Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

31 Januar 2024 - 10:59PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE

COMMISSION

Washington, D.C.

20549

FORM 6-K

Report of Foreign Private

Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange

Act of 1934

For the month of

January, 2024

Commission File Number

1-15106

PETRÓLEO BRASILEIRO

S.A. – PETROBRAS

(Exact name of registrant

as specified in its charter)

Brazilian Petroleum

Corporation – PETROBRAS

(Translation of Registrant's

name into English)

Avenida Henrique Valadares, 28 – 19th floor

20241-030 – Rio de Janeiro, RJ

Federative Republic of Brazil

(Address of principal

executive office)

Indicate by check mark

whether the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form

40-F _______

Indicate by check mark

whether the registrant by furnishing the information contained in this Form is also thereby furnishing the information to the Commission

pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

Petrobras informs on receipt of earnout from

Sépia and Atapu

—

Rio de Janeiro, January 31, 2024

– Petróleo Brasileiro S.A. – Petrobras informs that it has received, in cash, an amount of R$ 1.819 billion, referring

to the complement of the firm compensation (earnout) of the 2023, from the Sépia and Atapu blocks. The amount already includes

the gross-up of the taxes levied on the 28%, 21% and 21% stakes held by TotalEnergies EP Brasil Ltda, PETRONAS Petróleo Brasil

Ltda and QatarEnergy Brasil Ltda, respectively, in Sepia and 25% and 22.5% of Shell Brasil Petróleo Ltda and TotalEnergies EP Brasil

Ltda, in Atapu.

Under the terms of Ministerial Order

No. 08 of 19/04/2021 of the Ministry of Mines and Energy (MME) and the public notice for the 2nd round of bids for the Onerous Transfer

Surplus under the Production Sharing regime, which took place on 17/12/2021, earnout values were established for the Sépia and

Atapu blocks, which will be due between 2022 and 2032, and payable from the last working day of January of the year following that in

which the price of Brent-type oil reaches an annual average of more than US$ 40/bbl, limited to US$ 70/bbl.

Facts deemed material will be disclosed

to the market in due time.

www.petrobras.com.br/ir

For more information:

PETRÓLEO BRASILEIRO S.A. – PETROBRAS

| Investors Relations

email: petroinvest@petrobras.com.br/acionistas@petrobras.com.br

Av. Henrique Valadares, 28 – 9 th floor

– 20231-030 – Rio de Janeiro, RJ.

Tel.: 55 (21) 3224-1510/9947 | 0800-282-1540

This document may contain forecasts

within the meaning of Section 27A of the Securities Act of 1933, as amended (Securities Act), and Section 21E of the Securities Trading

Act of 1934, as amended (Trading Act) that reflect the expectations of the Company's officers. The terms: "anticipates", "believes",

"expects", "predicts", "intends", "plans", "projects", "aims", "should,"

and similar terms, aim to identify such forecasts, which evidently involve risks or uncertainties, predicted or not by the Company. Therefore,

future results of the Company's operations may differ from current expectations, and the reader should not rely solely on the information

included herein.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934,

the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

Date: January 31, 2024

PETRÓLEO BRASILEIRO S.A–PETROBRAS

By: /s/ Sergio Caetano Leite

______________________________

Sergio Caetano Leite

Chief Financial Officer and Investor Relations

Officer

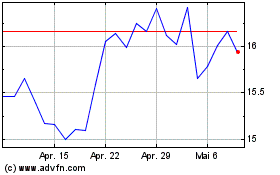

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

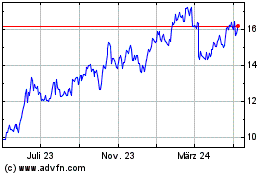

Petroleo Brasileiro ADR (NYSE:PBR.A)

Historical Stock Chart

Von Mai 2023 bis Mai 2024