UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of

Foreign Issuer

Pursuant to Rule 13a-16 or 15d-16

of the Securities Exchange Act of 1934

For the month of November, 2023

Commission File Number: 001-15276

Itaú Unibanco Holding S.A.

(Exact name of registrant as specified in its charter)

Itaú Unibanco Holding S.A.

(Translation of Registrant’s Name into English)

Praça

Alfredo Egydio de Souza Aranha, 100-Torre Conceicao

CEP

04344-902 São Paulo, SP, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant files or will file annual reports under cover Form 20-F

or Form 40-F.

Form

20-F ☒ Form 40-F ☐

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by Regulation

S-T Rule 101(b)(1):

Yes ☐ No ☒

Indicate by check mark if the registrant is submitting the Form 6-K in paper as permitted by

Regulation S-T Rule 101(b)(7):

Yes ☐ No ☒

Indicate by check mark whether by furnishing the information contained in this Form, the registrant is also thereby furnishing information

to the Commission pursuant to Rule 12g3-2(b) under the Securities Exchange Act of 1934.

Yes ☐ No ☒

If “Yes” is marked, indicate below the file number assigned to the registrant in connection with Rule 12g3-2(b):

82–

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned,

thereunto duly authorized.

Date: November 30, 2023.

|

|

|

| Itaú Unibanco Holding S.A. |

|

|

| By: |

|

/s/ Renato Lulia Jacob |

| Name: |

|

Renato Lulia Jacob |

| Title: |

|

Group Head of Investor Relations and Market Intelligence |

|

|

| By: |

|

/s/ Alexsandro Broedel |

| Name: |

|

Alexsandro Broedel |

| Title: |

|

Chief Financial Officer |

Corporate Bylaws approved at

the Extraordinary Stockholders’ Meeting of November 30, 2023, pending approval by the Central Bank of Brazil ITAÚ UNIBANCO

HOLDING S.A. CNPJ 60.872.504/0001-23 A Publicly-Held Company NIRE 35300010230 Authorized Capital: up to 13,176,900,000 shares Subscribed

and Paid-in Capital: R$90,729,000,000.00 – 9,804,135,348 shares BYLAWS Article 1 – NAME, TERM AND HEAD OFFICE - The publicly-held

joint stock company governed by these Bylaws and denominated ITAÚ UNIBANCO HOLDING S.A., incorporated with no final term, has

its head office and address for legal purposes in the City and State of São Paulo. Article 2 – PURPOSE - The company has

as its purpose (i) the banking activity in all its authorized forms, including foreign exchange transactions; (ii) the issuance and management

of credit cards, and the implementation of customer loyalty programs by virtue of relationships with the Company; (iii) the implementation

and management of payment arrangements; (iv) the implementation of customer loyalty programs by virtue of relationships with other companies;

(v) the development of partnerships to promote products and/or services by providing a marketplace on digital platforms, dissemination

materials and outlets; and (vi) all other activities required and/or complementary to achieve its purposes. Article 3 – CAPITAL

AND SHARES – Subscribed and paid up capital is ninety billion and seven hundred twenty–nine million Brazilian reais (R$90,729,000,000.00),

represented by nine billion, eight hundred and four million, one hundred and thirty–five thousand and three hundred forty–eight

(9,804,135,348) book–entry shares with no par value, of which four billion, nine hundred and fifty–eight million, two hundred

and ninety thousand and three hundred and fifty–nine (4,958,290,359) are common shares and four billion, eight hundred and forty–five

million, eight hundred and forty–four thousand and nine hundred and eighty–nine (4,845,844,989) are preferred shares, the

latter having no voting rights but with the following advantages: I - priority in receiving the minimum non-cumulative annual dividend

of R$0.022 per share, which shall be adjusted in the event of a stock split or reverse stock split; II – in the event of a sale

of the company’s controlling stake, the right to be included in a public offering of shares, thus assuring such shares the right

to a price equal to eighty percent (80%) of the value paid per voting share that is part of the controlling block and guaranteeing a

dividend at least equal to that of the common shares. 3.1. Authorized Capital – By means of a resolution of the Board of Directors,

the company is authorized to increase its capital stock irrespective of any statutory reform, up to the limit of thirteen billion, one

hundred and seventy-six million and nine hundred thousand (13,176,900,000) shares, of which six billion, five hundred and eighty-eight

million and four hundred and fifty thousand (6,588,450,000) are common shares and six billion, five hundred and eighty-eight million

and four hundred and fifty thousand (6,588,450,000) are preferred shares. The issues of shares for sale on Stock Exchanges, public subscription

and exchange of shares via a public offering for acquisition of control may CORPORATE BYLAWS APPROVED AT THE EXTRAORDINARY GENERAL MEETING

OF ITAÚ UNIBANCO HOLDING S.A. OF NOVEMBER 30, 2023 be performed irrespective of the preemptive rights of the preexisting stockholders

(Article 172 of Law No. 6,404/76). 3.2. Call Options – Within the limit of the Authorized Capital and in accordance with the plan

approved by the General Stockholders’ Meeting, call options may be granted to management members and employees of the company itself

and of controlled companies. 3.3. Book-Entry Shares – Without any changes in the rights and restrictions that are inherent to them,

under the provisions of this article, all of the company’s shares shall be in book-entry form, being registered in deposit accounts

at Itaú Corretora de Valores S.A., in the name of their holders, without the issue of share certificates, under the terms of Articles

34 and 35 of Law No. 6,404/76, for which a remuneration may be charged from stockholders in accordance with paragraph 3 of Article 35

of the above-mentioned law. 3.4. Share Buybacks – The company can acquire its own shares upon the authorization of the Board of

Directors, for the purposes of cancellation, holding as treasury stock for subsequent sale or for use under the Stock Option Plan or

the Stock Grant Plan. 3.5. Acquisition of Voting Rights by the Preferred Shares – The preferred shares will acquire voting rights

under the terms of the provisions of Article 111, paragraph 1, of Law No. 6,404/76, should the company fail to pay the priority dividend

for three consecutive fiscal years. Article 4 – GENERAL STOCKHOLDERS’ MEETING – The General Stockholders’ Meeting

shall meet annually within the four (4) months following the end of the fiscal year, in accordance with the legal requirements, and extraordinarily

whenever corporate interests so require. 4.1. The work of any General Stockholders’ Meeting shall be chaired by a management member

nominated by the Stockholders’ Meeting with a stockholder appointed by the chair as secretary. 4.2. Each common share is entitled

to one vote in the resolutions of the General Stockholders’ Meetings. 4.3. The following is the exclusive prerogative of the General

Stockholders’ Meeting: a) resolve upon the financial statements and the distribution and allocation of profits; b) resolve upon

the management report and the Board of Officers’ accounts; c) establish the aggregate and annual compensation of the members of

the Board of Directors and the Board of Officers; d) appoint, elect and remove members of the Board of Directors; e) approve changes

to the capital stock, with the proviso of the powers attributed to the Board of Directors by item 3.1 above, of mergers, amalgamations,

spin-offs or any other forms of corporate restructuring involving the company; f) resolve upon retained profits or the recognition of

reserves; and CORPORATE BYLAWS APPROVED AT THE EXTRAORDINARY GENERAL MEETING OF ITAÚ UNIBANCO HOLDING S.A. OF NOVEMBER 30, 2023

g) resolve upon Stock Option Plans or Stock Grant Plans issued by the company or by its controlled companies. Article 5 – MANAGEMENT

– The company will be managed by a Board of Directors and a Board of Officers. As provided for in legislation and in these Bylaws,

the Board of Directors will act in advisory, elective and supervisory roles and excluding operating and executive duties, which shall

be within the powers of the Board of Officers. 5.1. Investiture – The Directors and Officers will be invested in their positions

upon the signing of their terms of office in the minute book of the Board of Directors or the Board of Officers, as the case may be,

conditional on the prior signing of the members of management’s Instrument of Agreement, under the terms of the provision in the

Level 1 Corporate Governance Regulations of B3 S.A. – Brasil, Bolsa, Balcão (“B3”). 5.2. Management Compensation

- Management members shall receive both compensation and profit sharing, in accordance with the statutory limits. Payment of compensation

shall be established by the General Stockholders’ Meeting in the form of an aggregate and annual amount. It is incumbent upon the

Board of Directors to regulate the use of the amount set aside for compensation and the apportionment of the profit sharing to the members

of this Board of Directors and the Board of Officers. 5.3. Defense of management members - In addition to civil liability insurance,

the company may enter into an indemnity contract in favor of its management members or the management members of its controlled companies,

to guarantee the payment of expenses due to claims, inquiries, investigations, arbitration, administrative or legal procedures and proceedings,

in Brazil or any other jurisdiction, so as to hold them harmless against liability for acts carried out in the performance of their managerial

duties, construed as those carried out diligently and in good faith, in the company’s interest and in the exercise of fiduciary

duties of management members. The payment of expenses under the indemnity contract shall be subject to the company’s approval governance

in order to ensure the independence of the decision-making process and prevent any conflicts of interest. 5.3.1. The benefit described

in item 5.3. may be extended to employees who hold a management position in the company or its controlled companies, as well as those

individuals formally nominated by the company to hold management positions in other entities. Article 6 – BOARD OF DIRECTORS –

The Board of Directors will be composed of natural persons, elected by the General Stockholders’ Meeting, and will have one (1)

Chairman or two (2) Co–Chairmen and may have up to three (3) Vice–Chairmen chosen by the directors from among their peers.

6.1. The positions of Chairman or Co-Chairmen of the Board of Directors and of Chief Executive Officer or principal executive of the

company may not be held by the same person. CORPORATE BYLAWS APPROVED AT THE EXTRAORDINARY GENERAL MEETING OF ITAÚ UNIBANCO HOLDING

S.A. OF NOVEMBER 30, 2023 6.2. The Board of Directors shall have at least ten (10) and at most fourteen (14) members. Within these limitations,

it is the responsibility of the General Stockholders’ Meeting that elects the Board of Directors to initially establish the number

of Directors who will compose this body for each term of office, provided that at least the majority shall be non-executive members and

at least one-third shall be independent members, in accordance with the concepts defined in the company’s Corporate Governance

Policy. 6.3. The Co-Chairmen shall have identical prerogatives and duties, and shall work together in the chair of the Board of Directors.

6.4. In case of any definitive vacancy or incapacity in office: (a) of one of the Co-Chairmen, the remaining Co-Chairman shall automatically

take office as the Chairman of the Board of Directors; and (b) of the Chairman or both Co-Chairmen, the Board of Directors shall resolve

upon the appointment of one of its members for the position of Chairman of the Board of Directors. 6.4.1. In case of temporary vacancy

or incapacity in office: (a) of one Co-Chairman, the remaining Co-Chairman shall temporarily assume all the duties inherent to the position;

and (b) of the Chairman or both Co-Chairmen, the Board of Directors shall appoint an acting deputy from among its members. 6.5. The unified

term of office of a member of the Board of Directors is for one (1) year as from the date they are elected by the Stockholders’

Meeting, extendable until their successors take office. 6.6. No individual may be elected to the position of member of the Board of Directors

who is seventy (70) years of age on the date of their election. 6.7. The Board of Directors, which is convened by the Chairman or by

any of the Co-Chairmen, will meet, ordinarily, eight (8) times annually and, extraordinarily, whenever corporate interests so require,

and its resolutions will only be valid in the presence of at least an absolute majority of its acting members. 6.7.1. Any member of the

Board of Directors may participate in the meetings via telephone call, videoconference, video presence, email, or any other communication

means. In this case, the Member shall be deemed present at the meeting for purposes of confirming the opening or voting quorum, and their

vote cast shall be deemed valid for all legal intents and purposes. 6.8. It is incumbent upon the Board of Directors to: I. establish

the general business guidelines of the company; II. elect and remove from office the company's Officers and establish their duties; III.

nominate officers to compose the Boards of Officers of the controlled companies as specified; CORPORATE BYLAWS APPROVED AT THE EXTRAORDINARY

GENERAL MEETING OF ITAÚ UNIBANCO HOLDING S.A. OF NOVEMBER 30, 2023 IV. supervise the administration of the officers of the company,

examine at any time company accounts and documents, request information on contracts already executed or nearing the point of execution

and any other acts; V. call General Stockholders’ Meetings within at least twenty-one (21) days before the effective date, the

number of days being counted from the notice of the first call; VI. express an opinion on the management report, the Board of Officers’

accounts and the financial statements for each fiscal year to be submitted to the General Stockholders’ Meeting; VII. resolve upon

budgets for results and investments and respective action plans; VIII. appoint and remove from office the independent auditors, without

restriction as to the provision in Article 7; IX. resolve upon the distribution of interim dividends, including their distribution to

profits or existing revenue accounts contained in the most recent annual or semiannual balance sheet; X. resolve upon payment of interest

on capital; XI. resolve upon buyback operations on a nonpermanent basis, for treasury stock purposes, as well as resolve upon either

cancellation or sale of these shares; XII. resolve upon the purchase and writing of put and call options supported by the shares issued

by the company for the purposes of cancellation, holding as treasury stock or sale, observing CVM Instruction No. 567 of September 17,

2015, as amended; XIII. resolve upon the setting up of committees to handle specific issues within the scope of the Board of Directors;

XIV. elect and remove the members of the Audit Committee and the Compensation Committee; XV. approve the operational rules that the Audit

and Compensation Committees may establish for its own operation and be aware of the Committees’ activities through their reports;

XVI. assess and disclose on an annual basis who the independent members of the Board of Directors are, as well as examine any circumstances

that may compromise their independence; XVII. approve direct or indirect investments and divestments in corporate stakes for amounts

higher than fifteen per cent (15%) of the carrying amount of the company as registered in the most recent audited balance sheet; XVIII.

state a position on the public offerings of shares or other marketable securities issued by the company; XIX. resolve upon, within the

limit of the authorized capital, the increase of capital and issue of credit securities and other instruments convertible into shares

in accordance with item 3.1.; and CORPORATE BYLAWS APPROVED AT THE EXTRAORDINARY GENERAL MEETING OF ITAÚ UNIBANCO HOLDING S.A.

OF NOVEMBER 30, 2023 XX. examine transactions with related parties based on the materiality criteria provided for in its own policy,

by itself or by one of its Committees, provided that a report is submitted to the Board of Directors in the latter scenario. Article

7 – AUDIT COMMITTEE - The supervision (i) of the internal controls and risk management; (ii) of the activities of the internal

audit; and (iii) of activities of the independent audit shall be undertaken by the Audit Committee, upon which it shall be incumbent

to recommend to the Board of Directors the choice and dismissal of the independent auditors. 7.1. The Audit Committee shall be composed

of three (3) to seven (7) members, annually elected by the Board of Directors from among the members of the Board itself or professionals

of recognized skills and outstanding knowledge, with at least one of the members of this Committee being designated Financial Expert,

having proven knowledge of the accounting and audit fields. 7.1.1. The basic conditions for holding a position in the Audit Committee

are: a) not to be, or not to have been, in the past (12) twelve months: (i) an officer of the Company, its controlling company or associates,

controlled or jointly-controlled companies, directly or indirectly; (ii) an employee of the Company, its controlling company or associates,

controlled or jointly-controlled companies, directly or indirectly; (iii) a responsible technician, officer, manager, supervisor or any

other member, with management duties, of the team involved in the audit work at the Company; or (iv) a member of the Supervisory Council

of the Company, its controlling company or associates, controlled or jointly-controlled companies, directly or indirectly; b) not to

be a spouse, a partner or family member in a direct or a collateral line or by affinity, up to twice removed, of the persons referred

to in sections “a”, “(i)” and “(iii)”; and c) not to hold positions, in particular in advisory boards,

boards of directors or supervisory councils in companies that may be deemed as competitors in the market or where a conflict of interests

may arise. 7.1.2. The Board of Directors shall terminate the term of office of any member of the Audit Committee if their independence

had been affected by any conflict of interest or potential conflict of interest; 7.1.3. Members of the Audit Committee shall have a term

of office of one (1) year, and they may be reelected for up to five (5) annual terms of office, after which they may only reoccupy a

seat on the Committee at least three (3) years following the expiry date of the last permitted reappointment; 7.1.4. Up to one-third

(1/3) of the Audit Committee members may have their term of office renewed, subject to the maximum number of up to ten consecutive years,

and the time period set in item 7.1.3. is waived; CORPORATE BYLAWS APPROVED AT THE EXTRAORDINARY GENERAL MEETING OF ITAÚ UNIBANCO

HOLDING S.A. OF NOVEMBER 30, 2023 7.1.5. Under no circumstance may a member of the Audit Committee continue to hold office for a period

longer than: (i) ten (10) consecutive years, for up to one-third (1/3) of the members; and (ii) five (5) consecutive years for other

members. 7.1.6. The Audit Committee members shall remain in their positions until their successors take office. 7.2. The Audit Committee

shall meet on the convening of the Chairman and shall be responsible for: I) the quality and integrity of the financial statements; II)

compliance with the prevailing legal and regulatory requirements; III) the activities, independence, and quality of the work of the independent

audit companies and the internal audit; and IV) the quality and efficacy of the internal controls and risk management systems. 7.3. The

Board of Directors shall establish the amount for compensating the Audit Committee’s members, based upon market parameters as well

as the budget for covering expenses for the Committee’s operation, including the hiring of specialists for assisting in fulfilling

its responsibilities. 7.3.1. The Audit Committee member shall not receive any other type of compensation from the company or its associates

unrelated to their duties as a member of the Audit Committee, except in those cases in which the member of the Audit Committee is also

a member of the Board of Directors and opts to not receive compensation for the duties performed as a member of the latter body. 7.4.

At the end of each fiscal year, the Audit Committee shall prepare a report on the monitoring of activities related to the independent

and internal audits and the Internal Controls and Risk Management System, forwarding a copy to the Board of Directors and maintaining

said report on file and available to the Central Bank of Brazil and the Superintendence of Private Insurance for at least five years.

Likewise, a semiannual report shall be prepared at the end of the first half of each fiscal year. 7.4.1. The summary of the Audit Committee’s

Report, providing the main data, shall be published together with the financial statements. Article 8 – COMPENSATION COMMITTEE

– Compliance with the duties and responsibilities related to the compensation policy for the company’s management members

shall be incumbent upon the Compensation Committee, which shall report directly to the Board of Directors. 8.1. The Compensation Committee

shall be made up of three (3) to ten (10) members elected by the Board of Directors, one of its members being nominated for the position

of Chairman. 8.1.1. The Compensation Committee shall be made up of (i) professionals with the qualifications and experience necessary

to exercise proper and independent judgment on the Company’s compensation policy, including on the repercussions CORPORATE BYLAWS

APPROVED AT THE EXTRAORDINARY GENERAL MEETING OF ITAÚ UNIBANCO HOLDING S.A. OF NOVEMBER 30, 2023 in the management of risks, and

(ii) at least, one member who is not a management member; 8.1.2. The term of office of the members of the Compensation Committee shall

be one (1) year as from the date of the Meeting of the Board of Directors that elects them and expires on the date on which their substitutes

take office. 8.1.3. The members of the Compensation Committee may be reelected to the position, although remaining a member of the Compensation

Committee for a period of more than ten (10) years shall not be permitted. Having reached this term, the member may only rejoin the Committee

once a period of at least three (3) years has elapsed. 8.2. It is incumbent on the Compensation Committee to: I. prepare the compensation

policy for the management members of the company, proposing to the Board of Directors the various forms of fixed and variable compensation

in addition to benefits and special recruiting and severance programs; II. supervise the implementation and operation of the company’s

management members’ compensation policy; III. annually review the company’s management members’ compensation policy,

recommending its correction or improvement to the Board of Directors; IV. propose to the Board of Directors the amount of aggregate compensation

of management members to be submitted to the General Stockholders’ Meeting; V. assess future internal and external scenarios and

their possible impacts on the management compensation policy; VI. examine the company’s management members’ compensation

policy in relation to market practices with a view to identifying significant discrepancies in relation to similar companies, proposing

the necessary adjustments; and VII. ensure that the management members’ compensation policy is permanently compatible with the

risk management policy, with the targets and the current and expected financial situation for the company and with the provision in the

National Monetary Council Resolution No. 3,921/2010. 8.3. The Board of Directors may assign powers to the Compensation Committee in addition

to those provided for in these Bylaws. 8.4. The Board of Directors shall set an amount for compensating the members of the Compensation

Committee, in accordance with market parameters, as well as the budget for covering the expenses for its operation. 8.5. At the end of

each fiscal year, the Compensation Committee shall prepare a report on the activities undertaken within the scope of its duties, submitting

a copy to the Board of Directors and maintaining said report at the disposal of the Central Bank of Brazil for a minimum term of five

(5) years. CORPORATE BYLAWS APPROVED AT THE EXTRAORDINARY GENERAL MEETING OF ITAÚ UNIBANCO HOLDING S.A. OF NOVEMBER 30, 2023 Article

9 – BOARD OF OFFICERS – The management and representation of the company is incumbent upon the Board of Officers, elected

by the Board of Directors. 9.1. The Board of Officers shall have between five (5) and forty (40) members, comprising the positions of

Chief Executive Officer and Officer. 9.2. The Board of Directors will define the Officers who, in addition to the Chief Executive Officer,

will compose the Executive Committee, the Company’s highest executive body; 9.3. In the case of absence or incapacity of any officer,

the Board of Officers may choose the acting deputy from among its members. The Chief Executive Officer shall be substituted in their

absence or incapacity by an Officer who is a member of the Executive Committee appointed by them; 9.4. Should any position become vacant,

the Board of Directors may designate an officer to act as deputy in order to complete the term of office of the substituted officer.

9.5. The officers shall exercise their terms of office of one (1) year and are eligible for reelection and they shall remain in their

positions until their successors take office. 9.6. A person is ineligible (i) to hold the position of Chief Executive Officer who is

already sixty-two (62) year of age on the date of the election; and (ii) to hold other positions on the Board of Officers who are already

sixty (60) years of age on the date of the election. Article 10 – REPRESENTATION OF THE COMPANY, RESPONSIBILITIES AND POWERS OF

OFFICERS – The Company will be represented by two Officers together to: (i) assume obligations, exercising rights in any act, contract

or document that gives rise to a liability, including by pledging guarantees on obligations of third parties; (ii) waive rights, encumber

and dispose of permanent assets; and (iii) appoint powers-of-attorney to act. In any situation when the amount involved exceeds R$500

million, at least one of the Officers must be either the Chief Executive Officer or another Officer who is a member of the Executive

Committee. The Company shall be represented by two officers together to decide on opening, closing or reorganizing facilities. 10.1.

In case of the main paragraph, except for the provision in item “(iii)”, the company may also be represented jointly (i)

by an officer and a power-of-attorney, or (ii) by two powers-of-attorney. 10.1.1. Exceptionally, the Company may be represented by just

one power-of-attorney: (i) in the case of any government body, direct or indirect, in acts which do not imply the assumption or renouncement

of rights and obligations; (ii) in power-of-attorney instruments with an “ad judicia” clause; and (iii) in general stockholders’

meetings, meetings of stockholders or unit holders of companies or investment funds in which the company holds investments. In the event

of items (i) and (iii), the Company may also be represented by one officer only; CORPORATE BYLAWS APPROVED AT THE EXTRAORDINARY GENERAL

MEETING OF ITAÚ UNIBANCO HOLDING S.A. OF NOVEMBER 30, 2023 10.1.2. The Board of Directors may provide for or establish exceptions

in addition to those provided for in subitem 10.1.1; 10.1.3. With the exception of those of a legal nature, power-of-attorney instruments

shall have a mandatory term of no more than one year. 10.2. It is incumbent upon the Chief Executive Officer to convene and preside at

meetings of the Board of Officers, supervise its activities, structure the services of the company, and establish the internal and operational

norms. 10.3. The Officers are responsible for the activities assigned to them by the Board of Directors. Article 11 – SUPERVISORY

COUNCIL – The company will have a Supervisory Council that shall operate on a permanent basis, comprising from three (3) to five

(5) effective members and an equal number of alternate members. The election and operation of the Supervisory Council will be in accordance

with the provisions of Articles 161 to 165 of Law No. 6,404/76. Article 12 – FISCAL YEAR – The fiscal year will end on December

31 of each year. Semiannual balance sheets will be prepared and, on a discretionary basis, interim balance sheets, at any date, including

for the purposes of the payment of dividends, according to the legal provisions. Article 13 – ALLOCATION OF PROFIT – Together

with the financial statements, the Board of Directors shall submit to the Annual General Stockholders’ Meeting a proposal for the

allocation of profit for the year under the terms of Articles 186 and 191 to 199 of Law No. 6,404/76 and the following provisions: 13.1.

Before any other distribution, five percent (5%) shall be allocated to the Legal Reserve, which may not exceed twenty percent (20%) of

the capital stock. 13.2. The amount to be allocated to dividend payments to the stockholders will be specified in accordance with the

provisions in Article 14 and the following rules: a) the preferred shares will be entitled to the priority minimum annual dividend (Article

3, item I); b) the amount of the mandatory dividend that remains after the dividend payment in the previous subitem will be applied firstly

to remunerating the common shares for a dividend that is equal to the priority dividend distributed to the preferred shares; and c) the

shares of both types will participate in the profits to be distributed under equal conditions once a dividend identical to the minimum

on the preferred shares is also assured to the common shares; 13.3. The remaining balance will be allocated in accordance with what is

proposed by the Board of Directors, including the reserve referred to in Article 15, “ad referendum” of the General Stockholders’

Meeting. CORPORATE BYLAWS APPROVED AT THE EXTRAORDINARY GENERAL MEETING OF ITAÚ UNIBANCO HOLDING S.A. OF NOVEMBER 30, 2023 Article

14 – MANDATORY DIVIDEND – The stockholders are entitled to receive as a mandatory dividend for each fiscal year, an amount

of not less than twenty-five percent (25%) of the profit recorded in the same fiscal year, adjusted according to the decrease or increase

of the amounts specified in subitems “a” and “b” of item I of Article 202 of Law No. 6,404/76, and provided that

items II and III of the same law are observed. 14.1. The portion of the mandatory dividend that may have been paid in advance as interim

dividends to the Statutory Revenue Reserve account will be credited back to this same reserve account. 14.2. If so decided by the Board

of Directors, interest on capital may be paid, offsetting its amount against the amount of the mandatory dividend according to Article

9, paragraph 7, of Law No. 9,249/95. Article 15 – STATUTORY RESERVE – According to the proposal of the Board of Directors,

the General Stockholders’ Meeting may resolve upon the recognition of a Statutory Revenue Reserve, which will be limited to 100%

of the capital stock, for the purpose of ensuring that there will be funds for the payment of dividends, including interest on capital

(item 14.2), or interim payments, to keep the flow of remuneration to stockholders, and its balance can also be used in: (i) redemption,

reimbursement or own shares buyback operations, as set forth by legislation in force; and (ii) capital increases, including by means

of new bonus shares. 15.1. The Reserve shall be comprised of funds: a) equivalent to up to 100% of profit for the fiscal year, adjusted

according to Article 202 of Law No. 6,404/76, always respecting the stockholders’ right to receive mandatory dividends, under the

terms of these Bylaws and applicable legislation; b) equivalent to up to 100% of the paid-up portion of the Revaluation Reserves, recorded

as retained earnings; c) equivalent to up to 100% of the adjusted amounts for previous fiscal years, recorded as retained earnings; and

d) originating from the credits corresponding to interim dividend payments (item 14.1). 15.2. The balance of this reserve, added to the

Legal Reserve, may not exceed the capital stock, under the terms of Article 6.404/76 of Law No. 6,404/76. 15.3. The reserve shall be

separated into different subaccounts according to the fiscal years they were recognized, the profit allocated for its recognition and

the Board of Directors shall specify the profits used in the distribution of interim dividends, which may be charged to different subaccounts,

according to the category of the stockholders. Article 16 – BENEFICIAL OWNERS – The company is prohibited from issuing participation

certificates of the Beneficial Owner type. CORPORATE BYLAWS APPROVED AT THE EXTRAORDINARY GENERAL MEETING OF ITAÚ UNIBANCO HOLDING

S.A. OF NOVEMBER 30, 2023 Article 17 – LISTING SEGMENT – With the admission of the company to the special listing segment

called Level 1 Corporate Governance of B3, the company, its stockholders, management members and members of the Supervisory Council,

when installed, are subject to the provisions of the Listing Regulations for Level 1 Corporate Governance of B3 (“Level 1 Regulations”).

________________________________

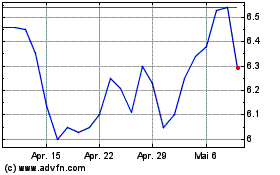

Itau Unibanco (NYSE:ITUB)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

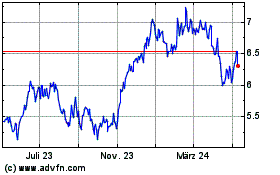

Itau Unibanco (NYSE:ITUB)

Historical Stock Chart

Von Mai 2023 bis Mai 2024