false

0000007332

0000007332

2024-10-01

2024-10-01

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d)

OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 1, 2024

SOUTHWESTERN ENERGY COMPANY

(Exact Name of Registrant as Specified in Charter)

| Delaware |

|

001-08246 |

|

71-0205415 |

(State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

10000 Energy Drive

Spring, Texas 77389

(Address of principal executive offices) (Zip Code)

(832) 796-1000

(Registrant’s telephone number, including

area code)

Check the appropriate box below if the Form 8-K

filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

¨

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

¨ Soliciting

material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

¨

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

¨

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| Title of Each Class |

|

Trading

Symbol(s) |

|

Name of Each Exchange

on Which Registered |

| Common Stock, Par Value of $0.01 |

|

SWN |

|

New York Stock Exchange (1) |

(1) The registrant’s common stock ceased being traded as of the close of the market on September 30, 2024 in connection with the closing of the Mergers described herein and will no longer be listed on the New York Stock Exchange.

Indicate by check mark whether the registrant is an emerging growth

company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ¨

If an emerging growth company, indicate by check mark if the registrant

has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant

to Section 13(a) of the Exchange Act. ¨

Introductory Note

On

October 1, 2024 (“Closing Date”), Southwestern Energy Company, a Delaware corporation (“Southwestern”

or the “Company”), completed its previously announced merger with Chesapeake

Energy Corporation, an Oklahoma corporation (“Chesapeake”), pursuant to the terms of that certain Agreement

and Plan of Merger, dated as of January 10, 2024 (the “Merger Agreement”), by and among Southwestern, Chesapeake,

Hulk Merger Sub, Inc., a Delaware corporation and wholly owned subsidiary of Chesapeake (“Merger Sub”) and Hulk

LLC Sub, LLC, a Delaware limited liability company and wholly owned subsidiary of Chesapeake (“Merger Sub LLC”).

Pursuant to the Merger Agreement, immediately following the Effective Time, Chesapeake changed its name to “Expand Energy Corporation”

(the “Company” or “Expand Energy”). In addition, Chesapeake changed its NASDAQ ticker symbol “CHK”

to “EXE” and expects to begin trading under the “EXE” trading symbol effective as of the open of trading on the

NASDAQ on October 2, 2024.

The Mergers

Pursuant

to the Merger Agreement, at the Effective Time (as defined below), Merger Sub merged with and into Southwestern (the “First Merger”),

with Southwestern surviving the First Merger as a direct wholly owned subsidiary of Chesapeake, and, subsequently, Southwestern merged

with and into Merger Sub LLC, with Merger Sub LLC continuing as the surviving entity (the “Surviving LLC”) and as a

direct, wholly owned subsidiary of Chesapeake (the “Second Merger”), and, subsequently, the Surviving LLC merged with

and into Chesapeake, with Chesapeake continuing as the surviving entity (together, with the First Merger and Second Merger, the “Mergers”),

and each eligible share of common stock of Southwestern, par value $0.01 per share (the “Southwestern Common Stock”)

issued and outstanding immediately prior to the Effective Time was converted automatically into the right to receive 0.0867 (the “Exchange

Ratio”) shares of Chesapeake Common Stock, with cash paid in lieu of the issuance of any fractional shares, in each case, as

provided in the Merger Agreement.

In addition, at the Effective Time:

| · | each outstanding and unexercised option award of Southwestern as of immediately prior to the Effective

Time ceased to represent a right to acquire shares of Southwestern Common Stock and was automatically canceled and terminated without

consideration payable or owed thereto; |

| · | each outstanding restricted stock award of Southwestern was automatically fully vested and each such restricted

stock award was converted into the right to receive a number of shares of Chesapeake Common Stock equal to (i) the Exchange Ratio,

multiplied by (ii) the total number of shares of Southwestern Common Stock attributable to such restricted stock award; |

| · | each outstanding restricted stock unit award of Southwestern under Southwestern’s Nonemployee Director

Deferred Compensation Plan was automatically fully vested, canceled, and converted into the right to receive a number of shares of Chesapeake

Common Stock equal to (i) the Exchange Ratio, multiplied by (ii) the total number of shares of Southwestern Common Stock subject

to such restricted stock unit award, together with accrued dividend equivalent payments in each case issuable and payable at the times

specified in Southwestern’s Nonemployee Director Deferred Compensation Plan and in accordance with such director’s deferral

elections as set forth in the applicable Deferred Compensation Agreement; |

| · | each outstanding restricted stock unit award of Southwestern that (i) was granted pursuant to Southwestern’s

2013 Incentive Plan, or (ii) was granted prior to the date of the Merger Agreement and was held by an employee of Southwestern or

its Subsidiaries (as defined in the Merger Agreement) who was terminated upon or immediately after the Effective Time, and was subject

only to time-based vesting conditions, was fully vested, canceled and converted into the right to receive a number of shares of Chesapeake

Common Stock equal to (A) the Exchange Ratio, multiplied by (B) the total number of shares of Southwestern Common Stock subject

to each such restricted stock unit award, together with accrued dividend equivalent payments, in each case issuable and payable in accordance

with the terms of the applicable award agreement; |

| · | each outstanding restricted stock unit award that was granted pursuant to Southwestern’s 2022 Incentive

Plan (and not described above) and that was subject only to time-based vesting conditions was canceled and converted into an award of

restricted stock units in respect of shares of Chesapeake Common Stock (rounded to the nearest whole share) equal to the product of (i) the

total number of shares of Southwestern Common Stock subject to such restricted stock unit award immediately prior to the Effective Time

multiplied by (ii) the Exchange Ratio. Such restricted stock unit award shall vest and become payable on the same terms and conditions

(including “double-trigger” vesting provisions) as are set forth in the corresponding award agreement (except that such award

will be payable in Chesapeake Common Stock); |

| · | each outstanding performance unit award that (i) was granted pursuant to the Southwestern’s

2013 Incentive Plan, or (ii) was granted prior to the date of the Merger Agreement and was held by an employee of Southwestern or

its Subsidiaries (as defined in the Merger Agreement) that was terminated upon or immediately after the Effective Time was (A) automatically

fully vested and became payable at the greater of (1) the level based on actual performance determined as of immediately prior to

the Effective Time in accordance with the terms of the applicable award agreement and (2) the target level (the number of shares

of Southwestern Common Stock payable pursuant to the foregoing, the “Earned Company Performance Shares”), and (B) canceled

and converted into the right to receive a number of shares Chesapeake Common Stock equal to (1) the Exchange Ratio, multiplied by

(2) the number of Earned Company Performance Shares, together with accrued dividend equivalent payments, in each case issuable and

payable in accordance with the terms of the applicable award agreement; |

| · | each outstanding performance unit award of Southwestern that was granted pursuant to

Southwestern’s 2022 Incentive Plan (and not described above) was deemed to correspond to a number of Earned Company

Performance Shares, and was canceled and converted into an award of time-based vesting restricted stock units in respect of that

number of shares of Chesapeake Common Stock (rounded to the nearest whole share) equal to (i) the number of Earned Company

Performance Shares with respect to such performance unit award multiplied by (ii) the Exchange Ratio. Such restricted stock

units shall time-vest at the end of the original performance period and are otherwise subject to and payable on the same terms and

conditions (including “double-trigger” vesting provisions) as are set forth in the corresponding award agreement (except

that such award will be payable in shares of Chesapeake Common Stock); |

| · | each outstanding performance cash unit award of Southwestern that (i) was granted pursuant to Southwestern’s

2013 Incentive Plan, or (ii) was granted prior to the date of Merger Agreement and was held by an employee of Southwestern or its

Subsidiaries (as defined in the Merger Agreement) who was terminated upon or immediately after the Effective Time was automatically fully

vested and payable in cash in an amount equal to $1.00 per unit granted under such performance cash unit award multiplied by the greater

of (A) the percentage earned based on actual performance determined as of immediately prior to the Effective Time in accordance with

the terms of the applicable award agreement and (B) 100%; and |

| · | each outstanding performance cash unit award of Southwestern that was granted pursuant to Southwestern’s

2022 Incentive Plan (other than those described above) was deemed earned at a level equal to $1.00 per unit granted under such performance

cash unit award multiplied by the greater of (i) the percentage earned based on actual performance determined as of immediately prior

to the Effective Time in accordance with the terms of the applicable award agreement and (ii) 100%. Such amount will vest and become

payable in cash at the end of the original performance period associated with the corresponding performance cash unit award of Southwestern

and was otherwise subject to and payable on the same terms and conditions (including “double-trigger” vesting provisions)

as are set forth in the corresponding award agreement. |

The foregoing description of the Mergers and the

Merger Agreement does not purport to be complete and is qualified in its entirety by reference to the full text of the Merger Agreement,

which is attached hereto as Exhibit 2.1 and is incorporated herein by reference.

| Item 1.01 |

Entry into a Material Definitive Agreement |

The information set forth in the Introductory Note

of this Current Report on Form 8-K is incorporated by reference into this Item 1.01.

| Item 1.02 |

Termination of a Material Definitive Agreement |

Southwestern Credit Agreement

In connection with the closing of the Mergers,

prior to the Effective Time, Southwestern terminated all outstanding lender commitments, including commitments of the lenders to issue

letters of credit, under that certain Amended and Restated Credit Agreement, dated as of April 8, 2022, by and among Southwestern,

JPMorgan Chase Bank, N.A., as administrative agent, and the lenders from time to time party thereto, as amended by that certain Amendment

No. 1 to Amended and Restated Credit Agreement, dated as of August 4, 2022 (as further amended, amended and restated, supplemented

or otherwise modified from time to time, the “Southwestern Credit Agreement”). In connection with the termination of

the Southwestern Credit Agreement, on the Closing Date, all outstanding obligations for principal, interests and fees under the Southwestern

Credit Agreement were paid off in full, and all liens securing such obligations and any letter of credit or hedging obligations permitted

by the Southwestern Credit Agreement to be secured by such liens and guarantees of such obligations were released.

| Item 2.01 |

Completion of Acquisition or Disposition of Assets |

As discussed in the Introductory Note to this

Current Report on Form 8-K, on October 1, 2024, Southwestern completed its previously announced merger with Chesapeake pursuant

to the terms of the Merger Agreement.

The foregoing description of the Merger Agreement

and the transactions contemplated thereby is a summary only, does not purport to be complete and is subject to and qualified in its entirety

by reference to the full text of the Merger Agreement. The information set forth in the Introductory Note of this Current Report on Form 8-K

is incorporated by reference into this Item 2.01.

| Item 3.01 |

Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing |

Prior to the completion of the Mergers, shares

of Southwestern Common Stock were listed and traded on the New York Stock Exchange (the “NYSE”) under the trading symbol

“SWN.” Pursuant to the Merger Agreement, Southwestern notified the NYSE of the Mergers and requested that the NYSE withdraw

the listing of Southwestern Common Stock. Upon Southwestern’s request, on October 1, 2024, the NYSE filed a notification of

removal from listing on Form 25 with the SEC with respect to the delisting of the Southwestern Common Stock and the deregistration

of the Southwestern Common Stock under Section 12(b) of the Exchange Act. The trading of Southwestern Common Stock on the NYSE

was suspended before the opening of the market on October 1, 2024, and the Southwestern Common Stock is no longer listed on the

NYSE.

In addition, Chesapeake, as successor in interest

to Merger Sub LLC, as successor in interest to Southwestern, intends to file with the SEC a Form 15 requesting that the reporting

obligations of Southwestern under Sections 13(a) and 15(d) of the Exchange Act be suspended.

| Item 3.03 |

Material Modification to Rights of Security Holders |

The information set forth in the Introductory

Note and Item 3.01 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

| Item 5.01 |

Changes in Control of Registrant |

As

a result of the consummation of the First Merger (the “Effective Time”), Southwestern became a wholly-owned subsidiary

of Chesapeake. Immediately following the First Merger, Southwestern merged with and into Merger Sub LLC, with Merger Sub LLC continuing

as the surviving entity and a wholly owned subsidiary of Chesapeake, and subsequently, Merger

Sub LLC merged with and into Chesapeake, with Chesapeake continuing as the surviving entity.

The information set forth under the Introductory

Note and Items 2.01, 3.03 and 5.02 of this Current Report on Form 8-K is incorporated by reference into this Item 5.01.

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers;

Compensatory Arrangements of Certain Officers |

Pursuant to the Merger Agreement, all of the directors

and officers of Southwestern, other than the General Counsel, ceased serving in such capacities, immediately prior to the Effective Time.

Each of the former named executive officers of Southwestern and the principal accounting officer of Southwestern whose employment is also

being terminated in connection with the Mergers will receive the following severance benefits pursuant to their respective executive severance

agreements: (i) a lump sum payment equal to the sum of any annualized bonus accrued to such officer through such officer’s

termination date and unpaid as of such date, plus the product of (a) 2.99 (for William J. Way, Carl F. Giesler, Jr. and Clayton

A. Carrell) or 2.0 (for John P. Kelly and Colin P. O’Beirne) and (b) the sum of (1) the executive’s base salary

as of the executive’s termination date plus (2) the maximum bonus opportunity available to the executive under the annual incentive

bonus program and (ii) continued participation in certain health and welfare benefits from the employment termination date until

the earliest of (x) the expiration of three years, (y) death or (z) the date he or she is afforded a comparable benefit

at comparable cost by a subsequent employer. Additionally, the long-term incentive awards held by such officers will fully vest. The former

directors of Southwestern will receive vested shares pursuant to their respective award agreements.

In addition, as contemplated by the Merger Agreement,

effective as of the Effective Time, Catherine A. Kehr, John D. Gass, Shameek Konar and S. P. “Chip” Johnson IV, who were members

of the board of directors of Southwestern, immediately prior to the Effective Time, were appointed to Chesapeake’s board of directors.

Chris Lacy, who was Senior Vice President, General Counsel and Secretary of Southwestern prior to the Effective Time, was appointed as

Chesapeake’s Executive Vice President, General Counsel and Corporate Secretary, as of the Effective Time.

| Item 7.01 |

Regulation FD Disclosure |

On October 1, 2024, Chesapeake issued a press

release announcing the completion of the Mergers and other matters.

The full text of the press release is included

as Exhibit 99.1 to this Current Report on Form 8-K and is incorporated by reference into this Item 7.01.

In accordance with General Instruction B.2 of

Form 8-K, the information furnished pursuant to Item 7.01 and the press release attached hereto as Exhibit 99.1 shall not be

deemed to be “filed” for purposes of Section 18 of the Exchange Act, or otherwise subject to the liabilities of that

section, nor shall such information be deemed incorporated by reference in any filing under the Securities Act or the Exchange Act, except

as shall be expressly set forth by specific reference in such a filing.

| Item 9.01 |

Financial Statements and Exhibits |

Exhibit

Number |

|

Description |

| |

|

| 2.1* |

|

Agreement and Plan of Merger, dated January 10, 2024, by and among Southwestern Energy Company, Chesapeake Energy Corporation, Hulk Merger Sub, Inc. and Hulk LLC Sub, LLC (incorporated by reference to Exhibit 2.1 to Southwestern Energy Company’s Current Report on Form 8-K filed on January 11, 2024). |

| |

|

| 99.1 |

|

Press Release, dated October 1, 2024. |

| |

|

| 104 |

|

Cover Page Interactive Data File (embedded within the Inline XBRL document) |

* Annexes, schedules and certain exhibits have been omitted

pursuant to Item 601(a)(5) of Regulation S-K. The Company hereby undertakes to furnish supplemental copies of any of the omitted

annexes, schedules and exhibits upon request by the SEC.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

as amended, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

SOUTHWESTERN ENERGY COMPANY |

| |

|

| Date: October 1, 2024 |

By: |

/s/ Christopher Lacy |

| |

Name: |

Christopher Lacy |

| |

Title: |

Senior Vice President, General Counsel and Secretary |

[Signature

Page to Closing 8-K]

Exhibit 99.1

|

NEWS RELEASE |

Chesapeake Energy and Southwestern Energy

Complete Merger and Provide Third Quarter Earnings Conference Call Information,

Company Rebranded

as Expand Energy

OKLAHOMA

CITY, October 1, 2024 – Chesapeake Energy Corporation (NASDAQ: CHK) and Southwestern

Energy Company (NYSE: SWN) today closed on their previously announced combination. The combined company has been rebranded as Expand

Energy Corporation. Expand Energy’s common stock will commence public trading on the NASDAQ under the ticker “EXE”

at the open of trading on October 2, 2024, and will continue to trade today under the symbol “CHK”.

“As America’s

largest natural gas producer and a top producer globally, Expand Energy is built to disrupt the industry’s traditional cost and

market delivery model,” said Nick Dell’Osso, Expand Energy’s President and Chief Executive Officer. “Behind our

advantaged portfolio, peer-leading returns program and resilient financial foundation, we are poised to capture the significant synergies

provided by this powerful combination. We will expand opportunity for shareholders and consumers alike by enhancing margins and reaching

more markets, reducing the overall cost of energy. The world needs more energy, and our team is committed to sustainably delivering it

to consumers.”

In connection with

its rebranding, Expand Energy launched a new website, which can be found at www.expandenergy.com.

The company will

release its 2024 third quarter operational and financial results as well as provide certain preliminary information regarding its 2025

capital and operational plan after market close on October 29, 2024. A conference call to discuss the results and preliminary 2025

plan has been scheduled for October 30, 2024 at 9:00 a.m. EDT. Participants can view the live webcast here. Participants

who would like to ask a question, can register here, and will receive the dial-in info and a unique PIN to join the call. Links

to the conference call will be provided on Expand Energy's website. A replay will be available on the website following the call.

About Expand

Energy

Expand Energy Corporation

(NASDAQ: EXE) is the largest independent natural gas producer in the United States, powered by dedicated and innovative employees focused

on disrupting the industry’s traditional cost and market delivery model to responsibly develop assets in the nation’s most

prolific natural gas basins. Expand Energy’s returns-driven strategy strives to create sustainable value for its stakeholders by

leveraging its scale, financial strength and operational execution. Expand Energy is committed to expanding America’s energy reach

to fuel a more affordable, reliable, lower carbon future.

Forward-Looking

Statements

This press release

contains “forward-looking statements” within the meaning of the federal securities laws. Forward-looking statements may be

identified by words such as “anticipates,” “believes,” “cause,” “continue,” “could,”

“depend,” “develop,” “estimates,” “expects,” “forecasts,” “goal,”

“guidance,” “have,” “impact,” “implement,” “increase,” “intends,”

“lead,” “maintain,” “may,” “might,” “plans,” “potential,” “possible,”

“projected,” “reduce,” “remain,” “result,” “scheduled,” “seek,”

“should,” “will,” “would” and other similar words or expressions. The absence of such words or expressions

does not necessarily mean the statements are not forward-looking. Forward-looking statements are not statements of historical fact and

reflect the current views of Expand Energy. These forward-looking statements include, but are not limited to, Expand Energy’s operations,

strategies and plans, synergies and anticipated future performance. Although we believe our forward-looking statements are reasonable,

statements made regarding future results are not guarantees of future performance and are subject to numerous assumptions, uncertainties

and risks that are difficult to predict. Forward-looking statements are based on current expectations, estimates and assumptions that

involve a number of risks and uncertainties that could cause actual results to differ materially from those projected.

| |

|

|

| INVESTOR

CONTACT: |

MEDIA

CONTACT: |

EXPAND

ENERGY CORPORATION |

Chris

Ayres

(405) 935-8870

ir@expandenergy.com |

Brooke

Coe

(405) 935-8878

media@expandenergy.com |

6100

North Western Avenue

P.O. Box 18496

Oklahoma City, OK 73154 |

Actual outcomes

and results may differ materially from the results stated or implied in the forward-looking statements included in this press release

due to a number of factors, including, but not limited to: the risk that the business combination could have an adverse effect on the

ability of Expand Energy to retain and hire key personnel, on the ability of Expand Energy to attract third-party customers and maintain

its relationships with derivatives counterparties and on Expand Energy’s operating results and businesses generally; the risk that

problems may arise in successfully integrating the businesses of the companies, which may result in Expand Energy not operating as effectively

and efficiently as expected; the risk of any unexpected costs or expenses resulting from the business combination; the outcome of existing

litigation and the risk of any further litigation relating to the business combination; the risk that Expand Energy may be unable to

achieve synergies or other anticipated benefits of the business combination or it may take longer than expected to achieve those synergies

or benefits and other important factors that could cause actual results to differ materially from those projected; the volatility in

commodity prices for crude oil and natural gas, the presence or recoverability of estimated reserves; the ability to replace reserves;

environmental risks, drilling and operating risks, including the potential liability for remedial actions or assessments under existing

or future environmental regulations and litigation; exploration and development risks; the effect of future regulatory or legislative

actions on Expand Energy or the industry in which it operates, including the risk of new restrictions with respect to oil and natural

gas development activities; the risk that the credit ratings of Expand Energy may be different from what Expand Energy expects; the ability

of management to execute its plans to meet its goals and other risks inherent in Expand Energy’s business; public health crises,

such as pandemics and epidemics, and any related government policies and actions; the potential disruption or interruption of Expand

Energy’s operations due to war, accidents, political events, civil unrest, severe weather, cyber threats, terrorist acts, or other

natural or human causes beyond Expand Energy’s control; and Expand Energy’s ability to identify and mitigate the risks and

hazards inherent in operating in the global energy industry. Other unpredictable or unknown factors not discussed in this press release

could also have material adverse effects on forward-looking statements. Such factors are difficult to predict and may be beyond the control

of Chesapeake Energy Corporation (“Chesapeake”), Southwestern Energy Company (“Southwestern”) and Expand Energy,

and may also include other risks and uncertainties including those detailed in Chesapeake’s annual reports on Form 10-K, quarterly

reports on Form 10-Q and current reports on Form 8-K that are available on Expand Energy’s website at http://investors.expandenergy.com/

and on the SEC’s website at http://www.sec.gov, and those detailed in Southwestern’s annual reports on Form 10-K, quarterly

reports on Form 10-Q and current reports on Form 8-K that are available on the SEC’s website at http://www.sec.gov. Forward-looking

statements are based on the estimates and opinions of management at the time the statements are made. Expand Energy undertakes no obligation

to publicly correct or update the forward-looking statements in this press release, in other documents, or on their respective websites

to reflect new information, future events or otherwise, except as required by applicable law. All such statements are expressly qualified

by this cautionary statement. Readers are cautioned not to place undue reliance on these forward-looking statements that speak only as

of the date hereof.

v3.24.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

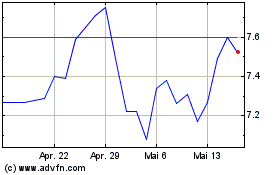

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Southwestern Energy (NYSE:SWN)

Historical Stock Chart

Von Jan 2024 bis Jan 2025