BELOIT, Wis., April 30 /PRNewswire-FirstCall/ -- Regal Beloit

Corporation (NYSE:RBC) today reported financial results for the

first quarter ended March 31, 2007. Strong performances by our

industrial businesses offset a weak residential HVAC market. The

residential HVAC market experienced record year-over-year decline

driven by the weak housing market and a comparison to a strong 2006

industry performance which was the result of the 13 SEER

legislation that went into effect in January of 2006. The Company's

initiatives continued to gain traction and had a significant impact

on the Company's performance. New products and acquisition growth

fueled sales growth, while Lean Six Sigma helped support operating

margins. Net sales increased 5.1% to $418.6 million from $398.3

million in the first quarter of 2006. In the Electrical segment,

sales increased 6.2% as industrial motor and generator sales

increases of 20% and 24% respectively, offset a 14% decline in

residential HVAC revenues. Motors sales growth was also aided by

$17.9 million of sales attributed to the Sinya motor business

acquired in the second quarter of 2006. Sales in the Mechanical

segment were down 2.1% from the prior year period; however, the

sale of substantially all of the assets of the Company's cutting

tools business in May 2006 reduced segment sales by approximately

$4.7 million for the quarter. The gross profit margin for the first

quarter of 2007 was 23.2% as compared to the 23.4% reported for the

first quarter of 2006. The reduction was a result of continued

increases in material costs and lower liquidations in our HVAC

business. Material cost increases were partially offset by higher

selling prices and productivity improvements. Income from

operations was $47.3 million or 11.3% of sales, an 8.5% increase

over the $43.6 million or 11.0% of sales reported for the first

quarter of 2006. Net income in the first quarter of 2007 was $26.8

million, a 12.7% increase from $23.8 million reported in the first

quarter of 2006. Diluted earnings per share increased 11.1% to $.80

as compared to $.72 for the first quarter of 2006. "We are pleased

with our results for the first quarter, especially considering the

most challenging residential HVAC market in decades and the

continued material cost pressures," commented Henry W. Knueppel,

Chairman and CEO, "The two-thirds of our business that is

commercial and industrial performed well during the quarter. While

we are not expecting the HVAC market to strengthen significantly in

the second quarter, we remain confident in our future as evidenced

by the recent 7.1% increase in our quarterly dividend. We expect

the EPS for the second quarter to be in the range of $.99 to

$1.06." Regal Beloit will be holding a conference call to discuss

first quarter financial results at 1:30 PM CDT (2:30 PM EDT) today.

Interested parties should call 800-288-8960, access code 871624. A

replay of the call will be available through May 14, 2007 at

800-475-6701, access code 871624. Regal Beloit Corporation is a

leading manufacturer of mechanical and electrical motion control

and power generation products serving markets throughout the world.

Regal Beloit is headquartered in Beloit, Wisconsin, and has

manufacturing, sales, and service facilities throughout the United

States, Canada, Mexico, Europe and Asia. CAUTIONARY STATEMENT This

news release contains "forward-looking statements" as defined in

the Private Securities Litigation Reform Act of 1995.

Forward-looking statements represent our management's judgment

regarding future events. In many cases, you can identify

forward-looking statements by terminology such as "may," "will,"

"plan," "expect," "anticipate," "estimate," "believe," or

"continue" or the negative of these terms or other similar words.

Actual results and events could differ materially and adversely

from those contained in the forward-looking statements due to a

number of factors, including: -- economic changes in global markets

where we do business, such as currency exchange rates, inflation

rates, interest rates, recession, foreign government policies and

other external factors that we cannot control; -- unanticipated

fluctuations in commodity prices and raw material costs; --

cyclical downturns affecting the global market for capital goods;

-- unexpected issues and costs arising from the integration of

acquired companies and businesses; -- marketplace acceptance of new

and existing products including the loss of, or a decline in

business from, any significant customers; -- the impact of capital

market transactions that we may effect; the availability and

effectiveness of our information technology systems; --

unanticipated costs associated with litigation matters; actions

taken by our competitors; -- difficulties in staffing and managing

foreign operations; -- other risks and uncertainties including but

not limited to those described in Item 1A-Risk Factors of the

Company's Annual Report on Form 10-K filed on February 28, 2007 and

from time to time in our reports filed with U.S. Securities and

Exchange Commission. All subsequent written and oral

forward-looking statements attributable to us or to persons acting

on our behalf are expressly qualified in their entirety by the

applicable cautionary statements. The forward-looking statements

included in this news release are made only as of their respective

dates, and we undertake no obligation to update these statements to

reflect subsequent events or circumstances. See also Item 1A - Risk

Factors in the Company's Annual Report on Form 10-K filed on

February 28, 2007. STATEMENTS OF INCOME In Thousands of Dollars

(Unaudited) Three Months Ended March 31, April 1, 2007 2006 Net

Sales $ 418,646 $ 398,326 Cost of Sales 321,419 305,046 Gross

Profit 97,227 93,280 Operating Expenses 49,896 49,662 Income From

Operations 47,331 43,618 Interest Expense 5,066 4,795 Interest

Income 89 120 Income Before Taxes & Minority Interest 42,354

38,943 Provision For Income Taxes 14,690 14,342 Income Before

Minority Interest 27,664 24,601 Minority Interest in Income, Net of

Tax 851 813 Net Income $ 26,813 $ 23,788 Per Share of Common Stock:

Earnings Per Share $ .87 $ .77 Earnings Per Share - Assuming

Dilution $ .80 $ .72 Cash Dividends Declared $ .14 $ .13 Average

Number of Shares Outstanding 30,814,312 30,700,533 Average Number

of Shares - Assuming Dilution 33,547,519 32,957,209 CONDENSED

BALANCE SHEETS In Thousands of Dollars ASSETS (Unaudited) (Audited)

Current Assets: March 31, December 30, 2007 2006 Cash and Cash

Equivalents $ 43,086 $ 36,520 Receivables and Other Current Assets

299,511 257,510 Inventories 269,488 275,138 Total Current Assets

612,085 569,168 Net Property, Plant and Equipment 273,024 268,880

Goodwill 546,187 546,152 Other Noncurrent Assets 50,910 53,359

Total Assets $1,482,206 $1,437,559 Liabilities and Shareholders'

Investment Accounts Payable $ 120,377 $ 108,050 Commercial Paper

Borrowings 49,125 49,000 Other Current Liabilities 108,735 101,871

Long-Term Debt 323,542 323,946 Other Noncurrent Liabilities 105,597

104,717 Shareholders' Investment 774,830 749,975 Total Liabilities

and Shareholders' Investment $1,482,206 $1,437,559 SEGMENT

INFORMATION In Thousands of Dollars (Unaudited) Mechanical Segment

Electrical Segment Three Months Ended Three Months Ended March 31,

April 1, March 31, April 1, 2007 2006 2007 2006 Net Sales $51,846

$52,961 $366,800 $345,365 Income from Operations $6,326 $3,707

$41,005 $39,911 CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS In

Thousands of Dollars (Unaudited) Three Months Ended March 31, 2007

April 1, 2006 CASH FLOWS FROM OPERATING ACTIVITIES: Net income $

26,813 $ 23,788 Adjustments to reconcile net income to net cash

provided by operating activities; net of effect of acquisitions

Depreciation and amortization 9,883 8,115 Minority interest 851 813

Excess tax benefit from stock-based compensation (3,310) (450) Loss

(gain) on sale of assets 8 (8) Stock-based compensation expense 865

867 Change in assets and liabilities, net (24,703) (35,377) Net

cash provided by used in operating activities 10,407 (2,252) CASH

FLOWS FROM INVESTING ACTIVITIES: Additions to property, plant and

equipment (12,163) (7,257) Purchases of short-term investments --

(4,225) Business acquisitions, net of cash acquired (565) (565)

Sale of property, plant and equipment -- 5,207 Net cash (used) in

investing activities (12,728) (6,840) CASH FLOWS FROM FINANCING

ACTIVITIES: Proceeds from short-term borrowing 9,200 -- Payments of

long-term debt (225) (197) Net (repayments) borrowings under

revolving credit facility (200) 3,500 Proceeds from commercial

paper borrowings, net 125 5,000 Dividends paid to shareholders

(4,345) (3,985) Proceeds from the exercise of stock options 747

1,363 Excess tax benefits from stock-based compensation 3,310 450

Net cash provided by financing activities 8,612 6,131 EFFECT OF

EXCHANGE RATE ON CASH 275 (66) Net increase (decrease) in cash and

cash equivalents 6,566 (3,027) Cash and cash equivalents at

beginning of period 36,520 32,747 Cash and cash equivalents at end

of period $ 43,086 $ 29,720 DATASOURCE: Regal Beloit Corporation

CONTACT: David A. Barta, Vice President, Chief Financial Officer of

Regal Beloit Corporation, +1-608-361-7405 Web site:

http://www.regal-beloit.com/

Copyright

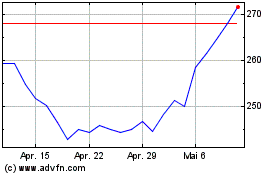

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

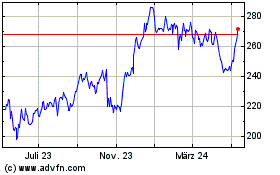

RBC Bearings (NYSE:RBC)

Historical Stock Chart

Von Jul 2023 bis Jul 2024