Joby Aviation, Inc. Announces Pricing of Public Offering of Common Stock

25 Oktober 2024 - 6:18AM

Business Wire

Joby Aviation, Inc. (NYSE: JOBY), a company developing electric

air taxis for commercial passenger service, announced today the

pricing of its underwritten public offering of 40,000,000 shares of

common stock at a public offering price of $5.05 per share, before

underwriting discounts and commissions. All of the shares of common

stock are being offered by Joby. In addition, Joby has granted the

underwriters a 30-day option to purchase up to an additional

6,000,000 shares of common stock at the public offering price, less

underwriting discounts and commissions. The gross proceeds from the

offering, before deducting underwriting discounts and commissions

and other offering expenses payable by Joby, are expected to be

$202 million, excluding any exercise of the underwriters’ option to

purchase additional shares. Joby currently intends to use the net

proceeds that it will receive from the offering, together with

existing cash, cash equivalents and short-term investments, to fund

its certification and manufacturing efforts, prepare for commercial

operations and for general working capital and other general

corporate purposes. The offering is expected to close on October

28, 2024, subject to satisfaction of customary closing

conditions.

Morgan Stanley and Allen & Company LLC are acting as joint

book-running managers for the offering.

A registration statement on Form S-3 relating to the shares

being sold in this offering was filed with the U.S. Securities and

Exchange Commission (the “SEC”) on October 24, 2024 and became

automatically effective upon filing. This offering is being made

only by means of a prospectus. A copy of the final prospectus

supplement and the accompanying prospectus relating to this

offering, when available, may be obtained for free by visiting

EDGAR on the SEC’s website at www.sec.gov. Alternatively, a copy of

the final prospectus supplement and the accompanying prospectus

relating to this offering, when available, may be obtained from:

Morgan Stanley & Co. LLC, Attention: Prospectus Department, 180

Varick Street, 2nd Floor, New York, New York 10014; or Allen &

Company LLC, Attention: Prospectus Department, 711 Fifth Avenue,

New York, New York 10022.

This press release shall not constitute an offer to sell or a

solicitation of an offer to buy these securities, nor shall there

be any sale of these securities in any state or jurisdiction in

which such offer, solicitation or sale would be unlawful prior to

registration or qualification under the securities laws of any such

state or jurisdiction.

About Joby

Joby Aviation, Inc. (NYSE: JOBY) is a California-based

transportation company developing an all-electric, vertical

take-off and landing air taxi, which it intends to operate as part

of a fast, quiet and convenient service in cities around the

world.

Forward-Looking

Statements

This press release contains “forward-looking statements” within

the meaning of the “safe harbor” provisions of the Private

Securities Litigation Reform Act of 1995, including statements

regarding the completion and timing of closing of the offering and

the intended use of the proceeds. You can identify forward-looking

statements by the fact that they do not relate strictly to

historical or current facts. These statements may include words

such as “anticipate”, “estimate”, “expect”, “project”, “plan”,

“intend”, “believe”, “may”, “will”, “should”, “can have”, “likely”

and other words and terms of similar meaning. Forward-looking

statements represent Joby’s current expectations regarding future

events and are subject to known and unknown risks and uncertainties

that could cause actual results to differ materially from those

implied by the forward-looking statements. Among those risks and

uncertainties are market conditions, including the trading price

and volatility of Joby’s common stock and risks relating to Joby’s

business and the satisfaction of closing conditions in the

underwriting agreement related to the offering. For a further

description of the risks and uncertainties relating to Joby’s

business in general, see the prospectus supplement related to the

offering and Joby’s current and future reports filed with the SEC,

including its Annual Report on Form 10-K for the year ended

December 31, 2023, filed with the SEC on February 27, 2024. The

forward-looking statements included in this press release speak

only as of the date of this press release, and Joby does not

undertake to update the statements included in this press release

for subsequent developments, except as may be required by law.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241024899106/en/

Investors: investors@jobyaviation.com

Media: press@jobyaviation.com

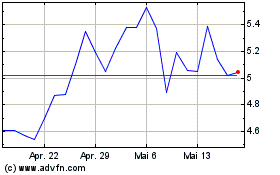

Joby Aviation (NYSE:JOBY)

Historical Stock Chart

Von Okt 2024 bis Nov 2024

Joby Aviation (NYSE:JOBY)

Historical Stock Chart

Von Nov 2023 bis Nov 2024