UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM N-CSR

CERTIFIED SHAREHOLDER REPORT OF REGISTERED MANAGEMENT INVESTMENT COMPANIES

Investment Company Act file number 811-21756

First Trust Strategic High Income Fund

(Exact name of registrant as specified in charter)

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Address of principal executive offices) (Zip code)

W. Scott Jardine, Esq.

First Trust Portfolios L.P.

120 East Liberty Drive, Suite 400

Wheaton, IL 60187

(Name and address of agent for service)

registrant's telephone number, including area code: 630-765-8000

Date of fiscal year end: October 31

Date of reporting period: April 30, 2010

Form N-CSR is to be used by management investment companies to file reports with

the Commission not later than 10 days after the transmission to stockholders of

any report that is required to be transmitted to stockholders under Rule 30e-1

under the Investment Company Act of 1940 (17 CFR 270.30e-1). The Commission may

use the information provided on Form N-CSR in its regulatory, disclosure review,

inspection, and policymaking roles.

A registrant is required to disclose the information specified by Form N-CSR,

and the Commission will make this information public. A registrant is not

required to respond to the collection of information contained in Form N-CSR

unless the Form displays a currently valid Office of Management and Budget

("OMB") control number. Please direct comments concerning the accuracy of the

information collection burden estimate and any suggestions for reducing the

burden to Secretary, Securities and Exchange Commission, 100 F Street, NE,

Washington, DC 20549. The OMB has reviewed this collection of information under

the clearance requirements of 44 U.S.C. Section 3507.

ITEM 1. REPORTS TO STOCKHOLDERS.

The Report to Shareholders is attached herewith.

FIRST TRUST STRATEGIC HIGH INCOME FUND

SEMI-ANNUAL REPORT

FOR THE SIX MONTHS ENDED

APRIL 30, 2010

(GRAPHIC)

(FIRST TRUST LOGO) BROOKFIELD

TABLE OF CONTENTS

FIRST TRUST STRATEGIC HIGH INCOME FUND (FHI)

SEMI-ANNUAL REPORT

APRIL 30, 2010

Shareholder Letter ........................................................ 1

At A Glance ............................................................... 2

Portfolio Commentary ...................................................... 3

Portfolio of Investments .................................................. 6

Statement of Assets and Liabilities ....................................... 12

Statement of Operations ................................................... 13

Statements of Changes in Net Assets ....................................... 14

Statement of Cash Flows ................................................... 15

Financial Highlights ...................................................... 16

Notes to Financial Statements ............................................. 17

Additional Information .................................................... 24

|

CAUTION REGARDING FORWARD-LOOKING STATEMENTS

This report contains certain forward-looking statements within the meaning of

the Securities Act of 1933, as amended, and the Securities Exchange Act of 1934,

as amended. Forward-looking statements include statements regarding the goals,

beliefs, plans or current expectations of First Trust Advisors L.P. ("First

Trust" or the "Advisor") and/or Brookfield Investment Management Inc.

("Brookfield" or the "Sub-Advisor") and their respective representatives, taking

into account the information currently available to them. Forward-looking

statements include all statements that do not relate solely to current or

historical fact. For example, forward-looking statements include the use of

words such as "anticipate," "estimate," "intend," "expect," "believe," "plan,"

"may," "should," "would" or other words that convey uncertainty of future events

or outcomes.

Forward-looking statements involve known and unknown risks, uncertainties and

other factors that may cause the actual results, performance or achievements of

First Trust Strategic High Income Fund (the "Fund") to be materially different

from any future results, performance or achievements expressed or implied by the

forward-looking statements. When evaluating the information included in this

report, you are cautioned not to place undue reliance on these forward-looking

statements, which reflect the judgment of the Advisor and/or Sub-Advisor and

their respective representatives only as of the date hereof. We undertake no

obligation to publicly revise or update these forward-looking statements to

reflect events and circumstances that arise after the date hereof.

PERFORMANCE AND RISK DISCLOSURE

There is no assurance that the Fund will achieve its investment objectives. The

Fund is subject to market risk, which is the possibility that the market values

of securities owned by the Fund will decline and that the value of the Fund

shares may therefore be less than what you paid for them. Accordingly, you can

lose money investing in the Fund. See "Risk Considerations" in the Notes to

Financial Statements for a discussion of other risks of investing in the Fund.

Performance data quoted represents past performance, which is no guarantee of

future results, and current performance may be lower or higher than the figures

shown. For the most recent month-end performance figures, please visit

http://www.ftportfolios.com or speak with your financial advisor. Investment

returns, net asset value and common share price will fluctuate and Fund shares,

when sold, may be worth more or less than their original cost.

HOW TO READ THIS REPORT

This report contains information that may help you evaluate your investment. It

includes details about the Fund and presents data and analysis that provide

insight into the Fund's performance and investment approach. By reading the

portfolio commentary by the portfolio management team of the Fund, you may

obtain an understanding of how the market environment affected the Fund's

performance. The statistical information that follows may help you understand

the Fund's performance compared to that of relevant market benchmarks.

It is important to keep in mind that the opinions expressed by personnel of

Brookfield are just that: informed opinions. They should not be considered to be

promises or advice. The opinions, like the statistics, cover the period through

the date on the cover of this report. The risks of investing in the Fund are

spelled out in the prospectus, the statement of additional information, this

report and other regulatory filings.

SHAREHOLDER LETTER

FIRST TRUST STRATEGIC HIGH INCOME FUND (FHI)

SEMI-ANNUAL REPORT

APRIL 30, 2010

Dear Shareholders:

I am pleased to present you with the semi-annual report for your investment in

First Trust Strategic High Income Fund (the "Fund").

First Trust Advisors L.P. ("First Trust") has always believed that staying

invested in quality products and having a long-term horizon can help investors

reach their financial goals. The past eighteen months have been challenging, but

successful investors understand that the success they have achieved is typically

because of their long-term investment perspective through all kinds of markets.

The report you hold contains detailed information about your investment; a

portfolio commentary from the Fund's management team that provides a recap of

the period; a performance analysis and a market and Fund outlook. Additionally,

you will find the Fund's financial statements for the six month period covered

by this report. I encourage you to read this document and discuss it with your

financial advisor.

First Trust offers a variety of products that can fit many financial plans to

help those investors who are seeking long-term financial success. You may want

to talk to your advisor about the other investments we offer that might fit your

financial plan.

At First Trust we continue to be committed to making available up-to-date

information about your investments so you and your financial advisor have

current information on your portfolio. We value our relationship with you, and

we thank you for the opportunity to assist you in achieving your financial

goals.

Sincerely,

/s/ James A. Bowen

James A. Bowen

President of First Trust Strategic High Income Fund

|

Page 1

FIRST TRUST STRATEGIC HIGH INCOME FUND

"AT A GLANCE"

AS OF APRIL 30, 2010 (UNAUDITED)

FUND STATISTICS

Symbol on New York Stock Exchange FHI

Common Share Price $ 3.32

Common Share Net Asset Value ("NAV") $ 3.52

Premium (Discount) to NAV (5.68)%

Net Assets Applicable to Common Shares $32,212,945

Current Monthly Distribution per Common Share (1) $ 0.025

Current Annualized Distribution per Common Share $ 0.300

Current Distribution Rate on Closing Common Share Price (2) 9.04%

Current Distribution Rate on NAV (2) 8.52%

|

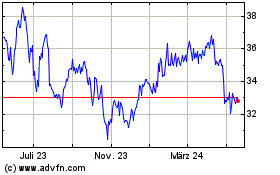

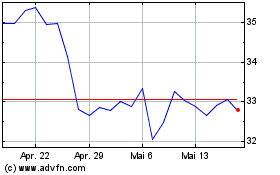

COMMON SHARE PRICE & NAV (WEEKLY CLOSING PRICE)

(PERFORMANCE GRAPH)

Common Share Price NAV

------------ ----- ----

4/30/09 4.66 3.7

5/1/09 4.7 3.62

5/8/09 4.67 3.13

5/15/09 4.17 3.11

5/22/09 4.45 3.16

5/29/09 5.25 3.17

6/5/09 4.75 3.04

6/12/09 4.69 3.02

6/19/09 4.24 3.04

6/26/09 3.76 3.08

7/2/09 3.78 3.03

7/10/09 3.35 2.95

7/17/09 3.54 2.99

7/24/09 2.73 3

7/31/09 2.9 2.95

8/7/09 2.73 2.92

8/14/09 2.61 2.84

8/21/09 2.67 2.82

8/28/09 2.73 2.89

9/4/09 2.54 2.79

9/11/09 2.65 2.81

9/18/09 2.67 2.74

9/25/09 2.68 2.77

10/2/09 2.69 2.82

10/9/09 2.77 2.79

10/16/09 2.64 2.84

10/23/09 2.6 2.87

10/30/09 2.63 2.92

11/6/09 2.6 2.89

11/13/09 2.61 2.96

11/20/09 2.73 3.02

11/27/09 2.78 3.16

12/4/09 2.84 3.15

12/11/09 2.87 3.16

12/18/09 2.91 3.19

12/24/09 2.9 3.18

12/31/09 2.93 3.18

1/8/10 2.89 3.2

1/15/10 3.03 3.37

1/22/10 3.05 3.37

1/29/10 3.1 3.4

2/5/10 3 3.38

2/12/10 3.02 3.35

2/19/10 3.04 3.38

2/26/10 3.07 3.4

3/5/10 3.08 3.34

3/12/10 3.11 3.38

3/19/10 3.17 3.4

3/26/10 3.2 3.41

4/1/10 3.29 3.39

4/9/10 3.26 3.42

4/16/10 3.25 3.49

4/23/10 3.27 3.5

4/30/10 3.32 3.52

|

PERFORMANCE

Average Annual

Total Return

6 Months Ended 1 Year Ended Inception (7/26/2005)

4/30/2010 4/30/2010 to 4/30/2010

-------------- ------------ ---------------------

Fund Performance (3)

NAV 26.63% 9.28% -18.22%

Market Value 32.60% -18.16% -20.00%

Index Performance

Barclays Capital Ba U.S. High Yield Index 10.33% 32.59% 7.84%

|

% OF TOTAL

ASSET CLASSIFICATION INVESTMENTS

-------------------- -----------

Corporate Bonds and Notes 59.8%

U.S. Government Agency

Mortgage-Backed Securities 20.7

Manufactured Housing Loans 7.9

Commercial Mortgage-Backed

Securities 6.3

Residential Mortgage-Backed

Securities 4.1

Franchise Loans 0.5

Senior Floating-Rate Notes 0.5

Collateralized Debt Obligations 0.1

Equity 0.1

-----

Total 100.0%

=====

|

% OF TOTAL

FIXED-INCOME

CREDIT QUALITY(4) INVESTMENTS

----------------- ------------

AAA 22.9%

A 0.5

BBB- 1.0

BB+ 2.3

BB 5.8

BB- 7.7

B+ 7.4

B 12.0

B- 14.4

CCC+ 10.0

CCC 3.6

CCC- 2.4

CC 1.3

C 6.0

D 2.7

-----

Total 100.0%

=====

|

(1) Most recent distribution paid or declared through 4/30/2010. Subject to

change in the future.

(2) Distribution rates are calculated by annualizing the most recent

distribution paid or declared through the report date and then dividing by

Common Share price or NAV, as applicable, as of 4/30/2010. Subject to

change in the future.

(3) Total return is based on the combination of reinvested dividend, capital

gain and return of capital distributions, if any, at prices obtained by the

Dividend Reinvestment Plan, and changes in NAV per share for net asset

value returns and changes in Common Share price for market value returns.

Total returns do not reflect sales load. Past performance is not indicative

of future results.

(4) The credit quality information represented reflects the ratings assigned by

one or more nationally recognized statistical rating organizations

(NRSROs). For situations in which a security is rated by more than one

NRSRO and ratings are not equivalent, the ratings are averaged.

Page 2

PORTFOLIO COMMENTARY

SUB-ADVISOR

BROOKFIELD INVESTMENT MANAGEMENT INC.

Brookfield Investment Management Inc. ("Brookfield") is an SEC-registered

investment advisor specializing in core fixed income, high yield, structured

products (Mortgage-backed securities ("MBS") including Commercial MBS,

Residential MBS and Asset-Backed Securities ("ABS") as well as global real

estate securities and listed infrastructure securities. Headquartered in New

York, the firm has approximately $24 billion of assets under management as of

March 31, 2010. Brookfield is a subsidiary of Brookfield Asset Management Inc.,

a global asset manager focused on property, power and other infrastructure

assets with approximately $100 billion of assets under management as of March

31, 2010.

PORTFOLIO MANAGEMENT TEAM

DANA E. ERIKSON, CFA,

MANAGING DIRECTOR

Mr. Erikson, Senior Portfolio Manager and the Head of the High Yield Team, is

responsible for Brookfield's corporate high yield and leveraged loan exposures,

the establishment of portfolio objectives and strategies. Mr. Erikson has over

20 years of investment experience. Prior to joining Brookfield, he was with

Evergreen Investments or one of its predecessor firms since 1996. He was a

senior portfolio manager and the Head of the High Yield team. Prior to that, he

was Head of High Yield Research. Prior to Evergreen, Mr. Erikson was Associate

Portfolio Manager for Prospect Street Investment Management Company.

Additionally, he was an Analyst with the Kellett Group and a Research Assistant

with Robert R. Nathan Associates. Mr. Erikson received a BA in economics from

Brown University and an MBA, with honors, from Northeastern University. He is a

member of the Boston Security Analysts Society.

ANTHONY BREAKS, CFA

DIRECTOR

Mr. Breaks is responsible for portfolio management of structured products and

for executing structured product financings for Brookfield and its partners. Mr.

Breaks joined Brookfield in 2005 from Brookfield Asset Management (formerly

known as Brascan). At Brascan he was responsible for portfolio investments and

credit analysis for a reinsurance affiliate, execution and management of a

synthetic CDO, and development of insurance related investment products. Prior

to joining Brascan in 2002, Mr. Breaks was a Director at Liberty Hampshire and

was responsible for structuring, restructuring and executing several CDOs, as

well as ongoing monitoring and credit analysis for the CDO assets. Mr. Breaks

began his career at Merrill Lynch in 1998 where he worked in trading and

structuring capacities in CDOs, adjustable rate mortgages and medium-term notes.

Mr. Breaks earned a BS in Electrical Engineering from the Massachusetts

Institute of Technology.

COMMENTARY

FIRST TRUST STRATEGIC HIGH INCOME FUND

The primary investment objective of the First Trust Strategic High Income Fund

("FHI" or the "Fund") is to seek a high level of current income. The Fund seeks

capital growth as a secondary objective. The Fund seeks to achieve its

investment objectives by investing up to 100% of its Managed Assets in

below-investment grade debt securities (commonly referred to as "high-yield" or

"junk bonds"). There can be no assurance that the Fund will achieve its

investment objectives, and the Fund may not be appropriate for all investors.

MARKET RECAP AND OUTLOOK

HIGH YIELD

The high yield market generated strong returns over the six months covered by

this report. Yield spreads on the broad market1 fell from 763 basis points at

October 31, 2009, to 555 basis points at April 30, 2010, as investor confidence

in the financial markets and the economy strengthened.

During the last six months, the high yield new issue market gradually opened as

capital markets were more accepting of risk. By the first quarter of 2010, the

high yield market was setting records for issuance, with more than $60 billion

of bonds issued during the three-month period. Many bonds came with security and

were used to refinance bank debt which was issued during 2006-2007 to finance

leveraged buyouts. One of the market's primary worries is the "mountain of

maturities" many companies face, between 2013-2015, as bonds and loans issued in

the 2006-2007 timeframe come due. While some commentators view this as a

significant risk to future returns, we view it as a "wall of worry" which may

fuel a further rally in high yield as companies successfully address these

concerns. We believe the record amount of new issuance is evidence that

corporate management teams and their equity sponsors are actively looking to

manage their capital structures. We view the market to be in a virtuous cycle

where new issuance, rather than pushing the market lower, serves to move it

higher because it inherently reduces overall credit risk by extending

maturities.

(1) Performance numbers for the Merrill Lynch U.S. High Yield Master II Index,

H0A0 retrieved from Bloomberg

Page 3

PORTFOLIO COMMENTARY (CONTINUED)

The level of defaults peaked in late 2009 and fell dramatically over the period

to April 30, 2010. The widely watched 12-month default rate ended the 2009

calendar year at 12.7%(2) and dropped more than half to 4.04% by the end of

April(3). Many strategists reduced their forecast default rate for 2010, and we

expect it to be around 2% for the 2010 calendar year, representing continued

improvement in credit quality.

Investor appetite for risk remained robust during the last six months, with

bonds rated CCC returning 18.9% compared with the overall market, which was up

11.6%. Surprisingly, upper-tier BB issues rose 10.4%, which may reflect good

performance in the fallen Financials sector, many of which retain BB ratings.

Bonds of companies in the Financial Services and Real Estate industries

performed well, as they recovered from poor performance in 2008. The Automotive

sector also outperformed as companies restructured and investors grew more

confident that the worst was over for the industry. The Technology sector

outperformed, as many companies in the industry began to recover in line with

the general economic recovery.

Industries which underperformed were generally considered to be defensive in

nature, including Telecommunications, Healthcare and Utilities. In 2008, these

sectors had been preferred amid a weaker environment. In general, performance of

an industry reflected the average credit quality of that industry; with

outperforming industries being lower quality and/or more beaten down in the 2008

downturn, and the underperforming industries representing more defensive, better

quality issues. (Source: Factset, Merrill Lynch.)

Supply/demand remained positive as 2010 commenced despite a record supply of new

issues. Credit Suisse estimates $1.2 billion of money flowed into the market

during the first quarter of 2010, an extension of the $22.9 billion that flowed

in during 2009(4). The steady flow of money into high yield retail mutual funds

put pressure on managers to deploy it quickly, which gave a boost to the new

issue calendar.

We continue to maintain our positive view of the high yield market despite the

hefty returns over the past 12 months. While yield spreads have narrowed nearer

to the long-term average, lower defaults, improving credit conditions, and the

gradual removal of the maturity mountain should protect investors from a market

correction. We believe we are on the right side of the credit cycle for

corporate credit and anticipate the yield advantage of high yield will prove

attractive in a low-yield world.

We believe that, on balance, the U.S. economy will surprise on the upside,

eventually overcoming residual investor fears of continued stagnation. We are

encouraged by the record pace of credit refinancing, and are beginning to see

signs of renewed IPO activity, both of which will serve to reduce credit risk

going forward.

In our opinion, confidence may receive a second boost should we see a return of

merger and acquisition ("M&A") activity in 2010 after a two-year hiatus. M&A

tends to be good for high yield investors on two fronts; first, it gives

companies a venue for selling assets and using cash to pay debt; and second,

bond investors benefit from a change-of-control put in the event their debtor is

taken over.

COMMERCIAL MBS/RESIDENTIAL MBS

Structured product securities, including MBS and CMBS, rallied over the first

quarter of 2010. Investors continued to add risk, with equities ending the

quarter higher and most fixed-income sectors experiencing price increases.

Nevertheless, volatility remains a risk amid government intervention and the

uncertain resolution of troubled real estate assets. Importantly, looking ahead,

overall loss projections for structured product securities for 2010 are improved

compared to 2009.

From a macro-economic perspective, the massive U.S. federal stimulus over the

past 12 months produced a number of measurable positive results. A steep yield

curve and renewed access to capital markets substantially improved profitability

of large U.S. banks in 2009, and further signs of strengthening economic

indicators suggested the U.S. economic recovery is sustainable.

The ongoing resolution of troubled assets over the coming 12 months will play an

important role in the economic recovery and investor sentiment. A level of

uncertainty continues to surround the commercial real estate sector, while the

residential housing market will be influenced by the significant shadow

inventory of unsold homes, as well as the continued impact of government policy

on loan servicing. From a consumer perspective, the rate of improvements in the

job market will be critical as well as straightforward credit provisions for

consumers, which currently remain limited.

We believe delinquency levels are likely to continue to increase in 2010, most

notably for employment-sensitive sectors, including prime MBS, CMBS, auto ABS

and credit card ABS. Additional government regulation is also anticipated as the

new issue securitization markets redevelop. Additional regulation is likely to

affect lending standards, which can either be a positive or a negative, largely

depending on the extent of the regulation.

(2) JMerrill Lynch, "Situation Room: High Yield in 2010: Year Ahead Outlook,"

December 28, 2009, p. 4

(3) JP Morgan, High Yield Market Monitor, April 1, 2010, p. 14

(4) Credit Suisse, "Leveraged Finance Strategy Update," April 6, 2010, p. 10

Page 4

PORTFOLIO COMMENTARY (CONTINUED)

Non-Agency MBS and CMBS were among one of a few issuance markets where less than

a handful of deals were issued in 2009. In early 2010, the new issue market

across MBS sectors returned to activity, bringing the first CMBS conduit

securitization and the first prime RMBS securitization. While investors watched

for the impact of the end of government programs, such as TALF (Term

Asset-Backed Loan Facility), designed to aid liquidity in the securitized

markets, and the Agency MBS purchase program, designed to retain liquidity for

Agency MBS, there was little adverse impact noted as these programs closed.

We anticipate that the yield curve will remain steep over 2010 and that new

supply of issues will remain low. As such, we believe that markets with more

excess yield will benefit. Once excess yield has been compressed,

differentiation among collateral, structure and servicer will provide a great

source of relative value.

PERFORMANCE ANALYSIS

For the six months ended April 30, 2010, the Fund's net asset value ("NAV")

increased by 20.5%, resulting in an NAV total return of 26.63%. For the period,

the Fund traded from a discount to NAV of 9.93% to a discount to NAV of 5.68%,

resulting in a market value total return5 of 32.60%. The Fund benefitted from

increased exposure to corporate bonds during the period. The bonds of Qwest

Communications, Paetec Holdings and United Rentals all contributed strongly to

performance as each benefitted from increasing investor confidence in economic

recovery, and in the ability of each company to manage its balance sheet. The

Fund also benefitted from the recovery in the structured products market.

Signature 5 Class C, a Collateralized Loan Obligation ("CLO") note that has been

deferring coupons and ACLB 1999-2 D, a subordinate franchise-backed note, were

both sold at significant gains to where they were valued at the start of the six

months covered by this report. In the case of Signature 5, buyers were

dramatically more willing to price in the future deferred cash flows. This was

the case for many of the Fund's structured products holdings. As more

traditional sectors rallied, investors were more willing to accept complexity

and reductions in liquidity for a chance to invest in an asset class that still

offers high returns.

Detractors of performance included select structured products holdings such as

MESC 13 M2, an asset-backed security secured by manufactured housing and ACLB

1998-2 B, a franchise-backed security, both of which traded poorly in the

secondary market.

The total return for the Fund's benchmark, the Barclays Capital Ba U.S. High

Yield Index, was 10.33% for the six months ended April 30, 2010. While the

benchmark contains mostly corporate debt, the Fund had significant exposure to

structured finance and mortgage-related securities during the period. As

investor risk appetite continued to return to the market during the period

covered by this report, corporate credit spreads tightened dramatically

resulting in strong performance by the Fund's benchmark. Lower quality names

performed the best, as evidenced by the 15.45% return of the Barclays Capital

Caa U.S. High Yield Index.

FUND REPOSITIONING

Upon taking over management of FHI at the start of the third quarter in 2009, we

began a process of repositioning the Fund to better meet the Fund's objectives

of high current income and, secondly, capital appreciation. The first step was

to increase the Fund's exposure to RMBS to above 25% and remove the Fund from

its temporary defensive posture positioning. This allowed more flexibility to

add high yielding corporate bonds as we sold distressed structured products.

Emboldened by an appreciating equity and corporate market, investors took

another look at structured products. As a result, in some cases we thought the

market was willing to pay more for certain bonds and we took the opportunity to

sell. As we sold structured products, we added to corporate bonds, primarily

below investment grade.

One of our goals has been to reduce exposure to lower quality bonds, while still

maximizing the value of the individual holdings. Many of these bonds may not be

paying a coupon or face the potential of a full principal loss. Deal structures

commonly make individual securities in the structure highly sensitive to losses

in the supporting asset pool. In the case of CLOs, the securities held by the

Fund may stop paying coupons for years while more senior classes are repaid. If

loan losses continue, the payments may never return. We are particularly focused

on selling these types of securities as they have little promise of capital

appreciation and are not secure sources of cash flow to be used for payment of

dividends.

At the end of the period, the Fund's portfolio had increased exposure to

corporate bonds (to approximately 60%). We are now within the target range for

corporate exposure for the Fund. While we will continue to attempt to reduce

exposure to structured product holding, we will look to invest the sale proceeds

across the fixed-income markets where we find value and income stability.

(5) Total return is based on the combination of reinvested dividend, capital

gain and return of capital distributions, if any, at prices obtained by the

Dividend Reinvestment Plan and changes in NAV per share for net asset value

returns and changes in Common Share price for market value returns. Total

returns do not reflect sales load. Past performance is not indicative of

future results.

Page 5

FIRST TRUST STRATEGIC HIGH INCOME FUND

PORTFOLIO OF INVESTMENTS (a)

APRIL 30, 2010 (UNAUDITED)

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

------------- ---------------------------------------------------------- ------ --------- -------------

ASSET-BACKED SECURITIES - 14.1%

Atherton Franchisee Loan Funding

$ 209,456 Series 1999-A, Class A2 (b) ........................... 7.23% 03/15/21 $ 188,758

Bombardier Capital Mortgage Securitization Corp.

316,834 Series 1999-B, Class A1B .............................. 6.61% 09/15/10 188,410

811,180 Series 1999-B, Class A3 ............................... 7.18% 12/15/15 512,480

Conseco Finance Securitizations Corp.

3,039,905 Series 2000-6, Class M1 ............................... 7.72% 09/01/31 1,029,593

Falcon Franchise Loan Trust

4,905,000 Series 2000-1, Class E (b) (c) ........................ 6.50% 04/05/16 12,262

4,231,000 Series 2003-1, Class E (c) (d) ........................ 6.00% 01/05/25 10,577

Green Tree Financial Corp.

258,614 Series 1997-4, Class B1 ............................... 7.23% 02/15/29 26,203

903,008 Series 1998-4, Class M1 ............................... 6.83% 04/01/30 456,009

4,622,414 Series 1999-3, Class M1 ............................... 6.96% 02/01/31 882,276

GSAMP Trust

440,199 Series 2004-AR2, Class B4 (d) ......................... 5.00% 08/25/34 13,781

976,588 Series 2006-S3, Class A2 (e) .......................... 5.77% 05/25/36 71,958

854,581 Series 2006-S5, Class A1 (f) .......................... 0.35% 09/25/36 28,083

Independence III CDO, Ltd.

5,000,000 Series 3A, Class C1 (c) (d) (f) ....................... 2.79% 10/03/37 50

Indymac Residential Asset Backed Trust

366,731 Series 2005-B, Class M10 (f) .......................... 3.76% 08/25/35 1,040

Long Beach Mortgage Loan Trust

1,920,999 Series 2006-A, Class A2 ............................... 5.55% 05/25/36 128,244

Merit Securities Corp.

544,840 Series 13, Class B1 (d) ............................... 7.95% 12/28/33 3,213

Park Place Securities, Inc.

1,856,435 Series 2004-WCW1, Class M8 (f) ........................ 3.76% 09/25/34 29,317

1,301,976 Series 2004-WCW2, Class M10 (d) (f) ................... 3.01% 10/25/34 53,027

Structured Asset Securities Corp.

850,879 Series 2006-GEL1, Class A1 (b) (f) .................... 0.40% 11/25/35 847,374

Summit CBO I, Ltd.

4,159,437 Series 1A, Class B (d) (f) ............................ 1.49% 05/23/11 41,594

-------------

TOTAL ASSET-BACKED SECURITIES

(Cost $3,882,778) ........................................ 4,524,249

-------------

COLLATERALIZED MORTGAGE OBLIGATIONS - 1.4%

Bear Stearns Alt-A Trust

604,830 Series 2006-8, Class 2A2 .............................. 5.09% 08/25/46 15,157

Countrywide Alternative Loan Trust

3,142,911 Series 2005-56, Class M4 (f) .......................... 1.18% 11/25/35 44,454

Deutsche Alt-A Securities, Inc. Mortgage Loan Trust

3,691,244 Series 2007-OA4, Class M10 (f) ........................ 3.26% 08/25/47 50,681

HarborView Mortgage Loan Trust

3,777,718 Series 2005-9, Class B10 (f) .......................... 2.01% 06/20/35 338,130

-------------

TOTAL COLLATERALIZED MORTGAGE OBLIGATIONS

(Cost $1,535,825) ........................................ 448,422

-------------

|

See Notes to Financial Statements

Page 6

FIRST TRUST STRATEGIC HIGH INCOME FUND

PORTFOLIO OF INVESTMENTS (a) - (CONTINUED)

APRIL 30, 2010 (UNAUDITED)

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

------------- ---------------------------------------------------------- ------ --------- -------------

COMMERCIAL MORTGAGE-BACKED SECURITIES - 7.7%

$ 688,031 Banc of America Commercial Mortgage Inc.

Series 2000-1, Class M (d) (e) ........................ 6.00% 11/15/31 $ 7

Banc of America Large Loan, Inc.

2,000,000 Series 2005-MIB1, Class L (d) (e) (f) ................. 3.25% 03/15/22 301,427

Bear Stearns Commercial Mortgage Securities

1,776,400 Series 2000-WF1, Class K (c) .......................... 6.50% 02/15/32 439,328

GE Capital Commercial Mortgage Corp.

700,000 Series 2000-1, Class G (d) ............................ 6.13% 01/15/33 346,436

GS Mortgage Securities Corp. II

6,789,251 Series 1998-C1, Class H (d) (e) ....................... 6.00% 10/18/30 399,490

LB-UBS Commercial Mortgage Trust

3,025,000 Series 2001-C7, Class Q (d) ........................... 5.87% 11/15/33 151,352

2,071,442 Series 2001-C7, Class S (d) (e) ....................... 5.87% 11/15/33 14,894

Morgan Stanley Capital I, Inc.

968,400 Series 1999-WF1, Class M (d) .......................... 5.91% 11/15/31 621,579

2,787,919 Series 2003-IQ5, Class O (d) .......................... 5.24% 04/15/38 198,484

-------------

TOTAL COMMERCIAL MORTGAGE-BACKED SECURITIES

(Cost $11,574,782) ....................................... 2,472,997

-------------

CORPORATE BONDS AND NOTES - 73.2%

AEROSPACE & DEFENSE - 2.8%

425,000 BE Aerospace, Inc. ....................................... 8.50% 07/01/18 455,813

425,000 Bombardier, Inc. (b) ..................................... 7.75% 03/15/20 453,688

-------------

909,501

-------------

AUTO COMPONENTS - 1.3%

400,000 TRW Automotive, Inc. (b) ................................. 7.25% 03/15/17 405,000

-------------

AUTOMOBILES - 1.2%

400,000 Ford Motor Co. ........................................... 6.50% 08/01/18 382,000

-------------

CHEMICALS - 2.2%

305,000 Hexion Finance Escrow LLC/Hexion Escrow

Corp. (b) ............................................. 8.88% 02/01/18 301,569

400,000 Westlake Chemical Corp. .................................. 6.63% 01/15/16 402,000

-------------

703,569

-------------

COMMERCIAL SERVICES & SUPPLIES - 5.4%

425,000 ACCO Brands Corp. (b) .................................... 10.63% 03/15/15 472,812

425,000 Deluxe Corp. ............................................. 7.38% 06/01/15 434,031

400,000 Iron Mountain, Inc. ...................................... 8.75% 07/15/18 424,500

400,000 KAR Holdings, Inc. ....................................... 10.00% 05/01/15 426,000

-------------

1,757,343

-------------

CONTAINERS & PACKAGING - 1.6%

90,000 Berry Plastics Corp. (b) ................................. 9.50% 05/15/18 89,663

400,000 Owens-Illinois, Inc. ..................................... 7.80% 05/15/18 423,000

-------------

512,663

-------------

DISTRIBUTORS - 1.6%

500,000 C&S Group Enterprises LLC (b) ............................ 8.38% 05/01/17 506,250

-------------

|

See Notes to Financial Statements

Page 7

FIRST TRUST STRATEGIC HIGH INCOME FUND

PORTFOLIO OF INVESTMENTS (a) - (CONTINUED)

APRIL 30, 2010 (UNAUDITED)

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

------------- ---------------------------------------------------------- ------ --------- -------------

CORPORATE BONDS AND NOTES - (CONTINUED)

DIVERSIFIED TELECOMMUNICATION SERVICES - 7.7%

$ 425,000 Cincinnati Bell, Inc ..................................... 8.75% 03/15/18 $ 432,437

400,000 Citizens Communications .................................. 7.13% 03/15/19 388,000

400,000 Global Crossing Ltd. (b) ................................. 12.00% 09/15/15 451,000

400,000 PAETEC Holding Corp ...................................... 9.50% 07/15/15 409,500

400,000 Qwest Corp. .............................................. 6.88% 09/15/33 386,000

425,000 Windstream Corp .......................................... 7.00% 03/15/19 402,688

-------------

2,469,625

-------------

ELECTRICAL EQUIPMENT - 0.8%

245,000 Coleman Cable, Inc. (b) .................................. 9.00% 02/15/18 251,431

-------------

ENERGY EQUIPMENT & SERVICES - 3.9%

425,000 Edgen Murray Corp. (b) ................................... 12.25% 01/15/15 420,750

400,000 Hercules Offshore LLC (b) ................................ 10.50% 10/15/17 414,000

400,000 McJunkin Red Man Corp. (b) ............................... 9.50% 12/15/16 418,500

-------------

1,253,250

-------------

FOOD & STAPLES RETAILING - 2.4%

400,000 ARAMARK Corp ............................................. 8.50% 02/01/15 412,500

400,000 Rite Aid Corp ............................................ 8.63% 03/01/15 357,000

-------------

769,500

-------------

FOOD PRODUCTS - 1.4%

425,000 B&G Foods, Inc. .......................................... 7.63% 01/15/18 437,750

-------------

GAS UTILITIES - 0.6%

175,000 Niska Gas Storage US LLC/Niska Gas

Storage Canada ULC (b) ................................ 8.88% 03/15/18 183,750

-------------

HEALTH CARE PROVIDERS & SERVICES - 1.3%

400,000 HCA, Inc ................................................. 9.25% 11/15/16 433,500

-------------

HOTELS, RESTAURANTS & LEISURE - 5.2%

400,000 AMC Entertainment, Inc. .................................. 8.75% 06/01/19 426,000

400,000 Harrah's Operating Co., Inc. ............................. 11.25% 06/01/17 438,000

425,000 MGM MIRAGE ............................................... 5.88% 02/27/14 377,187

400,000 MTR Gaming Group, Inc. ................................... 12.63% 07/15/14 422,000

-------------

1,663,187

-------------

HOUSEHOLD DURABLES - 1.3%

400,000 Jarden Corp .............................................. 7.50% 05/01/17 411,000

-------------

INDEPENDENT POWER PRODUCERS & ENERGY TRADERS - 2.6%

425,000 Dynegy Holdings, Inc. .................................... 7.75% 06/01/19 342,125

425,000 Edison Mission Energy .................................... 7.00% 05/15/17 311,844

225,000 Texas Competitive Electric Holdings Co., LLC,

Series A .............................................. 10.25% 11/01/15 169,875

-------------

823,844

-------------

IT SERVICES - 1.1%

400,000 First Data Corp. ......................................... 9.88% 09/24/15 368,000

-------------

|

See Notes to Financial Statements

Page 8

FIRST TRUST STRATEGIC HIGH INCOME FUND

PORTFOLIO OF INVESTMENTS (a) - (CONTINUED)

APRIL 30, 2010 (UNAUDITED)

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

------------- ---------------------------------------------------------- ------ --------- -------------

CORPORATE BONDS AND NOTES- (CONTINUED)

MACHINERY - 5.6%

$ 400,000 CNH America LLC .......................................... 7.25% 01/15/16 $ 419,000

400,000 Mueller Water Products, Inc. ............................ 7.38% 06/01/17 366,000

225,000 RBS Global, Inc./Rexnord LLC (b) ......................... 8.50% 05/01/18 226,688

400,000 Terex Corp. .............................................. 8.00% 11/15/17 392,000

400,000 Trimas Corp. (b) ......................................... 9.75% 12/15/17 414,500

-------------

1,818,188

-------------

MEDIA - 2.7%

425,000 CCO Holdings LLC/CCO Holdings Capital Corp. (b) .......... 8.13% 04/30/20 436,688

425,000 Mediacom LLC/Mediacom Capital Corp. (b) .................. 9.13% 08/15/19 439,875

-------------

876,563

-------------

METALS & MINING - 2.4%

155,000 AK Steel Corp. ........................................... 7.63% 05/15/20 160,425

600,000 United States Steel Corp. ................................ 7.00% 02/01/18 613,500

-------------

773,925

-------------

MULTILINE RETAIL - 1.3%

400,000 Neiman Marcus Group, Inc. ................................ 10.38% 10/15/15 423,500

-------------

OIL, GAS & CONSUMABLE FUELS - 5.8%

425,000 Arch Coal, Inc. (b) ...................................... 8.75% 08/01/16 454,750

400,000 Chesapeake Energy Corp. .................................. 6.88% 01/15/16 401,000

425,000 Crosstex Energy LP/Crosstex Energy Finance Corp. (b) ..... 8.88% 02/15/18 444,125

120,000 Linn Energy LLC/Linn Energy Finance Corp. (b) ............ 8.63% 04/15/20 125,100

425,000 Pioneer Natural Resources Co. ............................ 6.65% 03/15/17 439,765

-------------

1,864,740

-------------

PAPER & FOREST PRODUCTS - 3.3%

215,000 Appleton Papers, Inc. (b) ................................ 10.50% 06/15/15 219,300

185,000 Georgia-Pacific LLC ...................................... 7.25% 06/01/28 188,700

215,000 Georgia-Pacific LLC ...................................... 7.38% 12/01/25 216,613

400,000 Verso Paper Holdings LLC/Verso Paper, Inc. (b) ........... 11.50% 07/01/14 447,000

-------------

1,071,613

-------------

ROAD & RAIL - 1.4%

425,000 Avis Budget Car Rental LLC/Avis Budget

Finance, Inc. (b) ..................................... 9.63% 03/15/18 461,125

-------------

SEMICONDUCTORS & SEMICONDUCTOR EQUIPMENT - 0.8%

250,000 Freescale Semiconductor, Inc. (b) ........................ 9.25% 04/15/18 261,250

-------------

SPECIALTY RETAIL - 0.1%

40,000 Limited Brands, Inc. ..................................... 7.00% 05/01/20 41,000

-------------

TEXTILES, APPAREL & LUXURY GOODS - 2.7%

400,000 Easton-Bell Sports, Inc. (b) ............................ 9.75% 12/01/16 428,000

425,000 Levi Strauss & Co. ....................................... 9.75% 01/15/15 448,906

-------------

876,906

-------------

|

See Notes to Financial Statements

Page 9

FIRST TRUST STRATEGIC HIGH INCOME FUND

PORTFOLIO OF INVESTMENTS (a) - (CONTINUED)

APRIL 30, 2010 (UNAUDITED)

PRINCIPAL STATED STATED

VALUE DESCRIPTION COUPON MATURITY VALUE

------------- ---------------------------------------------------------- ------ --------- -------------

CORPORATE BONDS AND NOTES - (CONTINUED)

TRADING COMPANIES & DISTRIBUTORS - 2.7%

$ 425,000 RSC Equipment Rental, Inc./RSC

Holdings III LLC (b) .................................. 10.25% 11/15/19 $ 445,188

400,000 United Rentals North America, Inc. ....................... 9.25% 12/15/19 430,000

-------------

875,188

-------------

TOTAL CORPORATE BONDS AND NOTES

(Cost $22,667,195) ....................................... 23,585,161

-------------

U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES- 25.3%

3,875,000 FannieMae, June (g) ...................................... 5.50% 30 yr. TBA 4,077,229

FannieMae-ACES

5,760,968 Series 1998-M7, Class N, IO (f) ....................... 0.43% 05/25/36 69,463

3,875,000 Government National Mortgage

Association, June (g) ................................. 5.00% 30 yr. TBA 4,016,104

-------------

TOTAL U.S. GOVERNMENT AGENCY MORTGAGE-BACKED SECURITIES

(Cost $8,195,004) ........................................ 8,162,796

-------------

SENIOR FLOATING-RATE NOTES - 0.6%

ENERGY EQUIPMENT & SERVICES - 0.6%

225,000 Texas Competitive Electric Holdings Co., LLC

Tranche B2 (f) ........................................ 3.80% 10/10/14 184,247

-------------

TOTAL SENIOR FLOATING-RATE NOTES

(Cost $185,906) .......................................... 184,247

-------------

STRUCTURED NOTES - 0.0%

3,750,000 Preferred Term Securities XXV, Ltd. (d) .................. (h) 06/22/37 375

-------------

TOTAL STRUCTURED NOTES

(Cost $0) ............................................... 375

-------------

|

SHARES DESCRIPTION VALUE

------------- ------------------------------------------------------------------------------- -------------

PREFERRED SECURITIES - 0.1%

2,000 Soloso CDO, Ltd., Series 2005-1 (d) (h) ....................................... 20,000

3,000 White Marlin CDO, Ltd., Series AI (d) (h) (i) ................................. 15,000

-------------

TOTAL PREFERRED SECURITIES

(Cost $0) ..................................................................... 35,000

-------------

TOTAL INVESTMENTS - 122.4%

(Cost $48,041,490) (j) ........................................................ 39,413,247

NET OTHER ASSETS AND LIABILITIES - (22.4%) ................................... (7,200,302)

-------------

NET ASSETS - 100.0% ........................................................... $ 32,212,945

=============

|

(a) All percentages shown in the Portfolio of Investments are based on net

assets.

(b) This security, sold within the terms of a private placement memorandum, is

exempt from registration under Rule 144A under the Securities Act of 1933,

as amended (the "1933 Act"), and may be resold in transactions exempt from

registration, normally to qualified institutional buyers. Pursuant to

procedures adopted by the Fund's Board of Trustees, this security has been

determined to be liquid by Brookfield

See Notes to Financial Statements

Page 10

FIRST TRUST STRATEGIC HIGH INCOME FUND

PORTFOLIO OF INVESTMENTS (A) - (CONTINUED)

APRIL 30, 2010 (UNAUDITED)

Investment Management Inc., the Fund's investment sub-advisor. Although

market instability can result in periods of increased overall market

illiquidity, liquidity for each security is determined based on security

specific factors and assumptions, which require subjective judgment. At

April 30, 2010, securities noted as such amounted to $10,220,396 or 31.7%

of net assets.

(c) Security missed its last interest payment.

(d) This security, sold within the terms of a private placement memorandum, is

exempt from registration under Rule 144A under the 1933 Act and may be

resold in transactions exempt from registration, normally to qualified

institutional buyers (see Note 2C - Restricted Securities in the Notes to

Financial Statements).

(e) Security is receiving less than the stated coupon.

(f) Floating rate security. The interest rate shown reflects the rate in effect

at April 30, 2010.

(g) Security purchased on a forward commitment basis.

(h) Zero coupon investment.

(i) The issuer is in default. Income is not being accrued.

(j) Aggregate cost for financial reporting purposes, which approximates the

aggregate cost for federal income tax purposes. As of April 30, 2010, the

aggregate gross unrealized appreciation for all securities in which there

was an excess of value over tax cost was $2,165,334 and the aggregate gross

unrealized depreciation for all securities in which there was an excess of

tax cost over value was $10,793,577.

ACES Alternative Credit Enhancement Securities

CBO Collateralized Bond Obligation

CDO Collateralized Debt Obligation

IO Interest Only Security

TBA To be announced; maturity date has not yet been established. Upon

settlement and delivery of the mortgage pools, maturity dates will be

assigned.

|

VALUATION INPUTS

A summary of the inputs used to value the Fund's total investments as of April

30, 2010 is as follows (see Note 2A - Portfolio Valuation in the Notes to

Financial Statements):

LEVEL 2

TOTAL LEVEL 1 SIGNIFICANT LEVEL 3

VALUE AT QUOTED OBSERVABLE UNOBSERVABLE

4/30/2010 PRICES INPUTS INPUTS

----------- ------- ----------- ------------

Asset-Backed Securities ................. $ 4,524,249 $-- $ 4,459,816 $64,433

Collateralized Mortgage Obligations ..... 448,422 -- 448,422 --

Commercial Mortgage-Backed Securities ... 2,472,997 -- 2,472,997 --

Corporate Bonds and Notes ............... 23,585,161 -- 23,585,161 --

U.S. Government Agency Mortgage-Backed

Securities ........................... 8,162,796 -- 8,162,796 --

Senior Floating-Rate Notes .............. 184,247 -- 184,247 --

Structured Notes ........................ 375 -- 375 --

Preferred Securities .................... 35,000 -- -- 35,000

----------- --- ----------- -------

TOTAL INVESTMENTS $39,413,247 $-- $39,313,814 $99,433

=========== === =========== =======

|

The following table presents the Fund's investments measured at fair value on a

recurring basis using significant unobservable inputs (Level 3) for the period

presented.

NET CHANGE IN

TRANSFERS REALIZED NET UNREALIZED NET BALANCE

INVESTMENTS AT FAIR VALUE USING BALANCE AS OF IN (OUT) GAINS APPRECIATION PURCHASES AS OF

SIGNIFICANT UNOBSERVABLE INPUTS (LEVEL 3) OCTOBER 31, 2009 OF LEVEL 3 (LOSSES) (DEPRECIATION) (SALES) APRIL 30, 2010

----------------------------------------- ---------------- ---------- ----------- -------------- ----------- --------------

Asset-Backed Securities ................. $1,648,255 $(128,244) $ (671,914) $ 565,424 $(1,349,088) $64,433

Corporate Bonds and Notes ............... 482,400 -- (225,000) 717,600 (975,000) --

Structured Notes ........................ 92,250 -- 58,535 315,059 (465,844) --

Preferred Securities .................... 84,500 -- (306,657) 464,157 (207,000) 35,000

---------- --------- ----------- ---------- ----------- -------

Total Investments ....................... $2,307,405 $(128,244) $(1,145,036) $2,062,240 $(2,996,932) $99,433

========== ========= =========== ========== =========== =======

|

Net change in unrealized appreciation/depreciation from Level 3 investments held

as of April 30, 2010 was $429,851 and is included in the "Net change in

unrealized appreciation (depreciation) on investments" on the Statement of

Operations.

See Notes to Financial Statements

Page 11

FIRST TRUST STRATEGIC HIGH INCOME FUND

STATEMENT OF ASSETS AND LIABILITIES

APRIL 30, 2010 (UNAUDITED)

ASSETS:

Investments, at value

Cost ($48,041,490) ................................................. $ 39,413,247

Cash .................................................................. 503,149

Prepaid expenses ...................................................... 19,586

Receivables:

Investment securities sold ......................................... 8,155,964

Interest ........................................................... 793,610

------------

Total Assets .................................................... 48,885,556

------------

LIABILITIES:

Payables:

Investment securities purchased .................................... 16,584,982

Audit and tax fees ................................................. 29,425

Investment advisory fees ........................................... 23,429

Printing fees ...................................................... 13,669

Administrative fees ................................................ 8,333

Transfer agent fees ................................................ 4,089

Trustees' fees and expenses ........................................ 2,291

Legal fees ......................................................... 2,290

Custodian fees ..................................................... 669

Other liabilities ..................................................... 3,434

------------

Total Liabilities ............................................... 16,672,611

------------

NET ASSETS ............................................................ $ 32,212,945

============

NET ASSETS CONSIST OF:

Paid-in capital ....................................................... $127,981,197

Par value ............................................................. 91,506

Accumulated net investment income (loss) .............................. (1,123,783)

Accumulated net realized gain (loss) on investments ................... (86,107,732)

Net unrealized appreciation (depreciation) on investments ............. (8,628,243)

------------

NET ASSETS ............................................................ $ 32,212,945

============

NET ASSET VALUE, per Common Share (par value $0.01 per Common Share) .. $ 3.52

============

Number of Common Shares outstanding (unlimited number of Common

Shares has been authorized) ........................................ 9,150,594

============

|

See Notes to Financial Statements

Page 12

FIRST TRUST STRATEGIC HIGH INCOME FUND

STATEMENT OF OPERATIONS

FOR THE SIX MONTHS ENDED APRIL 30, 2010 (UNAUDITED)

INVESTMENT INCOME:

Interest ................................................................ $ 2,179,687

-----------

Total investment income ........................................... 2,179,687

-----------

EXPENSES:

Investment advisory fees ................................................ 133,797

Legal fees .............................................................. 79,250

Administrative fees ..................................................... 49,999

Printing fees ........................................................... 48,035

Audit and tax fees ...................................................... 25,260

Trustees' fees and expenses ............................................. 18,598

Transfer agent fees ..................................................... 18,000

Custodian fees .......................................................... 4,755

Other ................................................................... 34,967

-----------

Total expenses .................................................... 412,661

-----------

NET INVESTMENT INCOME ................................................... 1,767,026

-----------

NET REALIZED AND UNREALIZED GAIN (LOSS):

Net realized gain (loss) on investments .............................. (3,970,230)

Net change in unrealized appreciation (depreciation) of investments .. 9,051,235

-----------

NET REALIZED AND UNREALIZED GAIN (LOSS) ................................. 5,081,005

-----------

NET INCREASE (DECREASE) IN NET ASSETS RESULTING FROM OPERATIONS ......... $ 6,848,031

===========

|

See Notes to Financial Statements

Page 13

FIRST TRUST STRATEGIC HIGH INCOME FUND

STATEMENTS OF CHANGES IN NET ASSETS

SIX MONTHS

ENDED YEAR

4/30/2010 ENDED

(UNAUDITED) 10/31/2009

----------- ------------

OPERATIONS:

Net investment income (loss) ............................................... $ 1,767,026 $ 9,794,757

Net realized gain (loss) ................................................... (3,970,230) (78,709,995)

Net change in unrealized appreciation (depreciation) ....................... 9,051,235 45,535,716

----------- ------------

Net increase (decrease) in net assets resulting from operations ............ 6,848,031 (23,379,522)

----------- ------------

DISTRIBUTIONS TO SHAREHOLDERS FROM:

Net investment income ...................................................... (1,372,589) --

Return of capital .......................................................... -- (9,752,238)

----------- ------------

Total distributions to shareholders ........................................ (1,372,589) (9,752,238)

----------- ------------

CAPITAL TRANSACTIONS:

Proceeds from Common Shares reinvested ..................................... -- 488,089

----------- ------------

Net increase (decrease) in net assets resulting from capital transactions .. -- 488,089

----------- ------------

Total increase (decrease) in net assets .................................... 5,475,442 (32,643,671)

NET ASSETS:

Beginning of period ........................................................ 26,737,503 59,381,174

----------- ------------

End of period .............................................................. $32,212,945 $ 26,737,503

=========== ============

Accumulated net investment income (loss) at end of period .................. $(1,123,783) $ (1,518,220)

=========== ============

CAPITAL TRANSACTIONS WERE AS FOLLOWS:

Common Shares at beginning of period ....................................... 9,150,594 9,035,801

Common Shares issued as reinvestment under the Dividend Reinvestment Plan .. -- 114,793

----------- ------------

Common Shares at end of period ............................................. 9,150,594 9,150,594

=========== ============

|

See Notes to Financial Statements

Page 14

FIRST TRUST STRATEGIC HIGH INCOME FUND

STATEMENT OF CASH FLOWS

FOR THE SIX MONTHS ENDED APRIL 30, 2010 (UNAUDITED)

CASH FLOWS FROM OPERATING ACTIVITIES:

Net increase (decrease) in net assets resulting from operations ........... $ 6,848,031

Adjustments to reconcile net increase (decrease) in net assets resulting

from operations to net cash provided by operating activities:

Purchases of investments ............................................... (79,335,582)

Sales, maturities and paydowns of investments .......................... 79,416,131

Net amortization/accretion of premiums/discount on investments ......... 709,289

Net realized gain/loss on investments .................................. 3,970,230

Net change in unrealized appreciation/depreciation on investments ...... (9,051,235)

CHANGES IN ASSETS AND LIABILITIES:

Increase in interest receivable ........................................ (40,378)

Increase in receivable for investment securities sold .................. (8,130,827)

Increase in prepaid expenses ........................................... (13,550)

Increase in payable for investment securities purchased ................ 4,996,188

Increase in investment advisory fees payable ........................... 3,569

Decrease in audit and tax fees payable ................................. (21,608)

Decrease in legal fees payable ......................................... (1,608)

Decrease in printing fees payable ...................................... (12,460)

Increase in transfer agent fees payable ................................ 1,238

Decrease in custodian fees payable ..................................... (1,084)

Decrease in Trustees' fees and expenses payable ........................ (1,168)

Decrease in other liabilities .......................................... (84)

------------

CASH USED BY OPERATING ACTIVITIES ......................................... $ (664,908)

-----------

CASH FLOWS FROM FINANCING ACTIVITIES:

Distributions to Common Shareholders from net investment income ........ (1,372,589)

------------

CASH USED BY FINANCING ACTIVITIES ......................................... (1,372,589)

-----------

Decrease in cash .......................................................... (2,037,497)

Cash at beginning of period ............................................... 2,540,646

-----------

CASH AT END OF PERIOD ..................................................... $ 503,149

===========

|

See Notes to Financial Statements

Page 15

FIRST TRUST STRATEGIC HIGH INCOME FUND

FINANCIAL HIGHLIGHTS

FOR A COMMON SHARE OUTSTANDING THROUGHOUT EACH PERIOD

SIX MONTHS

ENDED YEAR YEAR YEAR YEAR PERIOD

4/30/2010 ENDED ENDED ENDED ENDED ENDED

(UNAUDITED) 10/31/2009(a) 10/31/2008 10/31/2007 10/31/2006 10/31/2005(b)

----------- ------------- ---------- ---------- ---------- -------------

Net asset value, beginning of period ............ $ 2.92 $ 6.57 $ 15.16 $ 19.82 $ 19.13 $ 19.10(c)

------- ------- ------- -------- -------- ---------

INCOME FROM INVESTMENT OPERATIONS:

Net investment income ........................... 0.19 1.07 2.05 2.17 2.08 0.39

Net realized and unrealized gain (loss) ......... 0.56 (3.64) (8.72) (4.84) 0.76 (0.17)

------- ------- ------- -------- -------- ---------

Total from investment operations ................ 0.75 (2.57) (6.67) (2.67) 2.84 0.22

------- ------- ------- -------- -------- ---------

DISTRIBUTIONS PAID TO SHAREHOLDERS FROM:

Net investment income ........................... (0.15) -- (0.81) (1.97) (2.15) (0.15)

Net realized gain ............................... -- -- -- (0.02) -- --

Return of capital ............................... -- (1.08) (1.11) -- -- --

------- ------- ------- -------- -------- ---------

Total distributions ............................. (0.15) (1.08) (1.92) (1.99) (2.15) (0.15)

------- ------- ------- -------- -------- ---------

Common Shares offering costs charged to

paid-in capital .............................. -- -- -- -- -- (0.04)

------- ------- ------- -------- -------- ---------

Net asset value, end of period .................. $ 3.52 $ 2.92 $ 6.57 $ 15.16 $ 19.82 $ 19.13

======= ======= ======= ======== ======== =========

Market value, end of period ..................... $ 3.32 $ 2.63 $ 6.34 $ 14.19 $ 21.19 $ 18.79

======= ======= ======= ======== ======== =========

TOTAL RETURN BASED ON NET ASSET VALUE (d) ....... 26.63% (42.52)% (47.16)% (14.65)% 15.73% 1.03%

======= ======= ======= ======== ======== =========

TOTAL RETURN BASED ON MARKET VALUE (d) .......... 32.60% (46.35)% (45.56)% (25.30)% 26.16% (5.28)%

======= ======= ======= ======== ======== =========

RATIOS TO AVERAGE NET ASSETS/SUPPLEMENTAL DATA:

Net assets, end of period (in 000's) ............ $32,213 $26,738 $59,381 $136,145 $176,375 $ 168,413

Ratio of total expenses to average net assets ... 2.78%(e) 1.78% 4.32% 3.70% 1.20% 1.33%(e)

Ratio of total expenses to average net assets

excluding interest expense and fees .......... 2.78%(e) 1.72% 2.21% 1.68% 1.20% 1.33%(e)

Ratio of net investment income to average

net assets ................................... 11.89%(e) 28.82% 19.21% 11.78% 10.84% 7.82%(e)

Portfolio turnover rate ......................... 207%(f) 127%(f) 4% 19% 78% 19%

INDEBTEDNESS:

Loan outstanding (in 000's) ..................... N/A N/A $15,000 $ 61,200 N/A N/A

Asset coverage per $1,000 of indebtedness (g) ... N/A N/A $ 4,959 $ 3,225 N/A N/A

|

(a) On June 29, 2009, the Fund's Board of Trustees approved an interim

sub-advisory agreement with Brookfield Investment Management Inc. (formerly

known as Hyperion Brookfield Asset Management, Inc.) ("Brookfield"), and on

October 14, 2009, the Shareholders voted to approve Brookfield as

investment sub-advisor.

(b) Initial seed date of July 19, 2005. The Fund commenced operations on July

26, 2005.

(c) Net of sales load of $0.90 per share on initial offering.

(d) Total return is based on the combination of reinvested dividend, capital

gain and return of capital distributions, if any, at prices obtained by the

Dividend Reinvestment Plan, and changes in net asset value per share for

net asset value returns and changes in Common Share price for market value

returns. Total returns do not reflect sales load and are not annualized for

periods less than one year.

(e) Annualized.

(f) In the six months ended April 30, 2010 and the fiscal year ended October

31, 2009, the Fund's portfolio turnover rate reflects mortgage pool forward

commitments as purchases and sales. This caused the reported portfolio

turnover rate to be higher than in previous fiscal years. The turnover rate

may vary greatly from year to year as well as within a year.

(g) Calculated by subtracting the Fund's total liabilities (not including the

loan outstanding) from the Fund's total assets, and dividing by the

outstanding loan balance in 000's.

N/A Not Applicable.

See Notes to Financial Statements

Page 16

NOTES TO FINANCIAL STATEMENTS

FIRST TRUST STRATEGIC HIGH INCOME FUND

APRIL 30, 2010 (UNAUDITED)

1. FUND DESCRIPTION

First Trust Strategic High Income Fund (the "Fund") is a diversified, closed-end

management investment company organized as a Massachusetts business trust on

April 15, 2005 and is registered with the Securities and Exchange Commission

("SEC") under the Investment Company Act of 1940, as amended (the "1940 Act").

The Fund trades under the ticker symbol FHI on the New York Stock Exchange

("NYSE").

The Fund's primary investment objective is to seek a high level of current

income. The Fund seeks capital growth as a secondary objective. The Fund seeks

to achieve its investment objectives by investing up to 100% of its managed

assets in below-investment grade debt securities (commonly referred to as

"high-yield" or "junk bonds"). Managed assets means the value of the securities

and other investments the Fund holds plus cash or other assets, including

interest accrued but not yet received minus liabilities other than the principal

amount of borrowings. There can be no assurance that the Fund will achieve its

investment objectives. The Fund may not be appropriate for all investors.

2. SIGNIFICANT ACCOUNTING POLICIES

The following is a summary of significant accounting policies consistently

followed by the Fund in the preparation of its financial statements. The

preparation of financial statements in accordance with accounting principles

generally accepted in the United States of America requires management to make

estimates and assumptions that affect the reported amounts and disclosures in

the financial statements. Actual results could differ from those estimates.

A. PORTFOLIO VALUATION:

The net asset value ("NAV") of the Common Shares of the Fund is determined daily

as of the close of regular trading on the NYSE, normally 4:00 p.m. Eastern time,

on each day the NYSE is open for trading. Domestic debt securities and foreign

securities are priced using data reflecting the earlier closing of the principal

markets for those securities. The NAV per Common Share is calculated by dividing

the value of all assets of the Fund (including accrued interest and dividends),

less all liabilities (including accrued expenses, dividends declared but unpaid

and any borrowings of the Fund) by the total number of Common Shares

outstanding.

The Fund's investments are valued daily at market value or, in the absence of

market value with respect to any portfolio securities, at fair value according

to procedures adopted by the Fund's Board of Trustees. Securities for which

market quotations are readily available are valued at market value, which is

currently determined using the last reported sale price on the business day as

of which such value is being determined or, if no sales are reported on such day

(as in the case of some securities traded over-the-counter), the last reported

bid price, except that certain U.S. Government securities are valued at the mean

between the last reported bid and asked prices. The Fund values mortgage-backed

securities and other debt securities not traded in an organized market on the

basis of valuations provided by dealers who make markets in such securities or

by independent pricing services approved by the Board of Trustees which use

information with respect to transactions in such securities, quotations from

dealers, market transactions for comparable securities, various relationships

between securities and yield to maturity in determining value. In the Fund's

financial statements, the Statement of Assets and Liabilities includes

investments with a value of $99,433 (0.3% of total investments) as of April 30,

2010 whose values have been determined based on prices supplied by dealers and

investments with a value of $39,313,814 (99.7% of total investments) whose

values have been determined based on prices supplied by independent pricing

services. A ready market does not exist for some of these investments. As such,

these values may differ from the values that would have been used had a ready

market for these investments existed, and the differences could be material.

Debt securities having a remaining maturity of less than sixty days when

purchased are valued at cost adjusted for amortization of premiums and accretion

of discounts.

In the event that market quotations are not readily available, the pricing

service or dealer does not provide a valuation for a particular asset, or the

valuations are deemed unreliable, the Fund's Board of Trustees has designated

First Trust Advisors L.P. ("First Trust") to use a fair value method to value

the Fund's securities and other investments. Additionally, if events occur after

the close of the principal markets for particular securities (e.g., domestic

debt and foreign securities), but before the Fund values its assets, that could

materially affect NAV, First Trust may use a fair value method to value the

Fund's securities and other investments. As a general principle, the fair value

of a security is the amount which the Fund might reasonably expect to receive

for the security upon its current sale. A variety of factors may be considered

in determining the fair value of such securities including 1) the fundamental

business data relating to the issuer; 2) an evaluation of the forces which

influence the market in which these securities are purchased and sold; 3) type

of holding; 4) financial statements of the issuer; 5) cost at date of purchase;

6) credit quality and cash flow of the issuer based on external analysis; 7)

information as to any transactions in or offers for the holding; 8) price and

extent of public trading in similar securities of the issuer/borrower, or

comparable companies; and 9) other relevant factors. The use of fair value

pricing by the Fund is governed by valuation procedures adopted by the Fund's

Board of Trustees, and in accordance with the provisions of the 1940 Act. When

fair value pricing of securities is employed, the prices of securities used by

the Fund to calculate its NAV may differ from market quotations or official

closing prices. In light of the judgment involved in fair valuations, there can

be no assurance that a fair value assigned to a particular security will be the

amount which the Fund might be able to receive upon its current sale.

Page 17

NOTES TO FINANCIAL STATEMENTS - (CONTINUED)

FIRST TRUST STRATEGIC HIGH INCOME FUND

APRIL 30, 2010 (UNAUDITED)

The Fund invests a significant portion of its assets in below-investment grade

debt securities, including mortgage-backed securities, asset-backed securities,

corporate bonds and collateralized debt obligations. The value and related

income of these securities is sensitive to changes in economic conditions,

including delinquencies and/or defaults. Instability in the markets for

fixed-income securities, particularly mortgage-backed and asset-backed

securities, has resulted in increased volatility and periods of illiquidity that

have adversely impacted the valuation of certain securities held by the Fund.

The Fund is subject to fair value accounting standards that define fair value,

establish the framework for measuring fair value and provide a three-level

hierarchy for fair valuation based upon the inputs to the valuation as of the

measurement date. The three levels of the fair value hierarchy are as follows:

- Level 1 - Level 1 inputs are quoted prices in active markets for

identical securities. An active market is a market in which

transactions for the security occur with sufficient frequency and

volume to provide pricing information on an ongoing basis.

- Level 2 - Level 2 inputs are observable inputs, either directly or

indirectly, and include the following:

- Quoted prices for similar securities in active markets.

- Quoted prices for identical or similar securities in markets

that are non-active. A non-active market is a market where

there are few transactions for the security, the prices are

not current, or price quotations vary substantially either

over time or among market makers, or in which little

information is released publicly.

- Inputs other than quoted prices that are observable for the

security (for example, interest rates and yield curves

observable at commonly quoted intervals, volatilities,

prepayment speeds, loss severities, credit risks, and

default rates).

- Inputs that are derived principally from or corroborated by

observable market data by correlation or other means.

- Level 3 - Level 3 inputs are unobservable inputs. Unobservable inputs

reflect the reporting entity's own assumptions about the assumptions

that market participants would use in pricing the security.

The inputs or methodology used for valuing securities are not necessarily an

indication of the risk associated with investing in those securities. A summary

of the inputs used to value the Fund's investments as of April 30, 2010, is

included with the Fund's Portfolio of Investments.

B. SECURITIES TRANSACTIONS AND INVESTMENT INCOME:

Securities transactions are recorded as of the trade date. Realized gains and

losses from securities transactions are recorded on the identified cost basis.

Interest income is recorded on the accrual basis. Amortization of premiums and

accretion of discounts are recorded using the effective interest method.

The Fund invests in certain lower credit quality securitized assets that have

contractual cash flows (for example, asset-backed securities, collateralized

mortgage obligations and commercial mortgage-backed securities). For these

securities, if there is a change in the estimated cash flows, based on an

evaluation of current information, then the estimated yield is adjusted on a

prospective basis over the remaining life of the security. Additionally, if the

evaluation of current information indicates a permanent impairment of the

security, the cost basis of the security is written down and a loss is

recognized. Debt obligations may be placed on non-accrual status, and related

interest income may be reduced by ceasing current accruals and

amortization/accretion and writing off interest receivables when the collection

of all or a portion of interest has become doubtful based on consistently

applied procedures. A debt obligation is removed from non-accrual status when

the issuer resumes interest payments or when collectibility of interest is

reasonably assured.

The Fund may purchase and sell securities on a "when-issued", "delayed delivery"

or "forward commitment" basis, with settlement to occur at a later date. The