BELOIT, Wis., May 1 /PRNewswire-FirstCall/ -- Regal Beloit

Corporation (NYSE:RBC) today reported financial results for the

first quarter ended March 29, 2008. Continued strong performance by

the global generator businesses and industrial businesses offset

the weak residential HVAC market. The Company's initiatives

continued to have a significant positive impact on its performance.

New products, the contribution from the 2007 acquisitions and the

impact of the continued globalization of commercial operations

drove the sales growth, while the Lean Six Sigma and productivity

efforts helped support operating margins during a period of

significant raw material inflation. Net sales increased 28.1% to

$536.3 million from $418.7 million in the first quarter of 2007.

Included in reported sales are $111.9 million of sales from the

four acquisitions completed late in 2007. In the Electrical

segment, sales increased 31.2%, including the impact of the 2007

acquisitions. Exclusive of the recently acquired businesses, global

generator sales increased 17.5% and industrial motors sales

increased 6.8%, offsetting a 3.3% decline in residential HVAC motor

sales and a 16.9% decline in commercial motor products used in

residential applications. Sales in the Mechanical segment increased

1.0% from the prior year period. From a geographic perspective,

China-based sales increased 33.1% as compared to the first quarter

of 2007. In total, sales to regions outside of the United States

were 25.6% of total sales in comparison to 19.2% for the first

quarter of 2007. The gross profit margin for the first quarter of

2008 was 22.8% as compared to the 23.2% reported for the first

quarter of 2007. The gross margin for the acquired businesses was

20.8%. For the legacy businesses, raw material and other inflation,

net of the impact of product price increases was $7.7 million,

which is within the Company's previously announced guidance of $7.0

to $9.0 million. This difference was largely offset by the impact

of productivity improvements and Lean Six Sigma projects. Income

from operations was $57.6 million or 10.7% of sales, a 21.8%

increase over the $47.3 million or 11.3% of sales reported for the

first quarter of 2007. Net income in the first quarter of 2008 was

$32.2 million, a 20.1% increase from $26.8 million reported in the

first quarter of 2007. Diluted earnings per share increased 21.3%

to $.97 as compared to $.80 for the first quarter of 2007. Cash

flow from operations increased 235.6% to $34.9 million from the

$10.4 million reported for the same period in 2007. Improved

working capital management and the increase in net income drove the

improvement over the prior year. The cash performance allowed the

Company to repay $8.2 million of debt in the first quarter. In

addition to the debt pay down, the Company also purchased 110,000

shares of its common stock in open market purchases during the

quarter at a total cost of $4.2 million. On April 24, the Company

also announced the acquisition of Wuxi Hwada Motor Co. and Wuxi New

Hwada Motor Co. (collectively Hwada) located in Wuxi, China. Hwada

is a leading designer and manufacturer of Integral IEC and NEMA

electric motors, which are used in various industrial applications

such as compressor, pump, paper and steel processing, and power

plants. The business is expected to add approximately $75.0 to

$80.0 million to sales and add $.04 to $.06 to diluted earnings per

share in 2008. The purchase price was $27.6 million in cash and the

assumption of approximately $8.0 million in net liabilities.

Additionally, under the terms of the transaction, the Company will

pay to the seller up to $8.5 million received by the Company in the

future upon the sale of certain real property rights owned by

Hwada. The acquisition will be discussed further on today's

conference call. "Given the difficult residential markets and raw

material cost environments, we are quite pleased with our results

for the first quarter. New products, continuous improvement in

execution, and our geographic diversification are driving solid

results," commented Henry W. Knueppel, Chairman and CEO. Knueppel

added, "While we remain cautious due to the unprecedented inflation

in raw materials and, to a lesser degree, the speculation regarding

the strength of end markets, we are confident in our ability to

deliver solid results. Accordingly our Board of Directors approved

our fourth dividend increase in as many years and we remain

committed to increasing shareholder value through the combination

of acquisitions and share buybacks. For the second quarter we

expect earnings per share to be in the range of $1.10 to $1.18."

Regal Beloit will be holding a conference call to discuss first

quarter financial results at 1:00 PM CT (2:00 PM ET) today.

Interested parties should call 800-288-8961. A replay of the call

will be available through May 14, 2008 at 800-475-6701, access code

920700. About REGAL BELOIT CORPORATION: Regal Beloit Corporation is

a leading manufacturer and marketer of branded mechanical and

electrical motion control and power generation products serving

markets throughout the world. Regal Beloit is headquartered in

Beloit, Wisconsin, and has manufacturing, sales, and service

facilities throughout the United States, Canada, Mexico, Europe and

Asia. CAUTIONARY STATEMENT This Quarterly Report contains

"forward-looking statements" as defined in the Private Securities

Litigation Reform Act of 1995. Forward-looking statements represent

our management's judgment regarding future events. In many cases,

you can identify forward-looking statements by terminology such as

"may," "will," "plan," "expect," "anticipate," "estimate,"

"believe," or "continue" or the negative of these terms or other

similar words. Actual results and events could differ materially

and adversely from those contained in the forward-looking

statements due to a number of factors, including: -- economic

changes in global markets where we do business, such as currency

exchange rates, inflation rates, interest rates, recession, foreign

government policies and other external factors that we cannot

control; -- unanticipated fluctuations in commodity prices and raw

material costs; -- cyclical downturns affecting the global market

for capital goods; -- unexpected issues and costs arising from the

integration of acquired companies and businesses; -- marketplace

acceptance of new and existing products including the loss of, or a

decline in business from, any significant customers; -- the impact

of capital market transactions that we may effect; -- the

availability and effectiveness of our information technology

systems; -- unanticipated costs associated with litigation matters;

-- actions taken by our competitors; -- difficulties in staffing

and managing foreign operations; and -- other risks and

uncertainties including but not limited to those described in Item

1A-Risk Factors of the Company's Annual Report on Form 10-K filed

on February 27, 2008 and from time to time in our reports filed

with U.S. Securities and Exchange Commission. All subsequent

written and oral forward-looking statements attributable to us or

to persons acting on our behalf are expressly qualified in their

entirety by the applicable cautionary statements. The

forward-looking statements included in this Form 10-K are made only

as of their respective dates, and we undertake no obligation to

update these statements to reflect subsequent events or

circumstances. See also Item 1A - Risk Factors in the Company's

Annual Report on Form 10-K filed on February 27, 2008. STATEMENTS

OF INCOME In Thousands of Dollars (Unaudited) Three Months Ended

March 29, March 31, 2008 2007 Net Sales $536,343 $418,646 Cost of

Sales 414,244 321,419 Gross Profit 122,099 97,227 Operating

Expenses 64,487 49,896 Income From Operations 57,612 47,331

Interest Expense 7,219 5,066 Interest Income 384 89 Income Before

Taxes & Minority Interest 50,777 42,354 Provision For Income

Taxes 18,012 14,690 Income Before Minority Interest 32,765 27,664

Minority Interest in Income, Net of Tax 598 851 Net Income $32,167

$26,813 Earnings Per Share of Common Stock: Basic $1.03 $0.87

Assuming Dilution $0.97 $0.80 Cash Dividends Declared $0.15 $0.14

Weighted Average Number of Shares Outstanding: Basic 31,316,878

30,814,312 Assuming Dilution 33,117,034 33,547,519 CONDENSED

BALANCE SHEETS In Thousands of Dollars (Unaudited) March 29,

December 29, ASSETS 2008 2007 Current Assets: Cash and Cash

Equivalents $50,531 $42,574 Receivables and Other Current Assets

411,728 367,717 Inventories 307,261 318,200 Total Current Assets

769,520 728,491 Net Property, Plant and Equipment 358,528 339,343

Other Noncurrent Assets 779,660 794,413 Total Assets $1,907,708

$1,862,247 LIABILITIES AND SHAREHOLDERS' INVESTMENT Accounts

Payable $202,462 $183,215 Other Current Liabilities 116,625 128,705

Long-Term Debt 550,694 558,918 Deferred Income Taxes 70,210 75,055

Other Noncurrent Liabilities 61,184 47,783 Minority Interest in

Consolidated 11,602 10,542 Subsidiaries Shareholders' Investment

894,931 858,029 Total Liabilities and Shareholders' Investment

$1,907,708 $1,862,247 SEGMENT INFORMATION In Thousands of Dollars

(Unaudited) Mechanical Segment Electrical Segment Three Months

Ended Three Months Ended March 29, March 31, March 29, March 31,

2008 2007 2008 2007 Net Sales $55,114 $54,594 $481,229 $364,052

Income from Operations $8,066 $6,881 $49,546 $40,450 CONDENSED

CONSOLIDATED STATEMENTS OF CASH FLOWS In Thousands of Dollars

(Unaudited) Three Months Ended March 29, 2008 March 31, 2007 CASH

FLOWS FROM OPERATING ACTIVITIES: Net income $32,167 $26,813

Adjustments to reconcile net income to net cash provided by

operating activities; Depreciation and amortization 14,152 9,883

Minority interest 598 851 Excess tax benefit from stock-based

compensation (452) (3,310) Loss (gain) on sale of assets, net 70 8

Stock-based compensation expense 882 865 Change in assets and

liabilities, net (12,551) (24,703) Net cash provided by operating

activities 34,866 10,407 CASH FLOWS FROM INVESTING ACTIVITIES:

Additions to property, plant and equipment (13,646) (12,163)

Business acquisitions, net of cash acquired 374 (565) Sale of

property, plant and equipment 1,149 -- Net cash used in investing

activities (12,123) (12,728) CASH FLOWS FROM FINANCING ACTIVITIES:

Net proceeds from short-term borrowing -- 9,200 Payments of

long-term debt (113) (225) Net repayments under revolving credit

facility (8,200) (200) Net proceeds from commercial paper

borrowings -- 125 Dividends paid to shareholders (4,700) (4,345)

Purchases of treasury stock (4,191) -- Proceeds from the exercise

of stock options 1,364 747 Excess tax benefits from stock-based

compensation 452 3,310 Net cash (used in) provided by financing

activities (15,388) 8,612 EFFECT OF EXCHANGE RATES ON CASH 602 275

Net increase in cash and cash equivalents 7,957 6,566 Cash and cash

equivalents at beginning of period 42,574 36,520 Cash and cash

equivalents at end of period $50,531 $43,086 DATASOURCE: Regal

Beloit Corporation CONTACT: David A. Barta, Vice President, Chief

Financial Officer of Regal Beloit Corporation, +1-608-361-7405 Web

site: http://www.regal-beloit.com/

Copyright

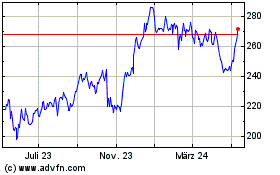

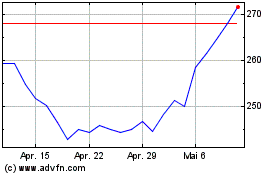

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024