0001688476false12/3100016884762023-09-012023-09-01

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT TO SECTION 13 OR 15(D) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): September 1, 2023

NexTier Oilfield Solutions Inc.

(Exact Name of Registrant as Specified in its Charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-37988 | | 38-4016639 |

(State or Other Jurisdiction of Incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | |

| 3990 Rogerdale Rd | | | | |

| Houston, | | Texas | | 77042 |

| (Address of Principal Executive Offices) | | (Zip Code) |

(713) 325-6000

(Registrant’s telephone number, including area code)

n/a

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

| |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425). |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12). |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)). |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)). |

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol | Name of each exchange on which registered |

| Common Stock, $0.01, par value | NEX | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter). Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.02 Termination of a Material Definitive Agreement.

In connection with the consummation of the Mergers (as defined below), on September 1, 2023, NexTier Oilfield Solutions Inc. (the “Company”) terminated all outstanding commitments under (i) the Second Amended and Restated Asset-Based Revolving Credit Agreement, dated October 31, 2019, by and among the Company (f/k/a Keane Group Holdings, LLC), as the lead borrower, the other borrowers party thereto from time to time, the subsidiary guarantors party thereto from time to time, the lenders party thereto, and Bank of America, N.A., as administrative and collateral agent (as amended, the “ABL Credit Agreement”) and (ii) the Term Loan Agreement, dated May 25, 2018, by and among the Company (f/k/a Keane Group Inc.), as the parent, Keane Group Holdings, LLC, as the lead borrower, the other borrowers party thereto from time to time, the subsidiary guarantors party thereto, Barclays Bank PLC, as administrative agent and collateral agent, and the lenders from time to time party thereto (as amended, the “Term Loan Credit Agreement” and, together with the ABL Credit Agreement, the “Credit Agreements”). In connection with the termination of the Credit Agreements, on September 1, 2023, all outstanding obligations under each of the ABL Credit Agreement and the Term Loan Credit Agreement (other than certain obligations as agreed among the parties thereto) were paid off in full and all liens securing any obligations under the Credit Agreements were released.

Item 2.01 Completion of Acquisition or Disposition of Assets.

On September 1, 2023, the Company completed its previously announced merger with Patterson-UTI Energy, Inc. (“Patterson-UTI”) in accordance with the terms of the Agreement and Plan of Merger, dated as of June 14, 2023 and amended as of July 28, 2023 (the “Merger Agreement”), by and among the Company, Patterson-UTI, Pecos Merger Sub Inc. (“Merger Sub Inc.”) and Pecos Second Merger Sub LLC (“Merger Sub LLC”), pursuant to which the Company and Patterson-UTI agreed to combine their respective businesses in a merger of equals. Pursuant to the Merger Agreement, Merger Sub Inc. merged with and into the Company, with the Company continuing as the surviving corporation and a wholly owned subsidiary of Patterson-UTI (the “First Merger”), and immediately thereafter, as part of the same transaction, the Company merged with and into Merger Sub LLC, a wholly owned subsidiary of Patterson-UTI (the “Second Merger” and, together with the First Merger, the “Mergers”), with Merger Sub LLC continuing as the surviving company (the “Surviving Company”).

As a result of the Mergers, each share of common stock, par value $0.01 per share, of the Company (the “Company Common Stock”) issued and outstanding immediately prior to the time the First Merger became effective (the “Effective Time”), other than the Excluded Shares (as defined in the Merger Agreement) (the “Eligible Shares”), was converted into the right to receive 0.7520 fully-paid and non-assessable shares of common stock (the “Exchange Ratio”), par value $0.01 per share, of Patterson-UTI (“Patterson-UTI Common Stock”).

The issuance of shares of Patterson-UTI Common Stock in connection with the First Merger was registered under the Securities Act of 1933, as amended (the “Securities Act”), pursuant to Patterson-UTI’s registration statement on Form S-4 (File No. 333-273295), declared effective by the Securities and Exchange Commission (the “SEC”) on July 31, 2023. The joint proxy statement/prospectus (the “Joint Proxy Statement/Prospectus”) included in Patterson-UTI’s registration statement contains additional information about the Mergers.

The foregoing description of the Mergers, the Merger Agreement and the transactions contemplated thereby is not complete and is subject to and qualified in its entirety by reference to the Merger Agreement, a copy of which was included as Annex A to the Joint Proxy Statement/Prospectus and is incorporated by reference into this Item 2.01.

Item 3.01 Notice of Delisting or Failure to Satisfy a Continued Listing Rule or Standard; Transfer of Listing.

In connection with the completion of the Mergers, the Company notified the New York Stock Exchange (the “NYSE”) that Eligible Shares were converted into the right to receive shares of Patterson-UTI Common Stock and requested the NYSE withdraw the listing of the shares of Company Common Stock. Upon the Company’s request, on September 1, 2023, the NYSE filed a notification of removal from listing on Form 25 with the SEC with respect to the delisting of the shares of Company Common Stock. Shares of Company Common Stock ceased being traded prior to the opening of the market on September 1, 2023, and are no longer listed on the NYSE. In addition, the Surviving Company intends to file with the SEC a Form 15 requesting that the reporting obligations of the Surviving Company under Sections 13(a) and 15(d) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), be suspended.

Item 3.03 Material Modification to Rights of Security Holders.

The information set forth in Item 1.02, Item 2.01, Item 3.01 and Item 5.03 of this Current Report on Form 8-K is incorporated by reference into this Item 3.03.

At the Effective Time, each Eligible Share was converted into the right to receive a number of shares of Patterson-UTI Common stock equal to the Exchange Ratio.

In addition, pursuant to the Merger Agreement, at the Effective Time, (a) whether vested or unvested, each outstanding Company stock option converted into a stock option relating to shares of Patterson-UTI Common Stock on the terms set forth in the Merger Agreement, (b) each outstanding Company performance stock unit award and Company performance unit award converted into a Patterson-UTI restricted stock unit award relating to shares of Patterson-UTI Common Stock on the terms set forth in the Merger Agreement and (c) each outstanding Company restricted stock unit award converted into a Patterson-UTI restricted stock unit award relating to shares of Patterson-UTI Common Stock on the terms set forth in the Merger Agreement. The number of shares of Company Common Stock subject to Company performance stock unit awards or performance unit awards was deemed to be the number of shares subject to such Company performance stock unit award or performance unit award with performance deemed achieved based on actual performance attained through immediately prior to the Effective Time.

Item 5.01 Changes in Control of Registrant.

As a result of the consummation of the First Merger, at the Effective Time, the Company became a wholly owned subsidiary of Patterson-UTI. The information set forth in Item 2.01 of this Current Report on Form 8-K is incorporated by reference into this Item 5.01.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

In accordance with the terms of the Merger Agreement, Robert W. Drummond, Stuart M. Brightman, Leslie A. Beyer, Gary M. Halverson, Patrick M. Murray, Amy H. Nelson, Melvin G. Riggs, Bernardo J. Rodriguez, Michael Roemer, James C. Stewart and Scott R. Wille, such members comprising all of the directors of the Company prior to the Effective Time, resigned as directors of the Company effective as of the Effective Time. None of these resignations were a result of any disagreement with the Company, its management or its board of directors.

Also effective as of the Effective Time, each of Robert W. Drummond, principial executive officer of the Company, Kenneth Pucheu, principal financial officer of the Company, Oladipo Iluyomade, principal accounting officer of the Company, and Kevin M. McDonald and Matthew R. Gillard, each named executive officers of the Company, ceased his respective service as an officer of the Company.

On August 30, 2023, the Company entered into a transaction bonus agreement with Kevin McDonald pursuant to which Mr. McDonald will receive a bonus in the amount of $275,000, payable in a lump sum within 10 days following the closing of the transactions contemplated by the Merger Agreement. The transaction bonus agreement also extends the post-employment non-compete period under Mr. McDonald’s employment agreement from 12 months to 18 months.

Item 5.03 Amendments to Certificate of Incorporation or Bylaws; Change in Fiscal Year.

In connection with the consummation of the Second Merger, the certificate of formation and limited liability company agreement of Merger Sub LLC as in effect immediately prior to the effective time of the Second Merger, as set forth in Exhibits 3.1 and 3.2 to this Current Report on Form 8-K, became the certificate of formation and limited liability company agreement of the Surviving Company. Such certificate of formation and limited liability company agreement were amended to change the name of the Surviving Company from “Pecos Second Merger Sub LLC” to “NexTier Oilfield Solutions LLC,” as set forth in Exhibits 3.3 and 3.4 to this Current Report on Form 8-K.

The foregoing disclosures are qualified in their entirety by reference to Exhibits 3.1, 3.2, 3.3 and 3.4 of this Current Report on Form 8-K, which are incorporated by reference into this Item 5.03.

Item 9.01 Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

Exhibit No. | | Description of Exhibit |

| | Certificate of Formation of the Surviving Company. |

| | Limited Liability Company Agreement of the Surviving Company. |

| | Certificate of Amendment of the Surviving Company. |

| | Amended and Restated Limited Liability Company Agreement of the Surviving Company. |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | | |

| | NEXTIER OILFIELD SOLUTIONS LLC (successor in interest to NexTier Oilfield Solutions Inc.) |

| | |

| Dated: September 1, 2023 | | By: Patterson-UTI Energy Inc., its managing member |

| | | |

| | By: | /s/ C. Andrew Smith |

| | Name: | C. Andrew Smith |

| | Title: | Executive Vice President and Chief Financial Officer |

CERTIFICATE OF FORMATION

OF

PECOS SECOND MERGER SUB LLC

This Certificate of Formation of Pecos Second Merger Sub LLC, dated as of June 12, 2023, is being duly executed and filed by Donna McClurkin-Fletcher, as an authorized person, to form a limited liability company under the Delaware Limited Liability Company Act (6 Del C. § 18-101, et seq.).

FIRST: The name of the limited liability company formed hereby is Pecos Second Merger Sub LLC (the “Company”).

SECOND: The address of the registered office of the Company in the State of Delaware is c/o The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801.

THIRD: The name and address of the registered agent of the Company for service of process in the State of Delaware is The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801.

IN WITNESS WHEREOF, the undersigned has executed this Certificate of Formation as of the date first written above.

| | |

| /s/ Donna McClurkin-Fletcher |

Name: Donna McClurkin-Fletcher Title: Authorized Person |

LIMITED LIABILITY COMPANY AGREEMENT

OF

PECOS SECOND MERGER SUB LLC

This Limited Liability Company Agreement (this “Agreement”) of Pecos Second Merger Sub LLC (the “Company”) is entered into by Patterson-UTI Energy, Inc., as the sole member (the “Member”), as of this 12th day of June, 2023.

The Member, by execution of this Agreement, hereby forms a limited liability company pursuant to and in accordance with the Delaware Limited Liability Company Act (6 Del. C. § 18-101, et seq.), as amended from time to time (the “Act”), and hereby agrees as follows:

1.Name. The name of the limited liability company formed hereby is Pecos Second Merger Sub LLC.

2.Formation of Company; Filing of Certificate. The Company was formed on June 12, 2023 upon the execution and filing of the Certificate of Formation of the Company (the “Certificate of Formation”) with the Secretary of State of the State of Delaware by Donna McClurkin-Fletcher, as an “authorized person” within the meaning of the Act. Upon the filing of the Certificate of Formation with the Secretary of State of the State of Delaware, her powers as an “authorized person” ceased, and the Member thereupon became the designated “authorized person” within the meaning of the Act.

3.Purposes. The Company is formed for the object and purpose of, and the nature of the business to be conducted and promoted by the Company is, engaging in any lawful act or activity for which limited liability companies may be formed under the Act.

4.Powers. In furtherance of its purposes, but subject to all of the provisions of this Agreement, the Company shall have and may exercise all the powers now or hereafter conferred by Delaware law on limited liability companies formed under the Act and all powers necessary, convenient or incidental to accomplish its purposes as set forth in Section 3.

5.Principal Business Office. The principal business office of the Company shall be located at 10713 W. Sam Houston Pkwy N, Suite 800, Houston, Texas 77064, or at such other location as may hereafter be determined by the Member.

6.Registered Office. The address of the registered office of the Company in the State of Delaware is c/o The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801.

7.Registered Agent. The name and address of the registered agent of the Company for service of process on the Company in the State of Delaware is The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801.

8.Member. The name and the mailing address of the Member are as follows:

| | | | | |

| Name | Address |

| Patterson-UTI Energy, Inc. | 10713 W. Sam Houston Pkwy N, Suite 800

Houston, Texas 77064 |

9.Limited Liability. Except as otherwise provided by the Act, the debts, obligations and liabilities of the Company, whether arising in contract, tort or otherwise, shall be solely the debts, obligations and liabilities of the Company, and the Member shall not be obligated personally for any such debt, obligation or liability of the Company solely by reason of being a member of the Company.

10.Capital Contributions. The Member has made contributions to the capital of the Company (if any) as set forth in the books and records of the Company.

11.Additional Contributions. The Member is not required to make any additional capital contribution to the Company. However, the Member may voluntarily make additional capital contributions to the Company at any time.

12.Allocation of Profits and Losses. For so long as the Member is the sole member of the Company, the Company’s profits and losses shall be allocated solely to the Member.

13.Distributions. Distributions shall be made to the Member at the times and in the aggregate amounts determined by the Member. Notwithstanding any provision to the contrary contained in this Agreement, the Company shall not make a distribution to the Member on account of its interest in the Company if such distribution would violate the Act or other applicable law.

14.Management. In accordance with Section 18-402 of the Act, management of the Company shall be vested in the Member. The Member shall have the power to do any and all acts necessary, convenient or incidental to or for the furtherance of the purposes of the Company described herein, including all powers, statutory or otherwise, possessed by members of a limited liability company under the laws of the State of Delaware. Notwithstanding any other provision of this Agreement, (i) the Member is authorized to execute and deliver any document on behalf of the Company and to cause the Company to perform its obligations thereunder without any vote or consent of any other person, and any such document executed by the Member on behalf of the Company shall be deemed to be duly authorized for all purposes and (ii) the Member has the authority to bind the Company. The Member may appoint directors, officers or other agents as it shall deem necessary or advisable who shall hold their offices and shall exercise such powers and perform such duties as shall be determined from time to time by the Member.

15.Waiver of Fiduciary Duties. This Agreement is not intended to, and does not, create or impose any implied duty (including, without limitation, any fiduciary duty and, for purposes of clarity, any prohibition on usurping opportunities of the Company) otherwise existing at law or in equity on the Member or any affiliate, officer, director, employee or agent of the Member (each of the foregoing, a “Responsible Party”). To the fullest extent permitted by applicable law, and notwithstanding any duty otherwise existing at law or in equity, each of the Company, the Member and any other person or entity that is a party to or is otherwise bound by this Agreement (including, without limitation, (a) the Company in its capacity as a debtor or debtor in possession in a bankruptcy case commenced under 11 U.S.C. (a “Bankruptcy Case”), (b) any successor to the Company in a Bankruptcy Case or otherwise, including, without

limitation, a trustee, a litigation trust or estate representative, including, without limitation, a representative under 11 U.S.C. Section 1123(b), and (c) any creditor or committee of creditors or equity holders seeking or obtaining standing to assert claims of the estate in a Bankruptcy Case) (each of the foregoing, a “Bound Party”) hereby expressly waives all duties (including, without limitation, any fiduciary duty) and, for purposes of clarity, any prohibition on usurping opportunities of the Company, that absent such waiver, may be implied at law or in equity or otherwise owed to a Bound Party, and in doing so, recognizes, acknowledges and agrees that the duties and obligations of the Responsible Parties are only as expressly set forth in this Agreement; provided that a Responsible Party shall act in good faith and in a manner that it subjectively believes is in or not opposed to the best interests of the Company.

16.Other Business Opportunities. Any Responsible Party may engage in or possess an interest in other business opportunities or ventures (unconnected with the Company) of every kind and description, independently or with others, including, without limitation, businesses that may compete with the Company and/or any Bound Party. No Responsible Party shall be required to present any such business opportunity or venture to any Bound Party, even if the opportunity is of the character that, if presented to any of such persons or entities, could be taken by them. No Bound Party shall have any rights in or to such business opportunities or ventures or the income or profits derived therefrom by virtue of this Agreement, notwithstanding any duty otherwise existing at law or in equity. The provisions of this Section shall apply to the Responsible Parties solely in their capacity as such and shall not be deemed to modify any contract or arrangement, including, without limitation, any noncompete provisions, otherwise agreed to by the Company and such Responsible Party.

17.Exculpation and Indemnification.

(a)To the fullest extent permitted by applicable law, neither the Member nor any current or former affiliate, stockholder, equityholder, officer, director, employee or agent of the Company or the Member (including the executors, heirs, assigns, successors or other legal representatives of any such persons) (collectively, the “Covered Persons”) shall be liable to a Bound Party for any loss, damage or claim incurred by reason of any act or omission performed or omitted by such Covered Person in good faith on behalf of the Company and in a manner reasonably believed to be within the scope of the authority conferred on such Covered Person by this Agreement, unless there has been a final and non-appealable judgment entered by a court of competent jurisdiction determining that, in respect of the matter in question, the Covered Person engaged in fraud or intentional malfeasance.

(b)To the fullest extent permitted by applicable law, a Covered Person shall be entitled to indemnification from the Company for any loss, damage or claim incurred by such Covered Person by reason of any act or omission performed or omitted by such Covered Person in good faith on behalf of the Company and in a manner reasonably believed to be within the scope of the authority conferred on such Covered Person by this Agreement, unless there has been a final and non-appealable judgment entered by a court of competent jurisdiction determining that, in respect of the matter in question, the Covered Person engaged in fraud or intentional malfeasance; provided, however, that any indemnity under this Section shall be provided out of and to the extent of Company assets only, and the Member shall not have any personal liability on account thereof.

(c)To the fullest extent permitted by applicable law, expenses (including reasonable legal fees) incurred by a Covered Person in defending any claim, demand, action, suit or proceeding shall, from time to time, be advanced by the Company prior to the final disposition of such claim, demand, action, suit or proceeding upon receipt by the Company of an undertaking by or on behalf of the Covered Person to repay such amount if it shall be determined that the Covered Person is not entitled to be indemnified as authorized in this Section.

(d)A Covered Person shall be fully protected in relying in good faith upon the records of the Company and upon such information, opinions, reports or statements presented to the Company by the person or entity as to matters the Covered Person reasonably believes are within such other person or entity’s professional or expert competence and who has been selected with reasonable care by or on behalf of the Company, including information, opinions, reports or statements as to the value and amount of the assets, liabilities, or any other facts pertinent to the existence and amount of assets from which distributions to the Member might properly be paid.

(e)The provisions of this Agreement, to the extent that they restrict or eliminate the duties and liabilities of a Covered Person otherwise existing at law or in equity, are agreed by the Member to replace and eliminate, as applicable, such other duties and liabilities of such Covered Person.

(f)Notwithstanding the foregoing provisions of this Section, the Company shall indemnify a Covered Person in connection with a proceeding (or part thereof) initiated by such Covered Person only if such proceeding (or part thereof) was authorized by the Member; provided, however, that a Covered Person shall be entitled to reimbursement of his or her reasonable counsel fees with respect to a proceeding (or part thereof) initiated by such Covered Person to enforce his or her right to indemnity or advancement of expenses under the provisions of this Section to the extent the Covered Person is successful on the merits in such proceeding (or part thereof).

(g)The foregoing provisions of this Section shall survive any termination of this Agreement.

(h)No amendment, modification or repeal of this Section shall have the effect of limiting or denying any rights under this Section with respect to actions taken or omitted to be taken or proceedings arising prior to any amendment, modification or repeal.

18.Transfers; Assignments. The Member may at any time transfer or assign in whole or in part its limited liability company interest in the Company. If the Member transfers or assigns any of its interest in the Company pursuant to this Section, the transferee or assignee shall be admitted to the Company, subject to Section 21, upon its execution of an instrument signifying its agreement to be bound by the terms and conditions of this Agreement, which instrument may be a counterpart signature page to this Agreement. If the Member transfers or assigns all of its interest in the Company pursuant to this Section, such admission shall be deemed effective immediately prior to the transfer or assignment, and, immediately following such admission, the transferor or assignor Member shall cease to be a member of the Company.

19.Resignation. The Member may at any time resign from the Company. If the Member resigns pursuant to this Section, an additional member shall be admitted to the Company, subject to Section 21, upon its execution of an instrument signifying its agreement to be bound by the terms and conditions of this Agreement. Such admission shall be deemed effective immediately prior to the resignation, and, immediately following such admission, the resigning Member shall cease to be a member of the Company.

20.Admission of Additional Members. One or more additional members of the Company may be admitted to the Company with the written consent of the Member and upon such terms (including with respect to participation in the management, profits, losses and distributions of the Company) as may be determined by the Member and the additional persons or entities to be admitted.

21.Dissolution.

(a)The Company shall dissolve and its affairs shall be wound up upon the first to occur of: (i) the written consent of the Member, (ii) any time there are no members of the Company, unless the Company is continued in accordance with the Act, or (iii) the entry of a decree of judicial dissolution of the Company under Section 18-802 of the Act.

(b)In the event of dissolution, the Company shall conduct only such activities as are necessary or advisable to wind up its affairs (including the sale of the assets of the Company in an orderly manner), and the assets or proceeds from the sale of the assets of the Company shall be applied in the manner, and in the order of priority, set forth in Section 18-804 of the Act.

22.Benefits of Agreement; No Third-Party Rights. The provisions of this Agreement are intended solely to benefit the Member and the Responsible Parties and Covered Persons and, to the fullest extent permitted by applicable law, shall not be construed as conferring any benefit upon any creditor of the Company (other than Covered Persons) (and no such creditor shall be a third-party beneficiary of this Agreement), and each Responsible Party shall have no duty or obligation to any creditor of the Company to make any contributions or payments to the Company.

23.Severability of Provisions. Each provision of this Agreement shall be considered severable and if for any reason any provision or provisions herein are determined to be invalid, unenforceable or illegal under any existing or future law, such invalidity, unenforceability or illegality shall not impair the operation of or affect those portions of this Agreement which are valid, enforceable and legal.

24.Entire Agreement. This Agreement constitutes the entire agreement of the Member with respect to the subject matter hereof.

25.Governing Law. This Agreement shall be governed by, and construed under, the laws of the State of Delaware (without regard to conflict of laws principles), all rights and remedies being governed by said laws.

26.Amendments. This Agreement may not be amended, modified or supplemented in any manner, whether by course of conduct or otherwise, except by an instrument in writing specifically designated as an amendment hereto, executed and delivered by the Member.

[Signature page follows.]

IN WITNESS WHEREOF, the undersigned, intending to be legally bound hereby, has duly executed this Agreement.

PATTERSON-UTI ENERGY, INC.

By: /s/ C. Andrew Smith

Name: C. Andrew Smith

Title: Executive Vice President and

Chief Financial Officer

[Signature Page to Limited Liability Company Agreement of Pecos Second Merger Sub LLC]

CERTIFICATE OF AMENDMENT

OF THE

CERTIFICATE OF FORMATION

OF

PECOS SECOND MERGER SUB LLC

The undersigned, being duly authorized to execute and file this Certificate of Amendment of Certificate of Formation for the purpose of amending the Certificate of Formation pursuant to Section 18-202 of the Limited Liability Company Act of the State of Delaware, does hereby certify as follows:

FIRST. The name of the limited liability company is Pecos Second Merger Sub LLC.

SECOND. The Certificate of Formation of the Company was filed with the office of the Secretary of State of the State of Delaware on June 12, 2023.

THIRD. Article First of the Certificate of Formation of the Company is hereby amended to read in its entirety as follows:

“FIRST The name of the limited liability company formed hereby is NexTier Oilfield Solutions LLC”.

IN WITNESS WHEREOF, the undersigned has executed this Certificate of Amendment of Certificate of Formation as of the 1st day of September, 2023.

PECOS SECOND MERGER SUB LLC

By: /s/ C. Andrew Smith

Name: C. Andrew Smith

Title: Authorized Person

AMENDED AND RESTATED LIMITED LIABILITY COMPANY AGREEMENT

OF

NEXTIER OILFIELD SOLUTIONS LLC

This Amended and Restated Limited Liability Company Agreement (this “Agreement”) of NexTier Oilfield Solutions LLC f/k/a Pecos Second Merger Sub LLC, a Delaware limited liability company (the “Company”), is entered into and adopted by Patterson-UTI Energy, Inc., as the sole member of the Company (the “Member”), as of this 1st day of September, 2023.

WHEREAS, the Company was formed on June 12, 2023 under the name “Pecos Second Merger Sub LLC” by the filing of a Certificate of Formation with the Secretary of State of the State of Delaware (such Certificate of Formation, as amended or restated from time to time in accordance with this Agreement, is referred to herein as the “Certificate of Formation”) in accordance with the Delaware Limited Liability Company Act (6 Del. C. § 18-101, et seq.), as amended from time to time (the “Act”) and the adoption of the initial Limited Liability Company Agreement of the Company, dated effective as of June 12, 2023 (the “Prior Agreement”) by the Member;

WHEREAS, pursuant to that certain Agreement and Plan of Merger, dated as of June 14, 2023, as amended, by and among the Member, Pecos Merger Sub Inc., a Delaware corporation and wholly owned subsidiary of the Member, the Company and NexTier Oilfield Solutions Inc., a Delaware corporation (“NexTier”), on the date hereof, NexTier merged with and into the Company, and the Company subsequently changed its name to “NexTier Oilfield Solutions LLC”; and

WHEREAS, the Member desires to enter into this Agreement to amend and restate the Prior Agreement in its entirety.

NOW, THEREFORE, for good and valuable consideration, the receipt and sufficiency of which is hereby acknowledged, the Member, acting pursuant to the Act, hereby agrees to amend and restate the Prior Agreement in its entirety as follows:

1.Name. The name of the limited liability company is NexTier Oilfield Solutions LLC.

2.Formation; Continuation. The Company was formed on June 12, 2023 as a limited liability company under the Act by the filing of the Certificate of Formation with the Secretary of State of the State of Delaware. The Member desires to and shall continue the Company for the purposes and upon the terms hereinafter set forth. This Agreement amends, restates and supersedes the Prior Agreement in its entirety.

3.Purposes. The Company has been formed for the object and purpose of, and the nature of the business to be conducted and promoted by the Company shall be, engaging in any lawful act or activity for which limited liability companies may be formed under the Act.

4.Powers. In furtherance of its purposes, but subject to all of the provisions of this Agreement, the Company shall have and may exercise all the powers now or hereafter conferred by Delaware law on limited liability companies formed under the Act and all powers necessary, convenient or incidental to accomplish its purposes as set forth in Section 3.

5.Principal Business Office. The principal business office of the Company shall be located at 10713 W. Sam Houston Pkwy N, Suite 800, Houston, Texas 77064, or at such other location as may hereafter be determined by the Member.

6.Registered Office. The address of the registered office of the Company in the State of Delaware is c/o The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801.

7.Registered Agent. The name and address of the registered agent of the Company for service of process on the Company in the State of Delaware is The Corporation Trust Company, 1209 Orange Street, Wilmington, DE 19801.

8.Member. The name and the mailing address of the Member are as follows:

| | | | | |

| Name | Address |

| Patterson-UTI Energy, Inc. | 10713 W. Sam Houston Pkwy N, Suite 800

Houston, Texas 77064 |

9.Limited Liability. Except as otherwise provided by the Act, the debts, obligations and liabilities of the Company, whether arising in contract, tort or otherwise, shall be solely the debts, obligations and liabilities of the Company, and the Member shall not be obligated personally for any such debt, obligation or liability of the Company solely by reason of being a member of the Company.

10.Capital Contributions. The Member has made contributions to the capital of the Company (if any) as set forth in the books and records of the Company.

11.Additional Contributions. The Member is not required to make any additional capital contribution to the Company. However, the Member may voluntarily make additional capital contributions to the Company at any time.

12.Allocation of Profits and Losses. For so long as the Member is the sole member of the Company, the Company’s profits and losses shall be allocated solely to the Member.

13.Distributions. Distributions shall be made to the Member at the times and in the aggregate amounts determined by the Member. Notwithstanding any provision to the contrary contained in this Agreement, the Company shall not make a distribution to the Member on account of its interest in the Company if such distribution would violate the Act or other applicable law.

14.Management. In accordance with Section 18-402 of the Act, management of the Company shall be vested in the Member. The Member shall have the power to do any and all acts necessary, convenient or incidental to or for the furtherance of the purposes of the Company described herein, including all powers, statutory or otherwise, possessed by members of a limited liability company under the laws of the State of Delaware. Notwithstanding any other provision of this Agreement, (i) the Member is authorized to execute and deliver any document on behalf of the Company and to cause the Company to perform its obligations thereunder without any vote or consent of any other person, and any such document executed by the Member on behalf of the Company shall be deemed to be duly authorized for all purposes and (ii) the Member has the authority to bind the Company. The Member may appoint directors, officers or other agents

as it shall deem necessary or advisable who shall hold their offices and shall exercise such powers and perform such duties as shall be determined from time to time by the Member.

15.Waiver of Fiduciary Duties. This Agreement is not intended to, and does not, create or impose any implied duty (including, without limitation, any fiduciary duty and, for purposes of clarity, any prohibition on usurping opportunities of the Company) otherwise existing at law or in equity on the Member or any affiliate, officer, director, employee or agent of the Member (each of the foregoing, a “Responsible Party”). To the fullest extent permitted by applicable law, and notwithstanding any duty otherwise existing at law or in equity, each of the Company, the Member and any other person or entity that is a party to or is otherwise bound by this Agreement (including, without limitation, (a) the Company in its capacity as a debtor or debtor in possession in a bankruptcy case commenced under 11 U.S.C. (a “Bankruptcy Case”), (b) any successor to the Company in a Bankruptcy Case or otherwise, including, without limitation, a trustee, a litigation trust or estate representative, including, without limitation, a representative under 11 U.S.C. Section 1123(b), and (c) any creditor or committee of creditors or equity holders seeking or obtaining standing to assert claims of the estate in a Bankruptcy Case) (each of the foregoing, a “Bound Party”) hereby expressly waives all duties (including, without limitation, any fiduciary duty) and, for purposes of clarity, any prohibition on usurping opportunities of the Company, that absent such waiver, may be implied at law or in equity or otherwise owed to a Bound Party, and in doing so, recognizes, acknowledges and agrees that the duties and obligations of the Responsible Parties are only as expressly set forth in this Agreement; provided that a Responsible Party shall act in good faith and in a manner that it subjectively believes is in or not opposed to the best interests of the Company.

16.Other Business Opportunities. Any Responsible Party may engage in or possess an interest in other business opportunities or ventures (unconnected with the Company) of every kind and description, independently or with others, including, without limitation, businesses that may compete with the Company and/or any Bound Party. No Responsible Party shall be required to present any such business opportunity or venture to any Bound Party, even if the opportunity is of the character that, if presented to any of such persons or entities, could be taken by them. No Bound Party shall have any rights in or to such business opportunities or ventures or the income or profits derived therefrom by virtue of this Agreement, notwithstanding any duty otherwise existing at law or in equity. The provisions of this Section shall apply to the Responsible Parties solely in their capacity as such and shall not be deemed to modify any contract or arrangement, including, without limitation, any noncompete provisions, otherwise agreed to by the Company and such Responsible Party.

17.Exculpation and Indemnification.

(a)To the fullest extent permitted by applicable law, neither the Member nor any current or former affiliate, stockholder, equityholder, officer, director, employee or agent of the Company or the Member (including the executors, heirs, assigns, successors or other legal representatives of any such persons) (collectively, the “Covered Persons”) shall be liable to a Bound Party for any loss, damage or claim incurred by reason of any act or omission performed or omitted by such Covered Person in good faith on behalf of the Company and in a manner reasonably believed to be within the scope of the authority conferred on such Covered Person by this Agreement, unless there has been a final and non-appealable judgment entered by a court of competent jurisdiction determining that, in respect of the matter in question, the Covered Person engaged in fraud or intentional malfeasance.

(b)To the fullest extent permitted by applicable law, a Covered Person shall be entitled to indemnification from the Company for any loss, damage or claim incurred by such Covered Person by reason of any act or omission performed or omitted by such Covered Person in good faith on behalf of the Company and in a manner reasonably believed to be within the

scope of the authority conferred on such Covered Person by this Agreement, unless there has been a final and non-appealable judgment entered by a court of competent jurisdiction determining that, in respect of the matter in question, the Covered Person engaged in fraud or intentional malfeasance; provided, however, that any indemnity under this Section shall be provided out of and to the extent of Company assets only, and the Member shall not have any personal liability on account thereof.

(c)To the fullest extent permitted by applicable law, expenses (including reasonable legal fees) incurred by a Covered Person in defending any claim, demand, action, suit or proceeding shall, from time to time, be advanced by the Company prior to the final disposition of such claim, demand, action, suit or proceeding upon receipt by the Company of an undertaking by or on behalf of the Covered Person to repay such amount if it shall be determined that the Covered Person is not entitled to be indemnified as authorized in this Section.

(d)A Covered Person shall be fully protected in relying in good faith upon the records of the Company and upon such information, opinions, reports or statements presented to the Company by the person or entity as to matters the Covered Person reasonably believes are within such other person or entity’s professional or expert competence and who has been selected with reasonable care by or on behalf of the Company, including information, opinions, reports or statements as to the value and amount of the assets, liabilities, or any other facts pertinent to the existence and amount of assets from which distributions to the Member might properly be paid.

(e)The provisions of this Agreement, to the extent that they restrict or eliminate the duties and liabilities of a Covered Person otherwise existing at law or in equity, are agreed by the Member to replace and eliminate, as applicable, such other duties and liabilities of such Covered Person.

(f)Notwithstanding the foregoing provisions of this Section, the Company shall indemnify a Covered Person in connection with a proceeding (or part thereof) initiated by such Covered Person only if such proceeding (or part thereof) was authorized by the Member; provided, however, that a Covered Person shall be entitled to reimbursement of his or her reasonable counsel fees with respect to a proceeding (or part thereof) initiated by such Covered Person to enforce his or her right to indemnity or advancement of expenses under the provisions of this Section to the extent the Covered Person is successful on the merits in such proceeding (or part thereof).

(g)The foregoing provisions of this Section shall survive any termination of this Agreement.

(h)No amendment, modification or repeal of this Section shall have the effect of limiting or denying any rights under this Section with respect to actions taken or omitted to be taken or proceedings arising prior to any amendment, modification or repeal.

18.Transfers; Assignments. The Member may at any time transfer or assign in whole or in part its limited liability company interest in the Company. If the Member transfers or assigns any of its interest in the Company pursuant to this Section, the transferee or assignee shall be admitted to the Company, subject to Section 21, upon its execution of an instrument signifying its agreement to be bound by the terms and conditions of this Agreement, which instrument may be a counterpart signature page to this Agreement. If the Member transfers or assigns all of its interest in the Company pursuant to this Section, such admission shall be deemed effective immediately prior to the transfer or assignment, and, immediately following such admission, the transferor or assignor Member shall cease to be a member of the Company.

19.Resignation. The Member may at any time resign from the Company. If the Member resigns pursuant to this Section, an additional member shall be admitted to the Company, subject to Section 21, upon its execution of an instrument signifying its agreement to be bound by the terms and conditions of this Agreement. Such admission shall be deemed effective immediately prior to the resignation, and, immediately following such admission, the resigning Member shall cease to be a member of the Company.

20.Admission of Additional Members. One or more additional members of the Company may be admitted to the Company with the written consent of the Member and upon such terms (including with respect to participation in the management, profits, losses and distributions of the Company) as may be determined by the Member and the additional persons or entities to be admitted.

21.Dissolution.

(a)The Company shall dissolve and its affairs shall be wound up upon the first to occur of: (i) the written consent of the Member, (ii) any time there are no members of the Company, unless the Company is continued in accordance with the Act, or (iii) the entry of a decree of judicial dissolution of the Company under Section 18-802 of the Act.

(b)In the event of dissolution, the Company shall conduct only such activities as are necessary or advisable to wind up its affairs (including the sale of the assets of the Company in an orderly manner), and the assets or proceeds from the sale of the assets of the Company shall be applied in the manner, and in the order of priority, set forth in Section 18-804 of the Act.

22.Benefits of Agreement; No Third-Party Rights. The provisions of this Agreement are intended solely to benefit the Member and the Responsible Parties and Covered Persons and, to the fullest extent permitted by applicable law, shall not be construed as conferring any benefit upon any creditor of the Company (other than Covered Persons) (and no such creditor shall be a third-party beneficiary of this Agreement), and each Responsible Party shall have no duty or obligation to any creditor of the Company to make any contributions or payments to the Company.

23.Severability of Provisions. Each provision of this Agreement shall be considered severable and if for any reason any provision or provisions herein are determined to be invalid, unenforceable or illegal under any existing or future law, such invalidity, unenforceability or illegality shall not impair the operation of or affect those portions of this Agreement which are valid, enforceable and legal.

24.Entire Agreement. This Agreement constitutes the entire agreement of the Member with respect to the subject matter hereof.

25.Governing Law. This Agreement shall be governed by, and construed under, the laws of the State of Delaware (without regard to conflict of laws principles), all rights and remedies being governed by said laws.

26.Amendments. This Agreement may not be amended, modified or supplemented in any manner, whether by course of conduct or otherwise, except by an instrument in writing specifically designated as an amendment hereto, executed and delivered by the Member.

[Signature page follows.]

IN WITNESS WHEREOF, the undersigned, intending to be legally bound hereby, has duly executed this Agreement.

PATTERSON-UTI ENERGY, INC.

By: /s/ C. Andrew Smith

Name: C. Andrew Smith

Title: Executive Vice President and

Chief Financial Officer

[Signature Page to Amended and Restated Limited Liability Company Agreement of NexTier Oilfield Solutions LLC]

Cover

|

Sep. 01, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 01, 2023

|

| Entity Registrant Name |

NexTier Oilfield Solutions Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-37988

|

| Entity Tax Identification Number |

38-4016639

|

| Entity Address, Address Line One |

3990 Rogerdale Rd

|

| Entity Address, State or Province |

TX

|

| Entity Address, Postal Zip Code |

77042

|

| Entity Address, City or Town |

Houston,

|

| City Area Code |

713

|

| Local Phone Number |

325-6000

|

| Title of 12(b) Security |

Common Stock, $0.01, par value

|

| Trading Symbol |

NEX

|

| Security Exchange Name |

NYSE

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001688476

|

| Amendment Flag |

false

|

| Current Fiscal Year End Date |

--12-31

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionEnd date of current fiscal year in the format --MM-DD.

| Name: |

dei_CurrentFiscalYearEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:gMonthDayItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

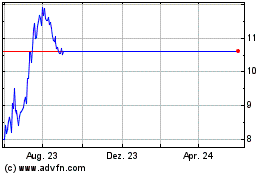

NexTier Oilfield Solutions (NYSE:NEX)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

NexTier Oilfield Solutions (NYSE:NEX)

Historical Stock Chart

Von Mai 2023 bis Mai 2024