Whitestone REIT (NYSE: WSR) (“Whitestone” or the “Company”) today

announced the appointments of Kristian (“Krissy”) M. Gathright and

Donald (“Don”) A. Miller, CFA, to the Board of Trustees, effective

immediately. These appointments reflect shareholder feedback

received over the last several months and conclude an exhaustive

search by Whitestone’s Nominating and Governance Committee in

combination with pre-eminent executive search firm Spencer Stuart.

Ms. Gathright currently serves as a Board member of Apple

Hospitality REIT (NYSE: APLE) that owns one of the largest and most

diverse portfolios of upscale, rooms-focused hotels in the United

States. During a span of over 20 years, she served in various roles

at the company, including operations, strategic decision-making,

raising capital and investor relations. In addition to her

extensive operational and strategic contributions at Apple REIT,

Ms. Gathright was instrumental in the company’s 2015 listing on the

NYSE and its ownership transition from retail to institutional

shareholders. She was serving as Apple REIT’s Executive Vice

President and Chief Operating Officer prior to her retirement in

2020. Ms. Gathright has also served on the Board of Trustees for

Spirit Realty (NYSE: SRC), a net lease REIT. Prior to its

acquisition in January 2024, Spirit Realty had an approximate $9.3

billion enterprise value, with over 29 million square feet of

retail assets. Ms. Gathright’s real estate operational expertise,

B2C knowledge and Board experience will be highly complementary to

Whitestone’s Board. For additional detail, please see Krissy's Bio

on Whitestone’s investor relations website.

Mr. Miller served as President and Chief Executive Officer for

Piedmont Office Realty Trust (NYSE: PDM) for over a decade,

including overseeing its initial public offering in 2010. Under his

leadership, Piedmont recycled approximately $2.2 billion in assets

and executed a consistent strategy focused on aggregating

high-quality assets in targeted markets – a strategy that was

reflected in Piedmont’s top-quartile ranking of stock performance

relative to its peer group during the last three years prior to Mr.

Miller’s retirement in 2019. Prior to his time at Piedmont, Mr.

Miller was the head of real estate activities at Wells Real Estate

Funds, where he was responsible for directing all aspects of

acquisitions, asset management, dispositions, leasing property

management and construction. He currently serves on the Board of

Directors for three privately held organizations with significant

real estate investments: Pacolet Milliken Enterprises, Watkins

Associated Industries, and The Feil Organization. Mr. Miller’s

multi-decade real estate leadership, Board expertise, and Sun Belt

experience will be a significant enhancement to Whitestone’s Board

of Trustees. For additional information, please refer to Don's Bio

on Whitestone’s investor relations website.

Ms. Gathright will serve as a member of the Audit and Nominating

and Corporate Governance Committees and Mr. Miller will serve as a

member of the Compensation and Nominating and Corporate Governance

Committees.

In connection with these two appointments and as previously

announced, Nandita V. Berry and David F. Taylor will step down from

the Board effective immediately. The Whitestone Board will continue

to comprise six trustees, five of whom are independent.

“We are excited to welcome Krissy and Don to the Board,” said

Amy S. Feng, Chair of the Board of Trustees. “With their collective

real estate industry expertise and track record of value creation,

I am confident that they will be significantly additive to the

Board as we oversee the management team’s continued success in

executing Whitestone’s growth strategy and driving enhanced

shareholder returns.”

Ms. Feng added, “On behalf of the Board, I also want to

acknowledge David’s and Nandita’s contributions, which were

instrumental in launching the Company’s reset strategy. We thank

them for their years of service to Whitestone.”

“Whitestone is poised to capture the substantial benefits of its

turnaround strategy,” said Ms. Gathright. “I am honored to be a

part of the Company’s Board and look forward to utilizing my REIT

operational experience and B2C background as I work closely with my

fellow Trustees and the management team to ensure Whitestone’s

continued growth and value creation.”

“Whitestone combines high-quality assets with best-in-class

operating performance, as evidenced by their performance over the

last three years under CEO Dave Holeman,” said Mr. Miller. “I look

forward to leveraging my expertise in the industry to support the

Company’s continued momentum and create significant shareholder

value.”

About Whitestone REITWhitestone REIT (NYSE:

WSR) is a community-centered real estate investment trust

(REIT) that acquires, owns, operates, and develops open-air,

retail centers located in some of the fastest growing markets in

the country: Phoenix, Austin, Dallas-Fort Worth, Houston and San

Antonio.

Our centers are convenience focused: merchandised with a mix of

service-oriented tenants providing food (restaurants and grocers),

self-care (health and fitness), services (financial and logistics),

education and entertainment to the surrounding communities.

The Company believes its strong community connections and

deep tenant relationships are key to the success of its current

centers and its acquisition strategy. For additional

information, please visit the Company's investor relations

website.

Forward-Looking StatementsThis Report contains

forward-looking statements within the meaning of the federal

securities laws, including discussion and analysis of our financial

condition and results of operations, statements related to our

expectations regarding the performance of our business, and other

matters. These forward-looking statements are not historical facts

but are the intent, belief or current expectations of our

management based on its knowledge and understanding of our business

and industry. Forward looking statements are typically identified

by the use of terms such as “may,” “will,” “should,” “potential,”

“predicts,” “anticipates,” “expects,” “intends,” “plans,”

“believes,” “seeks,” “estimates” or the negative of such terms and

variations of these words and similar expressions, although not all

forward-looking statements include these words. These statements

are not guarantees of future performance and are subject to risks,

uncertainties and other factors, some of which are beyond our

control, are difficult to predict and could cause actual results to

differ materially from those expressed or forecasted in the

forward-looking statements.

Factors that could cause actual results to differ materially

from any forward-looking statements made in this Report include:

the imposition of federal income taxes if we fail to qualify as a

real estate investment trust (“REIT”) in any taxable year or forego

an opportunity to ensure REIT status; uncertainties related to the

national economy and the real estate industry, both in general and

in our specific markets; legislative or regulatory changes,

including changes to laws governing REITs; adverse economic or real

estate developments or conditions in Texas or Arizona, Houston,

Dallas, and Phoenix in particular, including the potential impact

of public health emergencies, on our tenants’ ability to pay their

rent, which could result in bad debt allowances or straight-line

rent reserve adjustments; increases in interest rates, including as

a result of inflation, which may increase our operating costs or

general and administrative expenses; our current geographic

concentration in the Houston, Dallas, and Phoenix metropolitan area

markets makes us susceptible to potential local economic downturns;

natural disasters, such as floods and hurricanes, which may

increase as a result of climate change may adversely affect our

returns and adversely impact our existing and prospective tenants;

increasing focus by stakeholders on environmental, social, and

governance matters; financial institution disruptions; availability

and terms of capital and financing, both to fund our operations and

to refinance our indebtedness as it matures; decreases in rental

rates or increases in vacancy rates; harm to our reputation,

ability to do business and results of operations as a result of

improper conduct by our employees, agents or business partners;

litigation risks; lease-up risks, including leasing risks arising

from exclusivity and consent provisions in leases with significant

tenants; our inability to renew tenant leases or obtain new tenant

leases upon the expiration of existing leases; risks related to

generative artificial intelligence tools and language models, along

with the potential interpretations and conclusions they might make

regarding our business and prospects, particularly concerning the

spread of misinformation; our inability to generate sufficient cash

flows due to market conditions, competition, uninsured losses,

changes in tax or other applicable laws; geopolitical conflicts,

such as the ongoing conflict between Russia and Ukraine, the

conflict in the Gaza Strip and unrest in the Middle East; the need

to fund tenant improvements or other capital expenditures out of

our operating cash flow; and the risk that we are unable to raise

capital for working capital, acquisitions or other uses on

attractive terms or at all: the ultimate amount we will collect in

connection with the redemption of our equity investment in

Pillarstone Capital REIT Operating Partnership LP (“Pillarstone” or

“Pillarstone OP.”); and other factors detailed in the Company's

most recent Annual Report on Form 10-K, Quarterly Reports on Form

10-Q and other documents the Company files with the Securities and

Exchange Commission from time to time.

Investor and Media Contacts:David MordyDirector

of Investor RelationsWhitestone REIT(713)

435-2219ir@whitestonereit.com

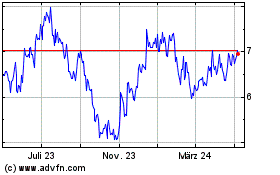

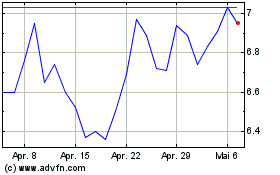

Piedmont Office Realty (NYSE:PDM)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Piedmont Office Realty (NYSE:PDM)

Historical Stock Chart

Von Nov 2023 bis Nov 2024