0000084748false00000847482023-10-262023-10-26

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): October 26, 2023

ROGERS CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Massachusetts | | 1-4347 | | 06-0513860 |

(State or other jurisdiction

of incorporation) | | (Commission

File Number) | | (IRS Employer

Identification No.) |

2225 W. Chandler Blvd., Chandler, Arizona 85224

(Address of principal executive offices) (Zip Code)

(480) 917-6000

Registrant’s telephone number, including area code

Not Applicable

(Former name or former address, if changed since last report) Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below): | | | | | |

| ☐ | Written communication pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communication pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communication pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | | | | |

Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

Common Stock, | par value $1.00 per share | ROG | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR §230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR §240.12b-2).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 Results of Operations and Financial Condition.

Item 7.01 Regulation FD Disclosure.

In a press release dated October 26, 2023, Rogers Corporation (the “Company”) announced its third quarter 2023 results. A copy of that press release is furnished herewith as Exhibit 99.1 and incorporated herein to these Items 2.02 and 7.01 by reference.

All information in this Form 8-K and the Exhibits attached hereto, including guidance or any other forward-looking statements, speaks as of October 26, 2023, and the Company undertakes no duty to update this information to reflect subsequent events, actual results or changes in the Company’s expectations, unless required by law.

The information in Items 2.02 and 7.01 of this Form 8-K and the Exhibits attached hereto shall not be deemed “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, except as shall be expressly set forth by specific reference in such filing.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits | | | | | | | | |

| Exhibit No. | Description |

| 99.1 | |

| 104 | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| | | | ROGERS CORPORATION | |

| | | (Registrant) | |

| | | | | |

| Date: October 26, 2023 | | | | By: | | /s/ Ramakumar Mayampurath | |

| | | | | | Ramakumar Mayampurath | |

| | | | | | Senior Vice President, Chief Financial Officer and Treasurer Principal Financial Officer | |

Rogers Corporation Reports Third Quarter 2023 Results

Operating Performance Drives Further Gross Margin and Earnings Improvement

Chandler, Arizona, October 26, 2023: Rogers Corporation (NYSE:ROG) today announced financial results for the third quarter of 2023.

"We continued our strong operating performance in the third quarter as we increased gross margin to over 35%, which drove stronger earnings and operating cash flow," stated Colin Gouveia, Rogers' President and CEO. "This marks the third consecutive quarter of gross margin improvement and delivers on the margin commitments we made previously. We are pleased with our progress thus far and remain committed to further improving our cost structure with our operational excellence initiatives. Third quarter sales were nearly flat compared to the prior quarter as global economic conditions remained challenging and customer inventory destocking continued. We are pleased with the strong progress we have made so far this year. We have significantly improved our margin and cost structure, bolstered the organization with new talent, secured important design wins, and are moving forward with targeted investments in fast growing markets."

Financial Overview

| | | | | | | | | | | | | |

| | | | | |

| GAAP Results | Q3 2023 | Q2 2023 | Q3 2022 | | |

| Net Sales ($M) | $229.1 | $230.8 | $247.2 | | |

| Gross Margin | 35.1% | 34.5% | 31.6% | | |

| Operating Margin | 11.8% | 12.1% | 7.5% | | |

| Net Income (Loss) ($M) | $19.0 | $17.9 | $14.8 | | |

| Net Income (Loss) Margin | 8.3% | 7.7% | 6.0% | | |

| Diluted Earnings Per Share | $1.02 | $0.96 | $0.78 | | |

| Net Cash Provided by Operating Activities ($M) | $42.0 | $15.7 | $13.5 | | |

| | | | | |

Non-GAAP Results1 | Q3 2023 | Q2 2023 | Q3 2022 | | |

| Adjusted Operating Margin | 14.3% | 13.4% | 10.8% | | |

| Adjusted Net Income ($M) | $23.2 | $20.0 | $21.2 | | |

| Adjusted Earnings Per Diluted Share | $1.24 | $1.07 | $1.11 | | |

| Adjusted EBITDA ($M) | $45.4 | $43.7 | $39.7 | | |

| Adjusted EBITDA Margin | 19.8% | 18.9% | 16.0% | | |

| Free Cash Flow ($M) | $35.3 | $4.2 | $(20.3) | | |

| | | | | |

Net Sales by Operating Segment (dollars in millions) | Q3 2023 | Q2 2023 | Q3 2022 | | |

| Advanced Electronics Solutions (AES) | $126.4 | $130.2 | $130.6 | | |

| Elastomeric Material Solutions (EMS) | $98.0 | $95.3 | $111.0 | | |

| Other | $4.8 | $5.3 | $5.6 | | |

1 - A reconciliation of GAAP to non-GAAP measures is provided in the schedules included below

Q3 2023 Summary of Results

Net sales of $229.1 million decreased 0.7% versus the prior quarter resulting from lower sales in the AES business unit, partially offset by higher EMS business unit sales. AES net sales decreased by 2.9% primarily related to lower EV/HEV, aerospace and defense (A&D) and ADAS sales. EMS net sales increased by 2.8% primarily from higher portable electronics and A&D sales, partially offset by lower general industrial sales. Currency exchange rates unfavorably impacted total company net sales in the third quarter of 2023 by $0.7 million compared to the prior quarter.

Gross margin improved to 35.1% compared to 34.5% in the prior quarter due to procurement cost savings and favorable product mix, partially offset by the decline in sales volume.

Selling, general and administrative (SG&A) expenses decreased by $1.8 million from the prior quarter to $44.3 million. The lower SG&A expense was due primarily to a decrease in variable compensation costs, partially offset by higher professional service fees.

GAAP operating margin of 11.8% decreased from 12.1% in the prior quarter. The lower operating margin was due to a decrease in other operating income, partially offset by the improvement in gross margin and lower SG&A and restructuring and impairment charges. Adjusted operating margin of 14.3% increased by 90 basis points versus the prior quarter.

GAAP earnings per diluted share were $1.02 compared to earnings per diluted share of $0.96 in the previous quarter. The increase in GAAP earnings per diluted share was due to an increase in other income and lower interest expense. On an adjusted basis, earnings were $1.24 per diluted share compared to adjusted earnings of $1.07 per diluted share in the prior quarter.

Ending cash and cash equivalents were $126.5 million, a decrease of $15.0 million versus the prior quarter. Net cash provided by operating activities in the third quarter was $42.0 million, capital expenditures were $6.7 million and a principal payment of $50 million was made on the outstanding borrowings under the Company’s revolving credit facility.

Financial Outlook

| | | | | |

| Q4 2023 |

Net Sales ($M) | $215 to $225 |

Gross Margin | 34.0% to 35.0% |

Earnings Per Diluted Share | $0.71 to $0.91 |

Adjusted Earnings Per Diluted Share1 | $0.90 to $1.10 |

| |

| 2023 |

Capital Expenditures ($M) | $55 to $65 |

1 - A reconciliation of GAAP to non-GAAP measures is provided in the schedules included below

Conference call and additional Information

A conference call to discuss the results for the third quarter will take place today, Thursday, October 26, 2023 at 5:00 pm ET. A live webcast of the event and the accompanying presentation can be accessed on the Rogers Corporation website at https://www.rogerscorp.com/investors.

About Rogers Corporation

Rogers Corporation (NYSE:ROG) is a global leader in engineered materials to power, protect and connect our world. Rogers delivers innovative solutions to help our customers solve their toughest material challenges. Rogers’ advanced electronic and elastomeric materials are used in applications for EV/HEV, automotive safety and radar systems, mobile devices, renewable energy, wireless infrastructure, energy-efficient motor drives, industrial equipment and more. Headquartered in Chandler, Arizona, Rogers operates manufacturing facilities in the United States, Asia and Europe, with sales offices worldwide.

Safe Harbor Statement

Statements included in this release that are not a description of historical facts are forward-looking statements. Words or phrases such as “believe,” “may,” “could,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “seek,” “plan,” “expect,” “should,” “would” or similar expressions are intended to identify forward-looking statements, and are based on Rogers’ current beliefs and expectations. This release contains forward-looking statements regarding our plans, objectives, outlook, goals, strategies, future events, future net sales or performance, capital expenditures, future restructuring, plans or intentions relating to expansions, business trends and other information that is not historical information. All forward-looking statements are based upon information available to us on the date of this release and are subject to risks, uncertainties and other factors, many of which are outside of our control, which could cause actual results to differ materially from those indicated by the forward-looking statements. Other risks and uncertainties that could cause such results to differ include: the duration and impacts of the coronavirus global pandemic and efforts to contain its transmission and distribute vaccines, including the effect of these factors on our business, suppliers, customers, end users and economic conditions generally; continuing disruptions to global supply chains and our ability, or the ability of our suppliers, to obtain necessary product components; failure to capitalize on, volatility within, or other adverse changes with respect to the Company's growth drivers, including advanced mobility and advanced connectivity, such as delays in adoption or implementation of new technologies; uncertain business, economic and political conditions in the United States (U.S.) and abroad, particularly in China, South Korea, Germany, the United Kingdom, Hungary and Belgium, where we maintain significant manufacturing, sales or administrative operations; the trade policy dynamics between the U.S. and China reflected in trade agreement negotiations and the imposition of tariffs and other trade restrictions, including trade restrictions on Huawei Technologies Co., Ltd. (Huawei); fluctuations in foreign currency exchange rates; our ability to develop innovative products and the extent to which our products are incorporated into end-user products and systems and the extent to which end-user products and systems incorporating our products achieve commercial success; the ability and willingness of our sole or limited source suppliers to deliver certain key raw materials, including commodities, to us in a timely and cost-effective manner; intense global competition affecting both our existing products and products currently under development; business interruptions due to catastrophes or other similar events, such as natural disasters, war, including the ongoing conflict between Russia and Ukraine, terrorism or public health crises; the impact of sanctions, export controls and other foreign asset or investment restrictions; failure to realize, or delays in the realization of anticipated benefits of acquisitions and divestitures due to, among other things, the existence of unknown liabilities or difficulty integrating acquired businesses; our ability to attract and retain management and skilled technical personnel; our ability to protect our proprietary technology from infringement by third parties and/or allegations that our technology infringes third party rights; changes in effective tax rates or tax laws and regulations in the jurisdictions in which we operate; failure to comply with financial and restrictive covenants in our credit agreement or restrictions on our operational and financial flexibility due to such covenants; the outcome of ongoing and future litigation, including our asbestos-related product liability litigation or risks arising from the terminated DuPont Merger; changes in environmental laws and regulations applicable to our business; and disruptions in, or breaches of, our information technology systems. Should any risks and uncertainties develop into actual events, these developments could have a material adverse effect on the Company. For additional information about the risks, uncertainties and other factors that may affect our business, please see our most recent annual report on Form 10-K and any subsequent reports filed with the Securities and Exchange Commission, including quarterly reports on Form 10-Q. Rogers Corporation assumes no responsibility to update any forward-looking statements contained herein except as required by law.

Investor contact:

Steve Haymore

Phone: 480-917-6026

Email: stephen.haymore@rogerscorporation.com

Website address: https://www.rogerscorp.com

(Financial statements follow)

Condensed Consolidated Statements of Operations (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended |

| (DOLLARS AND SHARES IN THOUSANDS, EXCEPT PER SHARE AMOUNTS) | September 30, 2023 | | September 30, 2022 | | September 30, 2023 | | September 30, 2022 |

| Net sales | $ | 229,148 | | | $ | 247,231 | | | $ | 703,816 | | | $ | 747,467 | |

| Cost of sales | 148,788 | | | 169,167 | | | 464,138 | | | 497,491 | |

| Gross margin | 80,360 | | | 78,064 | | | 239,678 | | | 249,976 | |

| | | | | | | |

| Selling, general and administrative expenses | 44,336 | | | 50,653 | | | 150,549 | | | 164,496 | |

| Research and development expenses | 7,827 | | | 9,140 | | | 25,511 | | | 25,450 | |

| Restructuring and impairment charges | 1,921 | | | 373 | | | 16,361 | | | 1,119 | |

| Other operating (income) expense, net | (846) | | | (578) | | | (7,507) | | | (2,852) | |

| Operating income | 27,122 | | | 18,476 | | | 54,764 | | | 61,763 | |

| | | | | | | |

| Equity income in unconsolidated joint ventures | 641 | | | 1,162 | | | 1,559 | | | 4,237 | |

| | | | | | | |

| Other income (expense), net | 761 | | | 977 | | | 9 | | | 1,563 | |

| Interest expense, net | (2,328) | | | (2,942) | | | (8,627) | | | (5,559) | |

| Income before income tax expense | 26,196 | | | 17,673 | | | 47,705 | | | 62,004 | |

| Income tax expense (benefit) | 7,161 | | | 2,835 | | | 14,311 | | | 12,683 | |

| Net income | $ | 19,035 | | | $ | 14,838 | | | $ | 33,394 | | | $ | 49,321 | |

| | | | | | | |

| Basic earnings per share | $ | 1.02 | | | $ | 0.79 | | | $ | 1.79 | | | $ | 2.62 | |

| | | | | | | |

| Diluted earnings per share | $ | 1.02 | | | $ | 0.78 | | | $ | 1.79 | | | $ | 2.60 | |

| | | | | | | |

| Shares used in computing: | | | | | | | |

| Basic earnings per share | 18,627 | | | 18,818 | | | 18,619 | | | 18,804 | |

| Diluted earnings per share | 18,685 | | | 18,999 | | | 18,668 | | | 18,997 | |

Condensed Consolidated Statements of Financial Position (Unaudited) | | | | | | | | | | | |

| (DOLLARS AND SHARES IN THOUSANDS, EXCEPT PAR VALUE) | September 30, 2023 | | December 31, 2022 |

| Assets | | | |

| Current assets | | | |

| Cash and cash equivalents | $ | 126,455 | | | $ | 235,850 | |

Accounts receivable, less allowance for doubtful accounts of $1,147 and $1,007 | 185,750 | | | 177,413 | |

| Contract assets | 46,476 | | | 38,853 | |

| Inventories | 157,073 | | | 182,402 | |

| Prepaid income taxes | 3,337 | | | 4,042 | |

| Asbestos-related insurance receivables, current portion | 3,881 | | | 3,881 | |

| | | |

| Other current assets | 31,825 | | | 17,426 | |

| Total current assets | 554,797 | | | 659,867 | |

Property, plant and equipment, net of accumulated depreciation of $391,898 and $381,584 | 341,696 | | | 358,415 | |

| Investments in unconsolidated joint ventures | 10,346 | | | 14,082 | |

| Deferred income taxes | 58,922 | | | 50,649 | |

| Goodwill | 352,214 | | | 352,365 | |

| Other intangible assets, net of amortization | 124,496 | | | 133,724 | |

| Pension assets | 5,523 | | | 5,251 | |

| Asbestos-related insurance receivables, non-current portion | 55,926 | | | 55,926 | |

| Other long-term assets | 16,946 | | | 15,935 | |

| Total assets | $ | 1,520,866 | | | $ | 1,646,214 | |

| Liabilities and Shareholders’ Equity | | | |

| Current liabilities | | | |

| Accounts payable | $ | 46,852 | | | $ | 57,342 | |

| Accrued employee benefits and compensation | 33,778 | | | 34,158 | |

| Accrued income taxes payable | 7,018 | | | 5,504 | |

| Asbestos-related liabilities, current portion | 4,968 | | | 4,968 | |

| Finance lease obligations, current portion | 345 | | | 498 | |

| Other accrued liabilities | 23,176 | | | 40,067 | |

| Total current liabilities | 116,137 | | | 142,537 | |

| Borrowings under revolving credit facility | 80,000 | | | 215,000 | |

| Pension and other postretirement benefits liabilities | 1,618 | | | 1,501 | |

| Asbestos-related liabilities, non-current portion | 59,739 | | | 60,065 | |

| Finance lease obligations, non-current portion | 1,147 | | | 1,295 | |

| Non-current income tax | 9,560 | | | 9,985 | |

| Deferred income taxes | 23,720 | | | 23,557 | |

| Other long-term liabilities | 18,333 | | | 19,808 | |

| Shareholders’ equity | | | |

Capital stock - $1 par value; 50,000 authorized shares; 18,616 and 18,574 shares issued and outstanding | 18,616 | | | 18,574 | |

| Additional paid-in capital | 148,992 | | | 140,702 | |

| Retained earnings | 1,131,848 | | | 1,098,454 | |

| Accumulated other comprehensive loss | (88,844) | | | (85,264) | |

| Total shareholders' equity | 1,210,612 | | | 1,172,466 | |

| Total liabilities and shareholders' equity | $ | 1,520,866 | | | $ | 1,646,214 | |

Reconciliation of non-GAAP financial measures to the comparable GAAP measures

Non-GAAP financial measures:

This earnings release includes the following financial measures that are not presented in accordance with generally accepted accounting principles in the United States of America (“GAAP”):

(1) Adjusted operating margin, which the Company defines as operating margin excluding acquisition-related amortization of intangible assets and discrete items, which are acquisition and related integration costs, dispositions, gains or losses on the sale or disposal of property, plant and equipment, restructuring, severance, impairment and other related costs, non-routine shareholder advisory costs, (income) costs associated with terminated merger, UTIS fire (recovery) charges and the related income tax effect on these items (collectively, “discrete items”);

(2) Adjusted net income, which the Company defines as net income (loss) excluding amortization of acquisition intangible assets, pension settlement charges and discrete items;

(3) Adjusted earnings per diluted share, which the Company defines as earnings per diluted share excluding amortization of acquisition intangible assets, pension settlement charges and discrete items, divided by adjusted weighted average shares outstanding - diluted;

(4) Adjusted EBITDA, which the Company defines as net income (loss) excluding interest expense, net, income tax expense (benefit), depreciation and amortization, stock-based compensation expense, pension settlement charges and discrete items;

(5) Adjusted EBITDA Margin, which the Company defines as the percentage that results from dividing Adjusted EBITDA by total net sales;

(6) Free cash flow, which the Company defines as net cash provided by (used in) operating activities less non-acquisition capital expenditures.

Management believes adjusted operating margin, adjusted net income, adjusted earnings per diluted share, adjusted EBITDA and adjusted EBITDA margin are useful to investors because they allow for comparison to the Company’s performance in prior periods without the effect of items that, by their nature, tend to obscure the Company’s core operating results due to potential variability across periods based on the timing, frequency and magnitude of such items. As a result, management believes that these measures enhance the ability of investors to analyze trends in the Company’s business and evaluate the Company’s performance relative to peer companies. Management also believes free cash flow is useful to investors as an additional way of viewing the Company's liquidity and provides a more complete understanding of factors and trends affecting the Company's cash flows. However, non-GAAP financial measures have limitations as analytical tools and should not be considered in isolation from, or as alternatives to, financial measures prepared in accordance with GAAP. In addition, these non-GAAP financial measures may differ from, and should not be compared to, similarly named measures used by other companies. Reconciliations of the differences between these non-GAAP financial measures and their most directly comparable financial measures calculated in accordance with GAAP are set forth below.

Reconciliation of GAAP operating margin to adjusted operating margin*: | | | | | | | | | | | | | |

| 2023 | 2022 |

| Operating margin | Q3 | Q2 | | Q3 | |

| GAAP operating margin (%) | 11.8% | 12.1% | | 7.5 | % | |

| | | | | |

| Acquisition and divestiture related costs: | | | | | |

| | | | | |

| Dispositions | (0.3)% | —% | | — | % | |

| Loss/(gain) on sale or disposal of assets | (0.1)% | (0.2)% | | — | % | |

| | | | | |

| Restructuring, business realignment and other cost saving initiatives: | | | | | |

| Restructuring, severance, impairment and other related costs | 1.0% | 2.0% | | 0.5 | % | |

| | | | | |

| Non-routine shareholder advisory costs | —% | —% | | — | % | |

| (Income) costs associated with terminated merger | 0.6% | 0.7% | | 1.4 | % | |

| UTIS fire (recovery)/charges | (0.3)% | (2.6)% | | (0.2) | % | |

| | | | | |

| Total discrete items | 1.0% | (0.1)% | | 1.7 | % | |

| Operating margin adjusted for discrete items | 12.8% | 12.0% | | 9.2 | % | |

| | | | | |

| Acquisition intangible amortization | 1.5% | 1.4% | | 1.7 | % | |

| | | | | |

| Adjusted operating margin | 14.3% | 13.4% | | 10.8 | % | |

*Percentages in table may not add due to rounding.

Reconciliation of GAAP net income to adjusted net income*: | | | | | | | | | | | | | |

| (amounts in millions) | 2023 | 2022 |

| Net income | Q3 | Q2 | | Q3 | |

| GAAP net income (loss) | $ | 19.0 | | $ | 17.9 | | | $ | 14.8 | | |

| | | | | |

| Acquisition and divestiture related costs: | | | | | |

| Acquisition and related integration costs | — | | — | | | 0.1 | | |

| Acquisition intangible amortization | 3.4 | | 3.3 | | | 4.1 | | |

| Dispositions | (0.7) | | 0.1 | | | — | | |

| Loss/(gain) on sale or disposal of assets | (0.2) | | (0.5) | | | — | | |

| | | | | |

| Restructuring, business realignment and other cost saving initiatives: | | | | | |

| Restructuring, severance, impairment and other related costs | 2.3 | | 4.6 | | | 1.3 | | |

| | | | | |

| Non-routine shareholder advisory costs | — | | 0.1 | | | — | | |

| (Income) costs associated with terminated merger | 1.4 | | 1.5 | | | 3.4 | | |

| UTIS fire (recovery)/charges | (0.7) | | (5.9) | | | (0.6) | | |

| | | | | |

Income tax effect of non-GAAP adjustments and intangible amortization | (1.4) | | (1.0) | | | (2.0) | | |

| Adjusted net income | $ | 23.2 | | $ | 20.0 | | | $ | 21.2 | | |

*Values in table may not add due to rounding.

Reconciliation of GAAP earnings per diluted share to adjusted earnings per diluted share*: | | | | | | | | | | | | | |

| 2023 | 2022 |

| Earnings per diluted share | Q3 | Q2 | | Q3 | |

| GAAP earnings per diluted share | $ | 1.02 | | $ | 0.96 | | | $ | 0.78 | | |

| | | | | |

| Acquisition and divestiture related costs: | | | | | |

| | | | | |

| Dispositions | (0.03) | | — | | | — | | |

| Loss/(gain) on sale or disposal of assets | (0.01) | | (0.02) | | | — | | |

| | | | | |

| Restructuring, business realignment and other cost saving initiatives: | | | | | |

| Restructuring, severance, impairment and other related costs | 0.09 | | 0.18 | | | 0.05 | | |

| | | | | |

| Non-routine shareholder advisory costs | — | | — | | | — | | |

| (Income) costs associated with terminated merger | 0.06 | | 0.06 | | | 0.14 | | |

| UTIS fire (recovery)/charges | (0.03) | | (0.25) | | | (0.02) | | |

| | | | | |

| | | | | |

| Total discrete items | $ | 0.09 | | $ | (0.01) | | | $ | 0.17 | | |

| | | | | |

| Earnings per diluted share adjusted for discrete items | 1.11 | | 0.94 | | | 0.95 | | |

| | | | | |

| Acquisition intangible amortization | $ | 0.13 | | $ | 0.13 | | | $ | 0.16 | | |

| | | | | |

| Adjusted earnings per diluted share | $ | 1.24 | | $ | 1.07 | | | $ | 1.11 | | |

*Values in table may not add due to rounding.

Reconciliation of GAAP net income to adjusted EBITDA*: | | | | | | | | | | | | | |

| 2023 | 2022 |

| (amounts in millions) | Q3 | Q2 | | Q3 | |

| GAAP net income (loss) | $ | 19.0 | | $ | 17.9 | | | $ | 14.8 | | |

| | | | | |

| Interest expense, net | 2.3 | | 2.8 | | | 2.9 | | |

| Income tax expense (benefit) | 7.2 | | 7.3 | | | 2.8 | | |

| Depreciation | 8.1 | | 10.4 | | | 7.3 | | |

| Amortization | 3.4 | | 3.3 | | | 4.1 | | |

| Stock-based compensation expense | 3.8 | | 5.0 | | | 3.5 | | |

| | | | | |

| Acquisition and divestiture related costs: | | | | | |

| Acquisition and related integration costs | — | | — | | | 0.1 | | |

| Dispositions | (0.7) | | 0.1 | | | — | | |

| Loss/(gain) on sale or disposal of assets | (0.2) | | (0.5) | | | — | | |

| | | | | |

| Restructuring, business realignment and other cost saving initiatives: | | | | | |

| Restructuring, severance, impairment and other related costs | 2.3 | | 2.3 | | | 1.3 | | |

| | | | | |

| Non-routine shareholder advisory costs | — | | 0.1 | | | — | | |

| (Income) costs associated with terminated merger | 0.9 | | 1.0 | | | 3.4 | | |

| UTIS fire (recovery)/charges | (0.7) | | (5.9) | | | (0.6) | | |

| | | | | |

| Adjusted EBITDA | $ | 45.4 | | $ | 43.7 | | | $ | 39.7 | | |

*Values in table may not add due to rounding.

Calculation of adjusted EBITDA margin*: | | | | | | | | | | | | | |

| 2023 | 2022 |

| Q3 | Q2 | | Q3 | |

| Adjusted EBITDA (in millions) | $ | 45.4 | $ | 43.7 | | $ | 39.7 | |

| Divided by Total Net Sales (in millions) | 229.1 | 230.8 | | 247.2 | |

| Adjusted EBITDA Margin | 19.8 | % | 18.9 | % | | 16.0 | % | |

*Values in table may not add due to rounding.

Reconciliation of net cash provided by (used in) operating activities to free cash flow*: | | | | | | | | | | | | | |

| 2023 | 2022 |

| (amounts in millions) | Q3 | Q2 | | Q3 | |

| Net cash provided by (used in) operating activities | $ | 42.0 | | $ | 15.7 | | | $ | 13.5 | | |

| Non-acquisition capital expenditures | (6.7) | | (11.5) | | | (33.8) | | |

| Free cash flow | $ | 35.3 | | $ | 4.2 | | | $ | (20.3) | | |

*Values in table may not add due to rounding.

Reconciliation of GAAP earnings per diluted share to adjusted earnings per diluted share guidance for the 2023 fourth quarter: | | | | | |

| Guidance

Q4 2023 |

| GAAP earnings per diluted share | $0.71 to $0.91 |

| |

| Discrete items | $0.06 |

| |

| Acquisition intangible amortization | $0.13 |

| |

| Adjusted earnings per diluted share | $0.90 - $1.10 |

# # # #

v3.23.3

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

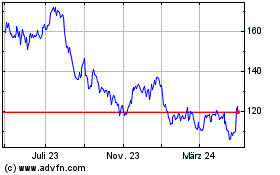

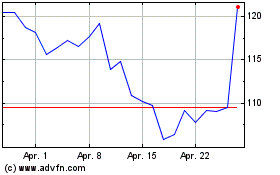

Rogers (NYSE:ROG)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Rogers (NYSE:ROG)

Historical Stock Chart

Von Mai 2023 bis Mai 2024