false

0001179929

0001179929

2024-11-13

2024-11-13

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

Current Report

Pursuant to Section 13 OR 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 13, 2024

MOLINA HEALTHCARE, INC.

(Exact name of registrant as specified in its charter)

|

Delaware

|

001-31719

|

13-4204626

|

| |

|

|

|

(State or other jurisdiction of incorporation)

|

(Commission File Number)

|

(IRS Employer Identification No.)

|

|

200 Oceangate, Suite 100,

|

Long Beach,

|

California

|

90802

|

| |

|

|

|

|

(Address of principal executive offices)

|

(Zip Code)

|

Registrant’s telephone number, including area code: (562) 435-3666

N/A

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.001 Par Value

|

MOH

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

|

Emerging growth company

|

☐

|

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section13(a) of the Exchange Act.

|

☐ |

Item 7.01. Regulation FD Disclosure.

On November 13, 2024, Molina Healthcare, Inc. (the "Company") announced that it intends to privately offer (the “Offering”), subject to market and other conditions, $500 million aggregate principal amount of senior notes due 2033 (the “Notes”). The Notes are to be sold only to persons reasonably believed to be “qualified institutional buyers” pursuant to Rule 144A under the Securities Act of 1933, as amended (the "Securities Act"), and to certain persons outside the United States in reliance on Regulation S under the Securities Act. The Notes have not been, and will not be, registered under the Securities Act or the securities laws of any other jurisdiction, and unless so registered, may not be offered or sold in the United States except pursuant to an applicable exemption from the registration requirements of the Securities Act and applicable state laws. This Current Report on Form 8-K shall not constitute an offer to sell or a solicitation of an offer to purchase the Notes and shall not constitute an offer, solicitation or sale in any state or jurisdiction where such offer, solicitation or sale is prohibited.

Uses and Definitions of Non-GAAP Financial Measures

The financial data provided to potential investors in connection with the Offering includes non-GAAP financial measures, including EBITDA and Adjusted EBITDA (collectively, the “Non-GAAP Financial Measures”). The Non-GAAP Financial Measures are supplemental measures of the Company’s performance that are not required by, or presented in accordance with, generally accepted accounting principles in the U.S. (“GAAP”). The Company believes that the Non-GAAP Financial Measures are useful supplemental measures to investors in comparing its performance to the performance of other public companies in the healthcare industry.

The Company defines EBITDA as net income adjusted for interest, taxes, depreciation and amortization. The Company defines Adjusted EBITDA as EBITDA adjusted for non-cash stock-based compensation expense, impairment charges, acquisition-related costs and other non-cash or non-recurring charges.

EBITDA and Adjusted EBITDA have important limitations as analytical tools and should not be considered in isolation or as substitutes for analysis of the Company’s results as reported under GAAP. Some of these limitations are that EBITDA and Adjusted EBITDA:

| |

•

|

exclude certain tax payments that may represent a reduction in cash available to the Company;

|

| |

•

|

do not reflect the Company’s cash expenditures, or future requirements, for capital expenditures or contractual commitments;

|

| |

•

|

do not reflect changes in, or cash requirements for, the Company’s working capital needs;

|

| |

•

|

do not reflect the significant interest expense, or the cash requirements, necessary to service interest or principal payments on the Company’s debt;

|

| |

•

|

although depreciation and amortization are non-cash charges, the assets being depreciated and amortized will often have to be replaced in the future, and EBITDA and Adjusted EBITDA do not reflect any cash requirements for such replacements; and

|

| |

•

|

may be calculated differently than other companies in the Company’s industry, limiting their usefulness as comparative measures.

|

In addition to the foregoing, Adjusted EBITDA adjusts for certain exceptional items that reflect cash payments that were made or received, or will be made or received, in the future.

Because of these limitations, the Non-GAAP Financial Measures should not be considered as measures of discretionary cash available to the Company to invest in the growth of the Company’s business. The Company compensates for these limitations by relying primarily on its GAAP results and using the Non-GAAP Financial Measures only on a supplemental basis.

The following EBITDA and Adjusted EBITDA information was provided to potential investors in connection with the Offering:

| |

|

Year Ended

December 31,

|

|

|

Nine Months

Ended September 30,

|

|

|

Twelve

Months

Ended

September

30,

|

|

| |

|

2021

|

|

|

2022

|

|

|

2023

|

|

|

2023

|

|

|

2024

|

|

|

2024

|

|

| |

|

(unaudited)

|

| |

|

(dollars in millions)

|

|

|

Net income

|

|

$ |

659 |

|

|

$ |

792 |

|

|

$ |

1,091 |

|

|

$ |

875 |

|

|

$ |

928 |

|

|

$ |

1,144 |

|

|

Adjustments:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation, and amortization of intangible assets and capitalized software

|

|

|

131 |

|

|

|

176 |

|

|

|

171 |

|

|

|

128 |

|

|

|

138 |

|

|

|

181 |

|

|

Interest expense

|

|

|

120 |

|

|

|

110 |

|

|

|

109 |

|

|

|

82 |

|

|

|

84 |

|

|

|

111 |

|

|

Income tax expense

|

|

|

216 |

|

|

|

271 |

|

|

|

373 |

|

|

|

300 |

|

|

|

315 |

|

|

|

388 |

|

|

EBITDA

|

|

$ |

1,126 |

|

|

$ |

1,349 |

|

|

$ |

1,744 |

|

|

$ |

1,385 |

|

|

$ |

1,465 |

|

|

$ |

1,824 |

|

|

Stock-based compensation

|

|

|

72 |

|

|

|

103 |

|

|

|

115 |

|

|

|

88 |

|

|

|

98 |

|

|

|

125 |

|

|

Acquisition-related expenses

|

|

|

93 |

|

|

|

49 |

|

|

|

7 |

|

|

|

4 |

|

|

|

46 |

|

|

|

49 |

|

|

Non-cash or non-recurring charges(1)

|

|

|

34 |

|

|

|

- |

|

|

|

68 |

|

|

|

41 |

|

|

|

16 |

|

|

|

43 |

|

|

Impairment charges(2)

|

|

|

- |

|

|

|

208 |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

Adjusted EBITDA

|

|

$ |

1,325 |

|

|

$ |

1,709 |

|

|

$ |

1,934 |

|

|

$ |

1,518 |

|

|

$ |

1,625 |

|

|

$ |

2,041 |

|

|

(1)

|

The year ended December 31, 2021 includes loss on debt repayment, change in premium deficiency reserves, loss on sale of property, and restructuring costs. The year ended December 31, 2022 includes gain on lease termination and disposal of fixed assets. The year ended December 31, 2023, includes a non-recurring credit loss on 2022 Marketplace risk adjustment receivables due to the insolvency of an issuer in the Texas risk pool, non-recurring litigation costs and one-time termination benefits. The nine months ended September 30, 2023, include a credit loss on 2022 Marketplace risk adjustment receivables due to the insolvency of an issuer in the Texas risk pool. The nine months ended September 30, 2024 includes non-recurring litigation and one-time termination benefits.

|

| |

|

| (2) |

Attributable to the Company's plan to reduce its leased real estate footprint. |

Note: The information furnished herewith pursuant to Item 7.01 of this Current Report on Form 8-K shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, and shall not be incorporated by reference into any registration statement or other document filed by the Company under the Securities Act or the Exchange Act, except as shall be expressly set forth by specific reference in such filing. The furnishing of this report is not intended to constitute a determination by the Company that the information is material or that dissemination of the information is required by Regulation FD.

Item 8.01. Other Events.

As disclosed above in Item 7.01, on November 13, 2024, the Company issued a press release announcing the Offering of the Notes. The full text of the press release is attached as Exhibit 99.1.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits:

|

Exhibit

No.

|

Description

|

| |

|

|

99.1

|

|

| |

|

|

104

|

Cover Page Interactive Data File (embedded within the Inline XBRL document)

|

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| |

|

MOLINA HEALTHCARE, INC.

|

|

| |

|

|

|

|

Date: November 13, 2024

|

By:

|

/s/ Jeff D. Barlow |

|

| |

|

Jeff D. Barlow,

Chief Legal Officer and Secretary

|

|

Exhibit 99.1

News Release

Investor Contact: Jeff Geyer, Jeffrey.Geyer@molinahealthcare.com, 305-317-3012

Media Contact: Caroline Zubieta, Caroline.Zubieta@molinahealthcare.com, 562-951-1588

Molina Healthcare Announces Proposed Offering

of $500 Million of Senior Notes Due 2033

Long Beach, Calif., November 13, 2024 – Molina Healthcare, Inc. (NYSE: MOH) (the “Company”) today announced that it intends to privately offer, subject to market and other conditions, $500 million aggregate principal amount of senior notes due 2033 (the “Notes”). The Company will make the offering pursuant to an exemption under the Securities Act of 1933, as amended (the “Securities Act”). The initial purchasers will sell the Notes only to persons reasonably believed to be “qualified institutional buyers” pursuant to Rule 144A under the Securities Act and to certain persons outside the United States in reliance on Regulation S under the Securities Act (“Regulation S”).

The Notes will not be guaranteed by any of the Company’s subsidiaries at the time of issuance. The interest rate, offering price and other terms of the Notes will be determined by negotiations between the Company and the representative of the initial purchasers. The issuance of the Notes will be subject to customary closing conditions.

The Company intends to use the net proceeds from this offering for general corporate purposes, which may include repayment of indebtedness, funding for acquisitions, share repurchases, capital expenditures, additions to working capital and capital contributions to the Company’s health plan subsidiaries to meet statutory requirements in new or existing states.

The Notes have not been registered under the Securities Act or any state securities laws and may not be offered or sold within the United States or to, or for the benefit of, a U.S. person (as defined in Regulation S) except in transactions exempt from, or not subject to, the registration requirements of the Securities Act.

This press release shall not constitute an offer to sell or a solicitation of an offer to purchase the Notes and shall not constitute an offer, solicitation or sale in any state or jurisdiction where such offer, solicitation or sale is prohibited.

About Molina Healthcare

Molina Healthcare, Inc., a FORTUNE 500 company, provides managed healthcare services under the Medicaid and Medicare programs and through the state insurance marketplaces. For more information about Molina Healthcare, please visit molinahealthcare.com.

MOH Announces Proposed Offering of $500 Million of Senior Notes Due 2033

Page 2

November 13, 2024

Safe Harbor Statement under the Private Securities Litigation Reform Act of 1995

This press release contains forward-looking statements. The Company intends such forward-looking statements to be covered under the safe harbor provisions for forward-looking statements contained in Section 27A of the Securities Act of 1933 and Section 21E of the Securities Exchange Act of 1934. Forward-looking statements provide current expectations of future events based on certain assumptions, and all statements other than statements of historical fact contained in this press release may be forward-looking statements. In some cases, you can identify forward-looking statements by words such as “intends,” “will,” “may,” or the negative of these terms or other similar expressions. Forward-looking statements contained in this press release include, but are not limited to, statements related to the Company’s offering of the Notes and the intended use of net proceeds of the offering, which are subject to risks and uncertainties, including, without limitation, risks related to whether the Company will consummate the offering of the Notes on the expected terms, or at all, market and other general economic conditions, and whether the Company will be able to satisfy the conditions required to close any sale of the Notes. Given these risks and uncertainties, the Company can give no assurances that its forward-looking statements will prove to be accurate, or that any other results or events projected or contemplated by its forward-looking statements will in fact occur, and it cautions investors not to place undue reliance on these statements. All forward-looking statements in this release represent the Company’s judgment as of the date hereof, and, except as otherwise required by law, the Company disclaims any obligation to update any forward‑looking statements to conform the statement to actual results or changes in its expectations.

-END-

v3.24.3

Document And Entity Information

|

Nov. 13, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

MOLINA HEALTHCARE, INC.

|

| Document, Type |

8-K

|

| Document, Period End Date |

Nov. 13, 2024

|

| Entity, Incorporation, State or Country Code |

DE

|

| Entity, File Number |

001-31719

|

| Entity, Tax Identification Number |

13-4204626

|

| Entity, Address, Address Line One |

200 Oceangate

|

| Entity, Address, Address Line Two |

Suite 100

|

| Entity, Address, City or Town |

Long Beach

|

| Entity, Address, State or Province |

CA

|

| Entity, Address, Postal Zip Code |

90802

|

| City Area Code |

562

|

| Local Phone Number |

435-3666

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Stock

|

| Trading Symbol |

MOH

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0001179929

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

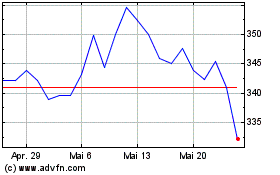

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Molina Healthcare (NYSE:MOH)

Historical Stock Chart

Von Dez 2023 bis Dez 2024