Form 424B3 - Prospectus [Rule 424(b)(3)]

31 Oktober 2024 - 8:58PM

Edgar (US Regulatory)

Nuveen

Municipal Income Fund, Inc. (NYSE: NMI) (the “Fund”)

Supplement

Dated October 31, 2024

To

The Fund’s Currently Effective Prospectus

Effective

October 31, 2024, the information appearing under the heading “Risk Factors” of the Prospectus is hereby supplemented with

the below. This supplement will be effective for the Fund until the Fund’s next annual report filed on Form N-CSR is available.

Direct

lending risk: The Fund may engage in direct lending. Direct loans between the Fund and a borrower may not be administered by an underwriter

or agent bank. The Fund may provide financing to commercial borrowers directly or through companies affiliated with the Fund. The terms

of the direct loans are negotiated with borrowers in private transactions. Furthermore, a direct loan may be secured or unsecured. The

Fund will rely primarily upon the creditworthiness of the borrower and/or any collateral for payment of interest and repayment of principal.

Direct loans may subject the Fund to liquidity risk, interest rate risk, and borrower default or insolvency. Direct loans are not publicly

traded and may not have a secondary market which may have an adverse impact on the ability of the Fund to dispose of a direct loan and/or

value the direct loan. The Fund’s performance may be impacted by the Fund’s ability to lend on favorable terms as the Fund

may be subject to increased competition or a reduced supply of qualifying loans which could lead to lower yields and reduce Fund performance.

As

part of its lending activities, the Fund may originate loans to companies that are experiencing significant financial or business difficulties,

including companies involved in bankruptcy or other reorganization and liquidation proceedings. Although the terms of such financing

may result in significant financial returns to the Fund, they involve a substantial degree of risk. The level of analytical sophistication,

both financial and legal, necessary for successful financing to companies experiencing significant business and financial difficulties

is unusually high. Different types of assets may be used as collateral for the Fund’s loans and, accordingly, the valuation of

and risks associated with such collateral will vary by loan. There is no assurance that the Fund will correctly evaluate the value of

the assets collateralizing the Fund’s loans or the prospects for a successful reorganization or similar action. In any reorganization

or liquidation proceeding relating to a borrower that the Fund is lending money to, the Fund may lose all or part of the amounts advanced

to the borrower or may be required to accept collateral with a value less than the amount of the loan advanced by the Fund to the borrower.

Furthermore, in the event of a default by a borrower, the Fund may have difficulty disposing of the assets used as collateral for a loan.

To the extent the Fund seeks to engage in direct lending, the Fund will be subject to enhanced risks of litigation, regulatory actions

and other proceedings. As a result, the Fund may be required to pay legal fees, settlement costs, damages, penalties or other charges,

any or all of which could materially adversely affect the Fund and its holdings.

PLEASE

KEEP THIS WITH YOUR

FUND’S

PROSPECTUS FOR FUTURE REFERENCE

EGN-NMIP-1024P

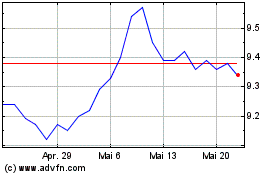

Nuveen Muni Income (NYSE:NMI)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

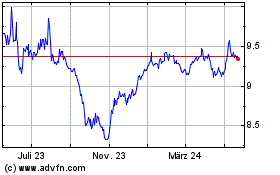

Nuveen Muni Income (NYSE:NMI)

Historical Stock Chart

Von Jan 2024 bis Jan 2025