UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 13D

Under the Securities Exchange Act of 1934

(Amendment No. 1)

Joby Aviation, Inc.

(Name of Issuer)

Common Stock

(Title of Class of Securities)

G65163100

(CUSIP Number)

JoeBen Bevirt

333 Encinal Street

Santa Cruz, CA 95060

(831) 201-6700

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

August 24, 2022

(Date of Event Which Requires Filing of This Statement)

If the filing person has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing this schedule because of Rule 13d-1(e), Rule 13d-1(f) or Rule 13d-1(g), check the following box. o

Note: Schedules filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7(b) for other parties to whom copies are to be sent.

•The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page.

The information required on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject to all other provisions of the Act (however, see the Notes).

| | | | | | | | |

| CUSIP No. G65163100 | 13D | Page 1 of 5 pages |

| | | | | | | | | | | | | | |

| 1 | Names of Reporting Persons

JoeBen Bevirt |

| 2 | Check the Appropriate Box if a Member of a Group (a) o (b) o |

| 3 | SEC Use Only |

| 4 | Source of Funds (See Instructions)

OO/PF |

| 5 | Check if disclosure of legal proceedings is required pursuant to Items 2(d) or 2(e) o

|

| 6 | Citizenship or Place of Organization

United States |

NUMBER OF

SHARES

BENEFICIALLY

OWNED BY EACH

REPORTING

PERSON

WITH | 7 | Sole Voting Power

95,277,964 |

| 8 | Shared Voting Power

0 |

| 9 | Sole Dispositive Power

95,277,964 |

| 10 | Shared Dispositive Power

0 |

| 11 | Aggregate Amount Beneficially Owned by Each Reporting Person

95,277,964 |

| 12 | Check if the Aggregate Amount in Row (11) Excludes Certain Shares o

|

| 13 | Percent of Class Represented by Amount in Row (11)

13.56% |

| 14 | Type of Reporting Person

IN |

| | | | | | | | |

| CUSIP No. G65163100 | 13D | Page 2 of 5 pages |

Explanatory Note

This Amendment No. 1 to Schedule 13D (this “Amendment No. 1”) amends and supplements the Statement on Schedule 13D filed with the United States Securities and Exchange Commission on February 22, 2022 (as amended to date, the “Schedule 13D”) relating to the common stock, par value $0.0001 per share (the “Common Stock”), of Joby Aviation, Inc., a Delaware corporation (the “Issuer”). Capitalized terms used herein without definition shall have the meaning set forth in the Schedule 13D.

Item 4. Purpose of Transaction.

Item 4 of the Schedule 13D is hereby amended and supplemented as follows:

10b5-1 Trading Plans

On August 24, 2022, the Reporting Person entered into a trading plan (the “2022 Trading Plan”) pursuant to Rule 10b5-1 under the Securities Exchange Act of 1934, as amended, pursuant to which, a broker dealer agreed to make periodic sales of up to an aggregate of 10,500,000 shares of Common Stock on behalf of the Reporting Person. A total of 731,162 shares of Common Stock were sold pursuant to the 2022 Trading Plan prior to its expiration on March 31, 2023. On March 17, 2023, the Reporting Person entered into a new trading plan (the “2023 Trading Plan” and, together with the 2022 Trading Plan, the “Trading Plans”) pursuant to Rule 10b5-1 under the Securities Exchange Act of 1934, as amended. Pursuant to the 2023 Trading Plan, a broker dealer agreed to make periodic sales of up to an aggregate of 14,572,251 shares of Common Stock on behalf of the Reporting Person. The 2023 Trading Plan expires in June 2025.

This description of the Trading Plans does not purport to be complete and is qualified in its entirety by the text of the Trading Plans, the form of which is attached as an exhibit to this Schedule 13D and incorporated herein by reference.

Item 5. Interest in Securities of the Issuer.

(a) – (b)

•Amount beneficially owned: 95,277,964

•Percent of Class: 13.56%

•Number of shares the Reporting Person has:

oSole power to vote or direct the vote: 95,277,964

oShared power to vote: 0

oSole power to dispose or direct the disposition of: 95,277,964

oShared power to dispose or direct the disposition of: 0

| | | | | | | | |

| CUSIP No. G65163100 | 13D | Page 3 of 5 pages |

The share amount reported herein consists of (i) 595,149 shares of Common Stock held directly by the Reporting Person, (ii) 189,109 shares of Common Stock held directly by the Reporting Person’s spouse, (iii) 155,737 shares of Common Stock held in a trust over which the Reporting Person’s spouse has voting and dispositive control, (iv) 58,363,787 shares of Common Stock held of record by The Joby Trust, (v) 32,824,274 shares of Common Stock held by the JoeBen Bevirt 2020 Descendants Trust, dated December 26, 2020 (the “Descendants Trust”), (vi) 343,557 shares of Common Stock held by the JoeBen Bevirt 2021 GRAT Trust (the “2021 GRAT Trust”), (vii) 2,717,177 shares of Common Stock held by the JoeBen Bevirt 2022 GRAT Trust (the “2022 GRAT Trust”), and (viii) 79,886 shares of Common Stock underlying restricted stock units held by the Reporting Person that will vest within 60 days of the date hereof. The Reporting Person is the trustee of The Joby Trust and the Descendants Trust and has voting and dispositive power over the shares held in the 2021 GRAT Trust, and the 2022 GRAT Trust and therefore may be deemed to be the beneficial owner of such shares as well as the shares held by the Reporting Person’s spouse and the shares held by the trust over which the Reporting Person’s spouse has voting and dispositive control.

The above percentage is based on 702,857,098 shares of Issuer Common Stock outstanding as of February 21, 2024.

(c) During the past 60 days, the Reporting Person has effected the following transactions: (i) on January 3, 2024, the Reporting Person sold 20,816 at a price of $6.13 per share to cover taxes due upon the release and settlement of restricted stock units, (ii) on January 4, 2024, The Joby Trust and the Descendants Trust sold an aggregate of 250,000 shares of Common Stock at a weighted average price of $6.12 per share pursuant to the 2023 Trading Plan, (iii) on January 18, 2024, the Reporting Person sold 5,474 shares of Common Stock at a weighted average price of $5.59 per share to cover taxes due upon the release and settlement of restricted stock units and (iv) on February 14, 2024, the Reporting Person sold 5,757 shares of Common Stock at a price of $6.03 per share to cover taxes due upon the release and settlement of restricted stock units.

(d) None.

(e) Not applicable.

Item 6. Contracts, Arrangements, Understandings or Relationships with Respect to Securities of the Issuer.

Item 6 of the Schedule 13D is hereby amended and supplemented as follows:

Item 4 above summarizes certain provisions of the Trading Plans and is incorporated herein by reference. The Form of Trading Plan is attached as an exhibit hereto and incorporated herein by reference.

Except as set forth herein, the Reporting Person does not have any contracts, arrangements, understandings or relationships (legal or otherwise) with any person with respect to any securities of the Issuer, including but not limited to any contracts, arrangements, understandings or relationships concerning the transfer or voting of such securities, finder’s fees,

| | | | | | | | |

| CUSIP No. G65163100 | 13D | Page 4 of 5 pages |

joint ventures, loan or option arrangements, puts or calls, guarantees of profits, division of profits or losses, or the giving or withholding of proxies.

Item 7. Materials to be Filed as Exhibits

| | | | | |

| Exhibit Number | Description |

| 2 | |

| | | | | | | | |

| CUSIP No. G65163100 | 13D | Page 5 of 5 pages |

SIGNATURES

After reasonable inquiry and to the best of my knowledge and belief, I certify that the information set forth in this statement is true, complete and correct.

| | | | | | | | |

Date: March 11, 2024 | By: | /s/ JoeBen Bevirt |

| Name: | JoeBen Bevirt |

MORGAN STANLEY

10b5-1 Preset Diversification Program® (PDP) 1

PART I

Account and Plan Information

Instructions: To be completed by MSSB and reviewed by the Seller.

The undersigned (referred to hereinafter as the “Seller”, “I” or “me”) hereby appoints Morgan Stanley Smith Barney LLC (“MSSB”) as my agent for the purposes of implementing this Sales Plan (this “Plan”) that complies with the requirements of Rule 10b5-1(c) under the Securities Exchange Act of 1934, as amended (the “Exchange Act”), as outlined below and for the purpose of executing this Plan. I understand that this Plan is subject to review prior to acceptance by MSSB and that, upon acceptance, MSSB will use commercially reasonable efforts to perform its obligations under this Plan.

The appointment of MSSB is for the purpose of selling the common stock of the Issuer (the “Shares”) pursuant to the terms and conditions set forth below. Subject to such terms and conditions, MSSB accepts such appointment. This Plan is valid only for the specific security, account number and maximum total shares indicated:

The date on which the Seller executes this Plan will be defined as the Adoption Date (the “Adoption Date”).

Issuer (the “Issuer”): Joby Aviation, Inc. Trading Symbol: JOBY

Adoption Date:

The date on which the Seller executes this Plan will be defined as the Adoption Date (the “Adoption Date”).

Seller’s Name:

Account #: -XXX FA Number:

Selling Start Date: The estimated Selling Start Date is MM/DD/YYYY. The Selling Start Date is the later of (i) and (ii):

(i) the 91st day after the Adoption Date, __________; or

(ii) the earlier of:

a.the third business day following the disclosure of the Issuer’s financial results in a Form 10-Q or Form 10-K for the completed fiscal quarter in which this Plan is adopted (estimated MM/DD/YYYY); or

b.the 121st day after the Adoption Date (MM/DD/YYYY).

•

The MSSB Financial Advisor listed in Part I of the Plan will confirm the relevant disclosure dates of the 10-Q or 10-K each quarter with a representative of the Issuer, and a representative of the Issuer will promptly confirm the relevant disclosure dates of the 10-Q or 10-K, as applicable to MSSB use commercially reasonable efforts to respond promptly to such request. The MSSB Financial Advisor listed in Part I of the Plan will submit the Selling Start date to the Executive Financial Services (EFS) Primary and Alternate contacts also identified in Part I in accordance with MSSB’s internal policies. If the EFS authorized person receives notification later than 12:00 PM ET on a particular business day, MSSB is not obligated to begin sales until the trading day after receipt of notification.

Note: The Selling Start Date should match the earliest Start Date on any order in Trade Schedules A or B. If the Selling Start Date or the Start Date entered for any order in Trade Schedules A or B is earlier than allowable under

1 Preset Diversification Program is a registered Trademark of Morgan Stanley Smith Barney LLC, protected in the United States and other countries.

Rule 10b5-1 or the Issuer’s policies, then the Selling Start Date and/or the order Start Date shall be the earliest allowable Selling Start Date under Rule 10b5-1 and such policies.

Plan End Date: Commission: _$ . per share

Note: The “Plan End Date” should match the latest End Date on any order in Trade Schedules A or B.

Seller’s Affiliation Status: ☐ Rule 144 affiliate ☐ Director or officer (as defined in Rule 16a-1(f) of the Exchange Act) ☐ Non-Rule 144 affiliate but subject to trading windows ☐ Other

Plan Total Share Quantity: Trade Schedule A: ___________

Trade Schedule B: ___________

Total Shares: ___________

Notice:

| | | | | |

To the Seller: Name: Address: Telephone: E-Mail: | Copies to: Name: Address: Telephone: E-Mail: |

| | | | | |

To Issuer: Name: Joby Aviation, Inc. Address: 333 Encinal Street Santa Cruz, CA 95060

Telephone: E-Mail: | Copies to: Name:

Section 16 Trade Notifications: E-mail notice to the Issuer’s Section 16 Officer shall be given to the following e-mail address(es): |

| | | | | |

To: MSSB 10b5-1 Preset Diversification Program Department Primary Contact: Alternate Contact:

Address:

Telephone: E-mail: | Copies to: MSSB Financial Advisor

Primary Contact: [Financial Advisor] Alternate Contact: [Client Services Associate] Address:

Telephone: E-mail: |

This Part I is an integral part of this Plan entered into by the Seller with MSSB and is subject to the terms and conditions set forth therein.

PART II

Trade Schedule A – Notice and Authorization of Exercise of Stock Options and Sale of Underlying Stock.

Instructions: May not be applicable for some plans. For use by any seller who wishes to sell shares obtained upon the exercise of stock options. When applicable, to be completed by MSSB and reviewed by the Seller. This Trade Schedule will be provided to the Issuer as notice of the intention to exercise stock options.

| | | | | |

Name of Seller: ____________________ | Name of Issuer: Joby Aviation, Inc. |

I understand that it is my responsibility to ensure that my employee stock options (the “Options”) will be vested prior to the purchase of Shares upon exercising the Options and will be vested prior to the Start Date of their associated sale periods listed below and will not expire before the End Date of such sale periods. I also acknowledge responsibility for notifying MSSB in the event of an expiration or forfeiture of the Options under the Issuer’s stock option plan (upon any termination of service with the Issuer or otherwise) that will prevent the occurrence of one or more transactions listed below. If I authorize the exercise of more than one vested Option grant at the same limit price, the Options will be exercised in the order listed below. I further acknowledge that in the event Options cannot be exercised and the corresponding Shares cannot be sold for any reason, including the occurrence of a suspension pursuant to this Plan, the term of this Plan will not be affected thereby and will end on the originally scheduled Plan End Date. I represent that the information below is accurate.

IN ADDITION TO THE COOLING-OFF PERIOD REQUIRED BY RULE 10b5-1(c)(1)(ii)(B), THE ISSUER MAY IMPOSE AN ADDITIONAL PERIOD OF TIME WHICH MUST ELAPSE BEFORE TRADING MAY COMMENCE UNDER THIS PLAN.

The following shall constitute my irrevocable direction and authorization to exercise the Options and sell the Shares as follows:

*** INFORMATION ON GRID MUST BE TYPED ***

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| (a) Date of Grant | (b) Grant ID | (c) Strike Price | (d) Option Vest Date | (e) Option

Expiration Date | (f) Sale Period(s) | (g) Number of Shares

to be Sold | (h) Limit Price |

| Start Date | End Date |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Note: Insert additional rows as necessary.

| | | | | |

| “No Sale” Periods (if any) |

| Start Date | End Date |

| |

| |

The maximum number of Shares to be sold under this Trade Schedule A is ________.

1.I hereby irrevocably authorize the Issuer to deliver Shares through the Depository Trust Company (DTC) to Morgan Stanley Smith Barney LLC - DTC#: 015. Delivery should be made to the MSSB account referenced in Part I – Account and Plan Information of this Plan.

2.I hereby authorize MSSB or its affiliates, as applicable, to wire to an account designated by the Issuer a cash amount sufficient to cover the cost of the exercise and any withholding taxes due to either the Issuer or, if applicable, the Issuer’s outside stock option plan administrator upon the exercise of any Options exercised and underlying Shares sold pursuant to this Plan.

Instructions for Trade Schedule A:

•Please list all orders chronologically by their Start Date. If Shares are available for sale on the same day, the sequence in which Shares are listed in the schedule above does not define the sequence in which trades will be executed.

•Each order listed in the grid will be available to sell on any trading day on or between the Sale Period Start Date and the Sale Period End Date defined for that order, until the number of shares indicated in column (g) are sold.

•In columns (a) through (e) please provide the details of the Option grants to be exercised and sold.

•In column (f), state the first and last date on which the Shares are authorized to be sold during the Sale Period (Share sales may occur on or between these dates). If, during any Sale Period the stated price is not reached for some or all of these Shares, they will not be carried over into any subsequent Sale Period unless explicitly indicated.

•In column (g), state the maximum number of Shares to be sold pursuant to the Option exercise. Do not aggregate with amounts authorized to be sold at a different price during the same Sale Period.

•In column (h), write a dollar price which is the minimum price per Share (the “Limit Price”) at which the Shares are authorized to be sold during the Sale Period. All limit orders will be treated as “limit not held” orders. Note: Option exercises and sales must be at a Limit Price, not at a “Market” price.

•In the grid labeled “No Sale” Periods, list the time period(s), if any, during which no sales may be made, notwithstanding their inclusion in this Trade Schedule A. These periods are independent of any suspension that may occur pursuant to this Plan.

This Trade Schedule A is an integral part of this Plan entered into by the Seller with MSSB and is subject to the terms and conditions set forth therein.

Trade Schedule B – Sale of Clean Stock/Restricted Stock/Restricted Stock Awards or Units or

Employee Stock Purchase Plan Stock.

Instructions: May not be applicable for some plans. For use by any seller who wishes to sell these types of shares. When applicable, to be completed by MSSB and reviewed by the Seller.

| | | | | |

Name of Seller: ______________________ | Name of Issuer: Joby Aviation, Inc. |

I acknowledge that in the event the number of Shares in column (e) cannot be sold for any reason, including the occurrence of a suspension pursuant to this Plan, the term of this Plan will not be affected and will end on the originally scheduled Plan End Date. I represent that the information below is accurate.

IN ADDITION TO THE COOLING-OFF PERIOD REQUIRED BY RULE 10b5-1(c)(1)(ii)(B), THE ISSUER MAY IMPOSE AN ADDITIONAL PERIOD OF TIME WHICH MUST ELAPSE BEFORE TRADING MAY COMMENCE UNDER THIS PLAN.

*** INFORMATION ON GRID MUST BE TYPED ***

| | | | | | | | | | | | | | | | | | | | |

(a) Type (Clean (CLN), Restricted (RST), Restricted Stock Awards (RSA) or Units (RSU) or Employee Stock Purchase Plan shares (ESPP)) | (b) Grant ID / Nature of Acquisition

(If applicable) | (c) Date Shares Acquired / Vest Date

(If applicable) | (d) Sale Period(s) | (e) Authorized Number of Owned Shares to be Sold | (f) Limit Price (“Market”

if a Market Order) |

Start Date | End Date |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

Note: Insert additional rows as necessary.

| | | | | |

| “No Sale” Periods (if any) |

| Start Date | End Date |

| |

| |

The maximum number of Shares to be sold under this Trade Schedule B is ________.

Instructions for Trade Schedule B:

•Please list all orders in chronologically by their Start Date. If Shares are available for sale on the same day, the sequence in which Shares are listed in the schedule above does not define the sequence in which trades will be executed.

•Each order listed in the grid will be available to sell on any trading day on or between the Sale Period Start Date and the Sale Period End Date defined for that order, until the number of shares indicated in column (g) are sold.

•In column (a), indicate the type of stock to be sold.

•In column (b), for restricted stock awards/units or ESPP shares, please state the grant ID, if applicable. For clean or restricted stock, please state the nature of acquisition.

•In column (c), state the date the Shares to be sold were acquired or vested. If the Shares were acquired/vested in more than one lot, state the acquisition/vest date for each lot. If performance based restricted stock awards or units and vest date is unknown at this time, indicate “TBD” in the grid above.

•In column (d), state the first and last date on which the Shares are authorized to be sold during the designated Sale Period (Share sales may occur on or between these dates). If, during any Sale Period the stated price is not reached for some or all of these Shares, they will not be carried over into any subsequent Sale Period, unless explicitly indicated.

•In column (e), state the maximum number of Shares authorized to be sold at the price during the designated Sale Period. Do not aggregate with amounts authorized to be sold at a lower price during the same designated Sale Period.

•In column (f), write either: (i) a dollar price, which is the minimum price (the “Limit” Price) at which Shares are authorized to be sold, or (ii) the word “market” if Shares are to be sold at the then-prevailing market price per Share during the Sale Period. All market orders will be treated as “market not held” orders. All limit orders will be treated as “limit not held” orders.

•In the grid labeled “No Sale” Periods, list the time period(s), if any, during which no sales may be made, notwithstanding their inclusion in this Trade Schedule B. These periods are independent of any suspension that may occur pursuant to this Plan.

This Trade Schedule B is an integral part of this Plan entered into by the Seller with MSSB and is subject to the terms and conditions set forth therein.

PART III

Sales Plan Disclosures and Representations

Instructions: The Seller must review and understand these disclosures and representations. The Seller is required to sign the last page of this Part III.

A. General Representations.

I understand that this Plan is intended to conform with certain provisions of Rule 10b5-1 of the Securities Exchange Act of 1934, as amended (“Rule 10b5-1”).

1.I hereby represent to MSSB that, as of the date of my signature below:

a.I am not aware of any material nonpublic information about the securities that are the subject of this Plan or the Issuer (if I am a director or officer (as defined in Rule 16a-1(f) of the Exchange Act) of the Issuer, I certify as to the foregoing in accordance with Rule 10b5-1).

b.I am entering into and adopting this Plan in good faith and not as part of a plan or scheme to evade the prohibitions of Section 10(b) of the Exchange Act or Rules 10b-5 or 10b5-1 thereunder (if I am a director or officer (as defined in Rule 16a-1(f) of the Exchange Act) of the Issuer, I certify as to the foregoing in accordance with Rule 10b5-1), or evade the prohibitions of any other law or rule.

c.I will at all times act in good faith with respect to this Plan, including any modifications or terminations of this Plan.

d.I understand that the protections of Rule 10b5-1 may not apply if I alter this Plan or deviate from the instructions in any way, other than in accordance with the modification provisions of this Plan and applicable law;

e.I own the securities which are the subject of this Plan free and clear and I acknowledge and confirm that:

(i)neither I, nor the Shares are subject to any pledges, liens, security interests or other impediments to transfer (except for those which I have entered into with MSSB, limitations imposed by Rule 144 under the Securities Act of 1933, as amended (“Rule 144”)), if applicable, or a lock-up agreement or other restriction that expires prior to the first date that sales may be made under this Plan) nor is there any contractual restriction or litigation, arbitration or other proceeding pending, or to my knowledge threatened, that would prevent or interfere with the exercise of Options to purchase shares of the Issuer or sale of Shares under this Plan;

(ii)the execution and delivery of this Plan by me and the transactions contemplated by this Plan will not contravene applicable law or any agreement or other instrument binding on me or any of my affiliates or any judgment, order or decree of any governmental body, agency or court having jurisdiction over me or my affiliates; and

(iii)the Shares under this Plan do not require any re-offer / resale prospectus (e.g. S-1, S-3 or re-offer S-8) in order to be sold in the Sales Periods as defined in Trade Schedule A or B, as applicable.

f.While this Plan is in effect, I will not enter into any corresponding or hedging transaction or position with respect to the securities which are the subject of this Plan (including, without limitation, with respect to any securities convertible or exchangeable into common stock of the Issuer) and, unless this Plan is modified or terminated in accordance with the terms hereof, I agree not to alter or deviate from the terms of this Plan;

g.I agree not to, directly or indirectly, communicate any information relating to the Shares or the Issuer to any employee of MSSB or its affiliates who is involved, directly or indirectly, in executing this Plan at any time while this Plan is in effect or attempt to exercise any influence over how, when or whether to effect any sales of Shares pursuant to this Plan;

h.I have no outstanding (and will not subsequently enter into while this Plan is in effect any additional) contract, instruction or plan that would qualify for the affirmative defense under Rule 10b5-1(c)(1) for purchases or sales of the Issuer’s securities on the open market, except as permitted by Rule 10b5-1(c)(1)(ii)(D) based on consultation with my own or the company’s counsel and notified to MSSB in writing.

i.If this Plan is designed to effect the open-market sale of the total amount of Shares under this Plan as a single transaction, other than eligible sell-to-cover transactions as described in Rule 10b5-1(c)(1)(ii)(D)(3), I have not, during the prior 12-month period, adopted (and will not subsequently adopt while this Plan is in

effect) a contract, instruction or plan that (1) was or is designed to effect the open-market purchase or sale of all of the securities covered by such contract, instruction or plan in a single transaction and (2) would otherwise qualify for the affirmative defense under Rule 10b5-1(c)(1).

j.I understand that it is my responsibility to comply with all applicable laws (including, without limitation, Rule 144, Section 16 of the Exchange Act and the rules and regulations promulgated thereunder, if applicable) and the policies of the Issuer with respect to the transactions contemplated by this Plan, and I agree to comply with all such laws and policies. I represent that this Plan conforms with the trading policies of the Issuer;

k.I understand that the laws governing insider trading are fact-specific and that MSSB does not and cannot guarantee that any transaction that is executed pursuant to this Plan will be deemed covered by the protections of Rule 10b5-1.

l.I acknowledge and confirm that I have provided MSSB with an Issuer Representation letter signed by an authorized representative of the Issuer substantially in the form of Part IV - Exhibit A to this Plan;

m.I agree to notify MSSB in writing to the individuals set forth in Part I – Account and Plan Information if I become aware of:

(i)any restriction that would prohibit any sale pursuant to this Plan (other than any such restriction relating to my possession or alleged possession of material nonpublic information about the Issuer or its securities). Such notice will indicate the anticipated duration of the restriction, but will not include any other information about the nature of the restriction or its applicability to me and will not in any way communicate any material nonpublic information about the Issuer or its securities to MSSB;

(ii)any change in the Issuer’s insider trading policies, or a change in my status under such policies, affecting this Plan;

(iii)any change in the Issuer’s policies regarding the timing or method of exercising Options covered by this Plan;

(iv)any change that would cause the sales hereunder not to meet all applicable requirements of Rule 144, if applicable; and

(v)any stock split, stock dividend or other like distributions affecting the Shares (“Recapitalization”).

I understand that MSSB will not be responsible for any incorrect order entered due to any of the above events if MSSB has not been notified by me at least one business day prior to such event.

n.I agree to notify MSSB in writing to the individuals set forth in Part I – Account and Plan Information before I:

(i)enter into, modify or terminate any new or existing contract, instruction or plan with another broker-dealer or agent to purchase or sell any securities of the Issuer that would qualify for the affirmative defense under Rule 10b5-1(c)(1) and be treated as a single “plan” with this Plan under Rule 10b5-1(c)(1)(ii)(D)(1) based on consultation with my own or the company’s counsel (I understand that any such modification or termination would act as a modification or termination of this Plan, as applicable, with any such modification subject to the modification provisions of Section D.2. of this Plan and the cooling-off period then required by Rule 10b5-1(c)(1)(ii)(B)); or

(ii)provide any other instructions to another broker-dealer or agent to purchase or sell any securities of the Issuer

o.I acknowledge that MSSB is not acting as my fiduciary but is acting in a brokerage capacity in connection with the adoption and implementation of this Plan;

p.If I am a director or executive officer of the Issuer, then I am not subject to any current pension fund blackout period applicable to the Issuer, and I have not received written notice of the imposition of, nor am I aware of, the actual or approximate beginning or ending dates of any such blackout period and I further acknowledge and agree that I may not modify or otherwise alter this Plan in such circumstances;

q.I represent that I am not entering into this Plan on behalf of, or with the assets of, an individual retirement account or individual retirement annuity, or any employee retirement or employee benefit plan (such as, for example, a Keogh or “HR-10” plan). [Explanatory Note: A plan involving the sale of stock acquired through

the exercise of employee stock options would not be “on behalf of, or with the assets of” any of the types of plans referred to in this paragraph.]

r.I represent that my account is not an “employee benefit plan” within the meaning of Section 3(3) of the Employee Retirement Income Security Act of 1974, as amended, or a “plan” as defined under Section 4975(e) of the Internal Revenue Code of 1986, as amended, or an entity whose underlying assets include the assets of any such plan by reason of such a plan's investment in such entity.

B. Section 16 Representations (for Section 16 insiders only).

1.I authorize the Issuer and MSSB to implement procedures for reporting to the Issuer all transactions under this Plan in the account referenced in Part I – Account and Plan Information. Upon execution of any transaction under this Plan and in no event later than the business day immediately following the trade date, I authorize MSSB to provide the terms of the transaction to the Issuer’s representative set forth in Part I – Account and Plan Information of this Plan and any other persons designated by the Issuer. For the avoidance of doubt, the Issuer’s representative has sole discretion to provide the list of designated persons to MSSB on behalf of the Issuer. I understand that MSSB shall not be responsible for any rejected or undeliverable emails sent to the electronic address(es) designated by the Issuer.

2.I understand that federal securities laws may require me to disgorge all profits earned in connection with any purchase and sale of securities that occurs within six months of each other if I own 10% or more of any class of the Issuer’s equity securities, or if I am an officer or director of the Issuer (i.e., “short-swing profits”). I further understand that it is my own responsibility to ensure compliance with such short-swing profit rules, and I will seek my own counsel with respect to ensuring compliance with such rules.

3.I understand that there are securities laws and rules that require certain persons to timely file reports with the Securities and Exchange Commission (the “SEC”) as to the shareholder’s purchases and sales of the Issuer’s securities (including, without limitation, Section 13 and Section 16 of the Exchange Act). I understand that it is my responsibility to ensure compliance with such rules in a timely manner to the extent applicable, and I will seek my own counsel with respect to whether and when such reports might need to be filed. MSSB will not be required to: (i) make any of these filings on my behalf, (ii) review any Exchange Act filing made by me, or (iii) determine whether any Exchange Act filing by me has been made on a timely basis. MSSB will not be liable to me for any misstatement, omission or defect in any of these filings.

C. Sales of Restricted Stock or Control Stock Pursuant to SEC Rule 144 (for Rule 144 sales only).

1.I understand that this Plan is applicable only as to securities that are freely tradable and that will not be subject to any restrictions against sale at the time of sale of such securities under this Plan. If I am considered an “affiliate” within the meaning of Rule 144, then I understand that the provisions of that rule may limit the number of Shares I can sell at any given time. In the event there is a conflict between the quantity of securities that I have directed to be sold and any lesser amount of Shares that are permitted to be sold pursuant to Rule 144 or other securities laws or rules, I hereby direct that the maximum limits established by such other laws or rules shall govern. In no event will MSSB effect any sale if such sale would exceed the then-applicable limitation under Rule 144 assuming MSSB’s sales under this Plan are the only sales subject to that limitation, or if any such sale would otherwise not comply with Rule 144.

2.I agree not to take, nor to cause any person or entity with which I would be required to aggregate sales of stock pursuant to Rule 144 to take, any action that would cause the sales under this Plan not to meet all applicable requirements of Rule 144, including volume limitations.

3.I agree to timely provide completed and signed Rule 144 paperwork to MSSB (including, without limitation, a Seller Representation Letter dated as of the date of this Plan substantially in the form of Part IV - Exhibit B to this Plan, and, if applicable, an Initial Electronic Signature Authentication Document, in each case prior to the Adoption Date). I acknowledge that MSSB requires this paperwork to facilitate Rule 144 trades for my account. If required by Rule 144, MSSB hereby agrees to submit my completed Form 144 – Notice of Proposed Sale of Securities to the SEC, subject to MSSB’s timely receipt of my Rule 144 paperwork, including my individual central index key (CIK) and CIK confirmation code (CCC) for electronic filings with the SEC. I understand that, if MSSB does not timely receive my Rule 144 paperwork or the CIK and CCC codes provided to MSSB are not accurate and up to date, MSSB may not be able to file a timely Form 144 on my behalf.

D. Implementation, Modification, Suspension and Termination.

1.Implementation of Plan.

a.I agree that (i) MSSB may route any trades under this Plan to its affiliates and their respective routing counterparties for execution (collectively, the “Execution Venues”), (ii) such Execution Venues are required to have risk management controls in place that are reasonably designed to manage the financial, regulatory and other risks of accessing the market, and (iii) MSSB and the other Execution Venues, in executing such orders, may treat such orders as “not held” and thus exercise both time and price discretion in their execution. I authorize the Execution Venues to treat such orders as “not held” and exercise time and price

discretion with respect to such orders. In executing an order as not held, MSSB will consider several factors, including price, the available liquidity pool, execution speed, transaction costs, service and opportunities for price improvement in determining where, when and how to route orders for execution However, sales of Shares under this Plan will not be made at a price less than the Limit Price, if applicable.

b.MSSB may sell the Shares subject to this Plan on any national securities exchange, in the over-the-counter market, on an automated trading system or otherwise. I agree that if MSSB or its affiliates is a market maker or dealer in such Shares at the time that any sale is to be made under this Plan, MSSB or its affiliates may, at its sole discretion, purchase such Shares in its capacity as market maker or dealer.

c.Prior to the Selling Start Date, I agree to deliver Shares subject to this Plan into an account at MSSB in my name and for my benefit, to the extent I currently own such Shares and such Shares are free of any restrictive legend. I understand that this Plan shall not be effective until I establish a valid account at MSSB to hold the Shares.

2.Modification of Plan.

a.I may not modify this Plan unless:

(i) such modification is accepted in writing by MSSB;

(ii) I provide MSSB with:

(a) an Issuer Representation Letter substantially in the form of Part IV - Exhibit A to this Plan;

(b) If I am a Rule 144 affiliate, representations substantially to the effect of those contained in Part IV - Exhibit B of this Plan;

(c) a modification letter and new trade schedule(s) in which I represent that, among other things, on the date of such modification that I am not aware of any material, non-public information regarding the Issuer or any of its securities, that the modification is being made in good faith and not as part of a scheme to evade any law, including, without limitation, the federal securities laws or any law governing insider trading, and that my representations and warranties contained in this Plan are true at and as of the date of such letter as if made at and as of such date; and

(iii) such modification occurs only outside of any “blackout periods” set forth in the Issuer’s insider trading policy and procedures.

b.I understand that any modification or change to the amount, price or timing of the sale of Shares under this Plan will constitute a termination of this Plan and the adoption of a new plan subject to the cooling-off period then required by Rule 10b5-1(c)(1)(ii)(B). The Issuer may impose additional requirements as a condition of allowing me to modify this Plan, including, but not limited to, an additional period of time which must elapse before trading may begin following such modification. I agree to comply with any such additional requirements imposed by Issuer and to advise MSSB of such requirements.

3.Suspension of Plan.

a.I understand that trading under this Plan may be suspended if MSSB has received written notice from the Issuer or from me of a legal, regulatory or contractual restriction applicable to the Issuer or to me. Upon receipt of such written notice, I expressly authorize MSSB to suspend trading as soon as practicable and trading shall not resume until MSSB has received written notice of the resolution of the underlying restriction. I understand that resumption of trading following such suspension is undertaken at my own risk without liability or consequence to MSSB. MSSB can make no representation as to the continued availability of the affirmative defense under Rule 10b5-1 in the event of any such resumption of trading. If the events giving rise to a suspension of trading cannot be resolved (as determined by MSSB in its sole discretion), I understand and acknowledge that MSSB reserves the right, in its sole discretion, to terminate this Plan in accordance with the provisions contained herein. In the event of a suspension, MSSB will resume effecting trades in accordance with this Plan as soon as MSSB determines that it is reasonably practical to do so.

b.I understand and agree that MSSB may not be able to effectuate a sale due to a market disruption or a legal, regulatory or contractual restriction to which MSSB or its affiliates may be subject, or any other event or circumstance, as determined by MSSB in its sole discretion. In such case, MSSB agrees to effectuate such sale as promptly as practical after the cessation or termination of such market disruption, restriction or other event or circumstance.

c.Upon the resumption of trading following a suspension, any trades having a Sales Period End Date scheduled to have occurred during such suspension period shall be deemed to have expired as of that scheduled Sales Period End Date as defined in Trade Schedule A or B, as applicable. Any trades having a Sales Period Start Date scheduled to have occurred during the period of suspension shall be placed as soon

as practicable for the balance of time remaining until the Sales Period End Date applicable to such trade. All other trades shall be placed as originally indicated in this Plan.

4.Termination of Plan.

a.I understand that this Plan will terminate at market close on the Plan End Date or, if earlier, upon the completed sale of the maximum Shares subject to this Plan. In addition, this Plan shall terminate, regardless of whether the maximum Shares have been sold, upon any of the following events:

(i) MSSB receives written notice of my death;

(ii) MSSB receives written notice of the commencement or impending commencement of any proceedings in respect of or triggered by my bankruptcy or insolvency;

(iii) MSSB receives written notice of a valid instruction to transfer all or substantially all of the assets within my securities account at MSSB to another broker-dealer;

(iv) MSSB receives written notice of a termination of an additional contract, instruction or plan that is being treated as a single “plan” with this Plan as described in Section A.1.n.(i) above (or MSSB receives written notice of a modification of such additional contract, instruction or plan and the requirements for a modification of the Plan are not or cannot be satisfied);

(v) MSSB receives two days’ written notice from me terminating this Plan (which may be given for any reason);

(vi) Any modification or change to the amount, price or timing of the sale of Shares under this Plan as described in Section D.2.b above;

(vii) I receive written notice from MSSB terminating this Plan (which may be given for any reason);

(viii) I fail to comply in any material respect with any applicable law and/or any obligation under this Plan; and

(ix) upon my or the Issuer’s demonstrating to MSSB that any of the following events have occurred:

(a)a public announcement has been made of a tender offer involving the Issuer’s securities;

(b)a definitive agreement has been announced relating to a merger, reorganization, consolidation or similar transaction in which the securities covered by this Plan would be subject to a lock-up provision;

(c)a sale has been made of all or substantially all of the assets of the Issuer on a consolidated basis to an unrelated person or entity, or if a transaction affecting the Issuer occurs in which the owners of the Issuer’s outstanding voting power prior to the transaction do not own at least a majority of the outstanding voting power of the successor entity immediately upon completion of the transaction;

(d)a dissolution or liquidation of the Issuer takes place or there is a commencement or impending commencement of any proceedings in respect of or triggered by the Issuer’s bankruptcy or insolvency; or

(e)that this Plan or its attendant transactions may violate existing, new or revised federal or state laws or regulations, or may cause a breach of a contract or agreement to which the Issuer is a party or by which the Issuer is bound.

d.I agree that I will act in good faith with respect to any terminations of this Plan.

e.I further understand that the Issuer’s policies state that if I elect to terminate this Plan, I may not trade in the securities of the Issuer for 30 days and may not adopt a new trading plan for 180 days.

f.In no event shall MSSB be deemed to have breached or failed to comply with this Plan if MSSB does not receive written notice of the above events prior to the placement of a scheduled order under this Plan. I understand that it may take two business days for any termination to take effect upon MSSB receiving written notice,

E. Indemnification; Limitation of Liability.

I understand that the purpose of this Plan is to provide me with an affirmative defense against allegations of insider trading and that MSSB can make no representation or guarantee that any transaction entered according to this Plan will not subsequently be found to violate federal or state laws or rules against trading by insiders or trading on the basis of material nonpublic information or other laws or rules governing securities transactions. Therefore, in consideration of MSSB’s acceptance of these instructions, I hereby agree to indemnify and hold harmless MSSB and its affiliates and their respective directors, officers, employees and agents (including, without limitation, Morgan Stanley & Co. LLC) from any claim, loss, damage, liability or expense (including, without limitation, any legal fees and expenses reasonably incurred) arising out of or attributable to this Plan (including, without limitation, any representations or warranties I have given or will give under or in connection with this Plan) or any transaction or transactions executed pursuant to this Plan or from any deviation I might make from this Plan. This indemnification will survive termination of this Plan.

Notwithstanding any other provision hereof, MSSB shall not be liable to me for (i) any special, indirect, punitive, exemplary or consequential damages, or incidental losses or damages of any kind, even if advised of the possibility of such losses or damages or if such losses or damages could have been reasonably foreseen, or (ii) any failure to perform or to cease performance or any delay in performance that results from a cause or circumstance that is beyond MSSB’s reasonable control, including but not limited to, failure of electronic or mechanical equipment, strikes, failure of common carrier or utility systems, outbreak or escalation of hostilities or other crisis or calamity, severe weather, market disruptions, material disruptions in securities settlement, payment or clearance services or other causes commonly known as “acts of God”.

F. Notice.

All notices and other communications provided for herein shall be in writing and shall be delivered by hand or overnight courier service, mailed by certified or registered mail or sent by electronic mail and made to the applicable persons indicated in Part I – Account and Plan Information. The parties acknowledge and agree that the distribution of material through an electronic medium is not necessarily secure and that there are confidentiality and other risks associated with such distribution.

G. Miscellaneous.

1.Additional Documents. I agree to complete, execute and deliver to MSSB any additional forms or other paperwork pursuant to this Plan at such times and in such form as MSSB may reasonably request.

2.My Obligation to Consult Legal Advisors. I understand that MSSB has advised that I should not enter into, modify, suspend or terminate this Plan except upon consultation with my own legal advisors.

3.Inconsistent Provisions. If any provision of this Plan is or becomes inconsistent with any applicable present or future law, rule or regulation, that provision will be deemed rescinded to the extent required in order to comply with the relevant law, rule or regulation. All other provisions of this Plan will continue and remain in full force and effect.

4.Non-Market Days and Trading Restrictions. If I have given instructions that require an order to be entered on a particular date, and the date that I have selected for a transaction falls on a day when the applicable primary market for the security is closed, then I direct that the transaction occur on the next regular business day on which such market is open following the original date indicated; provided that such date does not exceed the Sales Period End Date for that order or the Plan End Date or falls within a No Sales Period as defined in Trade Schedule A and/or B of this Plan.

5.State Insider Trading Laws. I understand that some states may have their own laws that relate to insider trading. I understand that MSSB makes no representation to me with respect to whether this Plan conforms to the laws of any particular state, and has advised that I should seek the advice of my own counsel with respect to matters of state law.

6.Prices. All references in this Plan to per share prices will be before deducting any commission equivalent, mark-up or differential and other expenses of sale.

7.Other Shares. I may instruct MSSB to sell securities of the Issuer other than pursuant to this Plan. The parties hereto agree that any such sale transaction will not be deemed to modify this Plan unless in connection with such transaction this Plan is modified pursuant to the process set forth in subsection D.2 above.

8.Adjustments to Share and Dollar Amounts. The exercise and sale prices, and number of Options to be exercised and Shares to be sold, will be adjusted following such time as I or the Issuer notifies MSSB promptly of a Recapitalization, which shall be made by providing a new schedule reflecting the adjustment in Shares and prices after the Recapitalization. I understand that MSSB will not be responsible for any incorrect order entered due to a Recapitalization if MSSB has not been notified at least one business day prior to such Recapitalization.

9.Effect of Instructions on Other Agreements with MSSB. Subject to “Entire Agreement; Subsequent Plans” subsection below, nothing in this Plan changes any other terms or agreements that are already applicable to my account or accounts, or that otherwise exist between MSSB and me.

10.Entire Agreement; Subsequent Plans. This Plan constitutes the entire agreement between the parties with respect to this Plan and supersedes any prior agreements or understandings with respect to this Plan. I understand that if I enter into a subsequent 10b5-1 trading plan, that plan will not amend, suspend or terminate this Plan unless explicitly agreed to by MSSB in writing.

11.Assignment. My rights and obligations under this Plan may not be assigned or delegated without the written permission of MSSB. MSSB may assign or delegate any or all of its rights or obligations under this Plan to a company affiliated with, or a successor to, MSSB or to any assignee to which MSSB determines to assign all or part of its business relating to sales plans of this kind. Any such assignment will not affect the status, or be deemed to be an amendment, of this Plan, the purpose of which is to provide me with an affirmative defense against charges of insider trading.

12.Choice of Law Regarding Interpretation of Instructions. This Plan shall be construed in accordance with the internal laws of the State of New York.

13.Enforceability in the Event of Bankruptcy. The parties acknowledge and agree that this Plan is a “securities contract” as defined in Section 741(7) of Title 11 of the United States Code (“Bankruptcy Code”) and shall be entitled to all of the protections afforded to such contracts under the Bankruptcy Code.

14.Headings. Headings used in this Plan are provided for convenience only and shall not be used to construe meaning or intent.

15.Counterparts. This Plan may be signed in any number of counterparts, each of which shall be deemed an original, with the same effect as if the signatures thereto and hereto were placed upon the same instrument. Upon execution by the parties hereto, this Plan shall be deemed effective as of the Adoption Date.

By signing this Plan I agree that I have read and understood all of the disclosures and representations outlined in this Plan and applicable Trade Schedules.

| | | | | | | | |

| Seller | | Morgan Stanley Smith Barney LLC |

| | | | | | | | | | | | | | | | | | | | |

| By: | | | By: | |

Signed By: | | Signed By: |

| | |

Title: | | Title: |

| | |

Adoption Date: | | Date: |

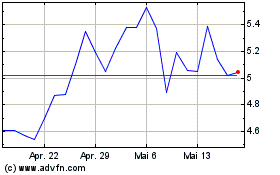

Joby Aviation (NYSE:JOBY)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Joby Aviation (NYSE:JOBY)

Historical Stock Chart

Von Apr 2023 bis Apr 2024