0000074260false00000742602024-03-062024-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(d) OF

THE SECURITIES EXCHANGE ACT OF 1934

Date of Report: (Date of earliest event reported) March 6, 2024

| | | | | | | | | | | | | | |

| OLD REPUBLIC INTERNATIONAL CORPORATION |

| (Exact name of registrant as specified in its charter) |

| | | | | | | | | | | | | | |

| Delaware | | 001-10607 | | 36-2678171 |

| (State or other jurisdiction | | (Commission | | (I.R.S. Employer |

| of incorporation) | | File Number) | | Identification No.) |

| | | | | | | | | | | | | | | | | |

| 307 North Michigan Avenue | Chicago | Illinois | 60601 | |

| (Address of principal executive offices) (Zip Code) | |

| | | | | |

| (312) | 346-8100 | | | |

| (Registrant’s telephone number, including area code) | |

| | | | | |

| N /A | |

| (Former name or former address, if changed since last report) | |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the Registrant under any of the following provisions (see General Instruction A.2 below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 140.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Common Stock / $1 par value | | ORI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On March 6, 2024, the Board of Directors (the “Board”) of Old Republic International Corporation (the “Company”) approved grants of restricted stock units and performance-based stock units to the named executive officers (as identified in the Company’s 2023 proxy statement) under the Old Republic International Corporation 2022 Incentive Compensation Plan. A summary of the terms of these awards is set forth below.

Description of RSU Awards

On March 6, 2024, the Compensation Committee of the Board (the “Compensation Committee”) granted the named executive officers awards of restricted stock units with dividend equivalent rights under the Company’s 2022 Incentive Compensation Plan (the “RSUs”), as follows: Craig R. Smiddy, 28,912 units; Frank J. Sodaro, 9,032 units; W. Todd Gray, 10,537 units; and Stephen J. Oberst, 12,042 units. The RSUs are rights to receive shares of common stock, which vest in three equal installments beginning one year after the date of the award. Within 60 days after each installment vests annually, the vested RSUs will be paid in common stock, and any associated dividend equivalents will be paid in cash. If a grantee dies or retires in good standing after attaining age 65 and 10 years of service or due to disability, or upon the Company’s divestment of grantee’s employer, the RSUs will continue to vest on the scheduled vesting date(s) and will pay out at the annual scheduled payment dates. In addition, the 2022 Incentive Compensation Plan contains additional terms regarding the treatment of an RSU award upon a change of control of the Company.

Description of PSU Awards

On March 6, 2024, the Compensation Committee granted the named executive officers awards of performance-based restricted stock units with dividend equivalent rights under the Company’s 2022 Incentive Compensation Plan (the “PSUs”), as follows: Craig R. Smiddy, 86,737 units; Frank J. Sodaro, 27,100 units; W. Todd Gray, 31,700 units; and Stephen J. Oberst, 36,250 units. The PSUs are rights to receive shares of common stock, which vest, if at all, based on the achievement of specified performance criteria, measured over a 3-year performance period. The performance criteria for the 2024 PSUs granted to all of the named executive officers consist of: (i) 3-Year Average Operating ROE, which reflects the operating return on equity over the 3-year performance period, of 6% (threshold), 11% (objective), 18% (maximum) (50% weighting) and (ii) 3-Year Book Value Annual Compound Total Return Per Share (including dividends), which reflects the total return per share over the 3-year performance period, of 6% (threshold), 11% (objective), 18% (maximum) (50% weighting).

The number of shares of common stock earned under the PSUs will depend on the level of achievement (threshold, objective, or maximum) of the performance objectives over the performance period, subject to the weighting criteria referenced above. Less than threshold will earn 0%, meeting the threshold will earn 50%, meeting the objective will earn 100% and meeting or exceeding the maximum will earn 200%, with achievement levels between the threshold and the maximum interpolated accordingly.

After the 3-year performance period, the Compensation Committee will determine the level of achievement of the PSUs. Within 90 days after the date the Compensation Committee certifies the level of achievement, any vested PSUs will be paid in Common Stock and any associated dividend equivalents will be paid in cash. A grantee will forfeit the PSUs upon termination of employment, except in the event grantee dies or retires in good standing after attaining age 65 and 10 years of service or due to disability, or upon the Company’s divestment of grantee’s employer. In the latter circumstances, the grantee will continue to be eligible to vest in the PSUs, depending upon the achievement of the performance as determined after the end of the performance period. In addition, the 2022 Incentive Compensation Plan contains additional terms regarding the treatment of a PSU award upon a change of control of the Company.

Amendment to Form of Option Award Agreement

The Compensation Committee also approved an amendment to the form of option award agreement under the 2022 Incentive Compensation Plan to provide that in the event of the divestment by the Company of an affiliate that employs a grantee, provided that the grantee does not transfer employment to a retained affiliate upon the divestment of the affiliate that employs the grantee, the grantee shall have the right to exercise the vested portion of an option award, in whole or in part, prior to the earlier of (i) the expiration date of the option award or (ii) the fourth anniversary of the date of the divestment.

The foregoing descriptions of the RSUs, PSUs and Option Award Agreement do not purport to be complete and are qualified in their entirety by reference to the applicable award agreements, forms of which are attached as Exhibits hereto.

Item 9.01. Financial Statements and Exhibits.

| | | | | |

| (d) | Exhibits |

| |

| Exhibit No. | Description |

| |

| |

| |

| |

| 104 | Cover page Interactive Data file (embedded within Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned thereunto duly authorized.

| | | | | | | | |

| OLD REPUBLIC INTERNATIONAL CORPORATION |

| Registrant |

| |

| |

| |

| Date: March 8, 2024 | By: /s/ Thomas A. Dare |

| | Thomas A. Dare |

| | Senior Vice President, |

| | Secretary and General Counsel |

| | |

[FORM OF] OLD REPUBLIC INTERNATIONAL CORPORATION RESTRICTED STOCK UNIT AWARD AGREEMENT (2022 INCENTIVE COMPENSATION PLAN) THIS RESTRICTED STOCK UNIT AWARD AGREEMENT, (this “Agreement”), dated as of [ ] (the “Date of Grant”), is made by and between Old Republic International Corporation, a Delaware corporation (the “Company”), and [ ] (the “Grantee” or “you” or “your”). WHEREAS, Grantee is employed by the Company or an Affiliate; WHEREAS, as a matter of separate inducement and agreement in connection with Grantee’s employment, and not in lieu of any salary or other compensation for Grantee’s services, the Company desires to enter into this Agreement with Grantee; and WHEREAS, the Company desires to grant to Grantee, subject to the restrictions set forth herein and the Company’s 2022 Incentive Compensation Plan (the “Plan”), the number of Restricted Stock Units (“RSUs”), as set forth below. NOW, THEREFORE, in consideration of the recitals and the mutual agreements herein contained, the parties hereto agree as follows: ARTICLE I GRANT OF RESTRICTED STOCK UNITS 1.1 Award of RSUs. As of the Date of Grant, the Company hereby grants to you [ ] RSUs (the “Award”) valued at $[ ] at market close on [ ], on the terms and conditions set forth in this Agreement. Each RSU represents the right to receive one share of Stock (“Share”), as set forth in this Agreement. 1.2 Award of Dividend Equivalents. The Company hereby grants to Grantee, with respect to each RSU, a Dividend Equivalent for dividends paid to substantially all holders of outstanding Shares with a record date after the Grant Date and prior to the date the applicable RSU is settled, forfeited, or otherwise expires. Each Dividend Equivalent entitles Grantee to receive the equivalent value of any such dividends paid on a single Share during the applicable vesting period. The Company will establish a separate Dividend Equivalent bookkeeping account (a “Dividend Equivalent Account”) for each Dividend Equivalent and credit the Dividend Equivalent Account on the applicable dividend payment date with the amount of any such cash paid. No interest will accrue on the Dividend Equivalents. Any and all Dividend Equivalents with respect to the RSUs that are forfeited shall also be forfeited and not deemed earned by nor distributed to Grantee.

2 ARTICLE II TERMS AND CONDITIONS OF AWARD The grant of RSUs provided in Article I shall be subject to the following terms, conditions, and restrictions: 2.1 Plan. This Award is issued under the Plan and is subject to the terms and conditions set forth in the Plan. In the event of a conflict between the terms of this Agreement and the Plan, the terms of the Plan shall control. Any capitalized term used in this Agreement that is not defined herein shall have the meaning set forth in the Plan. You acknowledge receiving a copy of the Plan. 2.2 Vesting; Forfeiture. (a) Vesting. The RSUs shall vest with respect to one-third of the Award on the first anniversary of the Date of Grant, two-thirds of the Award on the second anniversary of the Date of Grant and all of the Award on the third anniversary of the Date of Grant (the “Vesting Schedule”, and each anniversary a “Vesting Date”), subject to your continued employment or service through such date, except as otherwise provided in (b) below. The Plan contains additional terms that apply upon the consummation of a Change of Control that depend on whether this Award is assumed or not in the transaction. The RSUs will vest according to the Vesting Schedule above except that any fraction of an RSU that would otherwise be vested will be accumulated and will vest only when a whole RSU has accumulated. (b) Forfeiture. In the event of Grantee’s separation from service from the Company and all Affiliates for any reason prior to vesting in accordance with Section 2.2(a), all RSUs held by Grantee shall be automatically forfeited by Grantee as of the date of termination, unless such termination was due to: (i) Grantee’s retirement due to Disability, (ii) Grantee’s death, or (iii) the Company’s divestiture of the Affiliate that employs Grantee as described in the Plan. In addition, if Grantee is an employee of the Company and/or its Affiliates and Grantee retires in good standing on or after attaining age 65 and with 10 years of service with the Company and/or its Affiliates, the Award will continue to vest on the Vesting Dates for the remainder of the Vesting Schedule, subject to Grantee’s ongoing compliance with any restrictive covenants contained in any agreement with, or any plan, policy, or program of, the Company and/or its Affiliates. Any RSUs forfeited pursuant to this Agreement shall be forfeited without payment of any consideration by the Company, and neither Grantee nor any of Grantee’s successors, heirs, assigns or personal representatives shall thereafter have any further rights or interests in such RSUs. 2.3 Settlement. As soon as administratively practicable after each Vesting Date, but in no event more than 60 days after such Vesting Date (each a “Settlement Date”), the vested RSUs will be paid to Grantee in whole shares of Stock, with any fractional share of Stock paid in cash, and vested Dividend Equivalents (including any Dividend Equivalent Account balance) will be paid to Grantee in cash, each subject to applicable withholding. The Stock shall be valued at Fair Market Value as of the date the Committee directs payments to be made.

3 ARTICLE III MISCELLANEOUS 3.1 Rights as Shareholder. Unless and until any shares of Stock are issued in settlement of the Award, the Award shall not confer to Grantee any rights or status as a stockholder of the Company. 3.2 Limitations Applicable to Section 16 Persons. Notwithstanding any other provision of the Plan or this Agreement, if you are subject to Section 16 of the Exchange Act (those associates who are members of the Old Republic International Corporation Office of the Chief Executive Officer), the Plan, the RSUs, the Dividend Equivalents, and this Agreement shall be subject to any additional limitations set forth in any applicable exemptive rule under Section 16 of the Exchange Act (including any amendment to Rule 16b-3 of the Exchange Act) that are requirements for the application of such exemptive rule. To the extent permitted by applicable law, this Agreement shall be deemed amended to the extent necessary to conform to such applicable exemptive rule. 3.3 Form 10K and 10Q. You acknowledge having received (or having accessed through the SEC’s EDGAR website) a copy of the Company’s most recent Form 10K and 10Q. 3.4 Receipt of Plan. Grantee acknowledges receipt of a copy of the Plan and represents that he or she is familiar with the terms and provisions thereof, and hereby accepts this Award subject to all of the terms and provisions of the Plan and this Agreement. By accepting this Award, Grantee acknowledges and agrees that Grantee has reviewed the Plan in its entirety and has had an opportunity to obtain the advice of counsel prior to executing this Agreement and accepting the Award. Grantee hereby agrees to accept as binding, conclusive and final all decisions or interpretations of the Board or the Committee upon any questions arising under the Plan or this Agreement. 3.5 Notices. Except as provided in Section 3.6, every notice or other communication related to this Agreement shall be given in writing and shall be delivered either personally or by registered or certified mail, postage prepaid, which shall be addressed, in the case of the Company to both the Chief Financial Officer and the General Counsel of the Company at the principal office of the Company and, in your case, to your address appearing on the books of the Company or to your residence or to such other address as you may designate in writing. 3.6 Electronic Delivery; Online Portal. By accepting this Award, Grantee consents to receive the Plan, this Agreement, and any participant notices or communications by electronic delivery and to participate in the Plan through an on-line or electronic system established and maintained by the Company or Fidelity (or any successor administrator designated by the Company). Grantee acknowledges and consents to the use of the on-line or electronic system for all administrative purposes related to this Agreement. 3.7 Withholding. In accordance with Section 12.4 of the Plan, the Company shall require the satisfaction of tax obligations by net settlement through withholding from any payment of Stock required to be made in settlement of the Award an amount sufficient to satisfy such

4 federal, state, and local withholding tax requirements. The Company shall pay to the Grantee cash in lieu of any fractional share otherwise issuable to the Grantee because of such net settlement. 3.8 No Tax, Legal, or Financial Advice. The Company and its Affiliates are not providing any tax, legal or financial advice, nor are the Company and its Affiliates making any recommendations regarding your acquisition or sale of Stock. You acknowledge that you are subject to the restrictions on trading in shares of Stock, including, without limitation, the Shares underlying this Award, set forth in the applicable Corporate Policy and Practice Memorandum included with the materials relating to this Award or this Agreement. You should consult with your own personal tax, legal and financial advisors. You acknowledge that the ultimate liability for all taxes related to this Award is and remains your responsibility. Such tax liability may exceed any amount actually withheld by the Company, if any, pursuant to the terms of the Plan. 3.9 Limitation on Grantee’s Rights. Participation in the Plan confers no rights or interests other than as herein provided. This Agreement creates only a contractual obligation on the part of the Company as to amounts payable and may not be construed as creating a trust. Neither the Plan nor any underlying program, in and of itself, has any assets. Grantee will have only the rights of a general unsecured creditor of the Company with respect to amounts credited and benefits payable, if any, with respect to the RSUs and Dividend Equivalents, and rights no greater than the right to receive cash or the Shares as a general unsecured creditor with respect to the RSUs and Dividend Equivalents, as and when settled pursuant to the terms of this Agreement. 3.10 No Employment or Service Obligation. Nothing contained in this Agreement shall (i) confer upon Grantee any right with respect to continuation of employment or of a consulting or advisory relationship with the Company or any Affiliate or (ii) interfere in any way with the right of the Company or any Affiliate to terminate Grantee’s employment or consulting or advisory relationship at any time. 3.11 Adjustment. The number of RSUs subject to this Agreement are subject to adjustment as provided for in the Plan. 3.12 Successors. The terms of this Agreement shall be binding upon and inure to the benefit of the Company, its successors and assigns, and to you and your beneficiaries, executors, administrators, heirs, and successors. 3.13 Invalid Provision. The invalidity or unenforceability of any particular provision thereof shall not affect the other provisions hereof, and this Agreement shall be construed in all respects as if such invalid or unenforceable provision had been omitted. 3.14 Amendment. Grantee further acknowledges and agrees that this Agreement may not be modified, amended, or revised except as provided in the Plan. 3.15 Entire Agreement. This Agreement and the Plan contain the entire agreement and understanding of the parties hereto with respect to the subject matter contained herein and therein and supersede all prior communications, representations, and negotiations in respect thereto. 3.16 Clawback/Recovery. This Agreement and any payments hereunder are subject to recoupment in accordance with any clawback policy in effect from time to time that the Company

5 is specifically required to adopt pursuant to the listing standards of any national securities exchange or association on which the Company’s securities are listed or as is otherwise specifically required by the Dodd-Frank Wall Street Reform and Consumer Protection Act or other applicable law. As of the Date of Grant, the Company’s clawback policy generally provides, in the event of an accounting restatement, the Company shall seek to recover, reasonably promptly, all erroneously awarded compensation from an executive officer (those associates who are members of the Old Republic International Corporation Office of the Chief Executive Officer) during the time period covered in accordance with the Section 303A.14 of The New York Stock Exchange Listed Company Manual and Section 10D and Rule 10D-1 of the Securities Exchange Act of 1934, as amended. Such determination of the amount of erroneously awarded compensation, in the case of an accounting restatement, will be made without regard to any individual knowledge or responsibility related to the accounting restatement or the erroneously awarded compensation. Notwithstanding the foregoing, if the Company is required to undertake an accounting restatement, the Company shall recover the erroneously awarded compensation unless the recovery is determined to be impracticable by the Compensation Committee in accordance with the clawback policy. The foregoing description is qualified by reference to the Company’s complete clawback policy, which policy is hereby incorporated herein by reference. The Company’s clawback policy may be amended or restated from time to time as required by the listing standards of any national securities exchange or association on which the Company’s securities are listed, as is otherwise specifically required by the Dodd-Frank Wall Street Reform and Consumer Protection Act or other applicable law, or as otherwise determined by the Committee. 3.17 Governing Law. The provisions of this Agreement shall be construed, administered, and governed under the laws of the state of Delaware and applicable federal law. Notwithstanding any other provision of this Agreement or the Plan, the Company shall have no liability to issue any shares under this Agreement or the Plan unless such issuance would comply with all applicable laws and the applicable requirements of any securities exchange or similar entity. 3.18 Headings. Headings of Articles and Sections are included for convenience of reference only and do not constitute part of this Agreement and shall not be used in construing the terms of this Agreement. 3.19 Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. 3.20 Section 409A. (a) It is intended that this Agreement will comply with Section 409A of the Internal Revenue Code of 1986, and the interpretive guidance thereunder (“Section 409A”), including, to the maximum extent applicable, the exceptions for (among others) short-term deferrals, certain stock rights, separation pay arrangements, and this Agreement shall be administered accordingly, and interpreted and construed on a basis consistent with such intent. To the extent that any provision of this Agreement would fail to comply with the applicable requirements of Section 409A, the Company may, in its sole and absolute discretion and without requiring Grantee’s consent, make such modifications to this Agreement and/or payments to be made thereunder to the extent it determines necessary or advisable to comply with the requirements

6 of Section 409A. Nothing in this Agreement shall be construed as a guarantee of any particular tax effect for the Award, and the Company does not guarantee that any compensation or benefits provided under this Agreement will satisfy the provisions of Section 409A. (b) Notwithstanding anything to the contrary in this Agreement, the Company may delay any payment under this Agreement that the Company reasonably determines would violate applicable law until the earliest date the Company determines the making of the payment will not cause such a violation (in accordance with Treasury Regulation Section 1.409A- 2(b)(7)(ii)) and further determines that the delay will not result in the imposition of excise taxes under Section 409A. (c) With respect to a Grantee who is a retirement-eligible individual (those who during the Vesting Schedule will be or will attain age 65 with 10 years of service), the Settlement Dates shall be treated as fixed payment dates under Treasury Regulation Section 1.409A-3(i)(1)(i). [Signature Page Follows]

Signature Page to Restricted Stock Unit Award Agreement IN WITNESS WHEREOF, this Agreement has been executed and delivered by the parties hereto as of the [ ] day of [ ]. Company: Old Republic International Corporation Grantee: [ ] By: Signature Signature Title: Date: Date: Attachment I: 2022 Incentive Compensation Plan

Attachment I 2022 INCENTIVE COMPENSATION PLAN (attached)

[FORM OF] OLD REPUBLIC INTERNATIONAL CORPORATION PERFORMANCE-BASED RESTRICTED STOCK UNIT AWARD AGREEMENT (2022 INCENTIVE COMPENSATION PLAN) THIS PERFORMANCE-BASED RESTRICTED STOCK UNIT AWARD AGREEMENT, (this “Agreement”), dated as of [ ] (the “Date of Grant”), is made by and between Old Republic International Corporation, a Delaware corporation (the “Company”), and [ ] (the “Grantee” or “you” or “your”). WHEREAS, Grantee is employed by the Company or an Affiliate; WHEREAS, as a matter of separate inducement and agreement in connection with Grantee’s employment, and not in lieu of any salary or other compensation for Grantee’s services, the Company desires to enter into this Agreement with Grantee; and WHEREAS, the Company desires to grant to Grantee, subject to the restrictions set forth herein and the Company’s 2022 Incentive Compensation Plan (the “Plan”), the number of Performance-Based Restricted Stock Units (“PSUs”), as set forth below. NOW, THEREFORE, in consideration of the recitals and the mutual agreements herein contained, the parties hereto agree as follows: ARTICLE I GRANT OF PERFORMANCE-BASED RESTRICTED STOCK UNITS 1.1 Award of PSUs. As of the Date of Grant, the Company hereby grants to you [ ] PSUs (the “Award”) valued at $[ ] at market close on [ ], on the terms and conditions set forth in this Agreement. Each PSU represents the right to receive one share of Stock (“Share”), as set forth in this Agreement. 1.2 Award of Dividend Equivalents. The Company hereby grants to Grantee, with respect to each PSU, a Dividend Equivalent for dividends paid to substantially all holders of outstanding Shares with a record date after the Grant Date and prior to the date the applicable PSU is settled, forfeited, or otherwise expires. Each Dividend Equivalent entitles Grantee to receive the equivalent value of any such dividends paid on a single Share during the applicable vesting period. The Company will establish a separate Dividend Equivalent bookkeeping account (a “Dividend Equivalent Account”) for each Dividend Equivalent and credit the Dividend Equivalent Account on the applicable dividend payment date with the amount of any such cash paid. No interest will accrue on the Dividend Equivalents. Any and all Dividend Equivalents with respect to the PSUs that are forfeited shall also be forfeited and not deemed earned by nor distributed to Grantee.

2 ARTICLE II TERMS AND CONDITIONS OF AWARD The grant of PSUs provided in Article I shall be subject to the following terms, conditions, and restrictions: 2.1 Plan. This Award is issued under the Plan and is subject to the terms and conditions set forth in the Plan. In the event of a conflict between the terms of this Agreement and the Plan, the terms of the Plan shall control. Any capitalized term used in this Agreement that is not defined herein shall have the meaning set forth in the Plan. You acknowledge receiving a copy of the Plan. 2.2 Performance Period. The Performance Period to which this Award relates is the three (3) year period beginning January 1, 2024, and ending December 31, 2026. 2.3 Vesting; Forfeiture. (a) Vesting. The PSUs shall vest subject to the achievement by the Company of the Performance Goals set forth in Exhibit A to this Agreement, which are incorporated herein by reference, over the Performance Period provided in Section 2.2, as determined by the Committee and subject to your continued employment or service through the end of the Performance Period, except as otherwise provided in (b) below. No part of this Award will be paid until the Committee determines that the Performance Goals have been attained for the Performance Period and the amount that shall be payable with respect to the Award. The Plan contains additional terms that apply upon the consummation of a Change of Control that depend on whether this Award is assumed or not in the transaction. (b) Forfeiture. In the event of Grantee’s separation from service from the Company and all Affiliates for any reason prior to the end of the Performance Period, all PSUs held by Grantee shall be automatically forfeited by Grantee as of the date of termination, unless such termination was due to (i) Grantee’s retirement due to Disability; (ii) Grantee’s death; (iii) the Company’s divestiture of the Affiliate that employs Grantee as described in the Plan; or (iv) Grantee is an employee of the Company and/or its Affiliates and Grantee retires in good standing on or after attaining age 65 and with 10 years of service with the Company and/or its Affiliates subject to Grantee’s ongoing compliance with any restrictive covenants contained in any agreement with, or any plan, policy, or program of, the Company and/or its Affiliates (if such an exception to forfeiture applies, Grantee is considered “Continued Vesting Eligible”). Any PSUs forfeited pursuant to this Agreement shall be forfeited without payment of any consideration by the Company, and neither Grantee nor any of Grantee’s successors, heirs, assigns or personal representatives shall thereafter have any further rights or interests in such PSUs. 2.4 Settlement. Vested PSUs and Dividend Equivalents (including any Dividend Equivalent Account balance) will be paid on or before the 90th day following both (i) the end of the Performance Period, and (ii) certification by the Committee that the Performance Goals and any other material terms of this Award and the Plan have been satisfied (the “Settlement Date”). The vested PSUs will be paid to Grantee in whole shares of Stock, with any fractional share of Stock paid in cash, and vested Dividend Equivalents (including any Dividend Equivalent Account

3 balance) will be paid to Grantee in cash, each subject to applicable withholding. The Stock shall be valued at Fair Market Value as of the date the Committee directs payments to be made. ARTICLE III MISCELLANEOUS 3.1 Rights as Shareholder. Unless and until any shares of Stock are issued in settlement of the Award, the Award shall not confer to Grantee any rights or status as a stockholder of the Company. 3.2 Limitations Applicable to Section 16 Persons. Notwithstanding any other provision of the Plan or this Agreement, if you are subject to Section 16 of the Exchange Act (those associates who are members of the Old Republic International Corporation Office of the Chief Executive Officer), the Plan, the PSUs, the Dividend Equivalents, and this Agreement shall be subject to any additional limitations set forth in any applicable exemptive rule under Section 16 of the Exchange Act (including any amendment to Rule 16b-3 of the Exchange Act) that are requirements for the application of such exemptive rule. To the extent permitted by applicable law, this Agreement shall be deemed amended to the extent necessary to conform to such applicable exemptive rule. 3.3 Form 10K and 10Q. You acknowledge having received (or having accessed through the SEC’s EDGAR website) a copy of the Company’s most recent Form 10K and 10Q. 3.4 Receipt of Plan. Grantee acknowledges receipt of a copy of the Plan and represents that he or she is familiar with the terms and provisions thereof, and hereby accepts this Award subject to all of the terms and provisions of the Plan and this Agreement. By accepting this Award, Grantee acknowledges and agrees that Grantee has reviewed the Plan in its entirety and has had an opportunity to obtain the advice of counsel prior to executing this Agreement and accepting the Award. Grantee hereby agrees to accept as binding, conclusive and final all decisions or interpretations of the Board or the Committee upon any questions arising under the Plan or this Agreement. 3.5 Notices. Except as provided in Section 3.6, every notice or other communication related to this Agreement shall be given in writing and shall be delivered either personally or by registered or certified mail, postage prepaid, which shall be addressed, in the case of the Company to both the Chief Financial Officer and the General Counsel of the Company at the principal office of the Company and, in your case, to your address appearing on the books of the Company or to your residence or to such other address as you may designate in writing. 3.6 Electronic Delivery; Online Portal. By accepting this Award, Grantee consents to receive the Plan, this Agreement, and any participant notices or communications by electronic delivery and to participate in the Plan through an on-line or electronic system established and maintained by the Company or Fidelity (or any successor administrator designated by the Company). Grantee acknowledges and consents to the use of the on-line or electronic system for all administrative purposes related to this Agreement. 3.7 Withholding. In accordance with Section 12.4 of the Plan, the Company shall require the satisfaction of tax obligations by net settlement through withholding from any payment

4 of Stock required to be made in settlement of the Award an amount sufficient to satisfy such federal, state, and local withholding tax requirements. The Company shall pay to the Grantee cash in lieu of any fractional share otherwise issuable to the Grantee because of such net settlement. 3.8 No Tax, Legal, or Financial Advice. The Company and its Affiliates are not providing any tax, legal or financial advice, nor are the Company and its Affiliates making any recommendations regarding your acquisition or sale of Stock. You acknowledge that you are subject to the restrictions on trading in shares of Stock, including, without limitation, the Shares underlying this Award, set forth in the applicable Corporate Policy and Practice Memorandum included with the materials relating to this Award or this Agreement. You should consult with your own personal tax, legal and financial advisors. You acknowledge that the ultimate liability for all taxes related to this Award is and remains your responsibility. Such tax liability may exceed any amount actually withheld by the Company, if any, pursuant to the terms of the Plan. 3.9 Limitation on Grantee’s Rights. Participation in the Plan confers no rights or interests other than as herein provided. This Agreement creates only a contractual obligation on the part of the Company as to amounts payable and may not be construed as creating a trust. Neither the Plan nor any underlying program, in and of itself, has any assets. Grantee will have only the rights of a general unsecured creditor of the Company with respect to amounts credited and benefits payable, if any, with respect to the PSUs and Dividend Equivalents, and rights no greater than the right to receive cash or the Shares as a general unsecured creditor with respect to the PSUs and Dividend Equivalents, as and when settled pursuant to the terms of this Agreement. 3.10 No Employment or Service Obligation. Nothing contained in this Agreement shall (i) confer upon Grantee any right with respect to continuation of employment or of a consulting or advisory relationship with the Company or any Affiliate or (ii) interfere in any way with the right of the Company or any Affiliate to terminate Grantee’s employment or consulting or advisory relationship at any time. 3.11 Adjustment. The number of PSUs subject to this Agreement are subject to adjustment as provided for in the Plan. 3.12 Successors. The terms of this Agreement shall be binding upon and inure to the benefit of the Company, its successors and assigns, and to you and your beneficiaries, executors, administrators, heirs, and successors. 3.13 Invalid Provision. The invalidity or unenforceability of any particular provision thereof shall not affect the other provisions hereof, and this Agreement shall be construed in all respects as if such invalid or unenforceable provision had been omitted. 3.14 Amendment. Grantee further acknowledges and agrees that this Agreement may not be modified, amended, or revised except as provided in the Plan. 3.15 Entire Agreement. This Agreement and the Plan contain the entire agreement and understanding of the parties hereto with respect to the subject matter contained herein and therein and supersede all prior communications, representations, and negotiations in respect thereto.

5 3.16 Clawback/Recovery. This Agreement and any payments hereunder are subject to recoupment in accordance with any clawback policy in effect from time to time that the Company is specifically required to adopt pursuant to the listing standards of any national securities exchange or association on which the Company’s securities are listed or as is otherwise specifically required by the Dodd-Frank Wall Street Reform and Consumer Protection Act or other applicable law. As of the Date of Grant, the Company’s clawback policy generally provides, in the event of an accounting restatement, the Company shall seek to recover, reasonably promptly, all erroneously awarded compensation from an executive officer (those associates who are members of the Old Republic International Corporation Office of the Chief Executive Officer) during the time period covered in accordance with the Section 303A.14 of The New York Stock Exchange Listed Company Manual and Section 10D and Rule 10D-1 of the Securities Exchange Act of 1934, as amended. Such determination of the amount of erroneously awarded compensation, in the case of an accounting restatement, will be made without regard to any individual knowledge or responsibility related to the accounting restatement or the erroneously awarded compensation. Notwithstanding the foregoing, if the Company is required to undertake an accounting restatement, the Company shall recover the erroneously awarded compensation unless the recovery is determined to be impracticable by the Compensation Committee in accordance with the clawback policy. The foregoing description is qualified by reference to the Company’s complete clawback policy, which policy is hereby incorporated herein by reference. The Company’s clawback policy may be amended or restated from time to time as required by the listing standards of any national securities exchange or association on which the Company’s securities are listed, as is otherwise specifically required by the Dodd-Frank Wall Street Reform and Consumer Protection Act or other applicable law, or as otherwise determined by the Committee. 3.17 Governing Law. The provisions of this Agreement shall be construed, administered, and governed under the laws of the state of Delaware and applicable federal law. Notwithstanding any other provision of this Agreement or the Plan, the Company shall have no liability to issue any shares under this Agreement or the Plan unless such issuance would comply with all applicable laws and the applicable requirements of any securities exchange or similar entity. 3.18 Headings. Headings of Articles and Sections are included for convenience of reference only and do not constitute part of this Agreement and shall not be used in construing the terms of this Agreement. 3.19 Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. 3.20 Section 409A. (a) It is intended that this Agreement will comply with Section 409A of the Internal Revenue Code of 1986, and the interpretive guidance thereunder (“Section 409A”), including, to the maximum extent applicable, the exceptions for (among others) short-term deferrals, certain stock rights, separation pay arrangements, and this Agreement shall be administered accordingly, and interpreted and construed on a basis consistent with such intent. To the extent that any provision of this Agreement would fail to comply with the applicable requirements of Section 409A, the Company may, in its sole and absolute discretion and without

6 requiring Grantee’s consent, make such modifications to this Agreement and/or payments to be made thereunder to the extent it determines necessary or advisable to comply with the requirements of Section 409A. Nothing in this Agreement shall be construed as a guarantee of any particular tax effect for the Award, and the Company does not guarantee that any compensation or benefits provided under this Agreement will satisfy the provisions of Section 409A. (b) Notwithstanding anything to the contrary in this Agreement, the Company may delay any payment under this Agreement that the Company reasonably determines would violate applicable law until the earliest date the Company determines the making of the payment will not cause such a violation (in accordance with Treasury Regulation Section 1.409A- 2(b)(7)(ii)) and further determines that the delay will not result in the imposition of excise taxes under Section 409A. (c) With respect to a Grantee who is Continued Vesting Eligible, the Settlement Date shall be treated as a fixed payment date under Treasury Regulation Section 1.409A-3(i)(1)(i). In all cases, the Settlement Date for a vested Award shall always occur in the calendar year immediately following the end of the Performance Period. [Signature Page Follows]

Signature Page to Performance-Based Restricted Stock Unit Award Agreement IN WITNESS WHEREOF, this Agreement has been executed and delivered by the parties hereto as of the [ ] day of [ ]. Company: Old Republic International Corporation Grantee: [ ] By: Signature Signature Title: Date: Date: Exhibit A: Performance Goals Exhibit B: 2022 Incentive Compensation Plan

A-1 EXHIBIT A PERFORMANCE GOALS For the Performance Period identified in Section 2.2 of the Award, the Award is subject to the following weighted selected Performance Criteria and Performance Goals (threshold, objective, and maximum): Selected Performance Criteria (Weight) Performance Goals Award Percentage 3-Year Average Operating ROE (50%) Less than Threshold N/A 0% Threshold [insert figure] 50% Objective [insert figure] 100% Maximum [insert figure] 200% 3-Year Book Value Per Share Annual Compound Total Return (including dividends) (50%) Less than Threshold N/A 0% Threshold [insert figure] 50% Objective [insert figure] 100% Maximum [insert figure] 200%

B-1 EXHIBIT B 2022 INCENTIVE COMPENSATION PLAN (attached)

[FORM OF] OLD REPUBLIC INTERNATIONAL CORPORATION STOCK OPTION AWARD AGREEMENT (2022 INCENTIVE COMPENSATION PLAN) THIS STOCK OPTION AWARD AGREEMENT, (this “Agreement”), dated as of [ ] (the “Date of Grant”), is made by and between Old Republic International Corporation, a Delaware corporation (the “Company”), and [ ] (the “Grantee” or “you” or “your”). WHEREAS, Grantee is employed by the Company or an Affiliate; WHEREAS, as a matter of separate inducement and agreement in connection with Grantee’s employment, and not in lieu of any salary or other compensation for Grantee’s services, the Company desires to enter into this Agreement with Grantee; and WHEREAS, the Company desires to grant to the Grantee, subject to the restrictions set forth herein and the Company’s 2022 Incentive Compensation Plan (the “Plan”), an option to purchase the number of shares of the Company’s Stock (this “Option”), as set forth below. NOW, THEREFORE, in consideration of the recitals and the mutual agreements herein contained, the parties hereto agree as follows: ARTICLE I GRANT OF OPTION As of the Date of Grant, the Company hereby grants to you the following Option, on the terms and conditions set forth in this Agreement: Number of Option Shares Awarded: ____________ Grant Price (Fair Market Value as of Date of Grant): $ _____ /Share Expiration Date (10th anniversary of Date of Grant): ____________ ARTICLE II TERMS AND CONDITIONS OF AWARD The grant of the Option provided in Article I shall be subject to the following terms, conditions, and restrictions: 2.1 Plan. This Award is issued under the Plan and is subject to the terms and conditions set forth in the Plan. In the event of a conflict between the terms of this Agreement and the Plan,

2 the terms of the Plan shall control. Any capitalized term used in this Agreement that is not defined herein shall have the meaning set forth in the Plan. You acknowledge receiving a copy of the Plan. 2.2 Vesting Schedule. The Options shall vest with respect to one-third of the shares on the first anniversary of the Date of Grant, two-thirds of the shares on the second anniversary of the Date of Grant and all of the shares on the third anniversary of the Date of Grant, subject to your continued employment or service through such date, except as otherwise provided in Section 2.4 below. The Plan contains additional terms regarding vesting that apply upon the consummation of a Change of Control that depend on whether this Award is assumed or not in the transaction. 2.3 Option Exercise. In general, you may exercise this Option, in whole or in part, with respect to the extent it is vested. Subject to Section 4.4 of the Plan, this Option is not transferrable by you other than by will or the laws of descent and distribution, and may be exercised only by you during your lifetime and while you remain an employee of or provide service to the Company and/or one of its Affiliates. Through the on-line or electronic system described at Section 3.6, you (or your representative, guardian, devisee or heir, as applicable) may exercise all or part of the vested portion of this Option in accordance with the terms hereof by giving notice of exercise to the Company and specifying the number of shares of Stock to be purchased. The Grant Price shall be paid through withholding by the Company of a portion of the shares to be acquired upon exercise of the Option with a value, determined on the date of exercise, equal to such Grant Price plus the amount required to be withheld by the Company for taxes, as provided in Section 3.7 below. 2.4 Forfeiture. In the event of the severance of your employment relationship between the Company and all Affiliates for any reason prior to vesting in accordance with Section 2.2, the unvested portion of the Option shall be automatically terminated unless such termination was due to: (i) your retirement due to Disability, (ii) your death, or (iii) the Company’s divestiture of the Affiliate that employs you as described in the Plan. In addition, if you are an employee of the Company and/or its Affiliates and you retire in good standing on or after attaining age 65 and with 10 years of service with the Company and/or its Affiliates, the Option will continue to vest for the remainder of the vesting period described in Section 2.2, subject to your ongoing compliance with any restrictive covenants contained in any agreement with, or any plan, policy, or program of, the Company and/or its Affiliates. In addition to the foregoing, the vested and unvested portion of the Option shall be automatically terminated as of the date of your severance from employment, except in the circumstances below in which the vested portion of the Option will remain exercisable for a period of time: (a) Upon your death, your executors, administrators, or any person or persons to whom the Option is transferred by will, by the laws of descent and distribution or by beneficiary designation shall have the right to exercise the Option, in whole or in part, prior to the earlier of (i) the Expiration Date or (ii) the fourth anniversary of the date of your death. (b) Upon your retirement due to Disability or retirement in good standing after attainment of a combination of age and years of service equal to 65, you shall have the right to exercise the Option, in whole or in part, prior to the earlier of (i) the Expiration Date or (ii) the

3 fourth anniversary of your retirement date. Any portion of the Option that is subject to your compliance with restrictive covenants, as described above, shall be exercisable only after it has become vested. If you subsequently die after retirement but prior to the expiration date in the prior sentence, the Option shall be fully vested and your executors, administrators, or any person or persons to whom the Option is transferred will have the same time period in which to exercise the Option, in whole or in part. (c) Upon your involuntary severance from employment without Cause, you shall have the right to exercise the vested portion of the Option, in whole or in part, prior to the earlier of (i) the Expiration Date or (ii) the fourth anniversary of the date of your involuntary severance from employment. (d) Provided you do not transfer employment to a retained Affiliate upon the divestment of the Affiliate that employs you as described in the Plan, you shall have the right to exercise the vested portion of the Option, in whole or in part, prior to the earlier of (i) the Expiration Date or (ii) the fourth anniversary of the date of the divestment. The Plan contains additional terms regarding exercisability that apply upon the consummation of a Change of Control that depend on whether this Award is assumed or not in the transaction. ARTICLE III MISCELLANEOUS 3.1 Rights as Shareholder. Unless and until any shares of Stock are issued upon exercise of the Award, the Award shall not confer to the Grantee any rights or status as a stockholder of the Company. 3.2 Limitations Applicable to Section 16 Persons. Notwithstanding any other provision of the Plan or this Agreement, if you are subject to Section 16 of the Exchange Act (those associates who are members of the Old Republic International Corporation Office of the Chief Executive Officer), the Plan, the Option, and this Agreement shall be subject to any additional limitations set forth in any applicable exemptive rule under Section 16 of the Exchange Act (including any amendment to Rule 16b-3 of the Exchange Act) that are requirements for the application of such exemptive rule. To the extent permitted by applicable law, this Agreement shall be deemed amended to the extent necessary to conform to such applicable exemptive rule. 3.3 Form 10K and 10Q. You acknowledge having received (or having accessed through the SEC’s EDGAR website) a copy of the Company’s most recent Form 10K and 10Q. 3.4 Receipt of Plan. Grantee acknowledges receipt of a copy of the Plan and represents that he or she is familiar with the terms and provisions thereof, and hereby accepts this Award subject to all of the terms and provisions of the Plan and this Agreement. By accepting this Award, Grantee acknowledges and agrees that Grantee has reviewed the Plan in its entirety and has had an opportunity to obtain the advice of counsel prior to executing this Agreement and accepting the Award. Grantee hereby agrees to accept as binding, conclusive and final all decisions or interpretations of the Board or the Committee upon any questions arising under the Plan or this Agreement.

4 3.5 Notices. Except as provided in Section 3.6, every notice or other communication related to this Agreement shall be given in writing and shall be delivered either personally or by registered or certified mail, postage prepaid, which shall be addressed, in the case of the Company to both the Chief Financial Officer and the General Counsel of the Company at the principal office of the Company and, in your case, to your address appearing on the books of the Company or to your residence or to such other address as you may designate in writing. 3.6 Electronic Delivery; Online Portal. By accepting this Award, Grantee consents to receive the Plan, this Agreement, and any participant notices or communications by electronic delivery and to participate in the Plan through an on-line or electronic system established and maintained by the Company or Fidelity (or any successor administrator designated by the Company). Grantee acknowledges and consents to the use of the on-line or electronic system for all administrative purposes related to this Agreement. 3.7 Withholding. The Company shall, on the date as of which the exercise of this Option becomes a taxable event for federal income tax purposes, withhold a portion of the shares otherwise deliverable upon exercise of the Option, as provided in Section 2.3 above, with a value equal to any federal, state, and local taxes required by law to be withheld on account of such taxable event in accordance with Section 12.4 of the Plan. 3.8 No Tax, Legal, or Financial Advice. The Company and its Affiliates are not providing any tax, legal or financial advice, nor are the Company and its Affiliates making any recommendations regarding your Option or the acquisition or sale of the underlying shares of Stock. You acknowledge that you are subject to the restrictions on trading in shares of Stock, including, without limitation, the Shares underlying this Award, set forth in the applicable Corporate Policy and Practice Memorandum included with the materials relating to this Award or this Agreement. You should consult with your own personal tax, legal and financial advisors. You acknowledge that the ultimate liability for all taxes related to this Award is and remains your responsibility. Such tax liability may exceed any amount actually withheld by the Company, if any, pursuant to the terms of the Plan. 3.9 No Employment or Service Obligation. Nothing contained in this Agreement shall (i) confer upon Grantee any right with respect to continuation of employment or of a consulting or advisory relationship with the Company or any Affiliate or (ii) interfere in any way with the right of the Company or any Affiliate to terminate Grantee’s employment or consulting or advisory relationship at any time. 3.10 Adjustment. The number of shares of Stock subject to this Agreement and the Grant Price per Share are subject to adjustment as provided for in the Plan. In no event may this Option be exercised for a fraction of a share of Stock. 3.11 Successors. The terms of this Agreement shall be binding upon and inure to the benefit of the Company, its successors and assigns, and to you and your beneficiaries, executors, administrators, heirs, and successors.

5 3.12 Invalid Provision. The invalidity or unenforceability of any particular provision thereof shall not affect the other provisions hereof, and this Agreement shall be construed in all respects as if such invalid or unenforceable provision had been omitted. 3.13 Amendment. Grantee further acknowledges and agrees that this Agreement may not be modified, amended, or revised except as provided in the Plan. 3.14 Entire Agreement. This Agreement and the Plan contain the entire agreement and understanding of the parties hereto with respect to the subject matter contained herein and therein and supersede all prior communications, representations, and negotiations in respect thereto. 3.15 Clawback/Recovery. This Agreement and any payments hereunder are subject to recoupment in accordance with any clawback policy in effect from time to time that the Company is specifically required to adopt pursuant to the listing standards of any national securities exchange or association on which the Company’s securities are listed or as is otherwise specifically required by the Dodd-Frank Wall Street Reform and Consumer Protection Act or other applicable law. As of the Date of Grant, the Company’s clawback policy generally provides, in the event of an accounting restatement, the Company shall seek to recover, reasonably promptly, all erroneously awarded compensation from an executive officer (those associates who are members of the Old Republic International Corporation Office of the Chief Executive Officer) during the time period covered in accordance with the Section 303A.14 of The New York Stock Exchange Listed Company Manual and Section 10D and Rule 10D-1 of the Securities Exchange Act of 1934, as amended. Such determination of the amount of erroneously awarded compensation, in the case of an accounting restatement, will be made without regard to any individual knowledge or responsibility related to the accounting restatement or the erroneously awarded compensation. Notwithstanding the foregoing, if the Company is required to undertake an accounting restatement, the Company shall recover the erroneously awarded compensation unless the recovery is determined to be impracticable by the Compensation Committee in accordance with the clawback policy. The foregoing description is qualified by reference to the Company’s complete clawback policy, which policy is hereby incorporated herein by reference. The Company’s clawback policy may be amended or restated from time to time as required by the listing standards of any national securities exchange or association on which the Company’s securities are listed, as is otherwise specifically required by the Dodd-Frank Wall Street Reform and Consumer Protection Act or other applicable law, or as otherwise determined by the Committee. 3.16 Governing Law. The provisions of this Agreement shall be construed, administered, and governed under the laws of the state of Delaware and applicable federal law. Notwithstanding any other provision of this Agreement or the Plan, the Company shall have no liability to issue any shares under this Agreement or the Plan unless such issuance would comply with all applicable laws and the applicable requirements of any securities exchange or similar entity. 3.17 Headings. Headings of Articles and Sections are included for convenience of reference only and do not constitute part of this Agreement and shall not be used in construing the terms of this Agreement.

6 3.18 Counterparts. This Agreement may be executed in counterparts, each of which shall be deemed an original, but all of which together shall constitute one and the same instrument. [Signature Page Follows]

Signature Page to Stock Option Award Agreement IN WITNESS WHEREOF, this Agreement has been executed and delivered by the parties hereto as of the [ ] day of [ ]. Company: Old Republic International Corporation Grantee: [ ] By: Signature Signature Title: Date: Date: Attachment I: 2022 Incentive Compensation Plan

Attachment I 2022 INCENTIVE COMPENSATION PLAN (attached)

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

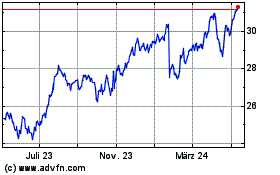

Old Republic (NYSE:ORI)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Old Republic (NYSE:ORI)

Historical Stock Chart

Von Apr 2023 bis Apr 2024