Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

06 Februar 2024 - 12:03PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of

Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of February, 2024

Commission File Number: 001-15276

Itaú Unibanco Holding S.A.

(Exact name of registrant as specified in its charter)

Itaú Unibanco Holding S.A.

(Translation of Registrant’s Name into English)

Praça

Alfredo Egydio de Souza Aranha, 100-Torre Conceicao

CEP

04344-902 São Paulo, SP, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F

or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation

S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82–

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: February 5, 2024.

|

|

|

| Itaú Unibanco Holding S.A. |

|

|

| By: |

|

/s/ Renato Lulia Jacob |

| Name: |

|

Renato Lulia Jacob |

| Title: |

|

Group Head of Investor Relations and Market Intelligence |

|

|

| By: |

|

/s/ Alexsandro Broedel |

| Name: |

|

Alexsandro Broedel |

| Title: |

|

Chief Financial Officer |

"In 2023, we reaped the results of our cultural and digital transformation.

We maintained the sustainable growth trajectory of the bank, with satisfaction, engagement and primacy rates at levels of excellence,

which directly reflects on our financial performance. We started 2024 optimistic and committed to deliver even more value to our clients,

stockholders and employees, taking advantage of the changes we have implemented in the organization so that our clients are placed in

the center of all our decisions.” Milton Maluhy Filho Itaú Unibanco’s CEO Itaú Unibanco’s profit increases

15.7% in 2023 and loan portfolio reaches R$1.2 trillion Annual profit was R$35.6 billion, mainly driven by the increase in loan portfolio

and margin with clients. São Paulo, February 5, 2024 - In 2023, Itaú Unibanco’s recurring managerial result totaled

R$35.6 billion, up 15.7% year-on-year with an annualized recurring managerial return on average equity of 21.0%. Among the factors that

most influenced the results are the growth of the loan portfolio, the higher liabilities’ margin, in addition to the positive impact

of repricing of our working capital. Accordingly, financial margin with clients increased. The result was also influenced by the increase

in commissions and fees and result from insurance operations, driven by higher card revenue, in both issuance and acquiring services,

and by a better performance of insurance operations. The total loan portfolio grew 3.1% in relation to 2022, reaching R$1,176.5 billion

in December 2023. In the individuals portfolio, the growth was due to the increases of 13.7% in personal loans, 6.8% in mortgage loans,

a market in which the bank has made headway in our clients’ journey over this period, and 5.1% in vehicles. The companies loan

portfolio2 was up 0.5% in the 12-month period with significant changes recorded in rural loans, mortgage loans, and BNDES and onlending.

Non-performing loans over 90 days overdue (NPL 90) reached 2.8% in December 2023, the lowest amount in the last five quarters. This decrease

was due to the reduction in this ratio for individuals in Brazil and reflects the bank's strategic risk management. Cost of credit totaled

R$36.9 billion in 2023, up 14.4% on a year-on-year basis, mainly due to the higher provision for loan losses driven by the increase in

the loan portfolio in the Retail Business segment in Brazil and the normalization of the provision flow in the Wholesale Business segment

also in Brazil; rise in impairment of corporate securities; and increase in discounts granted. 1 Includes financial guarantees provided

and private securities. 2 Without financial guarantees provided and private securities. In R$ million (except where otherwise indicated)

4Q23 3Q23 % 2023 2022 % Recurring Managerial Result 9,401 9,040 4.0% 35,618 30,786 15.7% Annualized Recurring Managerial Return on Average

Equity 21.2% 21.1% 10 b.p. 21.0% 20.3% 60 b.p. Total Adjusted Loan Portfolio1 (R$ billion) 1,176.5 1,163.2 1.1% 1,176.5 1,141.5 3.1%

90-day NPL ratio – Total 2.8% 3.0% -20 b.p. 2.8% 2.9% -10 b.p. Commissions and fees and result from insurance operations grew 5.3%

in 2023 when compared to 2022, driven by higher gains from card activities, in both issuance and acquiring services, higher volumes of

investment banking operations and increase in result from insurance operations. Non-interest expenses reached R$58,147 billion in 2023,

an increase of 6.5% in relation to the same period of 2022. In Brazil, non-interest expenses increased 8.2%, and business and technology

investments were the main drivers of this growth. Inflation for the period was 4.6% (IPCA) and there was a 4.58% (8.00% in 2022) increase

in salaries and benefits beginning in September 2023 under the collective wage agreement. Efficiency ratio in the 12-month period was

39.9% on a consolidated basis and 37.9% in Brazil, both at the lowest level of the historical series. Itaú Unibanco continues

to progress in the ESG agenda and makes up for the 24th consecutive year the portfolio of the Dow Jones Sustainability Index (DJSI World)

in 2024. Additionally, it is also included in the Corporate Sustainability Index (ISE) of B3. As part of its corporate governance practices

with the market and its stockholders, Itaú Unibanco discloses its 2024 consolidated forecast, according to the table below as

follows: (1) Includes financial guarantees provided and corporate securities; (2) Composed of results from loan losses, impairment and

discounts granted; (3) Commissions and fees (+) income from insurance, pension plan and premium bonds operations (-) expenses for claims

(-) insurance, pension plan and premium bonds selling expenses; (4) Considers pro forma adjustments in 2023 of the sale of Banco Itaú

Argentina. Further information on Itaú Unibanco earnings is available on Itaú Unibanco’s Investor Relations website:

www.itau.com.br/investor-relations. Comunicação Corporativa – Itaú Unibanco imprensa@itau-unibanco.com.br

"Our indicators in the fourth quarter of 2023 confirm a year of fairly sound and consistent results. The highlights are the growing profitability

ratios, with increased loan portfolio, decreasing delinquency ratios and efficiency ratio at our lowest historical level. Also noteworthy

is the payment of additional dividends to our stockholders in the amount of R$11.0 billion, which, together with the Interest on Capital

already declared, resulted in a payout of 60.3% in the year". Alexsandro Broedel Itaú Unibanco’s CFO

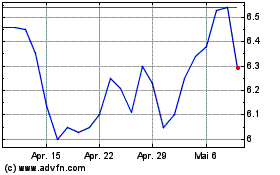

Itau Unibanco (NYSE:ITUB)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

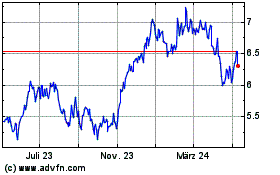

Itau Unibanco (NYSE:ITUB)

Historical Stock Chart

Von Mai 2023 bis Mai 2024