false

0000042682

0000042682

2024-10-24

2024-10-24

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 OR 15(d) of The Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): October 24, 2024

THE GORMAN-RUPP COMPANY

(Exact name of registrant as specified in its charter)

| |

|

|

|

|

|

Ohio

|

|

1-6747

|

|

34-0253990

|

|

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number)

|

|

(IRS Employer Identification No.)

|

| |

|

|

|

600 South Airport Road, Mansfield, Ohio

|

|

44903

|

|

(Address of principal executive offices)

|

|

(Zip Code)

|

Registrant’s telephone number, including area code: (419) 755-1011

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

☐

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

|

|

☐

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

☐

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

☐

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

Securities registered pursuant to Section 12(b) of the Act:

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Shares, without par value

|

GRC

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02 RESULTS OF OPERATIONS AND FINANCIAL CONDITION

On October 25, 2024, The Gorman-Rupp Company (the “Company”) issued a news release announcing its financial results for the third quarter ended September 30, 2024. The news release is included as Exhibit 99 and is being furnished, not filed, with this Current Report on Form 8-K.

Item 5.02 DEPARTURE OF DIRECTORS OR CERTAIN OFFICERS; ELECTION OF DIRECTORS; APPOINTMENT OF CERTAIN OFFICERS; COMPENSATORY ARRANGEMENTS OF CERTAIN OFFICERS

On October 24, 2024, Jeffrey S. Gorman notified the Board of Directors of the Company that, effective January 3, 2025, he will transition from Executive Chairman of the Board to Chairman of the Board. In his non-executive role as Chairman of the Board, Mr. Gorman will continue to provide valuable insights and governance oversight while working closely with the Board of Directors and the Company’s executive team in supporting the Company’s long-term strategic objectives.

Item 9.01 FINANCIAL STATEMENTS AND EXHIBITS

(d) Exhibits

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

THE GORMAN-RUPP COMPANY

|

|

|

|

By:

|

/s/ Brigette A. Burnell

|

|

|

|

Brigette A. Burnell

|

|

|

|

Executive Vice President, General Counsel and Corporate Secretary

|

|

October 25, 2024

Exhibit 99

GORMAN-RUPP REPORTS THIRD QUARTER 2024 FINANCIAL RESULTS

Mansfield, Ohio – October 25, 2024 – The Gorman-Rupp Company (NYSE: GRC) reports financial results for the third quarter ended September 30, 2024.

Third Quarter 2024 Highlights

| |

●

|

Net sales of $168.2 million increased 0.4%, or $0.7 million, compared to the third quarter of 2023

|

| |

●

|

Third quarter net income was $12.9 million, or $0.49 per share, compared to net income of $9.0 million, or $0.34 per share, for the third quarter of 2023

|

| |

●

|

Gross margin improved 260 basis points

|

| |

●

|

Interest expense decreased $2.7 million or 25.9% primarily due to debt refinanced in the second quarter of 2024

|

| |

●

|

Adjusted EBITDA1 of $32.0 million for the third quarter of 2024 increased $1.5 million, or 5.1%, from $30.5 million for the same period in 2023

|

| |

●

|

Jeffrey S. Gorman will transition from Executive Chairman to Chairman of the Board effective January 3, 2025

|

Net sales for the third quarter of 2024 were $168.2 million compared to net sales of $167.5 million for the third quarter of 2023, an increase of 0.4% or $0.7 million. The increase in sales was due to the impact of pricing increases taken in the first quarter of 2024 partially offset by a decrease in volume.

Sales increased $5.4 million in the municipal market due to domestic flood control and wastewater projects related to increased infrastructure investment, $2.3 million in the repair market also related to domestic flood control and wastewater projects, $1.8 million in the OEM market primarily related to computer cooling, and $1.2 million in the petroleum market primarily driven by increased international refueling applications. These increases were offset by a sales decrease of $4.4 million in the fire suppression market primarily resulting from backlog returning to more normal levels. Fire suppression sales in 2023 were up significantly compared to 2022 as the Company was working to return backlog and lead times to normal levels, which resulted in higher 2023 sales and a tougher year-over-year comparison for 2024. Sales for the third quarter of 2024 also decreased $3.8 million in the industrial market and $1.1 million in the construction market due to slower construction activity and $0.7 million in the agriculture market primarily driven by a significant decline in farm income.

Gross profit was $52.7 million for the third quarter of 2024, resulting in gross margin of 31.3%, compared to gross profit of $48.1 million and gross margin of 28.7% for the same period in 2023. The 260 basis point increase in gross margin included a 240 basis point improvement in cost of material, which consisted of a reduction in LIFO2 expense of 40 basis points and a 200 basis point improvement from the realization of selling price increases. The increase in gross margin also included a 20 basis point improvement on labor and overhead leverage.

Selling, general and administrative (“SG&A”) expenses were $25.7 million and 15.3% of net sales for the third quarter of 2024 compared to $23.2 million and 13.9% of net sales for the same period in 2023. SG&A expenses increased due to payroll and payroll related costs, including healthcare costs, as well as increased selling activity.

Operating income was $23.9 million for the third quarter of 2024, resulting in an operating margin of 14.2%, compared to operating income of $21.9 million and operating margin of 13.1% for the same period in 2023. Operating margin in the third quarter of 2024 increased 110 basis points compared to the same period in 2023 primarily due to improved cost of material, partially offset by increased SG&A expenses.

Interest expense was $7.8 million for the third quarter of 2024 compared to $10.5 million for the same period in 2023. The decrease in interest expense was due primarily to a series of refinancing transactions the Company completed on May 31, 2024.

Net income was $12.9 million, or $0.49 per share, for the third quarter of 2024 compared to net income of $9.0 million, or $0.34 per share, in the third quarter of 2023.

Adjusted EBITDA1 was $32.0 million and 19.0 % of sales for the third quarter of 2024 compared to $30.5 million and 18.2% of sales for the third quarter of 2023.

Year to date 2024 Highlights

| |

●

|

Net sales of $496.9 million decreased 0.4%, or $2.0 million, compared to 2023

|

| |

●

|

Net income was $29.1 million, or $1.11 per share, compared to net income of $26.0 million, or $0.99 per share, in 2023

|

| |

o

|

Adjusted earnings per share1 for 2024 and 2023 were $1.33 and $1.02, respectively

|

| |

●

|

Adjusted EBITDA1 of $95.6 million for 2024 increased $3.0 million, or 3.3%, from $92.6 million in 2023

|

| |

●

|

Total debt, net of cash, decreased $37.6 million further improving leverage

|

Net sales for the first nine months of 2024 were $496.9 million compared to net sales of $498.9 million for the first nine months of 2023, a decrease of 0.4% or $2.0 million. The decrease in sales was due to a decrease in volume partially offset by the impact of pricing increases taken in the first quarter of 2024.

Sales increased $14.8 million in the municipal market due to domestic flood control and wastewater projects related to increased infrastructure investment, $3.5 million in the repair market also related to domestic flood control and wastewater projects, $3.2 million in the OEM market primarily related to computer cooling, and $1.9 million in the petroleum market primarily driven by increased international refueling applications. Offsetting these increases was a decrease of $16.5 million in the fire suppression market primarily resulting from backlog returning to more normal levels. Fire suppression sales in 2023 were up significantly compared to 2022 as the Company was working to return backlog and lead times to normal levels, which resulted in higher 2023 sales and a tougher year-over-year comparison for 2024. Fire suppression incoming orders for the first nine months of 2024 were up 3.5% when compared to the first nine months of 2023. Sales for the first nine months of 2024 also decreased $4.8 million in the industrial market, and $1.1 million in the construction market due to slower construction activity, and $3.0 million in the agriculture market primarily driven by significant declines in farm income.

Gross profit was $155.1 million for the first nine months of 2024, resulting in gross margin of 31.2%, compared to gross profit of $145.3 million and gross margin of 29.1% for the same period in 2023. The 210 basis point increase in gross margin included a 250 basis point improvement in cost of material, which consisted of a reduction in LIFO2 expense of 60 basis points, a favorable impact of 20 basis points related to the amortization of acquired Fill-Rite customer backlog which occurred in 2023 and did not reoccur in 2024, and a 170 basis point improvement from the realization of selling price increases. These improvements were partially offset by a 40 basis point increase in labor and overhead expenses as a percent of sales.

SG&A expenses were $75.5 million and 15.2% of net sales for the first nine months of 2024 compared to $70.7 million and 14.2% of net sales for the same period in 2023. SG&A expenses for the first nine months of 2024 included $1.3 million of refinancing transaction costs and a $1.1 million gain on the sale of a fixed asset. SG&A expenses increased due to payroll and payroll related costs, including healthcare costs, as well as increased selling activity.

Operating income was $70.4 million for the first nine months of 2024, resulting in an operating margin of 14.2%, compared to operating income of $65.3 million and operating margin of 13.1% for the same period in 2023. Operating margin in the first nine months of 2024 increased 110 basis points compared to the same period in 2023 primarily due to improved cost of material, partially offset by increased labor, overhead, and SG&A expenses.

Interest expense was $26.9 million for the first nine months of 2024 compared to $31.1 million for the same period in 2023. The decrease in interest expense was due primarily to a series of debt refinancing transactions the Company completed on May 31, 2024. In addition to reducing interest expense, the refinancing also extended and staggered the Company’s debt maturities. The Company upsized, amended, and extended the existing Senior Term Loan Facility from $350.0 million to $370.0 million, amended and extended the existing $100.0 million revolving Credit Facility, and issued $30.0 million in new 6.40% Senior Secured Notes. The proceeds from these transactions, as well as $10.0 million of cash on hand, were used to retire the Company’s $90.0 million unsecured Subordinated Credit Facility.

Other income (expense), net was $6.7 million of expense for the first nine months of 2024 compared to $1.4 million of expense for the same period in 2023. Other expense for the first nine months of 2024 included a $4.4 million write-off of unamortized previously deferred debt financing fees and a $1.8 million prepayment fee related to the early retirement of the unsecured Subordinated Credit Facility.

Net income was $29.1 million, or $1.11 per share, for the first nine months of 2024 compared to net income of $26.0 million, or $0.99 per share, for the first nine months of 2023. Adjusted earnings per share1 for the first nine months of 2024 were $1.33 per share compared to $1.02 per share for the first nine months of 2023.

Adjusted EBITDA1 was $95.6 million and 19.2% of net sales for the first nine months of 2024 compared to $92.6 million and 18.6% of net sales for the first nine months of 2023.

The Company’s backlog of orders was $207.8 million at September 30, 2024 compared to $237.5 million at September 30, 2023 and $218.1 million at December 31, 2023. Incoming orders for the first nine months of 2024 were $496.1 million, or an increase of 4.1%, compared to the same period in 2023.

Net cash provided by operating activities for the first nine months of 2024 was $60.6 million compared to $71.7 million for the same period in 2023 with the decrease driven by working capital needs. Capital expenditures for the first nine months of 2024 were $10.3 million and consisted primarily of machinery and equipment. Capital expenditures for the full-year 2024 are presently planned to be approximately $18 - $20 million. Total debt, net of cash, decreased $37.6 million during the first nine months of 2024.

Scott A. King, President and CEO commented, “We continued to achieve gross margin and earnings improvement despite a nominal increase in sales compared to last year. In addition to the improvement in gross margin, interest expense in the third quarter decreased significantly from last year due to the refinancing transactions we completed during the second quarter. As a result of these improvements, we saw a 44% increase in earnings over last year. Our operating results allowed us to improve our debt, net of cash, by $20 million during the quarter, further improving leverage. Our year-to-date incoming orders are exceeding last year’s pace and are up just over 4%. As expected, we reduced our backlog during the quarter, however our backlog still remains at healthy levels as we head into the fourth quarter.”

Jeffrey S. Gorman transition to Chairman of the Board

Effective January 3, 2025, his 47th anniversary of working for Gorman-Rupp, Jeffrey S. Gorman, age 72, will transition from Executive Chairman of the Board to Chairman of the Board. In his new role as Chairman of the Board, Mr. Gorman will continue to provide valuable insights and governance oversight while working closely with the Board of Directors and the executive team in supporting the Company’s long-term strategic objectives.

About The Gorman-Rupp Company

Founded in 1933, The Gorman-Rupp Company is a leading designer, manufacturer and international marketer of pumps and pump systems for use in diverse water, wastewater, construction, dewatering, industrial, petroleum, original equipment, agriculture, fire suppression, heating, ventilating and air conditioning (HVAC), military and other liquid-handling applications.

(1) Non-GAAP Information

This release includes certain non-GAAP financial data and measures such as adjusted earnings, adjusted earnings per share, and adjusted earnings before interest, taxes, depreciation and amortization (“Adjusted EBITDA”). Adjusted earnings is earnings excluding amortization of customer backlog, write-off of unamortized previously deferred debt financing fees, and refinancing costs. Adjusted earnings per share is earnings per share excluding amortization of customer backlog per share, write-off of unamortized previously deferred debt financing fees per share, and refinancing costs per share. Adjusted earnings before interest, taxes, depreciation and amortization is net income (loss) excluding interest, taxes, depreciation and amortization, adjusted to exclude amortization of customer backlog, write-off of unamortized previously deferred debt financing fees, refinancing costs, and non-cash LIFO2 expense. Management utilizes these adjusted financial data and measures to assess comparative operations against those of prior periods without the distortion of non-comparable factors. The inclusion of these adjusted measures should not be construed as an indication that the Company’s future results will be unaffected by unusual or infrequent items or that the items for which the Company has made adjustments are unusual or infrequent or will not recur. Further, the impact of the LIFO2 inventory costing method can cause results to vary substantially from company to company depending upon whether they elect to utilize LIFO2 and depending upon which method they may elect. The Gorman-Rupp Company believes that these non-GAAP financial data and measures also will be useful to investors in assessing the strength of the Company’s underlying operations and liquidity from period to period. These non-GAAP financial measures are not intended to replace GAAP financial measures, and they are not necessarily standardized or comparable to similarly titled measures used by other companies. Provided later in this release is a reconciliation of adjusted earnings, adjusted earnings per share, and adjusted EBITDA to their respective corresponding GAAP financial measures, which includes descriptions of actual adjustments made in the current period and the corresponding prior period.

(2) LIFO Inventory Method

The majority of the Company’s inventories are valued on the last-in, first-out (LIFO) method and stated at the lower of cost or market. Current cost approximates replacement cost, or market, and LIFO cost is determined at the end of each fiscal year based on inventory levels on-hand at current replacement cost and a LIFO reserve. The Company uses the simplified LIFO method, under which the LIFO reserve is determined utilizing the inflation factor specified in the Producer Price Index for Machinery and Equipment – Pumps, Compressors and Equipment, as published by the U.S. Bureau of Labor Statistics. Interim LIFO calculations are based on management’s estimate of the expected year-end inflation index and, as such, are subject to adjustment each quarter. When inflation increases, the LIFO reserve and non-cash expense increase.

Forward-Looking Statements

In connection with the “safe harbor” provisions of the Private Securities Litigation Reform Act of 1995, The Gorman-Rupp Company provides the following cautionary statement: This news release contains various forward-looking statements based on assumptions concerning The Gorman-Rupp Company’s operations, future results and prospects. These forward-looking statements are based on current expectations about important economic, political, and technological factors, among others, and are subject to risks and uncertainties, which could cause the actual results or events to differ materially from those set forth in or implied by the forward-looking statements and related assumptions. Such uncertainties include, but are not limited to, our estimates of future earnings and cash flows, general economic conditions and supply chain conditions and any related impact on costs and availability of materials, integration of the Fill-Rite business in a timely and cost effective manner, retention of supplier and customer relationships and key employees, the ability to achieve synergies and cost savings in the amounts and within the time frames currently anticipated and the ability to service and repay indebtedness incurred in connection with the transaction. Other factors include, but are not limited to: company specific risk factors including (1) loss of key personnel; (2) intellectual property security; (3) acquisition performance and integration; (4) the Company’s indebtedness and how it may impact the Company’s financial condition and the way it operates its business; (5) general risks associated with acquisitions; (6) the anticipated benefits from the Fill-Rite transaction may not be realized; (7) impairment in the value of intangible assets, including goodwill; (8) defined benefit pension plan settlement expense; (9) risk of reserve and expense increases resulting from the LIFO2 inventory method; and (10) family ownership of common equity; and general risk factors including (11) continuation of the current and projected future business environment; (12) highly competitive markets; (13) availability and costs of raw materials and labor; (14) cybersecurity threats; (15) compliance with, and costs related to, a variety of import and export laws and regulations; (16) environmental compliance costs and liabilities; (17) exposure to fluctuations in foreign currency exchange rates; (18) conditions in foreign countries in which The Gorman-Rupp Company conducts business; (19) changes in our tax rates and exposure to additional income tax liabilities; and (20) risks described from time to time in our reports filed with the Securities and Exchange Commission. Except to the extent required by law, we do not undertake and specifically decline any obligation to review or update any forward-looking statements or to publicly announce the results of any revisions to any of such statements to reflect future events or developments or otherwise.

Brigette A. Burnell

Corporate Secretary

The Gorman-Rupp Company

Telephone (419) 755-1246

NYSE: GRC

For additional information, contact James C. Kerr, Chief Financial Officer, Telephone (419) 755-1548.

The Gorman-Rupp Company

Condensed Consolidated Statements of Income (Unaudited)

(thousands of dollars, except per share data)

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Net sales

|

|

$ |

168,182 |

|

|

$ |

167,456 |

|

|

$ |

496,963 |

|

|

$ |

498,946 |

|

|

Cost of products sold

|

|

|

115,521 |

|

|

|

119,322 |

|

|

|

341,828 |

|

|

|

353,631 |

|

|

Gross profit

|

|

|

52,661 |

|

|

|

48,134 |

|

|

|

155,135 |

|

|

|

145,315 |

|

|

Selling, general and administrative expenses

|

|

|

25,675 |

|

|

|

23,233 |

|

|

|

75,494 |

|

|

|

70,664 |

|

|

Amortization expense

|

|

|

3,101 |

|

|

|

3,026 |

|

|

|

9,278 |

|

|

|

9,398 |

|

|

Operating income

|

|

|

23,885 |

|

|

|

21,875 |

|

|

|

70,363 |

|

|

|

65,253 |

|

|

Interest expense

|

|

|

(7,766 |

) |

|

|

(10,475 |

) |

|

|

(26,886 |

) |

|

|

(31,147 |

) |

|

Other income (expense), net

|

|

|

(59 |

) |

|

|

(416 |

) |

|

|

(6,662 |

) |

|

|

(1,385 |

) |

|

Income before income taxes

|

|

|

16,060 |

|

|

|

10,984 |

|

|

|

36,815 |

|

|

|

32,721 |

|

|

Provision for income taxes

|

|

|

3,141 |

|

|

|

2,006 |

|

|

|

7,677 |

|

|

|

6,746 |

|

|

Net income

|

|

$ |

12,919 |

|

|

$ |

8,978 |

|

|

$ |

29,138 |

|

|

$ |

25,975 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Earnings per share

|

|

$ |

0.49 |

|

|

$ |

0.34 |

|

|

$ |

1.11 |

|

|

$ |

0.99 |

|

The Gorman-Rupp Company

Condensed Consolidated Balance Sheets (Unaudited)

(thousands of dollars, except share data)

| |

|

September 30,

|

|

|

December 31,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Assets

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Cash and cash equivalents

|

|

$ |

39,701 |

|

|

$ |

30,518 |

|

|

Accounts receivable, net

|

|

|

88,350 |

|

|

|

89,625 |

|

|

Inventories, net

|

|

|

101,781 |

|

|

|

104,156 |

|

|

Prepaid and other

|

|

|

10,806 |

|

|

|

11,812 |

|

|

Total current assets

|

|

|

240,638 |

|

|

|

236,111 |

|

|

Property, plant and equipment, net

|

|

|

133,619 |

|

|

|

134,872 |

|

|

Other assets

|

|

|

23,871 |

|

|

|

24,841 |

|

|

Goodwill and other intangible assets, net

|

|

|

485,346 |

|

|

|

494,534 |

|

|

Total assets

|

|

$ |

883,474 |

|

|

$ |

890,358 |

|

| |

|

|

|

|

|

|

|

|

|

Liabilities and shareholders' equity

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

Accounts payable

|

|

$ |

26,242 |

|

|

$ |

23,277 |

|

|

Current portion of long-term debt

|

|

|

18,500 |

|

|

|

21,875 |

|

|

Accrued liabilities and expenses

|

|

|

55,773 |

|

|

|

55,524 |

|

|

Total current liabilities

|

|

|

100,515 |

|

|

|

100,676 |

|

|

Pension benefits

|

|

|

7,754 |

|

|

|

11,500 |

|

|

Postretirement benefits

|

|

|

22,717 |

|

|

|

22,786 |

|

|

Long-term debt, net of current portion

|

|

|

362,489 |

|

|

|

382,579 |

|

|

Other long-term liabilities

|

|

|

22,665 |

|

|

|

23,358 |

|

|

Total liabilities

|

|

|

516,140 |

|

|

|

540,899 |

|

|

Shareholders' equity

|

|

|

367,334 |

|

|

|

349,459 |

|

|

Total liabilities and shareholders' equity

|

|

$ |

883,474 |

|

|

$ |

890,358 |

|

| |

|

|

|

|

|

|

|

|

|

Shares outstanding

|

|

|

26,227,540 |

|

|

|

26,193,998 |

|

The Gorman-Rupp Company

Condensed Consolidated Statements of Cash Flows (Unaudited)

(thousands of dollars, except share data)

| |

|

Nine Months Ended September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

Cash flows from operating activities:

|

|

|

|

|

|

|

|

|

|

Net income

|

|

$ |

29,138 |

|

|

$ |

25,975 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities:

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization

|

|

|

20,973 |

|

|

|

21,196 |

|

|

LIFO expense

|

|

|

3,445 |

|

|

|

6,414 |

|

|

Pension expense

|

|

|

1,989 |

|

|

|

2,426 |

|

|

Stock based compensation

|

|

|

3,025 |

|

|

|

2,335 |

|

|

Contributions to pension plans

|

|

|

(4,510 |

) |

|

|

(2,250 |

) |

|

Amortization of debt issuance fees

|

|

|

6,110 |

|

|

|

2,247 |

|

|

Gain on sale of property, plant, and equipment

|

|

|

(1,021 |

) |

|

|

- |

|

|

Other

|

|

|

296 |

|

|

|

1,282 |

|

|

Changes in operating assets and liabilities:

|

|

|

|

|

|

|

|

|

|

Accounts receivable, net

|

|

|

1,426 |

|

|

|

(6,515 |

) |

|

Inventories, net

|

|

|

(921 |

) |

|

|

656 |

|

|

Accounts payable

|

|

|

2,885 |

|

|

|

230 |

|

|

Commissions payable

|

|

|

(3,875 |

) |

|

|

(531 |

) |

|

Deferred revenue and customer deposits

|

|

|

(2,833 |

) |

|

|

2,053 |

|

|

Income taxes

|

|

|

670 |

|

|

|

2,186 |

|

|

Accrued expenses and other

|

|

|

(1,894 |

) |

|

|

5,499 |

|

|

Benefit obligations

|

|

|

5,671 |

|

|

|

8,456 |

|

|

Net cash provided by operating activities

|

|

|

60,574 |

|

|

|

71,659 |

|

|

Cash flows from investing activities:

|

|

|

|

|

|

|

|

|

|

Capital additions

|

|

|

(10,309 |

) |

|

|

(16,917 |

) |

|

Proceeds from sale of property, plant, and equipment

|

|

|

2,278 |

|

|

|

- |

|

|

Other

|

|

|

- |

|

|

|

608 |

|

|

Net cash used for investing activities

|

|

|

(8,031 |

) |

|

|

(16,309 |

) |

|

Cash flows from financing activities:

|

|

|

|

|

|

|

|

|

|

Cash dividends

|

|

|

(14,157 |

) |

|

|

(13,732 |

) |

|

Treasury share repurchases

|

|

|

(267 |

) |

|

|

(1,028 |

) |

|

Proceeds from bank borrowings

|

|

|

400,000 |

|

|

|

5,000 |

|

|

Payments to banks for borrowings

|

|

|

(428,375 |

) |

|

|

(33,125 |

) |

|

Debt issuance fees

|

|

|

(746 |

) |

|

|

- |

|

|

Other

|

|

|

(86 |

) |

|

|

(519 |

) |

|

Net cash used for financing activities

|

|

|

(43,631 |

) |

|

|

(43,404 |

) |

|

Effect of exchange rate changes on cash

|

|

|

271 |

|

|

|

(540 |

) |

|

Net increase in cash and cash equivalents

|

|

|

9,183 |

|

|

|

11,406 |

|

|

Cash and cash equivalents:

|

|

|

|

|

|

|

|

|

|

Beginning of period

|

|

|

30,518 |

|

|

|

6,783 |

|

|

End of period

|

|

$ |

39,701 |

|

|

$ |

18,189 |

|

The Gorman-Rupp Company

Non-GAAP Financial Information

(thousands of dollars, except per share data)

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Adjusted earnings:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reported net income – GAAP basis

|

|

$ |

12,919 |

|

|

$ |

8,978 |

|

|

$ |

29,138 |

|

|

$ |

25,975 |

|

|

Amortization of acquired customer backlog

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

857 |

|

|

Write-off of unamortized previously deferred debt financing fees

|

|

|

- |

|

|

|

- |

|

|

|

3,506 |

|

|

|

- |

|

|

Refinancing costs

|

|

|

- |

|

|

|

- |

|

|

|

2,413 |

|

|

|

- |

|

|

Non-GAAP adjusted earnings

|

|

$ |

12,919 |

|

|

$ |

8,978 |

|

|

$ |

35,057 |

|

|

$ |

26,832 |

|

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Adjusted earnings per share:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reported earnings per share – GAAP basis

|

|

$ |

0.49 |

|

|

$ |

0.34 |

|

|

$ |

1.11 |

|

|

$ |

0.99 |

|

|

Amortization of acquired customer backlog

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

0.03 |

|

|

Write-off of unamortized previously deferred debt financing fees

|

|

|

- |

|

|

|

- |

|

|

|

0.13 |

|

|

|

- |

|

|

Refinancing costs

|

|

|

- |

|

|

|

- |

|

|

|

0.09 |

|

|

|

- |

|

|

Non-GAAP adjusted earnings per share

|

|

$ |

0.49 |

|

|

$ |

0.34 |

|

|

$ |

1.33 |

|

|

$ |

1.02 |

|

| |

|

Three Months Ended September 30,

|

|

|

Nine Months Ended September 30,

|

|

| |

|

2024

|

|

|

2023

|

|

|

2024

|

|

|

2023

|

|

|

Adjusted earnings before interest, taxes, depreciation and amortization:

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Reported net income – GAAP basis

|

|

$ |

12,919 |

|

|

$ |

8,978 |

|

|

$ |

29,138 |

|

|

$ |

25,975 |

|

|

Interest expense

|

|

|

7,766 |

|

|

|

10,475 |

|

|

|

26,886 |

|

|

|

31,147 |

|

|

Provision for income taxes

|

|

|

3,141 |

|

|

|

2,006 |

|

|

|

7,677 |

|

|

|

6,746 |

|

|

Depreciation and amortization expense

|

|

|

6,884 |

|

|

|

7,038 |

|

|

|

20,973 |

|

|

|

21,196 |

|

|

Non-GAAP earnings before interest, taxes, depreciation and amortization

|

|

|

30,710 |

|

|

|

28,497 |

|

|

|

84,674 |

|

|

|

85,064 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Amortization of acquired customer backlog

|

|

|

- |

|

|

|

- |

|

|

|

- |

|

|

|

1,085 |

|

|

Write-off of unamortized previously deferred debt financing fees

|

|

|

- |

|

|

|

- |

|

|

|

4,438 |

|

|

|

- |

|

|

Refinancing costs

|

|

|

- |

|

|

|

- |

|

|

|

3,055 |

|

|

|

- |

|

|

Non-cash LIFO expense

|

|

|

1,318 |

|

|

|

1,974 |

|

|

|

3,445 |

|

|

|

6,414 |

|

|

Non-GAAP adjusted earnings before interest, taxes, depreciation and amortization

|

|

$ |

32,028 |

|

|

$ |

30,471 |

|

|

$ |

95,612 |

|

|

$ |

92,563 |

|

v3.24.3

Document And Entity Information

|

Oct. 24, 2024 |

| Document Information [Line Items] |

|

| Entity, Registrant Name |

THE GORMAN-RUPP COMPANY

|

| Document, Type |

8-K

|

| Document, Period End Date |

Oct. 24, 2024

|

| Entity, Incorporation, State or Country Code |

OH

|

| Entity, File Number |

1-6747

|

| Entity, Tax Identification Number |

34-0253990

|

| Entity, Address, Address Line One |

600 South Airport Road

|

| Entity, Address, City or Town |

Mansfield

|

| Entity, Address, State or Province |

OH

|

| Entity, Address, Postal Zip Code |

44903

|

| City Area Code |

419

|

| Local Phone Number |

755-1011

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Common Shares, without par value

|

| Trading Symbol |

GRC

|

| Security Exchange Name |

NYSE

|

| Entity, Emerging Growth Company |

false

|

| Amendment Flag |

false

|

| Entity, Central Index Key |

0000042682

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

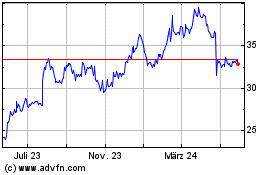

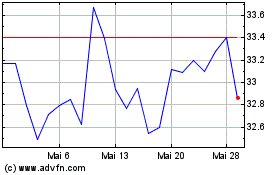

Gorman Rupp (NYSE:GRC)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Gorman Rupp (NYSE:GRC)

Historical Stock Chart

Von Dez 2023 bis Dez 2024