Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

28 November 2023 - 8:31PM

Edgar (US Regulatory)

Nuveen

Core

Equity

Alpha

Fund

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Shares

Description

(a)

Value

LONG-TERM

INVESTMENTS

-

99.4%

X

–

COMMON

STOCKS

-

98

.4

%

X

196,936,131

Automobiles

&

Components

-

1.2%

9,310

(b)

Tesla

Inc

$

2,329,548

Total

Automobiles

&

Components

2,329,548

Banks

-

1.8%

4,005

Bank

of

America

Corp

109,657

35,490

Citigroup

Inc

1,459,704

9,240

JPMorgan

Chase

&

Co

1,339,985

82,410

(b)

NU

Holdings

Ltd/Cayman

Islands,

Class

A

597,472

Total

Banks

3,506,818

Capital

Goods

-

6.5%

8,590

AGCO

Corp

1,016,025

29,770

Flowserve

Corp

1,183,953

6,200

General

Dynamics

Corp

1,370,014

9,220

Honeywell

International

Inc

1,703,303

22,300

Johnson

Controls

International

plc

1,186,583

3,740

Lockheed

Martin

Corp

1,529,510

3,220

Northrop

Grumman

Corp

1,417,412

13,650

Oshkosh

Corp

1,302,619

10,610

Raytheon

Technologies

Corp

763,602

42,090

Vertiv

Holdings

Co

1,565,748

Total

Capital

Goods

13,038,769

Commercial

&

Professional

Services

-

2.1%

7,250

Automatic

Data

Processing

Inc

1,744,205

10,040

Jacobs

Solutions

Inc

1,370,460

30,460

Rollins

Inc

1,137,072

Total

Commercial

&

Professional

Services

4,251,737

Consumer

Discretionary

Distribution

&

Retail

-

7.7%

15,620

Advance

Auto

Parts

Inc

873,627

57,570

(b)

Amazon.com

Inc

7,318,298

58,300

(b)

Coupang

Inc

991,100

10,240

Home

Depot

Inc/The

3,094,118

12,010

Ross

Stores

Inc

1,356,530

20,110

TJX

Cos

Inc/The

1,787,377

Total

Consumer

Discretionary

Distribution

&

Retail

15,421,050

Consumer

Durables

&

Apparel

-

1.4%

9,520

NIKE

Inc,

Class

B

910,302

35,270

Tapestry

Inc

1,014,012

131,030

(b)

Under

Armour

Inc,

Class

A

897,556

Total

Consumer

Durables

&

Apparel

2,821,870

Consumer

Services

-

3.0%

26,380

H&R

Block

Inc

1,135,923

23,390

Las

Vegas

Sands

Corp

1,072,197

682

(b)

LIBERTY

MEDIA

CORP-LIBERTY-A,

Class

A

21,769

8,090

McDonald's

Corp

2,131,230

17,280

Starbucks

Corp

1,577,146

Total

Consumer

Services

5,938,265

Nuveen

Core

Equity

Alpha

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Shares

Description

(a)

Value

Consumer

Staples

Distribution

&

Retail

-

2.8%

29,050

Albertsons

Cos

Inc,

Class

A

$

660,888

540

Costco

Wholesale

Corp

305,078

17,980

Sysco

Corp

1,187,579

3,040

Target

Corp

336,133

24,450

(b)

US

Foods

Holding

Corp

970,665

13,829

Walmart

Inc

2,211,672

Total

Consumer

Staples

Distribution

&

Retail

5,672,015

Energy

-

4.8%

42,020

Baker

Hughes

Co

1,484,147

6,489

Chevron

Corp

1,094,175

540

ConocoPhillips

64,692

24,470

Devon

Energy

Corp

1,167,219

12,100

Exxon

Mobil

Corp

1,422,718

29,940

Halliburton

Co

1,212,570

25,080

HF

Sinclair

Corp

1,427,804

11,980

Valero

Energy

Corp

1,697,686

Total

Energy

9,571,011

Equity

Real

Estate

Investment

Trusts

(REITs)

-

1.3%

1,860

American

Tower

Corp

305,877

5,040

Cousins

Properties

Inc

102,665

8,350

Digital

Realty

Trust

Inc

1,010,517

2,330

Host

Hotels

&

Resorts

Inc

37,443

26,470

Ventas

Inc

1,115,181

Total

Equity

Real

Estate

Investment

Trusts

(REITs)

2,571,683

Financial

Services

-

7.0%

15,150

Bank

of

New

York

Mellon

Corp/The

646,148

14,420

(b)

Berkshire

Hathaway

Inc,

Class

B

5,051,326

22,270

(b)

Block

Inc

985,670

23,430

Fidelity

National

Information

Services

Inc

1,294,976

12,040

(b)

Fiserv

Inc

1,360,039

12,310

Global

Payments

Inc

1,420,451

2,011

Mastercard

Inc,

Class

A

796,175

22,380

Nasdaq

Inc

1,087,444

1,570

(b)

PayPal

Holdings

Inc

91,782

27,630

(b)

Robinhood

Markets

Inc,

Class

A

271,050

4,540

Visa

Inc,

Class

A

1,044,245

Total

Financial

Services

14,049,306

Food,

Beverage

&

Tobacco

-

2.7%

15,420

Archer-Daniels-Midland

Co

1,162,976

20,870

Coca-Cola

Co/The

1,168,303

15,710

PepsiCo

Inc

2,661,902

3,760

Philip

Morris

International

Inc

348,101

Total

Food,

Beverage

&

Tobacco

5,341,282

Health

Care

Equipment

&

Services

-

7.6%

28,100

(b)

Boston

Scientific

Corp

1,483,680

19,390

(b)

Centene

Corp

1,335,583

5,910

Cigna

Group/The

1,690,674

6,300

CVS

Health

Corp

439,866

3,780

Elevance

Health

Inc

1,645,888

11,750

(b)

Globus

Medical

Inc,

Class

A

583,388

3,890

HCA

Healthcare

Inc

956,862

15,440

(b)

Hologic

Inc

1,071,536

1,150

Humana

Inc

559,498

530

(b)

Insulet

Corp

84,530

20,390

Medtronic

PLC

1,597,760

Shares

Description

(a)

Value

Health

Care

Equipment

&

Services

(continued)

33,980

Premier

Inc,

Class

A

$

730,570

5,330

ResMed

Inc

788,147

44,900

(b)

Teladoc

Health

Inc

834,691

2,970

UnitedHealth

Group

Inc

1,497,444

Total

Health

Care

Equipment

&

Services

15,300,117

Household

&

Personal

Products

-

2.5%

20,690

Colgate-Palmolive

Co

1,471,266

9,090

Kimberly-Clark

Corp

1,098,526

16,860

Procter

&

Gamble

Co/The

2,459,200

Total

Household

&

Personal

Products

5,028,992

Insurance

-

1.4%

10,600

Cincinnati

Financial

Corp

1,084,274

8,870

Marsh

&

McLennan

Cos

Inc

1,687,961

Total

Insurance

2,772,235

Materials

-

1.2%

5,030

Air

Products

and

Chemicals

Inc

1,425,502

3,760

Sherwin-Williams

Co/The

958,988

Total

Materials

2,384,490

Media

&

Entertainment

-

7.5%

34,610

(b)

Alphabet

Inc,

Class

A

4,529,065

36,710

(b),(c)

Alphabet

Inc,

Class

C

4,840,213

33,960

Comcast

Corp,

Class

A

1,505,786

11,960

(b)

Meta

Platforms

Inc

3,590,512

1,360

(b)

Spotify

Technology

SA

210,310

3,590

(b)

Walt

Disney

Co/The

290,970

Total

Media

&

Entertainment

14,966,856

Pharmaceuticals,

Biotechnology

&

Life

Sciences

-

8.5%

17,060

AbbVie

Inc

2,542,964

29,490

Bristol-Myers

Squibb

Co

1,711,600

2,070

Eli

Lilly

&

Co

1,111,859

21,459

Johnson

&

Johnson

3,342,239

23,891

Merck

&

Co

Inc

2,459,578

1,080

(b)

Mettler-Toledo

International

Inc

1,196,716

9,800

(b)

Neurocrine

Biosciences

Inc

1,102,500

60,350

Pfizer

Inc

2,001,809

21,750

Royalty

Pharma

PLC

590,295

1,833

Thermo

Fisher

Scientific

Inc

927,810

Total

Pharmaceuticals,

Biotechnology

&

Life

Sciences

16,987,370

Semiconductors

&

Semiconductor

Equipment

-

5.2%

17,840

(b)

Allegro

MicroSystems

Inc

569,810

480

Broadcom

Inc

398,678

16,280

Intel

Corp

578,754

13,480

(b)

Lattice

Semiconductor

Corp

1,158,336

16,640

NVIDIA

Corp

7,238,234

4,390

QUALCOMM

Inc

487,553

Total

Semiconductors

&

Semiconductor

Equipment

10,431,365

Software

&

Services

-

11.8%

5,540

(b)

Adobe

Inc

2,824,846

5,400

(b)

Atlassian

Corp

Ltd,

Class

A

1,088,154

8,240

(b)

Cadence

Design

Systems

Inc

1,930,632

3,950

(b)

DocuSign

Inc

165,900

44,535

Microsoft

Corp

14,061,926

Nuveen

Core

Equity

Alpha

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Shares

Description

(a)

Value

Software

&

Services

(continued)

11,421

(b)

Salesforce

Inc

$

2,315,951

1,000

(b)

Synopsys

Inc

458,970

19,110

(b)

Teradata

Corp

860,332

Total

Software

&

Services

23,706,711

Technology

Hardware

&

Equipment

-

8.8%

89,818

(c)

Apple

Inc

15,377,740

42,190

Cisco

Systems

Inc

2,268,134

Total

Technology

Hardware

&

Equipment

17,645,874

Telecommunication

Services

-

0.6%

9,170

(b)

T-Mobile

US

Inc

1,284,259

Total

Telecommunication

Services

1,284,259

Utilities

-

1.0%

440

Alliant

Energy

Corp

21,318

12,920

Evergy

Inc

655,044

18,200

Sempra

1,238,146

Total

Utilities

1,914,508

Total

Common

Stocks

(cost

$170,965,135)

196,936,131

Shares

Description

(a)

Value

X

–

EXCHANGE-TRADED

FUNDS

-

1

.0

%

X

1,932,435

4,500

iShares

Core

S&P

500

ETF

$

1,932,435

Total

Exchange-Traded

Funds

(cost

$1,981,175)

1,932,435

Type

Description

Number

of

Contracts

Notional

Amount

(d)

Exercise

Price

Expiration

Date

Value

OPTIONS

PURCHASED

-

0

.0

%

X

–

Put

Consumer

Discretionary

Select

Sector

SPDR

Fund

20

$

300,000

$

150

10/20/23

$

1,800

Call

General

Mills

Inc

5

37,500

75

10/20/23

37

Total

Options

Purchased

(cost

$4,092)

25

$

337,500

1,837

Total

Long-Term

Investments

(cost

$172,950,402)

198,870,403

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

SHORT-TERM

INVESTMENTS

-

3.2%

–

REPURCHASE

AGREEMENTS

-

3

.2

%

X

6,459,975

$

6,460

Repurchase

Agreement

with

Fixed

Income

Clearing

Corporation,

dated

09/29/23,

repurchase

price

$6,460,837,

collateralized

by

$9,160,600,

U.S.

Treasury

Bond,

2.875%,

due

05/15/52,

value

$6,589,191

1.520%

10/02/23

$

6,459,975

Total

Repurchase

Agreements

(cost

$6,459,975)

6,459,975

Total

Short-Term

Investments

(cost

$6,459,975)

6,459,975

Total

Investments

(cost

$

179,410,377

)

-

102

.6

%

205,330,378

Other

Assets

&

Liabilities,

Net

- (2.6)%

(

5,200,799

)

Net

Assets

Applicable

to

Common

Shares

-

100%

$

200,129,579

Investments

in

Derivatives

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Options

Written

Type

Description

Number

of

Contracts

Notional

Amount

(d)

Exercise

Price

Expiration

Date

Value

Call

S&P

500

Index

(20)

$

(

9,200,000

)

$

4,600

10/20/23

$

(

800

)

Call

S&P

500

Index

(20)

(

9,150,000

)

4,575

11/17/23

(

17,900

)

Call

S&P

500

Index

(35)

(

16,100,000

)

4,600

11/17/23

(

22,750

)

Total

Options

Written

(premiums

received

$104,654)

(75)

$(34,450,000)

$(41,450)

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Common

Stocks

$

196,936,131

$

–

$

–

$

196,936,131

Exchange-Traded

Funds

1,932,435

–

–

1,932,435

Options

Purchased

1,800

37

–

1,837

Short-Term

Investments:

Repurchase

Agreements

–

6,459,975

–

6,459,975

Investments

in

Derivatives:

Options

Written

(41,450)

–

–

(41,450)

Total

$

198,828,916

$

6,460,012

$

–

$

205,288,928

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

(a)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(b)

Non-income

producing;

issuer

has

not

declared

an

ex-dividend

date

within

the

past

twelve

months.

(c)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

derivatives.

(d)

For

disclosure

purposes,

Notional

Amount

is

calculated

by

multiplying

the

Number

of

Contracts

by

the

Exercise

Price

by

100.

ETF

Exchange-Traded

Fund

REIT

Real

Estate

Investment

Trust

S&P

Standard

&

Poor's

SPDR

Standard

&

Poor's

Depositary

Receipt

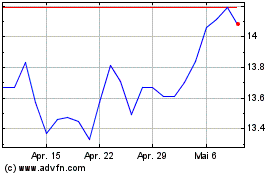

Nuveen Core Equity Alpha (NYSE:JCE)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

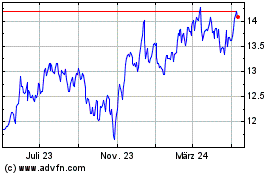

Nuveen Core Equity Alpha (NYSE:JCE)

Historical Stock Chart

Von Mai 2023 bis Mai 2024