HP Earnings Fall Amid Weakness in Printers, PCs -- 3rd Update

25 Februar 2016 - 1:28AM

Dow Jones News

By Don Clark

HP Inc. met Wall Street's modest expectations in its first

quarter as an independent company, despite signs that weak

conditions in printing and personal computers aren't improving

quickly.

The Palo Alto, Calif., company said earnings from continuing

operations declined 16% in the first fiscal quarter ended in

January, while revenue fell 12% from the year-earlier period.

HP projected profit for the current quarter with a midpoint

slightly lower than analysts estimated, while reaffirming the

company's guidance for the full year.

"What I'm most pleased about is we delivered on our plan," Dion

Weisler, HP's chief executive, said in an interview.

HP's stock gained a penny in after-hours trading after rising 50

cents to $10.81 at 4 p.m. in New York trading. It released results

after 4 p.m. The company is composed of a set of former businesses

of Hewlett-Packard Co., which broke up in early November into two

publicly held companies.

Mr. Weisler has cautioned that printers and PCs face a series of

headwinds that won't go away soon. In printing, which accounts for

about 80% of the company's profits, sales of both hardware and ink

have been hurt by changing habits of computer users and

competition--particularly rivals in Japan whose products have

gained a pricing edge on currency shifts.

In the first quarter, HP said total printing revenue declined

17%. Its revenue from ink and other supplies was down 14% and

hardware unit sales were off 20%.

In PCs, HP and rivals continue to suffer from a gradual slide in

demand since spending began shifting to smartphones and tablets

several years ago. The company, the No. 2 player in the market

behind Lenovo Group Ltd., said its PC revenue declined 13% in the

quarter.

HP said the strong U.S. dollar was a big factor in its results.

On a constant currency basis, the company said total revenue was

off only 5%.

Mr. Weisler joined HP in 2012 after stints at rivals Lenovo and

Acer Inc. He said HP has gained market share in PCs used by

companies, while walking away from "low-calorie" sales deals that

don't generate much profit because of low pricing.

More broadly, he argues HP can return to growth with the aid of

innovative products. One attempt emerged this week when the company

introduced its Elite X3, a big-screen smartphone that can be

plugged into a cradle and connected to a keyboard and display to

act like a PC.

"You can't cut your way to glory," Mr. Weisler said. "You have

to innovate."

Other new initiatives include a move into 3-D printing and

machines used to print large signs for advertising, Mr. Weisler

said. He predicted that HP's business in ink and other printing

supplies should stabilize by the end of 2017.

Reaching that goal will be a key factor shaping HP's prospects,

said Toni Sacconaghi, an analyst at Sanford C. Bernstein. Another

important factor, he said, will be whether the company can resume

generating cash at the rate investors expected, after a slight

slowdown in the first period.

Many investors are looking at the company for its ability to

keep churning out dividends more than growth. "That's where we are

still kind of hanging our hats," said Daniel Morgan, a senior

portfolio manager at Synovus Trust Co., which holds HP shares.

HP's first-quarter net income reflects the divestiture of the

business-oriented operations that now constitute Hewlett Packard

Enterprise Co., a separate publicly held company. Profit on that

basis for the period ended Jan. 31 came to $592 million, or 33

cents a share, down sharply from the year-earlier figure of $1.37

billion, or 73 cents a share.

Revenue declined to $12.25 billion from $13.86 billion. The

company hadn't previously provided figures for the year-earlier

period.

For continuing operations, HP said earnings on an adjusted basis

that excludes restructuring charges came to 36 cents a share,

compared with 41 cents for the same quarter a year ago. Analysts on

that basis had expected earnings of 36 cents per share on revenue

of $12.2 billion, according to Thomson Reuters.

For the second fiscal quarter ending in April, HP estimated

adjusted per-share earnings of between 35 cents and 40 cents a

share. Average analysts estimates were 39 cents per share. The

company didn't project revenue.

HP Enterprise, the second public company formed by the breakup

of the former Hewlett-Packard, is due to report its first quarterly

results on March 3.

Write to Don Clark at don.clark@wsj.com

(END) Dow Jones Newswires

February 24, 2016 19:13 ET (00:13 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

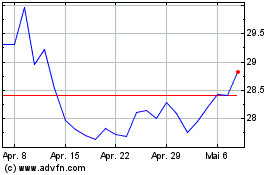

HP (NYSE:HPQ)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

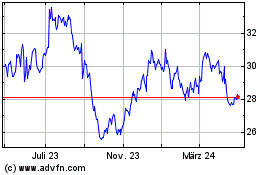

HP (NYSE:HPQ)

Historical Stock Chart

Von Jul 2023 bis Jul 2024