SPX Technologies, Inc. (NYSE:SPXC) (“SPX”, the “Company”, “we” or

“our”) today reported results for the third quarter ended September

28, 2024.

Gene Lowe, President and CEO, remarked, “I am

pleased with our Q3 financial results, which include solid growth

in company revenue and substantial margin expansion in both our

HVAC and Detection & Measurement segments.”

Mr. Lowe continued, “We continue to make

significant progress on our sustainability initiative, including

reducing carbon intensity levels ahead of schedule and introducing

numerous innovative climate conscious solutions. We also further

advanced our continuous improvement initiative, which is driving

increased production throughput and efficiency.”

Mr. Lowe commented further, “Our businesses

continue to execute well operationally, and demand remains solid in

our HVAC and Detection & Measurement segments. We are well

positioned to achieve our full-year guidance, including Adjusted

EBITDA* growth of approximately 35% and Adjusted EPS* growth of

approximately 28% at the midpoint of our range.”

Third Quarter 2024 Overview:

For the third quarter of 2024, the company reported

revenue of $483.7 million and operating income of $78.9 million,

compared with revenue of $448.7 million and operating income of

$57.7 million in the third quarter of 2023. Net income of $50.2

million for the third quarter of 2024 compares with a loss of

($20.4) million in the third quarter of 2023. Diluted income per

share from continuing operations in the third quarter of 2024 was

$1.08, compared with $0.76 in the third quarter of 2023.

For the third quarter of 2024, Adjusted EBITDA* was

$104.0 million, compared with $81.9 million in the third quarter of

2023, or an increase of 27.0%. Adjusted earnings per share* in the

third quarter of 2024 was $1.39, compared with $1.06 in the third

quarter of 2023. Adjusted EBITDA* and Adjusted earnings per share*

exclude amortization expense and acquisition-related costs, among

other items.

Third Quarter and Year-to-Date Financial

Comparisons:

| ($

millions) |

|

Q3 2024 |

|

Q3 2023 |

|

2024 YTD |

|

2023 YTD |

|

Revenue |

|

$ |

483.7 |

|

$ |

448.7 |

|

|

$ |

1,450.2 |

|

$ |

1,271.8 |

|

Consolidated operating income |

|

|

78.9 |

|

|

57.7 |

|

|

|

218.1 |

|

|

158.8 |

| Income

from continuing operations |

|

|

50.9 |

|

|

35.7 |

|

|

|

145.3 |

|

|

113.1 |

|

Net income |

|

|

50.2 |

|

|

(20.4 |

) |

|

|

143.4 |

|

|

58.4 |

|

Consolidated segment income* |

|

113.8 |

|

|

91.6 |

|

|

|

331.2 |

|

|

250.4 |

| Adjusted operating

income* |

|

97.5 |

|

|

75.8 |

|

|

|

284.7 |

|

|

203.5 |

|

Adjusted EBITDA* |

|

104.0 |

|

|

81.9 |

|

|

|

304.9 |

|

|

219.7 |

* Non-GAAP financial measure. See attached schedules for

reconciliation of each historical non-GAAP measure to the

respective most comparable GAAP financial measure. A reconciliation

of non-GAAP guidance measures is not practicable and, accordingly,

is not included.

HVAC Segment

Revenue for the third quarter of 2024 was $335.3 million,

compared with $289.2 million in the third quarter of 2023, an

increase of 15.9%, including a 9.0% increase in organic revenue*, a

6.8% increase from the acquisition of Ingénia, and a 0.1% favorable

impact related to the translation effect of currency fluctuation.

The growth in organic revenue* was due primarily to increased

volume of cooling products driven by continued strength in demand

and higher throughput resulting from expanded production

capacity.

Segment income in the third quarter of 2024 was $80.0 million,

or 23.9% of revenue. This compares with segment income of $58.3

million, or 20.2% of revenue in the third quarter of 2023. The

increase in segment income and 370 basis points increase in segment

income margin were primarily due to the revenue growth mentioned

above and associated operating leverage, as well as the impact of

continuous improvement initiatives, partially offset by increases

in personnel costs due to annual merit increases and growth-related

headcount additions.

Detection & Measurement

Segment

Revenue for the third quarter of 2024 was $148.4

million, compared with $159.5 million in the third quarter of 2023,

a decrease of (7.0)%, including a 0.8% favorable impact related to

the translation effect of currency fluctuation. The organic

revenue* decrease was primarily driven by lower large project

volume within our communication technologies business associated

with a larger-than-typical project that executed throughout 2023

and completed during the first quarter of 2024. These declines were

partially offset by higher project volumes at our transportation

and aids to navigation businesses, where volume can vary from

period to period based on project execution timing.

Segment income for the third quarter of 2024 was $33.8 million,

or 22.8% of revenue. This compares with segment income of $33.3

million, or 20.9% of revenue in the third quarter of 2023. The

increase in segment income and 190 basis points increase in segment

income margin were primarily due to increased volume and more

favorable product mix associated with projects within our

transportation and aids to navigation businesses, and the impact of

continuous improvement initiatives. This increase was partially

offset by the reduction in income associated with the volume

declines from the larger-than-typical project within our

communications technologies business mentioned above.

Financial Update: As of September 28, 2024, SPX

Technologies had total outstanding debt of $737.8 million and total

cash of $129.4 million. During the third quarter of 2024, SPX’s net

operating cash flow from continuing operations totaled $77.0

million. Capital expenditures for continuing operations for the

third quarter of 2024 were $7.9 million.

2024 Guidance Update:

SPX continues to target full-year 2024 guidance for adjusted

EBITDA* in a range of $410-$430 million, and adjusted earnings per

share* in a range of $5.45-$5.60. The Company is narrowing

full-year 2024 revenue guidance to a range of $1.97-$2.00 billion,

from a prior range of $1.97-$2.02 billion.

Segment and company performance is expected to be as

follows:

|

|

|

Revenue |

|

Segment Income Margin % |

|

HVAC |

|

$1,365-$1,385 million($1,365-$1,405 million

prior) |

|

23.25%-23.75%

(23.00%-24.00% prior) |

|

Detection & Measurement |

|

$605-$615 million(unchanged) |

|

21.25%-22.00%(20.75%-21.75% prior) |

|

Total SPX |

|

$1.970-$2.000 billion($1.970-$2.020 billion

prior) |

|

22.60%-23.20%(22.30%-23.30% prior) |

Form 10-Q: The company expects to file its

quarterly report on Form 10-Q for the quarter ended September 28,

2024 with the Securities and Exchange Commission on or before

November 7, 2024. This press release should be read in conjunction

with that filing, which will be available on the company's website

at www.spx.com, in the Investor Relations section.

Conference Call: SPX Technologies

will host a conference call at 4:45 p.m. (EDT) today to discuss

third quarter results. The call will be simultaneously webcast via

the company's website at www.spx.com and the slide presentation

will be available in the Investor Relations section of the

site.

Conference call:Dial in:

1-833-630-1956From outside the United States: +1-412-317-1837

Those interested in participating should dial in five minutes

prior to the start time and ask to be connected to the SPX

Technologies call.

Call replay:Dial in: 1-877-344-7529From outside

the United States: 1-412-317-0088Replay Access Code: 4037679

Upcoming Investor Events: Company

management plans to meet with investors during the fourth quarter

of 2024 and the company will also be participating in the Baird

Industrials Conference on November 13th in Chicago, the Wolfe

Research Small and Mid-Cap Conference on December 4th in New York

City, and virtually in the Sidoti Small Cap Conference on December

5th.

About SPX Technologies, Inc.: SPX

Technologies, Inc. is a diversified, global supplier of highly

engineered products and technologies, holding leadership positions

in the HVAC and detection and measurement markets. Based in

Charlotte, North Carolina, SPX has more than 4,100 employees in 15

countries. SPX is listed on the New York Stock Exchange under the

ticker symbol “SPXC.” For more information, please visit

www.spx.com.

Non-GAAP Financial Information:

This press release contains certain non-GAAP financial measures,

including consolidated segment income, adjusted operating income,

adjusted income from continuing operations before income taxes,

adjusted income from continuing operations, adjusted earnings per

share from continuing operations (or, adjusted EPS), EBITDA,

Adjusted EBITDA, and organic revenue growth (decline). These

non-GAAP financial measures do not provide investors with an

accurate measure of, and should not be used as a substitute for,

the comparable financial measures as determined in accordance with

accounting principles generally accepted in the United States

(“GAAP”). The Company believes these non-GAAP financial measures,

when read in conjunction with the comparable GAAP financial

measures, give investors a useful tool to assess and understand the

Company’s overall financial performance, because they exclude items

of income or expense that the Company believes are not reflective

of its ongoing operating performance, allowing for a better

period-to-period comparison of operations of the Company.

Additionally, the Company’s management uses these non-GAAP

financial measures as measures of the Company’s performance. The

Company acknowledges that there are many items that impact a

company’s reported results and the adjustments reflected in these

non-GAAP measures are not intended to present all items that may

have impacted these results. In addition, these non-GAAP measures

are not necessarily comparable to similarly titled measures used by

other companies.

Refer to the tables included in this press release

for the components of each of the non-GAAP financial measures, and

for the reconciliations of historical non-GAAP financial measures

to their respective comparable GAAP measures. Our non-GAAP

financial guidance excludes items, which would be included in our

GAAP financial measures, that we do not consider indicative of our

on-going performance; and are calculated in a manner consistent

with the presentation of the similarly titled historical non-GAAP

measures presented in this press release. These items include, but

are not limited to, acquisition costs, costs associated with

dispositions, and potential non-cash income or expense items

associated with changes in market interest rates and actuarial or

other data related to our pension and postretirement plans, as the

ultimate aggregate amounts associated with these items are out of

our control and/or cannot be reasonably predicted. Accordingly, a

reconciliation of our non-GAAP financial guidance to the most

comparable GAAP financial measures is not practicable. Full-year

guidance excludes changes in the number of shares outstanding;

impacts from future acquisitions, dispositions and related

transaction costs, restructuring costs, incremental impacts of

tariffs and trade tensions on market demand and costs subsequent to

the end of the third quarter, the impact of foreign exchange rate

changes subsequent to the end of the third quarter, and

environmental and litigation charges.

Forward Looking Statements:

Certain statements in this press release are forward-looking

statements within the meaning of Section 27A of the Securities Act

of 1933, as amended, and Section 21E of the Securities Exchange Act

of 1934, as amended, and are subject to the safe harbor created

thereby. Please read these results in conjunction with the

Company’s documents filed with the Securities and Exchange

Commission, including the Company’s most recent Annual Report on

Form 10-K and Quarterly Report on Form 10-Q. These filings identify

important risk factors and other uncertainties that could cause

actual results to differ from those contained in the

forward-looking statements, including the following: cyclical

changes and specific industry events in the Company’s markets;

changes in anticipated capital investment and maintenance

expenditures by customers; availability, limitations or cost

increases of raw materials and/or commodities that cannot be

recovered in product pricing; the impact of competition on profit

margins and the Company’s ability to maintain or increase market

share; inadequate performance by third-party suppliers and

subcontractors for outsourced products, components and services and

other supply-chain risks; the uncertainty of claims resolutions

with respect to environmental and other contingent liabilities; the

impact of climate change and any legal or regulatory actions taken

in response there to; cyber-security risks; risks with respect to

the protection of intellectual property, including with respect to

the Company’s digitalization initiatives; the impact of overruns,

inflation and the incurrence of delays with respect to long-term

fixed-price contracts; defects or errors in current or planned

products; the impact of pandemics and governmental and other

actions taken in response; domestic economic, political, legal,

accounting and business developments adversely affecting the

Company’s business, including regulatory changes; changes in

worldwide economic conditions, including as a result of

geopolitical conflicts; uncertainties with respect to the Company’s

ability to identify acceptable acquisition targets; uncertainties

surrounding timing and successful completion of acquisition or

disposition transactions, including with respect to integrating

acquisitions and achieving cost savings or other benefits from

acquisitions; the impact of retained liabilities of disposed

businesses; potential labor disputes; and extreme weather

conditions and natural and other disasters.

Actual results may differ materially from these

statements. The words “guidance,” “believe,” “targeting,” “expect,”

“anticipate,” “project” and similar expressions identify

forward-looking statements. Although the company believes that the

expectations reflected in its forward-looking statements are

reasonable, it can give no assurance that such expectations will

prove to be correct.

Statements in this press release speak only as of

the date of this press release, and SPX disclaims any

responsibility to update or revise such statements, except as

required by law.

SOURCE SPX Technologies, Inc.

Investor and Media

Contacts:Paul Clegg, VP, Investor Relations and

CommunicationsPhone: 980-474-3806E-mail:

spx.investor@spx.comSource: SPX Technologies, Inc.

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF

OPERATIONS |

|

(Unaudited; in millions, except per share

amounts) |

| |

|

|

|

|

|

|

|

| |

Three months ended |

|

Nine months ended |

| |

September 28, 2024 |

|

September 30, 2023 |

|

September 28, 2024 |

|

September 30, 2023 |

| |

|

|

|

|

|

|

|

|

Revenues |

$ |

483.7 |

|

|

$ |

448.7 |

|

|

$ |

1,450.2 |

|

|

$ |

1,271.8 |

|

| Costs

and expenses: |

|

|

|

|

|

|

|

|

Cost of products sold |

|

286.1 |

|

|

|

280.1 |

|

|

|

868.9 |

|

|

|

789.7 |

|

|

Selling, general and administrative |

|

101.6 |

|

|

|

96.3 |

|

|

|

305.7 |

|

|

|

290.9 |

|

|

Intangible amortization |

|

16.6 |

|

|

|

14.6 |

|

|

|

48.2 |

|

|

|

32.4 |

|

|

Special charges, net |

|

0.5 |

|

|

|

— |

|

|

|

0.9 |

|

|

|

— |

|

|

Other operating expense, net |

|

— |

|

|

|

— |

|

|

|

8.4 |

|

|

|

— |

|

|

Operating income |

|

78.9 |

|

|

|

57.7 |

|

|

|

218.1 |

|

|

|

158.8 |

|

| |

|

|

|

|

|

|

|

| Other

income (expense), net |

|

(1.4 |

) |

|

|

(0.2 |

) |

|

|

(7.1 |

) |

|

|

2.3 |

|

| Interest

expense |

|

(12.1 |

) |

|

|

(10.2 |

) |

|

|

(34.7 |

) |

|

|

(18.0 |

) |

| Interest

income |

|

0.6 |

|

|

|

0.8 |

|

|

|

1.2 |

|

|

|

1.5 |

|

|

Income from continuing operations before income taxes |

|

66.0 |

|

|

|

48.1 |

|

|

|

177.5 |

|

|

|

144.6 |

|

| Income

tax provision |

|

(15.1 |

) |

|

|

(12.4 |

) |

|

|

(32.2 |

) |

|

|

(31.5 |

) |

|

Income from continuing operations |

|

50.9 |

|

|

|

35.7 |

|

|

|

145.3 |

|

|

|

113.1 |

|

| |

|

|

|

|

|

|

|

| Income (loss) from

discontinued operations, net of tax |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Loss on disposition of

discontinued operations, net of tax |

|

(0.7 |

) |

|

|

(56.1 |

) |

|

|

(1.9 |

) |

|

|

(54.7 |

) |

|

Loss from discontinued operations, net of tax |

|

(0.7 |

) |

|

|

(56.1 |

) |

|

|

(1.9 |

) |

|

|

(54.7 |

) |

| |

|

|

|

|

|

|

|

| Net income (loss) |

$ |

50.2 |

|

|

$ |

(20.4 |

) |

|

$ |

143.4 |

|

|

$ |

58.4 |

|

| |

|

|

|

|

|

|

|

| Basic income (loss) per share

of common stock: |

|

|

|

|

|

|

|

|

Income from continuing operations |

$ |

1.10 |

|

|

$ |

0.78 |

|

|

$ |

3.15 |

|

|

$ |

2.49 |

|

|

Loss from discontinued operations, net of tax |

|

(0.02 |

) |

|

|

(1.23 |

) |

|

|

(0.04 |

) |

|

|

(1.21 |

) |

|

Net income (loss) per share |

$ |

1.08 |

|

|

$ |

(0.45 |

) |

|

$ |

3.11 |

|

|

$ |

1.28 |

|

| |

|

|

|

|

|

|

|

| Weighted-average number of

common shares outstanding — basic |

|

46.305 |

|

|

|

45.608 |

|

|

|

46.127 |

|

|

|

45.507 |

|

| |

|

|

|

|

|

|

|

| Diluted income (loss) per

share of common stock: |

|

|

|

|

|

|

|

|

Income from continuing operations |

$ |

1.08 |

|

|

$ |

0.76 |

|

|

$ |

3.09 |

|

|

$ |

2.43 |

|

|

Loss from discontinued operations, net of tax |

|

(0.02 |

) |

|

|

(1.20 |

) |

|

|

(0.04 |

) |

|

|

(1.18 |

) |

|

Net income (loss) per share |

$ |

1.06 |

|

|

$ |

(0.44 |

) |

|

$ |

3.05 |

|

|

$ |

1.25 |

|

| |

|

|

|

|

|

|

|

| Weighted-average number of

common shares outstanding — diluted |

|

47.265 |

|

|

|

46.751 |

|

|

|

47.003 |

|

|

|

46.560 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

(Unaudited; in millions) |

| |

|

|

|

| |

September 28, 2024 |

|

December 31, 2023 |

| ASSETS |

|

|

|

| Current assets: |

|

|

|

|

Cash and equivalents |

$ |

124.8 |

|

|

$ |

99.4 |

|

|

Accounts receivable, net |

|

339.4 |

|

|

|

279.8 |

|

|

Contract assets |

|

36.7 |

|

|

|

16.6 |

|

|

Inventories, net |

|

297.7 |

|

|

|

276.7 |

|

|

Other current assets |

|

29.0 |

|

|

|

37.1 |

|

|

Total current assets |

|

827.6 |

|

|

|

709.6 |

|

| Property, plant and

equipment: |

|

|

|

|

Land |

|

23.5 |

|

|

|

17.9 |

|

|

Buildings and leasehold improvements |

|

121.6 |

|

|

|

73.4 |

|

|

Machinery and equipment |

|

305.5 |

|

|

|

264.4 |

|

| |

|

450.6 |

|

|

|

355.7 |

|

|

Accumulated depreciation |

|

(226.6 |

) |

|

|

(215.2 |

) |

|

Property, plant and equipment, net |

|

224.0 |

|

|

|

140.5 |

|

| Goodwill |

|

854.3 |

|

|

|

704.8 |

|

| Intangibles, net |

|

730.7 |

|

|

|

680.8 |

|

| Other assets |

|

158.3 |

|

|

|

188.9 |

|

| Deferred income taxes |

|

2.3 |

|

|

|

4.0 |

|

| Assets of DBT and Heat

Transfer |

|

8.8 |

|

|

|

11.1 |

|

| TOTAL ASSETS |

$ |

2,806.0 |

|

|

$ |

2,439.7 |

|

| |

|

|

|

| LIABILITIES AND STOCKHOLDERS'

EQUITY |

|

|

|

| Current liabilities: |

|

|

|

|

Accounts payable |

$ |

139.4 |

|

|

$ |

118.7 |

|

|

Contract liabilities |

|

60.8 |

|

|

|

73.5 |

|

|

Accrued expenses |

|

160.6 |

|

|

|

168.5 |

|

|

Income taxes payable |

|

12.9 |

|

|

|

5.3 |

|

|

Short-term debt |

|

48.4 |

|

|

|

17.9 |

|

|

Current maturities of long-term debt |

|

24.2 |

|

|

|

17.3 |

|

|

Total current liabilities |

|

446.3 |

|

|

|

401.2 |

|

| |

|

|

|

| Long-term debt |

|

665.2 |

|

|

|

523.1 |

|

| Deferred and other income

taxes |

|

107.3 |

|

|

|

77.0 |

|

| Other long-term

liabilities |

|

215.0 |

|

|

|

204.1 |

|

| Liabilities of DBT and Heat

Transfer |

|

14.0 |

|

|

|

39.7 |

|

|

Total long-term liabilities |

|

1,001.5 |

|

|

|

843.9 |

|

| |

|

|

|

| Stockholders' equity: |

|

|

|

|

Common stock |

|

0.5 |

|

|

|

0.5 |

|

|

Paid-in capital |

|

1,367.7 |

|

|

|

1,353.6 |

|

|

Retained earnings |

|

181.7 |

|

|

|

38.3 |

|

|

Accumulated other comprehensive income |

|

260.4 |

|

|

|

261.1 |

|

|

Common stock in treasury |

|

(452.1 |

) |

|

|

(458.9 |

) |

|

Total stockholders' equity |

|

1,358.2 |

|

|

|

1,194.6 |

|

| TOTAL LIABILITIES AND

STOCKHOLDERS' EQUITY |

$ |

2,806.0 |

|

|

$ |

2,439.7 |

|

| |

|

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

RESULTS OF REPORTABLE SEGMENTS |

|

(Unaudited; in millions) |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

|

|

|

|

Nine months ended |

|

|

|

|

| |

|

September 28, 2024 |

|

September 30, 2023 |

|

Δ |

|

%/bps |

|

September 28, 2024 |

|

September 30, 2023 |

|

Δ |

|

%/bps |

| HVAC reportable

segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Revenues |

|

$ |

335.3 |

|

|

$ |

289.2 |

|

|

$ |

46.1 |

|

|

15.9 |

% |

|

$ |

994.2 |

|

|

$ |

809.8 |

|

|

$ |

184.4 |

|

|

22.8 |

% |

| Gross profit |

|

|

129.3 |

|

|

|

101.8 |

|

|

|

27.5 |

|

|

|

|

|

379.0 |

|

|

|

289.2 |

|

|

|

89.8 |

|

|

|

| Selling, general and

administrative expense |

|

|

49.3 |

|

|

|

43.5 |

|

|

|

5.8 |

|

|

|

|

|

146.9 |

|

|

|

128.0 |

|

|

|

18.9 |

|

|

|

| Income |

|

$ |

80.0 |

|

|

$ |

58.3 |

|

|

$ |

21.7 |

|

|

37.2 |

% |

|

$ |

232.1 |

|

|

$ |

161.2 |

|

|

$ |

70.9 |

|

|

44.0 |

% |

|

as a percent of revenues |

|

|

23.9 |

% |

|

|

20.2 |

% |

|

|

|

370bps |

|

|

23.3 |

% |

|

|

19.9 |

% |

|

|

|

340bps |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Detection &

Measurement reportable segment |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Revenues |

|

$ |

148.4 |

|

|

$ |

159.5 |

|

|

$ |

(11.1 |

) |

|

(7.0 |

)% |

|

$ |

456.0 |

|

|

$ |

462.0 |

|

|

$ |

(6.0 |

) |

|

(1.3 |

)% |

| Gross profit |

|

|

68.3 |

|

|

|

69.3 |

|

|

|

(1.0 |

) |

|

|

|

|

204.1 |

|

|

|

196.5 |

|

|

|

7.6 |

|

|

|

| Selling, general and

administrative expense |

|

|

34.5 |

|

|

|

36.0 |

|

|

|

(1.5 |

) |

|

|

|

|

105.0 |

|

|

|

107.3 |

|

|

|

(2.3 |

) |

|

|

| Income |

|

$ |

33.8 |

|

|

$ |

33.3 |

|

|

$ |

0.5 |

|

|

1.5 |

% |

|

$ |

99.1 |

|

|

$ |

89.2 |

|

|

$ |

9.9 |

|

|

11.1 |

% |

|

as a percent of revenues |

|

|

22.8 |

% |

|

|

20.9 |

% |

|

|

|

190bps |

|

|

21.7 |

% |

|

|

19.3 |

% |

|

|

|

240bps |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated

Revenues |

|

$ |

483.7 |

|

|

$ |

448.7 |

|

|

$ |

35.0 |

|

|

7.8 |

% |

|

$ |

1,450.2 |

|

|

$ |

1,271.8 |

|

|

$ |

178.4 |

|

|

14.0 |

% |

| Consolidated Operating

Income |

|

|

78.9 |

|

|

|

57.7 |

|

|

|

21.2 |

|

|

36.7 |

% |

|

|

218.1 |

|

|

|

158.8 |

|

|

|

59.3 |

|

|

37.3 |

% |

|

as a percent of revenues |

|

|

16.3 |

% |

|

|

12.9 |

% |

|

|

|

340bps |

|

|

15.0 |

% |

|

|

12.5 |

% |

|

|

|

250bps |

| Consolidated Segment

Income |

|

|

113.8 |

|

|

|

91.6 |

|

|

|

22.2 |

|

|

24.2 |

% |

|

|

331.2 |

|

|

|

250.4 |

|

|

|

80.8 |

|

|

32.3 |

% |

|

as a percent of revenues |

|

|

23.5 |

% |

|

|

20.4 |

% |

|

|

|

310bps |

|

|

22.8 |

% |

|

|

19.7 |

% |

|

|

|

310bps |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Consolidated operating

income |

|

$ |

78.9 |

|

|

$ |

57.7 |

|

|

$ |

21.2 |

|

|

|

|

$ |

218.1 |

|

|

$ |

158.8 |

|

|

$ |

59.3 |

|

|

|

| Exclude: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Corporate expense |

|

|

12.4 |

|

|

|

13.0 |

|

|

|

(0.6 |

) |

|

|

|

|

38.3 |

|

|

|

44.2 |

|

|

|

(5.9 |

) |

|

|

|

Acquisition-related and other costs (1) |

|

|

1.4 |

|

|

|

2.9 |

|

|

|

(1.5 |

) |

|

|

|

|

6.3 |

|

|

|

5.0 |

|

|

|

1.3 |

|

|

|

|

Long-term incentive compensation expense |

|

|

4.0 |

|

|

|

3.4 |

|

|

|

0.6 |

|

|

|

|

|

11.0 |

|

|

|

10.0 |

|

|

|

1.0 |

|

|

|

|

Amortization of intangible assets (2) |

|

|

16.6 |

|

|

|

14.6 |

|

|

|

2.0 |

|

|

|

|

|

48.2 |

|

|

|

32.4 |

|

|

|

15.8 |

|

|

|

|

Special charges, net |

|

|

0.5 |

|

|

|

— |

|

|

|

0.5 |

|

|

|

|

|

0.9 |

|

|

|

— |

|

|

|

0.9 |

|

|

|

|

Other operating expense, net (3) |

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

|

|

8.4 |

|

|

|

— |

|

|

|

8.4 |

|

|

|

| Consolidated segment

income |

|

$ |

113.8 |

|

|

$ |

91.6 |

|

|

$ |

22.2 |

|

|

24.2 |

% |

|

$ |

331.2 |

|

|

$ |

250.4 |

|

|

$ |

80.8 |

|

|

32.3 |

% |

|

as a percent of revenues |

|

|

23.5 |

% |

|

|

20.4 |

% |

|

|

|

310bps |

|

|

22.8 |

% |

|

|

19.7 |

% |

|

|

|

310bps |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (1) Represents

integration costs incurred of $1.4 and $6.3 during the three and

nine months ended September 28, 2024, respectively, and $2.9 and

$5.0 during the three and nine months ended September 30, 2023,

respectively, including additional “Cost of products sold” related

to the step-up of inventory (to fair value) acquired in connection

with the Ingénia acquisition of $1.8 during the nine months ended

September 28, 2024, and the ASPEQ acquisition of $2.5 and $3.6

during the three and nine months ended September 30, 2023,

respectively. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (2) Represents

amortization expense associated with acquired intangible

assets. |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| (3) Represents a

charge of $8.4 associated with a settlement with the seller of ULC

Robotics (“ULC”) regarding additional contingent

consideration. |

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH

FLOWS |

|

(Unaudited; in millions) |

| |

|

|

|

|

|

|

|

| |

Three months ended |

|

Nine months ended |

| |

September 28, 2024 |

|

September 30, 2023 |

|

September 28, 2024 |

|

September 30, 2023 |

| Cash flows from (used

in) operating activities: |

|

|

|

|

|

|

|

|

Net income (loss) |

$ |

50.2 |

|

|

$ |

(20.4 |

) |

|

$ |

143.4 |

|

|

$ |

58.4 |

|

| Less: Loss from discontinued

operations, net of tax |

|

(0.7 |

) |

|

|

(56.1 |

) |

|

|

(1.9 |

) |

|

|

(54.7 |

) |

| Income from continuing

operations |

|

50.9 |

|

|

|

35.7 |

|

|

|

145.3 |

|

|

|

113.1 |

|

| Adjustments to reconcile

income from continuing operations to net cash from operating

activities: |

|

|

|

|

|

|

|

|

Special charges, net |

|

0.5 |

|

|

|

— |

|

|

|

0.9 |

|

|

|

— |

|

|

(Gain) loss on change in fair value of equity security |

|

— |

|

|

|

— |

|

|

|

4.2 |

|

|

|

(3.6 |

) |

|

Deferred and other income taxes |

|

5.1 |

|

|

|

(12.1 |

) |

|

|

(5.5 |

) |

|

|

(22.5 |

) |

|

Depreciation and amortization |

|

23.5 |

|

|

|

19.7 |

|

|

|

67.9 |

|

|

|

46.4 |

|

|

Pension and other employee benefits |

|

2.9 |

|

|

|

2.5 |

|

|

|

9.8 |

|

|

|

8.2 |

|

|

Long-term incentive compensation |

|

4.0 |

|

|

|

3.4 |

|

|

|

11.0 |

|

|

|

10.0 |

|

|

Other, net |

|

(1.2 |

) |

|

|

(1.5 |

) |

|

|

(4.2 |

) |

|

|

(4.5 |

) |

| Changes in operating assets

and liabilities, net of effects from acquisitions and

divestitures: |

|

|

|

|

|

|

|

|

Accounts receivable and other assets |

|

(14.4 |

) |

|

|

(21.6 |

) |

|

|

(44.2 |

) |

|

|

(16.7 |

) |

|

Inventories |

|

(3.4 |

) |

|

|

5.4 |

|

|

|

(14.1 |

) |

|

|

(21.6 |

) |

|

Accounts payable, accrued expenses and other |

|

9.2 |

|

|

|

13.9 |

|

|

|

(23.8 |

) |

|

|

11.2 |

|

|

Cash spending on restructuring actions |

|

(0.1 |

) |

|

|

— |

|

|

|

(0.9 |

) |

|

|

— |

|

| Net cash from continuing

operations |

|

77.0 |

|

|

|

45.4 |

|

|

|

146.4 |

|

|

|

120.0 |

|

| Net cash used in discontinued

operations |

|

(25.6 |

) |

|

|

(31.0 |

) |

|

|

(27.0 |

) |

|

|

(38.0 |

) |

| Net cash from operating

activities |

|

51.4 |

|

|

|

14.4 |

|

|

|

119.4 |

|

|

|

82.0 |

|

| |

|

|

|

|

|

|

|

| Cash flows from (used

in) investing activities: |

|

|

|

|

|

|

|

|

Proceeds/borrowings related to company-owned life insurance

policies, net |

|

— |

|

|

|

1.6 |

|

|

|

42.9 |

|

|

|

2.6 |

|

|

Business acquisitions, net of cash acquired |

|

2.1 |

|

|

|

(0.2 |

) |

|

|

(292.0 |

) |

|

|

(547.3 |

) |

|

Capital expenditures |

|

(7.9 |

) |

|

|

(7.8 |

) |

|

|

(28.2 |

) |

|

|

(16.5 |

) |

| Net cash used in continuing

operations |

|

(5.8 |

) |

|

|

(6.4 |

) |

|

|

(277.3 |

) |

|

|

(561.2 |

) |

| Net cash used in discontinued

operations |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Net cash used in investing

activities |

|

(5.8 |

) |

|

|

(6.4 |

) |

|

|

(277.3 |

) |

|

|

(561.2 |

) |

| |

|

|

|

|

|

|

|

| Cash flows from (used

in) financing activities: |

|

|

|

|

|

|

|

|

Borrowings under senior credit facilities |

|

35.0 |

|

|

|

31.3 |

|

|

|

610.2 |

|

|

|

851.3 |

|

|

Repayments under senior credit facilities |

|

(80.0 |

) |

|

|

(35.0 |

) |

|

|

(462.0 |

) |

|

|

(455.0 |

) |

|

Borrowings under trade receivables arrangement |

|

85.0 |

|

|

|

20.0 |

|

|

|

217.0 |

|

|

|

81.0 |

|

|

Repayments under trade receivables arrangement |

|

(93.0 |

) |

|

|

(18.0 |

) |

|

|

(186.0 |

) |

|

|

(49.0 |

) |

|

Net repayments under other financing arrangements |

|

— |

|

|

|

(0.3 |

) |

|

|

(0.8 |

) |

|

|

(0.4 |

) |

|

Minimum withholdings paid on behalf of employees for net share

settlements, net of proceeds from the exercise of employee stock

options |

|

2.0 |

|

|

|

0.9 |

|

|

|

1.1 |

|

|

|

(1.5 |

) |

|

Financing fees paid |

|

(2.6 |

) |

|

|

— |

|

|

|

(2.6 |

) |

|

|

(1.3 |

) |

| Net cash from (used in)

continuing operations |

|

(53.6 |

) |

|

|

(1.1 |

) |

|

|

176.9 |

|

|

|

425.1 |

|

| Net cash from discontinued

operations |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

| Net cash from (used in)

financing activities |

|

(53.6 |

) |

|

|

(1.1 |

) |

|

|

176.9 |

|

|

|

425.1 |

|

| Change in cash and equivalents

due to changes in foreign currency exchange rates |

|

4.4 |

|

|

|

(0.5 |

) |

|

|

5.5 |

|

|

|

(1.0 |

) |

| Net change in cash and

equivalents |

|

(3.6 |

) |

|

|

6.4 |

|

|

|

24.5 |

|

|

|

(55.1 |

) |

| Consolidated cash and

equivalents, beginning of period |

|

133.0 |

|

|

|

95.6 |

|

|

|

104.9 |

|

|

|

157.1 |

|

| Consolidated cash and

equivalents, end of period |

$ |

129.4 |

|

|

$ |

102.0 |

|

|

$ |

129.4 |

|

|

$ |

102.0 |

|

| |

|

| |

Nine months ended |

| |

September 28, 2024 |

|

September 30, 2023 |

| Components of cash and

equivalents: |

|

|

|

|

Cash and equivalents |

$ |

124.8 |

|

$ |

100.9 |

| Cash and equivalents included

in assets of DBT and Heat Transfer |

|

4.6 |

|

|

1.1 |

| Total cash and

equivalents |

$ |

129.4 |

|

$ |

102.0 |

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

CASH AND DEBT RECONCILIATION |

|

(Unaudited; in millions) |

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Nine months ended |

|

|

|

|

|

|

|

|

| |

|

September 28, 2024 |

|

|

|

|

|

|

|

|

| Beginning cash and

equivalents |

|

$ |

104.9 |

|

|

|

|

|

|

|

|

|

| Cash from continuing

operations |

|

|

146.4 |

|

|

|

|

|

|

|

|

|

| Capital expenditures |

|

|

(28.2 |

) |

|

|

|

|

|

|

|

|

| Business acquisitions, net of

cash acquired |

|

|

(292.0 |

) |

|

|

|

|

|

|

|

|

| Proceeds/borrowings related to

company-owned life insurance policies, net |

|

|

42.9 |

|

|

|

|

|

|

|

|

|

| Borrowings under senior credit

facilities |

|

|

610.2 |

|

|

|

|

|

|

|

|

|

| Repayments under senior credit

facilities |

|

|

(462.0 |

) |

|

|

|

|

|

|

|

|

| Borrowings under trade

receivables agreement |

|

|

217.0 |

|

|

|

|

|

|

|

|

|

| Repayments under trade

receivables arrangement |

|

|

(186.0 |

) |

|

|

|

|

|

|

|

|

| Net repayments under other

financing arrangements |

|

|

(0.8 |

) |

|

|

|

|

|

|

|

|

| Minimum withholdings paid on

behalf of employees for net share settlements, net of proceeds from

the exercise of employee stock options |

|

|

1.1 |

|

|

|

|

|

|

|

|

|

| Financing fees paid |

|

|

(2.6 |

) |

|

|

|

|

|

|

|

|

| Cash used in discontinued

operations |

|

|

(27.0 |

) |

|

|

|

|

|

|

|

|

| Change in cash due to changes

in foreign currency exchange rates |

|

|

5.5 |

|

|

|

|

|

|

|

|

|

| Ending cash and

equivalents |

|

$ |

129.4 |

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| |

|

Debt atDecember 31, 2023 |

|

Borrowings |

|

Repayments |

|

Other |

|

Debt at September 28, 2024 |

|

Revolving loans |

|

$ |

— |

|

|

$ |

610.2 |

|

$ |

(455.2 |

) |

|

$ |

— |

|

$ |

155.0 |

|

| Term loans |

|

|

541.6 |

|

|

|

— |

|

|

(6.8 |

) |

|

|

— |

|

|

534.8 |

|

| Trade receivables financing

arrangement |

|

|

16.0 |

|

|

|

217.0 |

|

|

(186.0 |

) |

|

|

— |

|

|

47.0 |

|

| Other indebtedness |

|

|

2.4 |

|

|

|

0.1 |

|

|

(0.9 |

) |

|

|

0.7 |

|

|

2.3 |

|

| Less: Deferred financing costs

associated with the term loans |

|

|

(1.7 |

) |

|

|

— |

|

|

— |

|

|

|

0.4 |

|

|

(1.3 |

) |

| Totals |

|

$ |

558.3 |

|

|

$ |

827.3 |

|

$ |

(648.9 |

) |

|

$ |

1.1 |

|

$ |

737.8 |

|

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

NON-GAAP RECONCILIATION - ORGANIC REVENUE |

|

HVAC AND DETECTION & MEASUREMENT REPORTABLE

SEGMENTS |

|

(Unaudited) |

| |

|

|

|

|

|

|

| |

|

Three months ended September 28, 2024 |

|

| |

|

HVAC |

|

|

Detection & Measurement |

|

|

Net Revenue Growth (Decline) |

|

15.9 |

% |

|

(7.0 |

) |

% |

| |

|

|

|

|

|

|

| Exclude: Foreign Currency |

|

0.1 |

% |

|

0.8 |

|

% |

| |

|

|

|

|

|

|

| Exclude: Acquisitions |

|

6.8 |

% |

|

— |

|

% |

| |

|

|

|

|

|

|

| Organic Revenue Growth

(Decline) |

|

9.0 |

% |

|

(7.8 |

) |

% |

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

NON-GAAP RECONCILIATION - ADJUSTED OPERATING

INCOME |

|

(Unaudited; in millions) |

| |

|

|

|

|

|

|

|

|

| |

|

Three months ended |

|

Nine months ended |

| |

|

September 28, 2024 |

|

September 30, 2023 |

|

September 28, 2024 |

|

September 30, 2023 |

|

Operating income |

|

$ |

78.9 |

|

|

$ |

57.7 |

|

|

$ |

218.1 |

|

|

$ |

158.8 |

|

| |

|

|

|

|

|

|

|

|

| Include - TSA Income (1) |

|

|

— |

|

|

|

0.1 |

|

|

|

— |

|

|

|

0.3 |

|

| |

|

|

|

|

|

|

|

|

| Exclude: |

|

|

|

|

|

|

|

|

|

Acquisition-related and other costs (2) |

|

|

(2.0 |

) |

|

|

(3.4 |

) |

|

|

(10.0 |

) |

|

|

(12.0 |

) |

| |

|

|

|

|

|

|

|

|

|

Other operating expense, net (3) |

|

|

— |

|

|

|

— |

|

|

|

(8.4 |

) |

|

|

— |

|

| |

|

|

|

|

|

|

|

|

|

Amortization of acquired intangible assets |

|

|

(16.6 |

) |

|

|

(14.6 |

) |

|

|

(48.2 |

) |

|

|

(32.4 |

) |

| |

|

|

|

|

|

|

|

|

| Adjusted operating income |

|

$ |

97.5 |

|

|

$ |

75.8 |

|

|

$ |

284.7 |

|

|

$ |

203.5 |

|

|

as a percent of revenues |

|

|

20.2 |

% |

|

|

16.9 |

% |

|

|

19.6 |

% |

|

|

16.0 |

% |

| |

|

|

|

|

|

|

|

|

|

(1) Represents transition services income related to the Asbestos

Portfolio Sale for the three and nine months ended September 30,

2023. Amounts recorded in non-operating income for U.S. GAAP

purposes. The Asbestos Portfolio Sale is described in the Company’s

most recent Form 10-K. |

| |

|

|

|

|

|

|

|

|

|

(2) For the three and nine months ended September 28, 2024,

represents (i) certain acquisition and strategic/transformation

related costs of $0.6 and $3.7, respectively, and (ii) integration

costs of $1.4 and $4.5, respectively, and, for the nine month

period, an inventory step-up charge related to the Ingénia

acquisition of $1.8. For the three and nine months ended September

30, 2023, represents (i) acquisition and strategic/transformation

related costs of $0.5 and $7.0, respectively, (ii) integration

costs of $0.4 and $1.4, respectively, and (iii) inventory step-up

charges of $2.5 and $3.6, respectively, related to the ASPEQ

acquisition. |

| |

|

|

|

|

|

|

|

|

|

(3) For the nine months ended September 30, 2024, represents a

charge of $8.4 associated with a settlement with the seller of ULC

regarding additional contingent consideration. |

| |

|

|

|

|

|

|

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

NON-GAAP RECONCILIATION - EARNINGS PER SHARE |

|

Three Months Ended September 28, 2024 |

|

(Unaudited; in millions, except per share

values) |

| |

|

|

|

|

|

| |

GAAP |

|

Adjustments |

|

Adjusted |

|

Segment income |

$ |

113.8 |

|

|

$ |

— |

|

|

$ |

113.8 |

|

|

Corporate expense (1) |

|

(12.4 |

) |

|

|

0.6 |

|

|

|

(11.8 |

) |

|

Acquisition-related costs (2) |

|

(1.4 |

) |

|

|

1.4 |

|

|

|

— |

|

|

Long-term incentive compensation expense |

|

(4.0 |

) |

|

|

— |

|

|

|

(4.0 |

) |

|

Amortization of intangible assets (3) |

|

(16.6 |

) |

|

|

16.6 |

|

|

|

— |

|

|

Special charges, net |

|

(0.5 |

) |

|

|

— |

|

|

|

(0.5 |

) |

| Operating

income |

|

78.9 |

|

|

|

18.6 |

|

|

|

97.5 |

|

| |

|

|

|

|

|

|

Other expense, net (4) |

|

(1.4 |

) |

|

|

1.0 |

|

|

|

(0.4 |

) |

|

Interest expense, net |

|

(11.5 |

) |

|

|

— |

|

|

|

(11.5 |

) |

| Income from continuing

operations before income taxes |

|

66.0 |

|

|

|

19.6 |

|

|

|

85.6 |

|

|

Income tax provision (5) |

|

(15.1 |

) |

|

|

(4.6 |

) |

|

|

(19.7 |

) |

| Income from continuing

operations |

|

50.9 |

|

|

|

15.0 |

|

|

|

65.9 |

|

| |

|

|

|

|

|

| Diluted shares

outstanding |

|

47.265 |

|

|

|

|

|

47.265 |

|

| |

|

|

|

|

|

| Earnings per share

from continuing operations |

$ |

1.08 |

|

|

|

|

$ |

1.39 |

|

| |

|

|

|

|

|

|

(1) Adjustment represents the removal of certain acquisition and

strategic/transformation related costs ($0.6). |

| |

|

(2) Adjustment represents the removal of integration costs of $1.4

within the HVAC reportable segment. |

| |

|

(3) Adjustment represents the removal of amortization expense

associated with acquired intangible assets of $12.3 and $4.3 within

the HVAC and Detection & Measurement reportable segments,

respectively. |

| |

|

|

|

|

|

|

(4) Adjustment represents the removal of non-service pension and

postretirement charges of $1.0. |

| |

|

|

|

|

|

|

(5) Adjustment primarily represents the tax impact of items (1)

through (4) above. |

| |

|

|

|

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

NON-GAAP RECONCILIATION - EARNINGS PER SHARE |

|

Three Months Ended September 30, 2023 |

|

(Unaudited; in millions, except per share

values) |

| |

|

|

|

|

|

| |

GAAP |

|

Adjustments |

|

Adjusted |

|

Segment income |

$ |

91.6 |

|

|

$ |

— |

|

|

$ |

91.6 |

|

|

Corporate expense (1) |

|

(13.0 |

) |

|

|

0.6 |

|

|

|

(12.4 |

) |

|

Acquisition-related and other costs (2) |

|

(2.9 |

) |

|

|

2.9 |

|

|

|

— |

|

|

Long-term incentive compensation expense |

|

(3.4 |

) |

|

|

— |

|

|

|

(3.4 |

) |

|

Amortization of intangible assets (3) |

|

(14.6 |

) |

|

|

14.6 |

|

|

|

— |

|

| Operating

income |

|

57.7 |

|

|

|

18.1 |

|

|

|

75.8 |

|

| |

|

|

|

|

|

|

Other income (expense), net (4) |

|

(0.2 |

) |

|

|

1.2 |

|

|

|

1.0 |

|

|

Interest expense, net |

|

(9.4 |

) |

|

|

— |

|

|

|

(9.4 |

) |

| Income from continuing

operations before income taxes |

|

48.1 |

|

|

|

19.3 |

|

|

|

67.4 |

|

|

Income tax provision (5) |

|

(12.4 |

) |

|

|

(5.6 |

) |

|

|

(18.0 |

) |

| Income from continuing

operations |

|

35.7 |

|

|

|

13.7 |

|

|

|

49.4 |

|

| |

|

|

|

|

|

| Diluted shares

outstanding |

|

46.751 |

|

|

|

|

|

46.751 |

|

| |

|

|

|

|

|

| Earnings per share

from continuing operations |

$ |

0.76 |

|

|

|

|

$ |

1.06 |

|

| |

|

|

|

|

|

|

(1) Adjustment represents the removal of certain acquisition and

strategic/transformation related expenses of $0.5 and a

reclassification of transition services income of $0.1 from “Other

income (expense), net.” |

| |

|

(2) Adjustment represents the removal of (i) an inventory step-up

charge of $2.5 related to the ASPEQ acquisition and (ii)

integration costs of $0.4 within the HVAC reportable segment. |

| |

|

(3) Adjustment represents the removal of amortization expense

associated with acquired intangible assets of $4.3 and $10.3 within

the Detection & Measurement and HVAC reportable segments,

respectively. |

| |

|

|

|

|

|

|

(4) Adjustment represents the removal of (i) non-service pension

and postretirement charges of $1.2, (ii) the reclassification of

income related to a transition services agreement ($0.1) to

“Corporate expense,” and (iii) the removal of a charge related to

the Asbestos Portfolio Sale of $0.1. |

| |

|

|

|

|

|

|

(5) Adjustment primarily represents the tax impact of items (1)

through (4) above. |

| |

|

|

|

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

NON-GAAP RECONCILIATION - ADJUSTED EBITDA |

|

(Unaudited; in millions) |

| |

|

|

|

|

| |

|

Three months ended |

| |

|

September 28, 2024 |

|

September 30, 2023 |

|

Net income (loss) |

|

$ |

50.2 |

|

|

$ |

(20.4 |

) |

| |

|

|

|

|

| Exclude: |

|

|

|

|

|

Income tax provision |

|

|

(15.1 |

) |

|

|

(12.4 |

) |

|

Interest expense, net |

|

|

(11.5 |

) |

|

|

(9.4 |

) |

|

Amortization expense (1) |

|

|

(16.8 |

) |

|

|

(14.6 |

) |

|

Depreciation expense |

|

|

(6.7 |

) |

|

|

(5.1 |

) |

|

Loss from discontinued operations, net of tax |

|

|

(0.7 |

) |

|

|

(56.1 |

) |

| EBITDA |

|

|

101.0 |

|

|

|

77.2 |

|

| |

|

|

|

|

| Exclude: |

|

|

|

|

|

Acquisition-related and other costs (2) |

|

|

(2.0 |

) |

|

|

(3.4 |

) |

|

Non-service pension and postretirement charges |

|

|

(1.0 |

) |

|

|

(1.2 |

) |

|

Asbestos-related charges (3) |

|

|

— |

|

|

|

(0.1 |

) |

| Adjusted

EBITDA |

|

$ |

104.0 |

|

|

$ |

81.9 |

|

|

as a percent of revenues |

|

|

21.5 |

% |

|

|

18.3 |

% |

| |

|

|

|

|

|

(1) Represents amortization expense associated with acquired

intangible assets recorded within “Intangible amortization” and

amortization of capitalized software costs recorded within “Cost of

products sold.” |

| |

|

|

|

|

|

(2) For the three months ended September 28, 2024 and September 30,

2023, represents (i) certain acquisition and

strategic/transformation related costs of $0.6 and $0.5,

respectively, (ii) integration costs of $1.4 and $0.4,

respectively, and, for the three months ended September 30, 2023 an

inventory step-up charge of $2.5 related to the ASPEQ acquisition

within the HVAC reportable segment. |

| |

|

|

|

|

|

(3) Adjustment represents the removal of charges related to the

Asbestos Portfolio Sale. |

|

|

|

SPX TECHNOLOGIES, INC. AND SUBSIDIARIES |

|

NON-GAAP RECONCILIATION - ADJUSTED EBITDA |

|

(Unaudited; in millions) |

| |

|

|

|

|

| |

|

Nine months ended |

| |

|

September 28, 2024 |

|

September 30, 2023 |

|

Net income |

|

$ |

143.4 |

|

|

$ |

58.4 |

|

| |

|

|

|

|

| Exclude: |

|

|

|

|

|

Income tax provision |

|

|

(32.2 |

) |

|

|

(31.5 |

) |

|

Interest expense, net |

|

|

(33.5 |

) |

|

|

(16.5 |

) |

|

Amortization expense (1) |

|

|

(48.4 |

) |

|

|

(32.4 |

) |

|

Depreciation expense |

|

|

(19.5 |

) |

|

|

(14.0 |

) |

|

Loss from discontinued operations, net of tax |

|

|

(1.9 |

) |

|

|

(54.7 |

) |

| EBITDA |

|

|

278.9 |

|

|

|

207.5 |

|

| |

|

|

|

|

| Exclude: |

|

|

|

|

|

Acquisition-related and other costs (2) |

|

|

(10.0 |

) |

|

|

(12.0 |

) |

|

Other operating expense, net (3) |

|

|

(8.4 |

) |

|

|

— |

|

|

Non-service pension and postretirement charges |

|

|

(3.4 |

) |

|

|

(3.6 |

) |

|

Fair value adjustments on an equity security |

|

|

(4.2 |

) |

|

|

3.6 |

|

|

Asbestos-related charges (4) |

|

|

— |

|

|

|

(0.2 |

) |

| Adjusted

EBITDA |

|

$ |

304.9 |

|

|

$ |

219.7 |

|

|

as a percent of revenues |

|

|

21.0 |

% |

|

|

17.3 |

% |

| |

|

|

|

|

|

(1) Represents amortization expense associated with acquired

intangible assets recorded within “Intangible amortization” and

amortization of capitalized software costs recorded within “Cost of

products sold.” |

| |

|

|

|

|

|

(2) For the nine months ended September 28, 2024 and September 30,

2023, represents (i) certain acquisition and

strategic/transformation related costs of $3.7 and $7.0,

respectively, (ii) integration costs of $4.5 and $1.4,

respectively, and (iii) inventory step-up charges of $1.8 and $3.6,

respectively, related to the Ingénia and ASPEQ acquisitions within

the HVAC reportable segment. |

| |

|

|

|

|

|

(3) Represents a charge of $8.4 associated with a settlement with

the seller of ULC regarding additional contingent

consideration. |

| |

|

|

|

|

|

(4) Adjustment represents the removal of charges related to the

Asbestos Portfolio Sale. |

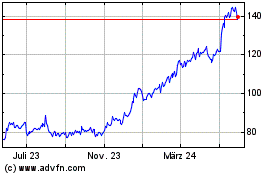

SPX Technologies (NYSE:SPXC)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

SPX Technologies (NYSE:SPXC)

Historical Stock Chart

Von Nov 2023 bis Nov 2024