UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A INFORMATION

Proxy

Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

|

|

|

|

|

|

|

| Check the appropriate box: |

|

|

|

|

|

|

| ☐ Preliminary Proxy Statement |

|

☐ |

|

|

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| ☒ Definitive Proxy Statement

|

|

|

|

|

|

|

| ☐ Definitive Additional Materials

|

|

|

|

|

|

|

| ☐ Soliciting Material Pursuant to

§ 240.14a-12 |

|

|

|

BlackRock Municipal Income Fund, Inc.

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if

Other than the Registrant)

|

|

|

|

|

|

|

| Payment of Filing Fee (Check the appropriate box):

|

| ☒ No fee required.

|

|

|

|

|

|

|

| ☐ Fee paid previously with preliminary materials.

|

| ☐ Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

July 25, 2024

Dear Shareholder:

A special meeting of the

shareholders of BlackRock Municipal Income Fund, Inc. (the “Fund”) will be held on Friday, September 6, 2024, at 10:00 a.m. (Eastern time) (the “Special Meeting”), to consider and vote on the proposals summarized below and

discussed in the enclosed proxy statement. The Special Meeting will be held in a virtual meeting format only. Shareholders will not have to travel to attend the meeting but will be able to view the meeting live and cast their votes by accessing a

web link.

The Fund’s Board of Directors (the “Board”) approved the conversion of the Fund from a registered closed-end management investment company listed on the New York Stock Exchange (“NYSE”) to an unlisted, continuously offered registered closed-end management

investment company that conducts quarterly repurchases of its shares pursuant to Rule 23c-3 under the Investment Company Act of 1940, as amended (the “1940 Act”) (sometimes referred to as

an “interval fund”) (the “Conversion”). In connection with the Conversion, the Board approved a number of changes to the Fund that also require shareholder approval.

The purpose of the Special Meeting is to ask shareholders of the Fund to vote on the following proposals (collectively, the “Proposals”) in

connection with the Conversion:

| |

1. |

The holders of shares of common stock (“Common Shares” and the holders thereof, “common

shareholders”) and the holders of Variable Rate Demand Preferred Shares (“VRDP Shares” and the holders thereof, “VRDP Holders”) of the Fund are being asked to vote together as a single class to approve the adoption of a

fundamental policy requiring the Fund to make quarterly offers to repurchase from shareholders between 5% and 25% of the Fund’s outstanding Common Shares at net asset value (“NAV”), pursuant to

Rule 23c-3 under the 1940 Act. |

| |

2(A). |

The common shareholders and the VRDP Holders of the Fund are being asked to vote together as a single class to approve a

change in the Fund’s fundamental investment objective. |

| |

2(B). |

The VRDP Holders of the Fund are being asked to vote as a separate class to approve the change in the Fund’s

fundamental investment objective. |

| |

3(A). |

The common shareholders and the VRDP Holders of the Fund are being asked to vote together as a single class to approve a

change in the Fund’s fundamental 80% investment policy. |

| |

3(B). |

The VRDP Holders of the Fund are being asked to vote as a separate class to approve the change in the Fund’s

fundamental 80% investment policy. |

| |

4. |

The common shareholders and the VRDP Holders of the Fund are being asked to vote together as a single class to approve an

Amended and Restated Investment Management Agreement of the Fund. |

Shareholder approval of each Proposal is contingent upon

shareholder approval of each other Proposal. Therefore, if the applicable shareholders do not approve each Proposal, then the approval of each other Proposal will be deemed null and the Conversion will not be implemented.

In addition, the Board also approved a number of other changes to the Fund in connection with the Conversion that do not require shareholder approval.

These changes include, among others, a change in the Fund’s name to “BlackRock Municipal Credit Alpha Portfolio, Inc.,” the delisting of the Fund’s Common Shares from the NYSE, the redemption of the Fund’s VRDP Shares and

the issuance of multiple classes of Common Shares. These changes are contingent upon the Fund receiving shareholder approval of each Proposal and are described in detail in the enclosed proxy statement.

The Board of the Fund unanimously recommends that you vote “FOR” each

Proposal. In connection with your vote, we urge you to read the full text of the enclosed proxy statement. Please be certain to vote by telephone or via the Internet or sign, date and return

the proxy card you receive from us.

You have received this proxy statement because you were a shareholder of record of the Fund on July

10, 2024 (the “Record Date”).

We would like to assure you of our commitment to ensuring that the Special Meeting provides

shareholders with a meaningful opportunity to participate, including the ability to ask questions of the Board and management. To support these efforts, we will:

| |

• |

|

Provide for shareholders to begin logging into the Special Meeting at 9:30 a.m. Eastern time on Friday, September 6,

2024, thirty minutes in advance of the Special Meeting. |

| |

• |

|

Permit shareholders attending the Special Meeting to submit questions via live webcast during the Special Meeting by

following the instructions |

| |

available on the meeting website during the Special Meeting. Questions relevant to Special Meeting matters will be answered during the Special Meeting, subject to time constraints.

|

| |

• |

|

Engage with and respond to shareholders who ask questions relevant to Special Meeting matters that are not answered during

the Special Meeting due to time constraints. |

| |

• |

|

Provide the ability for participating shareholders who hold Fund shares in their name to vote or revoke their prior vote at

the Special Meeting by following the instructions that will be available on the meeting website during the Special Meeting. Participating shareholders who are beneficial shareholders (that is if they hold Fund shares through a bank, broker,

financial intermediary or other nominee) will not be able to vote at the Special Meeting unless they have registered in advance to attend the Special Meeting, as described below. |

Your vote is important. Attendance at

the Special Meeting will be limited to the Fund’s shareholders as of the Record Date.

If your shares in the Fund are registered in

your name, you may attend and participate in the Special Meeting at https://meetnow.global/MXAWD5F by entering the control number found in the shaded box on your proxy card on the date and time of the Special Meeting. You may vote during the Special

Meeting by following the instructions that will be available on the meeting website during the Special Meeting.

If you are a beneficial

shareholder of the Fund (that is if you hold your shares of the Fund through a bank, broker, financial intermediary or other nominee) and want to attend the Special Meeting you must register in advance of the Special Meeting. To register, you must

submit proof of your proxy power (legal proxy) reflecting your Fund holdings along with your name and email address to Georgeson LLC, the Fund’s tabulator. You may email an image of your legal proxy to shareholdermeetings@computershare.com.

Requests for registration must be received no later than 5:00 p.m. (Eastern time) three business days prior to the meeting date. You will receive a confirmation email from Georgeson LLC (through Computershare) of your registration and a control

number and security code that will allow you to vote at the Special Meeting.

Even if you plan to attend the Special Meeting, please promptly follow

the enclosed instructions to submit your voting instructions by telephone or via the Internet. Alternatively, you may submit voting instructions by signing and dating the proxy card you receive, and if received by mail, returning it in the

accompanying postage-paid return envelope.

We encourage you to carefully review the enclosed materials, which explain these proposals in more

detail. As a shareholder, your vote is important, and we hope that you will respond today to ensure that your shares will be

represented at the Special Meeting. You may vote using one of the methods below by following the instructions on your proxy card or voting instruction form:

| |

• |

|

By touch-tone telephone; |

| |

• |

|

By signing, dating and returning the enclosed proxy card or voting instruction form in the postage-paid envelope; or

|

| |

• |

|

By participating at the Special Meeting as described above. |

If you do not vote using one of these methods, you may be called by Georgeson LLC, the Fund’s proxy solicitor, to vote your shares.

If you have any questions about the proposals to be voted on or the virtual Special Meeting, please call Georgeson LLC, the firm assisting us in the

solicitation of proxies, toll free at (866) 679-6457.

Sincerely,

Janey Ahn

Secretary of the Fund

50 Hudson Yards,

New York, NY 10001

IMPORTANT INFORMATION

FOR FUND SHAREHOLDERS

While we encourage

you to read the full text of the enclosed proxy statement, for your convenience we have provided a brief overview of some of the important questions concerning the special meeting of shareholders (the “Special Meeting”) of BlackRock

Municipal Income Fund, Inc. (the “Fund”) and the proposals to be voted on.

Questions and Answers

| Q: |

|

Why am I receiving the proxy statement? |

| A: |

|

The Fund is holding the Special Meeting to seek shareholder approval of the proposals listed below (collectively, the “Proposals”) in connection with the conversion of the Fund from a registered closed-end management investment company listed on the New York Stock Exchange (the “NYSE”) to an unlisted, continuously offered registered closed-end

management investment company operating pursuant to Rule 23c-3 under the Investment Company Act of 1940, as amended (the “1940 Act”) (sometimes referred to as an “interval fund”) (the

“Conversion”). The Board of Directors (the “Board,” the members of which are referred to as “Board Members”) of the Fund has approved the changes contemplated by the Proposals and unanimously recommends that

shareholders of the Fund vote in favor of each Proposal. |

| |

|

Proposal 1: The holders of shares of common stock (“Common Shares” and the holders thereof, “common shareholders”) and the holders of Variable Rate Demand Preferred Shares (“VRDP

Shares” and the holders thereof, “VRDP Holders”) of the Fund are being asked to vote together as a single class to approve the adoption of a fundamental policy requiring the Fund to make quarterly offers to repurchase from

shareholders between 5% and 25% of the Fund’s outstanding Common Shares at net asset value (“NAV”), pursuant to Rule 23c-3 under the 1940 Act. |

| |

|

Proposal 2(A): The common shareholders and the VRDP Holders of the Fund are being asked to vote together as a single class to approve a change in the Fund’s fundamental investment objective.

|

| |

|

Proposal 2(B): The VRDP Holders of the Fund are being asked to vote as a separate class to approve a change in the Fund’s fundamental investment objective. |

| |

|

Proposal 3(A): The common shareholders and the VRDP Holders of the Fund are being asked to vote together as a single class to approve a change in the Fund’s fundamental 80% investment policy.

|

| |

|

Proposal 3(B): The VRDP Holders of the Fund are being asked to vote as a separate class to approve a change in the Fund’s fundamental 80% investment policy. |

| |

|

Proposal 4: The common shareholders and the VRDP Holders of the Fund are being asked to vote together as a single class to approve an Amended and Restated Investment Management Agreement of the Fund.

|

| |

|

Shareholder approval of each Proposal is contingent upon shareholder approval of each other Proposal. Therefore, if the applicable shareholders do not approve each Proposal, then the approval of each other Proposal will

be deemed null and the Conversion will not be implemented. |

| |

|

The enclosed proxy statement describes the Proposals and provides you with other information relating to the Special Meeting. |

| Q: |

|

Did the Board approve any other changes to the Fund in connection with the Conversion? |

| A: |

|

The Board approved a number of other changes to the Fund in connection with the Conversion that do not require shareholder approval. These changes include, among others, a change in the Fund’s name to

“BlackRock Municipal Credit Alpha Portfolio, Inc.,” the delisting of the Fund’s Common Shares from the NYSE, the redemption of the Fund’s VRDP Shares and the issuance of multiple classes of Common Shares. The changes not

requiring shareholder approval are contingent upon the Fund receiving shareholder approval of each Proposal. Such changes are described in detail in the section of the proxy statement entitled “Overview of the Conversion—Summary of Changes

in Connection with the Conversion—Changes Not Requiring Shareholder Approval.” |

| |

|

These Questions and Answers and the enclosed proxy statement from time to time refer to the Fund as currently operated as an exchange-listed closed-end fund as “MUI” and

to the Fund as proposed to be operated as an unlisted, continuously offered interval fund as “BMCAP.” |

| Q: |

|

How will the structure of the Fund, which currently operates as an exchange-listed closed-end fund, differ following the Conversion, which will result in the Fund operating as

an unlisted, continuously offered closed-end interval fund? |

| A: |

|

Currently, in order to dispose of Fund shares, a shareholder must sell his or her Common Shares on the NYSE at market prices that may be greater than (at a premium to) or lower than (at a discount to) the Fund’s

NAV. Historically, the Fund’s shares have traded at both a premium and a discount to NAV. In comparison, shares of BMCAP will not be listed for trading on a stock exchange, and BMCAP does not expect any secondary market to develop for its

shares in the foreseeable future. To provide periodic liquidity to shareholders, BMCAP will have a fundamental policy that will require it to make quarterly offers to repurchase from shareholders between 5% and 25% of BMCAP’s outstanding Common

Shares at NAV, subject to certain conditions. Therefore, BMCAP’s mandatory repurchase offers provide shareholders with the ability to sell a portion of their BMCAP shares back directly to BMCAP at NAV on a periodic basis. Such repurchases are

referred to as “mandatory repurchases” because BMCAP will be required to conduct the repurchase offer except in certain limited circumstances. Because shareholders may only sell a portion of their BMCAP shares back directly to BMCAP on

a quarterly basis, the shares of BMCAP will not be listed for trading on any securities exchange, and a secondary market is not expected to develop for BMCAP shares, an investment in BMCAP, unlike MUI, is not a liquid investment.

|

| |

|

In addition, as an interval fund, BMCAP will rely on an exemptive order granted by the Securities and Exchange Commission (the “SEC”) to issue multiple classes of Common Shares and BMCAP may offer additional

classes of Common Shares in the future. Multiple share classes may allow BMCAP to be offered at varying minimum initial investment requirements and to a more diverse pool of investors based on certain eligibility requirements. The Fund’s Common

Shares outstanding immediately prior to the Conversion will be redesignated as Institutional Shares effective upon the Conversion. |

| Q: |

|

When is the Conversion expected to occur? |

| A: |

|

Subject to shareholders approving the Proposals, the Conversion is expected to occur prior to December 31, 2024, following the completion of a tender offer, as described below. If the applicable shareholders do not

approve each Proposal, then the approval of each other Proposal will be deemed null and the Conversion will not be implemented. |

| Q: |

|

Why is the Conversion being proposed? |

| A: |

|

BlackRock Advisors, LLC (the “Advisor”), the Fund’s investment adviser, and the Board believe that the interval fund structure of BMCAP is the optimal vehicle to take advantage of opportunities in the

illiquid high yield municipal bond market going forward. |

| |

|

In determining to approve the Conversion, the Board also considered the benefits to the Fund’s shareholders of having: (1) the ability to sell their shares at quarterly intervals at the NAV per share instead of

selling their shares on any business day in secondary market transactions at the market price, which could be lower than the NAV per share; and (2) the ability to purchase additional shares from the Fund at the NAV per share. |

| |

|

The Board also considered the Fund’s history with activist shareholders and that, based on information provided by management, interval funds historically have been less likely to be targeted by activist

shareholders than exchange-listed closed-end funds and therefore present less risk of portfolio or other disruption from activist shareholders. The Board noted that Karpus Management, Inc. (“Karpus”) had submitted its own nominees and

other shareholder proposals in connection with the Fund’s 2024 annual shareholder meeting and, under the terms of the Standstill Agreement (as defined below), Karpus agreed to withdraw these nominees and its other proposals. The Board,

therefore, noted that the Conversion and the Standstill Agreement are expected to decrease the threat of future activist investor interference. |

| Q: |

|

What are the Standstill Agreement and the Tender Offer? |

| A: |

|

On May 3, 2024, the Fund and the Advisor entered into a standstill agreement (the “Standstill Agreement”) with Karpus, pursuant to which the Fund agreed to commence a cash tender offer to repurchase 50%

of the Fund’s outstanding Common Shares at a price per share equal to 98% of the Fund’s NAV per Common Share determined following the expiration of the tender offer (the “Tender Offer”). Under the terms of the Standstill

Agreement, the Tender Offer is contingent upon the Fund obtaining all necessary approvals for the Conversion by December 31, 2024. If the necessary approvals for the Conversion are not obtained by December 31, 2024, Karpus will be entitled

in its sole discretion to extend the deadline for the Fund to obtain the approvals by up to 90 days upon written notice to the Fund. If the Fund does not obtain the necessary approvals prior to the deadline, the Fund is not required to conduct

the Tender Offer. In such event, the Fund, the Advisor and Karpus have agreed to renegotiate the terms of the Standstill Agreement in good faith. During the effective period of the Standstill Agreement, Karpus, the Fund and the Advisor agreed to be

bound by the terms of the Standstill Agreement, which include an agreement by Karpus to, among other things, abide by certain standstill covenants and vote its Common Shares on all proposals submitted to shareholders in accordance with the

recommendation of the Board, including proposals submitted at the Special Meeting related to shareholder approval of the Conversion. See “Additional Information—Standstill Agreement” in the enclosed proxy statement for additional

details regarding the Standstill Agreement. |

| |

|

If the Proposals are not approved and the Fund, the Advisor and Karpus are not able to renegotiate the terms of the Standstill Agreement, the Tender Offer and the Conversion will not be conducted and the Standstill

Agreement will terminate. |

| Q: |

|

What effect will the Conversion have on me as a shareholder? |

| A: |

|

If you hold Common Shares of MUI as of the effective date of the Conversion, you will hold Institutional Shares of BMCAP

immediately after the Conversion. Following the Conversion, |

| |

you will be subject to the terms of BMCAP and will be permitted to sell your shares only through the quarterly repurchase offers described above. |

| |

|

The principal differences between MUI and BMCAP are described in the enclosed proxy statement. |

| Q: |

|

What are the costs of the Conversion and who is responsible for paying the costs? |

| A: |

|

The costs associated with the Conversion, including the printing, distribution and proxy solicitation costs associated with the proxy statement and the Special Meeting and additional out-of-pocket costs, such as legal

expenses and auditor fees, incurred in connection with the preparation of the proxy statement, will be borne indirectly by the common shareholders of the Fund, regardless of whether the Conversion is completed. The Fund and BlackRock, Inc. have

retained Georgeson LLC (“Georgeson”), 1290 Avenue of the Americas, 9th Floor, New York, NY 10104, a proxy solicitation firm, to assist in the distribution of proxy materials and the

solicitation and tabulation of proxies. It is anticipated that Georgeson will be paid approximately $65,000 for such services (including reimbursements of out-of-pocket expenses). The total estimated expenses in connection with the Conversion,

including estimated expenses paid to Georgeson, are $469,000. The actual costs associated with the Conversion may be more or less than the estimated costs discussed herein. |

| |

|

VRDP Holders are not expected to bear any costs of the Conversion. |

| |

|

Neither the Fund nor the Advisor will pay any direct expenses of shareholders arising out of or in connection with the Conversion (e.g., expenses incurred by a shareholder as a result of attending the Special

Meeting, voting on the Conversion or other action taken by a shareholder in connection with the Conversion). |

| Q: |

|

What if I do not wish to participate in the Conversion? |

| A: |

|

The outstanding VRDP Shares are anticipated to be redeemed for cash prior to the Conversion. The Fund has filed a notice that it may redeem up to 67% of its currently outstanding VRDP Shares on one or more occasions

during the period from April 1, 2024 to October 1, 2024. Any such redemption would be made separately from the redemption of the Fund’s VRDP Shares in connection with the Conversion. |

| |

|

Common shareholders that do not wish to hold shares of BMCAP following the Conversion may sell their Common Shares in the normal course on the NYSE prior to the Conversion. You will incur any fees (e.g., brokerage) and

may incur taxable gain or loss based on difference between your tax basis in the shares and the amount you receive for them. |

| |

|

In addition, prior to the Conversion, common shareholders may tender their Common Shares for purchase by the Fund in the Tender Offer. If the Tender Offer is oversubscribed, the number of Common Shares purchased from

each common shareholder may be prorated, with the result that common shareholders may only be able to have a portion of their Common Shares repurchased. Common shareholders can sell any remaining Common Shares in the normal course on the NYSE for a

period of time prior to the Conversion, however, any such sale may be at a market price that is lower than (at a discount to) the Fund’s NAV. |

| Q: |

|

How will the Fund’s investment objectives, principal investment strategies and risks change following the Conversion? |

| A: |

|

BMCAP will have a different investment objective than MUI. The current investment objective of MUI is to seek to provide

common shareholders with high current income exempt from |

| |

federal income taxes. The Board approved, and has recommended that shareholders of the Fund approve, changing the Fund’s investment objective to seek to provide attractive after-tax total return, through income and capital appreciation. |

| |

|

BMCAP will follow similar investment strategies and will be subject to similar risks as MUI. Like MUI, BMCAP will invest at least 80% of its investments in municipal securities that pay interest that is exempt from U.S.

federal income taxes. However, while MUI invests at least 75% of its assets in investment grade municipal securities, BMCAP will invest at least 75% of its assets in municipal securities that are rated in the medium to lower categories by nationally

recognized rating services and will have no limit on its investments in below investment grade municipal securities (sometimes referred to a “high yield” or “junk bonds”). Although junk bonds generally pay higher rates of

interest than investment grade bonds, junk bonds are high risk investments that are considered speculative and may cause income and principal losses for BMCAP. |

| |

|

The differences in investment objectives and the principal investment strategies of MUI and BMCAP are more fully described in the enclosed proxy statement. Additional principal risks applicable to BMCAP that are not

applicable to MUI, which are set forth in the enclosed proxy statement, are related to BMCAP’s operation as an interval fund and the need to satisfy quarterly repurchase requests. |

| Q: |

|

How will the Fund’s Investment Management Agreement with the Advisor and the management fee change following the Conversion? |

| A: |

|

At the Special Meeting, shareholders of the Fund will be asked to approve an Amended and Restated Investment Management Agreement between the Advisor and the Fund (the “Amended Investment Management

Agreement”) to account for changes related to the Conversion. The terms of the Amended Investment Management Agreement are identical to those of the current Investment Management Agreement between the Advisor and the Fund (the “Current

Investment Management Agreement”), except that, under the Amended Investment Management Agreement, the Advisor’s management fee will be a monthly fee in an amount equal to 0.90% of the Fund’s net assets, rather than a monthly fee in

an amount equal to 0.55% of the Fund’s Managed Assets (as defined below). ”Managed Assets” means the sum of (i) the average daily value of the Fund’s Net Assets and (ii) the proceeds of any outstanding debt securities and

borrowings used for leverage. “Net Assets” means the total assets of the Fund minus the sum of its accrued liabilities. The liquidation preference of the VRDP Shares and any other outstanding preferred stock (other than accumulated

dividends) is not considered a liability in determining the Fund’s Net Assets. |

| |

|

MUI’s management fee is based on the Fund’s total assets, including assets attributable to leverage, and is therefore charged on a larger asset base to the extent that MUI uses leverage, which it has done

historically. As of January 31, 2024, MUI’s Managed Assets were $1,575,370,452, with leverage representing 39% of Managed Assets, and its net assets were $962,180,577. For the twelve months ended January 31, 2024, MUI’s effective

management fee rate was 0.93% (calculated as a percentage of net assets). Conversely, BMCAP’s management fee will not include assets attributable to leverage. As a result, BMCAP’s contractual management fee is lower than MUI’s

effective management fee rate (calculated as a percentage of net assets as of January 31, 2024). However, the Fund’s leverage levels are subject to change and BMCAP’s management fee rate may be higher or lower as compared to

MUI’s effective management fee rate (calculated as a percentage of net assets). Based on BMCAP’s anticipated use of leverage in the near term following the Conversion, BMCAP’s management fee rate is anticipated to be lower as

compared to MUI’s current effective management fee rate (calculated as a percentage of net assets). |

| |

|

The terms of Amended Investment Management Agreement and the basis for the Board approval of the Amended Investment Management Agreement are discussed in the section of the enclosed proxy statement entitled

“Proposal 4—Approval of the Amended and Restated Investment Management Agreement.” |

| Q: |

|

How will the Fund’s expenses change following the Conversion? |

| A: |

|

The total expense ratio of BMCAP’s Institutional Shares is estimated to be lower than MUI’s total expense ratio for the twelve months ended January 31, 2024, with and without reflecting the effect of the

Tender Offer. Holders of Common Shares immediately prior to the Conversion are expected to experience a reduction in their total expenses if the Conversion and Tender Offer are completed. |

| |

|

Set out below is comparison of the total expenses of MUI for the twelve months ended January 31, 2024 and the estimated total expenses of BMCAP’s Institutional Shares without reflecting the effect of the

Tender Offer, as well as the estimated total expenses on a pro forma basis of BMCAP’s Institutional Shares assuming the Tender Offer is fully subscribed and completed (in each case, both including and excluding interest expense). If the

Tender Offer is fully subscribed and completed, the Fund will repurchase 50% of its outstanding Common Shares, thereby reducing the Fund’s net assets by 50%, prior to the effective date of the Conversion. The Fund will repurchase less than 50%

of its outstanding Common Shares in the Tender Offer if the Tender Offer is not fully subscribed, in which case BMCAP’s expenses are estimated to be lower than those set forth in the pro forma column. |

| |

|

Total Expense Ratios Including Interest Expense |

|

|

|

|

|

| MUI Common

Shares |

|

BMCAP Institutional Shares (without

reflecting the effect of the Tender

Offer) |

|

Pro Forma BMCAP Institutional

Shares (assuming the Tender Offer

is fully

subscribed and completed) |

| 3.90% |

|

1.20% |

|

1.23% |

| |

|

Total Expense Ratios Excluding Interest Expense |

|

|

|

|

|

| MUI Common

Shares |

|

BMCAP Institutional Shares (without

reflecting the effect of the Tender

Offer) |

|

Pro Forma BMCAP Institutional

Shares (assuming the Tender Offer

is fully

subscribed and completed) |

| 1.04% |

|

0.97% |

|

1.00% |

| |

|

A detailed comparison of the expenses of MUI’s Common Shares and BMCAP’s Institutional Shares (with and without reflecting the effect of the Tender Offer) is included in the enclosed proxy statement.

|

| Q: |

|

Will there be any changes to the investment adviser and other service providers or portfolio managers of the Fund following the Conversion? |

| A: |

|

BlackRock Advisors, LLC will continue to be the Fund’s investment adviser, and the current portfolio managers of the Fund will continue to serve as the portfolio managers following the Conversion.

|

| |

|

The Board approved a change in the Fund’s transfer agent and dividend reinvestment plan agent from Computershare Trust Company, N.A. to BNY Mellon Investment Servicing (U.S.) Inc. and the appointment of BlackRock

Investments, LLC as the distributor of BMCAP’s Common Shares. Apart from these changes, there will be no other changes to the Fund’s service providers, which are set out in the enclosed proxy statement. |

| Q: |

|

Will there be any tax consequences to me resulting from the Conversion? |

| A: |

|

The Conversion will not be a taxable transaction. If you sell your shares on the secondary market prior to the Conversion, or if you tender your shares in the Tender Offer, the exchange of shares for cash will generally

be subject to U.S. federal income tax. Additionally, the sale of your shares in the Tender Offer may be treated as a dividend rather than a sale or exchange if your percentage ownership in the Fund is not reduced sufficiently. You may also receive

additional taxable capital gain distributions from the Fund due to its recognition of gains from selling portfolio securities to pay for tendered shares in the Tender Offer and/or the redemption of the Fund’s VRDP Shares. Following the

Conversion, the Fund intends to continue to qualify for treatment as a regulated investment company for U.S. federal income tax purposes. |

| Q: |

|

When and where will the Special Meeting be held? |

| A: |

|

The Special Meeting will be held on Friday, September 6, 2024, at 10:00 a.m. (Eastern time). The meeting will be held in a virtual meeting format only. Shareholders will not have to travel to attend the meeting but will

be able to view the meeting live and cast their votes by accessing a web link. |

| Q: |

|

How do I vote my shares? |

| A: |

|

You can provide voting instructions by telephone, by calling the toll-free number on the proxy card, or by going to the Internet address provided on the proxy card and following the instructions. If you vote by

telephone or via the Internet, you will be asked to enter a unique code that has been assigned to you, which is printed on your proxy card. This code is designed to confirm your identity, provide access to the voting website and confirm that your

voting instructions are properly recorded. Alternatively, if you received your proxy card by mail, you can vote your shares by signing and dating the proxy card and mailing it in the enclosed postage-paid envelope. |

| |

|

You may also vote at the meeting; however, even if you plan to attend the virtual meeting, we still encourage you to provide voting instructions by one of the methods discussed above. In addition, we ask that you please

note the following: |

| |

|

If your shares in the Fund are registered in your name, you may attend and participate in the meeting at https://meetnow.global/MXAWD5F by entering the control number found in the shaded box on your proxy card on the

date and time of the meeting. You may vote during the meeting by following the instructions that will be available on the meeting website during the meeting. |

| |

|

Also, if you are a beneficial shareholder of the Fund, you will not be able to vote at the virtual meeting unless you have registered in advance to attend the meeting. To register, you must submit proof of your proxy

power (legal proxy) reflecting your Fund holdings along with your name and email address to Georgeson, the Fund’s tabulator. You may email an image of your legal proxy to shareholdermeetings@computershare.com. Requests for

registration must be received no later than 5:00 p.m. (Eastern time) three business days prior to the meeting date. You will receive a confirmation email from Georgeson (through Computershare) of your registration and a control number and security

code that will allow you to vote at the meeting. |

| |

|

Even if you plan to attend the Special Meeting, please promptly follow the enclosed instructions to submit your voting instructions by telephone or via the Internet. Alternatively, you may submit voting instructions by

signing and dating the proxy card you receive, and if received by mail, returning it in the accompanying postage-paid return envelope. |

| Q: |

|

Whom do I call if I have questions? |

| A: |

|

If you need more information, or have any questions about voting, please call Georgeson, the Fund’s proxy solicitor, toll free at (866) 679-6457. |

Please vote now. Your vote is important.

To avoid the wasteful and unnecessary expense of further solicitation and no matter how large or small your

holdings may be, we urge you to indicate your voting instructions on the enclosed proxy card, and if received by mail, date and sign it and return it promptly in the postage-paid envelope provided, or record your voting instructions by telephone or

via the Internet. If you submit a properly executed proxy card but do not indicate how you wish your shares to be voted, your shares will be voted “FOR” the proposals in the enclosed proxy statement. If your shares of the Fund are

held through a broker, you must provide voting instructions to your broker about how to vote your shares in order for your broker to vote your shares as you instruct at the meeting.

July 25, 2024

NOTICE OF SPECIAL MEETING OF SHAREHOLDERS

TO BE HELD ON SEPTEMBER 6, 2024

To the

Shareholders:

A Special Meeting of the Shareholders of BlackRock Municipal Income Fund, Inc. (NYSE Ticker: MUI) (the “Fund”) will be

held on Friday, September 6, 2024, at 10:00 a.m. (Eastern time), to consider and vote on the following proposals (the “Special Meeting”), as more fully discussed in the accompanying proxy statement. The Special Meeting will be held in

a virtual meeting format only. Shareholders will not have to travel to attend the Special Meeting but will be able to view the Special Meeting live and cast their votes by accessing a web link.

| |

PROPOSAL 1. |

The holders of shares of common stock (“Common Shares” and the holders thereof, “common

shareholders”) and the holders of Variable Rate Demand Preferred Shares (“VRDP Shares” and the holders thereof, “VRDP Holders”) of the Fund are being asked to vote together as a single class to approve the adoption of a

fundamental policy requiring the Fund make quarterly offers to repurchase from shareholders between 5% and 25% of the Fund’s outstanding Common Shares at net asset value (“NAV”), pursuant to Rule

23c-3 under the 1940 Act. |

| |

PROPOSAL 2(A). |

The common shareholders and VRDP Holders of the Fund are being asked to vote together as a single class to approve a

change in the Fund’s fundamental investment objective. |

| |

PROPOSAL 2(B). |

The VRDP Holders of the Fund are being asked to vote as a separate class to approve the change in the Fund’s

fundamental investment objective. |

| |

PROPOSAL 3(A). |

The common shareholders and VRDP Holders of the Fund are being asked to vote together as a single class to approve a

change in the Fund’s fundamental 80% investment policy. |

| |

PROPOSAL 3(B). |

The VRDP Holders of the Fund are being asked to vote as a separate class to approve the change in the Fund’s

fundamental 80% investment policy. |

| |

PROPOSAL 4. |

The common shareholders and VRDP Holders of the Fund are being asked to vote together as a single class to approve an

Amended and Restated Investment Management Agreement of the Fund. |

The purpose of the Special Meeting is to seek shareholder

approval of the above-listed proposals in connection with the conversion of the Fund from a registered closed-end management investment company listed on the New York Stock Exchange (“NYSE”) to an

unlisted, continuously offered registered closed-end management investment company operating as an “interval fund” pursuant to Rule 23c-3 under the Investment

Company Act of 1940, as amended (the “Conversion”).

Shareholder approval of each Proposal is contingent upon shareholder approval of each

other Proposal. Therefore, if the applicable shareholders do not approve each Proposal, then the approval of each other Proposal will be deemed null and the Conversion will not be implemented.

Your Board unanimously recommends that you vote “FOR” each Proposal with respect to which you are being asked to vote.

Shareholders of record of the Fund as of the close of business on July 10, 2024 (the “Record Date”) are entitled to vote at the Special

Meeting and at any adjournments, postponements or delays thereof.

Please be certain to vote by telephone or via the Internet or sign, date and

return each proxy card you receive from us.

If you have any questions about the Proposals to be voted on or the virtual Meeting, please call

Georgeson LLC, the firm assisting us in the solicitation of proxies, toll free at (866) 679-6457.

By Order

of the Board,

Janey Ahn

Secretary of

the Fund

50 Hudson Yards,

New

York, NY 10001

TABLE OF CONTENTS

SPECIAL MEETING OF SHAREHOLDERS

SEPTEMBER 6, 2024

PROXY STATEMENT

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of

Directors (the “Board,” the members of which are referred to as “Board Members”) of BlackRock Municipal Income Fund, Inc. (the “Fund”). The proxies will be voted at the special meeting (the “Special Meeting”)

of shareholders of the Fund and at any and all adjournments, postponements or delays thereof. The Special Meeting will be held on Friday, September 6, 2024, at 10:00 a.m. (Eastern time). The Special Meeting will be held in a virtual meeting

format only. Shareholders will not have to travel to attend the Special Meeting, but will be able to view the meeting live, have a meaningful opportunity to participate, including the ability to ask questions of management, and cast their votes by

accessing a web link.

The purpose of the Meeting is to seek shareholder approval of following proposals in connection with the conversion of

the Fund from a registered closed-end management investment company listed on the New York Stock Exchange (“NYSE”) to an unlisted, continuously offered registered

closed-end management investment company operating as an “interval fund” pursuant to Rule 23c-3 under the Investment Company Act of 1940, as amended (the

“Conversion”).

|

|

|

| PROPOSAL 1. |

|

The holders of shares of common stock (“Common Shares” and the holders thereof, “common shareholders”) and the holders of Variable Rate Demand Preferred Shares (“VRDP Shares” and the holders thereof,

“VRDP Holders”) of the Fund are being asked to vote together as a single class to approve the adoption of a fundamental policy requiring the Fund to make quarterly offers to repurchase from shareholders between 5% and 25% of the

Fund’s outstanding Common Shares at net asset value (“NAV”), pursuant to Rule 23c-3 under the Investment Company Act of 1940, as amended (the “1940 Act”). |

|

|

| PROPOSAL 2(A). |

|

The common shareholders and VRDP Holders of the Fund are being asked to vote together as a single class to approve a change in the Fund’s fundamental investment objective. |

|

|

| PROPOSAL 2(B). |

|

The VRDP Holders of the Fund are being asked to vote as a separate class to approve the change in the Fund’s fundamental investment objective. |

|

|

| PROPOSAL 3(A). |

|

The common shareholders and VRDP Holders of the Fund are being asked to vote together as a single class to approve a change in the Fund’s fundamental 80% investment policy. |

|

|

| PROPOSAL 3(B). |

|

The VRDP Holders of the Fund are being asked to vote as a separate class to approve the change in the Fund’s fundamental 80% investment policy. |

|

|

| PROPOSAL 4. |

|

The common shareholders and VRDP Holders of the Fund are being asked to vote together as a single class to approve an Amended and Restated Investment Management Agreement of the Fund. |

1

Shareholder approval of each Proposal is contingent upon shareholder approval of each other Proposal.

Therefore, if the applicable shareholders do not approve each Proposal, then the approval of each other Proposal will be deemed null and the Conversion will not be implemented.

Distribution to shareholders of this Proxy Statement and the accompanying materials will commence on or about July 25, 2024.

The Fund is organized as a Maryland corporation. The Fund is a closed-end management investment company

registered under the 1940 Act. The Fund’s Common Shares are listed on the NYSE under the symbol “MUI.” The Fund’s VRDP Shares are not listed on any exchange and have not been registered under the Securities Act of 1933, as

amended, or any state securities laws.

Shareholders of record of the Fund as of the close of business on July 10, 2024 (the “Record

Date”) are entitled to notice of and to vote at the Special Meeting and at any and all adjournments, postponements or delays thereof. Shareholders of the Fund are entitled to one vote for each share held, with no shares having cumulative voting

rights. The VRDP Holders of the Fund will have equal voting rights with the holders of Common Shares. The holders of Common Shares and the VRDP Holders will vote together as a single class on Proposal 1, Proposal 2(A), Proposal 3(A) and Proposal 4.

In addition, the VRDP Holders will vote as a separate class on Proposal 2(B) and Proposal 3(B). The quorum and voting requirements for the Fund are described in the section herein entitled “Vote Required and Manner of Voting Proxies.”

The number of Common Shares outstanding as of the close of business on the Record Date, the number of Preferred Shares of the Fund outstanding as of

the close of business on the Record Date, and the managed assets of the Fund on the Record Date are 71,992,145 Common Shares, 5,617 Preferred Shares and $1,560,206,349.87, respectively. “Managed assets” means the total assets of the Fund

minus its accrued liabilities (other than aggregate indebtedness constituting financial leverage).

Even if you plan to attend the Special

Meeting, please sign, date and return the proxy card you receive or, if you provide voting instructions by telephone or via the Internet, please vote on the proposals affecting the Fund. If you vote by telephone or via the Internet, you will be

asked to enter a unique code that has been assigned to you, which is printed on your proxy card. This code is designed to confirm your identity, provide access to the voting website and confirm that your voting instructions are properly recorded.

All properly executed proxies received prior to the Special Meeting will be voted at the Special Meeting and at any and all adjournments,

postponements or delays thereof. On any matter coming before the Special Meeting as to which a shareholder has specified a choice on that shareholder’s proxy, the shares will be voted accordingly. If a proxy card is properly executed and

returned and no choice is specified with respect to the Proposals, the shares will be voted “FOR” the Proposals. Shareholders who execute proxies or provide voting instructions by telephone or via the Internet may revoke them

with respect to the Proposals at any time before a vote is taken on the Proposals by filing with the Fund a written notice of revocation (addressed to the Secretary of the Fund at the principal executive offices of the Fund at the New York address

provided herein), by delivering a duly executed proxy bearing a later date, or by attending the virtual Special Meeting and voting at the Special Meeting, in all cases prior to the exercise of the authority granted in the proxy card. Merely

attending the Special Meeting, however, will not revoke any previously executed proxy. If you hold shares through a bank, broker or other intermediary, please consult your bank, broker or intermediary regarding your ability to revoke voting

instructions after such instructions have been provided.

2

If your shares in the Fund are registered in your name, you may attend and participate in the

Special Meeting at https://meetnow.global/MXAWD5F by entering the control number found in the shaded box on your proxy card on the date and time of the Special Meeting. You may vote during the Special Meeting by following the instructions that will

be available on the Special Meeting website during the Special Meeting. If you are a beneficial shareholder of the Fund (that is if you hold your shares of the Fund through a bank, broker, financial intermediary or other nominee) you will not be

able to vote at the virtual Special Meeting unless you have registered in advance to attend the Special Meeting. To register, you must submit proof of your proxy power (legal proxy) reflecting your Fund holdings along with your name and email

address to Georgeson LLC (“Georgeson”), the Fund’s tabulator. You may email an image of your legal proxy to shareholdermeetings@computershare.com. Requests for registration must be received no later than 5:00 p.m. (Eastern time) three

business days prior to the Special Meeting date. You will receive a confirmation email from Georgeson (through Computershare) of your registration and a control number and security code that will allow you to vote at the Special Meeting. Even if you

plan to participate in the virtual Special Meeting, please promptly follow the enclosed instructions to submit voting instructions by telephone or via the Internet. Alternatively, you may submit voting instructions by signing and dating the proxy

card and voting instruction form you receive, and returning it in the accompanying postage-paid return envelope.

The Fund will furnish,

without charge, a copy of its annual report and most recent semi-annual report succeeding the annual report, if any, to a shareholder upon request. Such requests should be directed to the Fund at 50 Hudson Yards, New York, NY 10001, or by calling

toll free at 1-800-882-0052. Copies of annual and semi-annual reports of the Fund are also available on the EDGAR Database on the

U.S. Securities and Exchange Commission’s website at www.sec.gov.

BlackRock, Inc. (“BlackRock”) will update performance and

certain other data for the Fund on a monthly basis on its website in the “Closed-End Funds” section of http://www.blackrock.com as well as certain other material information as

necessary from time to time. Investors and others are advised to check the website for updated performance information and the release of other material information about the Fund. This reference to BlackRock’s website is intended to allow

investors public access to information regarding the Fund and does not, and is not intended to, incorporate BlackRock’s website in this Proxy Statement.

Please note that only one annual or semi-annual report or this Proxy Statement may be delivered to two or more shareholders of the Fund who share an

address, unless the Fund has received instructions to the contrary. To request a separate copy of an annual report or semi-annual report or this Proxy Statement, or for instructions on how to request a separate copy of these documents or as to how

to request a single copy if multiple copies of these documents are received, shareholders should contact the Fund at the New York address and phone number provided above.

Please vote now. Your vote is important.

To avoid the wasteful and unnecessary expense of further solicitation and no matter how large or small your

holdings may be, we urge you to indicate your voting instructions on the enclosed proxy card, and if received by mail, date and sign it and return it promptly in the postage-paid envelope provided, or record your voting instructions by telephone or

via the Internet. If you submit a properly executed proxy card but do not indicate how you wish your shares to be voted, your shares will be voted “FOR” each Proposal. If your shares of the Fund are held through a broker, you must

provide voting instructions to your broker about how to vote your shares in order for your broker to vote your shares as you instruct at the Special Meeting.

3

YOUR VOTE IS IMPORTANT.

PLEASE VOTE PROMPTLY BY SIGNING AND RETURNING THE

ENCLOSED PROXY CARD/VOTING INSTRUCTION FORM OR BY RECORDING YOUR

VOTING INSTRUCTIONS BY TELEPHONE OR VIA THE INTERNET, NO MATTER HOW

MANY SHARES YOU OWN.

IMPORTANT NOTICE

REGARDING THE AVAILABILITY OF PROXY MATERIALS FOR

THE SPECIAL MEETING OF SHAREHOLDERS TO BE HELD ON FRIDAY, SEPTEMBER 6, 2024.

THE PROXY STATEMENT FOR THIS MEETING IS AVAILABLE AT:

https://www.proxy-direct.com/blk-34046

4

OVERVIEW OF THE CONVERSION

This Proxy Statement from time to time refers to the Fund as currently operated as a listed closed-end fund as

“MUI” and to the Fund as proposed to be operated as an unlisted, continuously offered interval fund as “BMCAP.”

Background

Interval Fund Conversion

If each Proposal is approved by

shareholders, the Fund will convert from a registered closed-end management investment company listed on the New York Stock Exchange (“NYSE”) to an unlisted, continuously offered registered closed-end management investment company that

conducts periodic repurchases of its shares pursuant to Rule 23c-3 under the 1940 Act (sometimes referred to as an “interval fund”) (the “Conversion”) after conducting the Tender Offer (as defined below). Prior to the

effective date of the Conversion, the Fund will delist from the NYSE and will also take other actions in anticipation of the Conversion, including the redemption of the Fund’s outstanding VRDP Shares.

Effective upon the Conversion, the Fund will be renamed BlackRock Municipal Credit Alpha Portfolio, Inc. (“BMCAP”) and will operate as an

unlisted, continuously offered interval fund pursuant to Rule 23c-3 under the 1940 Act. BlackRock Advisors, LLC (the “Advisor”) will continue to be the Fund’s investment adviser, and the current portfolio managers of the Fund

will continue to serve as the portfolio managers.

BMCAP will have a different investment objective than MUI, and will follow similar investment

strategies and will be subject to similar risks as MUI. Like MUI, BMCAP will invest at least 80% of its investments in municipal securities that pay interest that is exempt from U.S. federal income taxes. However, while MUI invests at least 75% of

its assets in investment grade municipal securities, BMCAP will invest at least 75% of its assets in municipal securities that are rated in the medium to lower categories by nationally recognized rating services and will have no limit on its

investments in below investment grade municipal securities (sometimes referred to a “high yield” or “junk bonds”). Although junk bonds generally pay higher rates of interest than investment grade bonds, junk bonds are high risk

investments that are considered speculative and may cause income and principal losses for BMCAP. A comparison of the investment objective and principal investment strategies of each of MUI and BMCAP is set out in Appendix A. Additional

principal risks applicable to BMCAP that are not applicable to MUI, which are set forth in Appendix B, are related to BMCAP’s operation as an interval fund and the need to satisfy quarterly repurchase requests. The Advisor and the Board

believe that the interval fund structure of BMCAP is the optimal vehicle to take advantage of opportunities in the illiquid high yield municipal bond market going forward.

BMCAP may offer additional classes of Common Shares in the future. Multiple share classes would allow BMCAP to be offered at varying minimum initial

investment requirements and to a more diverse pool of investors based on their eligibility. The Fund’s Common Shares outstanding immediately prior to the Conversion will be redesignated as Institutional Shares effective upon the Conversion.

Accordingly, current shareholders of the Fund who do not dispose of their Common Shares prior to the Conversion through the Tender Offer and/or sales on the NYSE will hold Institutional Shares of BMCAP following the Conversion.

If shareholders approve the Proposals and the Conversion is implemented, the interval fund structure of BMCAP, which requires BMCAP to commit to

mandatory quarterly repurchase offers pursuant to Rule 23c-3 under the 1940 Act, will offer the benefits of a closed-end vehicle that will enable shareholders to pursue similar principal investment strategies without the risk that

5

shareholders might have to sell their Common Shares at a discount to the Fund’s net asset value (“NAV”) in order to exit their investment in the Fund. Currently, in order to

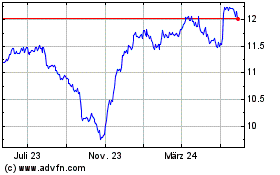

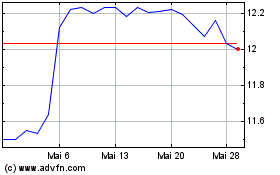

dispose of Fund Common Shares, a shareholder must sell his or her Common Shares on the NYSE at market prices that may be greater than (at a premium to) or lower than (at a discount to) the Fund’s NAV. Historically, the Fund’s Common Shares

have traded at both a premium and a discount to NAV. In comparison, Common Shares of BMCAP will not be listed for trading on a stock exchange, and BMCAP does not expect any secondary market to develop for its Common Shares in the foreseeable

future. To provide periodic liquidity to shareholders, BMCAP will have a fundamental policy that will require it to make quarterly offers to repurchase from shareholders between 5% and 25% of BMCAP’s outstanding Common Shares at NAV,

subject to certain conditions. Therefore, BMCAP’s mandatory repurchase offers provide shareholders with the ability to sell a portion of their BMCAP shares back directly to BMCAP at NAV on a periodic basis. Such repurchases are

referred to as “mandatory repurchases” because BMCAP will be required to conduct the repurchase offer unless except in certain limited circumstances.

In addition, current MUI shareholders who hold Institutional Shares following the Conversion are expected to experience a reduction in the total

expense ratio paid by shareholders in light of BMCAP’s lower estimated use of leverage, among other factors. The Conversion also has the potential to expand the Fund’s presence in distribution channels as a continuously offered

interval fund, which could increase the Fund’s asset base. If the Fund’s assets increase due to the potential enhanced distribution opportunities, investors in the Fund may benefit from potential long-term economies of scale,

including reduced expenses.

The Conversion will not be a taxable transaction. If you sell your shares on the secondary market prior to the

Conversion, or if you tender your shares in the Tender Offer, the exchange of shares for cash will generally be subject to U.S. federal income tax. Additionally, the sale of your shares in the Tender Offer may be treated as a dividend rather than a

sale or exchange if your percentage ownership in the Fund is not reduced sufficiently. You may also receive additional taxable capital gain distributions from the Fund due to its recognition of gains from selling portfolio securities to pay for

tendered shares in the Tender Offer and/or the redemption of the Fund’s VRDP Shares. Following the Conversion, the Fund intends to continue to qualify for treatment as a regulated investment company for U.S. federal income tax purposes.

The costs associated with the Conversion, including the printing, distribution and proxy solicitation costs associated with the proxy statement and

the Special Meeting and additional out-of-pocket costs, such as legal expenses and auditor fees, incurred in connection with the preparation of the proxy statement, will be borne indirectly by the common shareholders of the Fund, regardless of

whether the Conversion is completed. The Fund and BlackRock, Inc. have retained Georgeson LLC (“Georgeson”), 1290 Avenue of the Americas, 9th Floor, New York, NY 10104, a proxy

solicitation firm, to assist in the distribution of proxy materials and the solicitation and tabulation of proxies. It is anticipated that Georgeson will be paid approximately $65,000 for such services (including reimbursements of out-of-pocket

expenses). The total estimated expenses in connection with the Conversion, including estimated expenses paid to Georgeson, are $469,000. The actual costs associated with the Conversion may be more or less than the estimated costs discussed herein.

Standstill Agreement and Tender Offer

On May 3,

2024, the Fund and the Advisor entered into a standstill agreement (the “Standstill Agreement”) with Karpus Management, Inc. (“Karpus”), pursuant to which the Fund agreed to commence a cash tender offer to repurchase 50% of the

Fund’s outstanding Common Shares at a price per share equal to 98% of the Fund’s NAV per Common Share determined following the

6

expiration of the tender offer (the “Tender Offer”). Under the terms of the Standstill Agreement, the Tender Offer is contingent upon the Fund obtaining all necessary approvals for the

Conversion by December 31, 2024. If the necessary approvals for the Conversion are not obtained by December 31, 2024, Karpus will be entitled in its sole discretion to extend the deadline for the Fund to obtain the approvals by up to 90 days

upon written notice to the Fund. If the Fund does not obtain the necessary approvals prior to the deadline, the Fund is not required to conduct the Tender Offer. In such event, the Fund, the Advisor and Karpus have agreed to renegotiate the terms of

the Standstill Agreement in good faith. During the effective period of the Standstill Agreement, Karpus, the Fund and the Advisor agreed to be bound by the terms of the Standstill Agreement, which include an agreement by Karpus to, among other

things, abide by certain standstill covenants and vote its Common Shares on all proposals submitted to shareholders in accordance with the recommendation of the Board, including proposals submitted at the Special Meeting related to shareholder

approval of the Conversion. See “Additional Information—Standstill Agreement” for additional details regarding the Standstill Agreement.

Pursuant to the Standstill Agreement, if each Proposal is approved by the Fund’s shareholders, the Fund will conduct the Tender Offer for 50% of

the Fund’s outstanding Common Shares, which will provide shareholders with the opportunity to sell their Common Shares at 98% of NAV, prior to the Conversion. If the Tender Offer is oversubscribed, the number of Common Shares purchased from

each shareholder may be prorated, with the result that shareholders may only be able to have a portion of their Common Shares repurchased. However, current MUI shareholders seeking to exit the Fund prior to the Conversion will be able to sell their

remaining MUI Common Shares on the NYSE prior to the effective date of the Conversion.

If the Proposals are not approved and the Fund, the

Advisor and Karpus are not able to renegotiate the terms of the Standstill Agreement, the Tender Offer and the Conversion will not be conducted and the Standstill Agreement will terminate.

Board Considerations

The Board met on May 3, 2024

to review and consider the Conversion, the Standstill Agreement and the Tender Offer and subsequently on June 6-7, 2024 to further review and consider the Conversion. The Board Members who are not

“interested persons” of the Fund, as that term is defined in the 1940 Act (the “Independent Board Members”), were advised on this matter by independent counsel to the Independent Board Members. The Board, including the

Independent Board Members, received written materials from the Advisor containing relevant information about the Standstill Agreement, the Tender Offer and the Conversion, including, among other information, a description of the key terms of the

Standstill Agreement and negotiations with Karpus, a description of the benefits and considerations for the Fund and its shareholders in connection with the Tender Offer and the Conversion, as well as the Fund’s proposed operation as an

interval fund, and fee and expense information on an actual and pro forma basis.

The Board reviewed detailed comparative information

on the following topics with respect to the Fund, as currently structured, and the proposed interval fund: (1) investment objectives and policies; (2) portfolio management and liquidity requirements; (3) portfolio composition;

(4) current expense ratios and expense structures, including contractual investment advisory fees; (5) the expected tax implications of the Conversion to the Fund and shareholders; and (6) the differences in operation between an

exchange-listed closed-end fund like the Fund and an interval fund like BMCAP.

7

The Board also considered the benefits to the Fund’s shareholders of having: (1) the ability to

sell their shares at quarterly intervals at the NAV per share instead of selling their shares on any business day in secondary market transactions at the market price, which could be lower than the NAV per share; and (2) the ability to purchase

additional shares from the Fund at the NAV per share.

The Board also considered the Fund’s history with activist shareholders and that,

based on information provided by management, interval funds historically have been less likely to be targeted by activist shareholders than exchange-listed closed-end funds and therefore present less risk of

portfolio or other disruption from activist shareholders. The Board noted that Karpus had submitted its own nominees and other shareholder proposals in connection with the Fund’s 2024 annual shareholder meeting and, under the terms of the

Standstill Agreement, Karpus agreed to withdraw these nominees and its other proposals. The Board, therefore, noted that the Conversion and the Standstill Agreement are expected to decrease the threat of future activist investor interference.

In its evaluation of the Conversion, the Board also considered certain potential adverse effects, including, but not limited to: (1) the

significant solicitation efforts and costs associated with obtaining shareholder approval for the Conversion; (2) the change in liquidity profile of the Fund from daily liquidity at market price to limited quarterly liquidity at NAV; and (3) the

potential impact of suitability standards associated with implementing multiple share classes.

Based upon the information received by the Board,

including the information and considerations described above but without identifying any single factor as all-important or controlling, the Board concluded that the Fund should enter into the Standstill

Agreement, and take steps necessary to effect the Tender Offer and the Conversion. The Board approved the Standstill Agreement and the Tender Offer at the meeting held on May 3, 2024, and approved the changes in connection with the Conversion

at the meeting held on June 6-7, 2024.

Summary of Changes in Connection with the Conversion

The Board approved a number of changes to the Fund in connection with the Conversion, which are summarized below.

Changes Requiring Shareholder Approval

The following

changes approved by the Board in connection with the Conversion also require shareholder approval, as described in more detail in this Proxy Statement:

| |

• |

|

Adoption of Fundamental Policy to Conduct Quarterly Offers to Repurchase from Shareholders Between 5% and 25% of

Outstanding Shares at NAV (Proposal 1). In order to operate as an interval fund, the Fund must adopt a fundamental policy to make periodic offers to repurchase between 5% and 25% of its outstanding shares at NAV pursuant to Rule 23c-3 under the 1940 Act, subject to shareholder approval of such fundamental policy. A “fundamental” policy is a policy of the Fund may not be changed without the “vote of a majority of the

outstanding voting securities,” as defined in the 1940 Act (a “1940 Act Majority Vote”), of the Fund. The Board approved the adoption of the Interval Fund Policy (as defined below) as a fundamental policy of the Fund. For additional

information, see the discussion of Proposal 1 below. |

| |

• |

|

Change in the Fund’s Fundamental Investment Objective (Proposal 2). The Board approved a change in the

Fund’s fundamental investment objective in connection with the changes to |

8

| |

the Fund’s strategies. A comparison of the investment objective and principal investment strategies of each of MUI and BMCAP is set out in Appendix A. For additional information, see

the discussion of Proposal 2 below. |

| |

• |

|

Change in the Fund’s Fundamental 80% Investment Policy (Proposal 3). In connection with the changes to the

Fund’s investment strategies, the Board approved an amended fundamental 80% investment policy that is substantially similar to the Fund’s current fundamental 80% investment policy but which reflects certain changes to streamline the

policy. For additional information, see the discussion of Proposal 3 below. |

| |

• |

|

Amended and Restated Investment Management Agreement of the Fund (Proposal 4). In connection with the Conversion,

the Board approved amending and restating the Fund’s investment management agreement to change the Fund’s management fee from 0.55% of Managed Assets (as defined below) to 0.90% of net assets. “Managed Assets” means the sum of

(i) the average daily value of the Fund’s Net Assets and (ii) the proceeds of any outstanding debt securities and borrowings used for leverage. “Net Assets” means the total assets of the Fund minus the sum of its accrued

liabilities. The liquidation preference of the VRDP Shares and any other outstanding preferred stock (other than accumulated dividends) is not considered a liability in determining the Fund’s Net Assets. As a result of the change in management

fee calculation methodology (i.e., the change from Managed Assets to net assets (which excludes assets attributable to leverage)), BMCAP’s management fee is expected be lower than MUI’s current management fee rate (as a percentage of

MUI’s net assets); however, leverage levels are subject to change and BMCAP’s management fee rate may be higher or lower as compared to MUI’s effective management fee rate (calculated as a percentage of net assets). Based on

BMCAP’s anticipated use of leverage in the near term following the Conversion, BMCAP’s management fee rate is anticipated to be lower as compared to MUI’s current effective management fee rate (calculated as a percentage of net

assets). For additional information, see the discussion of Proposal 4 below. |

The Board has approved each of the changes

described above and unanimously recommends that shareholders of the Fund vote FOR each of the Proposals.

Each of the changes

summarized above (and further described below in the discussion of the applicable Proposal) is contingent upon shareholder approval of each of the other Proposals.

Changes Not Requiring Shareholder Approval

The following

changes approved by the Board in connection with the Conversion do not require shareholder approval:

| |

• |

|

Change in the Fund’s Name. In connection with the changes in the Fund’s investment objective and

principal investment strategies, the Board approved a change in the Fund’s name from “BlackRock Municipal Income Fund, Inc.” to “BlackRock Municipal Credit Alpha Portfolio, Inc.” effective upon the Conversion.

|

| |

• |

|

Changes to Non-Fundamental Investment Policies. The Board approved the

removal of (i) a non-fundamental investment policy requiring the Fund to invest at least 75% of its total assets in “investment grade” municipal bonds and (ii) a non-fundamental investment policy limiting the Fund’s investments in below investment grade municipal bonds (sometimes referred to a “high yield” or “junk bonds”) to 25% of the Fund’s

total assets. In addition, the Board approved the adoption of a non-fundamental policy to invest at least 75% of the Fund’s assets in municipal bonds that are rated in the medium to lower categories by

nationally recognized rating services (for example, Baa or lower by Moody’s Investors Service, Inc. or BBB or lower by S&P Global Ratings or Fitch Ratings, Inc.) or non-rated

|

9

| |

securities which are of comparable quality by the Advisor. These changes would take effect upon the Conversion. A comparison of the investment objective and principal investment strategies of

each of MUI and BMCAP is set out in Appendix A. |

| |

• |

|

Redemption of Preferred Shares. MUI currently uses leverage through the issuance of preferred shares (i.e., the

VRDP Shares) and investment in tender option bonds (“TOBs”) (also known as “inverse floaters”). It is expected that BMCAP will leverage a smaller portion of its assets using only TOBs. Accordingly, the Board approved the

redemption of the Fund’s outstanding VRDP Shares in advance of the Conversion. |

| |

• |

|

Delisting of the Fund from the NYSE. As the Institutional Shares will not be traded on a national securities

exchange, the Board approved the delisting of the Fund’s Common Shares from the NYSE prior to the Conversion. As noted above, prior to the delisting of the Fund, the Fund will conduct the Tender Offer for 50% of the Fund’s outstanding

Common Shares. If the Tender Offer is oversubscribed, the number of Common Shares purchased from each shareholder may be prorated, with the result that shareholders may only be able to have a portion of their Common Shares repurchased. However, MUI

shareholders seeking to exit the Fund prior to the Conversion will be able to sell their remaining MUI Common Shares on the NYSE prior to the effective date of the Conversion. |

| |

• |

|

Declassification of the Board of Directors. The Fund’s Board is currently classified into three classes of

Board Members: Class I, Class II and Class III. Each class is elected at an annual meeting of shareholders for a three-year term. The Fund currently holds meetings of shareholders to elect directors on an annual basis pursuant to

requirements of the NYSE. The Fund will no longer be subject to such requirements after it delists from the NYSE and will be required to hold shareholder meetings to elect Board Members only to the extent required by the 1940 Act. Accordingly, the

Board approved the declassification of the Board effective upon the Conversion. |

| |

• |

|

Bylaw Amendments. The Fund’s Amended and Restated Bylaws (the “Bylaws”) currently reflect the

Fund’s classified Board structure and the three-year term of office for each Board Member. The Board approved amendments to the Bylaws to remove the provisions relating to the Fund’s classified Board structure and three-year terms and to

reflect that BMCAP will be required to hold shareholder meetings to elect Board Members only to the extent required by the 1940 Act. |

| |

• |

|

Issuance of Multiple Share Classes. The Board approved BMCAP’s reliance on an exemptive order1 issued by the SEC to the Advisor (the “Multi-Class Exemptive Relief”) which permits BMCAP to issue multiple classes of shares. The Board also approved the redesignation of the Fund’s

outstanding Common Shares as the Institutional Shares. The Multi-Class Exemptive Relief requires, among other things, the Fund to comply with Rule 18f-3 under the 1940 Act, the provisions of which require a

fund’s board to adopt a plan setting forth the separate arrangement and expense allocation of each share class of a fund. Accordingly, the Board also approved a multi-class plan specifying the separate arrangements and expense allocations of

BMCAP’s share classes (the “Multi-Class Plan”). |

| |

• |

|

Adoption of a Distribution and Servicing Plan. Pursuant to the requirements of the Multi-Class Exemptive Relief,

the Board approved the adoption of a distribution and servicing plan in compliance with the provisions of Rule 12b-1 under the 1940 Act (the “Distribution and Servicing Plan”) in order to impose

asset-based distribution and/or service fees on certain share classes that may be offered by the Fund in the future. |

| 1 |

|

BlackRock Credit Strategies Fund, et al., 1940 Act Release Nos. 33388 (Mar. 5, 2019) (notice) and 33437 (Apr. 2, 2019) (order). |

10

| |

• |

|

Distribution Agreement and Dealer Agreement. The Board approved a distribution agreement between the Fund and

BlackRock Investments, LLC (the “Distributor”) pursuant to which the Distributor will serve as the distributor of BMCAP’s shares and serve in that capacity on a reasonable best efforts basis, subject to various conditions. The Board

also approved a form of dealer agreement to be entered into between the Distributor and additional selling agents (each, a “Dealer”). |

| |

• |

|