Form FWP - Filing under Securities Act Rules 163/433 of free writing prospectuses

30 November 2023 - 11:25PM

Edgar (US Regulatory)

Issuer Free Writing Prospectus, dated November 30, 2023

Filed Pursuant to Rule 433 under the Securities Act of 1933

Registration No. 333-255327

Pricing Term Sheet

Genesis Energy, L.P.

Genesis Energy Finance Corporation

$600,000,000 8.250% Senior Notes due 2029

November 30, 2023

|

|

|

|

|

| Issuers: |

|

Genesis Energy, L.P. and Genesis Energy Finance Corporation |

| Title of Securities: |

|

8.250% Senior Notes due 2029 |

| Aggregate Principal Amount: |

|

$600,000,000 (upsized from $550,000,000) |

| Final Maturity Date: |

|

January 15, 2029 |

| Issue Price: |

|

98.961%, plus accrued interest, if any, from December 7, 2023 |

| Interest Rate: |

|

8.250% |

| Yield to Maturity: |

|

8.500% |

| Interest Payment Dates: |

|

January 15 and July 15, beginning on July 15, 2024 |

| Interest Record Dates: |

|

January 1 and July 1 |

|

|

| Gross Proceeds: |

|

$593,766,000 |

| Optional Redemption: |

|

Make-whole call at T+50 until January 15, 2026 |

|

|

| |

|

On or after January 15, 2026 at the prices set forth below for the twelve-month period

beginning on January 15 of the years indicated below, plus accrued and unpaid

interest: |

|

|

|

| |

|

Year |

|

Percentage |

| |

2026 |

|

104.1250% |

| |

2027 |

|

102.0625% |

| |

2028 and thereafter |

|

100.000% |

|

|

| Equity Clawback: |

|

Up to 35% at 108.250% prior to January 15, 2026 |

| Joint Book-Running Managers: |

|

BofA Securities, Inc.

Wells Fargo Securities, LLC Capital One Securities, Inc.

Regions Securities LLC SMBC Nikko Securities America, Inc.

BNP Paribas Securities Corp. Citigroup Global Markets Inc.

Citizens Capital Markets, Inc. Fifth Third Securities, Inc.

RBC Capital Markets, LLC Scotia Capital (USA) Inc.

Truist Securities, Inc. |

| Co-manager: |

|

Comerica Securities, Inc. |

| Trade Date: |

|

November 30, 2023 |

| Settlement Date: |

|

December 7, 2023 (T+5) |

| Denominations: |

|

$2,000 and integral multiples of $1,000 in excess thereof |

| Distribution: |

|

SEC Registered |

| CUSIP / ISIN Numbers: |

|

CUSIP: 37185LAP7 ISIN:

US37185LAP76 |

|

|

|

| Certain Tax Disclosures |

|

The disclosure on page S-17 of the Preliminary Prospectus Supplement is amended by adding the

following: The notes will be issued with original issue discount

(“OID”) for U.S. federal income tax purposes. The notes will be

issued with OID for U.S. federal income tax purposes. Because the notes will be treated as issued with OID, in addition to the stated interest on the notes, a U.S. holder (as defined under “Certain United States Federal Income Tax

Considerations”) will be required to include such OID in gross income (as ordinary income) as it accrues, in advance of such U.S. holder’s receipt of cash attributable to such OID, regardless of such U.S. Holder’s regular method of

accounting for U.S. federal income tax purposes. See “Certain United States Federal Income Tax Considerations.”

The disclosure on page S-91 of the Preliminary Prospectus Supplement is amended by adding the following:

Original Issue Discount (OID)

The notes will be treated as issued with OID for U.S. federal income tax purposes

because the stated principal amount of the notes exceeds their issue price by at least a statutorily defined de minimis amount (generally 0.25% of the stated redemption price at maturity multiplied by the number of complete years from the issue date

to maturity). Because the notes will be treated as issued with OID, in addition to the stated interest on the notes, a U.S. holder will be required to include such OID in gross income (as ordinary income) as the OID accrues (based on a constant

yield method), in advance of the corresponding cash payments (regardless of such holder’s method of accounting for U.S. federal income tax purposes). Under this method, a U.S. holder generally will be required to include in income increasingly

greater amounts of OID in successive accrual period. |

|

|

| Changes to Preliminary Prospectus Supplement |

|

At September 30, 2023, on a pro forma basis after giving effect to the application of the net proceeds of this offering as described herein, we would have had approximately $3.2557 billion of total indebtedness

(excluding $9.5 million in respect of outstanding letters of credit), approximately $155.8 million of which (excluding $9.5 million in respect of outstanding letters of credit) would be secured indebtedness to which the notes would be

effectively junior (to the extent of the value of the collateral securing such indebtedness), and we would have had approximately $684.7 million of borrowing capacity available under our $850.0 million senior secured credit facility,

subject to compliance with financial covenants, for additional secured borrowings, which would be effectively senior to the notes. In the pro forma column under “Capitalization” at page S-25, the

amount of cash and cash equivalents is $21.1 million, the revolving credit facility is $155.8 million, the amount of the 2029 Notes offered hereby is $600 million, the amount of total long-term debt is $3.2557 billion and the

total capitalization is $5.068 billion. Our net proceeds from the offering are approximately $583.0 million. |

General

This Pricing Term

Sheet is qualified in its entirety by reference to the Preliminary Prospectus Supplement, dated November 30, 2023. The information in this Pricing Term Sheet supplements the Preliminary Prospectus Supplement and supersedes the information in

the Preliminary Prospectus Supplement to the extent it is inconsistent with the information in the Preliminary Prospectus Supplement. Capitalized terms used in this Pricing Term Sheet but not defined have the meanings given them in the Preliminary

Prospectus Supplement.

The issuers have filed a registration statement (including a preliminary prospectus supplement and a prospectus) with the U.S.

Securities and Exchange Commission (SEC) for this offering to which this communication relates. Before you invest, you should read the preliminary prospectus supplement for this offering as supplemented hereby, the issuers’ prospectus in that

registration statement and any other documents the issuers have filed with the SEC for more complete information about the issuers and this offering. You may get these documents for free by searching the SEC online data base (EDGAR) on the SEC web

site at http://www.sec.gov. Alternatively, the issuers, any underwriter or any dealer participating in this offering will arrange to send you the prospectus supplement and prospectus if you request it by calling BofA Securities toll-free at 1-800-294-1322 or by emailing BofA Securities at: dg.prospectus_requests@bofa.com.

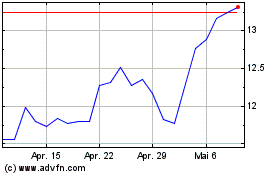

Genesis Energy (NYSE:GEL)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Genesis Energy (NYSE:GEL)

Historical Stock Chart

Von Mai 2023 bis Mai 2024