Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

24 Mai 2024 - 6:37PM

Edgar (US Regulatory)

The New Germany Fund, Inc.

| Schedule of Investments |

as of March 31, 2024 (Unaudited) |

| |

Shares |

Value ($) |

| Germany 94.5% |

|

|

| Common Stocks 90.0% |

|

|

| Aerospace & Defense 3.9% |

|

|

| Hensoldt AG† |

145,098 |

6,805,411 |

| |

|

|

| Chemicals 5.1% |

|

|

| Covestro AG 144A* |

34,465 |

1,885,897 |

| Evonik Industries AG |

140,000 |

2,769,970 |

| K+S AG (Registered)† |

62,000 |

967,973 |

| LANXESS AG |

47,500 |

1,272,400 |

| Wacker Chemie AG |

18,608 |

2,100,520 |

| |

|

8,996,760 |

| Commercial Services & Supplies 2.3% |

|

|

| Bilfinger SE |

87,157 |

4,074,678 |

| |

|

|

| Consumer Staples Distribution & Retail 0.6% |

|

|

| HelloFresh SE* |

145,000 |

1,032,020 |

| |

|

|

| Diversified Telecommunication Services 1.4% |

|

|

| United Internet AG (Registered) |

109,992 |

2,477,299 |

| |

|

|

| Electrical Equipment 0.6% |

|

|

| Nordex SE* † |

80,000 |

1,050,332 |

| |

|

|

| Electronic Equipment, Instruments & Components 1.1% |

|

|

| Jenoptik AG |

59,345 |

1,845,354 |

| |

|

|

| Entertainment 4.0% |

|

|

| CTS Eventim AG & Co. KGaA |

78,000 |

6,943,659 |

| |

|

|

| Financial Services 1.3% |

|

|

| GRENKE AG |

85,894 |

2,244,302 |

| |

|

|

| Ground Transportation 1.0% |

|

|

| Sixt SE |

17,627 |

1,759,497 |

| |

|

|

| Health Care Equipment & Supplies 4.0% |

|

|

| Carl Zeiss Meditec AG |

44,000 |

5,501,287 |

| Eckert & Ziegler SE |

37,000 |

1,497,285 |

| |

|

6,998,572 |

| Health Care Providers & Services 2.0% |

|

|

| Fresenius Medical Care AG |

90,000 |

3,464,217 |

| |

|

|

| Hotels, Restaurants & Leisure 1.9% |

|

|

| Delivery Hero SE ''A'' 144A* |

113,662 |

3,253,944 |

| |

|

|

| Independent Power & Renewable Electricity Producers 1.1% |

|

|

| Encavis AG* |

108,000 |

1,965,421 |

| |

|

|

| Insurance 3.0% |

|

|

| Talanx AG |

67,000 |

5,309,749 |

| |

|

|

| Interactive Media & Services 4.5% |

|

|

| Scout24 SE 144A |

104,863 |

7,909,590 |

| |

|

|

| IT Services 6.7% |

|

|

| Bechtle AG |

95,000 |

5,023,952 |

| GFT Technologies SE |

71,000 |

2,069,785 |

| Ionos SE* |

196,410 |

4,516,961 |

| |

|

11,610,698 |

| Life Sciences Tools & Services 3.1% |

|

|

| Evotec SE* |

81,130 |

1,267,515 |

| Gerresheimer AG |

37,000 |

4,170,665 |

| |

|

5,438,180 |

| |

Shares |

Value ($) |

| Machinery 13.7% |

|

|

| Deutz AG |

477,920 |

3,036,720 |

| GEA Group AG |

70,000 |

2,961,941 |

| KION Group AG |

26,000 |

1,369,362 |

| Knorr-Bremse AG |

74,000 |

5,600,836 |

| Krones AG |

38,000 |

5,034,209 |

| Stabilus SE |

58,146 |

3,704,034 |

| Vossloh AG |

44,000 |

2,171,061 |

| |

|

23,878,163 |

| Media 1.8% |

|

|

| Stroeer SE & Co. KGaA |

53,000 |

3,227,439 |

| |

|

|

| Metals & Mining 1.5% |

|

|

| Aurubis AG |

15,700 |

1,104,885 |

| thyssenkrupp AG |

305,745 |

1,641,981 |

| |

|

2,746,866 |

| Oil, Gas & Consumable Fuels 0.2% |

|

|

| Verbio SE |

13,499 |

306,801 |

| |

|

|

| Passenger Airlines 3.0% |

|

|

| Deutsche Lufthansa AG (Registered)* |

664,089 |

5,220,600 |

| |

|

|

| Pharmaceuticals 0.5% |

|

|

| Dermapharm Holding SE |

25,000 |

881,035 |

| |

|

|

| Professional Services 0.9% |

|

|

| Amadeus Fire AG |

12,300 |

1,596,293 |

| |

|

|

| Real Estate Management & Development 4.7% |

|

|

| LEG Immobilien SE* |

64,000 |

5,499,042 |

| PATRIZIA SE |

52,822 |

491,615 |

| TAG Immobilien AG* |

161,809 |

2,214,388 |

| |

|

8,205,045 |

| Semiconductors & Semiconductor Equipment 3.8% |

|

|

| AIXTRON SE |

79,000 |

2,089,760 |

| Elmos Semiconductor SE |

30,000 |

2,393,695 |

| Siltronic AG† |

15,000 |

1,331,270 |

| SMA Solar Technology AG* |

12,924 |

746,541 |

| |

|

6,561,266 |

| Software 2.3% |

|

|

| Nemetschek SE |

25,900 |

2,564,879 |

| TeamViewer SE 144A* |

97,908 |

1,459,344 |

| |

|

4,024,223 |

| Specialty Retail 1.3% |

|

|

| Fielmann Group AG |

50,000 |

2,297,602 |

| |

|

|

| Textiles, Apparel & Luxury Goods 5.3% |

|

|

| HUGO BOSS AG |

78,000 |

4,599,911 |

| Puma SE |

104,000 |

4,718,375 |

| |

|

9,318,286 |

| Trading Companies & Distributors 1.0% |

|

|

| Brenntag SE |

20,000 |

1,686,059 |

| |

|

|

| Transportation Infrastructure 1.0% |

|

|

| Fraport AG Frankfurt Airport Services Worldwide* |

32,371 |

1,707,704 |

| |

|

|

| Wireless Telecommunication Services 1.4% |

|

|

| 1&1 AG |

19,578 |

338,637 |

| Freenet AG |

78,000 |

2,196,369 |

| |

|

2,535,006 |

| Total Common Stocks (Cost $151,438,740) |

|

157,372,071 |

| |

|

|

| Preferred Stocks 4.5% |

|

|

| Chemicals 1.6% |

|

|

| FUCHS SE |

57,000 |

2,824,819 |

| |

|

|

| Machinery 2.9% |

|

|

| Jungheinrich AG |

138,954 |

5,142,982 |

| Total Preferred Stocks (Cost $5,405,981) |

|

7,967,801 |

| Total Germany (Cost $156,844,721) |

|

165,339,872 |

| |

|

|

| |

Shares |

Value ($) |

| |

|

|

| Netherlands 3.6% |

|

|

| Common Stocks |

|

|

| Consumer Staples Distribution & Retail 3.6% |

|

|

| Redcare Pharmacy NV 144A* (Cost $3,431,517) |

38,228 |

6,259,319 |

| |

|

|

| Luxembourg 1.4% |

|

|

| Common Stocks |

|

|

| Commercial Services & Supplies 0.8% |

|

|

| Befesa SA 144A |

39,621 |

1,363,788 |

| |

|

|

| Media 0.6% |

|

|

| RTL Group SA† |

33,000 |

1,114,509 |

| Total Luxembourg (Cost $4,180,595) |

|

2,478,297 |

| |

|

|

| Securities Lending Collateral 2.9% |

|

|

DWS Government & Agency Securities Portfolio ''DWS Government Cash Institutional Shares'', 5.26%

(Cost $5,070,435) (a) (b) |

5,070,435 |

5,070,435 |

| |

|

|

| Cash Equivalents 0.5% |

|

|

DWS Central Cash Management Government Fund, 5.36%

(Cost $806,593) (b) |

806,593 |

806,593 |

| |

|

|

| |

% of Net |

|

| |

Assets |

Value ($) |

| Total Investment Portfolio (Cost $170,333,861) |

102.9 |

179,954,516 |

| Other Assets and Liabilities, Net |

(2.9) |

(5,110,119) |

| Net Assets |

100.0 |

174,844,397 |

| |

| |

| For information on the Fund’s policies regarding the valuation of investments and other significant accounting policies, please refer to the Fund’s most recent semi-annual or annual financial statements. |

|

A summary of the Fund’s transactions with affiliated

investments during the period ended March 31, 2024 are as follows:

|

| Value ($) at 12/31/2023 |

Purchases Cost

($) |

Sales Proceeds

($) |

Net

Realized

Gain/

(Loss)

($) |

Net

Change in

Unrealized

Appreciation/

(Depreciation)

($) |

Income

($) |

Capital

Gain

Distributions

($) |

Number

of Shares

at

3/31/2024 |

Value ($)

at

3/31/2024 |

| Securities Lending Collateral 2.9% |

|

|

|

|

| DWS Government & Agency Securities Portfolio ''DWS Government Cash Institutional Shares'', 5.26% (a) (b) |

| 5,067,060 |

3,375 (c) |

– |

– |

– |

2,674 |

– |

5,070,435 |

5,070,435 |

| Cash Equivalents 0.5% |

|

|

|

|

| DWS Central Cash Management Government Fund, 5.36% (b) |

|

|

|

|

| 527,370 |

7,713,067 |

7,433,844 |

– |

– |

8,825 |

– |

806,593 |

806,593 |

| 5,594,430 |

7,716,442 |

7,433,844 |

– |

– |

11,499 |

– |

5,877,028 |

5,877,028 |

|

* |

|

Non-income producing security. |

| † |

|

All or a portion of these securities were on loan. The value of all securities loaned at March 31, 2024 amounted to $4,753,484, which is 2.7% of net assets. |

| (a) |

|

Represents cash collateral held in connection with securities lending. Income earned by the Fund is net of borrower rebates. |

| (b) |

|

Affiliated fund managed by DWS Investment Management Americas, Inc. The rate shown is the annualized seven-day yield at period end. |

| (c) |

|

Represents the net increase (purchases cost) or decrease (sales proceeds) in the amount invested in cash collateral for the period ended March 31, 2024. |

| 144A: |

|

Security exempt from registration under Rule 144A of the Securities Act of 1933. These securities may be resold in transactions exempt from registration, normally to qualified institutional buyers. |

| |

|

|

| For purposes of its industry concentration policy, the Fund classifies issuers of portfolio securities at the industry sub-group level. Certain of the categories in the above Schedule of Investments consist of multiple industry sub-groups or industries. |

| |

| |

|

Securities are listed in the country of domicile. For

purposes of the Fund's investment objective policy to invest in German companies, non-Germany domiciled securities may qualify as German

companies as defined in the Fund's Statement of Investment Objectives, Policies and Investment Restrictions.

|

| |

| Fair Value Measurements |

| Various inputs are used in determining the value of the Fund’s investments. These inputs are summarized in three broad levels. Level 1 includes quoted prices in active markets for identical securities. Level 2 includes other significant observable inputs (including quoted prices for similar securities, interest rates, prepayment speeds and credit risk). Level 3 includes significant unobservable inputs (including the Fund’s own assumptions in determining the fair value of investments). The level assigned to the securities valuations may not be an indication of the risk associated with investing in those securities. |

| |

| The following is a summary of the inputs used as of March 31, 2024 in valuing the Fund’s investments. |

| |

|

|

|

|

| Assets |

Level 1 |

Level 2 |

Level 3 |

Total |

| Common Stocks and/or Other Equity Investments (d) |

|

| Germany |

$ |

165,339,872 |

$ |

— |

$ |

— |

$ |

165,339,872 |

| Netherlands |

|

6,259,319 |

|

— |

|

— |

|

6,259,319 |

| Luxembourg |

|

2,478,297 |

|

— |

|

— |

|

2,478,297 |

| Short-Term Instruments (d) |

|

5,877,028 |

|

— |

|

— |

|

5,877,028 |

| Total |

$ |

179,954,516 |

$ |

— |

$ |

— |

$ |

179,954,516 |

| |

|

|

|

|

| (d) See Schedule of Investments for additional detailed categorizations. |

|

OBTAIN

AN OPEN-END FUND PROSPECTUS

To obtain a summary prospectus, if available, or

prospectus, download one from fundsus.dws.com, talk to your financial representative or call (800) 728-3337. We advise you to carefully

consider the product's objectives, risks, charges and expenses before investing. The summary prospectus and prospectus contain this and

other important information about the investment product. Please read the prospectus carefully before you invest.

CLOSED-END FUNDS

The shares of most closed-end funds, including the

Fund, are not continuously offered. Once issued, shares of closed-end funds are bought and sold in the open market. Shares of closed-end

funds frequently trade at a discount to net asset value. The price of the fund’s shares is determined by a number of factors, several

of which are beyond the control of the fund. Therefore, the fund cannot predict whether its shares will trade at, below or above net asset

value.

The brand DWS represents DWS Group GmbH & Co. KGaA

and any of its subsidiaries such as DWS Distributors, Inc. which offers investment products or DWS Investment Management Americas Inc.

and RREEF America L.L.C. which offer advisory services.

NO BANK GUARANTEE | NOT FDIC INSURED | MAY LOSE VALUE

NGF-PH1

R-080548-2 (1/25) |

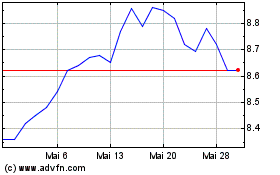

New Germany (NYSE:GF)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

New Germany (NYSE:GF)

Historical Stock Chart

Von Jan 2024 bis Jan 2025