Form 8-K - Current report

26 September 2023 - 10:29PM

Edgar (US Regulatory)

0001437071false00014370712023-09-252023-09-250001437071us-gaap:CommonStockMember2023-09-252023-09-250001437071ivr:SeriesBCumulativeRedeemablePreferredStockMember2023-09-252023-09-250001437071ivr:SeriesCCumulativeRedeemablePreferredStockMember2023-09-252023-09-25

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): September 25, 2023

Invesco Mortgage Capital Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Maryland | | 001-34385 | | 26-2749336 |

(State or other jurisdiction

of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

| | | | | | | | | | | |

| 1331 Spring Street N.W., Suite 2500 | | |

| Atlanta, | Georgia | | 30309 |

| (Address of principal executive offices) | | (Zip Code) |

Registrant’s telephone number, including area code: (404) 892-0896

n/a

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of Each Class | | Trading Symbol | | Name of Each Exchange on Which Registered |

| Common Stock, par value $0.01 per share | | IVR | | New York Stock Exchange |

| 7.75% Fixed-to-Floating Series B Cumulative Redeemable Preferred Stock | | IVR PrB | | New York Stock Exchange |

| 7.50% Fixed-to-Floating Series C Cumulative Redeemable Preferred Stock | | IVR PrC | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| | | | | |

| Item 5.02 | Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

On September 25, 2023, Mr. Gregory G. McGreevey notified the Board of Directors (“Board”) of the registrant that he will retire from the Board as an executive director effective as of September 26, 2023.

On September 26, 2023, the Board appointed Ms. Carolyn Gibbs to serve as a director effective as of that date. Ms. Gibbs, age 62, has served as the Global Head of Investments Engagement and Services for Invesco since March 2023, with areas of responsibility including ESG, Global Thought Leadership and the Global Investors’ Forum, an initiative for Invesco’s multiple investment teams. She is a member of Invesco’s Investments Executive Leadership team and a member of the Americas Executive Leadership team. Ms. Gibbs previously served as Head of Investments Engagement from 2017 to February 2023. Ms. Gibbs joined Invesco in 1992 as a fixed income analyst and has served in fixed income portfolio management and leadership roles during her tenure. She earned a BA degree in English, magna cum laude, from Texas Christian University, and an MBA in finance from the Wharton School of the University of Pennsylvania. Ms. Gibbs is a Chartered Financial Analyst.

Ms. Gibbs is deemed an executive director since she is also an employee of our manager or one of its affiliates. Executive directors do not receive compensation for serving on our Board and do not serve on any of the standing committees of the Board.

On September 26, 2023, Invesco Mortgage Capital Inc. issued a press release announcing that its Board of Directors declared a cash dividend of $0.40 per share of common stock for the third quarter of 2023. A copy of that press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

| | | | | |

| Item 9.01 | Financial Statements and Exhibits. |

| | | | | | | | |

| | |

Exhibit No. | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document). |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Invesco Mortgage Capital Inc.

By: /s/ Tina Carew

Tina Carew

Vice President, General Counsel and Secretary

Date: September 26, 2023

Invesco Mortgage Capital Inc. Announces Quarterly Common Dividend

Investor Relations Contact: Greg Seals, 404-439-3323

Atlanta - September 26, 2023 -- Invesco Mortgage Capital Inc. (the “Company”) (NYSE: IVR) today announced that its Board of Directors declared a cash dividend of $0.40 per share of common stock for the third quarter of 2023. The dividend will be paid on October 27, 2023 to stockholders of record on October 9, 2023, with an ex-dividend date of October 5, 2023.

About Invesco Mortgage Capital Inc.

Invesco Mortgage Capital Inc. is a real estate investment trust that primarily focuses on investing in, financing and managing mortgage-backed securities and other mortgage-related assets. Invesco Mortgage Capital Inc. is externally managed and advised by Invesco Advisers, Inc., a subsidiary of Invesco Ltd. (NYSE: IVZ), a leading independent global investment management firm. Additional information is available at www.invescomortgagecapital.com.

Cautionary Notice Regarding Forward-Looking Statements

This press release may include statements and information that constitute "forward-looking statements" within the meaning of the U.S. securities laws as defined in the Private Securities Litigation Reform Act of 1995, as amended, and such statements are intended to be covered by the safe harbor provided by the same. Forward-looking statements are subject to substantial risks and uncertainties, many of which are difficult to predict and are generally beyond the Company's control. These forward-looking statements include those related to our intention and ability to pay dividends, as well as any other statements other than statements of historical fact. The words “believe,” “expect,” “anticipate,” “estimate,” “plan,” “continue,” “intend,” “should,” “may,” or similar expressions and future or conditional verbs such as “will,” “may,” “could,” “should,” and “would,” and any other statement that necessarily depends on future events, are intended to identify forward-looking statements.

Any forward-looking statement speaks only as of the date on which it is made. New risks and uncertainties arise over time, and it is not possible to predict those events or how they may affect the Company. Except as required by law, the Company is not obligated to, and does not intend to, update or revise any forward-looking statements, whether as a result of new information, future events or otherwise.

v3.23.3

Cover

|

Sep. 25, 2023 |

| Entity Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Sep. 25, 2023

|

| Entity Registrant Name |

Invesco Mortgage Capital Inc.

|

| Entity Incorporation, State or Country Code |

MD

|

| Entity File Number |

001-34385

|

| Entity Tax Identification Number |

26-2749336

|

| Entity Address, Address Line One |

1331 Spring Street N.W., Suite 2500

|

| Entity Address, City or Town |

Atlanta,

|

| Entity Address, State or Province |

GA

|

| Entity Address, Postal Zip Code |

30309

|

| City Area Code |

404

|

| Local Phone Number |

892-0896

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001437071

|

| Amendment Flag |

false

|

| Common Stock, par value $0.01 per share |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.01 per share

|

| Trading Symbol |

IVR

|

| Security Exchange Name |

NYSE

|

| 7.75% Fixed-to-Floating Series B Cumulative Redeemable Preferred Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

7.75% Fixed-to-Floating Series B Cumulative Redeemable Preferred Stock

|

| Trading Symbol |

IVR PrB

|

| Security Exchange Name |

NYSE

|

| 7.50% Fixed-to-Floating Series C Cumulative Redeemable Preferred Stock |

|

| Entity Information [Line Items] |

|

| Title of 12(b) Security |

7.50% Fixed-to-Floating Series C Cumulative Redeemable Preferred Stock

|

| Trading Symbol |

IVR PrC

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ivr_SeriesBCumulativeRedeemablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=ivr_SeriesCCumulativeRedeemablePreferredStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

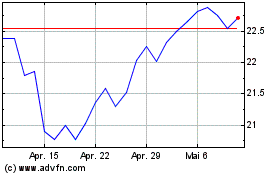

Invesco Mortgage Capital (NYSE:IVR-C)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

Invesco Mortgage Capital (NYSE:IVR-C)

Historical Stock Chart

Von Jan 2024 bis Jan 2025