false000127618700012761872024-07-152024-07-150001276187et:CommonUnitsMember2024-07-152024-07-150001276187et:ETprIMember2024-07-152024-07-15

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

| | | | | | | | |

| July 15, 2024 |

| Date of Report (Date of earliest event reported) |

|

| ENERGY TRANSFER LP |

| (Exact name of Registrant as specified in its charter) |

| | |

| Delaware | 1-32740 | 30-0108820 |

| (State or other jurisdiction of incorporation) | (Commission File Number) | (IRS Employer Identification No.) |

8111 Westchester Drive, Suite 600

Dallas, Texas 75225

(Address of principal executive offices) (zip code)

| | | | | |

| (214) | 981-0700 |

| (Registrant’s telephone number, including area code) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading symbol(s) | | Name of each exchange on which registered |

| Common Units | | ET | | New York Stock Exchange |

| 9.250% Series I Fixed Rate Perpetual Preferred Units | | ETprI | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ¨

Item 7.01. Regulation FD Disclosure.

On July 15, 2024, Energy Transfer LP, a Delaware limited partnership (“Energy Transfer”), issued a press release announcing the completion of the transactions contemplated by the Contribution and Sale Agreement, dated as of May 28, 2024, by and among ETC Midland Gas Gathering LLC, a Texas limited liability company and a wholly owned subsidiary of Energy Transfer, WTG Midstream LLC, a Delaware limited liability company and, solely for the limited purposes set forth therein, Energy Transfer. A copy of the press release is attached hereto as Exhibit 99.1 and is incorporated herein by reference. In accordance with General Instruction B.2 of Form 8-K, the information in this Item 7.01, including Exhibit 99.1, shall not be deemed “filed” for the purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the liabilities of that section, nor shall such information, including Exhibit 99.1, be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended, or the Exchange Act, except as shall be expressly set forth by specific reference in such filing.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

| | | | | | | | |

| Exhibit Number | | Description |

| | |

| | |

| | |

| | |

| | |

| | |

| 104 | | Cover Page Interactive File (the cover page tags are embedded within the Inline XBRL document) |

| | |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | ENERGY TRANSFER LP |

| | By: | LE GP, LLC, |

| | | its general partner |

| | | |

| Date: | July 16, 2024 | | /s/ Dylan A. Bramhall |

| | | Dylan A. Bramhall |

| | | Executive Vice President & Group Chief Financial Officer |

ENERGY TRANSFER COMPLETES ACQUISITION OF WTG MIDSTREAM

Expands Permian Basin pipeline and processing network

providing further access to growing supplies of natural gas and NGLs

DALLAS — July 15, 2024 - Energy Transfer LP (NYSE: ET) (Energy Transfer) announced today the completion of its previously announced acquisition of WTG Midstream Holdings LLC (WTG). Total consideration for the transaction was $2,275 million in cash and approximately 50.8 million newly issued ET common units.

The acquired assets add approximately 6,000 miles of complementary gas gathering pipelines that extend Energy Transfer’s network in the Midland Basin. Also, as part of the transaction, the Partnership added eight gas processing plants with a total capacity of approximately 1.3 Bcf/d, and two additional processing plants which are under construction.

The transaction is expected to add a growing supply of NGL and natural gas volumes to Energy Transfer’s system, providing incremental revenue from gathering and processing activities along with downstream transportation and fractionation fees. The Partnership expects the WTG assets to add approximately $0.04 of Distributable Cash Flow (DCF) per common unit in 2025, increasing to approximately $0.07 per common unit in 2027.

About Energy Transfer

Energy Transfer LP (NYSE: ET) owns and operates one of the largest and most diversified portfolios of energy assets in the United States, with more than 130,000 miles of pipeline and associated energy infrastructure. Energy Transfer’s strategic network spans 44 states with assets in all of the major U.S. production basins. Energy Transfer is a publicly traded limited partnership with core operations that include complementary natural gas midstream, intrastate and interstate transportation and storage assets; crude oil, natural gas liquids (“NGL”) and refined product transportation and terminalling assets; and NGL fractionation. Energy Transfer also owns Lake Charles LNG Company, as well as the general partner interests, the incentive distribution rights and approximately 21% of the outstanding common units of Sunoco LP (NYSE: SUN), and the general partner interests and approximately 39% of the outstanding common units of USA Compression Partners, LP (NYSE: USAC). For more information, visit the Energy Transfer LP website at www.energytransfer.com.

Forward Looking Statements

This communication contains “forward-looking statements.” In this context, forward-looking statements often address future business and financial events, conditions, expectations, plans or ambitions, and often include, but are not limited to, words such as “believe,” “expect,” “may,” “will,” “should,” “could,” “would,” “anticipate,” “estimate,” “intend,” “plan,” “seek,” “see,” “target” or similar expressions, or variations or negatives of these words, but not all forward-looking statements include such words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the transaction and the anticipated benefits thereof. All such forward-looking statements are based upon current plans, estimates, expectations and ambitions that are subject to risks, uncertainties and assumptions, many of which are beyond the control of Energy Transfer, that could cause actual results to differ materially from those expressed in such forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to: anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined company’s operations; the ability of Energy Transfer to integrate the business successfully and to achieve anticipated synergies and value creation; potential litigation relating to the transaction; the risk that disruptions from the transaction will harm Energy Transfer’s business, including current plans and operations and that management’s time and attention will be diverted on transaction-related issues; potential adverse reactions or changes to business relationships, including with employees

suppliers, customers, competitors or credit rating agencies, resulting from the completion of the transaction; rating agency actions; legislative, regulatory and economic developments, changes in local, national, or international laws, regulations, and policies affecting Energy Transfer; changes in the supply, demand or price of oil, natural gas, and natural gas liquids; those risks described in Item 1A of Energy Transfer’s Annual Report on Form 10-K, filed with the Securities and Exchange Commission (the “SEC”) on February 16, 2024, and its subsequent Quarterly Reports on Form 10‑Q and Current Reports on Form 8-K.

While the list of factors presented here is considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may present significant additional obstacles to the realization of forward-looking statements. Energy Transfer cautions you not to place undue reliance on any of these forward-looking statements as they are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and the development of new markets or market segments in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this communication. Energy Transfer does not assume any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. Neither future distribution of this communication nor the continued availability of this communication in archive form on Energy Transfer’s website should be deemed to constitute an update or re-affirmation of these statements as of any future date.

Energy Transfer

Investor Relations:

Bill Baerg, Brent Ratliff, Lyndsay Hannah, 214-981-0795

Media Relations:

Media@energytransfer.com

214-840-5820

v3.24.2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=et_CommonUnitsMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=et_ETprIMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

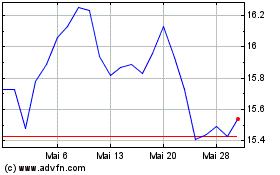

Energy Transfer (NYSE:ET)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Energy Transfer (NYSE:ET)

Historical Stock Chart

Von Dez 2023 bis Dez 2024