false

0001846750

0001846750

2024-01-19

2024-01-19

0001846750

TCOA:UnitsEachConsistingOfOneClassOrdinaryShareAndOneRedeemableWarrantMember

2024-01-19

2024-01-19

0001846750

TCOA:ClassOrdinaryShare0.0001ParValuePerShareMember

2024-01-19

2024-01-19

0001846750

TCOA:RedeemableWarrantsEachWarrantExercisableForOneClassOrdinaryShareAtExerciseMember

2024-01-19

2024-01-19

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant

to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date

of Report (Date of earliest event reported): January 19, 2024

Zalatoris Acquisition Corp.

(Exact

name of registrant as specified in its charter)

Delaware

(State

or other jurisdiction of incorporation)

| 001-41143 |

|

86-1837862 |

| (Commission File Number) |

|

(IRS Employer

Identification No.) |

99 Wall Street, Suite 5801,

New York, New York 10005

(Address of principal executive offices) (Zip Code)

Registrant’s

telephone number, including area code (917) 675-3106

N/A

(Former

name or former address, if changed since last report)

Check

the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under

any of the following provisions:

| ☒ | Written

communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement

communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement

communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities

registered pursuant to Section 12(b) of the Act:

| Title

of Each Class |

|

Trading

Symbol(s) |

|

Name

of Each Exchange on Which Registered |

| Units, each consisting of

one Class A Ordinary share and one Redeemable Warrant |

|

TCOA.U |

|

New York Stock Exchange |

| Class A Ordinary Share, $0.0001

par value per share |

|

TCOA |

|

New York Stock Exchange |

| Redeemable Warrants, each warrant exercisable

for one Class A Ordinary Share at an exercise price of $11.50 per share |

|

TCOA WS |

|

New York Stock Exchange |

Indicate

by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405

of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging

growth company ☒

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying

with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item

7.01. Regulation FD Disclosure.

As

previously reported, on September 8, 2023, Zalatoris Acquisition Corp., a Delaware corporation (the “Company”), entered

into a definitive Business Combination Agreement and Plan of Merger (the “Business Combination Agreement”) with Millymont

Limited, a private limited company incorporated in Ireland (“Holdco”), AnyTech365 Merger Sub, Inc., a Delaware corporation

and wholly-owned subsidiary of Holdco (“Merger Sub”), J. Streicher Technical Services, LLC, a Delaware limited liability

company (“J. Streicher”), Anteco Systems, S.L., trading as AnyTech365, a company incorporated in Spain and registered

at the Commercial Registry of Malaga under reference MA-122108 (the “Target”), Miguel Angel Casales Ruiz and Thomas

Marco Balsloev, as the Target’s representatives (the “Target’s Representatives”), and Jaleel Lewis, as

the Company’s representative (the “Company Representative”). The Company, Merger Sub, Holdco, J. Streicher,

Target, Target’s Representatives, and Company Representative are sometimes referred to herein individually as a “Party”

and, collectively as the “Parties.”

On

January 19, 2024, the Company issued a press release announcing the confidential submission of a draft registration statement on Form

F-4, including a preliminary proxy statement/prospectus (the “Registration Statement”) to the U.S. Securities and

Exchange Commission (the “SEC”) with respect to the Business Combination Agreement and the proposed business combination

(the “Transaction”). Furnished as Exhibit 99.1 hereto and incorporated into this Item 7.01 by reference is the Press

Release. Neither the information in this Item 7.01 nor Exhibit 99.1 is to be deemed filed for purposes of Section 18 of the Securities

Act of 1934, as amended (the “Exchange Act”), or otherwise subject to liabilities under that section, and shall not

be deemed to be incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act.

Additional

Information and Where to Find It

In

connection with the Transaction between the Parties, Holdco filed confidentially with the SEC a preliminary Registration Statement, which

will be delivered to the Company’s stockholders once definitive. This Current Report on Form 8-K does not contain all the information

that should be considered concerning the Transaction and the other matters for the Company’s stockholders’ approval in connection

with the Transaction (the “Stockholder Approval Matters”) and is not intended to form the basis of any investment

decision or any other decision in respect of the Transaction and the Stockholder Approval Matters. The Company’s stockholders and

other interested persons are advised to read, when available, the definitive Registration Statement and other documents filed in connection

with the Transaction and Stockholder Approval Matters, as these materials will contain important information about the Company, the Target,

the Transaction and the Stockholder Approval Matters. When available, the Registration Statement and other relevant materials for the

Transaction and Stockholder Approval Matters will be mailed to stockholders of the Company as of a record date to be established for

voting on the Transaction and the Stockholder Approval Matters. Stockholders will also be able to obtain copies of the Registration Statement

and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov, or by directing a

request to: Zalatoris Acquisition Corp., 99 Wall Street, Suite 5801, New York, NY 10005.

No

Offer or Solicitation

This

Current Report on Form 8-K is for informational purposes only and is not intended to and shall not constitute a proxy statement or the

solicitation of a proxy, consent or authorization with respect to any securities or in respect of the Transaction and is not intended

to and shall not constitute an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy or subscribe

for any securities or a solicitation of any vote of approval, nor shall there be any sale, issuance or transfer of securities in any

jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities

laws of any such jurisdiction.

Participants

in Solicitation

The

Company and its directors and executive officers may be deemed participants in the solicitation of proxies from the Company’s stockholders

with respect to the Business Combination and related matters. A list of the names of those directors and executive officers and a description

of their interests in the Company is contained in the Company’s Registration Statement on Form S-1, as amended, which was initially

filed with the SEC on March 8, 2021 and is available free of charge at the SEC’s web site at www.sec.gov, or by directing a request

to Zalatoris Acquisition Corp., 99 Wall Street, Suite 5801, New York, NY 10005. Additional information regarding the interests of such

participants will be contained in the Prospectus and Proxy Statement when available.

The

Target and its directors, managers, and executive officers may also be deemed to be participants in the solicitation of proxies from

the Company’s stockholders in connection with the Business Combination and related matters. A list of the names of such parties

and information regarding their interests in the Business Combination and related matters will be included in the Prospectus and Proxy

Statement when available.

Cautionary

Statement Regarding Forward-Looking Statements

This

Current Report on Form 8-K contains “forward-looking statements” within the meaning of the Private Securities Litigation

Reform Act of 1995. Such statements include, but are not limited to, statements about future financial and operating results, our plans,

objectives, expectations and intentions with respect to future operations, products and services; and other statements identified

by words such as “will likely result,” “are expected to,” “will continue,” “is anticipated,”

“estimated,” “believe,” “intend,” “plan,” “projection,” “outlook”

or words of similar meaning. These forward-looking statements include, but are not limited to, statements regarding the Target’s

industry and market sizes, future opportunities for the Company and the Target, the Company’s and the Target’s estimated

future results and the transactions contemplated by the Transaction, including the implied enterprise value and ownership structure and

the likelihood and ability of the parties to successfully consummate the Transaction. Such forward-looking statements are based upon

the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive uncertainties

and contingencies, many of which are difficult to predict and generally beyond our control. Actual results and the timing of events may

differ materially from the results anticipated in these forward-looking statements.

In

addition to factors previously disclosed in the Company’s reports filed with the SEC and those identified elsewhere in this communication,

the following factors, among others, could cause actual results and the timing of events to differ materially from the anticipated results

or other expectations expressed in the forward-looking statements: (1) the risk that the Transaction may not be completed in a timely

manner or at all, which may adversely affect the price of the Company’s securities; (2) the risk that the Transaction may

not be completed by the Company’s deadline as set out in the Company’s charter and the potential failure to obtain an extension

of such deadline if sought by the Company; (3) the failure to satisfy the conditions to the consummation of the Transaction, including

the adoption of the Business Combination Agreement by the stockholders of the Company and the receipt of certain governmental and regulatory

approvals; (4) the lack of a third-party valuation in determining whether or not to pursue the Transaction; (5) the occurrence

of any event, change or other circumstance that could give rise to the termination of the Business Combination Agreement; (6) the

effect of the announcement or pendency of the Transaction on the Target’s business relationships, performance and business generally;

(7) risks that the Transaction disrupts current plans and operations of the Target; (8) the outcome of any legal proceedings that

may be instituted against the Target or the Company related to the Transaction; (9) the ability to maintain the listing of the Company’s

securities on the NYSE; (10) the price of the Company’s securities, including following the closing of the Transaction, may

be volatile due to a variety of factors, including changes in the competitive and regulated industries in which the Target operates,

variations in performance across competitors, changes in laws and regulations affecting the Target’s business and changes in the

capital structure; (11) the ability to implement business plans, forecasts, and other expectations after the completion of the Transaction

and to identify and realize additional opportunities; (12) the risk of downturns and the possibility of rapid change in the highly

competitive industry in which the Target operates, and the risk of changes in applicable law, rules, regulations and regulatory guidance

that could adversely impact the Target’s operations; (13) the risk that the Target and its current and future collaborators

are unable to successfully develop and commercialize the Target’s products or services, or experience significant delays in doing

so; (14) the risk that the Target may not achieve or sustain profitability; (15) the risk that the Target will need to raise

additional capital to execute its business plan, which may not be available on acceptable terms or at all; and (16) the risk that

the Target experiences difficulties in managing its growth and expanding operations.

Actual

results, performance or achievements may differ materially, and potentially adversely, from any projections and forward-looking statements

and the assumptions on which those forward-looking statements are based. There can be no assurance that the data contained herein is

reflective of future performance to any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor

of future performance as projected financial information and other information are based on estimates and assumptions that are inherently

subject to various significant risks, uncertainties and other factors, many of which are beyond our control. All information set forth

herein speaks only as of the date hereof in the case of information about the Company and the Target or the date of such information

in the case of information from persons other than the Company or the Target, and we disclaim any intention or obligation to update any

forward-looking statements as a result of developments occurring after the date of this communication. Forecasts and estimates regarding

the Target’s industry and end markets are based on sources we believe to be reliable, however there can be no assurance these forecasts

and estimates will prove accurate in whole or in part. Annualized, pro forma, projected, and estimated numbers are used for illustrative

purpose only, are not forecasts and may not reflect actual results

Item

9.01. Financial Statements and Exhibits.

Exhibit

Number |

|

Description

of Exhibit |

| 99.1 |

|

Press Release dated January 19, 2024 |

| 104 |

|

Cover

Page Interactive Data File (Embedded within the Inline XBRL document and included in Exhibit) |

SIGNATURES

Pursuant

to the requirements of the Securities Exchange Act of 1934, as amended, the Company has caused this report to be signed on its behalf

by the undersigned duly authorized officer.

| |

ZALATORIS ACQUISITION CORP. |

| |

|

|

| Date: January 19, 2024 |

By: |

/s/ Paul Davis |

| |

|

Paul Davis |

| |

|

Chief Executive Officer |

4

Exhibit 99.1

Zalatoris Acquisition Corp

Announces Confidential Submission of Draft Registration Statement to the SEC for Proposed Business Combination with AnyTech365, an AI-powered

IT Security Company

NEW YORK, NY, January 19, 2024 (Newswire.com)

– Anteco Systems, S.L. (“AnyTech365”), a leader in AI-powered IT security, and Zalatoris Acquisition Corp. (the

“Company”) (NYSE: TCOA), a special purpose acquisition company, have submitted a confidential draft of Registration Statement

on Form F-4, including a preliminary proxy statement/prospectus (the “Registration Statement”), to the U.S. Securities and

Exchange Commission (the “SEC”) with respect to their previously announced business combination agreement (“Business

Combination Agreement”) and proposed business combination (the “Transaction”).

The Registration Statement contains a preliminary

proxy statement and prospectus in connection with the Business Combination Agreement and proposed business combination. While the Registration

Statement has not yet become effective and the information contained therein is subject to change, it provides important information about

AnyTech365, the Company, and the Transaction.

The Transaction is subject

to, among other things, approval by the Company’s stockholders, satisfaction of the conditions stated in the Business Combination

Agreement and other customary closing conditions, including the Registration Statement being declared effective by the SEC, the receipt

of certain regulatory approvals, and approval by the New York Stock Exchange (“NYSE”) to list the securities of

the combined company.

About AnyTech365

Founded in 2014 and headquartered in Marbella,

Spain, AnyTech365 is a leading European AI-powered IT Security company helping end users and small businesses have a worry-free experience

with all things tech. With approximately 280 employees and offices in Marbella and Torremolinos (Spain), Casablanca (Morocco), and San

Francisco (California, US), AnyTech365 offers an array of security, performance, threat prevention and optimization software and hardware.

AnyTech365’s flagship product is their unique

and groundbreaking AI-powered AnyTech365 IntelliGuard, which is the cornerstone and foundation within all products, services and plans.

AnyTech365 offers qualified technicians who are available 24/7, 365 days a year, providing fast, technical focused support for practically

any security, performance or optimization issues that users may experience with their PC, laptop, smartphone, wearable technology, smart

home devices or any Internet-connected device.

To learn more, visit www.anytech365.com.

About Zalatoris Acquisition Corp.

The Company is a blank check company, which was

formed to acquire one or more businesses and assets, via a merger, capital stock exchange, asset acquisition, stock purchase, or reorganization.

The Company was formed to effect a business combination with middle market “enabling technology” businesses or assets with

a focus on eCommerce, FinTech, Big Data & Analytics and Robotic Process Automation.

About J. Streicher (Sponsor)

J. Streicher Holdings, LLC, though its subsidiaries

(“J. Streicher”), is a private and diverse US financial organization that is founded on tradition, personal relationships,

innovation, and steadfast principles. J. Streicher & Co. LLC, its broker dealer, holds the distinction of being one of the oldest

firms on the NYSE, with roots dating back to 1910. Throughout J. Streicher’s history, it has consistently provided exceptional service

to its family of listed companies, even in challenging market conditions.

While J. Streicher’s broker dealer primarily

focuses on NYSE activities, its international investment team specializes in identifying, investing in, and nurturing potential target

companies, guiding them through the complex process of transitioning into publicly traded entities. The ultimate goal is to position these

companies for a successful listing. J. Streicher's core strength lies in its ability to recognize strategic private target companies and

assist them in becoming publicly traded entities on prestigious exchanges such as the NYSE or NASDAQ.

Additional Information and Where to Find It

As discussed above, the Company filed confidentially

with the SEC a preliminary Registration Statement, which will be delivered to its stockholders once definitive. This document does not

contain all the information that should be considered concerning the proposed business combination and the other matters for the Company’s

stockholders’ approval in connection with the Transaction (the “Stockholder Approval Matters”) and is not intended to

form the basis of any investment decision or any other decision in respect of the proposed business combination and the other Stockholder

Approval Matters. The Company’s stockholders and other interested persons are advised to read, when available, the definitive Registration

Statement and other documents filed in connection with the proposed business combination and other Stockholder Approval Matters, as these

materials will contain important information about the Company, AnyTech365, the proposed business combination and the other Stockholder

Approval Matters. When available, the Registration Statement and other relevant materials for the proposed business combination and other

Stockholder Approval Matters will be mailed to stockholders of the Company as of a record date to be established for voting on the proposed

business combination and the other Stockholder Approval Matters. Stockholders of the Company will also be able to obtain copies of the

Registration Statement and other documents filed with the SEC, without charge, once available, at the SEC’s website at www.sec.gov,

or by directing a request to: Zalatoris Acquisition Corp., 99 Wall Street, Suite 5801, New York, NY 10005.

Participants in Solicitation

The Company and its directors and executive

officers may be deemed participants in the solicitation of proxies from the Company’s stockholders with respect to the proposed

business combination and related matters. A list of the names of those directors and executive officers and a description of their interests

in the Company is contained in the Company’s Registration Statement on Form S-1, as amended, which was initially filed

with the SEC on March 8, 2021 and is available free of charge at the SEC’s web site at www.sec.gov, or by directing a request

to Zalatoris Acquisition Corp., 99 Wall Street, Suite 5801, New York, NY 10005. Additional information regarding the interests of such

participants will be contained in the definitive Registration Statement when available.

AnyTech365 and its directors, managers,

and executive officers may also be deemed to be participants in the solicitation of proxies from the Company’s stockholders in connection

with the proposed business combination and related matters. A list of the names of such parties and information regarding their interests

in the proposed business combination and related matters will be included in the definitive Registration Statement when available.

Cautionary Statement Regarding Forward-Looking

Statements

This document contains “forward-looking

statements” within the meaning of the Private Securities Litigation Reform Act of 1995. Such statements include, but are not limited

to, statements about future financial and operating results, our plans, objectives, expectations and intentions with respect to future

operations, products and services; and other statements identified by words such as “will likely result,” “are expected

to,” “will continue,” “is anticipated,” “estimated,” “believe,” “intend,”

“plan,” “projection,” “outlook” or words of similar meaning. These forward-looking statements include,

but are not limited to, statements regarding AnyTech365’s industry and market sizes, future opportunities for the Company and AnyTech365,

the Company’s and AnyTech365’s estimated future results and the Transaction, including the implied enterprise value and ownership

structure and the likelihood and ability of the parties to successfully consummate the Transaction. Such forward-looking statements are

based upon the current beliefs and expectations of our management and are inherently subject to significant business, economic and competitive

uncertainties and contingencies, many of which are difficult to predict and generally beyond our control. Actual results and the timing

of events may differ materially from the results anticipated in these forward-looking statements.

In addition to factors previously disclosed

in the Company’s reports filed with the SEC and those identified elsewhere in this communication, the following factors, among

others, could cause actual results and the timing of events to differ materially from the anticipated results or other expectations expressed

in the forward-looking statements: (1) the risk that the Transaction may not be completed in a timely manner or at all, which may

adversely affect the price of the Company’s securities; (2) the risk that the Transaction may not be completed by the Company’s

deadline in the Company’s charter and the potential failure to obtain an extension of such deadline if sought by the Company; (3) the

failure to satisfy the conditions to the consummation of the Transaction, including the adoption of the Business Combination Agreement

by the stockholders of the Company and the receipt of certain governmental and regulatory approvals; (4) the lack of a third-party

valuation in determining whether or not to pursue the Transaction; (5) the occurrence of any event, change or other circumstance

that could give rise to the termination of the Business Combination Agreement; (6) the effect of the announcement or pendency of

the Transaction on AnyTech365’s business relationships, performance and business generally; (7) risks that the Transaction

disrupts current plans and operations of AnyTech365; (8) the outcome of any legal proceedings that may be instituted against AnyTech365

or the Company related to the Business Combination Agreement or the Transaction; (9) the ability to maintain the listing of the

Company’s securities on the NYSE; (10) the price of the Company’s securities, including following the closing of the

proposed business combination, may be volatile due to a variety of factors, including changes in the competitive and regulated industries

in which AnyTech365 operates, variations in performance across competitors, changes in laws and regulations affecting AnyTech365’s

business and changes in the capital structure; (11) the ability to implement business plans, forecasts, and other expectations after

the completion of the Transaction and to identify and realize additional opportunities; (12) the risk of downturns and the possibility

of rapid change in the highly competitive industry in which AnyTech365 operates, and the risk of changes in applicable law, rules, regulations

and regulatory guidance that could adversely impact AnyTech365’s operations; (13) the risk that AnyTech365 and its current

and future collaborators are unable to successfully develop and commercialize AnyTech365’s products or services, or experience

significant delays in doing so; (14) the risk that AnyTech365 may not achieve or sustain profitability; (15) the risk that

AnyTech365 will need to raise additional capital to execute its business plan, which may not be available on acceptable terms or at all;

and (16) the risk that AnyTech365 experiences difficulties in managing its growth and expanding operations.

Actual results, performance or achievements

may differ materially, and potentially adversely, from any projections and forward-looking statements and the assumptions on which those

forward-looking statements are based. There can be no assurance that the data contained herein is reflective of future performance to

any degree. You are cautioned not to place undue reliance on forward-looking statements as a predictor of future performance as projected

financial information and other information are based on estimates and assumptions that are inherently subject to various significant

risks, uncertainties and other factors, many of which are beyond our control. All information set forth herein speaks only as of the date

hereof in the case of information about the Company and AnyTech365 or the date of such information in the case of information from persons

other than the Company or AnyTech365, and we disclaim any intention or obligation to update any forward-looking statements as a result

of developments occurring after the date of this communication. Forecasts and estimates regarding AnyTech365’s industry and end

markets are based on sources we believe to be reliable; however, there can be no assurance these forecasts and estimates will prove accurate

in whole or in part. Annualized, pro forma, projected, and estimated numbers are used for illustrative purpose only, are not forecasts

and may not reflect actual results.

No Offer or Solicitation

This document is for informational

purposes only and is not intended to and shall not constitute a proxy statement or the solicitation of a proxy, consent or authorization

with respect to any securities or in respect of the proposed business combination and is not intended to and shall not constitute an offer

to sell or the solicitation of an offer to sell or the solicitation of an offer to buy or subscribe for any securities or a solicitation

of any vote of approval, nor shall there be any sale, issuance or transfer of securities in any jurisdiction in which such offer, solicitation

or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction.

Contacts

Investor Relations & Media Contacts:

Email: pr@zalatorisac.com

Number: +1 (917) 675-3106

v3.23.4

Cover

|

Jan. 19, 2024 |

| Document Type |

8-K

|

| Amendment Flag |

false

|

| Document Period End Date |

Jan. 19, 2024

|

| Entity File Number |

001-41143

|

| Entity Registrant Name |

Zalatoris Acquisition Corp.

|

| Entity Central Index Key |

0001846750

|

| Entity Tax Identification Number |

86-1837862

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity Address, Address Line One |

99 Wall Street

|

| Entity Address, Address Line Two |

Suite 5801

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10005

|

| City Area Code |

917

|

| Local Phone Number |

675-3106

|

| Written Communications |

true

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Elected Not To Use the Extended Transition Period |

false

|

| Units, each consisting of one Class A Ordinary share and one Redeemable Warrant |

|

| Title of 12(b) Security |

Units, each consisting of

one Class A Ordinary share and one Redeemable Warrant

|

| Trading Symbol |

TCOA.U

|

| Security Exchange Name |

NYSE

|

| Class A Ordinary Share, $0.0001 par value per share |

|

| Title of 12(b) Security |

Class A Ordinary Share, $0.0001

par value per share

|

| Trading Symbol |

TCOA

|

| Security Exchange Name |

NYSE

|

| Redeemable Warrants, each warrant exercisable for one Class A Ordinary Share at an exercise |

|

| Title of 12(b) Security |

Redeemable Warrants, each warrant exercisable

for one Class A Ordinary Share at an exercise price of $11.50 per share

|

| Trading Symbol |

TCOA WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=TCOA_UnitsEachConsistingOfOneClassOrdinaryShareAndOneRedeemableWarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=TCOA_ClassOrdinaryShare0.0001ParValuePerShareMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=TCOA_RedeemableWarrantsEachWarrantExercisableForOneClassOrdinaryShareAtExerciseMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

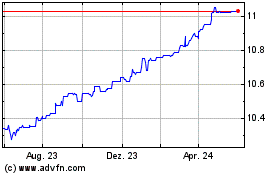

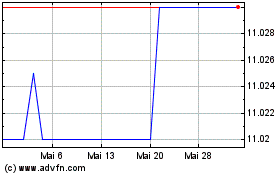

Zalatoris Acquisition (NYSE:TCOA)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Zalatoris Acquisition (NYSE:TCOA)

Historical Stock Chart

Von Nov 2023 bis Nov 2024