- STERIS plc (NYSE: STE) (“STERIS” or the “Company”) today

announced financial results for its fiscal 2025 second quarter

ended September 30, 2024. Total revenue from continuing operations

for the second quarter of fiscal 2025 increased 7% to $1.3 billion

compared with $1.2 billion in the second quarter of fiscal 2024.

Constant currency organic revenue from continuing operations for

the second quarter increased 7%.

“We are pleased with our second quarter and first half results,”

said Dan Carestio, President and CEO of STERIS. “The diversified

nature of our business segments continues to prove beneficial to

our performance. We are reiterating our full year

outlook for fiscal 2025.”

Second Quarter Results from Continuing

OperationsAs reported, net income for the second quarter

was $150.2 million or $1.51 per share, compared with net income of

$119.8 million or $1.20 per diluted share in the second quarter of

fiscal 2024. Adjusted net income for the second quarter of fiscal

2025 was $212.2 million or $2.14 per diluted share, compared with

the previous year’s second quarter of $184.9 million or $1.86 per

diluted share.

Healthcare revenue as reported grew 9% in the

quarter to $944.2 million compared with $870.1 million in the

second quarter of fiscal 2024. This performance reflected 12%

improvement in consumable revenue, 14% growth in service revenue,

and a 2% decline in capital equipment revenue. Constant currency

organic revenue increased 7% for the quarter compared with the

prior year. Healthcare operating income was $228.0 million compared

with $204.1 million in last year’s second quarter. The increase in

operating income was primarily due to improved volume, price and

productivity.

Fiscal 2025 second quarter revenue for Applied

Sterilization Technologies (AST) increased 9% as reported

to $256.7 million compared with $235.1 million in the same period

last year. This performance reflected 6% growth in service revenue

and a significant increase in capital equipment revenue. Constant

currency organic revenue in the quarter increased 9%. Segment

operating income was $109.9 million in the second quarter of fiscal

2025, compared with operating income of $110.8 million in the same

period last year. The operating income decline compared with the

prior year reflects, among other things, increased labor and energy

costs and a loss incurred on a large capital equipment sale.

Life Sciences second quarter revenue as

reported decreased 4% to $127.9 million compared with $133.1

million in the second quarter of fiscal 2024, due to the

divestiture of the CECS business on April 1, 2024, which was

primarily service revenue. This performance reflected 21% growth in

consumable revenue offset by a 35% decline in capital equipment

revenue and 14% decline in service revenue. Constant

currency organic revenue increased 3% in the quarter compared with

the prior year. Reflecting improvement in price and favorable mix,

operating income increased to $53.7 million in the second quarter

of fiscal 2025 compared with $50.3 million in the prior year’s

second quarter.

Cash Flow Net cash provided by operations for

the first half of fiscal 2025 was $554.5 million, compared with

$427.2 million in fiscal 2024. Free cash flow for the first half of

fiscal 2025 was $344.5 million compared with $284.7 million in the

prior year period. The increase in free cash flow during the period

was driven primarily by the growth in earnings and improved working

capital.

Fiscal 2025 Outlook ReiteratedFor fiscal 2025,

the Company continues to expect as reported revenue to increase

6.5-7.5%. Based on forward rates through March 31, 2025, currency

is expected to be slightly favorable to revenue in fiscal 2025.

Constant currency organic revenue from continuing operations is

anticipated to increase 6-7%. Adjusted earnings per diluted share

from continuing operations is anticipated to be in the range of

$9.05 to $9.25 compared with $8.20 in adjusted earnings from

continuing operations in fiscal 2024. The fiscal 2025 outlook

assumes an effective tax rate of approximately 23%. Capital

expenditures are anticipated to be approximately $360 million and

free cash flow is expected to be approximately $700

million.

Conference Call As previously announced, STERIS

management will host a conference call tomorrow, November 7, 2024

at 9:00 a.m. ET. The conference call can be heard at

www.steris-ir.com or via phone by dialing 1-833-535-2199 in the

United States or 1-412-902-6776 internationally, then asking to

join the conference call for STERIS plc.

For those unable to listen to the conference call live, a replay

will be available beginning at 12:00 p.m. ET tomorrow either at

www.steris-ir.com or via phone. To access the replay of the call,

please use the access code 6859931 and dial 1-877-344-7529 in the

United States or 1-412-317-0088 internationally.

About STERIS STERIS is a leading global

provider of products and services that support patient care with an

emphasis on infection prevention. WE HELP OUR CUSTOMERS CREATE A

HEALTHIER AND SAFER WORLD by providing innovative healthcare and

life sciences products and services. For more information, visit

www.steris.com.

Company Contact: Julie Winter, Vice President,

Investor Relations and Corporate

CommunicationsJulie_Winter@steris.com

Non-GAAP Financial MeasuresAdjusted net income,

adjusted income from operations, free cash flow, adjusted EPS and

constant currency organic revenue are non-GAAP measures that may be

used from time to time and should not be considered replacements

for U.S. GAAP results. Non-GAAP financial measures are presented in

this release with the intent of providing greater transparency to

supplemental financial information used by management and the Board

of Directors in their financial analysis and operational decision

making. These amounts are disclosed so that the reader has the same

financial data that management uses with the belief that it will

assist investors and other readers in making comparisons to our

historical operating results and analyzing the underlying

performance of our operations for the periods presented. The

Company believes that the presentation of these non-GAAP financial

measures, when considered along with our U.S. GAAP financial

measures, provides a more complete understanding of the factors and

trends affecting our business than could be obtained absent this

disclosure.

Adjusted net income, adjusted EPS and adjusted income from

operations exclude the amortization of intangible assets acquired

in business combinations, acquisition and divestiture related

transaction costs and gains or losses, integration costs related to

acquisitions, tax restructuring costs, and certain other unusual or

non-recurring items. STERIS believes this measure is useful because

it excludes items that may not be indicative of or are unrelated to

our core operating results and provides a baseline for analyzing

trends in our underlying businesses.

The Company defines free cash flow as cash flows from operating

activities less purchases of property, plant, equipment and

intangibles, plus proceeds from the sale of property, plant,

equipment, and intangibles. STERIS believes that free cash flow is

a useful measure of the Company’s ability to fund future principal

debt repayments and growth outside of core operations, pay cash

dividends, and repurchase ordinary shares.

To measure the percentage organic revenue growth, the Company

removes the impact of significant acquisitions and divestitures

that affect the comparability and trends in revenue. To measure the

percentage constant currency organic revenue growth, the impact of

changes in currency exchange rates and acquisitions and

divestitures that affect the comparability and trends in revenue

are removed. The impact of changes in currency exchange rates is

calculated by translating current year results at prior year

average currency exchange rates.

Because non-GAAP financial measures are not standardized, it may

not be possible to compare these financial measures with other

companies’ non-GAAP financial measures having the same or similar

names. These adjusted financial measures should not be considered

in isolation or as a substitute for reported sales, gross profit,

operating income, net earnings and net earnings per diluted share,

the most directly comparable U.S. GAAP financial measures. These

non-GAAP financial measures are an additional way of viewing

aspects of the Company’s operations that, when viewed with U.S.

GAAP results and the reconciliations to corresponding U.S. GAAP

financial measures below, provide a more complete understanding of

the business. The Company strongly encourages investors and

shareholders to review its financial statements and publicly-filed

reports in their entirety and not to rely on any single financial

measure.

CAUTIONARY STATEMENT REGARDING FORWARD-LOOKING

INFORMATIONThis release and the referenced conference call

may contain statements concerning certain trends, expectations,

forecasts, estimates, or other forward-looking information

affecting or relating to STERIS or its industry, products or

activities that are intended to qualify for the protections

afforded “forward-looking statements” under the Private Securities

Litigation Reform Act of 1995 and other laws and regulations.

Forward-looking statements speak only as to the date the statement

is made and may be identified by the use of forward-looking terms

such as “may,” “will,” “expects,” “believes,” “anticipates,”

“plans,” “estimates,” “projects,” “targets,” “forecasts,”

“outlook,” “impact,” “potential,” “confidence,” “improve,”

“optimistic,” “deliver,” “orders,” “backlog,” “comfortable,”

“trend,” and “seeks,” or the negative of such terms or other

variations on such terms or comparable terminology. Many important

factors could cause actual results to differ materially from those

in the forward-looking statements including, without limitation,

statements related to the expected benefits of and timing of

completion of the Restructuring Plan, disruption of production or

supplies, changes in market conditions, political events, pending

or future claims or litigation, competitive factors, technology

advances, actions of regulatory agencies, and changes in laws,

government regulations, labeling or product approvals or the

application or interpretation thereof. Many of these important

factors are outside of STERIS’s control. No assurances can be

provided as to any result or the timing of any outcome regarding

matters described in STERIS’s securities filings or otherwise with

respect to any regulatory action, administrative proceedings,

government investigations, litigation, warning letters, cost

reductions, business strategies, earnings or revenue trends or

future financial results. References to products are summaries only

and should not be considered the specific terms of the product

clearance or literature. Unless legally required, STERIS does not

undertake to update or revise any forward-looking statements even

if events make clear that any projected results, express or

implied, will not be realized. Other potential risks and

uncertainties that could cause actual results to differ materially

from those in the forward-looking statements include, without

limitation, (a) the impact of public health crises on STERIS’s

operations, supply chain, material and labor costs, performance,

results, prospects, or value, (b) STERIS's ability to achieve the

expected benefits regarding the accounting and tax treatments of

the redomiciliation to Ireland, (c) operating costs, Customer loss

and business disruption (including, without limitation,

difficulties in maintaining relationships with employees,

Customers, clients or suppliers) being greater than expected, (d)

STERIS’s ability to successfully integrate acquired businesses into

its existing businesses, including unknown or inestimable

liabilities, impairments, or increases in expected integration

costs or difficulties in connection with the integration of such

businesses, (e) uncertainties related to tax treatments under the

TCJA and the IRA, (f) the possibility that Pillar Two Model Rules

could increase tax uncertainty and adversely impact STERIS's

provision for income taxes and effective tax rate and subject

STERIS to additional income tax in jurisdictions who adopt Pillar

Two Model Rules, (g) STERIS's ability to continue to qualify for

benefits under certain income tax treaties in light of ratification

of more strict income tax treaty rules (through the MLI) in many

jurisdictions where STERIS has operations, (h) changes in tax laws

or interpretations that could increase our consolidated tax

liabilities, including changes in tax laws that would result in

STERIS being treated as a domestic corporation for United States

federal tax purposes, (i) the potential for increased pressure on

pricing or costs that leads to erosion of profit margins, including

as a result of inflation, (j) the possibility that market demand

will not develop for new technologies, products or applications or

services, or business initiatives will take longer, cost more or

produce lower benefits than anticipated, (k) the possibility that

application of or compliance with laws, court rulings,

certifications, regulations, or regulatory actions, including

without limitation any of the same relating to FDA, EPA or other

regulatory authorities, government investigations, the outcome of

any pending or threatened FDA, EPA or other regulatory warning

notices, actions, requests, inspections or submissions, the outcome

of any pending or threatened litigation brought by private parties,

or other requirements or standards may delay, limit or prevent new

product or service introductions, affect the production, supply

and/or marketing of existing products or services, result in costs

to STERIS that may not be covered by insurance, or otherwise affect

STERIS’s performance, results, prospects or value, (l) the

potential of international unrest, including the Russia-Ukraine or

Israel-Hamas military conflicts, economic downturn or effects of

currencies, tax assessments, tariffs and/or other trade barriers,

adjustments or anticipated rates, raw material costs or

availability, benefit or retirement plan costs, or other regulatory

compliance costs, (m) the possibility of reduced demand, or

reductions in the rate of growth in demand, for STERIS’s products

and services, (n) the possibility of delays in receipt of orders,

order cancellations, or delays in the manufacture or shipment of

ordered products, due to supply chain issues or otherwise, or in

the provision of services, (o) the possibility that anticipated

growth, cost savings, new product acceptance, performance or

approvals, or other results may not be achieved, or that

transition, labor, competition, timing, execution, impairments,

regulatory, governmental, or other issues or risks associated with

STERIS’s businesses, industry or initiatives including, without

limitation, those matters described in STERIS's various securities

filings, may adversely impact STERIS’s performance, results,

prospects or value, (p) the impact on STERIS and its operations, or

tax liabilities, of Brexit or the exit of other member countries

from the EU, and the Company’s ability to respond to such impacts,

(q) the impact on STERIS and its operations of any legislation,

regulations or orders, including but not limited to any new trade

or tax legislation (including CAMT and excise tax on stock

buybacks), regulations or orders, that may be implemented by the

U.S. administration or Congress, or of any responses thereto, (r)

the possibility that anticipated financial results or benefits of

recent acquisitions, of STERIS’s restructuring efforts, or of

recent divestitures, including anticipated revenue, productivity

improvement, cost savings, growth synergies and other anticipated

benefits, will not be realized or will be other than anticipated,

(s) the level of STERIS’s indebtedness limiting financial

flexibility or increasing future borrowing costs, (t) rating agency

actions or other occurrences that could affect STERIS’s existing

debt or future ability to borrow funds at rates favorable to STERIS

or at all, (u) the effects of changes in credit availability and

pricing, as well as the ability of STERIS’s Customers and suppliers

to adequately access the credit markets, on favorable terms or at

all, when needed, and (v) the possibility that our expectations

about the pre-tax savings resulting from the Restructuring Plan,

the number of positions eliminated pursuant to the Restructuring

Plan and the costs, charges and cash expenditures associated with

the announced restructuring plan may not be realized on the

timeline or timelines we expect, or at all.

- STERIS 2Q25 Financial Tables

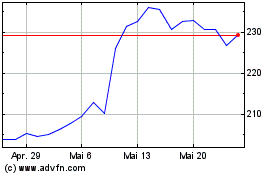

STERIS (NYSE:STE)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

STERIS (NYSE:STE)

Historical Stock Chart

Von Dez 2023 bis Dez 2024