Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

03 September 2024 - 7:44PM

Edgar (US Regulatory)

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 6-K

REPORT OF FOREIGN ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 OF THE

SECURITIES EXCHANGE ACT OF 1934

For September, 2024

(Commission File No. 1-31317)

Companhia de Saneamento Básico do Estado de São Paulo - SABESP

(Exact name of registrant as specified in its charter)

Basic Sanitation Company of the State of Sao Paulo - SABESP

(Translation of Registrant's name into English)

Rua Costa Carvalho, 300

São Paulo, S.P., 05429-900

Federative Republic of Brazil

(Address of Registrant's principal executive offices)

Indicate by check mark whether the registrant files or will file

annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F ______

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(1)__.

Indicate by check mark if the registrant is submitting the Form 6-K

in paper as permitted by Regulation S-T Rule 101(b)(7)__.

Indicate by check mark whether the registrant by furnishing the

information contained in this Form is also thereby furnishing the

information to the Commission pursuant to Rule 12g3-2(b) under

the Securities Exchange Act of 1934.

Yes ______ No ___X___

If "Yes" is marked, indicated below the file number assigned to the

registrant in connection with Rule 12g3-2(b):

TABLE OF CONTENT

| 1. Introduction |

2 |

| 2. References |

2 |

| 3. Definitions |

2 |

| 4. Objectives |

8 |

| 5. Guidelines |

8 |

| 6. Disclosure |

21 |

| 1.1 | | This Institutional Policy is intended to ensure strict equality in the dissemination and

communication of Material Acts or Facts related to the Company and to establish rules for trading in securities issued by Sabesp. |

| 1.2 | | This Policy sets forth specific rules to: |

| (i) | | Shareholders with more than 5% of the capital stock, who nominate and elect members of the

Board of Directors or Fiscal Council; |

| (ii) | | members of the statutory bodies; |

| (iii) | | employees with access to Material Acts or Facts; |

| (iv) | | Subsidiaries and Affiliates; |

| (v) | | trusted third parties; and |

| (vi) | | the Company, when holding its own Securities. |

| 1.3 | | The rules provided for in this Policy must be complied with by all Sabesp employees, even

by those who have not sign the Statement of Adherence yet (Appendix 1), as applicable. |

2.

References

| ● | | Resolution 44/2021

issued by Brazilian Securities and Exchange Commission (“CVM Resolution 44/2021”); |

| ● | | Resolution 80/2022

issued by Brazilian Securities and Exchange Commission (“CVM Resolution 80/2022”); |

| ● | | Novo Mercado Regulation;

and |

3.

Definitions

3.1. The following terms used in this Policy have

the meanings outlined below:

| 3.1.1 | | “Sabesp shares” are to shares representing

the capital stock of Sabesp. |

| 3.1.2 | | “Members of Management” are to Executive Officers

and members of the Company’s Board of Directors. |

| 3.1.3 | | “ADSs” are to American Depositary Shares, a

security traded in the United States representing shares of the capital stock of Sabesp. ADSs can be attested by ADRs, or American Depositary

Receipts. |

| 3.1.4 | | “B3” are to B3 S.A - Brasil Bolsa Balcão. |

| 3.1.5 | | “Stock Exchange” are to B3, NYSE and any other

stock exchanges or organized over-the counter markets where the Company’s securities are traded. |

| 3.1.6 | | “Corporate Events Calendar” are to the calendar

published on the CVM/B3 website and on the Investor Relations website (https://ri.sabesp.com.br/en/) with the official dates of publication

of annual financial statements (DFPs), quarterly information (ITRs), Annual Shareholders’ Meetings (AGMs), and other scheduled

corporate events. |

| 3.1.7 | | “Affiliates” are to companies over which Sabesp

has significant influence, as defined in paragraphs 1, 4 and 5 of Art. 243 of Federal Law 6,404/1976. |

| 3.1.8 | | “Company or Sabesp” are to Companhia de Saneamento

Básico do Estado de São Paulo – Sabesp. |

| 3.1.9 | | “Subsidiaries” are to companies controlled

directly or indirectly by Sabesp, as defined in paragraph 2 of Art. 243 of Federal Law 6,404/1976. |

| 3.1.10 | | “CVM” are to Brazilian Securities and Exchange

Commission (https://www.gov.br/cvm). |

| 3.1.11 | | “Derivative” are to a financial instrument

backed by or relating to underlying financial assets, indices, indicators, rates, goods, currencies, energy assets, transport, commodities

or any other variables. |

| 3.1.12 | | “Employee” are to any person who renders paid

services to an employer on a non-sporadic basis, and to whom he/she must be subordinated, whatever their title, function or position

in the Company. |

| 3.1.13 | | “Employee with access to Material Acts or Facts”

are to any employee who, by virtue of their title, function or position in Sabesp, its subsidiaries or affiliates, has access to any

Material Acts or Facts. |

| | | The

following are considered employees with potential access, permanent or occasional, to Material Acts and Facts: |

| · | | Heads, Chief of Staff and the Ombudsman; |

| · | | Advisors to the Executive Board; |

| · | | Executive secretaries and permanent participants of statutory

bodies meetings; |

| · | | Department managers of the superintendencies responsible

for the following matters: Accounting, Investor Relations, Planning and Control, Billing Protection, Engineering and Asset Management,

Finance, Legal, Compliance and Risk, Auditing, Communication, Strategy and Sustainability and Corporate Governance; |

| · | | Department Managers of Water Resources, Contract Management,

New Businesses (Regulated and non-Regulated), Economic Regulation and Technological Innovation and Intellectual Property. |

| | | The Executive Officers and the persons described above may designate other employees with potential access to Material Acts and Facts,

either in a permanent or eventual manner. |

| | | Employees holding the positions described above, as well as those designated by them, must sign the Statement of Consent to this Policy

(Appendix 1) |

| 3.1.14 | | “Securities lending (lease)” are to a transaction

whereby one investor (the lender) lends a fixed amount of securities to another (the borrower), for a fixed period, whether or not a

rate is agreed between them. In general, the lender is a long-term investor, who is not planning to sell the assets, at least during

the period of the agreement. The borrower, on the other hand, is an investor who needs the assets only for a short period of time, usually

to execute a strategy or meet an existing investment commitment. |

| 3.1.15 | | “Federal Law 6,385/1976” are to Law No. 6,385,

of December 7, 1976, as amended. Provides for the securities market and creates the Brazilian Securities and Exchange Commission. |

| 3.1.16 | | “Federal Law 6,404/1976” are to Law No. 6,404,

of December 15, 1976, as amended. provides for joint-stock companies (Brazilian Corporate Law). |

| 3.1.17 | | “Members of the Statutory Bodies” are to members

of the Board of Directors, Executive Officers, members of the Fiscal Council (effective and alternate), members of the statutory Audit

Committee, other statutory committees and any other bodies with technical or advisory functions, existing or to be created in the future

by statutory ordinance of Sabesp. |

| 3.1.18 | | “Direct trades” are to trades executed directly

by the owner of a security. |

| 3.1.19 | | “Indirect trades or through third parties”

are to trades executed through: (i) Related People; or (ii) Third parties under a trust agreement or a portfolio or share management

agreement. |

| | Trades by investment funds in which people indicated on

1.2 hold shares are not considered to be indirect trades, and are not subject to the prohibitions of this Policy, provided that: (i)

the fund manager’s investment decisions cannot in any way be influenced by the shareholders; and (ii) the investment funds are

not exclusive. |

| 3.1.20 | | “NYSE” are to The New York Stock Exchange. |

| 3.1.21 | | “Statutory Body” are to the Board of Directors,

Executive Office, Fiscal Council, statutory Audit Committee, other statutory committees and any other bodies with technical or consultative

functions, existing or to be created in the future by statutory ordinance of Sabesp. |

| 3.1.22 | | “Related Person” are to the natural persons

stated in item 1.2 (ii) and, pursuant to CVM Resolution 44/2021, these are: (i) spouse not separated judicially or extrajudicially;

(ii) cohabitant; (iii) any dependent included in the annual tax return; and (iv) companies controlled directly or indirectly. |

| 3.1.23 | | “Tied Person” are to an individual or legal

entity, fund or universality of rights which acts representing the same interests of another individual or legal entity, fund or universality

of rights as defined in CVM Resolution 85/2022. |

| 3.1.24 | | “Novo Mercado Regulation” are to the regulation

applicable to companies with shares traded in the special listing segment of B3 referred to as the Novo Mercado. Sabesp has been listed

in this segment since 2002. |

| 3.1.25 | | “CVM Resolution 44/2021” are to the CVM resolution

which provides for the disclosure of information on material act or fact, the trading of Securities pending undisclosed material act

or fact, and the disclosure of information on the trading of Securities. |

| 3.1.26 | | “CVM Resolution 80/2022” are to the CVM resolution

which provides for the registration and provision of periodic and occasional information on issuers of securities admitted to trading

on regulated securities markets. |

| 3.1.27 | | “CVM Resolution 85/2022” are to the CVM resolution

which provides for the public offerings for the acquisition of shares of publicly-held companies. |

| 3.1.28 | | “SEC” are to the U.S. Securities and Exchange

Commission. |

| 3.1.29 | | “Securities Act of 1933” are to the Securities

Act of 1933, as amended. A US law of 1933 setting rules for the disclosure of complete and fair information on securities, in order to

protect investors against fraud. |

| 3.1.30 | | “Securities Exchange Act of 1934” are to the

Securities Exchange Act of 1934, as amended. A US law on regulation of securities exchanges, enacted in 1934. |

| 3.1.31 | | “Trusted third parties” are to any individual

or legal entity that may have access to Material Acts or Facts as a result of a commercial or professional relationship, or a relationship

of trust, with Sabesp, such as independent auditors, securities analysts, consultants and members of the securities distribution system. |

| 3.1.32 | | “Statement of Consent” are to the statement

of consent to the Institutional Policy for Disclosure of Material Acts or Facts and Trading in Securities Issued by Sabesp, to be signed

by the persons indicated in item 1.2. A model is contained in Appendix 1 to the Policy. |

| 3.1.33 | | “Securities” are to shares, debentures, promissory

notes, subscription warrants, receipts and rights of subscription, and any other security listed in article 2 of Federal Law 6,385/1976;

and also ADSs, bonds and other securities traded in international markets equivalent to the items mentioned in article 2 of Federal Law

6,385/1976. |

| 4.1 | | To set guidelines for disclosing information regarding Material Acts or Facts. |

| 4.2 | | To set rules for trading in securities issued by Sabesp. |

| 4.3 | | To set guidelines for disclosing information on the trading in securities. |

| 4.4 | | To set guidelines for disclosing Notices to the Market. |

| 4.5 | | To mitigate the risk of non-compliance in the process of disclosing relevant information

and trading in securities issued by the Company. |

| 5.1 | | The Shareholders with more than 5% of the capital stock, who nominate and elect members of

the Board of Directors or Fiscal Council, the Subsidiaries and Affiliates must be informed on the provisions and updates of this Policy. |

| 5.2 | | People indicated on 1.2 (i) to (iii) must sign the Statement of Consent to this Policy (Appendix

1), to be filed at the Company’s headquarters as long as the person maintains a relationship with Sabesp, and for at least five

years after the relationship is terminated. |

| 5.3 | | The contract signed by the people indicated on 1.2 (iv) and (v) must contain a clause providing

for compliance with the guidelines established in this Policy, as applicable. |

| 5.4 | | People indicated on 1.2 must ensure that their subordinates and trusted third parties observe

the secrecy of undisclosed Material Acts or Facts, and are jointly responsible in the event of non-compliance, pursuant to CVM Resolution

44/2021, article 8. |

| 5.5 | | Any failure to comply with this Policy may be subject to penalties by the CVM, without prejudice

to civil, criminal and administrative liability by Sabesp or other bodies. |

| 5.6 | | Disclosure of Material Acts or Facts |

| 5.6.1 | | For the purposes of this Policy, Material Acts or Facts are considered (i) any resolutions

of a shareholders’ meeting or of the Company’s management bodies; or (ii) any other act or fact of a political or administrative,

technical, business, economic or financial nature related to Company business, that could have a measurable influence on: |

| a) | | the quoted price of Company securities or securities backed by them; |

| b) | | investors’ decisions to buy, sell or hold these securities; or |

| c) | | investors’ decisions to exercise any rights inherent to their condition as shareholders. |

| 5.6.1.1 | | Some examples of potential Material Acts or Facts, in addition to those given in the sole

paragraph of article 2 of CVM Resolution 44/2021 are: |

| a) | | performance and financial results, and forecasts and expectations affecting them; |

| b) | | publication of an Investment Plan; |

| c) | | the election of a Chief Executive Officer or a Chief Financial Officer and Investor Relations

Officer; |

| d) | | the resignation or dismissal of a member of the management; |

| e) | | decisions of the regulatory agency that have a significant impact on the Company, such as

a tariff adjustment and/or tariff restructuring; |

| f) | | legal or arbitration proceedings with significant impact on the business; |

| g) | | a significant reduction in water production due to restrictions on the main inputs used,

such as water resources, electricity and chemical products; |

| h) | | a change in the news channel used to disclose Material Acts or Facts; and |

| i) | | the engagement or discharge of a market maker. |

Duties and Responsibilities

| 5.6.2 | | The disclosure of Material Acts or Facts and Notice to the Market, as well as the filing

at CVM/B3 of the communications listed in items 5.2.9 and 5.2.11 of this Policy, are primarily the responsibility of the Chief Financial

Officer and Investor Relations Officer. |

| 5.6.3 | | The Shareholders with more than 5% of the capital stock, who nominate and elect members of

the Board of Directors or Fiscal Council and members of the statutory bodies must communicate any Material Acts or Facts of which they

are aware to the Chief Financial Officer and Investor Relations Officer, who is required to take the action outlined in CVM Resolution

44/2021. |

| 5.6.4 | | If the members of the statutory bodies have personal knowledge of a material act or fact

and observe that the Chief Financial Officer and Investor Relations Officer has not fulfilled his duty to communicate and disclose it,

they shall only be exempt from responsibility if they immediately inform the CVM of the material act or fact in question, except as provided

for in 5.6.11. |

| 5.6.5 | | The Chief Financial Officer and Investor Relations Officer must inquire people indicated

on 1.2 whether they are aware of Material Acts or Facts that should be disclosed to the market pursuant to CVM Resolution 44/2021, article

4, sole paragraph: |

| (i) | | if the CVM or the stock exchange on which Sabesp’s securities are traded demands additional

clarification of the Material Act or Fact; |

| (ii) | | if there are unusual fluctuations in the quotation, price or volume of Sabesp securities

traded, or securities backed by them; and/or |

| (iii) | | if there is a leak to the media of a potential Material Act or Fact. |

| 5.6.5.1 | | People indicated on 1.2 must respond immediately to requests for clarification from the Chief

Financial Officer and Investor Relations Officer about the occurrence of Material Acts or Facts. |

Method and channels of communication of Material

Acts or Facts

| 5.6.6 | | Disclosure of Material Acts or Facts must be: |

| a) | | immediate, comprehensive, equitable and simultaneous in all the markets where Company securities

are traded; |

| b) | | issued in writing, using simple, clear, objective and concise language, and the information

given must be useful, true, complete and consistent, so as not to mislead the investor; |

| c) | | made at least one (1) hour before the opening or, preferably, immediately after the close

of business on B3 and the NYSE, using the CVM/B3 electronic system and the following channels of communication: |

| i. | | the SEC electronic system; |

| ii. | | the news website indicated in the Company’s records filed with the CVM; |

| iii. | | domestic and international news agencies; |

| iv. | | emails to registered addressees; |

| v. | | the “investors” page of Sabesp’s website, at “https://ri.sabesp.com.br/en/”; |

| vi. | | the Sabesp Corporate Portal; |

| d) | | issued in English simultaneously with the disclosure in Portuguese. |

| 5.6.7 | | Any change in the channels used to disclose Material Acts or Facts must be made as provided

for in CVM Resolution 44/2021, article 3, paragraph 7. |

| 5.6.8 | | The communication of Material Acts or Facts to the CVM must occur before or at the same time

as they are announced in any channel of communication, including a press release, on the social media, or at meetings of a professional

association, investors or a selected audience, in Brazil or abroad, including through digital platforms. |

| 5.6.9 | | If there is a change in the facts or intentions to which a Material Act or Fact already disclosed

refers, there must be an immediate correction or amendment, subject to item 5.6.6. |

| 5.6.10 | | Clarifications and details given to the CVM, the SEC and to the stock exchanges or communication

vehicles, relating to the disclosure of Material Acts or Facts, can only be given by the Chief Financial Officer and Investor Relations

Officer. |

| 5.6.11 | | Exceptionally, a Material Act or Fact may not be disclosed if its disclosure might put the

legitimate interests of the Company at risk, and always by the discretion of the management. |

| 5.6.11.1 | | In the event that a Material Act or Fact is involuntarily released, or if there is an atypical

movement in the price of securities issued by the Company or backed by them, it must be immediately disclosed as provided for in items

5.6.2 and 5.6.6, even if the information refers to transactions in progress (not concluded), preliminary negotiations, feasibility studies

or mere intentions. |

Mechanism for control and restriction of access to Material Acts or Facts

| 5.6.12 | | People indicated on 1.2 who have knowledge of any Material Act or Fact not yet disclosed

as provided for in item 5.6.6: |

| (i) | | must keep it confidential, pursuant to article 8 of CVM Resolution 44/2021; |

| (ii) | | if they hold documents, files or any record of the material act or fact, they must ensure,

through access restriction resources, that such documents will not be unauthorizedly accessed; |

| (iii) | | may discuss it or comment on it only with the people directly involved in the matter in question; |

| (iv) | | must ensure that their subordinates and trusted third parties keep it confidential, and are

answerable jointly with them in case of non-compliance, pursuant to article 8 of CVM Resolution 44/2021; |

| (v) | | must not discuss or comment on it with family members or others; |

| (vi) | | must not discuss or comment on it in public places; and |

| (vii) | | must not supply it to the press or reproduce it on social networks. |

| 5.6.13 | | Any employee of the Company is only authorized to comment on Material Acts or Facts, supply

them to the press or reproduce them on social media if they have been widely disclosed as described in item 5.6.6. |

| 5.6.14 | | If applicable, before publication of minutes, statutory bodies must assess whether or not

the content is a Material Act or Fact; if it is, the Material Act or Fact must be immediately communicated to the Chief Financial Officer

and Investor Relations Officer as provided for in items 5.6.3 and 5.6.4., for disclosure pursuant to item 5.6.6. The minutes may only

be published after the Material Act or Fact has been disclosed. |

Notice to the Market

| 5.6.15 | | Other information that may be useful for shareholders and the market in general, but which

does not represent a Material Act or Fact, must be disclosed in a Notice to the Market, at least on the CVM/B3 electronic system. |

| 5.6.15.1 | | Some examples of Notice to the Market: |

| a) | | Information, including press releases, which supplement but do not represent Material Acts

or Facts (article 3 paragraph 3 of CVM Resolution 44/2021); |

| b) | | information on live streaming with Company executives and/or representatives of the Shareholders

with more than 5% of the capital stock, who nominate and elect members of the Board of Directors or Fiscal Council that directly or indirectly

address matters related to Sabesp, via digital platforms open to the public in general. For the purpose of this Policy, the term “executives”

means Members of Statutory Bodies and representatives of Sabesp speaking on its behalf; |

| c) | | material presented in meetings with analysts and market agents (article 33-XIV of CVM Resolution

80/2022) and in the live streaming described in item b) above; |

| d) | | changes in the composition or dissolution of the Statutory Audit Committee (article 33-XXIX

of CVM Resolution 80/2022); |

| e) | | transactions with related parties (article 30-XXXII and Appendix F of CVM Resolution 80/2022); |

| f) | | Information on a change in auditors (article 28, CVM Resolution 23/2021); |

| g) | | other occasional information listed in article 33 of CVM Resolution 80/2022 or in CVM ordinances,

as applicable; |

| h) | | acquisition/disposal of a shareholding interest (article 12, CVM Resolution 44/2021); and |

| i) | | clarifications to queries or questionings from CVM/B3, in terms of the corresponding request. |

| 5.7 | | Trading in securities issued by Sabesp. |

| 5.7.1 | | Pursuant to article 13 of CVM Resolution 44/2021, it is prohibited to use Material Information

not yet disclosed, by any person who has had access to it, in order to obtain benefits, for themselves or others, by trading Securities. |

| 5.7.1.1 | | For the purposes of defining the illicit act referred to in the caput, it is presumed that: |

| I - | | the individual who traded Securities with Material Information not yet disclosed made

use of such information in said trading; |

| II - | | the individuals or legal entities mentioned in items 1.2 (i), (ii) and (vi), regarding

business with Securities of their own issue, have access to all Material Information not yet disclosed; |

| III - | | the individuals listed in item II, as well as those who have a business, professional,

or trust relationship with the Company, by having access to Material Information not yet disclosed, are aware that it is Privileged Information; |

| IV - | | the manager who resigns from the Company disposing of Material Information not yet disclosed,

benefits from such information if he trades Securities issued by the Company within 3 (three) months as of his resignation; |

| V - | | are relevant, from the moment that studies or analysis related to the matter are initiated,

the information about the operations of incorporation, total or partial spin-off, merger, restructuring, or any form of corporate reorganization

or business combination, change in the Company's control, including by means of execution, amendment or termination of shareholders'

agreement, decision to promote the cancellation of the registration of the publicly held company or change in the environment or trading

segment of the shares issued by it; and |

| VI - | | information about judicial or extrajudicial reorganization and bankruptcy requests made

by the Company itself are relevant, as from the moment studies or analysis related to such request are started. |

| 5.7.1.2 | | The assumptions foreseen in 5.7.1.1: |

| I - | | are relative and must be analyzed in conjunction with other elements indicating whether

or not the illicit act mentioned in 5.7.1 was, in fact, committed; and |

| II - | | may, if appropriate, be used jointly. |

| 5.7.1.3 | | The assumptions provided for in item 5.7.1.1 do not apply to the stock option plan or to

the granting of shares as a component of compensation, approved at a shareholders' meeting, or negotiations regarding fixed-income Securities,

pursuant to article 13, paragraph 3 of CVM Resolution 44/2021. |

| 5.7.1.4 | | The restriction of item 5.7.1.1 does not apply to subscriptions of new Securities issued

by the Company, pursuant to article 13, paragraph 4 of CVM Resolution 44/2021. |

| 5.7.2 | | Neither the Company nor the people indicated on 1.2, including anyone who by virtue of their

title, function or position with Sabesp, its subsidiaries or affiliates, becomes aware of Material Acts or Facts, may trade in securities

issued by Sabesp, or backed by them, including ADSs, in the following circumstances: |

| a) | | when Material Acts or Facts are pending disclosure; |

| b) | | if they are aware of information on another entity which might affect the quotation, prices

or traded volume of securities issued by Sabesp; and |

| c) | | during the 15-day period preceding an official announcement of quarterly accounting information

or annual financial statements, according to the Corporate Events Calendar. |

| 5.7.2.1 | | The restriction period referred to in item 5.7.2 c) will only end after the filing of the

information in the CVM/B3 electronic system. |

| 5.7.2.2 | | The Chief Financial Officer and Investor Relations Officer may determine other blackout periods,

even after the disclosure of the act or fact, if share trading could interfere with the terms of a deal to which the Material Act or

Fact relates, to the detriment of the shareholders of the Company or of the Company itself. |

| 5.7.3 | | The assumptions, restrictions, and disclosure requirements set forth in this Policy apply: |

| (i) | | to negotiations executed inside or outside regulated market environments, including private

negotiations, of Securities; |

| (ii) | | to negotiations executed directly or indirectly, either through controlled companies or third

parties contracted as fiduciary or portfolio managers; |

| (iii) | | to negotiations executed for his own behalf or for third parties; and |

| (iv) | | to Loan operations (rental) of Securities issued by Sabesp. |

| 5.7.4 | | People indicated on 1.2 may not make use of privileged access to Material Acts or Facts not

yet disclosed as described in item 5.6.6 to obtain, directly or indirectly, for themselves or for a third party, any monetary advantage,

including by buying or selling securities issued by the Company or backed by them. |

| 5.7.5 | | Material information is any information about a potential material act or fact, not limited

to the examples listed in item 5.6.1.1. |

| 5.7.6 | | Privileged information is any relevant information not yet disclosed to the market, to which

the people mentioned in item 1.2 have had access due to their position, role or title in the Company. |

| 5.7.7 | | People indicated on 1.2 who wish to trade in ADSs of Sabesp must: |

| a) | | register with

the Depositary Bank of the Company’s ADSs; |

| b) | | trade in accordance

with the US rules for capital markets, including, without limitation, the Securities Act of 1933, the Securities Exchange Act of 1934,

and this Policy; |

| c) | | trade in accordance

with the Deposit Agreement in force between Sabesp, the Depositary Bank and the owners and holders of ADSs. |

Individual

Investment Plan

| 5.7.8 | | Pursuant to paragraph 4 of article 16 of Resolution CVM 44/2021, is not authorized the execution

of Individual Investment or Divestment Plan, and they are expressly forbidden to trade in securities issued by Sabesp during the periods

and under the terms of prohibitions defined in this Policy. |

Communication

of ownership

| 5.7.9 | | Ownership of and trading in securities issued by the Company must be communicated to the

Company, through the Financial and Investor Relations Office, with copies to Investor Relations Superintendence and to the Investor Relations

Department: |

| (i) | | by members of the statutory bodies, who must also give details of their Related People, at

the time and in the form indicated in articles 11 and 21 of CVM Resolution 44/2021. |

| (ii) | | by the Company itself and its subsidiaries and affiliates, pursuant to articles 11 and 21

of CVM Resolution 44/2021. |

| 5.7.9.1 | | The communication must also indicate positions in derivatives or other securities backed

by securities issued by the Company. |

| 5.7.10 | | Members of the statutory bodies must inform the Company of any change in the list of Related

People within fifteen (15) days of the date of the change. |

Communication

of Trading in a Significant Shareholding Interest

| 5.7.11 | | If the shareholders that elect members of the Board of Directors or the Fiscal Council, or

any individual or legal entity, or group of people acting jointly or representing the same interests, execute a relevant trade, as defined

in paragraph 1 to 3 of article 12 of CVM Resolution 44/2021, they must inform the Company, through the Investor Relations Superintendence,

with a copy to the Investor Relations Department, in the manner and at the time indicated in article 12 of CVM Resolution 44/2021. |

| 5.7.11.1 | | If an acquisition or sale affects the control or administrative structure of the Company,

or gives rise to an obligation to make a public offering, the acquirer or seller must make a public announcement pursuant to article

12 of CVM Resolution 44/2021. |

| 5.8.1 | | Failure to comply with the provisions of the Policy and of CVM Resolution 44/2021 is a serious

violation, for the purposes of paragraph 3 of article 11 of Federal Law No. 6,385/1976. |

| 5.8.2 | | If employees fail to comply with this Policy they will be subject to the rules of Corporate

Procedure PE-AU0007 – Investigation of Occurrences and Verification of Penalties, as applicable. |

| 5.8.3 | | If there is a difference in interpretation between the English and Portuguese versions of

this Policy, the Portuguese version shall prevail. |

| 5.8.4 | | People indicated on 1.2 must observe the rules contained in this Policy, even if they are

not notified of blackout periods relating to Sabesp securities. |

| 5.8.5 | | The guidelines contained in this Policy do not exempt third parties from their responsibilities

under the laws or regulations, even if the third parties in question are not directly connected with the Company but have used Material

Information not disclosed yet, in order to obtain benefit, for themselves or others, by trading Securities. |

| 5.8.6 | | The Chief Financial Officer and Investor Relations Officer is responsible for executing and

monitoring this Policy. |

| a) | | Electronic Document Manager; |

| b) | | Sabesp’s corporate website; |

| d) | | CVM/B3 electronic system. |

| Related Appendices (Appendices Database) |

Related Documents |

Registration Details |

| |

- |

- |

| Files Attached (Supplementary to the Organizational Instrument) |

| PI0022v7 – Appendix 1 –Statement of Consent.docx |

| |

|

STATEMENT OF CONSENT

to the Institutional Policy for Disclosure

of Material Acts or Facts and Trading in Securities Issued by Sabesp |

|

I, [name], TAX ID CPF No. [...],

address at [Street, No., unit, City, State, CEP], as [function or title], hereby confirm that I have received a copy and am

aware of the terms and conditions of the current Policy on Disclosure of Material Acts or Facts and Trading in Securities Issued by Sabesp

– PI0022, approved at a Meeting of the Board of Directors of Companhia de Saneamento Básico do Estado de São Paulo

– SABESP, as required by CVM Resolution 44/2021.

I hereby give my consent to the Policy

and undertake to comply with all its terms and conditions. I also confirm that I am aware that failure to comply with the provisions of

the Policy and of CVM Resolution 44/2021 is a serious violation, for the purposes of paragraph 3 of article 11 of Federal Law No. 6,385/76.

[city], [date]

[name]

|

| |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized, in the city São Paulo, Brazil.

Date: September 2, 2024

|

Companhia de Saneamento Básico do Estado de São Paulo - SABESP |

|

|

|

| By: |

/s/ Catia Cristina Teixeira Pereira

|

|

| |

Name: Catia Cristina Teixeira Pereira

Title: Chief Financial Officer and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements. These statements are statements that are not historical facts, and are based on management's current view and estimates of future economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes", "estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual results to differ materially from current expectations.

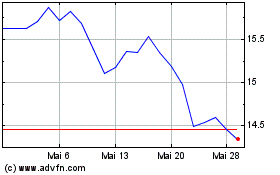

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Companhia Sanea (NYSE:SBS)

Historical Stock Chart

Von Jan 2024 bis Jan 2025