As filed with the Securities and Exchange Commission

on March 4, 2024

Registration

No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-8

REGISTRATION STATEMENT UNDER THE SECURITIES

ACT OF 1933

|

THE LION

ELECTRIC COMPANY

(Exact name of registrant

as specified in its charter) |

|

Québec, Canada

(State or other jurisdiction of

incorporation or organization) |

Not Applicable

(I.R.S. Employer

Identification No.) |

|

921 chemin de la Rivière-du-Nord

Saint-Jérôme, Québec, J7Y

5G2

Canada

(Address of Principal Executive Offices) |

J7Y 5G2

(Zip Code) |

The Lion Electric Company Omnibus Incentive

Plan, effective as of May 6, 2021

The Lion Electric Company Second Amended and

Restated Stock Option Plan for

Directors, Executive Officers, Employees and Consultants, effective as of May 6, 2021

(Full title of the plan)

Puglisi & Associates

850 Library Avenue, Suite 204

Newark, Delaware 19711

(Name and address of agent for service)

(302) 738-6680

(Telephone number, including area code, of agent

for service)

Indicate by check mark whether the registrant is a large accelerated

filer, an accelerated filer, a non-accelerated filer, a smaller reporting company or an emerging growth company. See the definitions of

“large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth

company” in Rule 12b-2 of the Exchange Act.

| Large accelerated

filer ¨ |

Accelerated filer x |

| Non-accelerated filer ¨ |

Smaller reporting company ¨ |

| |

Emerging growth company x |

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ¨

THE LION ELECTRIC COMPANY

REGISTRATION STATEMENT ON FORM S-8

This Registration Statement on Form S-8 is

being filed by The Lion Electric Company (the “Company” or the “Registrant”) to register 13,917,294

common shares of the Company (“Omnibus Shares”) that may be issued pursuant to the Company’s Omnibus Incentive

Plan, effective May 6, 2021 (the “Omnibus Plan”), and 8,701,199 common shares of the Company (“Legacy

Shares”, and, together with the Omnibus Shares, the “Shares”) that may be issued pursuant to the Company’s

legacy equity-based incentive plan adopted in November 2017, as amended and restated in December 2019 and May 2021 (the

“Legacy Plan”, and together with the Omnibus Plan, the “Plans”). In addition, this Registration

Statement registers the resale of up to 385,717 Shares that may be issued to the selling shareholders pursuant to the grant of options,

deferred share units, performance share units, and/or restricted share units under the Plans, subject to exercise, vesting and settlement.

This Registration Statement contains two parts.

The first part contains a “reoffer” prospectus prepared in accordance with Part I of Form S-3 (in accordance with

Instruction C of the General Instructions to Form S-8). The reoffer prospectus permits reoffers and resales of those Shares referred

to above that constitute “restricted securities,” within the meaning of Form S-8, by the selling shareholders named herein.

The second part contains information required to be set forth in the Registration Statement pursuant to Part II of Form S-8.

REOFFER PROSPECTUS

385,717 SHARES

The Lion Electric

Company

COMMON SHARES

This reoffer prospectus relates to 385,717 common

shares, no par value (the “Shares”), of The Lion Electric Company (“Lion,” “we,”

“us,” “our,” or the “Company”) which may be reoffered and resold from time to

time by the Selling Shareholders, named herein, who are directors, officers, employees or consultants of the Company or a subsidiary thereof,

and that will be acquired, by the grant of options, deferred share units, performance share units, and restricted share units prior to

the filing of this Registration Statement under (i) The Lion Electric Company Omnibus Incentive Plan, effective May 6, 2021

(the “Omnibus Plan”), and/or (ii) The Lion Electric Company Second Amended and Restated Stock Option Plan for

Directors, Executive Officers, Employees and Consultants, effective as of May 6, 2021 (the “Legacy Plan”, and,

together with the Omnibus Plan, the “Plans”) for such Selling Shareholders’ own account. We will not receive

any proceeds from any sale of the Shares offered pursuant to this reoffer prospectus.

The Selling Shareholders may offer and sell the

Shares at various times and in various types of transactions, including sales in the open market, sales in negotiated transactions and

sales by a combination of these methods. The Shares may be sold at the market price of the common shares of the Company (the “Common

Shares”) at the time of a sale, at prices relating to the market price over a period of time, or at prices negotiated with the

buyers of the Shares. The Shares may be sold through underwriters or dealers which the Selling Shareholders may select. If underwriters

or dealers are used to sell the Shares, we will name them and describe their compensation in a reoffer prospectus supplement. For a description

of the various methods by which the Selling Shareholders may offer and sell the Shares described in this reoffer prospectus, see the section

entitled “Plan of Distribution.”

Our Common Shares are listed on the Toronto Stock

Exchange (the “TSX”) and the New York Stock Exchange (the “NYSE”) under the symbol “LEV.”

On February 29, 2024, the closing price of our Common Shares was US$1.47 (C$ 1.99) on the TSX and was US$1.46 (C$1.98) on the NYSE.

Investing in our Common Shares involves a high

degree of risk. See “Risk Factors” section of our filings with the Securities and Exchange Commission (the “Commission”)

incorporated by reference herein and the applicable reoffer prospectus supplement.

Neither the Commission nor any state securities

commission has approved or disapproved of these securities or determined if this reoffer prospectus is truthful or complete. Any representation

to the contrary is a criminal offense.

The date of this reoffer prospectus is March 4,

2024

If you are in a jurisdiction where offers to

sell, or solicitations of offers to purchase, the securities offered by this document are unlawful, or if you are a person to whom it

is unlawful to direct these types of activities, then the offer presented in this document does not extend to you. We have not authorized

anyone to provide any information other than that contained in this reoffer prospectus, in any prospectus supplement or in any free writing

prospectus prepared by or on behalf of us or to which we have referred to you. We do not take responsibility for, and we do not provide

any assurance as to the reliability of, any other information that others may give you. We have not authorized any other person to provide

you with different information. The information contained in this document speaks only as of the date of this document, unless the information

specifically indicates that another date applies.

TABLE OF CONTENTS

THE COMPANY

The Lion Electric Company is a reporting issuer

in Canada, with our Common Shares listed for trading on the TSX and on the NYSE under the symbol “LEV.”

Lion’s business focuses on the design, development,

manufacturing, and distribution of all-electric medium- and heavy-duty urban vehicles (“EV”). Each Lion vehicle is

purpose-built for electric and entirely designed and assembled in-house, with its own chassis, truck cabin or bus body, proprietary battery

technology with modular energy capacity and Lion software integration. Lion’s vehicles are assembled without relying on traditional

combustion-engine vehicle retrofitting or third-party integrators. For certain specialized truck applications, Lion has also established

partnerships and other relationships with third-party suppliers to enable it to offer to its clients a variety of vehicle configurations,

upfit equipment options and applications which range from classic boxes for box trucks to other specialized applications such as all-electric

ambulances and utility trucks.

Lion has more than 13 years of focused all-electric

vehicle research and development, manufacturing and commercialization experience. Lion’s vehicles and technology benefit from over

22 million miles driven by more than 1,850 of its purpose-built all-electric vehicles that are on the road today, in real-life operating

conditions.

Lion’s medium and heavy-duty EVs are specifically

designed to address the needs of the sub-250 mile (or 400-km) mid-range urban market, which is generally viewed as well suited for electrification

given vehicles are typically driven over a relatively modest distance and return to base at the end of every workday. Mid-range EV applications

require less battery capacity, generally resulting in a lower vehicle cost, allowing for a suitable payload, and avoiding the need for

an extensive charging station network alongside vehicle routes, all of which are viewed as contributing to a suitable use case and provide

the potential for favorable economics when compared to incumbent diesel solutions.

Lion complements its product offering with various

services available on-site at Lion’s experience centers, which are dedicated spaces where prospective customers, policymakers and

other transportation industry stakeholders can familiarize themselves with Lion’s EVs, learn about their specifications and advantages,

obtain sales support and meet sales representatives, discuss grant and subsidy assistance, obtain charging infrastructure assistance,

receive vehicle training, maintenance support and have existing vehicles serviced. Services available on-site at Lion’s experience

centers include product demonstrations and sales support, full-service training, charging infrastructure assistance and maintenance support.

Lion has experience centers strategically located in key markets in the United States and Canada. Lion currently has 12 experience centers

strategically located in key markets.

Our head and registered office is located at 921,

chemin de la Rivière du Nord, Saint-Jerome (Quebec), Canada, J7Y 5G2. Our company website is https://thelionelectric.com/en. Information

on or accessible through our Internet website is not a part of this reoffer prospectus.

When used in this reoffer prospectus, the terms

the “Company,” “Lion,” “issuer,” “we,” “our,” and “us”

refer to The Lion Electric Company and its consolidated subsidiaries, unless otherwise specified.

RISK FACTORS

You should carefully consider the specific risks

set forth under the caption “Risk Factors” in any of our filings with the Commission pursuant to Sections 13(a), 13(c), 14

or 15(d) of the Securities and Exchange Act of 1934, as amended (the “Exchange Act”), incorporated by reference

in this prospectus, before making an investment decision. For more information, see “Where You Can Find More Information.”

OFFER STATISTICS AND EXPECTED TIMETABLE

The Selling Shareholders may sell from time to

time pursuant to this prospectus (as may be detailed in prospectus supplements) up to 385,717 Shares. The actual per Share price that

the Selling Shareholders will offer pursuant hereto will depend on a number of factors that may be relevant as of the time of offer. See

“Plan of Distribution” below.

FORWARD-LOOKING STATEMENTS

This prospectus contains or incorporates

forward-looking statements within the meaning of Section 27A of the U.S. Securities Act of 1933, as amended (the

“Securities Act”) and Section 21E of the Exchange Act. These forward-looking statements are

management’s beliefs and assumptions. In addition, other written or oral statements that constitute forward-looking statements

are based on current expectations, estimates and projections about the industry and markets in which we operate and statements may

be made by or on our behalf. Words such as “should,” “could,” “may,” “expect,”

“anticipate,” “intend,” “plan,” “believe,” “seek,”

“estimate,” variations of such words and similar expressions are intended to identify such forward-looking statements.

These statements are not guarantees of future performance and involve certain risks, uncertainties and assumptions that are

difficult to predict. There are a number of important factors that could cause our actual results to differ materially from those

indicated by such forward-looking statements.

We describe material risks, uncertainties and

assumptions that could affect our business, including our financial condition and results of operations, under “Risk Factors”

and may update our descriptions of such risks, uncertainties and assumptions in any prospectus supplement. We base our forward-looking

statements on our management’s beliefs and assumptions based on information available to our management at the time the statements

are made. We caution you that actual outcomes and results may differ materially from what is expressed, implied or forecast by our forward-looking

statements. Accordingly, you should be careful about relying on any forward-looking statements. Except as required under the federal securities

laws, the rules and regulations of the Commission, stock exchange rules, and other applicable laws, regulations and rules, we do

not have any intention or obligation to update publicly any forward-looking statements after the distribution of this prospectus, whether

as a result of new information, future events, changes in assumptions, or otherwise.

USE OF PROCEEDS

The proceeds from the sale of the Shares offered

pursuant to this reoffer prospectus are solely for the account of the Selling Shareholders. We will not receive any of the proceeds from

any sale of Shares by the Selling Shareholders.

SELLING SHAREHOLDERS

The Shares being registered by this reoffer prospectus

consists of 385,717 Shares that may be issued to the individuals listed below (the “Selling Shareholders”) pursuant

to the grant of options, deferred share units, performance share units, and/or restricted share units under the Plans, subject to exercise,

vesting and settlement.

We are registering these Shares to permit the

Selling Shareholders to resell these Shares when each deems appropriate. The Selling Shareholders may resell all, a portion, or none of

the Shares, at any time and from time to time. The Selling Shareholders may also sell, transfer or otherwise dispose of some or all of

the Shares in transactions exempt from the registration requirements of the Securities Act of 1933, as amended (the “Securities

Act”). We do not know when or in what amounts the Selling Shareholders may offer any Shares for sale under this reoffer prospectus.

This reoffer prospectus does not constitute a commitment by the Selling Shareholders to sell all or any of the stated number of their

Shares, and the actual number of Shares offered and sold will be determined from time to time by each Selling Shareholder at his or her

sole discretion. Each of the Selling Shareholders has voting and investment control power over his or her Shares. Although a person’s

name is included in the table below, neither that person nor we are making an admission that the named person is our “affiliate.”

The following table sets forth: (i) the name

of each Selling Shareholder; (ii) the number and percentage of our Common Shares that the Selling Shareholder beneficially owned

as of March 4, 2024 prior to the offering for resale of the Shares under this reoffer prospectus; (iii) the number of Shares

that may be offered for resale for the account of the Selling Shareholder under this reoffer prospectus; and (iv) the number and

percentage of Common Shares to be beneficially owned by the Selling Shareholder after the offering of the resale shares (assuming all

of the offered resale Shares are sold by such Selling Shareholder (whether vested or unvested)). The percentages appearing in the column

entitled “Number of Shares Beneficially Owned After the Offering” are based on 226,184,932 Common Shares outstanding as of

January 1, 2024. Common Shares that may be acquired by the Selling Shareholder pursuant to previous grants under the Plans, whether

vested or unvested, that constitute Shares are deemed to be outstanding and to be beneficially owned by the Selling Shareholder holding

such Shares for the purposes of computing the percentage ownership of such Selling Shareholder but are not treated as outstanding for

the purposes of computing the percentage ownership of each of the other Selling Shareholders. The actual number of Shares beneficially

owned prior to and after the offering is subject to adjustment and could be materially less or more than the estimated amount indicated

depending upon factors, which we cannot predict at this time.

The Selling Shareholders are not required to

sell any Shares and there is no assurance that any of the Selling Shareholders will sell any or all of the Shares covered by this reoffer

prospectus. We are not aware of any agreements, arrangements or understandings with respect to the sale or other disposition of any of

the Shares covered hereby.

| Name of Selling Shareholder | |

Number of Shares

Beneficially

Owned Prior to

Offering(1) | | |

Number of

Shares

Being

Registered

for | | |

Number of Shares

Beneficially

Owned After the

Offering(3) | |

| | |

Number | | |

Percent | | |

Resale(2) | | |

Number | | |

Percent | |

| Sheila Colleen Bair (4) | |

| 38,841 | | |

| 0 | % | |

| 30,967 | | |

| 7,874 | | |

| 0 | % |

| Nathan Baguio (5) | |

| 336,567 | | |

| 0 | % | |

| 291,446 | | |

| 45,121 | | |

| 0 | % |

| Dominik Beckman(6) | |

| 10,083 | | |

| 0 | % | |

| 10,083 | | |

| 0 | | |

| 0 | % |

| Eric Pansegrau (7) | |

| 15,928 | | |

| 0 | % | |

| 15,928 | | |

| 0 | | |

| 0 | % |

| Suzanne Schwartz (8) | |

| 6,312 | | |

| 0 | % | |

| 6,312 | | |

| 0 | | |

| 0 | % |

| Rod Copes (9) | |

| 30,981 | | |

| 0 | % | |

| 30,981 | | |

| 0 | | |

| 0 | % |

| (1) | In computing the number of shares of Common Shares beneficially owned by a person and the percentage ownership

of that person, we deemed to be outstanding all shares of Common Shares subject to options, deferred share units, performance share units,

and restricted share units or other derivative securities held by that person that are exercisable, vested or convertible as of March 4,

2024 or that will become exercisable, vested or convertible within 60 days after March 4, 2024, but we did not deem these shares

outstanding for the purpose of computing the percentage ownership of any other person. |

| (2) | The numbers of Common Shares reflect all Common Shares acquired or issuable to a person pursuant to applicable

grants previously made under the Plans irrespective of whether such grants are exercisable, vested or convertible as of March 4,

2024 or will become exercisable, vested or convertible within 60 days after March 4, 2024. |

| (3) | In computing the number of Common Shares beneficially owned by a person and the percentage ownership of

that person following the offering, we deemed to be outstanding all Common Shares then subject to options, deferred share units, performance

share units, and restricted share units or other derivative securities held by that person that are vested, exercisable or convertible

as of March 4, 2024 or that would become vested, exercisable or convertible within 60 days after March 4, 2024, but we did not

deem these Common Shares outstanding for the purpose of computing the percentage ownership of any other person. We further

presumed that the person sold all Shares eligible to be resold in this offering irrespective any applicable vesting, exercisability or

conversion limitations, but retained ownership of all other Common Shares beneficially owned as of March 4, 2024. |

| (4) | Sheila Colleen Bair’s beneficial ownership includes (i) 3,937 Common Shares held of record

as of March 4, 2024, (ii) 30,967 options to purchase Common Shares, which have vested as of March 4, 2024, and (iii) 3,937

Common Shares purchase warrants expiring December 15, 2027. |

| (5) | Nathan Baguio’s beneficial ownership includes (i) 45,121 Common Shares held of record as of

March 4, 2024, and (ii) 291,446 options to purchase Common Shares, which have vested or will vest within 60 days of March 4,

2024. |

| (6) | Dominik Beckman’s beneficial ownership 10,083 options to purchase Common Shares, which have vested

or will vest within 60 days of March 4, 2024 |

| (7) | Eric Pansegrau’s beneficial ownership includes 15,928 options to purchase Common Shares, which have

vested or will vest within 60 days of March 4, 2024. |

| (8) | Suzanne Schwartz’s beneficial ownership includes 6,312 options to purchase Common Shares, which

have vested or will vest within 60 days of March 4, 2024. |

| (9) | Rod Cope’s beneficial ownership includes 30,981 Common Shares held of record by Copes &

Copes Company, for which Rod Cope exercises voting and dispositive power. |

PLAN OF DISTRIBUTION

The purpose of this reoffer prospectus is to allow

the Selling Shareholders to offer for sale and sell all or a portion of each individual’s Shares. The Selling Shareholders may sell

the Common Shares registered pursuant to this reoffer prospectus directly to purchasers or through broker-dealers or agents, who may receive

compensation in the form of discounts, concessions or commissions from the Selling Shareholder or the purchasers. These commissions as

to any particular broker-dealer or agent may be in excess of those customary in the types of transactions involved. Neither we nor the

Selling Shareholders can presently estimate the amount of this compensation.

The Common Shares offered under this reoffer prospectus

may be sold in one or more transactions at fixed prices, at prevailing market prices at the time of sale, at prices related to the prevailing

market prices, at varying prices determined at the time of sale, or at negotiated prices. These sales may be effected in transactions,

which may involve block transactions, on any national securities exchange on which the Common Shares may be then-listed.

The aggregate proceeds to each Selling Shareholder

from the sale of the Shares will be the purchase price of the Common Shares less discounts and commissions, if any. The Selling Shareholders

reserve the right to accept and, together with his, her or its agents from time to time, to reject, in whole or in part, any proposed

purchase of the Shares to be made directly or through agents. We will not receive any of the proceeds from a sale of the Shares by the

Selling Shareholders.

The Selling Shareholders and any broker-dealers

or agents that participate in the sale of the Shares may be deemed to be “underwriters” under the Securities Act. Any discounts,

commissions, concessions or profit they earn on any resale of the Shares may be underwriting discounts and commissions under the Securities

Act. If a Selling Shareholder is an “underwriter” under the Securities Act, the Selling Shareholder will be subject to the

prospectus delivery requirements of the Securities Act.

Any securities covered by this reoffer prospectus

which qualify for sale pursuant to Rule 144 of the Securities Act may be sold under Rule 144 of the Securities Act rather than

pursuant to this reoffer prospectus.

There can be no assurance that the Selling Shareholders

will sell any or all of the securities offered by them hereby.

LEGAL MATTERS

The validity of the Shares being offered by this

prospectus has been passed upon by Stikeman Elliott LLP, counsel to Lion as to Canadian law. We have been advised on U.S. securities matters

by Troutman Pepper Hamilton Sanders LLP.

EXPERTS

The consolidated financial statements of the Company

for the year ended December 31, 2023 were audited by Raymond Chabot Grant Thornton LLP / Raymond Chabot Grant Thornton S.E.N.C.R.L.,

independent registered public accounting firm. Such consolidated financial statements are incorporated herein by reference in reliance

upon such report given on the authority of such firm as experts in accounting and auditing.

INDEMNIFICATION

Insofar as indemnification by us for liabilities

arising under the Securities Act may be permitted to our directors, officers or persons controlling the Company pursuant to provisions

of our articles, or otherwise, we have been advised that in the opinion of the Commission, such indemnification is against public policy

as expressed in the Securities Act and is therefore unenforceable. In the event that a claim for indemnification by such director, officer

or controlling person of us in the successful defense of any action, suit or proceeding is asserted by such director, officer or controlling

person in connection with the securities being offered, we will, unless in the opinion of our counsel the matter has been settled by controlling

precedent, submit to a court of appropriate jurisdiction the question whether such indemnification by us is against public policy as expressed

in the Securities Act and will be governed by the final adjudication of such issue.

WHERE YOU CAN FIND MORE INFORMATION

We are subject to the informational requirements

of the Exchange Act that are applicable to foreign private issuers. Accordingly, Lion is required to file or furnish reports and other

information with the SEC, including annual reports on Form 40-F and reports on Form 6-K. Our Commission filings, including the

complete registration statement of which this prospectus is a part, are available to the public from commercial document retrieval services

and also available at the Internet website maintained by the Commission at http://www.sec.gov.

INCORPORATION OF CERTAIN DOCUMENTS BY REFERENCE

The Commission allows us to “incorporate

by reference” into this prospectus the information we file with it, which means that we can disclose important information to you

by referring you to those documents. The information incorporated by reference is an important part of this prospectus, and information

that we file later with the Commission will automatically update and supersede this information. The following documents are incorporated

by reference into this reoffer prospectus:

All reports and other documents subsequently filed

by the Company pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after the date of this Registration Statement,

but prior to the filing of a post-effective amendment which indicates that all securities offered hereby have been sold or which deregisters

all securities then remaining unsold, shall be deemed to be incorporated by reference herein and to be a part hereof from the date of

the filing of such reports and documents.

We will provide without charge to any person (including

any beneficial owner) to whom this prospectus is delivered, upon oral or written request, a copy of any document incorporated by reference

in this prospectus but not delivered with the prospectus (except for exhibits to those documents unless a documents states that one of

its exhibits is incorporated into the document itself). Such request should be directed to:

The Lion Electric Company

921 chemin de la Rivière-du-Nord

Saint-Jérôme, Québec, J7Y

5G2

Canada

450-432-5466 ext. 171

Attn: Isabelle Adjahi

You should rely only on the information incorporated

by reference or provided in this prospectus or any prospectus supplement. We have not authorized anyone else to provide you with different

information. You should not assume that the information in this prospectus or any prospectus supplement is accurate as of any date other

than the date on the front page of those documents.

Part I — Information Required in

the Section 10(a) Prospectus

| Item 1. | Plan Information. * |

| Item 2. | Registrant Information and Employee Plan Annual Information.* |

| * | The documents containing the information specified in “Item 1. Plan Information” and “Item

2. Registrant Information and Employee Plan Annual Information” of Form S-8 will be sent or given to participants, as specified

by Rule 428(b)(1) under the Securities Act of 1933, as amended (the “Securities Act”). Such documents are

not required to be, and are not, filed with the United States Securities and Exchange Commission (the “Commission”)

either as part of this registration statement or as a prospectus or prospectus supplement pursuant to Rule 424 under the Securities

Act. These documents and the documents incorporated by reference in this registration statement pursuant to Item 3 of Part II of

Form S-8, taken together, constitute a prospectus that meets the requirements of Section 10(a) of the Securities Act. |

Part II — Information Required in

the Registration Statement

| Item 3. | Incorporation of Documents by Reference. |

The following documents filed by The Lion Electric

Company (the “Company,” “Lion,” “we,” “us” or “our”)

with the Commission are incorporated herein by reference:

| (d) | All documents filed by the Registrant pursuant to Section 13(a)or 15(d) of the Exchange Act

subsequent to the date of this registration statement and prior to the filing of a post-effective amendment to this registration statement

which indicates that all securities offered hereby have been sold or which deregisters all securities then remaining unsold, shall be

deemed to be incorporated by reference into this registration statement and to be a part hereof commencing on the respective dates on

which such documents are filed. |

| Item 4. | Description of Securities. |

| | |

| | Not applicable. |

| Item 5. | Interests of Named Experts and Counsel. |

| | |

| | Not applicable. |

| Item 6. | Indemnification of Directors and Officers. |

Under the Business Corporations Act (Québec)

(the “QBCA”) and the Registrant’s bylaws, the Registrant must indemnify its current or former directors or officers

or another individual who acts or has acted at its request as a director or officer, or an individual acting in a similar capacity, of

another entity, against all costs, charges and expenses, including an amount paid to settle an action or satisfy a judgment, reasonably

incurred by the individual in respect of any civil, criminal, administrative, investigative or other proceeding in which the individual

is involved because of his or her association with the Registrant or another entity. The QBCA also provides that the Registrant must advance

moneys to such individual for costs, charges and expenses incurred in connection with such a proceeding; provided that such individual

shall repay such payment if he or she does not fulfill the conditions described below.

Indemnification is prohibited under the QBCA unless

the individual:

| · | acted with honesty and loyalty in the Registrant’s interests, or in the interest of the other group

for which the individual acted as director or officer or in a similar capacity at the Registrant’s request; and |

| · | in the case of a proceeding that is enforced by a monetary penalty, the individual had reasonable grounds

for believing that his or her conduct was lawful. |

The QBCA and the Registrant’s bylaws authorize

the Registrant to purchase and maintain insurance for the benefit of each of its current or former directors or officers and each person

who acts or has acted at the Registrant’s request as a director, officer or an individual acting in a similar capacity of the Registrant,

or of any subsidiary of the Registrant.

In addition, the Registrant entered into separate

indemnity agreements with each of its directors and officers. These indemnity agreements, among other things, require the Registrant to

indemnify its directors and officers for certain expenses, including attorneys’ fees, judgments, fines and settlement amounts incurred

by a director or officer in any action or proceeding arising out of their services as a director or officer, or any subsidiary of the

Registrant.

Insofar as indemnification for liabilities arising

under the Securities Act of 1933, as amended (the “Securities Act”), may be permitted to directors, officers or persons

controlling the Registrant pursuant to the foregoing provisions, the Registrant has been informed that in the opinion of the U.S. Securities

and Exchange Commission (the “Commission”) such indemnification is against public policy as expressed in the Act and

is therefore unenforceable.

| Item 7. | Exemption from Registration Claimed. |

Shares previously issued pursuant to awards granted

prior to the filing of this Registration Statement that constitute “restricted securities” were issued to directors, officers,

employees and consultants in non-public offerings in reliance upon Section 4(a)(2) of the Securities Act.

| Item 8. | Exhibits. |

| | |

| | An Exhibit Index appears on page 10 hereof

and is incorporated herein by reference. |

(a) The

undersigned registrant hereby undertakes:

(1) To file, during any

period in which offers or sales are being made, a post-effective amendment to this registration statement:

| (i) | To include any prospectus required by Section 10(a)(3) of the Securities Act; |

| (ii) | To reflect in the prospectus any facts or events arising after the effective date of the registration

statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change

in the information set forth in the registration statement. Notwithstanding the foregoing, any increase or decrease in the volume of securities

offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or

high end of the estimated maximum offering range may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if,

in the aggregate, the changes in the volume and price represent no more than a 20% change in the maximum aggregate offering price set

forth in the “Calculation of Registration Fee” table in the effective registration statement; and |

| (iii) | To include any material information with respect to the plan of distribution not previously disclosed

in the registration statement or any material change to such information in the registration statement; |

Provided, however, that paragraphs

(a)(1)(i) and (a)(1)(ii) do not apply if the information required to be included in a post-effective amendment by those paragraphs

is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of

the Exchange Act that are incorporated by reference in the registration statement.

(2) That, for the purpose

of determining any liability under the Securities Act, each such post-effective amendment shall be deemed to be a new registration statement

relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide

offering thereof.

(3) To remove from registration

by means of a post-effective amendment any of the securities being registered which remain unsold at the termination of the offering.

(b) The

undersigned registrant hereby undertakes that, for purposes of determining any liability under the Securities Act, each filing of the

registrant's annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable,

each filing of an employee benefit plan's annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated

by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered therein,

and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

(h) Insofar

as indemnification for liabilities arising under the Securities Act may be permitted to directors, officers and controlling persons of

the registrant pursuant to the foregoing provisions, or otherwise, the registrant has been advised that in the opinion of the Commission

such indemnification is against public policy as expressed in the Securities Act and is, therefore, unenforceable. In the event that

a claim for indemnification against such liabilities (other than the payment by the registrant of expenses incurred or paid by a director,

officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director,

officer or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel

the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question whether such indemnification

by it is against public policy as expressed in the Securities Act and will be governed by the final adjudication of such issue.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets all of the requirements for filing on Form S-8

and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in the City

of Saint-Jérôme, Province of Québec, Canada, on March 4, 2024.

| |

THE

LION ELECTRIC COMPANY |

| |

|

| |

By: |

/s/ Marc Bedard |

| |

|

Name: Marc Bedard |

| |

|

Title: Chief Executive

Officer |

| |

|

(Principal Executive

Officer) |

POWERS OF ATTORNEY AND SIGNATURES

KNOW ALL MEN BY THESE PRESENTS, that each

person whose signature appears below hereby constitutes and appoints Marc Bedard and Richard Coulombe, and each of them, with full power

to act without the other, such person’s true and lawful attorneys-in-fact and agents, with full power of substitution and resubstitution,

for him and in his name and on his behalf as a director and/or officer of The Lion Electric Company to prepare, execute and deliver any

and all amendments, including post-effective amendments, and supplements to this registration statement on Form S-8, including any

amendment to this registration statement for the purpose of registering additional shares in accordance with General Instruction E to

Form S-8, and to file the same, with exhibits and schedules thereto, and other documents in connection therewith (including any necessary

amendments thereof), with the Securities and Exchange Commission, granting unto said attorneys-in-fact and agents, and each of them, full

power and authority to do and perform each and every act necessary or desirable to be done in connection with the above-described matters,

as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said attorneys-in-fact

and agents, or any of them, or their or his substitute or substitutes may lawfully do or cause to be done by virtue hereof. This Power

of Attorney may be executed in multiple counterparts, each of which shall be deemed an original, but which taken together shall constitute

one instrument.

Pursuant to the requirements of the Securities

Act of 1933, this registration statement has been signed by the following persons in the capacities and on March 4, 2024.

| Signature |

|

Title |

| |

|

|

| /s/ Marc Bedard |

|

Founder, Chief Executive Officer & Director |

| Marc Bedard |

|

(principal executive officer) |

| |

|

|

| /s/ Richard Coulombe |

|

Chief Financial Officer |

| Richard Coulombe |

|

(principal financial officer) |

| |

|

|

| /s/ Latasha Akoma |

|

Director |

| Latasha Akoma |

|

|

| |

|

|

| /s/ Sheila Colleen Bair |

|

Director |

| Sheila Colleen Bair |

|

|

| |

|

|

| /s/ Dane L. Parker |

|

Director |

| Dane L. Parker |

|

|

| |

|

|

| /s/ Ann L. Payne |

|

Director |

| Ann L. Payne |

|

|

| |

|

|

| |

|

Director |

| Pierre-Olivier Perras |

|

|

| |

|

|

| /s/ Michel Ringuet |

|

Lead Director |

| Michel Ringuet |

|

|

| |

|

|

| |

|

Director |

| Lorenzo Roccia |

|

|

| |

|

|

| /s/ Pierre Wilkie |

|

Director |

| Pierre Wilkie |

|

|

| |

|

|

| /s/ Pierre Larochelle |

|

Director and Chairman of the Board |

| Pierre Larochelle |

|

|

AUTHORIZED REPRESENTATIVE

Pursuant to the requirements of Section 6(a) of

the Securities Act of 1933, as amended, the undersigned has signed this Form S-8, solely in its capacity as duly authorized representative

of the Lion Electric Company in the United States, on March 4, 2024.

| |

|

PUGLISI & ASSOCIATES |

| |

|

|

| |

By: |

/s/ Donald J. Puglisi |

| |

Name: |

Donald J. Puglisi |

| |

Title: |

Managing Director |

Exhibit 5.1

March 4, 2024

The Lion Electric Company

921 chemin de la Rivière-du-Nord

Saint-Jérôme (Québec)

J7Y 5G2

Ladies and Gentlemen:

We have acted as Canadian counsel to The Lion Electric Company (the

“Corporation”), a corporation governed by the Business Corporations Act (Québec), in connection with

the Corporation’s Registration Statement on Form S-8 (the “Registration Statement”) to which this opinion is

an exhibit, filed by the Corporation with the Securities and Exchange Commission on or about the date hereof relating to the registration,

under the Securities Act of 1933, as amended (the “Securities Act”), by the Corporation of up to an aggregate 22,618,493

common shares in the capital of the Corporation (the “Shares”) issuable under (A) The Lion Electric Company Omnibus

Incentive Plan, effective May 6, 2021 (the “Omnibus Plan”) or (B) The Lion Electric Company Second Amended and

Restated Stock Option Plan for Directors, Executive Officers, Employees and Consultants, effective as of May 6, 2021 (the “Legacy

Plan”, and, together with the Omnibus Plan, the “Plans”), including 385,717 common shares in the capital

of the Corporation that may be issued to the selling shareholders described in the Registration Statement pursuant to and in accordance

with the terms of options, deferred share units, performance share units, and/or restricted share units, as applicable, granted under

the Plans as of the date hereof.

In connection with the foregoing and for the purpose of the opinion

hereinafter expressed, we have examined the Registration Statement and the Plans, and have also examined originals or copies, certified

or otherwise identified to our satisfaction, of and relied upon the following documents (collectively, the “Corporate Documents”):

(i) a certificate of an officer of the Corporation dated the date hereof, with respect to the constating documents of the Corporation

and certain factual matters relating to the Corporation, the Plans and the Shares; (ii) the amended and restated articles of the Corporation;

(iii) the by-laws of the Corporation; and (iv) certified extracts of certain resolutions and other authorizing documents of the Corporation’s

directors and security holders. As to various questions of fact material to the opinion rendered herein and which were not independently

established, we have relied exclusively and without independent verification upon the Corporate Documents for purposes of providing the

opinion we have expressed below. We have not conducted any independent enquiries or investigations in respect of the opinion hereinafter

expressed.

Where our opinion below refers to the Shares being issued as “fully-paid

and non-assessable”, such opinion assumes that all required consideration (in whatever form) will have been paid or provided. No

opinion is expressed as to the adequacy of any consideration received.

Our opinion below is expressed only with respect to the laws of the

Province of Québec (the “Jurisdiction”) and of the laws of Canada applicable in this Jurisdiction. Any

reference to the laws of a Jurisdiction includes the laws of Canada that apply in the Jurisdiction. Our opinion is expressed with respect

to the laws of the Jurisdiction in effect on the date of this opinion. We have no responsibility or obligation to update this opinion,

take into account or inform any person of any changes in law, facts or other developments subsequent to this date that do or may affect

the opinion we express, or advise any person of any other change in any matter addressed in this opinion.

Based and relying upon the foregoing, and subject to the assumptions,

qualifications and limitations set forth in this opinion, we are of the opinion that the Shares have been duly and validly authorized

for issuance and, if and when issued in accordance with such authorization and the terms of the applicable Plan, will be validly issued

as fully paid and non-assessable.

This opinion is rendered solely in connection with the Registration

Statement and is expressed as of the date hereof. Our opinion is expressly limited to the matters set forth above and we render no opinion,

whether by implication or otherwise, as to any other matters relating to Company, the Registration Statement or the Shares. This opinion

may not be used or relied upon by you for any other purpose or used or relied upon by any other person.

We consent to the inclusion of this opinion as part of the Registration

Statement and consent to being named in the Registration Statement under the heading “Legal Matters”. In giving this consent,

we do not admit that we come within the category of persons whose consent is required under Section 7 of the Securities Act or the rules

promulgated thereunder.

Yours truly,

/s/ Stikeman Elliott LLP

Stikeman Elliott LLP

Exhibit 23.2

|

Consent of Independent

Registered Public Accounting Firm |

Raymond Chabot

Grant Thornton LLP

Suite 2000

National Bank Tower

600 De La Gauchetière Street West

Montréal, Quebec H3B 4L8

T 514-878-2691

|

| |

|

| |

Classification: Public |

We have issued our report dated February 28, 2024, with respect to

the consolidated financial statements included in the Annual Report of The Lion Electric Company on Form 40-F for the fiscal year ended

December 31, 2023, which is incorporated by reference in this Registration Statement.

We consent to the incorporation by reference in this Registration

Statement on Form S-8 being filed with the United States Securities and Exchange Commission of the aforementioned report.

Montreal, Canada

March 4, 2024

| |

|

|

| Member of Grant Thornton International Ltd |

|

rcgt.com |

Exhibit 107.1

Calculation of Filing Fee Tables

Form

S-8

(Form Type)

The

Lion Electric Company

(Exact Name of Registrant as Specified in its Charter)

Table 1: Newly Registered Securities

|

Security

Type |

Security

Class

Title |

Fee

Calculation Rule |

Amount

Registered(1) |

Proposed

Maximum

Offering Price

Per Unit |

Maximum

Aggregate

Offering Price |

Fee Rate |

Amount of

Registration Fee |

| Equity |

Common Shares, no par value |

Rule 457(c) and (h) |

22,263,757(2) |

$1.71(3) |

$38,071,024 |

0.00014760 |

$5,619.28 |

| Equity |

Common Shares, no par value |

Rule 457(h) |

385,717(4) |

$1.44 (3) |

$555,432.48 |

0.00014760 |

$81.98 |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

| Total Offering Amounts |

|

$38,626,456.48 |

|

$5,701.26 |

| Total Fee Offsets |

|

|

|

— |

| Net Fee Due |

|

|

|

$5,701.26 |

(1) Pursuant to Rule 416(a) under

the Securities Act of 1933, as amended (the “Securities Act”), this Registration Statement on Form S-8 (this “Registration

Statement”) also covers an indeterminate number of additional common shares, without par value (“Common Shares”), of

The Lion Electric Company that may become issuable under The Lion Electric Company Omnibus Incentive Plan (the “Omnibus Plan”)

and the Lion Electric Company legacy equity-based incentive plan (the “Legacy Plan” and, together with the Omnibus Plan, the

“Plans”) by reason of any share dividend, share split, recapitalization, or other similar transaction effected without the

receipt of consideration, which results in an increase in the number of outstanding Common Shares..

(2) Represents Common Shares that have been reserved for future issuance,

or that have been issued to the Selling Shareholders (as defined in this Registration Statement), under the Plans.

(3) Estimated solely for the purpose of calculating the registration

fee pursuant to Rule 457(c) and (h) under the Securities Act on the basis of the average of the high and low market prices of the Common

Shares on the NYSE as of February 28, 2024.

(4) Represents Common Shares reserved for issuance upon exercise of

outstanding stock options under the Plans.

(5) Calculated solely for the purpose of determining the registration

fee pursuant to Rule 457(h)(1) of the Securities Act, based on the weighted average exercise price per share of the outstanding stock

options. The U.S. dollar amounts with respect to outstanding stock options were calculated based on the Bank of Canada noon rate of exchange

reported on February 28, 2024, which was C$1.00=US$0.7367.

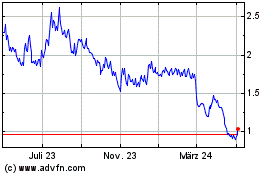

Lion Electric (NYSE:LEV)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

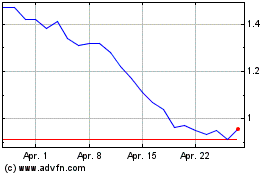

Lion Electric (NYSE:LEV)

Historical Stock Chart

Von Apr 2023 bis Apr 2024