production to nearly all be exported in part to meet Asia’s growing petrochemical demand.

The midstream energy sector, as represented by the

Alerian Midstream Energy Index (AMNA), returned 12.2% for the semi-annual fiscal period, right on top of broader energy’s gain.

Supporting the sector were good earnings reports relative to consensus, continued management discipline toward capital allocation and

M&A, and benign policy implications from Washington. We think midstream’s growing free cash flow, low leverage, and attractive

valuation provide a compelling investment backdrop.

Earnings for midstream companies over the past six

months came in at the high end of expectations following strong volumes, the robust 13% inflation tariff escalator, and isolated marketing

opportunities from wide price differentials, particularly between west Texas and the Gulf Coast. On capital allocation, healthy balance

sheets were maintained with dividend growth and share buybacks remaining a management focus. Leverage targets are now generally between

3.0x to 4.0x earnings before interest, taxes, depreciation and amortization (EBITDA) with leverage being a full “turn” lower

versus levels prior to 2020. Buybacks eclipsed $2.3 billion over the past six months and are on pace to exceed our annual buyback expectation

of $4 billion. Most notable to capital returns was Cheniere Energy’s outsized share repurchase at over $1.5 billion during the past

six months and Western Midstream’s 52% distribution boost. We expect free cash flow to increasingly be targeted at dividend growth

and opportunistic share repurchases.

(unaudited)

2024 Semi-Annual Report | May 31, 2024

Midstream companies remained active in M&A with

two notable corporate transactions. First, Sunoco LP (SUN) agreed to acquire NuStar Energy (NS), a liquids pipeline company, in an all-stock

transaction at a 24% premium. Then, EQT Corp (EQT), a large natural gas producer, entered an agreement to acquire Equitrans Midstream

(ETRN), a natural gas pipeline and gathering company, in an all-stock transaction at an 18% premium. The commonality between the transactions

was the all-equity nature and vertical integration as a rationale. We do not believe vertical integration will emerge as a trend, yet

it bears watching. Midstream companies also looked to further boost their asset bases through bolt-on acquisitions from motivated private

equity sellers, with three separate deals for Permian basin gathering and processing assets topping $4.5 billion in transaction value.

Specifically, Energy Transfer agreed to acquire WTG Midstream, Kinetik bought Durango Midstream, and PSX tapped Pinnacle Midstream. Along

with being accretive, the rationale for the Permian focus and synergy is the ability for the acquirors to more fully utilize existing

infrastructure to transport increased volumes of natural gas and natural gas liquids to the demand and export center along the Gulf Coast.

It was not all buying though. Companies also divested non-core assets, with Kinetik selling its interest in Gulf Coast Express and PSX

dealing its position in Rockies Express. We believe complementary asset acquisitions combined with the pruning of non-core assets will

continue through the remainder of the year and continue to serve investors well. Speaking of non-core assets, look for TC Energy to complete

the announced spin-off of its liquids business, South Bow Corporation (SOBO), in the second half of this year.

The outsized buildout of datacenters to support AI

is resulting in meaningful electricity growth in the U.S. after years of relatively stable demand. Further, data centers require a continuous

and reliable power supply to ensure uninterrupted operations. We believe that renewables will play a role, yet neither solar nor wind

are completely reliable. For that reason, we think natural gas is the best reliable supply source to meet this need because natural gas

is relatively low cost, abundant domestically, and cleaner than coal. This idea continued to gain traction during the quarter with AI

being mentioned countless times on energy conference calls. We estimate AI power demand growth could require an additional 7 to 16 bcf/d

of U.S. natural gas production to meet electricity demand from data centers. We expect this to benefit all forms of natural gas infrastructure

over the next five years. And over the more immediate time period, we believe Independent Power Producers (IPPs) will profit from their

ability to enter into power supply contracts with data centers and to supply marginal power to data centers when regulated electric utility

companies are unable to meet demand. During these time periods, IPPs benefit from outsized power prices.

While U.S. GDP growth improved 3.4% in the fourth quarter

of 2023, with further gains to start 2024, some economic signals suggest that a recession is on the horizon. This may weigh on investor

psyche until resolved. Regarding energy, while multiple recessions occurred i n the last 40 years, energy demand still increased in 38

out of the last 41 years (2008 and 2020 decreased). Following the 2020 recession, energy companies reduced capital expenditures and focused

on reducing debt levels. We believe the energy sector, and specifically midstream, is prepared to deal with a potential recession. With

the world remaining undersupplied energy over the longer-term, sector balance sheets now less levered, and management teams looking for

share repurchase opportunities, we believe energy is well positioned should slower economic growth manifest.

High inflation persisted in early 2024, though moderated

as mid-year approached. Whatever the level, midstream provided investors with inflation protection. Pipelines typically benefit from long-term

contracts where tariffs increase based on inflation levels. Further, tariffs on regulated liquids pipelines include an inflation escalator

based on the Producer Price Index. Federal Energy Regulatory Commission (FERC) indexing allowed for a tariff increase of over 13% beginning

July 1, 2023, until June 30, 2024. We estimate the cumulative total allowable tariff increase since 2020 through year-end 2024 will exceed

26%.

On the policy front, the Department of Energy (DOE)

announced a pause in its review of pending LNG export applications. The DOE wants to update its economic and environmental analysis that

underpin this review, specifically how it assesses climate change. Importantly, the pause does not affect the projects that have already

made a Final Investment Decision. The build-out of new LNG facilities through 2027 is unaffected. We expect that once the Presidential

election is over in November, the DOE will lift its pause and continue its review of pending LNG export applications. Lastly, the Mountain

Valley Pipeline (MVP) received all construction and operational permits and full authorization under the Fiscal Responsibility Act (FRA)

last year. As a reminder, MVP is a 2 bcf/d pipeline transporting natural gas from the Marcellus shale into Virginia. After several years

of delay, MVP entered operational service in June of 2024.

Sustainable infrastructure

The semi-annual period ending May 31, 2024, had financial

markets experiencing notable shifts and uncertainties, shaped by fluctuating long-term interest rates and geopolitical tensions. Initially,

from December to January, there was a pervasive sense of skepticism surrounding the growth potential of pure renewables and utilities

due to devalued stock prices that seemingly discounted growth prospects too harshly. However, amidst these challenges, there remained

optimism driven by compelling investment opportunities, particularly in sectors benefiting from decarbonization and electrification trends.

These included renewables and utilities, which saw elevated power purchase agreement prices reflecting strong demand for cleaner energy

sources in Europe and the U.S. As the period progressed, despite initial optimism, broader infrastructure sectors, including utilities,

faced significant challenges, with Europe particularly impacted by weak economic conditions and oversupply concerns in energy markets.

Conversely, the U.S. market showed resilience driven by robust demand from AI, data centers, and electric vehicles, bolstering the performance

of U.S. utilities within portfolios. By March, sentiment began to improve as expectations of lower inflation and potential policy rate

cuts emerged, although ongoing uncertainties around interest rates and energy prices continued to weigh on infrastructure valuations.

Through April and May, U.S. utilities emerged as standout

performers fueled by increasing power demand, particularly from AI and data centers, highlighting the sector’s pivotal role in supporting

technological advancements. Meanwhile, in Europe, despite lagging behind their U.S. counterparts, utilities and environmental services

groups still delivered strong performances, buoyed by rising power prices and solid earnings reports. This period also witnessed significant

corporate actions such as National Grid’s equity issuance to fund ambitious capex plans, indicative of continued investment in grid

infrastructure to support electrification and renewables growth.

(unaudited)

Looking ahead, amidst the persisting uncertainties in interest rates and

energy prices, buying opportunities remain compelling, especially in sectors poised to benefit from ongoing electrification efforts and

technological advancements. The portfolio strategy emphasizes utilities for their predictable earnings growth and the burgeoning demand

from data centers and AI applications, which prioritize reliable and clean energy sources. Furthermore, ongoing M&A activity within

the sector, fueled by substantial private equity investment, suggests potential for a re-rating of growth opportunities in listed infrastructure,

underscoring the sector’s dynamic landscape and future prospects.

Waste transition

The second quarter of 2024 featured announcements detailing

a resurgence in green and sustainable project finance activities, indicating continued support for energy and waste transition efforts,

despite the unfavorable impacts of a high interest rate environment and a relatively soft macroeconomic environment.

Per Moody’s Investors Service, the global issuance

of green, social, sustainability, and sustainability-linked bonds rose 36% in first quarter 2024 over the prior period in fourth quarter

2023. In particular, the global issuance of sustainability bonds nearly doubled over the prior quarter and increased 16% year-over-year.

And, per the non-profit Climate Bonds Initiative, the global issuance of green bonds rose 43% in Q1 2024 over the prior period in Q4 2023

and is predicted to total $1 trillion for the full year in 2024. U.S. issuers typically account for the largest geographical share and

represented slightly more than 14% of Q1 2024 global green bond issuance. While sustainability bonds and green bonds are typically issued

on a public, rated basis, a similar trend in increased issuance has been anecdotally witnessed in the private, non-rated market as well.

In the waste-to-energy sector, there has been significant

growth in recent years in the number of projects that convert waste feedstocks into renewable natural gas, or RNG. These RNG projects

have been supported by a variety of incentives, including fuel credits provided by the federal Renewable Fuel Standard (RFS) and the California

Low Carbon Fuel Standard (LCFS), and by investment tax credits via the Inflation Reduction Act. Because there is substantial growth potential

for RNG, which provides a meaningful decarbonization of transportation fuels, there continue to be efforts to encourage more RNG production

in the U.S. In May of 2024, the U.S. Senate introduced the Renewable Natural Gas Incentive Act, which if enacted into law would provide

a $1 per gallon tax credit for RNG produced and sold as a transportation fuel. Such a per-gallon incentive would put RNG on a more level

playing field with Renewable Diesel and Sustainable Aviation Fuel, which each already receive a similar per-gallon production incentive.

In the waste-to-value sector, there has been increased

focus on eliminating PFAS, also known as “forever chemicals” and contained in plastic waste, as well as Extended Producer

Responsibility laws, which have been primarily directed toward reducing plastic waste.

In April 2024, the U.S. Environmental Protection Agency

(EPA) designated two types of PFAS chemicals as Hazardous Materials. The intent of such classification is to hold polluters accountable

for the financial burden of removing or destroying PFAS. Initially, the EPA does not intend to pursue municipal landfills or municipal

water utilities in its enforcement activities. However, the Hazardous Material classification is expected to result in an industry-wide

effort to eliminate PFAS. While early in the cycle, these efforts are expected to bolster the construction of new facilities implementing

high-temperature technologies such as gasification, pyrolysis, and incineration — each of which may also be utilized for waste-to-energy

or waste-to-value purposes, in addition to PFAS destruction.

In May 2024, the state of Minnesota enacted an Extended

Producer Responsibility (EPR) law for plastics packaging waste and boat-wrap waste. Under the law, brand manufacturers are required to

pay for plastic recycling costs at an increasing rate over time - 50% of recycling costs beginning in 2029, 75% in 2030, and 90% in 2031.

Minnesota is the fifth state to enact an EPR law for plastics packaging, joining California, Colorado, Maine, and Oregon. Although a primary

goal of such EPR programs is to reduce the upfront amount of plastic waste generated, their implementation is also expected to result

in the construction of new plastics recycling facilities near major metropolitan areas.

Social impact

Education

The public market for issuance of new K-12 charter

school and private school revenue bonds year-to-date for 2024 saw similar numbers of bond issuances as the same period in 2023, but with

a much higher par value. Through May, there were 35 new issues for $1,603,130,000 as compared to 36 issues for $835,188,000 for the period

in 2023. The 2024 numbers include six specialty investor transactions for $129,965,000 versus nine transactions totaling $214,613,000

during the same period in 2023.1

The primary driver of this increase in par value was a greater number of large school portfolio

transactions. If the market follows historical trends, Q3 and Q4 should see a significant increase in transactions volume and total par

value issuance. While there were only 101 new issues representing $3.459 billion in par value in all of 2023, we believe that to be an

outlier as par value for K-12 charter school and private school bonds increased every year from 2011 to 2021 and in 21 of 27 years since

1998.1 With steady municipal bond fund inflows year-to-date ($6.7 billion inflows for 2024 vs $1.4 billion outflows for the

period in 2023)2 and the benchmark 30-year MMD daily rate far below 2023’s high of 4.57%, and Q4 2023’s average

of 4.06%,3 Ecofin expects to see total par value of over $4.0 billion for K-12 charter school and private school revenue bond

issuance in 2024.

During the period, the Equitable Facilities Fund published

their report, “2022 Charter School Bond Default Study: Default and Loss Rates Continue to Decline”, which provided valuable

bond default analysis based on data from every charter school bond issue ever completed as of December 31, 2022. Some key findings include:

| ● |

Only “94 charter schools (or their affiliates), representing 99 transactions, or 4.3% of the entire

portfolio of 2,298 transactions, have experienced a monetary default in which borrowers failed to make full and timely debt service

payments promised at the time of issuance.” |

| ● |

“Primary causes for an obligor’s inability to make scheduled debt service payments were identified as: subpar academic

results; financial stress; lower than expected enrollment; governance.” |

| ● |

A median recovery rate of 69.1% when “you combine the 59 foreclosure property sales with the refundings, bond exchanges,

and those obligors which were able to overcome the default and make all debt service payments current again.”4 |

(unaudited)

2024 Semi-Annual Report | May 31, 2024

In April, we saw the release of U.S. News & World

Report (U.S. News) 2023-2024 rankings of the best public high schools in the country. Nineteen charter schools were recognized in the

nation’s top 100 high schools, including the top two spots overall, Arizona’s BASIS Peoria (#1) and Indiana’s Signature

School in Evansville (#2). This is particularly impressive when you consider that charter schools make up only about 8% of the nation’s

public high schools.5

In addition to charter schools, other school choice options have exploded across the nation. By the end

of 2023 seven states enacted new private school choice programs and 11 states expanded existing programs. This has resulted in access

to private school choice programs for around 20 million students nationwide.6

Ten states now have universal or near-universal

private school choice programs, meaning nearly 100% of their students are eligible to participate in their state’s program. These

programs come in the form of education savings accounts, voucher programs or tax credits. Prior to 2023, only Arizona and West Virginia

had universal eligibility, but they’ve now been joined by Arkansas, Florida, Indiana, Iowa, North Carolina, Ohio, Oklahoma, and

Utah. With 30 states now providing some type of private school choice for families, it is clear that parents will continue to embrace

these popular programs and continue to drive their expansion throughout the nation.6

Across the education universe, we continue

to see an increase in both volume and credit quality of education investment opportunities through May 2024.

Senior Living

Senior living occupancy continues to improve since

the lows of COVID and our senior population is one quarter closer to outpacing the current bed supply. In fact, within one year, the first

baby boomer turns 80 years old.

In Q1 2024, the for-profit senior living sector recorded

its eleventh quarter in a row of occupancy gains. Based on the past two years of absorption, primary market occupancy recovery should

reach pre-pandemic levels in the second half of 20247. As of Q1 2024, primary market occupancy increased 0.5% to 85.6% occupied.

Non-profit senior living has fared better than their

for-profit brethren since the pandemic hit. As of Q1 2024, non-profit entrance fee continuing care retirement communities (“CCRC’s”)

were 90.6% occupied.

Occupancy recovery has been fueled by over four years

of slowing construction starts. In fact, 2023 recorded the lowest primary market inventory growth since 2005, when NIC started recording

the data. High interest rates, persistently elevated construction costs and tighter lending conditions will continue to propel occupancy

in the months to come. In Q1 2024, primary market inventory growth continued its decline to a mere 1.4% assisted living units and 1.2%

independent living units. Given the incredibly low units under construction, the market is setting up for a severe supply and demand imbalance

just as the baby boomer population is knocking on the doorstep.

The stark reality is that given the current pace of

new senior living development, our country will only supply 40% of the projected demand by 2030. That is an extraordinary shortfall which

would require more than $275 billion of investment over the next few years to close the projected demand gap. To put that in context,

based on a current development pace of 26,000 new units annually, the industry would need to be running at more than triple the pace to

meet the future demand. 7

Anecdotally, NIC Map Vision recently published their Senior Housing Market Outlook, which highlighted

the concerning need for significant senior housing growth to keep pace with the unprecedented baby boomer deluge projected in 2027. The

timing couldn’t be better as, operationally, most communities have weathered the COVID storm and are showing rent growth and labor

market normalization which has led to margin expansion for the first time in years.

From now until 2030, an average of 10,000 baby boomers

will turn 65 every day.8 With the combination of increased population and a slow pace of new senior living inventory supply,

we are bullish on the critical need to house and care for the impending “Silver Tsunami”.

Concluding thoughts

We continue to stand by our positive long-term outlook

for the energy and power and sustainable infrastructure sectors. Opportunities for investing in education and senior living continue to

expand for many reasons positioning the sectors well for continued growth.

The S&P Energy Select Sector® Index

is a capitalization-weighted index of S&P 500® Index companies in the energy sector involved in the development or

production of energy products. The Alerian Midstream Energy Index is a broad-based composite of North American energy infrastructure companies.

The capped, float-adjusted, capitalization-weighted index, whose constituents earn the majority of their cash flow from midstream activities

involving energy commodities, is disseminated real-time on a price-return basis (AMNA) and on a total-return basis (AMNAX).

It is not possible to invest directly in an index.

Performance data quoted represent past performance;

past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment,

when sold, may be worth more or less than its original cost.

| 1 |

Electronic Municipal Market Access (https://emma.msrb.org/) & MuniOS (https://www.munios.com/) |

| 2 |

Refinitiv Lipper US Fund Flows (https://www.lipperusfundflows.com/) |

| 3 |

Bloomberg |

| 4 |

2022 Charter School Bond Default Study: Default and Loss Rates Continue to Decline, Wendy Berry, Equitable Facilities Fund |

| 5 |

U.S. News Ranks Charter Schools Among the Top Public High Schools in the Nation, May 3, 2024, https://publiccharters.org/news/us-news-ranks-charters-among-top-in-nation/ |

| 6 |

18 States embrace school choice as Illinois hurts low-income families, Hannah Schmid, January 22, 2024, https://www.illinoispolicy.org/18-states-embrace-school-choice-as-illinois-hurts-low-income-families/ |

| 7 |

NIC & NIC MAP Vision |

| 8 |

census.gov |

(unaudited)

Tortoise

Energy Infrastructure Corp. (TYG)

Fund description

TYG

seeks a high level of total return with an emphasis on current distributions paid to stockholders. TYG invests primarily in equity securities

in energy infrastructure companies. The fund is positioned to benefit from growing energy demand and accelerated efforts to reduce global

CO2 emissions in energy production. Energy infrastructure companies

generate, transport and distribute electricity, as well as process, store, distribute and market natural gas, natural gas liquids, refined

products and crude oil.

Fund performance

Good earnings reports relative to consensus, continued

management discipline toward capital allocation and mergers and acquisitions (M&A), and benign policy implications from Washington

drove midstream sector performance higher. Further, midstream’s growing free cash flow, low leverage, inflation protection, and

attractive valuation provided a compelling investment backdrop. Both dividend growth and opportunistic share repurchases continued. Enthusiasm

for artificial intelligence energy demand needs from a significant forecast for new data centers also aided the both the midstream and

renewable and power infrastructure sector. The fund’s market-based and NAV-based returns for the fiscal period ending May 31, 2024,

were 24.7% and 19.8%, respectively (including the reinvestment of distributions). The Tortoise MLP Index® returned 11.0%

during the same period.

| 2024 mid-fiscal year

summary |

|

| Quarterly distributions paid per share |

$0.7100 |

| Distribution rate (as of 5/31/2024) |

8.5% |

| Year-over-year distribution increase (decrease) |

0.0% |

| Cumulative distributions paid per share to stockholders since inception in February 2004 |

$45.2675 |

| Market-based total return |

24.72% |

| NAV-based total return |

19.80% |

| Premium (discount) to NAV (as of 5/31/2024) |

(17.2)% |

Key asset performance drivers

| Top

five contributors |

Company type |

| Constellation Energy Corp. |

Power company |

| Targa Resources Corp. |

Natural gas pipeline company |

| ONEOK, Inc. |

Natural gas pipeline company |

| NextEra Energy Partners LP |

Diversified infrastructure company |

| The Williams Companies, Inc. |

Natural gas pipeline company |

| Bottom

five contributors |

Company type |

| Tortoise Holdco II, LLC – Private |

Private renewable investment |

| Cheniere Energy, Inc. |

Natural gas pipeline company |

| New Fortress Energy, Inc. |

Natural gas pipeline company |

| Xcel Energy Inc. |

Diversified infrastructure company |

| Ameren Corporation |

Power company |

Unlike the fund return, index return is pre-expenses

and taxes.

Performance data quoted represent past performance;

past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment,

when sold, may be worth more or less than its original cost. Portfolio composition is subject to change due to ongoing management of the

fund. References to specific securities or sectors should not be construed as a recommendation by the fund or its adviser. See Schedule

of Investments for portfolio weighting at the end of the fiscal quarter.

(unaudited)

2024 Semi-Annual Report | May 31, 2024

Tortoise

Energy Infrastructure

Corp. (TYG) (continued)

Value

of $10,000 vs. Tortoise Energy Infrastructure Fund – Market (unaudited)

From May 31, 2014 through May 31, 2024

The chart assumes an initial investment of $10,000.

Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance

data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate,

and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher

than the performance quoted and can be obtained by calling 866-362-9331. Performance assumes the reinvestment of capital gains and income

distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption

of Fund shares.

Annualized Rates of Return as of

May 31, 2024

| | |

1-Year | |

3-Year | |

5-Year | |

10-Year | |

Since

Inception(1) |

| Tortoise Energy Infrastructure Fund – NAV | |

| 32.41% | | |

| 15.04% | | |

| -7.67% | | |

| -7.07% | | |

| 3.35% | |

| Tortoise Energy Infrastructure Fund – Market | |

| 36.50% | | |

| 16.62% | | |

| -10.40% | | |

| -8.61% | | |

| 2.16% | |

| Tortoise MLP Index® | |

| 36.45% | | |

| 23.17% | | |

| 12.55% | | |

| 3.36% | | |

| 9.56% | |

| Tortoise Decarbonization Infrastructure IndexSM(2) | |

| 21.99% | | |

| N/A | | |

| N/A | | |

| N/A | | |

| N/A | |

| (1) |

Inception date of the Fund was Feburary 25, 2004. |

| (2) |

The Tortoise Decarbonization Infrastructure Index was added to reflect the inclusion of a broader scope of energy infrastructure

equities including midstream, utilities, and renewables in TYG effective November 30, 2021. |

Fund structure and distribution

policy

The fund is structured to qualify as a Regulated Investment

Company (RIC) allowing it to pass-through to shareholders income and capital gains earned, thus avoiding double-taxation. To qualify as

a RIC, the fund must meet specific income, diversification and distribution requirements. Regarding income, at least 90 percent of the

fund’s gross income must be from dividends, interest and capital gains. The fund must meet quarterly diversification requirements

including the requirement that at least 50 percent of the assets be in cash, cash equivalents or other securities with each single issuer

of other securities not greater than 5 percent of total assets. No more than 25 percent of total assets can be invested in any one issuer

other than government securities or other RIC’s. The fund must also distribute at least 90 percent of its investment company income.

RIC’s are also subject to excise tax rules which require RIC’s to distribute approximately 98 percent of net income and net

capital gains to avoid a 4 percent excise tax.

The fund has adopted a managed distribution policy

(“MDP”). Annual distribution amounts are expected to fall in the range of 7% to 10% of the average week-ending net asset value

(“NAV”) per share for the prior fiscal semi-annual period. Distribution amounts will be reset both up and down to provide

a consistent return on trailing NAV. Under the MDP, distribution amounts will normally be reset in February and August, with no changes

in distribution amounts in May and November.

Leverage

The fund’s leverage utilization increased $0.7

million during the six months ended May 31, 2024, compared to the six months ended November 30, 2023, and represented 20.5% of total assets

at May 31, 2024. At year-end, the fund was in compliance with applicable coverage ratios, 74.4% of the leverage cost was fixed, the weighted-average

maturity was 1.8 years and the weighted-average annual rate on leverage was 4.19%. These rates will vary in the future as a result of

changing floating rates, utilization of the fund’s credit facility and as leverage matures or is redeemed. During the six month

period ended May 31, 2024, $14.5 million of Senior Notes were paid in full upon maturity.

Please see the Financial Statements and Notes to Financial

Statements for additional detail regarding critical accounting policies, results of operations, leverage, taxes and other important fund

information.

For further information regarding the fund’s

leverage and distributions to stockholders, as well as a discussion of the tax impact on distributions, please visit www.tortoiseecofin.com.

(unaudited)

TYG Key Financial

Data (supplemental unaudited information)

(dollar amounts in thousands unless otherwise indicated)

The information presented below is supplemental

non-GAAP financial information, is not inclusive of required financial disclosures (e.g. Total Expense Ratio), and should be read in conjunction

with the full financial statements.

| | |

2023 | | |

2024 | |

| | |

Q1(1) | | |

Q2(1) | | |

Q3(1) | | |

Q4(1) | | |

Q1(1) | | |

Q2(1) | |

| Selected Financial Information | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Distributions paid on common stock | |

$ | 8,045 | | |

$ | 8,046 | | |

$ | 8,045 | | |

$ | 7,643 | | |

$ | 7,643 | | |

$ | 7,643 | |

| Distributions paid on common stock per share | |

| 0.7100 | | |

| 0.7100 | | |

| 0.7100 | | |

| 0.7100 | | |

| 0.7100 | | |

| 0.7100 | |

| Total assets, end of period(2) | |

| 577,524 | | |

| 504,066 | | |

| 527,003 | | |

| 492,651 | | |

| 508,813 | | |

| 563,922 | |

| Average total assets during period(2)(3) | |

| 595,508 | | |

| 547,380 | | |

| 526,517 | | |

| 503,464 | | |

| 496,314 | | |

| 532,401 | |

| Leverage(4) | |

| 146,213 | | |

| 114,713 | | |

| 120,413 | | |

| 107,814 | | |

| 113,294 | | |

| 115,517 | |

| Leverage as a percent of total assets | |

| 25.3 | % | |

| 22.8 | % | |

| 22.8 | % | |

| 21.9 | % | |

| 22.3 | % | |

| 20.5 | % |

| Operating expenses before leverage costs and current taxes(5) | |

| 1.13 | % | |

| 1.22 | % | |

| 1.26 | % | |

| 1.73 | % | |

| 1.21 | % | |

| 1.28 | % |

| Net unrealized appreciation (depreciation), end of period | |

| (34,286 | ) | |

| (65,512 | ) | |

| (34,940 | ) | |

| (58,511 | ) | |

| (39,969 | ) | |

| 18,703 | |

| Net assets, end of period | |

| 416,799 | | |

| 380,323 | | |

| 403,510 | | |

| 380,497 | | |

| 382,860 | | |

| 435,800 | |

| Average net assets during period(6) | |

| 429,315 | | |

| 409,946 | | |

| 406,929 | | |

| 384,850 | | |

| 377,999 | | |

| 414,387 | |

| Net asset value per common share | |

| 36.78 | | |

| 33.56 | | |

| 35.61 | | |

| 35.35 | | |

| 35.57 | | |

| 40.48 | |

| Market value per share | |

| 30.89 | | |

| 26.95 | | |

| 30.13 | | |

| 28.11 | | |

| 29.27 | | |

| 33.51 | |

| Shares outstanding (000’s) | |

| 11,332 | | |

| 11,332 | | |

| 11,332 | | |

| 10,765 | | |

| 10,765 | | |

| 10,765 | |

| (1) |

Q1 is the period from December through February. Q2 is the period from March through May. Q3 is the period

from June through August. Q4 is the period from September through November. |

| (2) |

Includes deferred issuance and offering costs on senior notes and preferred stock. |

| (3) |

Computed by averaging month-end values within each period. |

| (4) |

Leverage consists of senior notes, preferred stock and outstanding borrowings under credit facilities. |

| (5) |

As a percent of total assets. |

| (6) |

Computed by averaging daily net assets within each period. |

2024 Semi-Annual Report | May 31, 2024

Tortoise

Midstream Energy Fund, Inc. (NTG)

Fund description

NTG seeks to provide stockholders

with a high level of total return with an emphasis on current distributions. NTG invests primarily in midstream energy equities that own

and operate a network of pipeline and energy related logistical infrastructure assets with an emphasis on those that transport, gather,

process and store natural gas and natural gas liquids (NGLs). NTG targets midstream energy equities, including MLPs benefiting from U.S.

natural gas production and consumption expansion, with minimal direct commodity exposure.

Fund performance

Good earnings reports relative to consensus, continued

management discipline toward capital allocation and mergers and acquisitions (M&A), and benign policy implications from Washington

drove midstream sector performance higher. Further, midstream’s growing free cash flow, low leverage, inflation protection, and

attractive valuation provided a compelling investment backdrop. Both dividend growth and opportunistic share repurchases continued. Enthusiasm

for artificial intelligence energy demand needs from a significant forecast for new data centers also aided the both the midstream and

renewable and power infrastructure sector. The fund’s market-based and NAV-based returns for the fiscal period ending May 31, 2024,

were 22.7% and 18.3%, respectively (including the reinvestment of distributions). The Tortoise MLP Index® returned 11.0%

during the same period.

| 2024 mid-fiscal year summary |

|

| Quarterly distributions paid per share |

$0.7700 |

| Distribution rate (as of 5/31/2024) |

7.6% |

| Year-over-year distribution increase (decrease) |

0.0% |

| Cumulative distributions paid per share to stockholders since inception in July 2010 |

$25.6600 |

| Market-based total return |

22.68% |

| NAV-based total return |

18.30% |

| Premium (discount) to NAV (as of 5/31/2024) |

(16.7)% |

Key asset performance drivers

| Top

five contributors |

Company type |

| Targa Resources Corp. |

Natural gas pipeline company |

| ONEOK, Inc. |

Natural gas pipeline company |

| The Williams Companies, Inc. |

Natural gas pipeline company |

| Plains GP Holdings, L.P. |

Crude oil pipeline company |

| NextEra Energy Partners LP |

Diversified infrastructure company |

| Bottom five contributors |

Company type |

| Cheniere Energy, Inc. |

Natural gas pipeline company |

| New Fortress Energy, Inc. |

Natural gas pipeline company |

| EnLink Midstream, LLC |

Natural gas pipeline company |

| Vistra Energy Corp. |

Natural gas pipeline company |

| Excelerate Energy, Inc. |

Natural gas pipeline company |

Unlike the fund return, index return is pre-expenses

and taxes.

Performance data quoted represent past performance;

past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment,

when sold, may be worth more or less than its original cost. Portfolio composition is subject to change due to ongoing management of the

fund. References to specific securities or sectors should not be construed as a recommendation by the fund or its adviser. See Schedule

of Investments for portfolio weighting at the end of the fiscal quarter.

(unaudited)

Tortoise

Midstream Energy Fund,

Inc. (NTG) (continued)

Value

of $10,000 vs. Tortoise Midstream Energy Fund – Market (unaudited)

From May 31, 2014 through May 31, 2024

The chart assumes an initial investment of $10,000.

Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance

data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate,

and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher

than the performance quoted and can be obtained by calling 866-362-9331. Performance assumes the reinvestment of capital gains and income

distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption

of Fund shares.

Annualized Rates of Return as of

May 31, 2024

| | |

1-Year | |

3-Year | |

5-Year | |

10-Year | |

Since

Inception(1) |

| Tortoise Midstream Energy Fund – NAV | |

| 41.13% | | |

| 19.08% | | |

| -12.15% | | |

| -9.03% | | |

| -3.38% | |

| Tortoise Midstream Energy Fund – Market | |

| 39.08% | | |

| 21.42% | | |

| -14.29% | | |

| -10.17% | | |

| -4.97% | |

| Tortoise MLP Index® | |

| 36.45% | | |

| 23.17% | | |

| 12.55% | | |

| 3.36% | | |

| 7.69% | |

| (1) |

Inception date of the Fund was July 27, 2010. |

Fund structure and distribution

policy

The fund is structured to qualify as a Regulated Investment

Company (RIC) allowing it to pass-through to shareholders income and capital gains earned, thus avoiding double-taxation. To qualify as

a RIC, the fund must meet specific income, diversification and distribution requirements. Regarding income, at least 90 percent of the

fund’s gross income must be from dividends, interest and capital gains. The fund must meet quarterly diversification requirements

including the requirement that at least 50 percent of the assets be in cash, cash equivalents or other securities with each single issuer

of other securities not greater than 5 percent of total assets. No more than 25 percent of total assets can be invested in any one issuer

other than government securities or other RIC’s. The fund must also distribute at least 90 percent of its investment company income.

RIC’s are also subject to excise tax rules which require RIC’s to distribute approximately 98 percent of net income and net

capital gains to avoid a 4 percent excise tax.

The fund has adopted a managed distribution policy

(“MDP”). Annual distribution amounts are expected to fall in the range of 7% to 10% of the average week-ending net asset value

(“NAV”) per share for the prior fiscal semi-annual period. Distribution amounts will be reset both up and down to provide

a consistent return on trailing NAV. Under the MDP, distribution amounts will normally be reset in February and August, with no changes

in distribution amounts in May and November.

Leverage

The fund’s leverage utilization increased $3.0

million during the six months ended May 31, 2024 compared to the six months ended November 30, 2023, and represented 18.2% of total assets

at May 31, 2024. At year-end, the fund was in compliance with applicable coverage ratios, 75.8% of the leverage cost was fixed, the weighted-average

maturity was 3.1 years and the weighted-average annual rate on leverage was 3.92%. These rates will vary in the future as a result of

changing floating rates, utilization of the fund’s credit facility and as leverage matures or is redeemed.

Please see the Financial Statements and Notes to Financial

Statements for additional detail regarding critical accounting policies, results of operations, leverage, taxes and other important fund

information.

For further information regarding the fund’s

leverage and distributions to stockholders, as well as a discussion of the tax impact on distributions, please visit www.tortoiseecofin.com.

(unaudited)

2024 Semi-Annual Report | May 31, 2024

NTG Key Financial

Data (supplemental unaudited information)

(dollar amounts in thousands unless otherwise indicated)

The information presented below is supplemental

non-GAAP financial information, is not inclusive of required financial disclosures (e.g. Total Expense Ratio), and should be read in conjunction

with the full financial statements.

| | |

2023 | | |

2024 | |

| | |

Q1(1) | | |

Q2(1) | | |

Q3(1) | | |

Q4(1) | | |

Q1(1) | | |

Q2(1) | |

| Selected Financial Information | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Distributions paid on common stock | |

$ | 4,128 | | |

$ | 4,128 | | |

$ | 4,128 | | |

$ | 3,921 | | |

$ | 3,921 | | |

$ | 3,921 | |

| Distributions paid on common stock per share | |

| 0.7700 | | |

| 0.7700 | | |

| 0.7700 | | |

| 0.7700 | | |

| 0.7700 | | |

| 0.7700 | |

| Total assets, end of period(2) | |

| 296,682 | | |

| 261,858 | | |

| 287,287 | | |

| 272,818 | | |

| 279,021 | | |

| 310,068 | |

| Average total assets during period(2)(3) | |

| 304,884 | | |

| 281,520 | | |

| 280,548 | | |

| 276,916 | | |

| 273,920 | | |

| 295,102 | |

| Leverage(4) | |

| 66,120 | | |

| 56,920 | | |

| 60,720 | | |

| 53,524 | | |

| 56,024 | | |

| 56,569 | |

| Leverage as a percent of total assets | |

| 22.3 | % | |

| 21.7 | % | |

| 21.1 | % | |

| 19.6 | % | |

| 20.1 | % | |

| 18.2 | % |

| Operating expenses before leverage costs and current taxes(5) | |

| 1.19 | % | |

| 1.36 | % | |

| 1.43 | % | |

| 2.15 | % | |

| 1.33 | % | |

| 1.43 | % |

| Net unrealized appreciation (depreciation), end of period | |

| 6,856 | | |

| (11,572 | ) | |

| 17,267 | | |

| 5,003 | | |

| 14,580 | | |

| 44,972 | |

| Net assets, end of period | |

| 221,555 | | |

| 200,046 | | |

| 225,096 | | |

| 217,066 | | |

| 220,886 | | |

| 246,768 | |

| Average net assets during period(6) | |

| 226,098 | | |

| 215,743 | | |

| 220,209 | | |

| 217,415 | | |

| 214,843 | | |

| 238,661 | |

| Net asset value per common share | |

| 41.33 | | |

| 37.32 | | |

| 41.99 | | |

| 42.62 | | |

| 43.37 | | |

| 48.45 | |

| Market value per common share | |

| 35.28 | | |

| 31.53 | | |

| 35.40 | | |

| 34.22 | | |

| 35.84 | | |

| 40.34 | |

| Shares outstanding (000’s) | |

| 5,361 | | |

| 5,361 | | |

| 5,361 | | |

| 5,093 | | |

| 5,093 | | |

| 5,093 | |

| (1) |

Q1 is the period from December through February. Q2 is the period from March through May. Q3 is the period

from June through August. Q4 is the period from September through November. |

| (2) |

Includes deferred issuance and offering costs on

senior notes and preferred stock. |

| (3) |

Computed by averaging month-end values within each period. |

| (4) |

Leverage consists of senior notes, preferred stock and outstanding borrowings under the credit facility. |

| (5) |

Computed as a percent

of total assets. |

| (6) |

Computed by averaging daily net assets within each period. |

Tortoise

Pipeline & Energy Fund, Inc. (TTP)

Fund description

TTP seeks a high level of total return

with an emphasis on current distributions paid to stockholders. TTP invests primarily in equity securities of North American pipeline

companies that transport natural gas, natural gas liquids (NGLs), crude oil and refined products and, to a lesser extent, in other energy

infrastructure companies.

Fund performance

Good earnings reports relative to consensus, continued

management discipline toward capital allocation and mergers and acquisitions (M&A), and benign policy implications from Washington

drove midstream sector performance higher. Further, midstream’s growing free cash flow, low leverage, inflation protection, and

attractive valuation provided a compelling investment backdrop. Both dividend growth and opportunistic share repurchases continued. Enthusiasm

for artificial intelligence energy demand needs from a significant forecast for new data centers also aided the both the midstream and

renewable and power infrastructure sector. The fund’s market-based and NAV-based returns for the fiscal period ending May 31, 2024,

were 28.5% and 18.5%, respectively (including the reinvestment of distributions). The Tortoise North American Pipeline IndexSM returned

12.1% for the same period.

| 2024 mid-fiscal year summary |

|

| Quarterly distributions paid per share |

$0.5900 |

| Distribution rate (as of 5/31/2024) |

6.8% |

| Year-over-year distribution increase (decrease) |

0.0% |

| Cumulative distributions paid per share to stockholders since inception in October 2011 |

$20.8375 |

| Market-based total return |

28.46% |

| NAV-based total return |

18.52% |

| Premium (discount) to NAV (as of 5/31/2024) |

(12.2)% |

Please refer to the inside front cover of the

report for important information about the fund’s distribution policy.

Key asset performance drivers

| Top

five contributors |

Company type |

| ONEOK, Inc. |

Natural gas pipeline company |

| Equitrans Midstream Corporation |

Gathering & processing company |

| Targa Resources Corp. |

Natural gas pipeline company |

| Plains GP Holdings, L.P. |

Crude oil pipeline company |

| The Williams Companies, Inc. |

Natural gas pipeline company |

| Bottom five contributors |

Company type |

| Cheniere Energy, Inc. |

Natural gas pipeline company |

| Sunoco LP |

Natural gas pipeline company |

| Westlake Chemical Partners LP |

Chemicals company |

| Excelerate Energy, Inc. |

Natural gas pipeline company |

| Kinetik Holdings Inc |

Gathering & processing company |

Unlike the fund return, index return is pre-expenses.

Performance data quoted represent past performance;

past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment,

when sold, may be worth more or less than its original cost. Portfolio composition is subject to change due to ongoing management of the

fund. References to specific securities or sectors should not be construed as a recommendation by the fund or its adviser. See Schedule

of Investments for portfolio weighting at the end of the fiscal quarter.

(unaudited)

2024 Semi-Annual Report | May 31, 2024

Tortoise

Pipeline & Energy

Fund, Inc. (TTP) (continued)

Value

of $10,000 vs. Tortoise Pipeline and Energy Fund – Market (unaudited)

From May 31, 2014 through May 31, 2024

The chart assumes an initial investment of $10,000.

Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance

data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate,

and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher

than the performance quoted and can be obtained by calling 866-362-9331. Performance assumes the reinvestment of capital gains and income

distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption

of Fund shares.

Annualized Rates of Return as of

May 31, 2024

| | |

1-Year | |

3-Year | |

5-Year | |

10-Year | |

Since

Inception(1) |

| Tortoise Pipeline and Energy Fund – NAV | |

| 41.85% | | |

| 19.95% | | |

| -1.91% | | |

| -4.83% | | |

| 0.61% | |

| Tortoise Pipeline and Energy Fund – Market | |

| 51.20% | | |

| 24.57% | | |

| -2.27% | | |

| -5.14% | | |

| -0.79% | |

| Tortoise North American Pipeline Index | |

| 28.14% | | |

| 14.84% | | |

| 10.32% | | |

| 5.78% | | |

| 8.51% | |

| (1) |

Inception date of the Fund was October 26, 2011. |

Fund structure and distribution

policy

The fund is structured to qualify as a Regulated Investment

Company (RIC) allowing it to pass-through to shareholders income and capital gains earned, thus avoiding double-taxation. To qualify as

a RIC, the fund must meet specific income, diversification and distribution requirements. Regarding income, at least 90 percent of the

fund’s gross income must be from dividends, interest and capital gains. The fund must meet quarterly diversification requirements

including the requirement that at least 50 percent of the assets be in cash, cash equivalents or other securities with each single issuer

of other securities not greater than 5 percent of total assets. No more than 25 percent of total assets can be invested in any one issuer

other than government securities or other RIC’s. The fund must also distribute at least 90 percent of its investment company income.

RIC’s are also subject to excise tax rules which require RIC’s to distribute approximately 98 percent of net income and net

capital gains to avoid a 4 percent excise tax.

The fund has adopted a distribution policy which is

included on the inside front cover of this report. To summarize, the fund has adopted a managed distribution policy (“MDP”).

Annual distribution amounts are expected to fall in the range of 7% to 10% of the average week-ending net asset value (“NAV”)

per share for the prior fiscal semi-annual period. Distribution amounts will be reset both up and down to provide a consistent return

on trailing NAV. Under the MDP, distribution amounts will normally be reset in February and August, with no changes in distribution amounts

in May and November. The fund may designate a portion of its distributions as capital gains and may also distribute additional capital

gains in the last quarter of the year to meet annual excise distribution requirements. Distribution amounts are subject to change from

time to time at the discretion of the Board.

Leverage

The fund’s leverage utilization increased $0.8

million during the six months ended May 31, 2024, compared to the six months ended November 30, 2023, and represented 17.3% of total assets

at May 31, 2024. At year-end, the fund was in compliance with applicable coverage ratios, 60.0% of the leverage cost was fixed, the weighted-average

maturity was 0.6 years and the weighted-average annual rate on leverage was 5.37%. These rates will vary in the future as a result of

changing floating rates, utilization of the fund’s credit facility and as leverage matures or is redeemed.

Please see the Financial Statements and Notes to Financial

Statements for additional detail regarding critical accounting policies, results of operations, leverage and other important fund information.

For further information regarding the fund’s

leverage and distributions to stockholders, as well as a discussion of the tax impact on distributions, please visit www.tortoiseecofin.com.

(unaudited)

TTP Key

Financial Data (supplemental unaudited

information)

(dollar amounts in thousands unless otherwise indicated)

The information presented below is supplemental

non-GAAP financial information, is not inclusive of required financial disclosures (e.g. Total Expense Ratio), and should be read in conjunction

with the full financial statements.

| | |

2023 | | |

2024 |

| | |

Q1(1) | | |

Q2(1) | | |

Q3(1) | | |

Q4(1) | | |

Q1(1) | | |

Q2(1) | |

| Selected Financial Information | |

| | | |

| | | |

| | | |

| | | |

| | | |

| | |

| Distributions paid on common stock | |

$ | 1,248 | | |

$ | 1,249 | | |

$ | 1,249 | | |

$ | 1,186 | | |

$ | 1,186 | | |

$ | 1,186 | |

| Distributions paid on common stock per share | |

| 0.5900 | | |

| 0.5900 | | |

| 0.5900 | | |

| 0.5900 | | |

| 0.5900 | | |

| 0.5900 | |

| Total assets, end of period(2) | |

| 87,895 | | |

| 81,736 | | |

| 88,301 | | |

| 86,167 | | |

| 88,476 | | |

| 96,617 | |

| Average total assets during period(2)(3) | |

| 90,503 | | |

| 86,135 | | |

| 86,853 | | |

| 86,272 | | |

| 86,558 | | |

| 93,406 | |

| Leverage(4) | |

| 20,143 | | |

| 17,443 | | |

| 17,343 | | |

| 15,943 | | |

| 16,343 | | |

| 16,737 | |

| Leverage as a percent of total assets | |

| 22.9 | % | |

| 21.3 | % | |

| 19.6 | % | |

| 18.5 | % | |

| 18.5 | % | |

| 17.3 | % |

| Operating expenses before leverage costs(5) | |

| 1.31 | % | |

| 1.37 | % | |

| 1.39 | % | |

| 1.30 | % | |

| 1.32 | % | |

| 1.36 | % |

| Net unrealized appreciation (depreciation), end of period | |

| 13,950 | | |

| 9,483 | | |

| 17,306 | | |

| 17,779 | | |

| 21,106 | | |

| 29,711 | |

| Net assets, end of period | |

| 67,264 | | |

| 63,730 | | |

| 70,447 | | |

| 69,525 | | |

| 71,745 | | |

| 79,434 | |

| Average net assets during period(6) | |

| 69,939 | | |

| 66,399 | | |

| 69,717 | | |

| 69,161 | | |

| 69,552 | | |

| 77,012 | |

| Net asset value per common share | |

| 31.78 | | |

| 30.11 | | |

| 33.29 | | |

| 34.58 | | |

| 35.68 | | |

| 39.51 | |

| Market value per common share | |

| 27.09 | | |

| 24.81 | | |

| 28.36 | | |

| 28.02 | | |

| 29.23 | | |

| 34.70 | |

| Shares outstanding (000’s) | |

| 2,116 | | |

| 2,116 | | |

| 2,116 | | |

| 2,011 | | |

| 2,011 | | |

| 2,011 | |

| (1) |

Q1 is the period from December through February. Q2 is the period from March through May. Q3 is the period from June through

August. Q4 is the period from September through November. |

| (2) |

Includes deferred issuance and offering costs on senior notes and preferred stock. |

| (3) |

Computed by averaging month-end values within each period. |

| (4) |

Leverage consists of senior notes, preferred stock and outstanding borrowings under the revolving credit facility. |

| (5) |

Computed as a percent of total assets. |

| (6) |

Computed by averaging daily net assets within each period. |

2024 Semi-Annual Report | May 31, 2024

Tortoise

Energy Independence Fund, Inc. (NDP)

Fund description

NDP seeks a high level of total return

with an emphasis on current distributions paid to stockholders. NDP invests primarily in equity securities of upstream North American

energy companies that engage in the exploration and production of crude oil, condensate, natural gas and natural gas liquids that generally

have a significant presence in North American oil and gas fields, including shale reservoirs.

Fund performance

Good earnings reports relative to consensus, continued

management discipline toward capital allocation and mergers and acquisitions (M&A), and benign policy implications from Washington

drove broader energy sector performance higher. Further, while geopolitical turmoil continued in both Ukraine and Israel, the energy sector

sustained flows from areas of supply to demand centers. The Organization of the Petroleum Exporting Countries Plus (OPEC+) remained constant

in their goal to balance crude oil markets. Both dividend growth and opportunistic share repurchases continued. Enthusiasm for artificial

intelligence energy demand needs from a significant forecast for new data centers also specifically aided natural gas exposed areas of

energy. The fund’s market-based and NAV-based returns for the fiscal period ending May 31, 2024, were 22.0% and 16.4%, respectively

(including the reinvestment of distributions).

| 2024 mid-fiscal year summary |

|

| Quarterly distributions paid per share |

$0.6300 |

| Distribution rate (as of 5/31/2024) |

7.4% |

| Year-over-year distribution increase (decrease) |

0.0% |

| Cumulative distributions paid per share to stockholders since inception in July 2012 |

$18.5925 |

| Market-based total return |

21.99% |

| NAV-based total return |

16.36% |

| Premium (discount) to NAV (as of 5/31/2024) |

(14.4)% |

The fund utilizes a covered call strategy when appropriate,

which seeks to generate income while reducing overall volatility. No covered calls were written during the period.

Key asset performance drivers

| Top

five contributors |

Company type |

| Diamondback Energy Inc |

Oil & gas production company |

| Targa Resources Corp. |

Natural gas pipeline company |

| Kodiak Gas Services Inc. |

Gathering & processing company |

| Constellation Energy Corp. |

Power company |

| Exxon Mobil Corp. |

Oil & gas production company |

| Bottom five contributors |

Company type |

| Cheniere Energy, Inc. |

Natural gas pipeline company |

| Darling Ingredients Inc. |

Renewable infrastructure company |

| Baker Hughes Co. |

Oilfield services company |

| Excelerate Energy, Inc. |

Natural gas pipeline company |

| Kinetik Holdings Inc. |

Gathering & processing company |

Unlike the fund return, index return is pre-expenses.

Performance data quoted represent past performance:

past performance does not guarantee future results. Like any other stock, total return and market value will fluctuate so that an investment,

when sold, may be worth more or less than its original cost. Portfolio composition is subject to change due to ongoing management of the

fund. References to specific securities or sectors should not be construed as a recommendation by the fund or its adviser. See Schedule

of Investments for portfolio weighting at the end of the fiscal quarter.

(unaudited)

Tortoise

Energy Independence

Fund, Inc. (NDP) (continued)

Value

of $10,000 vs. Tortoise Energy Independence Fund – Market (unaudited)

From May 31, 2014 through May 31, 2024

The chart assumes an initial investment of $10,000.

Performance reflects waivers of fee and operating expenses in effect. In the absence of such waivers, total return would be reduced. Performance

data quoted represents past performance and does not guarantee future results. Investment returns and principal value will fluctuate,

and when sold, may be worth more or less than their original cost. Performance current to the most recent month-end may be lower or higher

than the performance quoted and can be obtained by calling 866-362-9331. Performance assumes the reinvestment of capital gains and income

distributions. The performance does not reflect the deduction of taxes that a shareholder would pay on Fund distributions or the redemption

of Fund shares.

Annualized Rates of Return as of

May 31, 2024

| | |

1-Year | |

3-Year | |

5-Year | |

10-Year | |

Since

Inception(1) |

| Tortoise Energy Independence Fund – NAV | |

| 36.31% | | |

| 28.92% | | |

| 2.57% | | |

| -8.01% | | |

| -3.88% | |

| Tortoise Energy Independence Fund – Market | |

| 35.88% | | |

| 28.61% | | |

| -4.85% | | |

| -8.28% | | |

| -5.50% | |

| S&P 500 Energy Select Sector Index | |

| 25.97% | | |

| 26.42% | | |

| 15.39% | | |

| 3.86% | | |

| 6.42% | |

| (1) |

Inception date of the Fund was July 26, 2012. |

Fund structure and distribution

policy

The fund is structured to qualify as a Regulated Investment

Company (RIC) allowing it to pass-through to shareholders income and capital gains earned, thus avoiding double-taxation. To qualify as

a RIC, the fund must meet specific income, diversification and distribution requirements. Regarding income, at least 90 percent of the

fund’s gross income must be from dividends, interest and capital gains. The fund must meet quarterly diversification requirements

including the requirement that at least 50 percent of the assets be in cash, cash equivalents or other securities with each single issuer

of other securities not greater than 5 percent of total assets. No more than 25 percent of total assets can be invested in any one issuer

other than government securities or other RIC’s. The fund must also distribute at least 90 percent of its investment company income.

RIC’s are also subject to excise tax rules which require RIC’s to distribute approximately 98 percent of net income and net

capital gains to avoid a 4 percent excise tax.

The fund has adopted a distribution policy which is

included on the inside front cover of this report. To summarize, the fund has adopted a managed distribution policy (“MDP”).

Annual distribution amounts are expected to fall in the range of 7% to 10% of the average week-ending net asset value (“NAV”)

per share for the prior fiscal semi-annual period. Distribution amounts will be reset both up and down to provide a consistent return

on trailing NAV. Under the MDP, distribution amounts will normally be reset in February and August, with no changes in distribution amounts

in May and November. The fund may designate a portion of its distributions as capital gains and may also distribute additional capital

gains in the last quarter of the year to meet annual excise distribution requirements. Distribution amounts are subject to change from

time to time at the discretion of the Board.

Leverage

The fund’s leverage utilization increased $1.4