0001587523PRE 14Afalse00015875232023-01-012023-12-31iso4217:USD00015875232022-01-012022-12-3100015875232021-01-012021-12-3100015875232020-01-012020-12-310001587523kn:ChangeInPensionValueAdjustmentMemberecd:PeoMember2023-01-012023-12-310001587523kn:ChangeInPensionValueAdjustmentMemberecd:PeoMember2022-01-012022-12-310001587523kn:ChangeInPensionValueAdjustmentMemberecd:PeoMember2021-01-012021-12-310001587523kn:ChangeInPensionValueAdjustmentMemberecd:PeoMember2020-01-012020-12-310001587523kn:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearAdjustmentMemberecd:PeoMember2023-01-012023-12-310001587523kn:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearAdjustmentMemberecd:PeoMember2022-01-012022-12-310001587523kn:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearAdjustmentMemberecd:PeoMember2021-01-012021-12-310001587523kn:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearAdjustmentMemberecd:PeoMember2020-01-012020-12-310001587523ecd:PeoMemberkn:FairValueOfEquityAwardsOutstandingAndUnvestedDuringTheYearAdjustmentMember2023-01-012023-12-310001587523ecd:PeoMemberkn:FairValueOfEquityAwardsOutstandingAndUnvestedDuringTheYearAdjustmentMember2022-01-012022-12-310001587523ecd:PeoMemberkn:FairValueOfEquityAwardsOutstandingAndUnvestedDuringTheYearAdjustmentMember2021-01-012021-12-310001587523ecd:PeoMemberkn:FairValueOfEquityAwardsOutstandingAndUnvestedDuringTheYearAdjustmentMember2020-01-012020-12-310001587523ecd:PeoMemberkn:ChangeInFairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearsAdjustmentMember2023-01-012023-12-310001587523ecd:PeoMemberkn:ChangeInFairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearsAdjustmentMember2022-01-012022-12-310001587523ecd:PeoMemberkn:ChangeInFairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearsAdjustmentMember2021-01-012021-12-310001587523ecd:PeoMemberkn:ChangeInFairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearsAdjustmentMember2020-01-012020-12-310001587523kn:FairValueOfVestedEquityAwardsGrantedDuringTheYearAdjustmentMemberecd:PeoMember2023-01-012023-12-310001587523kn:FairValueOfVestedEquityAwardsGrantedDuringTheYearAdjustmentMemberecd:PeoMember2022-01-012022-12-310001587523kn:FairValueOfVestedEquityAwardsGrantedDuringTheYearAdjustmentMemberecd:PeoMember2021-01-012021-12-310001587523kn:FairValueOfVestedEquityAwardsGrantedDuringTheYearAdjustmentMemberecd:PeoMember2020-01-012020-12-310001587523kn:ChangeInFairValueOfVestedEquityAwardsGrantedInPriorYearsAdjustmentMemberecd:PeoMember2023-01-012023-12-310001587523kn:ChangeInFairValueOfVestedEquityAwardsGrantedInPriorYearsAdjustmentMemberecd:PeoMember2022-01-012022-12-310001587523kn:ChangeInFairValueOfVestedEquityAwardsGrantedInPriorYearsAdjustmentMemberecd:PeoMember2021-01-012021-12-310001587523kn:ChangeInFairValueOfVestedEquityAwardsGrantedInPriorYearsAdjustmentMemberecd:PeoMember2020-01-012020-12-310001587523kn:FairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearAdjustmentMemberecd:PeoMember2023-01-012023-12-310001587523kn:FairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearAdjustmentMemberecd:PeoMember2022-01-012022-12-310001587523kn:FairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearAdjustmentMemberecd:PeoMember2021-01-012021-12-310001587523kn:FairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearAdjustmentMemberecd:PeoMember2020-01-012020-12-310001587523kn:PensionAdjustmentsServiceCostMemberecd:PeoMember2023-01-012023-12-310001587523kn:PensionAdjustmentsServiceCostMemberecd:PeoMember2022-01-012022-12-310001587523kn:PensionAdjustmentsServiceCostMemberecd:PeoMember2021-01-012021-12-310001587523kn:PensionAdjustmentsServiceCostMemberecd:PeoMember2020-01-012020-12-310001587523ecd:NonPeoNeoMemberkn:ChangeInPensionValueAdjustmentMember2023-01-012023-12-310001587523ecd:NonPeoNeoMemberkn:ChangeInPensionValueAdjustmentMember2022-01-012022-12-310001587523ecd:NonPeoNeoMemberkn:ChangeInPensionValueAdjustmentMember2021-01-012021-12-310001587523ecd:NonPeoNeoMemberkn:ChangeInPensionValueAdjustmentMember2020-01-012020-12-310001587523kn:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearAdjustmentMemberecd:NonPeoNeoMember2023-01-012023-12-310001587523kn:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearAdjustmentMemberecd:NonPeoNeoMember2022-01-012022-12-310001587523kn:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearAdjustmentMemberecd:NonPeoNeoMember2021-01-012021-12-310001587523kn:GrantDateFairValueOfEquityAwardsGrantedDuringTheYearAdjustmentMemberecd:NonPeoNeoMember2020-01-012020-12-310001587523ecd:NonPeoNeoMemberkn:FairValueOfEquityAwardsOutstandingAndUnvestedDuringTheYearAdjustmentMember2023-01-012023-12-310001587523ecd:NonPeoNeoMemberkn:FairValueOfEquityAwardsOutstandingAndUnvestedDuringTheYearAdjustmentMember2022-01-012022-12-310001587523ecd:NonPeoNeoMemberkn:FairValueOfEquityAwardsOutstandingAndUnvestedDuringTheYearAdjustmentMember2021-01-012021-12-310001587523ecd:NonPeoNeoMemberkn:FairValueOfEquityAwardsOutstandingAndUnvestedDuringTheYearAdjustmentMember2020-01-012020-12-310001587523ecd:NonPeoNeoMemberkn:ChangeInFairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearsAdjustmentMember2023-01-012023-12-310001587523ecd:NonPeoNeoMemberkn:ChangeInFairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearsAdjustmentMember2022-01-012022-12-310001587523ecd:NonPeoNeoMemberkn:ChangeInFairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearsAdjustmentMember2021-01-012021-12-310001587523ecd:NonPeoNeoMemberkn:ChangeInFairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearsAdjustmentMember2020-01-012020-12-310001587523ecd:NonPeoNeoMemberkn:FairValueOfVestedEquityAwardsGrantedDuringTheYearAdjustmentMember2023-01-012023-12-310001587523ecd:NonPeoNeoMemberkn:FairValueOfVestedEquityAwardsGrantedDuringTheYearAdjustmentMember2022-01-012022-12-310001587523ecd:NonPeoNeoMemberkn:FairValueOfVestedEquityAwardsGrantedDuringTheYearAdjustmentMember2021-01-012021-12-310001587523ecd:NonPeoNeoMemberkn:FairValueOfVestedEquityAwardsGrantedDuringTheYearAdjustmentMember2020-01-012020-12-310001587523kn:ChangeInFairValueOfVestedEquityAwardsGrantedInPriorYearsAdjustmentMemberecd:NonPeoNeoMember2023-01-012023-12-310001587523kn:ChangeInFairValueOfVestedEquityAwardsGrantedInPriorYearsAdjustmentMemberecd:NonPeoNeoMember2022-01-012022-12-310001587523kn:ChangeInFairValueOfVestedEquityAwardsGrantedInPriorYearsAdjustmentMemberecd:NonPeoNeoMember2021-01-012021-12-310001587523kn:ChangeInFairValueOfVestedEquityAwardsGrantedInPriorYearsAdjustmentMemberecd:NonPeoNeoMember2020-01-012020-12-310001587523ecd:NonPeoNeoMemberkn:FairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearAdjustmentMember2023-01-012023-12-310001587523ecd:NonPeoNeoMemberkn:FairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearAdjustmentMember2022-01-012022-12-310001587523ecd:NonPeoNeoMemberkn:FairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearAdjustmentMember2021-01-012021-12-310001587523ecd:NonPeoNeoMemberkn:FairValueOfEquityAwardsOutstandingAndUnvestedInPriorsYearAdjustmentMember2020-01-012020-12-310001587523ecd:NonPeoNeoMemberkn:PensionAdjustmentsServiceCostMember2023-01-012023-12-310001587523ecd:NonPeoNeoMemberkn:PensionAdjustmentsServiceCostMember2022-01-012022-12-310001587523ecd:NonPeoNeoMemberkn:PensionAdjustmentsServiceCostMember2021-01-012021-12-310001587523ecd:NonPeoNeoMemberkn:PensionAdjustmentsServiceCostMember2020-01-012020-12-31000158752312023-01-012023-12-31000158752322023-01-012023-12-31000158752332023-01-012023-12-31000158752342023-01-012023-12-31000158752352023-01-012023-12-31000158752362023-01-012023-12-31

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934

(Amendment No. )

Filed by the Registrant ☒ Filed by a Party other than the Registrant ☐

Check the appropriate box:

| | | | | | | | |

☒ | | Preliminary Proxy Statement |

☐ | | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

☐ | | Definitive Proxy Statement |

☐ | | Definitive Additional Materials |

☐ | | Soliciting Material Pursuant to § 240.14a-12 |

KNOWLES CORPORATION

(Name of Registrant as Specified in its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check all boxes that apply):

| | | | | | | | | | | | | | |

| ☒ | | No fee required. |

☐ | | Fee paid previously with preliminary materials. |

☐ | | Fee computed on table in exhibit required by Item 25(b) per Exchange Act Rules 14a-6(i)(1) and 0-11. |

| | |

NOTICE OF 2024 ANNUAL MEETING OF SHAREHOLDERS |

Knowles Corporation u 1151 Maplewood Drive u Itasca, Illinois 60143

March 15, 2024

Dear Fellow Stockholders:

Notice is hereby given that the 2024 Annual Meeting of Shareholders (including any adjournments or postponements thereof, the "2024 Annual Meeting") of Knowles Corporation, a Delaware corporation (including any consolidated subsidiaries thereof, the "Company," "Knowles," "we," "us" and "our") will be held on April 30, 2024 at 9:00 a.m. Central Time at The Langham Chicago Hotel, 330 N. Wabash Avenue, Chicago, Illinois 60611. The principal business of the 2024 Annual Meeting will be the consideration of the following matters:

1.to elect the nine directors named in the attached Proxy Statement for a one-year term or until their respective successors have been duly elected and qualified;

2.to ratify the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for 2024;

3.to approve, on a non-binding, advisory basis the compensation of our named executive officers;

4.to amend the Company's Restated Certificate of Incorporation to provide for officer exculpation as permitted by Delaware law;

5.to approve the Second Amended and Restated 2018 Equity and Cash Incentive Plan; and

6.to transact any other business that may properly come before the 2024 Annual Meeting.

All shareholders of record at the close of business on March 8, 2024 (the "Record Date") are entitled to vote at the 2024 Annual Meeting or any postponement or adjournment thereof. We plan to send a Notice of Internet Availability of Proxy Materials on or about March 15, 2024. Your vote is very important. Whether or not you plan to attend the meeting, we urge you to review the proxy materials and vote your shares as soon as possible by carefully following the instructions on the Notice of Internet Availability of Proxy Materials. Alternatively, if you have requested written proxy materials, please sign, date and return the proxy card in the return envelope provided as promptly as possible.

Thank you for your continued support of our Company.

On behalf of the Board of Directors,

ROBERT J. PERNA

Secretary

Important Notice of Internet Availability of Proxy Materials for the Annual Meeting to be Held on April 30, 2024: The Notice of Meeting, Proxy Statement for the 2024 Annual Meeting, and Annual Report on Form 10-K for the fiscal year ended December 31, 2023 are available at www.proxyvote.com.

This summary highlights information contained elsewhere in this Proxy Statement. It does not contain all of the information that you should consider in connection with the matters before the 2024 Annual Meeting. Please read the entire Proxy Statement carefully before voting.

| | | | | | | | | | | |

| | | |

| ANNUAL MEETING INFORMATION | |

| | | |

| Date | April 30, 2024 | |

| | | |

| Time | 9:00 a.m. Central Time | |

| | | |

| Place | The Langham Chicago Hotel, 330 N. Wabash Avenue, Chicago, Illinois 60611. | |

| | | |

| Record Date | The Board of Directors set March 8, 2024 as the Record Date for the 2024 Annual Meeting. This means that only shareholders as of the close of business on that date are entitled to receive this notice of the 2024 Annual Meeting and vote at the 2024 Annual Meeting and any adjournments or postponements of the 2024 Annual Meeting. A list of these shareholders will be available for at least ten days ending on the day before the 2024 Annual Meeting. To arrange review of the list of shareholders for any purpose relevant to the 2024 Annual Meeting, please contact investor relations at investorrelations@knowles.com. | |

| | | |

| Voting | Shareholders at the close of business on the Record Date will be entitled to vote their shares using the Internet or the telephone or by attending the 2024 Annual Meeting in person. Instructions for voting by using the Internet or the telephone are set forth in the Notice of Internet Availability that has been provided to you. Shareholders of record who received a paper copy of the proxy materials also may vote their shares by marking their votes on the proxy card provided, signing and dating it, and mailing it in the envelope provided, or by attending and voting in person at the 2024 Annual Meeting. For more information on voting, attending the 2024 Annual Meeting, and other meeting information, please see "Information about the 2024 Annual Meeting" on page 73 of this Proxy Statement. | |

| | | |

| | | | | | | | | | | |

| | | |

AGENDA AND BOARD RECOMMENDATIONS |

| | Unanimous Board Recommendation | See

Page |

| Proposal 1 | Election of nine directors named in this Proxy Statement for a one-year term or until their respective successors have been duly elected and qualified | FOR

each nominee | |

| Proposal 2 | Ratification of the appointment of PricewaterhouseCoopers LLP as our independent registered public accounting firm for fiscal year 2024 | FOR | |

| Proposal 3 | Non-binding, advisory vote to approve our named executive officer compensation | FOR | |

| Proposal 4 | To amend the Company's Restated Certificate of Incorporation to provide for officer exculpation as permitted by Delaware law | FOR | |

| Proposal 5 | Approval of the Second Amended and Restated Knowles Corporation 2018 Equity and Cash Incentive Plan | FOR | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| DIRECTOR NOMINEES | |

| | |

| Our Board is currently comprised of nine directors. You are being asked to vote on the election of the director nominees listed below for a one-year term. For more information about the background and qualifications of the director nominees, please see "Nominees for Election to the Board" on page 15 of this Proxy Statement. | |

| Name | Age | Independence | Tenure | Committees | |

| Keith Barnes | 72 | Yes | 10 Years | Compensation Committee

Governance and Nominating Committee | |

| Erania Brackett | 50 | Yes | 1 Year | Compensation Committee | |

| Daniel Crowley | 61 | Yes | 1 Years | Compensation Committee | |

| Didier Hirsch | 72 | Yes | 9 Years | Audit Committee

Governance and Nominating Committee | |

| Ye Jane Li | 56 | Yes | 6 Years | Audit Committee | |

| Donald Macleod | 75 | Yes | 10 Years | Audit Committee | |

| Jeffrey Niew | 57 | No | 10 Years | N/A | |

| Cheryl Shavers | 70 | Yes | 6 Years | Compensation Committee

Governance and Nominating Committee | |

| Michael Wishart | 69 | Yes | 4 Years | Audit Committee | |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| | | | | | |

| BOARD COMPOSITION AND DIVERSITY | |

| | |

| | |

| |

| |

| |

| |

| |

| |

| |

| |

| |

| | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | |

| DIRECTOR SKILLS AND EXPERTISE |

| Qualifications/Experience | Barnes | Brackett | Crowley | Hirsch | Li | Macleod | Niew | Shavers | Wishart |

| Strategic Planning | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Global/International | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Technology Industry Experience | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Financial Expertise | ● | | | ● | ● | ● | ● | | ● |

| Sales, Marketing and Brand Management | ● | ● | ● | | ● | | ● | | |

| Engineering | | ● | ● | | ● | | ● | ● | |

| Supply Chain | | ● | ● | | | ● | | | ● |

| Investment Banking/ Capital Markets | ● | | ● | ● | | | | | ● |

| Enterprise Risk Management | ● | ● | | ● | ● | ● | ● | ● | |

| Information Technology | | | | ● | ● | | | ● | |

| Public Company Board | ● | | ● | ● | ● | ● | | ● | ● |

| | | | | | | | |

| DEFINITIONS |

Strategic Planning: Leadership experience in formulating and accomplishing strategic objectives for an organization Global/International: Board leadership experience with multinational companies or in international markets Technology Industry Experience: Leadership experience with other companies in the technology industry, including an understanding of the competitive landscape and strategic positioning of the Company Financial Expertise: Significant experience in corporate finance or financial accounting Sales, Marketing and Brand Management: Expertise in sales, marketing, and brand management at a global scale and in local markets relevant to our business | | Engineering: Experience in engineering or in leading research and development teams working on cutting edge innovations Supply Chain: Leadership experience at other companies with complex supply chains Investment Banking/ Capital Markets: Experience overseeing investment capital decisions and strategic investments Risk Management: Significant experience in enterprise risk management Information Technology: Experience in the management of information security or cybersecurity risks Public Company Board: Experience serving on the boards of other public companies |

|

|

|

|

|

| | | | | | | | | | | | | | | | | |

| | | | | |

| CORPORATE GOVERNANCE HIGHLIGHTS |

| | |

• | All directors are elected annually |

| • | Each Board committee is comprised of independent directors |

| • | Separate non-executive Chairman and Chief Executive Officer roles |

| • | Average tenure of independent directors is six years |

| • | Regular Board, committee and director evaluations |

| • | Policies prohibiting hedging and pledging of Company stock |

| • | Simple majority voting standard for uncontested director elections with a director resignation policy |

• | Robust annual director evaluation program |

| | | | | |

| | | | | | | | |

| EXECUTIVE COMPENSATION HIGHLIGHTS | |

| PHILOSOPHY AND OBJECTIVES | |

| Knowles' executive compensation program is designed to achieve the following key objectives: | |

| •Motivate executives to enhance LONG-TERM shareholder value •Reinforce PAY FOR PERFORMANCE culture by aligning executive compensation with Knowles business objectives and financial performance •Provide a total compensation opportunity that allows Knowles to ATTRACT AND RETAIN TALENTED executives •Use incentive programs for RISK MITIGATION to promote desired behavior without encouraging unnecessary or excessive risk-taking | |

| | |

| 2023 COMPENSATION STRATEGY AND RESULTS | |

| Target Compensation Pay Mix | |

| | |

| Short-Term / Annual Incentive Plan ("AIP") | |

| For 2023, we introduced new financial measures to our annual incentive plan. For corporate executives, the AIP provides a weighted payout opportunity based on business segment performance. For more information about our AIP, please see “Executive Compensation Discussion and Analysis" beginning on page 29 of this Proxy Statement. | |

| | |

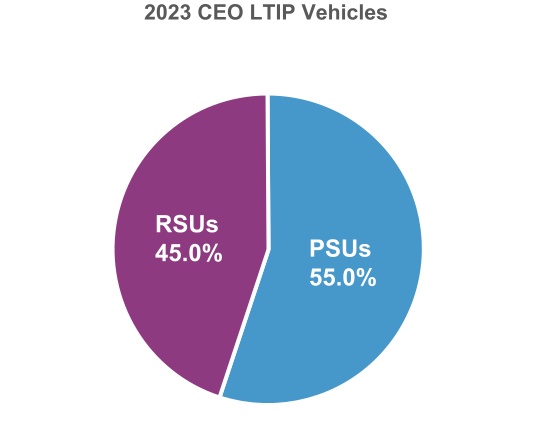

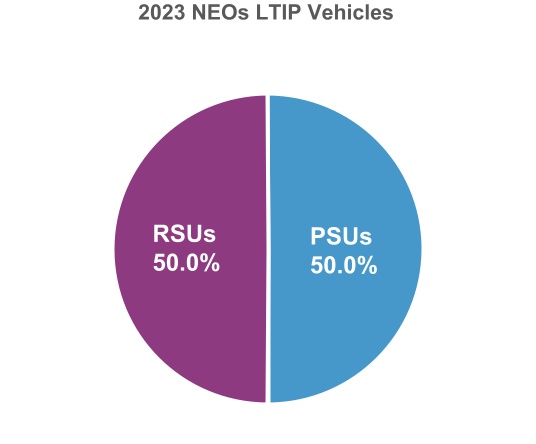

| Long-Term Incentive Plan ("LTIP") | |

| Our long-term incentive plan (LTIP) rewards executives for long-term shareholder value creation. The LTIP remains the same since 2020. For more information about our LTIP, please see “Executive Compensation Discussion and Analysis" beginning on page 29 of this Proxy Statement. | |

| | |

| | | | | | | | |

| EXECUTIVE COMPENSATION HIGHLIGHTS | |

| 2023 Business Highlights | |

| | |

| Incentive Payout Highlights | |

| | |

| | |

| COMPENSATION PROGRAM GOVERNANCE | |

| The following highlights the governance practices applicable to our compensation program, which the Compensation Committee believes support our pay-for-performance philosophy and serve the interests of our shareholders: | |

| | |

We are committed to conducting our business in accordance with the highest level of ethical and corporate governance standards. Our Board periodically reviews Knowles' corporate governance practices and takes other actions to address changes in regulatory requirements, developments in governance best practices and matters raised by shareholders. The following describes some of the actions taken to help ensure that our conduct earns the respect and trust of shareholders, customers, business partners, employees and the communities in which we live and work.

Governance Guidelines and Codes

Our Board has adopted written corporate governance guidelines (the "Corporate Governance Guidelines") that set forth the policies and procedures by which the Company and the Board are governed. In addition, our Board and its committees have adopted policies and procedures that govern how the Company and its executives conduct business and manage risk. These documents are available on our website at https://investor.knowles.com/governance/governance-documents.

Director Independence

Our Corporate Governance Guidelines provide that at least two-thirds of the Board and all of the members of the Audit, Compensation and Governance and Nominating Committees must be independent from management and must meet all of the applicable criteria for independence established by the New York Stock Exchange ("NYSE"), the Securities and Exchange Commission ("SEC") and the Board. Our Board makes an annual determination of the independence of each director. No director may be deemed independent unless the Board determines that neither the director nor any of the director's immediate family members has a material relationship with Knowles, directly or as an officer, shareholder or partner of an organization that has a material relationship with Knowles.

Our Board has determined that each director who served on the Board in 2023, except for Mr. Niew, has no material relationship with Knowles and meets the independence requirements of the NYSE and the SEC. In addition, all members of our Board, except for Mr. Niew, meet our Standards for Director Independence, which are available on our website at https://investor.knowles.com/governance/governance-documents.

Board Leadership Structure

Our Board has adopted a structure whereby the Chairman of the Board is an independent director. Our Board believes that having a chairman who is independent of management provides strong leadership for the Board and helps ensure critical and independent thinking with respect to our Company's strategy and performance. Our CEO is also a member of the Board as the management representative. We believe this is important to make information and insight directly available to the directors in their deliberations. Our Board believes that this structure provides an appropriate, well-functioning balance between non-management and management directors that combines experience, accountability and effective risk oversight.

Risk Oversight

Senior management is responsible for day-to-day management of risks facing Knowles, including the creation of appropriate risk management policies and procedures. The Board is responsible for overseeing management in the execution of these responsibilities and for assessing the Company's overall approach to risk management. The Board regularly assesses significant risks to the Company in the course of its review and oversight of the Company's strategy and the Company's annual operating plan. As part of its responsibilities, the Board and its standing committees also regularly review material strategic, operational, financial, legal, compensation, compliance and ESG risks with executive officers. The Audit Committee also performs an oversight role with respect to financial, legal, cybersecurity, enterprise and compliance risks, and reports on its findings and assessments at each regularly scheduled Board meeting. The Compensation Committee considers risk in connection with its design of compensation programs, and has engaged an independent compensation consultant to assist in mitigating compensation-related risk. The Governance and Nominating Committee oversees and monitors risks relating to the Company's governance structure and processes and ESG risks and opportunities.

Director Attendance at Shareholders Meetings

Directors are encouraged to attend the annual meeting of the stockholders. All directors then in office attended the 2023 Annual Meeting. The Company expects all of its current directors to attend the 2024 Annual Meeting.

Directors' Meetings

Our Board conducts executive sessions in conjunction with its regularly scheduled meetings at least quarterly without management representatives present. Mr. Macleod, as Chairman of the Board, presides at these sessions. If Mr. Macleod is determined to no longer be an independent director or is not present at any of these sessions, the Chair of the Governance and Nominating Committee, who is currently Dr. Shavers, will preside.

Audit Committee Procedures; Disclosure Controls and Procedures Committee

The Audit Committee holds quarterly meetings at which it routinely meets separately with each of our independent registered public accounting firm (PwC), our Chief Audit Executive, and management to assess certain matters including the status of the independent audit process and management's assessment of the effectiveness of the Company's internal controls over financial reporting. In addition, the Audit Committee, as a whole, reviews and meets to discuss each Form 10-Q and Form 10-K (including the financial statements) prior to the filing of those forms with the SEC. Management maintains a Disclosure Controls and Procedures Committee, which includes among its members our Chief Financial Officer, Controller, Vice President of Investor Relations, Vice President of Tax, Chief Audit Executive and General Counsel. This management committee meets at least quarterly to review our quarterly earnings releases and each Form 10-Q and Form 10-K, as well as any other material disclosures, to support our disclosure controls and procedures.

Complaints "Hotline" and Communication with Directors

In accordance with the Sarbanes-Oxley Act of 2002 ("Sarbanes-Oxley"), the Audit Committee has established procedures for (i) the receipt, retention and treatment of complaints regarding accounting, internal accounting controls or auditing matters ("accounting matters") and (ii) the confidential, anonymous submission by employees of concerns regarding questionable accounting matters. Such complaints or concerns may be submitted anonymously to Knowles at 1151 Maplewood Drive, Itasca, Illinois 60143, in care of our Director of Compliance or General Counsel, by email to Audit.Committee@knowles.com, or through an external service provider as described in our Code of Business Conduct, which is available on our website at https://investor.knowles.com/governance/governance-documents. Shareholders and other interested persons may also communicate with our Board and the non-management directors using any of these methods or channels. In general, all such communication will be forwarded promptly to the Chairman of the Board or relevant director. Knowles reserves the right to not forward to Board members any abusive, threatening or otherwise inappropriate material.

Compensation Consultant Independence and Fee Disclosure

The Compensation Committee has the authority and discretion to retain external compensation consultants and other advisors as it deems appropriate. The Compensation Committee has adopted a policy providing for the continuing independence and accountability to the Compensation Committee of any advisor retained by the Compensation Committee to assist the Compensation Committee in the discharge of its duties. The policy formalizes the independent relationship between the Compensation Committee's advisors and Knowles, while permitting management limited ability to access the advisors' knowledge of Knowles for compensation matters.

In order to ensure the independence of the compensation consultant, the consultant reports directly to the Compensation Committee and works specifically for the Compensation Committee solely on executive compensation matters. Under the policy, the Compensation Committee will annually review and pre-approve services that may be provided by the independent advisor to management without further committee approval. Compensation Committee approval is required prior to management retaining the Compensation Committee's independent advisor for any executive compensation services or other consulting services or products above an aggregate annual limit of $50,000.

The Compensation Committee's independent compensation consultant periodically reviews and advises on the adequacy and appropriateness of our overall executive compensation plans, programs and practices and, from time to time, answers specific questions raised by the Compensation Committee or management. Compensation decisions are made by, and are the responsibility of, the Compensation Committee and our Board, and may reflect factors and

considerations other than the information and recommendations provided by the Compensation Committee's consultant.

The Compensation Committee has appointed Compensia, Inc. ("Compensia") as its independent compensation consultant. During 2023, Compensia provided no other services to, and had no other relationship with, Knowles. Compensia focuses on executive compensation matters and does not have departments, groups or affiliates that provide services other than those related to executive compensation and benefits.

Qualifications and Nominations of Directors

The Governance and Nominating Committee considers and recommends to the Board nominees for election to, or for filling any vacancy on, our Board or its committees in accordance with our By-Laws, our Corporate Governance Guidelines and the Governance and Nominating Committee's charter. As part of the Board’s succession planning, the Governance and Nominating Committee periodically reviews the skills and experience of each of the current directors. As part of this review, the Governance and Nominating Committee noted that Mr. Macleod was scheduled to retire at the 2024 Annual Meeting in accordance with the board retirement age policy set forth in the Company's Corporate Governance Guidelines. However, in light of Mr. Macleod’s deep knowledge of the Company and the industry, and his invaluable contributions to the Board’s discussion of strategic alternatives for the Consumer MEMS Microphone (CMM) business and the Company’s on-going strategic transformation, upon recommendation of the Governance and Nominating Committee, the Board waived the retirement policy for Mr. Macleod and requested that he remain on the Board as Chairman for an additional year.

The Governance and Nominating Committee uses a board skills matrix to ensure the Board as a whole appropriately reflects the key attributes, experiences, qualifications and skills most needed to support the Company’s long-term strategy. Upon completion of the Board skills matrix, the Governance and Nominating Committee identifies areas of director knowledge and experience that may benefit the Board in the future and uses that information as part of the director search and nomination effort. To be considered for Board membership, a nominee for director must be an individual who has the highest personal and professional integrity, who has demonstrated exceptional ability and judgment, and who will be most effective, in conjunction with the other members of our Board, in serving the long-term interests of our shareholders.

The Governance and Nominating Committee also considers directors' qualifications as independent directors (the Board requires that at least two-thirds of its members be independent and all of the members of the Audit, Compensation and Governance and Nominating Committees be independent); the Audit Committee's process of determining the financial literacy of members of the Audit Committee and the qualification of Audit Committee members as "audit committee financial experts;" the qualification of Compensation Committee members as "independent directors" and "non-employee directors;" and the diversity, skills, background and experiences of Board members in the context of the needs of the Board. In consideration of directors' qualifications, the Governance and Nominating Committee may also consider such other factors as it may deem to be in the best interests of Knowles and its shareholders. The Board believes that a diverse membership having a variety of skills, styles, experience and competencies is an important feature of a well-functioning board. Accordingly, the Board believes that diversity (inclusive of gender and race) should be a consideration in Board succession planning and recruiting, consistent with nominating only the most qualified candidates for the Board who bring the required skills, competencies and fit to the boardroom. The Board remains committed to considering board candidate slates that are as diverse as possible and, to that end, amended the Corporate Governance Guidelines in July 2021 to provide that women and minority candidates shall be included in the pool of candidates for any director search.

Whenever the Governance and Nominating Committee concludes, based on the reviews or considerations described above or due to a vacancy, that a new nominee to our Board is required or advisable, it will consider recommendations from directors, management, shareholders and, if it deems appropriate, consultants retained for that purpose. It is the policy of the Committee to consider director candidates recommended by the Company's shareholders and apply the same criteria in considering those director candidates that it employs in considering candidates proposed from any other source. Shareholders who wish to recommend an individual for nomination should send that person's name and supporting information to the Governance and Nominating Committee, in care of the Secretary of Knowles at 1151 Maplewood Drive, Itasca, Illinois 60143. Shareholders who wish to directly nominate an individual for election as a director, without going through the Governance and Nominating Committee, must comply with the procedures in our By-Laws. For more information, please see "Shareholder Proposals and Director Nominations for the 2025 Annual Meeting" on page 77 of this Proxy Statement.

Insider Trading Policy

We maintain an insider trading policy that contains prohibitions on, among other items, officers, directors and employees purchasing or selling our securities while in possession of material, non-public information, or otherwise using such information for their personal benefit. While not required to enter into trading plans, our executives and directors are permitted to enter into trading plans that are intended to comply with the requirements of Rule 10b5-1 of the Exchange Act. Our insider trading policy is available on our website at https://investor.knowles.com/governance/governance-documents.

Prohibition on Hedging, Pledging and Short Sales

The Company prohibits its directors, executive officers, and employees who receive long-term incentive plan awards (and their respective family members) from engaging in any hedging transactions or any form of hedging involving the Company's securities, including short sales, put and call stock options, pre-paid variable forward contracts, equity swaps, collars, and exchange funds. In addition, such persons may not pledge or hypothecate or approve the pledging or hypothecation of any Company securities which they own or beneficially control, as collateral for any loan or line of credit or to hold Company securities in a margin account.

Stock Ownership Guidelines

Knowles has stock ownership guidelines for executive officers of 4x base salary for the CEO and 2x base salary for the other executive officers. Stock ownership requirements for any Vice President are determined by the CEO. Executive Officers have five years from the date on which they become subject to the guidelines to satisfy the applicable guideline level and, if the level is not achieved, the Compensation Committee, in consultation with management, may pay a portion of that executive officer's annual bonus or other awards in shares. Once an individual reaches age 58, the Compensation Committee will have the discretion to relax the applicable guidelines for that executive officer. For the purposes of these guidelines, ownership includes shares owned outright or held in a trust by the individual and jointly with, or separately by, the individual's spouse and/ or children sharing the same household as the individual, shares held through Knowles' 401(k) plan, share units held through Knowles' Deferred Compensation Plan (the "Deferred Compensation Plan"), and unvested restricted stock awards. Unearned PSUs and unexercised stock options are not counted toward satisfaction of the stock ownership guidelines. As of December 31, 2023, Messrs. Niew, Anderson, Cabrera, Giesecke, and Perna were in compliance with their ownership guideline.

In addition, to further align the interest of the independent directors of the Board with the Company's shareholders, the Board has adopted stock ownership guidelines for the non-employee directors. Under the guidelines, each non-employee director is expected to own Company common stock with a value at least equal to 3x the base annual cash compensation paid to such director during the period he or she serves as a director, not including any additional cash compensation paid to chairs of the Board or committees and to committee members. Non-employee directors are expected to meet these requirements within five years after the date of their election or appointment to the Board. As of December 31, 2023, all of our non-employee directors were in compliance with these guidelines.

Clawback Policy

The Company has adopted a formal incentive clawback policy, which it believes is reflective of the maturation of Knowles as a public company and indicative of sound corporate governance. In the event of a financial restatement, or certain misconduct more particularly described in the clawback policy, the Compensation Committee has the authority to require the return, repayment or forfeiture of any performance-based compensation (cash and equity) for a period of up to 36 months after such payment or award was made, granted, or vested, regardless of fault. The clawback policy complies with the newly adopted Securities and Exchange Commission rules and the corresponding corresponding NYSE Listed Company Manual 303A.14 requirements. A copy of the clawback policy can be found at https://investor.knowles.com/governance/governance-documents.

| | |

| ONGOING SHAREHOLDERS ENGAGEMENT PROGRAM |

Our directors and management are dedicated to being responsive and transparent with our shareholders on key topics, including executive compensation, corporate governance, environmental sustainability, and human capital management matters. We value the views of shareholders when establishing and evaluating relevant policies and practices. In January 2023, we reached out to shareholders representing approximately 80% of shares outstanding and conducted meetings with investors who accepted our invitations to engage, which represented approximately

18% of shares outstanding. Consistent with our long-standing practice, our investor outreach was conducted by our Chairman of the Board, without executive management present. Key themes addressed during this outreach included: our corporate strategy, re-segmentation, governance matters (including board composition), executive compensation, our diversity initiatives, and environmental, social, and governance matters. In addition, throughout the year members of our Investor Relations team and leaders of our business engage with our shareholders to seek their input and feedback, to remain well-informed regarding their perspectives, and to help increase their understanding of our business. Our management team regularly reports to our Board shareholder views on key topics of interest expressed by our shareholders. This shareholder input informs our Board's ongoing process of continually enhancing governance policies, practices, and disclosures.

| | |

CORPORATE RESPONSIBILITY AND SUSTAINABILITY |

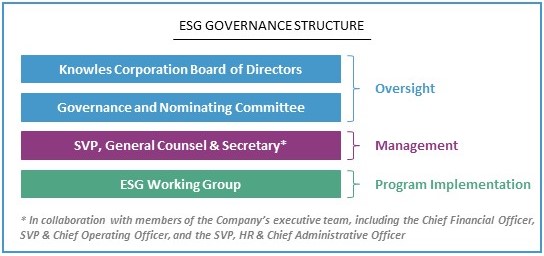

Environment, Social, and Governance

The Company is committed to conducting business in an ethical, socially responsible, and environmentally sustainable manner. Our Board, primarily through its Governance and Nominating Committee, oversees our corporate responsibility and sustainability programs. Oversight of environmental, social, and governance ("ESG") matters is an important part of the Board's work, and ESG matters are considered in setting the policies and principles that govern our business.

As a Company that embraces innovation, Knowles is committed to finding innovative ways to address the ESG items that matter to our stakeholders, including employees, shareholders, suppliers, customers, and our community at large. We are dedicated to understanding and reducing our environmental footprint, in an effort to become more efficient as a business and improve future sustainability. We are committed to responsible and inclusive human capital management across our workforce, and contributing to the communities where we operate. We are dedicated to maintaining strong governance practices in our business operations, as we believe this is part of being a good corporate citizen. We understand that environmental stewardship, social responsibility, and ethical business practices are a critical part of driving a sustainable future for our Company. In 2023, we published our third annual Corporate Sustainability Report, wherein we announced our establishment of an interim target for reduction of Level 1 and Level 2 GHG emissions. We also highlighted additional ESG initiatives, including our commitment to advance gender diversity in engineering through a pledge of $200,000 to University of Illinois at Chicago to support the enrollment and academic success of female students pursuing STEM degrees; our efforts, particularly in China and Malaysia, to reduce our environmental impact, and our innovations to support the growing electric vehicle market. Our 2023 Corporate Sustainability Report can be found at https://www.knowles.com/about-knowles/environmental-social-governance. The information contained on www.knowles.com is provided for reference only and is not incorporated into this Proxy Statement.

Corporate Governance and Ethical Business Practices

As a socially responsible company, we strive to align our business practices and policies with the needs of our key stakeholders, and to that end we have developed comprehensive governance policies that meet or exceed the

requirements of applicable laws, regulations and rules, and the NYSE's listing standards. Our Corporate Governance Guidelines, Code of Business Conduct, and overall corporate governance structure is strengthened by our anonymous and confidential ethics and compliance hotline which allows us to hear our employees' suggestions, concerns or reports of misconduct.

We are committed to respecting human rights and establishing high ethical standards across the Company. We have a Human Rights Policy, which governs all employment and work activities involving our employees in our facilities worldwide. The Human Rights Policy is consistent with the core tenets of the International Labor Organization's fundamental conventions and the United Nations Universal Declaration of Human Rights, and is informed by other internationally recognized standards, including the Responsible Business Alliance. We expect our employees and business partners to abide by the provisions of the Human Rights Policy, which includes principles of non-discrimination, fair compensation and working hours, freely chosen employment, and a ban on child labor. We have also adopted a Statement on Modern Slavery and Human Trafficking, which highlights the policies and measures we have implemented under the United Kingdom Modern Anti-Slavery Act of 2015. The statement was approved by our Board and can be accessed on our website at https://www.knowles.com/about-knowles/environmental-social-governance.

Social Responsibility

In accordance with our values, we embrace a culture where bright, creative people are expected and celebrated, and everyone's contribution helps drive change and achieve success. We are committed to being a good corporate citizen by supporting the professional development and well-being of our employees and contributing to our community. An important component of achieving this goal is fostering a workplace environment that embraces diversity and inclusion. Our diversity and inclusion strategy is centered on three pillars: to educate, train, and build awareness; to recruit, grow, and promote; and to give back and get involved. Our Diversity, Equity & Inclusion (“DE&I”) Council, established in 2021, is tasked with helping implement these three pillars.

Under this framework, we have implemented a communications campaign to educate our employees and the community on our vision and philosophy regarding diversity and inclusion, as well as the initiatives we have undertaken toward reaching our goals. Those initiatives have included partnering with non-profit organizations and various academic institutions to provide scholarships, mentoring, and internship opportunities for students from underrepresented groups. We have also worked to increase diversity in our candidate pool and through targeted career development programs. See "Human Capital Management" below for more information on our diversity and inclusion initiatives.

Environmental Stewardship

We are dedicated to preserving the environment for future generations and providing a healthy and safe workplace for our employees while promoting our continued success. Through sustainable practices, such as reducing waste, increasing energy efficiency and using renewable materials, we strive to meet the global environmental needs of today and tomorrow. We are working towards a sustainable supply chain by taking steps to identify suppliers who share our commitment to understanding and reducing our environmental impact. We recognize the importance of managing resources responsibly and practicing conservation principles. We have adopted a target to be carbon neutral by 2040, and are targeting a 25% reduction in our Scope 1 and Scope 2 greenhouse gas emissions by 2030. As we continue to review and manage our environmental impact, our path forward will include:

•continuously assessing our ESG priorities to identify focus areas, risks, and opportunities;

•establishing, measuring, and regularly reviewing environmental objectives;

•educating our employees to help them understand and work towards our goals;

•reporting progress in reducing our environmental footprint; and

•considering environmental impacts when making business decisions.

Human Capital Management

We believe our success is dependent upon attracting, developing and retaining high performing employees at all levels of the organization. Our Chief Human Resources Officer is responsible for developing and executing our human capital strategy, with oversight by the Compensation Committee of our Board of Directors. Key initiatives of the Company with respect to human capital management include:

Recruitment, Training and Development

We understand that our most important resource is our people. We utilize a variety of recruitment vehicles to source top talent. We are building relationships with organizations that support the advancement of underrepresented minority groups to sustain a pipeline of diverse talent for opportunities across our Company. We are also working to increase diversity within our professional and management positions and have implemented customized development programs to meet the unique needs of our employees' growth trajectories. We also invest in the ongoing training and development of our employees by offering tuition and continuous education reimbursement, leveraging an e-learning platform, and implementing formal mentorship programs. We have a formal succession planning initiative with the primary objective of identifying and developing our next generation of leaders. Our Chief Human Resources Officer annually reviews with the Board of Directors our overall talent management strategy and progress.

Commitment to Diversity, Inclusion and Equality

We believe our diverse teams, with their unique ideas, thoughts, and perspectives, form the building blocks for our culture of innovation at Knowles. We strive to create and maintain a workplace environment that embraces the diversity of thoughts, ideas, beliefs, and experiences brought by our team members. We recognize that nurturing an inclusive workplace enables us to attract, develop, and retain our team members regardless of their race, color, gender identity, language, national origin, religion, orientation, or age. To successfully execute on our strategy, we have established a Diversity and Inclusion Council comprised of employees from various areas of the Company along with members of senior management who serve as executive sponsors. The Council is tasked with advising the management team on concrete initiatives we can undertake as an organization to strengthen diversity and inclusion at the Company. Under the Council's leadership, we have commemorated and celebrated numerous diversity, cultural, and historical events throughout the year.

Knowles is also committed to the advancement of women in the workplace and gender diversity in engineering careers. We strive to be an employer of choice for women in engineering. We understand the importance of gender diversity and with it, the need for advancing women in Science, Technology, Engineering, and Mathematics (""STEM") careers. We continue to partner with local organizations to help bridge the gender gap in STEM and shape the next generation of women who aspire to be leaders in the new era of technology. For example, Knowles has been a perennial sponsor of the University of Illinois at Chicago's ("UIC") Women in Engineering Summer Program. We have also supported UIC's women engineering students with programs such as academic scholarships, summer internship programs, mentorship programs, and full-time employment opportunities. Our goal is to build a pipeline of multi-generational talent and accelerate the development of women engineers into advanced technical and leadership positions at Knowles. Additionally, we are focused on increasing the representation of women in leadership roles at Knowles.

We have also worked to increase represented groups in our candidate pool, among our new hires, and in leadership positions. For our 2023 summer internship program, 67% of our corporate intern class consisted of minority and/or women students, and 50% of our corporate tech interns were women. In addition, in 2023 approximately 37% of our new hires in the United States were women.

We are fully committed to supporting our communities and the advancement of underrepresented minority groups. In 2023, we continued our partnership with the Partnership to Educate and Advance Kids (PEAK), a Chicago-based nonprofit that is focused on providing academically average students from the city's most challenging and under-served neighborhoods with financial, educational, and personal support through their high school years. Knowles has pledged $10,000 annually to provide a PEAK student the opportunity to pursue a high-quality high school education.

In addition, Knowles piloted the PEAK Student Tutoring Program, where our employees assist students with STEM-related subjects.

Providing a Competitive Total Rewards Program

To be able to attract and retain the best employees, Knowles provides a competitive total rewards program that incorporates our pay for performance philosophy. Our total rewards program includes market-competitive base pay, broad-based short-term and long-term incentive plans, healthcare benefits, retirement plans, paid time off, family leave and employee assistance programs.

Fostering a Safe Work Environment

We believe it is important to provide a healthy and safe workplace for our employees. We continue to maintain an Environmental, Health, and Safety Policy that reflects our goals to ensure the health, safety, and welfare of our employees. During 2023, environmental, health, and safety training and instruction were provided at all levels within the Company. In addition, our Environmental, Health & Safety ("EHS") Managers across the globe conduct regular reviews of key EHS performance indicators, which include the reporting and correction of any unsafe workplace behaviors, working conditions that could potentially lead to injury, or workplace incidents or illnesses that required first air or other medical treatment.

Additional information regarding Knowles' activities related to its people and sustainability, as well as workforce diversity data, can be found in the Knowles 2023 Corporate Sustainability Report, which is located on our website. The contents of our website and our Corporate Sustainability Report are referenced for general information only and are not incorporated into this Proxy Statement.

| | | | | |

| PROPOSAL 1 - ELECTION OF DIRECTORS |

Our Board currently consists of nine directors. All directors stand for one-year terms. If re-elected at the 2024 Annual Meeting, each of the nine director nominees will have terms of service that expire at the 2025 Annual Meeting of Shareholders (the "2025 Annual Meeting") or until their respective successors have been duly elected and qualified.

Director Nominee Skills and Experience

The Board, in part through its delegation to the Governance and Nominating Committee, seeks to recommend qualified individuals to become members of the Board. The Board selects individuals as director nominees who, in the opinion of the Board, demonstrate the highest personal and professional integrity along with exceptional ability and judgment, who can serve as a sounding board for our CEO on planning and policy, and who will be most effective, in connection with the other directors and director nominees, in collectively serving the long-term interests of all our shareholders. The Board prefers nominees to be independent of the Company but believes it is desirable to have on the Board at least one representative of current management. In considering diversity in selecting director nominees, the Governance and Nominating Committee gives weight to the extent to which candidates would increase the effectiveness of the Board by broadening the mix of experience, knowledge, backgrounds, skills, ages and tenures represented among its members. The Board believes that diversity (inclusive of gender and race) should be a consideration in Board succession planning and recruiting, consistent with nominating only the most qualified candidates for the Board who bring the required skills, competencies and fit to the boardroom. Given the global reach and the complexity of businesses operated by Knowles, the Board also considers multi-industry and multi-geographic experience a significantly favorable characteristic. This blend of Board attributes is summarized in the chart below.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| DIRECTOR SKILLS AND EXPERTISE |

| Qualifications/Experience | Barnes | Brackett | Crowley | Hirsch | Li | Macleod | Niew | Shavers | Wishart |

| Strategic Planning | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Global/International | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Technology Industry Experience | ● | ● | ● | ● | ● | ● | ● | ● | ● |

| Financial Expertise | ● | | | ● | ● | ● | ● | | ● |

| Sales, Marketing and Brand Management | ● | ● | ● | | ● | | ● | | |

| Engineering | | ● | ● | | ● | | ● | ● | |

| Supply Chain | | ● | ● | | | ● | | | ● |

| Investment Banking/ Capital Markets | ● | | ● | ● | | | | | ● |

| Risk Management | ● | ● | | ● | ● | ● | ● | ● | |

| Information Technology | | | | ● | ● | | | ● | |

| Public Company Board | ● | | ● | ● | ● | ● | | ● | ● |

| | | | | | | | |

| DEFINITIONS |

Strategic Planning: Leadership experience in formulating and accomplishing strategic objectives for an organization Global/International: Board leadership experience with multinational companies or in international markets Technology Industry Experience: Leadership experience with other companies in the technology industry, including an understanding of the competitive landscape and strategic positioning of the Company Financial Expertise: Significant experience in corporate finance or financial accounting Sales, Marketing and Brand Management: Expertise in sales, marketing, and brand management at a global scale and in local markets relevant to our business | | Engineering: Experience in engineering or in leading research and development teams working on cutting edge innovations Supply Chain: Leadership experience at other companies with complex supply chains Investment Banking/ Capital Markets: Experience overseeing investment capital decisions and strategic investments Risk Management: Significant experience in enterprise risk management Information Technology: Experience in the management of information security or cybersecurity risks Public Company Board: Experience serving on the boards of other public companies |

|

|

|

|

|

Nominees for Election to the Board

The Board of Directors, upon the recommendation of the Governance and Nominating Committee, has determined that Keith Barnes, Erania Brackett, Daniel Crowley, Didier Hirsch, Jane Li, Donald Macleod, Jeffrey Niew, Cheryl Shavers, and Michael Wishart meet the Board's standards for director qualifications and has nominated each of them to stand for election to the Board for one-year terms expiring at the 2025 Annual Meeting or until their respective successors are duly elected and qualified or their earlier removal, resignation or retirement. Mr. Macleod was scheduled to retire at the 2024 Annual Meeting in accordance with the board retirement age policy set forth in the Company's Corporate Governance Guidelines. However, in light of Mr. Macleod’s deep knowledge of the Company and the industry, and his invaluable contributions to the Board’s discussion of strategic alternatives for the Consumer MEMS Microphone (CMM) business and the Company’s on-going strategic transformation, upon recommendation of the Governance and Nominating Committee, the Board waived the retirement policy for Mr. Macleod and requested that he remain on the Board as Chairman for an additional year. Below we have provided a biography for each of the Board's nominees, including a description of the qualifications, experience, attributes and skills of each such nominee.

The Board of Directors has determined that all of the Board's nominees with the exception of Mr. Niew qualify as independent directors under NYSE corporate governance listing standards and the Company's Standards for Director Independence (as defined below). All of the Board's nominees have consented to be named in this Proxy Statement and to serve as a director of the Company if elected. Proxies may not be voted for a greater number of persons than the number of nominees named in this Proxy Statement. The Board of Directors is not aware that any of its nominees will be unwilling or unable to serve as a director. However, if any of the Board's nominees is unable to serve or for good cause will not serve as a director, the Board of Directors may choose a substitute nominee. If any substitute nominees are designated, we will file an amended proxy statement that, as applicable, identifies the substitute nominees, discloses that such nominees have consented to being named in the revised proxy statement and to serve if elected, and includes certain biographical and other information about such nominees required by SEC rules. The persons named as proxies on the Company's proxy card will vote for the Company's remaining nominees and substitute nominees chosen by the Board.

Process for Director Elections

The enclosed proxy card enables a shareholder to vote "for" or "against" or "abstain" from voting as to each director nominated by the Board. If you vote "abstain" for any director nominee, as opposed to voting "for" or "against" any such director nominee, your shares voted as such will be counted for purposes of establishing a quorum, but will have no effect on the outcome of the vote on Proposal 1. Abstentions and broker non-votes will not constitute votes "for" or votes "against" Proposal 1 and will accordingly have no effect on the outcome of the vote on Proposal 1. Pursuant to our By-Laws, if an incumbent director nominee does not receive a majority of votes cast, such nominee will be required to tender his or her resignation for consideration by the Board, and the Board will then determine whether or not to accept the resignation.

YOUR VOTE IS VERY IMPORTANT. To assure that your shares are represented at the 2024 Annual Meeting, we urge you to date, sign and return the enclosed proxy card promptly in the postage-paid envelope provided, or vote by telephone or the Internet as instructed on the proxy card, whether or not you plan to attend the 2024 Annual Meeting.

The persons named as proxies intend to vote the proxies "FOR" the election of each of the Board's nine nominees, unless otherwise specified on the proxy card.

| | |

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE "FOR" THE ELECTION OF EACH OF THE FOLLOWING NOMINEES FOR DIRECTOR. |

Director Biographies

| | | | | | | | | | | | | | |

| Independent Age: 72 Director since: February 2014

Committee(s): Compensation (Chair); Governance and Nominating | KEITH BARNES Select Business Experience: Mr. Barnes is the retired Chairman and CEO of Verigy Pte. Ltd., a manufacturer of testing equipment for the semiconductor industry. Mr. Barnes served as CEO (from 2006 to 2010) and Chairman of the Board (from 2008 to 2011) of Verigy Ltd. He was formerly Chairman and CEO (from 2003 to 2006) of Electroglas, Inc. and CEO (from 1995 to 2001) of Integrated Measurement Systems, Inc. Before that, he was a division president at Cadence Design Systems, Inc., and prior thereto, division president of Valid Logic Systems, Inc. Other Board Experience: Mr. Barnes is a director (since 2011) and the current chairman of the compensation committee of Viavi Solutions Corporation as well as a director (since 2015) and the current chairman of the compensation committee of Rogers Corporation. Mr. Barnes was previously a director of Mentor Graphics Corporation (from 2012 to 2017). Skills and Qualifications: Mr. Barnes has extensive experience, including as a specialist in maximizing shareholder value and leading companies through initial public offerings, secondary offerings and debt financings. He has had leadership roles in successful spin offs, mergers and acquisitions. |

| | | | |

|  Independent Independent Age: 50 Director since: May 2023

Committee(s): Compensation | ERANIA BRACKETT Select Business Experience: Ms. Brackett is Senior Vice President, Customer Experience, Orthodontic Aligner Solutions and Head of ESG for Dentsply Sirona Inc., a global company that develops, manufactures, and markets comprehensive solutions for the professional dental industry, including technologically-advanced dental equipment and healthcare consumable products. Ms. Brackett has served in that position since April 2023. Prior to that time she served as Senior Vice President and Chief Marketing Officer of Dentsply Sirona from August 2021 to March 2023. Prior to Dentsply Sirona, she worked at Medtronic plc, a medical technology company, as Vice President, Global Commercial Marketing, Patient Management, Cardiac Rhythm & Heart Failure division, from September 2020 to August 2021; as Senior Director, Patient Management Global Commercial Marketing, from May 2019 to September 2020; and as Senior Director, Global Hardware and Software Operations, from December 2017 to May 2019. Before joining Medtronic, Ms. Brackett worked at GE Healthcare, a medical technology subsidiary of General Electric, for 15 years and held various commercial and operational leadership roles.

Skills and Qualifications: Ms. Brackett provides the Board with deep insights into the medical devices market through her over twenty years of experience in the medtech industry at leading global manufacturing companies. She is also an accomplished executive who brings extensive marketing and operational leadership experience to the Board. |

| | | | | | | | | | | | | | |

|  Independent Independent Age: 61 Director since: July 2022

Committee(s): Compensation | DANIEL J. CROWLEY Select Business Experience: Mr. Crowley is the Chairman, President and CEO of Triumph Group, Inc., a global company that designs, engineers, manufactures, repairs and overhauls a broad portfolio of aerospace and defense systems, components and structures, serving the global aviation industry. Mr. Crowley has served as Triumph's President and CEO since 2016 and as its Chairman since 2020. He previously served as a corporate Vice President and President of Integrated Defense Systems at Raytheon Company (now Raytheon Technologies Corporation) from 2013 until 2015, and as President of Raytheon’s Network Centric Systems division from 2010 until 2013. Prior to joining Raytheon, Mr. Crowley served as Chief Operating Officer of Lockheed Martin Aeronautics after holding a series of increasingly responsible assignments across its space, electronics, and aeronautics sectors.

Other Board Experience: Mr. Crowley is a director of Triumph Group, Inc. (since 2016) and its Chairman (since 2020). Skills and Qualifications: Mr. Crowley is an accomplished CEO who brings extensive leadership, strategic thinking, operational efficiency, and product development experience to the Board, having held key leadership positions at several large, global manufacturing and industrial companies. He also provides the Board with deep insights into the defense market through his over three decades of experience in the aerospace and defense industry. |

| | | | |

|  Independent IndependentAge: 72 Director since: December 2014

Committee(s): Audit (Chair); Governance and Nominating | DIDIER HIRSCH Select Business Experience: Mr. Hirsch was the Senior Vice President and Chief Financial Officer (from 2010 to 2018) of Agilent Technologies, Inc. ("Agilent"), a global leader in life science, diagnostics and applied chemical markets, providing instruments, software, services and consumables for the entire laboratory workflow. Previously, he served as Agilent's Chief Accounting Officer (from 2007 to 2010), interim Chief Financial Officer (2010), Vice President, Corporate Controllership and Tax (from 2006 to 2010), Vice President and Controller (from 2003 to 2006) and Vice President and Treasurer (from 1999 to 2003). Prior to joining Agilent, Mr. Hirsch served in various financial capacities and roles at Hewlett-Packard Company (from 1989 to 1999).

Other Board Experience: Mr. Hirsch is a director (since 2020) of Sophia Genetics S.A. In January 2024 he was elected to the board of Azenta, Inc. and serves as its Audit Committee Chair and a member of its Finance Committee. He was formerly a director (from 2012 to 2015) of International Rectifier Corporation and a director (from 2012 to 2021) of Logitech International S.A. Skills and Qualifications: Mr. Hirsch's qualifications to serve on our Board include his experience as Chief Financial Officer of a public company, his financial and risk management expertise, his experience on the boards of directors of several other public companies (including his service as chair of an audit committee), his international experience, his regulatory knowledge and his work with technology and semiconductor companies throughout his career. |

| | | | | | | | | | | | | | |

|  Independent IndependentAge: 56 Director since: February 2018

Committee(s): Audit

| YE JANE LI Select Business Experience: Ms. Li is a Strategic Advisor (since 2013) at Diversis Capital, LLC, a private equity firm that invests in middle-market companies. She was the Chief Operating Officer (from 2012 to 2015) at Huawei Enterprise USA, Inc., a company that markets IT products and solutions to datacenters and enterprises. Previously, Ms. Li served as the General Manager (from 2010 to 2012) at Huawei Symantec USA, Inc., a consultant (2009) to The Gores Group, a private equity firm focusing on the technology sector, and the Executive Vice President and General Manager (from 2004 to 2009) at Fujitsu Compound Semiconductor Inc. and its joint venture with Sumitomo Electric Industries, Ltd., Eudyna Devices Inc. Prior to 2004, Ms. Li held executive and management positions with NeoPhotonics Corporation, Novalux Inc. and Corning Incorporated. Other Board Experience: Ms. Li is a director of Semtech Corporation (since 2016), ServicePower (since 2017), and PDF Solutions, Inc. (since 2021). She was previously a director (from 2020 to 2023) of CTS Corporation and (from 1998 to 2001) of Women in Cable TV and Telecommunications, a non-profit organization promoting women's leadership in the Cable TV and Telecommunications industries. Skills and Qualifications: Ms. Li's qualifications to serve as a member of the Board include her senior executive level experience in a wide range of technology companies, from telecommunication components and systems, to semiconductor to IT and datacenters, representing a variety of market segments Knowles serves. Her background and experience also provide the Board with invaluable insights into Asian markets, which are important strategic markets for Knowles. |

| | | | |

| Chairman of the Board

Independent Age: 75 Director since: February 2014

Committee(s): Audit; Governance and Nominating | DONALD MACLEOD Select Business Experience: Mr. Macleod was the CEO (from 2009 to 2011) of National Semiconductor Corporation ("National Semiconductor"), an analog semiconductor company, until National Semiconductor was acquired by Texas Instruments Incorporated. Mr. Macleod joined National Semiconductor in 1978 and served in a variety of executive positions prior to becoming CEO, including Chief Operating Officer (from 2001 to 2009) and Chief Financial Officer (from 1991 to 2001). Other Board Experience: Mr. Macleod previously served as a director (from 2007 to 2019) of Broadcom Inc. (formerly, Avago Technologies Limited), Chairman (from 2012 to 2017) of the Board of Intersil Corporation and Chairman of the Board (from 2010 to 2011) of National Semiconductor. Skills and Qualifications: Mr. Macleod's qualifications to serve as a director include his strategic perspectives in product development and marketing and supply chain optimization and guiding financial performance developed through his more than 30 years of experience in senior management and executive positions in the semiconductor industry (both in Europe and the United States). As a member of the board of directors of several publicly-traded semiconductor companies, he has also gained substantial knowledge and understanding of how to successfully operate a technology company like Knowles. Furthermore, he brings significant accounting and finance qualifications and experience to the Board. Mr. Macleod is a member of the Institute of Chartered Accountants of Scotland. |

| | | | | | | | | | | | | | |

|  Director DirectorPresident and CEO Age: 57 Director since: February 2014 | JEFFREY NIEW Select Business Experience: Mr. Niew is the President & CEO (since 2013) of Knowles. He was formerly the Vice President of Dover Corporation and President and CEO (from 2011 to February 2014) of Dover Communication Technologies. Mr. Niew joined Knowles Electronics LLC in 2000, and became Chief Operating Officer in 2007, President in 2008 and President and CEO in 2010. Prior to joining Knowles Electronics, Mr. Niew was employed by Littelfuse, Inc. (from 1995 to 2000) where he held various positions in product management, sales and engineering in the Electronic Products group, and by Hewlett-Packard Company (from 1988 to 1994) where he served in various engineering and product management roles in the Optoelectronics Group. Other Board Experience: Mr. Niew is a member of the Advisory Board of the University of Illinois College of Engineering. Mr. Niew stepped down from his position as a director of Advanced Diamond Technologies, Inc. in 2020, after serving in that role for over five years. Skills and Qualifications: Mr. Niew is Knowles' current CEO and the Board believes it is desirable to have on the Board at least one active management representative to facilitate the Board's access to timely and relevant information and its oversight of the Company's strategy, planning, performance and enterprise risks. Mr. Niew brings to the Board considerable management experience and a deep understanding of Knowles' markets and operating model which he gained during over 20 years in management positions at Knowles, including 16 years in senior management positions. His broad experience in all aspects of management and Knowles' products, technologies, customers, markets, operations and executive team enable him to give valuable input to the Board in matters involving business strategy, capital allocation, transactions and succession planning. |

| | | | |

|  Independent IndependentAge: 70 Director since: August 2017

Committee(s): Governance and Nominating (Chair); Compensation | DR. CHERYL SHAVERS Select Business Experience: Dr. Shavers has been the Chairman and CEO (since February 2001) of Global Smarts, Inc., a business advisory services company. She served as Under Secretary of Commerce for Technology (from 1999 to 2001) for the United States Department of Commerce after having served as its Under Secretary Designate in 1999. She has served on the Advisory Boards for E.W. Scripps Company and the Anita Borg Institute for Technology. She also has served in several engineering and managerial roles for Intel Corporation as well as Portfolio Manager of Microprocessor Products Group in Intel Capital prior to 1999. Other Board Experience: Dr. Shavers is a director (since 2018) of ITT Inc. and (since 2021) of Voyager Space Holdings. She was previously the Non-Executive Chairman (from 2001 to 2003) of BitArts Ltd., as well as a director of ATMI, Inc. (from 2006 to 2014), Rockwell Collins, Inc. (from 2014 to 2018) and Mentor Graphics Corporation (from 2016 to 2017). Skills and Qualifications: Dr. Shavers brings extensive leadership and operations experience as a CEO along with particular experience with developing technology plans and the transition of advanced technology into business opportunities. |

| | | | |

| | | | | | | | | | | | | | |

| | | | |

|  Independent IndependentAge: 69 Director since: May 2020

Committee(s): Audit

| MICHAEL WISHART Select Business Experience: Mr. Wishart has been the chief executive officer since 2015 of efabless corporation, an early-stage company offering an open platform and marketplace for community-based design of electronics. Mr. Wishart co-founded efabless in 2014 and has served on its board of directors since then. Mr. Wishart previously served as a managing director and advisory director of Goldman, Sachs & Co. from 1999 until he retired in June 2011. From 1991 to 1999, he served as managing director, including as head of the global technology investment banking group for Lehman Brothers. From 1978 to 1980 and from 1982 to 1991 he held various positions in the investment banking division at Smith Barney, Harris Upham & Co. Other Board Experience: Mr. Wishart served on the board of directors of Spansion Inc. from 2013 until 2015 and of Cypress Semiconductor Corporation from 2015 until 2020, and he currently serves on the board of OneD Material, a private company engaged in the technology transfer and licensing of proprietary silicon-graphite anode material to improve the performance of lithium ion batteries. In addition, Mr. Wishart is a venture partner at Tyche Partners, a venture capital firm focused on hardware-related companies, since 2015. Skills and Qualifications: Mr. Wishart brings strategy and leadership experience within the global technology industry and insights into capital markets that will benefit Knowles in driving sustainable growth and enhancing shareholder value. |

Overview of the Board and Board Committees

All of our directors, with the exception of our CEO Mr. Niew, qualify as independent directors under New York Stock Exchange ("NYSE") corporate governance listing standards and the Company's Standards for Director Independence available on our website at https://investor.knowles.com/governance/governance-documents.

Our Board has three standing committees: the Audit Committee, the Compensation Committee and the Governance and Nominating Committee. Our Board has determined that each member of the Audit Committee qualifies as an "audit committee financial expert" as defined by SEC rules, is "financially literate" as defined in the NYSE Listing Standards and qualifies as independent under special standards established by the SEC and the NYSE for members of audit committees. Our Board has also determined that each member of the Compensation Committee meets the definition of "non-employee director" under Rule 16b-3 of the Securities Exchange Act of 1934, as amended (the "Exchange Act"), and qualifies as independent under special standards established by the SEC and the NYSE for members of compensation committees.

Our Board met eight times in 2023 and each director attended 100% of the Board and committee meetings held while such director was a member of the Board or the relevant committee. The table below sets forth a summary information about our current Board of Directors.

| | | | | | | | | | | |

| Directors | Audit Committee | Compensation Committee | Governance and Nominating Committee |

| Keith Barnes | | Chair | ü |

| Erania Brackett | | ü | |

| Daniel Crowley | | ü | |

| Didier Hirsch | Chair | | ü |