NEW YORK COMMUNITY BANCORP INC false 0000910073 0000910073 2024-03-06 2024-03-06 0000910073 us-gaap:CommonStockMember 2024-03-06 2024-03-06 0000910073 nycb:BifurcatedOptionNotesUnitSecuritiesMember 2024-03-06 2024-03-06 0000910073 nycb:FixedToFloatingRateSeriesANoncumulativePerpetualPreferredStockMember 2024-03-06 2024-03-06

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D. C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): March 6, 2024

NEW YORK COMMUNITY BANCORP, INC.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

1-31565 |

|

06-1377322 |

(State or other jurisdiction

of incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

|

|

| 102 Duffy Avenue, Hicksville, New York |

|

11801 |

| (Address of principal executive offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: (516) 683-4100

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

| Title of each class |

|

Trading

Symbol |

|

Name of each exchange

on which registered |

| Common Stock, par value $0.01 per share |

|

NYCB |

|

New York Stock Exchange |

| Bifurcated Option Note Unit Securities SM |

|

NYCB PU |

|

New York Stock Exchange |

| Fixed-to-Floating Rate Series A Noncumulative Perpetual Preferred Stock, $0.01 par value |

|

NYCB PA |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 7.01. Regulation FD Disclosure.

On March 6, 2024, New York Community Bancorp, Inc., a Delaware corporation (“NYCB” or the “Company”) entered into separate investment agreements with affiliates of funds managed by Liberty 77 Capital, L.P. (“Liberty”) and certain other investors (together with Liberty, the “Investors”) in order to facilitate the sale and issuance to the Investors shares of (i) common stock, par value $0.01 per share, of the Company (the “Common Stock”), (ii) a new series of preferred stock, par value $0.01 per share, of the Company designated as Series B Non-Cumulative Convertible Preferred Stock and (iii) a new series of preferred stock, par value $0.01 per share, of the Company designated as Series C Non-Cumulative Convertible Preferred Stock (together with the Series B Non-Cumulative Convertible Preferred Stock, the “Preferred Stock”) at a price per share of $2.00 and for an aggregate investment amount of $1.05 billion. In addition, investors will receive 60% warrant coverage to purchase non-voting, Common Stock-equivalent stock with an exercise price of $2.50 per share (the “Warrants”) a 25% premium to the price paid on Common Stock (the issuance of Common Stock, Preferred Stock and Warrants the “Transactions”).

On March 7, 2024, NYCB released a presentation to investors about the proposed Transactions. The presentation is attached to this Current Report on Form 8-K as Exhibit 99.1 and is incorporated herein by reference.

The preceding information, as well as Exhibit 99.1 referenced therein, shall not be deemed “filed” for purposes of Section 18 of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that Section, or incorporated by reference into any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 8.01. Other Events.

On March 6, 2024, NYCB issued a press release announcing and describing the Transactions (the “Announcement Press Release”). Also on March 6, 2024, NYCB issued a second press release following the execution of definitive deal documentation (the “Signing Press Release”).

A copy of the Announcement Press Release is attached hereto as Exhibit 99.2 and incorporated herein by reference. A copy of the Signing Press Release is also attached hereto as Exhibit 99.3 and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

Cautionary Note Regarding Forward-Looking Statements

The foregoing disclosures may include forward-looking statements within the meaning of the federal securities laws by the Company pertaining to such matters as our goals, intentions, and expectations regarding revenues, earnings, loan production, asset quality, capital levels, and acquisitions, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of probable losses on loans; our assessments of interest rate and other market risks; and our ability to achieve our financial and other strategic goals, including those related to our merger with Flagstar Bancorp, Inc., which was completed on December 1, 2022, the purchase and assumption of certain assets and liabilities of Signature Bridge Bank beginning March 20, 2023 (the “Signature Transaction”), and our transition to a $100 billion plus bank.

Forward-looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “should,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time. Additionally, forward-looking statements speak only as of the date they are made; the Company does not assume any duty, and does not undertake, to update our forward-looking statements. Furthermore, because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in our statements, and our future performance could differ materially from our historical results.

Our forward-looking statements are subject to the following principal risks and uncertainties: general economic conditions and trends, either nationally or locally; conditions in the securities markets; changes in interest rates; changes in deposit flows, and in the demand for deposit, loan, and investment products and other financial services; changes in real estate values; changes in the quality or composition of our loan or investment portfolios; changes in future allowance for credit losses requirements under relevant accounting and regulatory requirements; the ability to pay future dividends at currently expected rates; changes in our capital management and balance sheet strategies and our ability to successfully implement such strategies; changes in competitive pressures among financial institutions or from non-financial institutions; changes in legislation, regulations, and policies; the success of our blockchain and fintech activities, investments and strategic partnerships; the restructuring of our mortgage business; the impact of failures or disruptions in or breaches of the Company’s operational or security systems, data or infrastructure, or those of third parties, including as a result of cyberattacks or campaigns; the impact of natural disasters, extreme weather events, military conflict (including the Russia/Ukraine conflict, the conflict in Israel and surrounding areas, the possible expansion of such conflicts and potential geopolitical consequences), terrorism or other geopolitical events; and a variety of other matters which, by their nature, are subject to significant uncertainties and/or are beyond our control. Our forward-looking statements are also subject to the following principal risks and uncertainties with respect to our merger with Flagstar Bancorp, which was completed on December 1, 2022, and the Signature Transaction; the possibility that the anticipated benefits of the transactions will not be realized when expected or at all; the possibility of increased legal and compliance costs, including with respect to any litigation or regulatory actions related to the business practices of acquired companies or the combined business; diversion of management’s attention from ongoing business operations and opportunities; the possibility that the Company may be unable to achieve expected synergies and operating efficiencies in or as a result of the transactions within the expected timeframes or at all; and revenues following the transactions may be lower than expected. Additionally, there can be no assurance that the Community Benefits Agreement entered into with NCRC, which was contingent upon the closing of the Company’s merger with Flagstar Bancorp, Inc., will achieve the results or outcome originally expected or anticipated by us as a result of changes to our business strategy, performance of the U.S. economy, or changes to the laws and regulations affecting us, our customers, communities we serve, and the U.S. economy (including, but not limited to, tax laws and regulations).

More information regarding some of these factors is provided in the Risk Factors section of our Annual Report on Form 10-K for the year ended December 31, 2022, Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023, and September 30, 2023 and in other SEC reports we file. Our forward-looking statements may also be subject to other risks and uncertainties, including those we may discuss in this Amendment, during investor presentations, or in our other SEC filings, which are accessible on our website and at the SEC’s website, www.sec.gov.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

|

|

NEW YORK COMMUNITY BANCORP, INC. |

|

|

|

|

| Date: March 7, 2024 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Salvatore J. DiMartino |

|

|

|

|

|

|

Salvatore J. DiMartino |

|

|

|

|

|

|

Executive Vice President and Director of Investor Relations |

Exhibit 99.1 Investor Presentation March 7, 2024

Cautionary Statements Forward-Looking Information This presentation may

include forward-looking statements by the Company and our authorized officers pertaining to such matters as our goals, intentions, and expectations regarding the timeframe in which the Company expects to file its 2023 Form 10-K and the contents

thereof; revenues, earnings, loan production, asset quality, capital levels, and acquisitions, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of probable losses on loans; our assessments

of interest rate and other market risks; and our ability to achieve our financial and other strategic goals, including those related to our merger with Flagstar Bancorp, Inc., which was completed on December 1, 2022, and our recent acquisition of

substantial portions of the former Signature Bank through an FDIC-assisted transaction. Forward-looking statements are typically identified by such words as “believe,” “expect,” “anticipate,” “intend,”

“outlook,” “estimate,” “forecast,” “project,” “should,” and other similar words and expressions, and are subject to numerous assumptions, risks, and uncertainties, which change over time.

Additionally, forward-looking statements speak only as of the date they are made; the Company does not assume any duty, and does not undertake, to update our forward-looking statements. Furthermore, because forward-looking statements are subject to

assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in our statements, and our future performance could differ materially from our historical results. Our forward-looking

statements are subject to the following principal risks and uncertainties: general economic conditions and trends, either nationally or locally; conditions in the securities markets; changes in interest rates; changes in deposit flows, and in the

demand for deposit, loan, and investment products and other financial services; changes in real estate values; changes in the quality or composition of our loan or investment portfolios; changes in competitive pressures among financial institutions

or from non-financial institutions; changes in legislation, regulations, and policies; the success of our blockchain and fintech activities, investments and strategic partnerships; the restructuring of our mortgage business; the impact of failures

or disruptions in or breaches of the Company’s operational or security systems, data or infrastructure, or those of third parties, including as a result of cyberattacks or campaigns; the impact of natural disasters, extreme weather events,

military conflict (including the Russia/Ukraine conflict, the conflict in Israel and surrounding areas, the possible expansion of such conflicts and potential geopolitical consequences), terrorism or other geopolitical events; and a variety of other

matters which, by their nature, are subject to significant uncertainties and/or are beyond our control. Our forward-looking statements are also subject to the following principal risks and uncertainties with respect to our merger with Flagstar

Bancorp, which was completed on December 1, 2022, and our recent acquisition of substantial portions of the former Signature Bank through an FDIC-assisted transaction: the possibility that the anticipated benefits of the transactions will not be

realized when expected or at all; the possibility of increased legal and compliance costs, including with respect to any litigation or regulatory actions related to the business practices of acquired companies or the combined business; diversion of

management’s attention from ongoing business operations and opportunities; the possibility that the Company may be unable to achieve expected synergies and operating efficiencies in or as a result of the transactions within the expected

timeframes or at all; and revenues following the transactions may be lower than expected. Additionally, there can be no assurance that the Community Benefits Agreement entered into with NCRC, which was contingent upon the closing of the

Company’s merger with Flagstar Bancorp, Inc., will achieve the results or outcome originally expected or anticipated by us as a result of changes to our business strategy, performance of the U.S. economy, or changes to the laws and regulations

affecting us, our customers, communities we serve, and the U.S. economy (including, but not limited to, tax laws and regulations). . More information regarding some of these factors is provided in the Risk Factors section of our Annual Report on

Form 10-K for the year ended December 31, 2022, Quarterly Report on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023, and in other SEC reports we file. Our forward-looking statements may also be subject to other risks and

uncertainties, including those we may discuss in this news release, on our conference call, during investor presentations, or in our SEC filings, which are accessible on our website and at the SEC’s website, www.sec.gov. Our Supplemental Use

of Non-GAAP Financial Measures This presentation may contain certain non-GAAP financial measures which management believes to be useful to investors in understanding the Company’s performance and financial condition, and in comparing our

performance and financial condition with those of other banks. Such non-GAAP financial measures are supplemental to, and are not to be considered in isolation or as a substitute for, measures calculated in accordance with GAAP. 1

Key Messages NYCB Announces Over $1 Billion Equity Investment Anchored

by Former U.S. Treasury Secretary 1 Steven Mnuchin’s Liberty Strategic Capital, Hudson Bay Capital and Reverence Capital Former Secretary Steven Mnuchin, Joseph Otting, Milton Berlinski and Allen Puwalski to Join 2 NYCB Board of Directors 3

Joseph Otting to Become CEO and Alessandro DiNello to be Named as Non-Executive Chairman Reconstituted Board and Management Team Positioned to Deliver Well Capitalized $100+ Billion 4 National Bank with a Diversified, De-Risked Business Model The

Strategic Investment Reinforces Our Strong Liquidity, Which is Also Supplemented by a 5 Diversified and Retail Focused Deposit Base 2

Transaction Summary Issuer New York Community Bancorp, Inc. Deal Size

$1.05 Billion Common Issue Price $2.00 per share Strike Price Premium: 25% Warrants Coverage: 60% Term: 7 years Common Stock: 59,750,000 common shares (1) Securities Issued Series B Convertible Non-Voting Preferred Stock: 192,062 preferred shares

(1) Series C Convertible Non-Voting Preferred Stock: 273,188 preferred shares Pro Forma Tangible Book $6.65 Value per Share $450 Million from Liberty Strategic Capital, $250 Million from Hudson Bay Capital, Lead Investors $200 Million from Reverence

Capital 2 Board members from Liberty Strategic Capital; 1 Board member from Reverence Governance Capital; 1 Board member at the recommendation of Hudson Bay Capital; the Board will be reduced to 9 members Regulatory Approval No regulatory approvals

required for closing (Expected to close on 3/11/2024) Common Dividends Reduced to $0.01 per share per quarter Exclusive Financial Advisor Jefferies LLC and Sole Placement Agent Note 1: 1 preferred share – 1,000 common shares basis.

3

NYCB Flagstar Today Key Franchise Summary Stats Branch Map (1) ◼

We are a Top 20 bank in the U.S. with a focus on commercial banking and a private banking network ◼ Assets: $114 Billion MI NY CT WI ◼ Branches: 420 ◼ Headquarters: Hicksville, NY NV NJ OH IN CA AZ NC Community Banking ◼

Flagstar Bank, N.A. is a leading national bank with a balanced, diversified lending platform Private Bank Offices FL Branches Private Banking (3) Deposit and Loan Snapshot (Q4’23) ◼ 134 private client banking teams with offices in 10

cities AD&C Other - 93 in the Northeast and 41 on the West Coast 3% 3% ◼ High touch single-point-of-contact model IB CRE Non-Int. Checking 12% Bearing 22% 25% Mortgage Origination and Servicing Warehouse Multi-family 6% 44% th ◼ 7

largest bank originator of residential mortgages MMA (2) ($15.1 Billion in FY 2023) 16% C&I th CDs ◼ 5 largest sub-servicer of mortgage loans nationwide, 24% 26% 1-4 servicing 1.4 Million loans as of December 31, 2023 Savings Family 11% nd

◼ 2 largest mortgage warehouse lender nationally 7% based on total commitments (4) Total Deposits: $77.2 Billion Total Loans HFI: $84.6 Billion Note 1: Includes depository institutions with a U.S. parent. Note 2: Includes historical Flagstar

originations prior to the business combination. Note 3: Deposit and loan composition data as of 12/31/2023. Note 4: Deposit balance as of 3/5/2024. 4

Loan Portfolio Overview Loan Composition (Q4’23) Key Loan

Highlights Other ◼ C&I is well diversified, includes Equipment Finance, Dealer Finance, AD&C 3% Warehouse, and others, with a minimal loss history 3% ◼ Multi-family loan portfolio primarily non-luxury, rent-regulated buildings in

New York City, with ~37% maturing / repricing in next 3 CRE years 12% ◼ CRE includes diversified property types including Retail, Industrial, Hotel, Self Storage, Student Housing, and others, which are primarily Warehouse income producing

Multi-family 6% 44% ◼ Proactive and enhanced monitoring of office portfolio, with improved ACL ratio of 8.1% ◼ Homebuilder Finance is a national lending platform with good C&I spreads (300-375bps); have relationships with ~70 of top

100 24% builders nationwide and no nonperforming or criticized loans 1-4 ◼ Warehouse lending is national platform with low credit risk; zero net Family 7% charge-offs for the past 9 years prior to the acquisition ◼ Average Q4’23

yield on loans HFI: 5.72% Total Loans HFI: $84.6 Billion ◼ Since 1993 losses have aggregated 23bps on Multi-family and 33bps (1) on CRE Note 1: Of aggregate originations. 5

Diversified and Retail-Concentrated Deposit Base with Significant

Insured Deposits (1) (2) Well Diversified Deposit Base 80% Insured and Collateralized Deposits Premier Banking; 4% Uninsured Online Banking; 7% 20% Custodial; 9% Priv. Client Comm. Banking; 1% Group 28% Other; 1% Retail Wholesale; 16% Banking 34%

Insured and Collateralized 80% (2) (2) Deposit Stability Ample Liquidity ◼ Total deposits of $77.2 Billion ◼ Total liquidity of $31.6 Billion which exceeds uninsured deposits, with (3) ◼ Total retail deposits have increased

compared to year-end 2023 a coverage ratio of 207% ◼ Total uninsured deposits, excluding collateralized and internal ◼ Cash held on balance sheet of $14.4 Billion accounts, are $15.3 Billion ◼ Increased our reciprocal deposit

capacity to approximately $18 Billion - We continue to have the ability to offer the reciprocal deposit ◼ Unencumbered securities of $3.0 Billion lendable value product to our customers ◼ Greater than 90% of the balances in our top 20

deposit relationships ◼ Fully collateralized credit facility with available capacity from the are fully insured or collateralized Federal Reserve Bank of New York and excess lendable value of ◼ We continue to have the ability to hold

custodial deposits, which collateral at the Federal Home Loan Bank of New York totaling $12.2 approximate $9.7 Billion, an increase from year-end 2023 Billion Note 1: Composition data as of 12/31/2023. Note 2: As of 3/5/2024. Note 3: Represents

total liquidity divided by uninsured deposits less collateralized and internal accounts. 6

Capital Ratio Implications of a $1.05 Billion Equity Raise + ACL

Sensitivities Current Capital Ratios + $1.05 Billion Equity Raise $500 Million ACL Increase; Total ACL 1.76% Capital Ratios Current (Q4'23) PF for Equity Raise PF for Equity Raise + ACL Increase 9.8% CET1 Capital Ratio 9.1% 10.3% 10.4% Tier 1

Capital Ratio 9.6% 10.8% Total Capital Ratio 11.8% 13.0% 12.7% 8.3% Leverage Ratio 7.8% 8.6% 6.9% TCE/TA 6.4% 7.3% Current Capital Ratios + $1.05 Billion Equity Raise $750 Million ACL Increase; Total ACL 2.06% Capital Ratios Current (Q4'23) PF for

Equity Raise PF for Equity Raise + ACL Increase 9.6% CET1 Capital Ratio 9.1% 10.3% 10.2% Tier 1 Capital Ratio 9.6% 10.8% 12.5% Total Capital Ratio 11.8% 13.0% Leverage Ratio 7.8% 8.6% 8.2% 6.8% TCE/TA 6.4% 7.3% Note: The capital raise takes the form

of noncumulative perpetual preferred securities to be converted or exchanged into common stock upon the receipt of certain governmental and shareholder approvals. Prior to their conversion or exchange into common stock, the noncumulative perpetual

preferred securities will be considered additional Tier 1 capital for regulatory purposes. Upon their conversion or exchange into common, the capital will be considered common equity Tier 1 capital. Data shown on this slide assumes a full conversion

of the convertible preferred securities. Note: Assumes equity raised at Common Issue Price: $2.00 + Warrants. 7

Where We Are Going | 2024 Strategic Initiatives Continue to Build

Capital Position 1 Proactive Management of Liquidity Profile 2 Enhance Focus on Credit Risk Management 3 Continue to Reduce CRE Concentrations 4 Build Upon Regulatory and Compliance Focus 5 Continue to Strengthen Management Team 6 These Strategic

Initiatives Are Expected to Support Long Term Profitability 8

Exhibit 99.2

102 Duffy Avenue, Hicksville, NY 11801 • Phone: (516) 683-4420

• flagstar.com

|

|

|

|

|

| NEWS RELEASE FOR IMMEDIATE

RELEASE |

|

|

|

Investor Contact:

Salvatore J. DiMartino (516)

683-4286 Media Contact:

Steven Bodakowski

(248) 312-5872 |

NEW YORK COMMUNITY BANCORP, INC.

ANNOUNCES OVER $1 BILLION EQUITY INVESTMENT ANCHORED BY FORMER U.S. TREASURY SECRETARY STEVEN MNUCHIN’S LIBERTY STRATEGIC CAPITAL, HUDSON BAY AND REVERENCE CAPITAL

Former Secretary Steven Mnuchin, Joseph Otting, Allen Puwalski and Milton Berlinski to Join NYCB Board of Directors

Joseph Otting to Become CEO and Alessandro DiNello to be Named as Non-Executive Chairman

Investment is Strong Endorsement of New Management Team; Creates Strong Balance Sheet

Reconstituted Board and Management Team Positioned to Deliver Well Capitalized $100+ Billion National Bank with a

Diversified, De-Risked Business Model

HICKSVILLE, N.Y., March 6, 2024 – New York Community

Bancorp, Inc. (NYSE: NYCB) (“NYCB” or the “Company”) today announced that Liberty Strategic Capital (“Liberty”), Hudson Bay Capital (“Hudson Bay”), Reverence Capital Partners (“Reverence Capital”),

Citadel Global Equities (“Citadel”), other institutional investors and certain members of the Company’s management (collectively, the “Investors”) will make a combined over $1 billion investment in the Company, subject

to finalization of definitive documentation and receipt of applicable regulatory approvals. Liberty is expected to invest $450 million, Hudson Bay will invest $250 million, and Reverence will invest $200 million as part of the

transaction.

In connection with the transaction, the Company will add four new directors to its Board, including Steven

Mnuchin, the 77th Secretary of the Treasury, Joseph Otting, former Comptroller of the Currency, Allen Puwalski from Hudson Bay, and Milton Berlinski, Managing Partner of Reverence Capital.

In addition, Mr. Otting will become Chief Executive Officer and Mr. DiNello will be named as Non-Executive

Chairman, providing his strong banking knowledge in support of Mr. Otting and the Board. Mr. Otting served as the 31st Comptroller of the Currency and has had a long, distinguished

career in banking including, having served as CEO of One West Bank from 2010 to 2015 and as Acting Director of the Federal Housing Finance Agency in 2018.

Secretary Steven Mnuchin stated, “In evaluating this investment, we were mindful of the Bank’s credit risk profile. With the over $1 billion of

capital invested in the Bank, we believe we now have sufficient capital should reserves need to be increased in the future to be consistent with or above the coverage ratio of NYCB’s large bank peers.”

Non-Executive Chairman Sandro DiNello stated, “We welcome the approach that Liberty and its partners took in its

evaluation of the Bank and look forward to incorporating their insights going forward. The strategic investment involving former Secretary Steven Mnuchin, former Comptroller Joseph Otting and Milton Berlinski, along with the other institutional

investors is a positive endorsement of the turnaround that is underway and allows us to execute on our strategy from a position of strength. We enter this next chapter with a strong balance sheet and liquidity position supported by a diversified and

retail focused deposit base. Our new leadership team, with the support of the reconstituted Board, will continue to take the actions that are necessary to improve earnings, profitability and drive enhanced value for shareholders.”

Secretary Mnuchin stated, “We decided to make this investment because we believe Sandro, alongside new management, has taken the appropriate actions to

stabilize the Company and to position NYCB to become a best-in-class $100+ billion national bank with a diversified and de-risked

business model that supports long term profitability. We are delighted that former Comptroller Otting will be NYCB’s new CEO and believe that the actions taken by NYCB establish a strong foundation for future growth through our new relationship

with other new Board members and investors. We are confident that NYCB is poised to generate sustainable shareholder value.”

Mr. Berlinski

added, “We are excited to be investing behind this management team with such a strong investor group and believe NYCB has a great opportunity to reposition the company and return to growth. NYCB franchise is well positioned for continued

success with the addition of former Comptroller Otting.”

As part of the reconstitution, the Board will be reduced to nine members and will include

Secretary Mnuchin, Mr. Otting, Mr. Puwalski, Mr. Berlinski, Mr. DiNello, Marshall Lux, Peter Schoels, Jennifer Whip and David Treadwell.

Transaction Details

In connection with the equity capital raise transaction, NYCB will sell and issue, in the aggregate, to the Investors shares of common stock of the Company at

a price per share of $2.00 and a series of convertible preferred stock with a conversion price of $2.00, for an aggregate investment amount of $1.05 billion. In addition, investors will receive 60% warrant coverage to purchase non-voting, common-equivalent stock with an exercise price of $2.50 per share, a 25% premium to the price paid on common stock.

Holders of the preferred stock will not have voting rights and will be entitled to quarterly non-cumulative cash

dividends, as and if declared by the Board. Each share of preferred stock is convertible into common stock on a 1 preferred share – 1,000 common shares basis. Series B preferred stock will automatically convert upon certain transfers permitted

by federal banking regulations and stockholder approval of a charter amendment to increase the Company’s authorized common stock, while Series C preferred stock will automatically convert upon the achievement of certain trigger events related

to receipt of antitrust clearance under the Hart-Scott-Rodino Act and the charter amendment. The Company will provide customary shelf and piggyback registration rights to each of the Investors. Additionally, Liberty will also have the ability to

request an underwritten shelf take-down and block trade rights.

Timing and Approvals

The transaction is expected to close on or around Monday, March 11, 2024, subject to the satisfaction of certain closing conditions, receipt of any

regulatory approvals required in connection with the new roles of Mr. Otting and Mr. DiNello, and the filing of a supplemental listing application required to authorize for listing on the New York Stock Exchange the shares of common stock

issued under each investment agreement and to be issued upon the conversion of shares of the preferred stock issued under the investment agreements.

Advisors

Jefferies LLC is acting as exclusive

financial advisor and sole placement agent to NYCB. Skadden, Arps, Slate, Meagher & Flom LLP is serving as legal counsel to NYCB. Sullivan & Cromwell LLP is serving as legal counsel to Liberty Strategic Capital.

About New York Community Bancorp, Inc.

New York

Community Bancorp, Inc. is the parent company of Flagstar Bank, N.A., one of the largest regional banks in the country. The Company is headquartered in Hicksville, New York. At December 31, 2023, the Company had $113.9 billion of assets,

$85.8 billion of loans, deposits of $81.4 billion, and total stockholders’ equity of $8.4 billion.

Flagstar Bank, N.A. operates 420 branches, including strong footholds in the Northeast and Midwest and

exposure to high growth markets in the Southeast and West Coast. Flagstar Mortgage operates nationally through a wholesale network of approximately 3,000 third-party mortgage originators. In addition, the Bank has 134 private banking teams located

in over ten cities in the metropolitan New York City region and on the West Coast, which serve the needs of high-net worth individuals and their businesses.

New York Community Bancorp, Inc. has market-leading positions in several national businesses, including multi-family lending, mortgage origination and

servicing, and warehouse lending. Flagstar Mortgage is the seventh largest bank originator of residential mortgages for the 12-months ending December 31, 2023, while we are the industry’s fifth

largest sub-servicer of mortgage loans nationwide, servicing 1.4 million accounts with $382 billion in unpaid principal balances. Additionally, the Company is the second largest mortgage warehouse

lender nationally based on total commitments.

About Liberty Strategic Capital

Liberty Strategic Capital is a Washington, D.C.-based private equity firm focused on strategic investments in technology, financial services and fintech, and

new forms of content. The firm was founded in 2021 and is led by Steven T. Mnuchin, the 77th Secretary of the Treasury. Our leadership team combines decades of public service and private sector experience, creating unique insight into the

intersection of capital, technology, and government regulation.

About Hudson Bay

Hudson Bay Capital is a multi-billion-dollar global investment management firm operating in Greenwich, New York, Miami, Boston, London and Dubai. Hudson Bay

Capital’s team seeks to achieve outstanding performance by uncovering market inefficiencies and undervalued investment opportunities that are uncorrelated to each other and to market indices while maintaining a focus on risk management and

capital preservation. The firm’s scalable, repeatable investment process has generated consistent, risk-adjusted returns through varying market conditions. Hudson Bay Capital has been managing assets on behalf of pension plans, sovereign wealth

funds, endowments, foundations, high net worth individuals and families since 2006.

About Reverence Capital

Reverence Capital Partners is a private investment firm focused on three complementary strategies: (i) Financial Services-Focused Private Equity,

(ii) Opportunistic, Structured Credit, and (iii) Real Estate Solutions. Today, Reverence manages in excess of $8 billion in AUM. Reverence focuses on thematic investing in leading global Financial Services businesses. The firm was

founded in 2013, by Milton Berlinski, Peter Aberg and Alex Chulack, after distinguished careers advising and investing in a broad array of financial services businesses. The Partners collectively bring over 100 years of advisory and investing

experience across a wide range of Financial Services sectors.

Forward Looking Statements

This press release may include forward-looking statements by the Company pertaining to such matters as our goals, intentions, and expectations regarding

revenues, earnings, loan production, asset quality, capital levels, and acquisitions, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of probable losses on loans; our assessments of

interest rate and other market risks; and our ability to achieve our financial and other strategic goals, including those related to our merger with Flagstar Bancorp, Inc., which was completed on December 1, 2022, the Signature Transaction, and

our transition to a $100 billion plus bank.

Forward-looking statements are typically identified by such words as “believe,”

“expect,” “anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “should,” and other similar words and expressions, and are subject to numerous

assumptions, risks, and uncertainties, which change overtime. Additionally, forward-looking statements speak only as of the date they are made; the Company does not assume any duty, and does not undertake, to update our forward-looking statements.

Furthermore, because forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in our statements, and our future performance could differ

materially from our historical results.

Our forward-looking statements are subject to the following principal risks and uncertainties: general economic

conditions and trends, either nationally or locally; conditions in the securities markets; changes in interest rates; changes in deposit flows, and in the demand for deposit, loan, and investment products and other financial services; changes in

real estate values; changes in the quality or composition of our loan or investment portfolios; changes in future allowance for credit losses requirements under relevant accounting and regulatory requirements; the ability to pay future dividends at

currently expected rates; changes in our capital management and balance sheet strategies and our ability to successfully implement such strategies; changes in competitive pressures among financial institutions or from

non-financial institutions; changes in legislation, regulations, and policies; the success of our blockchain and fintech activities, investments and strategic partnerships; the restructuring of our mortgage

business; the impact of failures or disruptions in or breaches of the Company’s operational or security systems, data or infrastructure, or those of third parties, including as a result of cyberattacks or campaigns; the impact of natural

disasters, extreme weather events, military conflict (including the Russia/Ukraine conflict, the conflict in Israel and surrounding areas, the possible expansion of such conflicts and potential geopolitical consequences), terrorism or other

geopolitical events; and a variety of other matters which, by their nature, are subject to significant uncertainties and/or are beyond our control. Our forward-looking statements are also subject to the following principal risks and uncertainties

with respect to our merger with Flagstar Bancorp, which was completed on December 1, 2022, and the

|

|

|

|

|

|

|

Signature Transaction; the possibility that the anticipated benefits of the transactions will not be realized

when expected or at all; the possibility of increased legal and compliance costs, including with respect to any litigation or regulatory actions related to the business practices of acquired companies or the combined business; diversion of

management’s attention from ongoing business operations and opportunities; the possibility that the Company may be unable to achieve expected synergies and operating efficiencies in or as a result of the transactions within the expected

timeframes or at all; and revenues following the transactions may be lower than expected. Additionally, there can be no assurance that the Community Benefits Agreement entered into with NCRC, which was contingent upon the closing of the

Company’s merger with Flagstar Bancorp, Inc., will achieve the results or outcome originally expected or anticipated by us as a result of changes to our business strategy, performance of the U.S. economy, or changes to the laws and regulations

affecting us, our customers, communities we serve, and the U.S. economy (including, but not limited to, tax laws and regulations).

More information

regarding some of these factors is provided in the Risk Factors section of our Annual Report on Form 10-K for the year ended December 31, 2022, Quarterly Reports on Form

10-Q for the quarters ended March 31, 2023, June 30, 2023, and September 30, 2023 and in other SEC reports we file. Our forward-looking statements may also be subject to other risks and

uncertainties, including those we may discuss in this Amendment, during investor presentations, or in our other SEC filings, which are accessible on our website and at the SEC’s website, www.sec.gov.

Important Information and Where You Can Find It

This press release may be deemed to be solicitation material in respect of a charter amendment. In connection with the requisite stockholder approval, NYCB

will file with the SEC a preliminary proxy statement and a definitive proxy statement, which will be sent to the stockholders of NYCB, seeking certain approvals related to the issuances of shares of common stock issued under each investment

agreement and to be issued upon the conversion of shares of the preferred stock issued under the investment agreements.

INVESTORS AND SECURITY HOLDERS OF

NYCB AND THEIR RESPECTIVE AFFILIATES ARE URGED TO READ, WHEN AVAILABLE, THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE

DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT NYCB AND THE TRANSACTION. Investors and security holders will be able to obtain a free copy of the proxy statement, as well as other relevant documents filed with the SEC containing

information about NYCB, without charge, at the SEC’s website (http://www.sec.gov). Copies of documents filed with the SEC by NYCB can also be obtained, without charge, by directing a request to Investor Relations, New York

Community Bancorp, Inc., 102 Duffy Avenue, Hicksville, New York 11801 or by telephone (516-683-4420).

Participants in the Solicitation of Proxies in Connection with Proposed Transaction

NYCB and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of

the requisite stockholder approvals under the rules of the SEC. Information regarding NYCB’s directors and executive officers is available in its definitive proxy statement for its 2023 annual stockholders meeting, which was filed with the SEC

on April 21, 2023, and certain of its Current Reports on Form 8-K. Other information regarding the participants in the solicitation of proxies in respect of the proposed transaction and a description of

their direct and indirect interests, by security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC. Free copies of these documents, when available, may be obtained as described in

the preceding paragraph.

Not an Offer of Securities

The information in this communication is for informational purposes only and shall not constitute, or form a part of, an offer to sell or the solicitation of

an offer to sell or the solicitation of an offer to buy any securities. The securities that are the subject of the private placement have not been registered under the Securities Act and may not be offered or sold in the United States absent

registration or an applicable exemption from registration requirements.

Exhibit 99.3

102 Duffy Avenue, Hicksville, NY 11801 • Phone: (516) 683-4420 • flagstar.com

|

|

|

| NEWS RELEASE |

|

Investor Contact: |

|

|

| FOR IMMEDIATE RELEASE |

|

Salvatore J. DiMartino (516)

683-4286 |

|

|

|

|

Media Contact: |

|

|

|

|

Steven Bodakowski (248) 312-5872 |

NEW YORK COMMUNITY BANCORP, INC. ANNOUNCES OVER $1 BILLION EQUITY

INVESTMENT ANCHORED BY FORMER U.S. TREASURY SECRETARY STEVEN T. MNUCHIN’S

LIBERTY STRATEGIC CAPITAL, HUDSON BAY CAPITAL AND REVERENCE CAPITAL

Former Secretary Steven Mnuchin, Joseph Otting, Milton Berlinski and Allen Puwalski to Join NYCB Board of Directors

Joseph Otting to Become CEO and Alessandro DiNello to be Named as Non-Executive Chairman

HICKSVILLE, N.Y., March 7, 2024 – New York Community Bancorp, Inc. (NYSE: NYCB) (“NYCB” or the “Company”) today announced

that Liberty Strategic Capital (“Liberty”), funds managed by Hudson Bay Capital Management (“Hudson Bay”), Reverence Capital Partners (“Reverence Capital”), Citadel Global Equities (“Citadel”), other

institutional investors and certain members of the Company’s management (collectively, the “Investors”) will make individual investments aggregating to over $1 billion in the Company. Liberty will invest $450 million, Hudson Bay will

invest $250 million, and Reverence will invest $200 million as part of the transaction.

In connection with the transactions, the Company will add four

new directors to its Board, including Steven Mnuchin, the 77th Secretary of the Treasury, Joseph Otting, former Comptroller of the Currency, Milton Berlinski, Managing Partner of Reverence Capital, and Allen Puwalski, at the recommendation of Hudson

Bay.

In addition, Mr. Otting will become Chief Executive Officer and Mr. DiNello will be named as Non-Executive Chairman, providing his strong

banking knowledge in support of Mr. Otting and the Board. Mr. Otting served as the 31st Comptroller of the Currency and has had a long, distinguished career in banking including, having served as CEO of OneWest Bank from 2010 to 2015 and

as Acting Director of the Federal Housing Finance Agency in 2018.

Secretary Steven Mnuchin stated, “In evaluating our investment, we were mindful of

the Bank’s credit risk profile. With the over $1 billion of capital invested in the Bank, we believe we now have sufficient capital should reserves need to be increased in the future to be consistent with or above the coverage ratio of

NYCB’s large bank peers.”

Non-Executive Chairman Sandro DiNello stated, “We welcome the approach that Liberty, Reverence and the

other investors took in their respective evaluations of the Bank and look forward to incorporating their insights going forward. The strategic investments involving former Secretary Steven Mnuchin, former Comptroller Joseph Otting and Milton

Berlinski, along with the other institutional investors is a positive endorsement of the turnaround that is underway and allows us to execute on our strategy from a position of strength. We enter this next chapter with a strong balance sheet and

liquidity position supported by a diversified and retail focused deposit base. Our new leadership team, with the support of the reconstituted Board, will continue to take the actions that are necessary to improve earnings, profitability and drive

enhanced value for shareholders.”

Secretary Mnuchin stated, “We decided to make this investment because we believe Sandro, alongside new

management, has taken the appropriate actions to stabilize the Company and to position NYCB to become a best-in-class $100+ billion national bank with a diversified and de-risked business model that supports long term profitability. We are delighted

that former Comptroller Otting will be NYCB’s new CEO and believe that the actions taken by NYCB establish a strong foundation for future growth through our new relationship with other new Board members and investors. We are confident that NYCB

is poised to generate sustainable shareholder value.”

Mr. Berlinski added, “We are excited to be investing behind this management team

with such strong investors and believe NYCB has a great opportunity to reposition the company and return to growth. NYCB’s franchise is well positioned for continued success with the addition of former Comptroller Otting.”

As part of the reconstitution, the Board will be reduced to nine members and will include Secretary Mnuchin, Mr. Otting, Mr. Puwalski,

Mr. Berlinski, Mr. DiNello, Marshall Lux, Peter Schoels, Jennifer Whip and David Treadwell.

Transactions Details

In connection with the equity capital raise transactions, NYCB will sell and issue, in the aggregate, to the Investors approximately (i) 59,750,000 shares

of common stock, par value $0.01 per share, of the Company at a price per share of $2.00, (ii) 192,062 shares of a new series of preferred stock, par value $0.01 per share, of the Company designated as Series B Noncumulative Convertible

Preferred Stock at a price per share of $2,000 and with a conversion price of $2.00, and (iii) 273,188 shares of a new series of preferred stock, par value $0.01 per share, of the Company designated as Series C Noncumulative Convertible

Preferred Stock at a price per share of $2,000 and with a conversion price of $2.00, for an aggregate investment amount of $1.05 billion. In addition, investors will receive 7-year warrants to purchase non-voting, common-equivalent stock of the

Company representing $315 million of underlying shares of common stock of the Company with an exercise price of $2.50 per share, a 25% premium to the price paid on common stock. Upon completion of the transactions, the aggregate shares issued to the

Investors are expected to represent approximately 41.4% of the outstanding shares of Company on an as converted fully diluted basis.

Holders of the

preferred stock will not have voting rights and will be entitled to quarterly non-cumulative cash dividends, as and if declared by the Board. Each share of preferred stock is convertible into common stock on a 1 preferred share – 1,000 common

shares basis. Series B preferred stock will automatically convert upon certain transfers permitted by federal banking regulations , while Series C preferred stock will automatically convert upon the achievement of certain trigger events related to

receipt of antitrust clearance under the Hart Scott Rodino Act and shareholder approval. The Company will provide customary shelf and piggyback registration rights to each of the Investors. Additionally, Liberty and Reverence will also have the

ability to request an underwritten shelf take-down and block trade rights.

Timing and Approvals

The transaction is expected to close on or around Monday, March 11, 2024, subject to the satisfaction of certain closing conditions, including the filing

of a supplemental listing application required to authorize for listing on the New York Stock Exchange the shares of common stock issued under each investment agreement and to be issued upon the conversion of shares of the preferred stock issued

under the investment agreements.

Advisors

Jefferies LLC is acting as exclusive financial advisor and sole placement agent to NYCB. Skadden, Arps, Slate, Meagher & Flom LLP is serving as legal

counsel to NYCB. Sullivan & Cromwell LLP is serving as legal counsel to Liberty Strategic Capital. Schulte Roth & Zabel LLP is serving as legal counsel to Hudson Bay Capital. Latham & Watkins LLP is acting as legal counsel

to Jefferies LLC.

About New York Community Bancorp, Inc.

New York Community Bancorp, Inc. is the parent company of Flagstar Bank, N.A., one of the largest regional banks in the country. The Company is headquartered

in Hicksville, New York. At December 31, 2023, the Company had $113.9 billion of assets, $85.8 billion of loans, deposits of $81.4 billion, and total stockholders’ equity of $8.4 billion.

Flagstar Bank, N.A. operates 420 branches, including strong footholds in the Northeast and Midwest and exposure to high growth markets in the Southeast and

West Coast. Flagstar Mortgage operates nationally through a wholesale network of approximately 3,000 third-party mortgage originators. In addition, the Bank has 134 private banking teams located in over ten cities in the metropolitan New York City

region and on the West Coast, which serve the needs of high-net worth individuals and their businesses.

New York Community Bancorp, Inc. has

market-leading positions in several national businesses, including multi-family lending, mortgage origination and servicing, and warehouse lending. Flagstar Mortgage is the seventh largest bank originator of residential mortgages for the 12-months

ending December 31, 2023 and the industry’s fifth largest sub-servicer of mortgage loans nationwide, servicing 1.4 million accounts with $382 billion in unpaid principal balances. Additionally, the Company is the second largest

mortgage warehouse lender nationally based on total commitments.

About Liberty Strategic Capital

Liberty Strategic Capital is a Washington, D.C.-based private equity firm focused on strategic investments in technology, financial services and fintech, and

new forms of content. The firm was founded in 2021 and is led by Steven T. Mnuchin, the 77th Secretary of the Treasury. Our leadership team combines decades of public service and private sector experience, creating unique insight into the

intersection of capital, technology, and government regulation.

About Hudson Bay Capital Management

Hudson Bay Capital Management is a global investment management firm operating in Greenwich, New York, Miami, Boston, London and Dubai. Hudson Bay

Capital’s team seeks to achieve outstanding performance by uncovering market inefficiencies and undervalued investment opportunities that are uncorrelated to each other and to market indices while maintaining a focus on risk management,

portfolio construction and capital preservation. Hudson Bay Capital has been managing assets on behalf of pension plans, sovereign wealth funds, endowments, foundations, high net worth individuals and families since 2006.

About Reverence Capital

Reverence Capital Partners is a private investment firm focused on three complementary strategies: (i) Financial Services-Focused Private Equity,

(ii) Opportunistic, Structured Credit, and (iii) Real Estate Solutions. Today, Reverence manages in excess of $8 billion in AUM. Reverence focuses on thematic investing in leading global Financial Services businesses. The firm was founded

in 2013, by Milton Berlinski, Peter Aberg and Alex Chulack, after distinguished careers advising and investing in a broad array of financial services businesses. The Partners collectively bring over 100 years of advisory and investing experience

across a wide range of Financial Services sectors.

Forward Looking Statements

This press release may include forward-looking statements by the Company pertaining to such matters as our goals, intentions, and expectations regarding

revenues, earnings, loan production, asset quality, capital levels, and acquisitions, among other matters; our estimates of future costs and benefits of the actions we may take; our assessments of probable losses on loans; our assessments of

interest rate and other market risks; and our ability to achieve our financial and other strategic goals, including those related to our merger with Flagstar Bancorp, Inc., which was completed on December 1, 2022, the Signature Transaction, and

our transition to a $100 billion plus bank.

Forward-looking statements are typically identified by such words as “believe,” “expect,”

“anticipate,” “intend,” “outlook,” “estimate,” “forecast,” “project,” “should,” and other similar words and expressions, and are subject to numerous assumptions, risks, and

uncertainties, which change over time. Additionally, forward-looking statements speak only as of the date they are made; the Company does not assume any duty, and does not undertake, to update our forward-looking statements. Furthermore, because

forward-looking statements are subject to assumptions and uncertainties, actual results or future events could differ, possibly materially, from those anticipated in our statements, and our future performance could differ materially from our

historical results.

Our forward-looking statements are subject to the following principal risks and uncertainties: general economic conditions and

trends, either nationally or locally; conditions in the securities markets; changes in interest rates; changes in deposit flows, and in the demand for deposit, loan, and investment products and other financial services; changes in real estate

values; changes in the quality or composition of our loan or investment portfolios; changes in future allowance for credit losses requirements under relevant accounting and regulatory requirements; the ability to pay future dividends at currently

expected rates; changes in our capital management and balance sheet strategies and our ability to successfully implement such strategies; changes in competitive pressures among financial institutions or from non-financial institutions; changes in

legislation, regulations, and policies; the success of our blockchain and fintech activities, investments and strategic partnerships; the restructuring of our mortgage business; the impact of failures or disruptions in or breaches of the

Company’s operational or security systems, data or infrastructure, or those of third parties, including as a result of cyberattacks or campaigns; the impact of natural disasters, extreme weather events, military conflict (including the

Russia/Ukraine conflict, the conflict in Israel and surrounding areas, the possible

|

|

|

|

|

|

|

expansion of such conflicts and potential geopolitical consequences), terrorism or other geopolitical events; and a variety of other matters which, by their nature, are subject to significant

uncertainties and/or are beyond our control. Our forward-looking statements are also subject to the following principal risks and uncertainties with respect to our merger with Flagstar Bancorp, which was completed on December 1, 2022, and the

Signature Transaction; the possibility that the anticipated benefits of the transactions will not be realized when expected or at all; the possibility of increased legal and compliance costs, including with respect to any litigation or regulatory

actions related to the business practices of acquired companies or the combined business; diversion of management’s attention from ongoing business operations and opportunities; the possibility that the Company may be unable to achieve expected

synergies and operating efficiencies in or as a result of the transactions within the expected timeframes or at all; and revenues following the transactions may be lower than expected. Additionally, there can be no assurance that the Community

Benefits Agreement entered into with NCRC, which was contingent upon the closing of the Company’s merger with Flagstar Bancorp, Inc., will achieve the results or outcome originally expected or anticipated by us as a result of changes to our

business strategy, performance of the U.S. economy, or changes to the laws and regulations affecting us, our customers, communities we serve, and the U.S. economy (including, but not limited to, tax laws and regulations).

More information regarding some of these factors is provided in the Risk Factors section of our Annual Report on Form 10-K for the year ended

December 31, 2022, Quarterly Reports on Form 10-Q for the quarters ended March 31, 2023, June 30, 2023, and September 30, 2023 and in other SEC reports we file. Our forward-looking statements may also be subject to other

risks and uncertainties, including those we may discuss in this Amendment, during investor presentations, or in our other SEC filings, which are accessible on our website and at the SEC’s website, www.sec.gov.

Important Information and Where You Can Find It

This press release may be deemed to be solicitation material in respect of a charter amendment. In connection with the requisite stockholder approval, NYCB

will file with the SEC a preliminary proxy statement and a definitive proxy statement, which will be sent to the stockholders of NYCB, seeking certain approvals related to the issuances of shares of common stock issued under each investment

agreement and to be issued upon the conversion of shares of the preferred stock issued under the investment agreements.

INVESTORS AND SECURITY HOLDERS OF

NYCB AND THEIR RESPECTIVE AFFILIATES ARE URGED TO READ, WHEN AVAILABLE, THE PROXY STATEMENT AND ANY OTHER RELEVANT DOCUMENTS FILED OR TO BE FILED WITH THE SEC IN CONNECTION WITH THE TRANSACTION, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THOSE

DOCUMENTS, BECAUSE THEY WILL CONTAIN IMPORTANT INFORMATION ABOUT NYCB AND THE TRANSACTION. Investors and security holders will be able to obtain a free copy of the proxy statement, as well as other relevant documents filed with the SEC containing

information about NYCB, without charge, at the SEC’s website (http://www.sec.gov). Copies of documents filed with the SEC by NYCB can also be obtained, without charge, by directing a request to Investor Relations, New York Community

Bancorp, Inc., 102 Duffy Avenue, Hicksville, New York 11801 or by telephone (516-683-4420).

Participants in the Solicitation of Proxies in Connection with Proposed Transaction

NYCB and certain of their respective directors, executive officers and employees may be deemed to be participants in the solicitation of proxies in respect of

the requisite stockholder approvals under the rules of the SEC. Information regarding NYCB’s directors and executive officers is available in its definitive proxy statement for its 2023 annual stockholders meeting, which was filed with the SEC

on April 21, 2023, and certain of its Current Reports on Form 8-K. Other information regarding the participants in the solicitation of proxies in respect of the proposed transaction and a description of their direct and indirect interests, by

security holdings or otherwise, will be contained in the proxy statement and other relevant materials to be filed with the SEC. Free copies of these documents, when available, may be obtained as described in the preceding paragraph.

Not an Offer of Securities

The information in

this communication is for informational purposes only and shall not constitute, or form a part of, an offer to sell or the solicitation of an offer to sell or the solicitation of an offer to buy any securities. The securities that are the subject of

the private placement have not been registered under the Securities Act and may not be offered or sold in the United States absent registration or an applicable exemption from registration requirements.

v3.24.0.1

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=nycb_BifurcatedOptionNotesUnitSecuritiesMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=nycb_FixedToFloatingRateSeriesANoncumulativePerpetualPreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

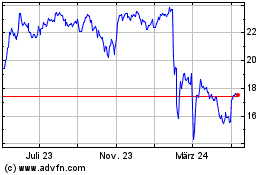

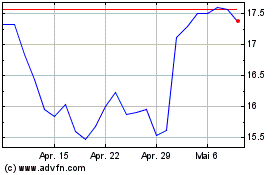

New York Community Bancorp (NYSE:NYCB-A)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

New York Community Bancorp (NYSE:NYCB-A)

Historical Stock Chart

Von Apr 2023 bis Apr 2024