false000177794600017779462023-07-112023-07-110001777946irnt:RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShare1Member2023-07-112023-07-110001777946irnt:CommonStockParValue00001PerShare2Member2023-07-112023-07-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 11, 2023

IronNet, Inc.

(Exact name of registrant as specified in its charter)

|

|

|

|

|

|

|

|

|

|

Delaware |

|

001-39125 |

|

83-4599446 |

(State or other jurisdiction of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

7900 Tysons One Place, Suite 400

McLean, VA 22102

(Address of principal executive offices, including zip code)

(443) 300-6761

(Registrant’s telephone number, including area code)

N/A

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

|

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

Common Stock, par value $0.0001 per share |

|

IRNT |

|

The New York Stock Exchange |

Redeemable Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share |

|

IRNT.WS |

|

The New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging Growth Company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 1.01 Entry into a Material Definitive Agreement.

On July 11, 2023, the Letter Agreement (the “Letter Agreement”) executed on June 16, 2023 between IronNet, Inc., a Delaware corporation (the “Company”), and C5 CC Ferrous, LLC, a Delaware limited Liability company (the “JV”, and, together with the Company, the “Parties”), as amended on July 11, 2023 was deemed executed and delivered by the Parties in accordance with its terms. The JV is an affiliate of C5 Capital Limited (“C5”), a beneficial owner of more than 5% of the Company’s outstanding

common stock. Pursuant to the Letter Agreement, the JV has agreed to provide certain funding to the Company and the Company has agreed to take certain steps including with respect to the privatization of the Company and the de-listing from the public securities markets, each as further described below.

Pre-Closing Funding

Pursuant to the Letter Agreement, the JV has agreed to fund the on-going operational needs of the Company in several tranches (each, a “Funding Tranche”) up to a maximum aggregate amount of $15,480,000, subject to the Company’s achievement of certain transactional and operational milestones. In connection with each Funding Tranche, the Company will issue the JV a senior, secured convertible promissory note (the “Pre-Closing Notes”). On July 11, 2023, the Company and the JV agreed to amend the Letter Agreement to reduce the amount of the first Funding Tranche to $1,750,000 and to increase the amount of the second Funding Tranche to $1,750,000. As of the same date, the JV completed the first Funding Tranche, and the Company issued a Pre-Closing Note in the original principal amount of $1,750,000 to the JV.

Each Pre-Closing Note will bear interest at a rate of 12% per annum from the date of issuance, and have a maturity date 12 months after the issuance date of the applicable Pre-Closing Note. The JV may elect to convert the outstanding principal amount of the Pre-Closing Notes, and accrued and unpaid interest, into shares of the Company’s common stock, par value $0.0001 per share (the “Common Stock”), at a conversion rate equal to 70% of the trading price of the Common Stock on the execution date of the applicable Pre-Closing Note (the “Conversion Rate”). The Pre-Closing Notes will be senior to all existing indebtedness and secured by a lien against all assets (including intellectual property) of the Company and its subsidiaries. The Pre-Closing Notes grant the JV the right, but not an obligation, to participate on a pro rata basis in subsequent securities issuances and financings, subject to customary exceptions and anti-dilution protections and customary transfer restrictions.

In the event that the Company fails to timely pay amounts due under the Pre-Closing Notes or the Company materially defaults in its performance of any other covenant under the or the Pre-Closing Notes or the related security agreement, which default is not cured within 30 days after written notice thereof, then at the option of the JV, all unpaid principal, accrued interest and other amounts owing under the Pre-Closing Notes shall be immediately due and payable.

In the event that the Company files any petition or action for relief under any bankruptcy, reorganization, insolvency or moratorium law or any other law for the relief of or relating to debtors, or makes any assignment for the benefit of creditors or takes any corporate action in furtherance thereof, or if an involuntary petition is filed against the Company (unless such petition is dismissed or discharged within 60 days) under any bankruptcy statute, or a custodian, receiver, trustee, assignee for the benefit of creditors is appointed to take possession, custody or control of any property of the Company, then all unpaid principal, accrued interest and other amounts owing under the Pre-Closing Notes will accelerate and automatically become immediately due and payable.

Modification of Existing Notes

Pursuant to the Letter Agreement, the Company has agreed to modify the promissory notes previously issued to the JV and members of the Company’s board of directors (the “Existing Notes”) to provide the holders the option to convert the outstanding principal amount and accrued and unpaid interest into shares of Common Stock at the Conversion Rate.. The Existing Notes will remain subordinated to the Pre-Closing Notes. As previously disclosed in its Current Report on Form 8-K filed on July 7, 2023, the Company executed amendments to the Existing Notes on June 30, 2023.

Take-Private Transaction and Management Restructuring

The Letter Agreement obligates the Company to promptly take certain actions to facilitate the privatization and de-listing of the Company’s Common Stock from the New York Stock Exchange (“NYSE”) and from registration under Section 12(b) of the Securities Exchange Act of 1934, as amended (the “Exchange Act”). These steps include (i) identifying and effectuating a stock split structure for the Company and implementing a related recapitalization involving the issuance of preferred stock to the JV, (ii) the Company becoming current in its Exchange Act reporting obligations; (iii) filing a proxy statement relating to the planned stock split and the issuance of a series of preferred stock in connection with a contemplated recapitalization, and (iv) taking all steps otherwise necessary to consummate the take private transaction contemplated by the Letter Agreement (the “Take-Private Transaction”).

The JV has agreed to provide additional financing to the Company after the consummation of the Take-Private Transaction, in the maximum aggregate amount of $51,000,000, subject to the Company meeting certain transactional and/or operational milestones specified in the Letter Agreement.

As further described in Item 5.02 of this Current Report on Form 8-K, pursuant to the terms of the Letter Agreement, in connection with the Take-Private Transaction, the Company’s Board of Directors (the “Board”) agreed to appoint Linda Zecher-Higgins as Chief Executive Officer of the Company and Cameron Pforr as President and Chief Financial Officer. General (Ret.) Keith

Alexander, Founder, Chairman and former Chief Executive Officer of the Company, will remain Chairman of the Company, and will depart from his role as Chief Executive Officer.

Non-Solicitation Covenant

The Letter Agreement includes non-solicit terms applicable to the Company that prohibit the Company from directly or indirectly: (i) soliciting or facilitating third party offers or proposals regarding an acquisition of the Company, any share purchase, merger, consolidation, share exchange, financing transaction, business combination, refinancing, reorganization, sale or transfer of the assets or equity of the Company or its subsidiaries outside the ordinary course of business, or any other financing transaction; (ii) furnishing any non-public information to any third party for the purpose of facilitating any such alternative transaction; (iii) participating in any discussions with any third party regarding any such alternative transaction; or (iv) entering into an agreement regarding any such alternative transaction. The non-solicit covenants applicable to the Company are subject to certain fiduciary exceptions that would permit the Company to terminate the Letter Agreement and the transactions contemplated by the Letter Agreement, subject to payment to the JV of a termination fee equal to $5,000,000 plus the principal and accrued interest under outstanding Pre-Closing Notes and the out-of-pocket and costs and reasonable expenses incurred by the JV in connection with the transactions contemplated by the Letter Agreement.

The foregoing description of the Letter Agreement and the Amendment to the Letter Agreement do not purport to be complete and are subject to, and are qualified in their entirety by reference to, the form of Letter Agreement and Amendment to the Letter Agreement filed hereto as Exhibits 10.1 and 10.2, and incorporated herein by reference.

Item 2.03 Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

The information set forth in Item 1.01 of this Current Report is incorporated by reference into this Item 2.03.

Item 3.02 Unregistered Sales of Equity Securities.

The information set forth in Item 1.01 of this Current Report is incorporated by reference into this Item 3.02. The Pre-Closing Note issued on July 11, 2023, the remainder of the Pre-Closing Notes, and the shares of Common Stock issuable upon conversion of the Pre-Closing Notes, will not be registered under the Securities Act of 1933, as amended (the “Securities Act”), and will be issued in reliance on the exemption from registration provided by Section 4(a)(2) of the Securities Act.

Item 5.02 Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

Departure of Chief Executive Officer

On July 11, 2023 (the “Separation Date”), General Keith Alexander informed the Board of his intention to resign as the Company’s Chief Executive Officer (“CEO”), effective immediately pursuant to the Letter Agreement. General Alexander will continue to serve as a Director and Chairman of the Board following his resignation as Chief Executive Officer.

It is contemplated that the Company and General Alexander will enter into a Separation Agreement providing for certain severance benefits payable to Mr. Alexander, certain releases and certain other agreements, which remain subject to final negotiation and further authorization and approval by the Board.

Appointment of Chief Executive Officer and Director

On July 11, 2023, pursuant to the Letter Agreement, the Company appointed Linda Zecher Higgins as the Company’s CEO, effective as of the Separation Date. On the same day, the Board, upon recommendation of the Nominating and Governance Committee of the Board, appointed Ms. Zecher as a director of the Company to fill the vacancy on the board existing as of the Separation Date created by the departure of William E. Welch on September 30, 2022. Ms. Zecher was appointed as a Class III director, whose term is scheduled to expire at the annual meeting of stockholders to be held in 2024.

Ms. Zecher, 70, is the Chief Executive Officer and Managing Partner of the Barkley Group, a consulting firm focused on cybersecurity and digital transformation, and has served in this capacity since January 2017. Ms. Zecher also currently serves as Chairman of C5. Prior to that, Ms. Zecher served as the President and Chief Executive Officer, and a member of the Board of Directors, of Houghton Mifflin Harcourt Company, from 2011 to 2016. Prior to that, she was Corporate Vice President, Worldwide Public Sector of Microsoft Corporation from 2003 to 2011. Ms. Zecher has served on the board of directors of Hasbro, Inc. since 2014, Tenable Holdings Inc. since August 2019, and C5 Acquisition Corp since January 2022. Ms. Zecher received a B.S. in Earth Science from Ohio State University.

The Company believes that Ms. Zecher’s experience in leading the transformations of businesses in the digital space, her expertise and skill in driving technological innovation and her expertise in financial markets, financial investment, financial restructuring qualify Ms. Zecher to serve on the Board.

There is no arrangement or understanding between Ms. Zecher and any other persons or entities pursuant to which Ms. Zecher was appointed as a director other than the matters referred to in Item 1.01 of this Form 8-K. There have been no transactions, nor are there any currently proposed transactions, in which the Company was or is to be a participant and which Ms. Zecher, or any member of her immediate family, had, or will have, a direct or indirect material interest.

Appointment of President

On July 11, 2023 and pursuant to the Letter Agreement, the Company appointed Cameron Pforr, Chief Financial Officer, as the president of the Company. Mr. Pforr will continue to serve as the Company’s Chief Financial Officer.

Mr. Pforr, 58, has served as the Company’s Chief Financial Officer since September 2022. Previously, Mr. Pforr served as President of Fidelis Cybersecurity, a cybersecurity company, a position he held since March 2022 after having previously served as Fidelis’s Chief Financial Officer from April 2020 to March 2022. From 2016 to April 2020, Mr. Pforr served as Vice President of Strategy and Corporate Development at Jenzabar, a provider of information technology services and consulting for the higher education industry. He previously held senior management roles at Permabit Technology Corporation, a software company later acquired by Red Hat, Inc., and WhipTail Technologies, Inc., a data storage array company that was acquired by Cisco Systems. Earlier in his career, Mr. Pforr was an investment banker with Revolution Partners and Deutsche Bank Securities and a consultant with Bain and Company. Prior to his business career, Mr. Pforr served as a Foreign Service Officer for the U.S. Department of State and an analyst for the U.S. Department of Defense. Mr. Pforr received a B.S. in Computer Science from the College of William and Mary, an M.A. in International Studies from the University of Pennsylvania, and an M.B.A. from the University of Pennsylvania’s Wharton School.

There is no arrangement or understanding between Mr. Pforr and any other persons or entities pursuant to which Mr. Pforr was appointed as president other than the matters referred to in Item 1.01 of this Form 8-K. There have been no transactions, nor are there any currently proposed transactions, in which the Company was or is to be a participant and which Mr. Pforr, or any member of his immediate family, had, or will have, a direct or indirect material interest.

Item 8.01 Other Events

The Company will use the proceeds of the Pre-Closing Note issued on July 11, 2023 to satisfy certain of its current liabilities. However, even after the application of the proceeds, management anticipates that, in the absence of additional sources of liquidity, the Company’s existing cash and cash equivalents and anticipated cash flows from operations will not be sufficient to meet the Company’s operating and liquidity needs beyond the end of July 2023.

In the event further funding is not provided by the JV or that the Company determines that additional sources of liquidity will not be available to it or will not allow it to meet its obligations as they become due, the Company may need to file a voluntary petition for relief under the United States Bankruptcy Code in order to implement a plan of reorganization, court-supervised sale and/or liquidation. Furthermore, in the event the Company is unable to pursue bankruptcy protection under Chapter 11 of the United States Bankruptcy Code, it may be necessary to pursue bankruptcy protection under Chapter 7 of the United States Bankruptcy Code, in which case a Chapter 7 trustee would be appointed or elected to liquidate the Company’s assets for distribution in accordance with the priorities established by the United States Bankruptcy Code. The Company expects that liquidation under Chapter 7 would result in significantly smaller distributions being made to stakeholders than those it might obtain under Chapter 11 primarily because of the likelihood that the Company’s assets would have to be sold or otherwise disposed of by a Chapter 7 trustee in a distressed fashion over a short period of time rather than sold by existing management as a going concern business. In the event that the Company pursues bankruptcy protection under Chapter 7, the Company’s material business activities will cease, and the Company will no longer have the capability to prepare financial statements and other disclosures required for periodic reports for filing with the Securities and Exchange Commission. The Company expects that no distributions would be available for stockholders in a Chapter 7 liquidation.

On July 12, 2023, the Company issued a press release announcing its entry into the Letter Agreement and that it had received the initial Funding Tranche. A copy of that press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference.

Forward-Looking Statements

Certain statements in this Current Report on Form 8-K may be considered forward-looking statements, including statements with respect to the implementation of the Take-Private Transaction, the completion of the management changes contemplated by the Letter Agreement, further financing to be provided by the JV, the negotiation of definitive agreements with C5 and the JV relating to the foregoing and the Company’s expectations with respect to the sufficiency of the Company’s cash resources and the ability to secure additional sources of liquidity, including the issuance of additional Pre-Closing Notes to the JV, the Company’s ability to continue as a going concern and the potential need to pursue bankruptcy protection. Forward-looking statements generally relate to future events and can be identified by terminology such as “may,” “should,” “could,” “might,” “plan,” “possible,” “strive,” “budget,” “expect,” “intend,” “will,” “estimate,” “believe,” “predict,” “potential,” “pursue,” “aim,” “goal,” “mission,” “anticipate” or “continue,” or the negatives of these terms or variations of them or similar terminology. Such forward-looking statements are subject to risks, uncertainties, and other factors which could cause actual results to differ materially from

those expressed or implied by such forward-looking statements. These forward-looking statements are based upon estimates and assumptions that, while considered reasonable by the Company and its management, are inherently uncertain. Factors that may cause actual results to differ materially from current expectations include, but are not limited to, the Company’s ability to regain compliance with NYSE listing standards, the Company’s receipt of additional financing from the JV pursuant to the Letter Agreement, and risks and uncertainties set forth in the sections entitled “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements” in the Company’s Annual Report on Form 10-K for the fiscal year ended January 31, 2022, and other documents filed by the Company from time to time with the SEC. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and the Company assumes no obligation and does not intend to update or revise these forward-looking statements other than as required by applicable law.

|

|

Item 9.01 |

Financial Statements and Exhibits. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

IRONNET, INC. |

|

|

|

|

By: |

/s/ Cameron D. Pforr |

|

|

Date: July 12, 2023 Cameron D. Pforr

President & Chief Financial Officer |

Exhibit 10.1

CONFIDENTIAL

June 16, 2023

IronNet, Inc.

7900 Tyson One Place, Suite 400

McLean, VA 22102

Re: Agreement to Take-Private

Dear Ladies and Gentlemen:

This letter memorializes the agreement between C5 CC Ferrous, LLC (“JV”) and IronNet, Inc. (“IronNet” or the “Company”) (the JV and the Company each a “Party” and, together, the “Parties”), by which the Parties agree to the following (in each case in accordance with the terms hereof): (1) the JV shall provide funds necessary to cover the Company’s on-going operational shortfall from the Effective Date until the Recapitalization; (2) the Board shall appoint new management for the Company, in consultation with the JV; (3) the Parties shall take steps necessary to remove the Company from the public securities markets and take it private (the “take private” transaction); and (4) following the consummation of the take-private transaction (the “Closing”), the JV and its co-investors shall recapitalize the Company (the “Recapitalization”). The steps outlined herein are intended to be consistent with the JV’s June 12, 2023 presentation to the Board (the “Presentation”). In the event of any inconsistency between the Presentation and this Agreement, this Agreement shall control.

The Company is entering into this Agreement to facilitate the negotiation of definitive documentation pursuant to which the Recapitalization would be consummated (the “Definitive Agreements”) and conditional on the receipt of the Pre-Closing Funding Tranches (as defined below) at each Pre-Closing Milestone (as defined below), on the terms and subject to the conditions set forth herein.

Prior to the Closing, the JV will fund the on-going operational needs of the Company in tranches (each, a “Pre-Closing Funding Tranche”) upon the achievement of certain transactional and/or operational milestones (each, a “Pre-Closing Milestone”), in each case as set forth on Exhibit A hereto. Each Pre-Closing Funding Tranche shall be memorialized in the form of a senior, secured convertible promissory note that reflects the following terms and other reasonable and customary terms and conditions to be agreed by the Parties (each, a “Pre-Closing Note”):

a.The aggregate amount to be funded prior the Closing shall not exceed $15,480,000 (the “Pre-Closing Funding Amount”).

d.Convertible to Common Stock at holder’s election at a conversion rate equivalent to a 70% of the trading price of the stock on the date of the note’s execution.

e.Company will provide the JV with weekly reports on receivables, payables, and any other relevant information pertaining to the financial needs and operational requirements of the Company, which will form the basis for on-going funding.

f.Pro rata right, but not an obligation, to participate in subsequent securities issuances and financings, subject to customary exceptions and anti-dilution protections and customary transfer restrictions.

g.Senior to all existing indebtedness and secured by an all assets of the Company group (including intellectual property).

h.Current C5 and Directors’ notes to be treated with same conversion feature offered to the Pre-Closing Funding Tranche but will subordinate to Pre-Closing Notes.

2.Post-Closing Funding and Conversion.

Following the Closing and subject to Section 5, the JV will fund the on-going operational needs of the Company in tranches (each, a “Post-Closing Funding Tranche”) upon the achievement of certain milestones (each, a “Post-Closing Milestone”), in each case as set forth on Exhibit B hereto. Each Post-Closing Funding Tranche shall be pursuant to a convertible preferred security on the terms set forth in Exhibit C hereto and other reasonable and customary terms and conditions to be agreed by the Parties (the “Preferred Stock”). The Post-Closing Funding Amount shall not exceed $51 million (inclusive of the repayment of

the Pre-Closing Notes as contemplated by Section 5). Additionally, any Company indebtedness issued to the Board or to affiliates of C5 Capital (other than the Pre-Closing Notes, which shall be repaid at the Closing) shall be converted into Preferred Stock, except to the extent that proceeds are available to repay Pre-Closing financing. Notwithstanding anything to the contrary contained in this Agreement, to the extent any Preferred Stock has been issued to JV, JV’s rights in respect of such Preferred Stock shall apply in accordance with the terms thereof regardless of whether any additional Post-Closing Funding Tranches are funded.

a.The Board will promptly appoint Linda Zecher as Chief Executive Officer of the Company, following customary background checks, receipt of the first Pre-Closing Funding Tranche by the first Pre-Closing Milestone, and completion of customary documentation, and Cameron Pforr as President and Chief Financial Officer. The Company and Linda Zecher shall separately agree as to reasonable and customary terms regarding her employment (which shall be reasonably acceptable to the JV).

b.The Board will be reconstituted, post-close of the transaction to consist of seven (7) Directors, with at least three (3) nominated in consultation with the JV.

4.Take Private and Delisting1

The Board shall promptly take the following steps, as shall be further specified in the Definitive Agreements:

a.Finalize stockholder register analysis to identify most advantageous share split, in consultation with the JV.

b.The Company becomes current on all required SEC filings.

c.Board votes to approve a resolution to initiate the reverse stock split and executes such amendments to its by-laws and articles and notices to shareholders as may be necessary to effectuate the reverse stock split and amend its capital structure to issue Preferred Stock.

d.Following the above steps (1)-(3), and such other actions as may be necessary, the Company shall file a preliminary proxy statement and related filings with the SEC and shall work diligently to respond to any SEC comments.

e.Following receipt of all required approvals from shareholders, the Company shall implement the split and purchase fractional shares and establish the Preferred Stock; and

f.Following the purchase of fractional shares, the Company will terminate the public listing of its stock, terminate all existing registration statements, make all required filings at the SEC, and take all steps necessary to consummate the “take private” transaction.

1 Additional tasks are outlined in the Step Plan includedwith the Presentation. The Step Plan is intended for illustrative and planning purposes, and may not capture everything required to consummate the transactions contemplated by this Agreement.

The Board and the Company shall cooperate with the JV in all fundraising activities necessary for the JV to perform its obligations under this Agreement. The Board and the Company acknowledge and agree that following the Closing, any funds raised shall first be applied to repay the Pre-Closing Notes in full.

6.Representation, Warranties, Covenants and Agreements.

In executing this Agreement, the Board represents that it:

a.has determined that pursuit of the Proposed Transaction is in the best interests of the Company and its stockholders, in each case subject to review and approval of the Definitive Agreements.

b.has the authority to enter into this Agreement.

c.will take, and will instruct the Company to take, all steps necessary to implement the terms of this Agreement, in each case subject to review and approval of the Definitive Agreements.

d.shall, during the period from the date hereof until the earlier of the validtermination of this Agreement or consummation of the take private transaction, use commercially reasonable efforts to (x) conduct its business in the ordinary course of business, comply in all material respects with applicable Law and preserve intact its business organization, and preserve the goodwill and present and future relationships with customers, suppliers, Governmental Entities and other Persons with which it has business relations or regulator relations and (y) continue to accrue and collect accounts receivable, accrue and pay accounts payable and other expenses, establish reserves

for uncollectible accounts and manage inventory, in the case of each of the foregoing clauses (x) and (y), consistent with past practice.

e.Provide the JV sufficient advanced notice of its failure or inability to comply with the foregoing paragraph (d) to enable the JV to take ameliorative measures and protect its interests.

f.not enter into any financialarrangements inconsistent with this Agreement.

7.Certain Matters. The Company has previously provided to the JV certain projections as to the amount of funding required to fund the Company’s operations on a month-by-month basis until such time as the Company is cash flow positive on a standalone basis (the “Runway Projections”). The Board and the Company each represent that, to its knowledge (as applicable), the Runway Projection are the Company’s current projections of such items based on its good faith determinations. In connection with each Pre-Closing and Post-Closing Funding Tranche, the Board and the Company shall each represent that, to its knowledge (as applicable), the Runway Projection were, as the date hereof, the Company’s current projections of such items based on good faith determination. Additionally, the Board and the Company shall keep the JV apprised as promptly as practicable as to any material changes to the Runway Projections required to ensure that such Runway Projections remain true and correct.

8.Debt Restructuring. Promptly following the execution and delivery of this Agreement, the Parties shall undertake to restructure the Company’s existing indebtedness to 3i Tumin commencing discussions as soon as practicable.

9.Alternative Transactions. Beginning as of the date this Agreement is first executed by the Company and until such time C5 Capital informs the Company in writing that it is terminating discussions regarding the transactions contemplated by this Agreement (the “Expiration Date”), the Company shall not, directly or indirectly, through any of their respective directors, officers, affiliates, or financial, legal or other representatives:

a)solicit, or knowingly facilitate any inquiry, proposal or offer from any third party regarding: (i) any acquisition of the Company or any of its subsidiaries (collectively, “subsidiaries”); (ii) any share purchase, merger, consolidation, share exchange, debt or equity financing, business combination, refinancing, reorganization, recapitalization or other similar transaction with or involving (directly or indirectly) the Company or any of its subsidiaries; (iii) any direct or indirect sale, lease, exchange, transfer or other similar disposition of the assets or equity of the Company or any of its subsidiaries outside of the ordinary course of business of the Company and its subsidiaries or (iv) any other financing transaction with or involving the Company and its subsidiaries (each, an “Alternative Transaction”);

b)furnish or continue to make available any non-public information regarding the Company or any of its subsidiaries to any third party for the purpose of facilitating an Alternative Transaction;

c)participate in any discussions with any third party regarding an Alternative Transaction; or

d)enter into an agreement regarding an Alternative Transaction

In addition, until the Expiration Date, the Company shall promptly advise C5 Capital of any proposal, offer or indication of interest relating to an Alternative Transaction, or any inquiry or contact with any third party with respect thereto, and shall promptly inform C5 Capital of the material financial terms and conditions thereof.

Notwithstanding anything to the contrary in this Agreement, if in the course of discharging its fiduciary duties respecting superior offers, the Board determines on or before June 30, 2023 that the transactions contemplated by this Agreement are inferior to any other bona fide offer made to it and that, based on advice of legal counsel, the Company is duty- bound to accept such offer (a “Fiduciary Out”), the Company may terminate this Agreement upon making a payment to the JV in an amount equal to the sum of: (i) principal and accrued interest under the Pre-Closing Notes (in connection with which such Pre-Closing Notes shall be deemed repaid), (ii) $5,000,000 and (iii) the aggregate out-of-pocket costs and reasonable expenses of JV in connection with this Agreement and the transactions contemplated hereby, including, without limitation, reasonable fees and disbursements of accountants, attorneys, investment bankers, and consultants (collectively, “Termination Expenses”). Notwithstanding anything to the contrary set forth in this Agreement, in the event JV is required to file suit to seek all or a portion of the Termination Amount, JV shall be entitled, in addition to payment of the Termination Expenses, to payment by Company of all additional expenses, including reasonable attorneys’ fees and expenses, which it incurs in enforcing its rights hereunder. The return and cancellation of the Pre-Closing Notes and the payment of the Termination Expenses shall be in lieu of any other damage, remedy or claim by JV against the Company on account of the termination of this Agreement by the Company for a Fiduciary Out.

10.EFFECTIVENESS AND TERMINATION.

This Agreement shall be of no force and effect unless and until the Company shall have received the first Pre-Closing Funding Tranche by the first Pre-Closing Milestone, upon which occurrence this Agreement shall be deemed executed and delivered by each parties. This Agreement shall automatically terminate and be of no further force or effect (unless the parties otherwise agree in writing) at any point upon the first to occur of (x) the failure of any other Pre-Closing Funding Tranche to be received by the Company by the applicable Pre-Closing Milestone within 5 business days of the achievement thereof or (y) the Expiration Date.

The Parties hereto agree and acknowledge that if any of theprovisions of this Agreement were not performed in accordance with their specific terms or were otherwise breached, irreparable damage would occur, no adequate remedy at law would exist and damages would be difficult to determine, and accordingly, prior to any valid termination of this Agreement, each of the parties hereto shall be entitled to, and may seek in the alternative, such remedies as are available at law and in equity, and the parties shall be entitled to an injunction or injunctions to prevent breaches of this Agreement and to specific performance of the terms hereof, in any court of proper jurisdiction. The parties waive any requirement for the securing or posting of any bond in connection with the obtaining of any specific performance or injunctive relief and the parties will waive, in any action for specific performance, the defense of adequacy of a remedy at law.

EACH OF THE PARTIES HERETO IRREVOCABLY WAIVES ANY AND ALL RIGHT TO TRIAL BY JURY IN ANY LEGAL PROCEEDING ARISING OUT OF OR RELATING TO THIS AGREEMENT OR THE TRANSACTIONS CONTEMPLATED HEREBY (INCLUDING ANY DISPUTE ARISING OUT OF OR RELATING TO THE EQUITY FINANCING OR THE EQUITY COMMITMENT LETTER OR THE PERFORMANCE OF SERVICES THEREUNDER OR RELATED THERETO).

All notices and other communications hereunder shall be in writing and shall be deemed given: (a) upon personal delivery to the party to be notified; (b) when received when sent by email by the party to be notified; provided, that notice given by email shall not be effective unless either (i) a duplicate copy of such email notice is promptly given by one of the other methods described in this section or (ii) the receiving party delivers a written confirmation of receipt for such notice either by email or any other method described in this Section 13; or (c) when delivered by commercial delivery service; in each case to the party to be notified at the following address:

To JV:

C5 Capital USA LLC

1701 Pennsylvania Ave, NW Washington, D.C., 20006

Attention: Michael C. Sloan, GeneralCounsel

Email: mike.sloan@c5capital.com

Cohen Circle, LLC

3 Columbus Circle, 24th Floor New York, NY 10024

Attention: Mehar Jagota, General Counsel

Email: mehar@cohencircle.com

To the Company:

IronNet

7900 Tyson One Place, Suite 400

McLean, VA 22102

Attention: Cameron Pforr

Email: Cameron.pforr@ironnet.com

or to such other address as any party shall specify by written notice so given, and such notice shall be deemed to have been delivered as of the date so telecommunicated or personally delivered. Any party to this Agreement may notify any other party of any changes to the address or any of the other details specified in this section; provided, that such notification shall only be effective on the date specified in such notice or five (5) Business Days after the notice is given, whichever is later.

IN WITNESS WHEREOF, the parties hereto have caused this Agreementto be duly executed and delivered as of the last date written below (the “Effective Date”).

|

|

|

|

|

|

|

|

IronNet |

|

By: |

|

|

|

Name: Keith B. Alexander Title: Chief ExecutiveOfficer Date: June 16, 2023 |

|

|

|

|

|

For the JV |

|

|

C5 CC Ferrous, LLC |

|

By: |

/s/Paul Singer |

|

|

Name: Paul Singer Title: AuthorizedSignatory Date: June 13, 2023 |

Exhibit A

Pre-Closing Funding Tranches

|

|

|

Tranches (Expected Timing)2 |

Pre-Closing Milestone |

Amount Funded ($) |

Tranche 1 (June 16, 2023) |

•Restructuring of certain existing indebtedness •Appoint Management and JV Board Member |

$2.0 million |

Tranche 2 (June 26, 2023) |

•Updated Runway Projections •Finalize Stockholder Register Analysis (reference Section 4.a. above) •Weekly operational/financial report •Agreement as to Preferred Stock Terms (Ex. C) |

$1.5 million |

Tranche 3 (July 3, 2023) |

•Become Current on all SEC Filings •Board Vote on Resolution to Initiate Reverse Stock Split •File Preliminary Proxy Statement with SEC for Reverse Stock Split •Weekly operational/financial report |

$1 million |

Tranche 4 (July 10, 2023) |

•Updated Runway Projections •Weekly operational/financial report |

$3.66 million |

Tranche 5 (July 17, 2023) |

•Updated Runway Projections •Weekly operational/financial report |

$ 1 million |

|

|

|

Tranche 5 (July 24, 2023) |

•Updated Runway Projections •Weekly operational/financial report |

$ 1 million |

Tranche 6 (August 2, 2023) |

•Updated Runway Projections •Weekly operational/financial report |

$ 2.66 million |

Tranche 7 (August 28, 2023) |

•Updated Runway Projections •Weekly operational/financial report |

$2.66 million |

TOTAL: |

|

$15.480mm |

2 Such dates assume execution and delivery of this Agreement on June 16, 2023.

Exhibit B

Post-Closing Funding Tranches

Funding to be determined per the agreed Milestones in the table below based on actual cash requirements on a quarterly basis.

|

|

|

|

Post-Closing Milestone |

Amount Funded ($) |

Tranche 1 |

•Within 5% of quarterly sales target •Maintain customer retention above 65% •Updated Runway Projections |

TBD |

Tranche 2 |

•Within 5% of quarterly sales target •Maintain customer retention above 65% •Updated Runway Projections |

TBD |

Tranche 3 |

•Within 5% of quarterly sales target •Maintain customer retention above 65% •Updated Runway Projections |

TBD |

Tranche 4 |

•Within 5% of quarterly sales target •Maintain customer retention above 65% •Updated Runway Projections |

TBD |

|

|

|

Tranche 5 |

•Within 5% of quarterly sales target •Maintain customer retention above 65% •Updated Runway Projections |

TBD |

TOTAL: |

|

Not to exceed $38mm |

Exhibit C

Summary of Terms – Preferred Stock

SUBJECT TO REVIEW BY COMPANY COUNSEL UNTIL PRE-CLOSING TRANCHE 2 HAS BEEN FUNDED

|

|

Stock: |

JV will be issued newly created convertible preferred Stock (the “Preferred Stock”) that reflect the terms and conditions contained in this summary. |

Liquidation Preference, Dividends and Conversion; Warrants |

The Preferred Stock will have a senior liquidation preference relative to the Common Stock in connection with any liquidation, dissolution or winding up of the Company (or customary other deemed liquidation events), and in such circumstance will be entitled to receive an amount equal to the greater of (a) 2.0x the original purchase price for such Preferred Stock, accruing 12% dividend (the “Dividend Rate”), payable in cash or in kind at the Company’s election (such amount, the “Preference Amount”) or (b) the amount such holders would be entitled to receive on an as converted to Common Stock basis and all holders of Common Stock participated pro rata. The balance of any liquidation proceeds shall then be distributed to the holders of the existing Common Stock. |

|

The Preferred Stock will be convertible into Common Stock, initially on a one-for-one basis at any time at the option of JV. Each share of Preferred Stock will automatically convert into a share of Common Stock upon the closing of a Public Transaction or with the consent of the holders of a majority of the then outstanding Preferred Stock. A “Public Transaction” means any of (i) the Company or its successor’s initial public offering pursuant to a registration statement under the Securities Act of 1933, as amended (an “IPO”), (ii) a direct listing of any equity securities issued by the Company or a successor on a national securities exchange or (iii) any other transaction that results in any equity securities of the Company or a successor being traded on a national securities exchange (including a business combination with a special purpose acquisition company). |

|

The price per share of the Preferred Stock shall be equal to 70% of the VWAP of the Company’s common stock during the 30-day period immediately preceding the signing of this Agreement. |

|

JV will receive a warrant to purchase shares of Common Stock at a purchase price of $0.01 per share. The warrant shall entitle JV to purchase a number of shares equal to 12% of the outstanding common stock as of immediately following the Closing. The warrant shall have a term of ten years. |

|

|

JV Put Option: |

JV may require the Company to redeem the Preferred Stock (the “JV Put Option”) for the then applicable Preference Amount following the 2nd anniversary of the Closing in certain tranches, as follows: a.Starting in year 2, up to 25% can be redeemed b.Starting in year 3, up to 50% can be redeemed c.Starting in year 4, up to 75% can be redeemed |

|

|

|

d. Starting in year 5, up to 100% can be redeemed |

Voting Rights: Board of Directors |

The Preferred shall vote together with the Common Stock on an as-converted basis, and not as a separate class, except (i) so long as 50% of the shares of Preferred issued in the transaction are outstanding, the Preferred as a separate class shall be entitled to elect three (3) members of the Board of Directors (each a “Preferred Director”), (ii) as required by law, and (iii) as provided in “Protective Provisions” below. The Company’s Charter will provide that the number of authorized shares of Common Stock may be increased or decreased with the approval of a majority of the Preferred and Common Stock, voting together as a single class, and without a separate class vote by the Common Stock. As of immediately following the Closing, the Board of Directors shall be comprised of 7 members, inclusive of the Preferred Directors and the Chief Executive Officer of the Company. |

Protective Provisions: |

So long as 50% shares of Preferred issued in the transaction continue to be held by JV on an as-converted basis (the calculation of which shall exclude from both the numerator and denominator any shares redeemed pursuant to the put option described above), in addition to any other vote or approval required under the Company’s Charter or Bylaws, the Company will not, without the written consent of the Requisite Holders, either directly or by amendment, merger, consolidation, recapitalization, reclassification, or otherwise: (i) liquidate, dissolve or wind up the affairs of the Company or effect any Deemed Liquidation Event; (ii) amend, alter, or repeal any provision of the Charter or Bylaws; (iii) create or authorize the creation of or issue any other security convertible into or exercisable for any equity security; (iv) purchase or redeem or pay any dividend on any capital stock prior to the Preferred, other than stock repurchased at cost from former employees and consultants in connection with the cessation of their service; (v) adopt, amend, terminate or repeal any equity (or equity-linked) compensation plan or amend or waive any of the terms of any option or other grant pursuant to any such plan; (vi) create or authorize the creation of any debt security; or (vii) create or hold capital stock in any subsidiary that is not wholly-owned, or dispose of any subsidiary stock or all or substantially all of any subsidiary assets; or (viii) increase or decrease the authorized number of directors constituting the Board of Directors or change the number of votes entitled to be cast by any director or directors on any matter. |

|

|

Registration Rights: |

The Company will enter into a customary registration rights agreement by and between such JV and the Company (the “Registration Rights Agreement”). The Registration Rights Agreement will provide JV with two demand registrations and unlimited piggyback registration rights following the IPO until such time as JV is able to sell its equity interests in the Company without limitation during a three-month period without registration. |

Equity Incentive Plan: |

The Company will implement a new equity incentive program to provide for a pool not to exceed 15% of the Company’s outstanding common stock as of immediately following the Closing. |

|

|

Expenses: |

The fees and expenses of the Company and the JV arising from this Agreement will be paid from the investment proceeds. |

Anti-dilution Provisions: |

In the event that the Company issues additional securities at a purchase price less than the current Preferred conversion price, such conversion price shall be adjusted in accordance with a weighted average basis. |

Voting Agreement |

The Company shall work in good faith to cause certain key holders of Common Stock at JV’s direction to enter into a voting agreement pursuant to which such holders will transfer their voting rights in respect of such Common Stock to JV (or its designee) until a deemed liquidation event. |

Exhibit 10.2

Exhibit 10.2

AMENDMENT TO LETTER AGREEMENT

This Amendment (“Amendment”) to the Letter Agreement, dated June 16, 2023 (the “Letter Agreement”), by and between IRONNET, INC. (the “Company”) and C5 CC FERROUS, LLC (the “JV” and, together with the Company, each a “Party” and collectively, the “Parties”) is made and entered into as of July 11, 2023 (the “Amendment Date”) by and between the Parties. Capitalized terms used herein and not otherwise defined shall have the meaning set forth in the Letter Agreement.

WHEREAS, the Parties wish to amend Exhibit A to the Letter Agreement to reduce the initial Pre-Closing Funding Tranche to $1.75 million, and to increase the second Pre-Closing Funding Tranche to $1.75 million, and to thereby cause the Letter Agreement to be deemed executed and delivered by each Party pursuant to Section 10 thereof.

NOW, THEREFORE, in consideration of the mutual covenants contained herein, and for other good and valuable consideration, the receipt and sufficiency of which are acknowledged hereby, the Parties hereby further agree as follows:

1)Exhibit A of the Letter Agreement is hereby amended to read in its entirety as follows:

Exhibit A

Pre-Closing Funding Tranches

|

|

|

Tranches (Expected Timing) |

Pre-Closing Milestone |

Amount Funded ($) |

Tranche 1 (June 16, 2023) |

•Restructuring of certain existing indebtedness •Appoint Management and JV Board Member |

$1.75 million |

Tranche 2 (June 26, 2023) |

•Updated Runway Projections •Finalize Stockholder Register Analysis (reference Section 4.a. above) •Weekly operational/financial report •Agreement as to Preferred Stock Terms (Ex. C) |

$1.75 million |

Tranche 3 (July 3, 2023) |

•Become Current on all SEC Filings •Board Vote on Resolution to Initiate Reverse Stock Split •File Preliminary Proxy Statement with SEC for Reverse Stock Split •Weekly operational/financial report |

$1 million |

Tranche 4 (July 10, 2023) |

•Updated Runway Projections •Weekly operational/financial report |

$3.66 million |

Tranche 5 (July 17, 2023) |

•Updated Runway Projections •Weekly operational/financial report |

$ 1 million |

Tranche 5 (July 24, 2023) |

•Updated Runway Projections •Weekly operational/financial report |

$ 1 million |

Tranche 6 (August 2, 2023) |

•Updated Runway Projections •Weekly operational/financial report |

$ 2.66 million |

Tranche 7 (August 28, 2023) |

•Updated Runway Projections •Weekly operational/financial report |

$2.66 million |

TOTAL: |

|

$15.480mm |

2)Conflict of Terms. In the event the terms in this Amendment conflict with any term in the Agreement, the terms of this Amendment will govern.

3)Entire Agreement. The Parties agree that this Amendment constitutes the entire agreement between the Parties relating to its subject matter and supersedes all prior or simultaneous representations, discussions, negotiations, and agreements, whether oral or written; provided, however, that the Note(s), as modified by this Amendment, remain in full force and effect.

[Signature page follows.]

This Amendment is accepted and agreed as of the Amendment Date:

|

|

|

|

|

|

|

|

IRONNET,INC. |

|

By: |

/s/Cameron Pforr |

|

|

Name: Cameron Pforr Title: Chief Financial Officer |

|

|

|

|

|

|

|

|

C5 CC FERROUS, LLC |

|

By: |

/s/Paul Singer |

|

|

Name: Paul Singer Title: AuthorizedSignatory |

Exhibit 99.1

Linda Zecher appointed CEO of IronNet

Cameron Pforr, CFO of IronNet, appointed President

MCLEAN, VA (July 12, 2023) – IronNet’s Board of Directors has appointed Linda Zecher as Chief Executive Officer (CEO) effective immediately. Cameron Pforr, the company’s current Chief Financial Officer (CFO), has been appointed President of IronNet. GEN (Ret.) Keith Alexander will continue to serve as Chairman of the Board, transitioning to a non-executive role. John O’Hara has been appointed to Senior Vice President of Corporate Development and Partnerships reporting to the CEO. These changes are consistent with the Take Private Letter Agreement between IronNet, Inc. and a joint venture formed by C5 Capital and Cohen Circle, initially signed on June 16, 2023 and executed and delivered on July 11, 2023.

Linda brings significant experience shaping successful business transformations. She currently serves as Chairman of C5 Capital, Director of the Board of Hasbro and as a Board Member of Tenable, a cloud-based cybersecurity platform. Linda formerly served as President, CEO and Director of Houghton Mifflin Harcourt, a global education and learning company. Previously Linda was Corporate Vice President of Microsoft’s Worldwide Public Sector organization.

“I am thrilled to welcome Linda Zecher to the company, who assumes the role of CEO of IronNet. Linda is an exceptional leader with a background in cybersecurity and other industries who will help us drive IronNet’s Collective Defense Platform forward and allow us to continue to protect governments, sectors and companies against the cybercriminals and nation-state adversaries who are taking advantage of a legacy siloed approach to cyberdefense" said GEN (Ret.) Keith Alexander, Founder, Chairman and former CEO of IronNet.

Linda Zecher commented, “I look forward to collaborating with this talented team at IronNet to drive sustainable growth and value creation in the company, and to deliver for our customers.”

Cameron Pforr, in his role as President and CFO of IronNet, brings a wealth of financial and operational experience to the firm. He joined IronNet in August 2022 to assist with a strategic restructuring and strengthening of the capital structure of the company. Prior to IronNet, Cameron served as CFO and later as President of Fidelis Cybersecurity, a leading NDR provider to the federal and enterprise space. His prior work experience includes over ten years as a senior investment banker at Deutsche Bank Alex Brown, Revolution Partners, and Bain & Company where he was a founding member of the software practice.

John O’Hara, current Vice President of Corporate Development and Partnerships, will become Senior Vice President of Corporate Development and Partnerships and take on expanded responsibilities working closely with the engineering team to expand capabilities in support of our customer base.

The IronNet Collective Defense Platform has enabled the company to achieve a global footprint with a legacy of protecting critical infrastructure. The platform is built on IronNet’s IronDefense®, an advanced network detection and response (NDR) solution that uses artificial intelligence and machine learning to increase the visibility of the threat landscape while improving detection efficacy in a network environment through automated correlations-based detections.

IronDefense combines with IronNet’s IronDome®, the first automated cyber solution delivering anonymized threat intelligence collaboration at machine speed, to create the platform which serves as an early warning system for all participating companies, organizations, and governments to enable their SOC teams to be more efficient and effective with existing cyber defense tools and analyst capacity. In the past year, IronNet updated its platform to further improve alert fidelity and analyst workflow by enhancing embedded risk scoring for easier alert prioritization. These enhancements result in significantly reduced alert loads and false positives, as well as shortened mean time to investigation.

IronNet’s IronRadarSM, an easy-to-install solution for companies of all sizes that is designed to proactively and automatically update customer cybersecurity tools to detect and block adversary command and control (C2) infrastructure as it is being set up, was recently introduced. IronRadar integrates seamlessly with the IronNet Collective Defense Platform to create a suite of solutions that provide actionable, timely, and relevant cyber-attack intelligence earlier in an intrusion before a threat has a significant impact.

About IronNet, Inc.

Founded in 2014 by GEN (Ret.) Keith Alexander, IronNet, Inc. (NYSE: IRNT) is a global cybersecurity leader that is transforming how organizations secure their networks by delivering the first-ever collective defense platform operating at scale. Employing a number of former NSA cybersecurity operators with offensive and defensive cyber experience, IronNet integrates

deep tradecraft knowledge into its industry-leading products to solve the most challenging cyber problems facing the world today.

Forward-Looking Statements

This press release includes “forward-looking statements” within the meaning of the “safe harbor” provisions of the United States Private Securities Litigation Reform Act of 1995, including, without limitation, statements regarding IronNet’s ability to provide visibility and detection of malicious behaviors and to help defend against increased cyber threats facing the globe. When used in this press release, the words “estimates,” “projected,” “expects,” “anticipates,” “forecasts,” “plans,” “intends,” “believes,” “seeks,” “may,” “will,” “should,” “future,” “propose” and variations of these words or similar expressions (or the negative versions of such words or expressions) are intended to identify forward-looking statements. These forward-looking statements are not guarantees of future performance, conditions, or results, and involve a number of known and unknown risks, uncertainties, assumptions and other important factors, many of which are outside IronNet’s management’s control, that could cause actual results or outcomes to differ materially from those discussed in the forward-looking statements. Important factors, among others, that may affect actual results or outcomes include: IronNet’s ability to continue as a going concern; risks and uncertainties associated with a potential filing for relief under the United States Bankruptcy Code; IronNet’s inability to recognize the anticipated benefits of collaborations with IronNet’s partners and customers; IronNet’s ability to execute on its plans to develop and market new products and the timing of these development programs; the rate and degree of market acceptance of IronNet’s products; the success of other competing technologies that may become available; the performance of IronNet’s products; potential litigation involving IronNet; and general economic and market conditions impacting demand for IronNet’s products. The foregoing list of factors is not exhaustive. You should carefully consider the foregoing factors and the other risks and uncertainties described under the heading “Risk Factors” in IronNet’s Annual Report on Form 10-K for the year ended January 31, 2022, filed with the Securities and Exchange Commission (the “SEC”) on May 2, 2022, IronNet’s most recent Quarterly Report on Form 10-Q for the quarter ended October 31, 2022, filed with the SEC on May 2, 2023, and other documents that IronNet files with the SEC from time to time. These filings identify and address other important risks and uncertainties that could cause actual events and results to differ materially from those contained in the forward-looking statements. Forward-looking statements speak only as of the date they are made. Readers are cautioned not to put undue reliance on forward-looking statements, and IronNet does not undertake any obligation to update or revise any forward-looking statements, whether as a result of new information, future events or otherwise, except as required by law.

About C5 Capital

C5 Capital (C5) is a specialist venture capital firm that invests in cybersecurity, space and energy security. C5's investment strategy is focused on building long-term relationships with innovative and resilient founders that share in our mission to build a secure future. C5 Capital is headquartered in Washington, DC with offices in London, Luxembourg and Vienna. For more information, visit: www.c5capital.com.

About Cohen Circle

Cohen Circle is an investment firm founded by financial services pioneers, Betsy Cohen and her son Daniel Cohen. Since 2015, the firm has provided transformative capital to late stage fintech growth companies. Today, the firm makes investments across the capital structure in the fintech, technology, and impact spaces.

For more information visit www.cohencircle.com.

General information: info@cohencircle.com

IronNet Contacts:

Investor Contact: IR@ironnet.com

Media Contact: Media@ironnet.com

v3.23.2

Document and Entity Information

|

Jul. 11, 2023 |

| Document and Entity Information [Line Items] |

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0001777946

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 11, 2023

|

| Entity Registrant Name |

IronNet, Inc.

|

| Entity Incorporation State Country Code |

DE

|

| Entity File Number |

001-39125

|

| Entity Tax Identification Number |

83-4599446

|

| Entity Address, Address Line One |

7900 Tysons One Place

|

| Entity Address, Address Line Two |

Suite 400

|

| Entity Address, City or Town |

McLean

|

| Entity Address, State or Province |

VA

|

| Entity Address, Postal Zip Code |

22102

|

| City Area Code |

(443)

|

| Local Phone Number |

300-6761

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre Commencement Tender Offer |

false

|

| Pre Commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Common Stock Par Value 0.0001 Per Share 2 [Member] |

|

| Document and Entity Information [Line Items] |

|

| Security 12b Title |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

IRNT

|

| Security Exchange Name |

NYSE

|

| Redeemable Warrants Each Whole Warrant Exercisable For One Share Of Common Stock At An Exercise Price Of 11.50 Per Share 1 [Member] |

|

| Document and Entity Information [Line Items] |

|

| Security 12b Title |

Redeemable Warrants, each whole warrant exercisable for one share of Common Stock at an exercise price of $11.50 per share

|

| Trading Symbol |

IRNT.WS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=irnt_CommonStockParValue00001PerShare2Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=irnt_RedeemableWarrantsEachWholeWarrantExercisableForOneShareOfCommonStockAtAnExercisePriceOf1150PerShare1Member |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

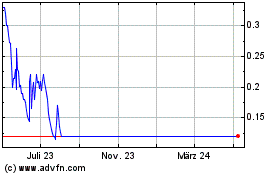

IronNet (NYSE:IRNT)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

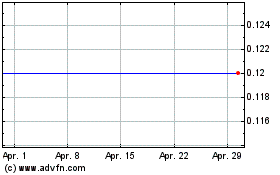

IronNet (NYSE:IRNT)

Historical Stock Chart

Von Dez 2023 bis Dez 2024