0000894627VAALCO ENERGY INC /DE/false2024Q3--12-31http://fasb.org/us-gaap/2024#AccountingStandardsUpdate201613Memberhttp://fasb.org/us-gaap/2024#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesAndOtherLiabilitieshttp://fasb.org/us-gaap/2024#PrepaidExpenseAndOtherAssetsCurrenthttp://fasb.org/us-gaap/2024#AccruedLiabilitiesAndOtherLiabilitiesxbrli:sharesiso4217:USDiso4217:USDxbrli:sharesxbrli:pureutr:bbliso4217:USDutr:bbliso4217:USDegy:itemutr:Mcf00008946272024-01-012024-09-3000008946272024-11-0700008946272024-09-3000008946272023-12-310000894627us-gaap:NonrelatedPartyMember2024-09-300000894627us-gaap:NonrelatedPartyMember2023-12-310000894627us-gaap:RelatedPartyMember2024-09-300000894627us-gaap:RelatedPartyMember2023-12-3100008946272024-07-012024-09-3000008946272023-07-012023-09-3000008946272023-01-012023-09-300000894627us-gaap:CommonStockMember2023-12-310000894627us-gaap:TreasuryStockCommonMember2023-12-310000894627us-gaap:AdditionalPaidInCapitalMember2023-12-310000894627us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-12-310000894627us-gaap:RetainedEarningsMember2023-12-310000894627us-gaap:CommonStockMember2024-01-012024-03-310000894627us-gaap:AdditionalPaidInCapitalMember2024-01-012024-03-3100008946272024-01-012024-03-310000894627us-gaap:TreasuryStockCommonMember2024-01-012024-03-310000894627us-gaap:RetainedEarningsMember2024-01-012024-03-310000894627us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-01-012024-03-310000894627us-gaap:CommonStockMember2024-03-310000894627us-gaap:TreasuryStockCommonMember2024-03-310000894627us-gaap:AdditionalPaidInCapitalMember2024-03-310000894627us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-03-310000894627us-gaap:RetainedEarningsMember2024-03-3100008946272024-03-310000894627us-gaap:CommonStockMember2024-04-012024-06-300000894627us-gaap:AdditionalPaidInCapitalMember2024-04-012024-06-3000008946272024-04-012024-06-300000894627us-gaap:TreasuryStockCommonMember2024-04-012024-06-300000894627us-gaap:RetainedEarningsMember2024-04-012024-06-300000894627us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-04-012024-06-300000894627us-gaap:CommonStockMember2024-06-300000894627us-gaap:TreasuryStockCommonMember2024-06-300000894627us-gaap:AdditionalPaidInCapitalMember2024-06-300000894627us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-06-300000894627us-gaap:RetainedEarningsMember2024-06-3000008946272024-06-300000894627us-gaap:CommonStockMember2024-07-012024-09-300000894627us-gaap:AdditionalPaidInCapitalMember2024-07-012024-09-300000894627us-gaap:TreasuryStockCommonMember2024-07-012024-09-300000894627us-gaap:RetainedEarningsMember2024-07-012024-09-300000894627us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-07-012024-09-300000894627us-gaap:CommonStockMember2024-09-300000894627us-gaap:TreasuryStockCommonMember2024-09-300000894627us-gaap:AdditionalPaidInCapitalMember2024-09-300000894627us-gaap:AccumulatedOtherComprehensiveIncomeMember2024-09-300000894627us-gaap:RetainedEarningsMember2024-09-300000894627us-gaap:CommonStockMember2022-12-310000894627us-gaap:TreasuryStockCommonMember2022-12-310000894627us-gaap:AdditionalPaidInCapitalMember2022-12-310000894627us-gaap:AccumulatedOtherComprehensiveIncomeMember2022-12-310000894627us-gaap:RetainedEarningsMember2022-12-3100008946272022-12-310000894627us-gaap:CommonStockMember2023-01-012023-03-310000894627us-gaap:TreasuryStockCommonMember2023-01-012023-03-310000894627us-gaap:AdditionalPaidInCapitalMember2023-01-012023-03-3100008946272023-01-012023-03-310000894627us-gaap:RetainedEarningsMember2023-01-012023-03-310000894627srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:RetainedEarningsMember2022-12-310000894627srt:CumulativeEffectPeriodOfAdoptionAdjustmentMember2022-12-310000894627us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-01-012023-03-310000894627us-gaap:CommonStockMember2023-03-310000894627us-gaap:TreasuryStockCommonMember2023-03-310000894627us-gaap:AdditionalPaidInCapitalMember2023-03-310000894627us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-03-310000894627us-gaap:RetainedEarningsMember2023-03-3100008946272023-03-310000894627us-gaap:CommonStockMember2023-04-012023-06-300000894627us-gaap:TreasuryStockCommonMember2023-04-012023-06-300000894627us-gaap:AdditionalPaidInCapitalMember2023-04-012023-06-3000008946272023-04-012023-06-300000894627us-gaap:RetainedEarningsMember2023-04-012023-06-300000894627us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-04-012023-06-300000894627us-gaap:CommonStockMember2023-06-300000894627us-gaap:TreasuryStockCommonMember2023-06-300000894627us-gaap:AdditionalPaidInCapitalMember2023-06-300000894627us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-06-300000894627us-gaap:RetainedEarningsMember2023-06-3000008946272023-06-300000894627us-gaap:CommonStockMember2023-07-012023-09-300000894627us-gaap:TreasuryStockCommonMember2023-07-012023-09-300000894627us-gaap:AdditionalPaidInCapitalMember2023-07-012023-09-300000894627us-gaap:RetainedEarningsMember2023-07-012023-09-300000894627us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-07-012023-09-300000894627us-gaap:CommonStockMember2023-09-300000894627us-gaap:TreasuryStockCommonMember2023-09-300000894627us-gaap:AdditionalPaidInCapitalMember2023-09-300000894627us-gaap:AccumulatedOtherComprehensiveIncomeMember2023-09-300000894627us-gaap:RetainedEarningsMember2023-09-3000008946272023-09-300000894627srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201613Member2024-06-300000894627srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201613Member2023-06-300000894627srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201613Member2023-12-310000894627srt:CumulativeEffectPeriodOfAdoptionAdjustmentMemberus-gaap:AccountingStandardsUpdate201613Member2022-12-310000894627us-gaap:FairValueInputsLevel1Member2024-09-300000894627us-gaap:FairValueInputsLevel2Member2024-09-300000894627us-gaap:FairValueInputsLevel3Member2024-09-300000894627us-gaap:FairValueInputsLevel1Member2023-12-310000894627us-gaap:FairValueInputsLevel2Member2023-12-310000894627us-gaap:FairValueInputsLevel3Member2023-12-310000894627egy:SvenskaPetroleumExplorationAktiebolagMember2024-02-292024-02-290000894627egy:SvenskaPetroleumExplorationAktiebolagMember2024-04-302024-04-3000008946272024-04-302024-04-300000894627egy:SvenskaPetroleumExplorationAktiebolagMember2024-04-300000894627egy:SvenskaPetroleumExplorationAktiebolagMember2024-01-012024-09-300000894627egy:SvenskaPetroleumExplorationAktiebolagMember2024-05-012024-09-300000894627egy:SvenskaPetroleumExplorationAktiebolagMember2024-07-012024-09-300000894627egy:SvenskaPetroleumExplorationAktiebolagMember2023-07-012023-09-300000894627egy:SvenskaPetroleumExplorationAktiebolagMember2023-01-012023-09-300000894627us-gaap:OperatingSegmentsMemberegy:GabonSegmentMember2024-07-012024-09-300000894627us-gaap:OperatingSegmentsMemberegy:EgyptMember2024-07-012024-09-300000894627us-gaap:OperatingSegmentsMemberegy:CanadaMember2024-07-012024-09-300000894627us-gaap:OperatingSegmentsMemberegy:EquatorialGuineaSegmentMember2024-07-012024-09-300000894627us-gaap:OperatingSegmentsMemberegy:CoteDivoire1Member2024-07-012024-09-300000894627egy:CorporateAndReconcilingItemsMember2024-07-012024-09-300000894627us-gaap:OperatingSegmentsMemberegy:GabonSegmentMember2024-01-012024-09-300000894627us-gaap:OperatingSegmentsMemberegy:EgyptMember2024-01-012024-09-300000894627us-gaap:OperatingSegmentsMemberegy:CanadaMember2024-01-012024-09-300000894627us-gaap:OperatingSegmentsMemberegy:EquatorialGuineaSegmentMember2024-01-012024-09-300000894627us-gaap:OperatingSegmentsMemberegy:CoteDivoire1Member2024-01-012024-09-300000894627egy:CorporateAndReconcilingItemsMember2024-01-012024-09-300000894627us-gaap:OperatingSegmentsMemberegy:GabonSegmentMember2023-07-012023-09-300000894627us-gaap:OperatingSegmentsMemberegy:EgyptMember2023-07-012023-09-300000894627us-gaap:OperatingSegmentsMemberegy:CanadaMember2023-07-012023-09-300000894627us-gaap:OperatingSegmentsMemberegy:EquatorialGuineaSegmentMember2023-07-012023-09-300000894627egy:CorporateAndReconcilingItemsMember2023-07-012023-09-300000894627us-gaap:OperatingSegmentsMemberegy:GabonSegmentMember2023-01-012023-09-300000894627us-gaap:OperatingSegmentsMemberegy:EgyptMember2023-01-012023-09-300000894627us-gaap:OperatingSegmentsMemberegy:CanadaMember2023-01-012023-09-300000894627us-gaap:OperatingSegmentsMemberegy:EquatorialGuineaSegmentMember2023-01-012023-09-300000894627egy:CorporateAndReconcilingItemsMember2023-01-012023-09-300000894627us-gaap:OperatingSegmentsMemberegy:GabonSegmentMember2024-09-300000894627us-gaap:OperatingSegmentsMemberegy:EgyptMember2024-09-300000894627us-gaap:OperatingSegmentsMemberegy:CanadaMember2024-09-300000894627us-gaap:OperatingSegmentsMemberegy:EquatorialGuineaSegmentMember2024-09-300000894627us-gaap:OperatingSegmentsMemberegy:CoteDivoire1Member2024-09-300000894627us-gaap:CorporateNonSegmentMember2024-09-300000894627us-gaap:OperatingSegmentsMemberegy:GabonSegmentMember2023-12-310000894627us-gaap:OperatingSegmentsMemberegy:EgyptMember2023-12-310000894627us-gaap:OperatingSegmentsMemberegy:CanadaMember2023-12-310000894627us-gaap:OperatingSegmentsMemberegy:EquatorialGuineaSegmentMember2023-12-310000894627us-gaap:OperatingSegmentsMemberegy:CoteDivoire1Member2023-12-310000894627us-gaap:CorporateNonSegmentMember2023-12-310000894627egy:CrudeOilSalesAndPurchaseAgreementsMember2024-07-012024-09-300000894627egy:CrudeOilSalesAndPurchaseAgreementsMember2023-07-012023-09-300000894627egy:CrudeOilSalesAndPurchaseAgreementsMember2024-01-012024-09-300000894627egy:CrudeOilSalesAndPurchaseAgreementsMember2023-01-012023-09-300000894627egy:CarriedInterestRecoupmentMember2024-07-012024-09-300000894627egy:CarriedInterestRecoupmentMember2023-07-012023-09-300000894627egy:CarriedInterestRecoupmentMember2024-01-012024-09-300000894627egy:CarriedInterestRecoupmentMember2023-01-012023-09-300000894627us-gaap:OilAndGasMember2024-07-012024-09-300000894627us-gaap:OilAndGasMember2023-07-012023-09-300000894627us-gaap:OilAndGasMember2024-01-012024-09-300000894627us-gaap:OilAndGasMember2023-01-012023-09-300000894627us-gaap:ForeignCountryMemberegy:ProductionSharingContractSeptember172018ThroughSeptember162028Member2024-09-300000894627us-gaap:ForeignCountryMemberegy:ProductionSharingContractSeptember172018ThroughSeptember162028Member2023-12-310000894627country:EG2024-07-012024-09-300000894627country:EG2023-07-012023-09-300000894627country:EG2024-01-012024-09-300000894627country:EG2023-01-012023-09-300000894627country:CAsrt:CrudeOilMember2024-07-012024-09-300000894627country:CAsrt:CrudeOilMember2023-07-012023-09-300000894627country:CAsrt:CrudeOilMember2024-01-012024-09-300000894627country:CAsrt:CrudeOilMember2023-01-012023-09-300000894627country:CAegy:GasMember2024-07-012024-09-300000894627country:CAegy:GasMember2023-07-012023-09-300000894627country:CAegy:GasMember2024-01-012024-09-300000894627country:CAegy:GasMember2023-01-012023-09-300000894627country:CAsrt:NaturalGasLiquidsReservesMember2024-07-012024-09-300000894627country:CAsrt:NaturalGasLiquidsReservesMember2023-07-012023-09-300000894627country:CAsrt:NaturalGasLiquidsReservesMember2024-01-012024-09-300000894627country:CAsrt:NaturalGasLiquidsReservesMember2023-01-012023-09-300000894627country:CA2024-07-012024-09-300000894627country:CA2023-07-012023-09-300000894627country:CA2024-01-012024-09-300000894627country:CA2023-01-012023-09-300000894627egy:CoteDivoire1Member2024-07-012024-09-300000894627egy:CoteDivoire1Member2023-07-012023-09-300000894627egy:CoteDivoire1Member2024-01-012024-09-300000894627egy:CoteDivoire1Member2023-01-012023-09-300000894627egy:CustomerOneMembercountry:GAus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-07-012024-09-300000894627egy:CustomerOneMemberegy:CoteDivoire1Memberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-07-012024-09-300000894627egy:CustomerOneMembercountry:EGus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-07-012024-09-300000894627egy:CustomerOneMembercountry:CAus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-07-012024-09-300000894627egy:CustomerTwoMembercountry:CAus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-07-012024-09-300000894627egy:CustomerThreeMembercountry:CAus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-07-012024-09-300000894627egy:CustomerOneMembercountry:GAus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-09-300000894627egy:CustomerOneMemberegy:CoteDivoire1Memberus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-09-300000894627egy:CustomerOneMembercountry:EGus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-09-300000894627egy:CustomerOneMembercountry:CAus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-09-300000894627egy:CustomerTwoMembercountry:CAus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-09-300000894627egy:CustomerThreeMembercountry:CAus-gaap:CustomerConcentrationRiskMemberus-gaap:SalesRevenueNetMember2024-01-012024-09-300000894627us-gaap:WellsAndRelatedEquipmentAndFacilitiesMember2024-09-300000894627us-gaap:WellsAndRelatedEquipmentAndFacilitiesMember2023-12-310000894627us-gaap:ConstructionInProgressMember2024-09-300000894627us-gaap:ConstructionInProgressMember2023-12-310000894627egy:UndevelopedAcreageMember2024-09-300000894627egy:UndevelopedAcreageMember2023-12-310000894627us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2024-09-300000894627us-gaap:OtherCapitalizedPropertyPlantAndEquipmentMember2023-12-310000894627egy:CommodityContractOctober2024ToDecember2024Member2024-01-012024-09-300000894627egy:CommodityContractOctober2024ToDecember2024Member2024-09-3000008946272023-10-012023-10-310000894627egy:CommodityContractNovember2024ToMarch2025Member2024-01-012024-09-300000894627egy:CommodityContractNovember2024ToMarch2025Member2024-09-300000894627egy:CashSettlementsPaidOnMaturedDerivativeContractsNetMemberegy:CrudeOilSwapsMember2024-07-012024-09-300000894627egy:CashSettlementsPaidOnMaturedDerivativeContractsNetMemberegy:CrudeOilSwapsMember2023-07-012023-09-300000894627egy:CashSettlementsPaidOnMaturedDerivativeContractsNetMemberegy:CrudeOilSwapsMember2024-01-012024-09-300000894627egy:CashSettlementsPaidOnMaturedDerivativeContractsNetMemberegy:CrudeOilSwapsMember2023-01-012023-09-300000894627egy:UnrealizedGainLossMemberegy:CrudeOilSwapsMember2024-07-012024-09-300000894627egy:UnrealizedGainLossMemberegy:CrudeOilSwapsMember2023-07-012023-09-300000894627egy:UnrealizedGainLossMemberegy:CrudeOilSwapsMember2024-01-012024-09-300000894627egy:UnrealizedGainLossMemberegy:CrudeOilSwapsMember2023-01-012023-09-300000894627egy:CrudeOilSwapsMember2024-07-012024-09-300000894627egy:CrudeOilSwapsMember2023-07-012023-09-300000894627egy:CrudeOilSwapsMember2024-01-012024-09-300000894627egy:CrudeOilSwapsMember2023-01-012023-09-300000894627egy:EtameMarineBlockMember2024-09-300000894627egy:EtameMarineBlockMember2024-09-300000894627egy:ShareBuybackProgramMember2022-11-010000894627egy:ShareBuybackProgramMember2022-11-012022-11-010000894627egy:ShareBuybackProgramMember2022-11-012024-03-140000894627egy:MergedConcessionAgreementMemberegy:EgyptianGeneralPetroleumCorporationEGPCMember2022-02-012022-02-010000894627egy:EgyptianGeneralPetroleumCorporationEGPCMemberegy:MergedConcessionAgreementMembersrt:ScenarioForecastMember2026-02-010000894627egy:MergedConcessionAgreementMemberegy:EgyptianGeneralPetroleumCorporationEGPCMember2024-02-010000894627egy:AccruedLiabilitiesAndOtherMembersrt:ParentCompanyMember2024-09-300000894627egy:OtherLongtermLiabilitiesMembersrt:ParentCompanyMember2024-09-300000894627egy:EgyptianGeneralPetroleumCorporationEGPCMembersrt:MinimumMember2024-09-300000894627egy:EgyptianGeneralPetroleumCorporationEGPCMember2024-01-012024-09-300000894627egy:EgyptianGeneralPetroleumCorporationEGPCMember2024-09-300000894627egy:EgyptianGeneralPetroleumCorporationEGPCMembersrt:MinimumMember2024-01-012024-09-300000894627egy:TransglobeMember2022-10-130000894627egy:TransglobeMember2024-09-300000894627egy:TheFacilityMemberus-gaap:RevolvingCreditFacilityMember2022-05-160000894627egy:TheFacilityMemberus-gaap:RevolvingCreditFacilityMember2023-10-010000894627egy:TheFacilityMemberus-gaap:RevolvingCreditFacilityMember2024-09-300000894627egy:TheFacilityMemberus-gaap:RevolvingCreditFacilityMember2024-01-012024-09-300000894627us-gaap:AccumulatedTranslationAdjustmentMember2023-12-310000894627us-gaap:AccumulatedTranslationAdjustmentMember2024-01-012024-03-310000894627us-gaap:AccumulatedTranslationAdjustmentMember2024-03-310000894627us-gaap:AccumulatedTranslationAdjustmentMember2024-04-012024-06-300000894627us-gaap:AccumulatedTranslationAdjustmentMember2024-06-300000894627us-gaap:AccumulatedTranslationAdjustmentMember2024-07-012024-09-300000894627us-gaap:AccumulatedTranslationAdjustmentMember2024-09-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

______________________

FORM 10-Q

______________________

(Mark One)

| | | | | |

| x | QUARTERLY REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the quarterly period ended September 30, 2024

or

| | | | | |

| o | TRANSITION REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934 |

For the transition period from _______ to _______

Commission File Number 1-32167

______________________

VAALCO Energy, Inc.

(Exact name of registrant as specified in its charter)

______________________

| | | | | |

Delaware | 76-0274813 |

(State or other jurisdiction of incorporation or organization) | (I.R.S. Employer Identification No.) |

| |

2500 CityWest Blvd. Suite 400 Houston, Texas | 77042 |

(Address of principal executive offices) | (Zip code) |

(713) 623-0801

(Registrant’s telephone number, including area code)

______________________

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading symbol(s) | Name of each exchange on which registered |

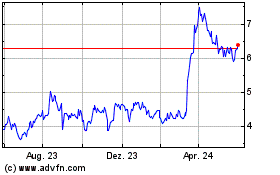

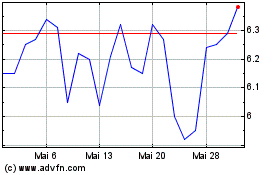

| Common Stock | EGY | New York Stock Exchange |

| Common Stock | EGY | London Stock Exchange |

Indicate by check mark whether the registrant (1) has filed all reports required to be filed by Section 13 or 15(d) of the Securities Exchange Act of 1934 during the preceding 12 months (or for such shorter period that the registrant was required to file such reports), and (2) has been subject to such filing requirements for the past 90 days. Yes x No o

Indicate by check mark whether the registrant has submitted electronically every Interactive Data File required to be submitted pursuant to Rule 405 of Regulation S-T (§232.405 of this chapter) during the preceding 12 months (or for such shorter period that the registrant was required to submit such files). Yes x No o

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,” and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| | | | | | | | | | | | | | |

| Large accelerated filer | o | | Accelerated filer | x |

| Non‑accelerated filer | o | | Smaller reporting company | o |

| | | Emerging growth company | o |

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. o

Indicate by check mark whether the registrant is a shell company (as defined in Rule 12b-2 of the Exchange Act). Yes o No x

As of November 7, 2024, there were outstanding 103,743,163 shares of common stock, $0.10 par value per share, of the registrant.

VAALCO ENERGY, INC. AND SUBSIDIARIES

Table of Contents

PART I. FINANCIAL INFORMATION

ITEM 1. CONDENSED CONSOLIDATED FINANCIAL STATEMENTS (Unaudited)

VAALCO ENERGY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED BALANCE SHEETS (Unaudited) | | | | | | | | | | | |

| As of September 30, 2024 | | As of December 31, 2023 |

| (in thousands) |

| ASSETS | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 89,101 | | | $ | 121,001 | |

| Restricted cash | 146 | | | 114 | |

| Receivables: | | | |

Trade, net of allowances for credit loss and other of $0.7 million and $0.5 million, respectively | 84,344 | | | 44,888 | |

Accounts with joint venture owners, net of allowance for credit losses of $1.2 million and $0.8 million, respectively | 1,131 | | | 1,814 | |

Egypt receivables and other, net of allowances for credit loss and other of $0.0 million and $4.6 million | 42,163 | | | 45,942 | |

| Crude oil inventory | 4,776 | | | 1,948 | |

| Prepayments and other | 15,138 | | | 12,434 | |

| Total current assets | 236,799 | | | 228,141 | |

| Crude oil, natural gas and NGLs properties and equipment, net | 531,589 | | | 459,786 | |

| Other noncurrent assets: | | | |

| Restricted cash | 9,462 | | | 1,795 | |

Value added tax and other receivables, net of allowances for credit loss and other of $0.0 million | 10,228 | | | 4,214 | |

| Right of use operating lease assets | 2,320 | | | 2,378 | |

| Right of use finance lease assets | 83,093 | | | 89,962 | |

| Deferred tax assets | 57,035 | | | 29,242 | |

| Abandonment funding | 6,268 | | | 6,268 | |

| Other long-term assets | 1,109 | | | 1,430 | |

| Total assets | $ | 937,903 | | | $ | 823,216 | |

| LIABILITIES AND SHAREHOLDERS' EQUITY | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 15,047 | | | $ | 22,152 | |

| Accounts with joint venture owners | 984 | | | 5,990 | |

| Accrued liabilities and other | 103,848 | | | 67,597 | |

| Operating lease liabilities - current portion | 335 | | | 2,396 | |

| Finance lease liabilities - current portion | 12,560 | | | 10,079 | |

| Foreign income taxes payable | 43,473 | | | 19,261 | |

| Total current liabilities | 176,247 | | | 127,475 | |

| Asset retirement obligations | 65,868 | | | 47,343 | |

| Operating lease liabilities - net of current portion | 2,006 | | | 33 | |

| Finance lease liabilities - net of current portion | 70,912 | | | 78,293 | |

| Deferred tax liabilities | 103,356 | | | 73,581 | |

| Other long-term liabilities | 18,482 | | | 17,709 | |

| Total liabilities | 436,871 | | | 344,434 | |

| Commitments and contingencies (Note 10) | | | |

| Shareholders’ equity: | | | |

Preferred stock, $25 par value; 500,000 shares authorized, none issued | — | | | — | |

Common stock, $0.10 par value; 160,000,000 shares authorized, 122,304,124 and 121,397,553 shares issued, 103,743,163 and 104,346,233 shares outstanding, respectively | 12,230 | | | 12,140 | |

| Additional paid-in capital | 361,147 | | | 357,498 | |

| Accumulated other comprehensive income | 1,013 | | | 2,880 | |

Less treasury stock, 18,560,961 and 17,051,320 shares, respectively, at cost | (78,024) | | | (71,222) | |

| Retained earnings | 204,666 | | | 177,486 | |

| Total shareholders' equity | 501,032 | | | 478,782 | |

| Total liabilities and shareholders' equity | $ | 937,903 | | | $ | 823,216 | |

See notes to unaudited condensed consolidated financial statements.

VAALCO ENERGY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS AND COMPREHENSIVE INCOME (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended

September 30, | | Nine Months Ended

September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in thousands, except per share amounts) |

| Revenues: | | | | | | | |

| Crude oil, natural gas and natural gas liquids sales | $ | 140,334 | | | $ | 116,269 | | | $ | 357,267 | | | $ | 305,912 | |

| Operating costs and expenses: | | | | | | | |

| Production expense | 42,324 | | | 39,956 | | | 126,859 | | | 106,760 | |

| FPSO demobilization and other costs | — | | | — | | | — | | | 5,647 | |

| Exploration expense | — | | | 1,194 | | | 48 | | | 1,259 | |

| Depreciation, depletion and amortization | 47,031 | | | 32,538 | | | 105,987 | | | 94,958 | |

| General and administrative expense | 6,929 | | | 6,216 | | | 21,230 | | | 16,835 | |

| Credit losses and other | 69 | | | 822 | | | 5,222 | | | 2,437 | |

| Total operating costs and expenses | 96,353 | | | 80,726 | | | 259,346 | | | 227,896 | |

| Other operating income (expense), net | 102 | | | 5 | | | 68 | | | (298) | |

| Operating income | 44,083 | | | 35,548 | | | 97,989 | | | 77,718 | |

| Other income (expense): | | | | | | | |

| Derivative instruments gain (loss), net | 210 | | | (2,320) | | | (380) | | | (2,268) | |

| Interest expense, net | (588) | | | (1,426) | | | (2,640) | | | (5,375) | |

| Bargain purchase gain | — | | | — | | | 19,898 | | | (1,412) | |

| Other income (expense), net | (141) | | | 183 | | | (3,925) | | | (97) | |

| Total other income (expense), net | (519) | | | (3,563) | | | 12,953 | | | (9,152) | |

| Income before income taxes | 43,564 | | | 31,985 | | | 110,942 | | | 68,566 | |

| Income tax expense | 32,574 | | | 25,844 | | | 64,115 | | | 52,203 | |

| Net income | $ | 10,990 | | | $ | 6,141 | | | $ | 46,827 | | | $ | 16,363 | |

| Other comprehensive income (loss) | | | | | | | |

| Currency translation adjustments | 1,655 | | | (2,216) | | | (1,867) | | | (335) | |

| Comprehensive income | $ | 12,645 | | | $ | 3,925 | | | $ | 44,960 | | | $ | 16,028 | |

| | | | | | | |

| Basic net income per share: | | | | | | | |

| Net income per share | $ | 0.10 | | | $ | 0.06 | | | $ | 0.45 | | | $ | 0.15 | |

| Basic weighted average shares outstanding | 103,743 | | 106,289 | | 103,644 | | 106,876 |

| Diluted net income per share: | | | | | | | |

| Net income per share | $ | 0.10 | | | $ | 0.06 | | | $ | 0.45 | | | $ | 0.15 | |

| Diluted weighted average shares outstanding | 103,842 | | 106,433 | | 103,728 | | 107,072 |

See notes to unaudited condensed consolidated financial statements.

VAALCO ENERGY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Shares

Issued | | Treasury Shares | | Common Stock | | Additional Paid-In

Capital | | Accumulated Other

Comprehensive Loss | | Treasury Stock | | Retained Earnings | | Total |

| (in thousands) |

| Balance at January 1, 2024 | 121,398 | | (17,051) | | $ | 12,140 | | | $ | 357,498 | | | $ | 2,880 | | | $ | (71,222) | | | $ | 177,486 | | | $ | 478,782 | |

| Shares issued - stock-based compensation | 543 | | — | | 54 | | | 393 | | | — | | | — | | | — | | | 447 | |

| Stock-based compensation expense | — | | — | | — | | | 936 | | | — | | | — | | | — | | | 936 | |

| Treasury stock | — | | (1,434) | | — | | | — | | | — | | | (6,344) | | | — | | | (6,344) | |

| Dividend distributions | — | | — | | — | | | — | | | — | | | — | | | (6,463) | | | (6,463) | |

| Other comprehensive loss | — | | — | | — | | | — | | | (2,454) | | | — | | | — | | | (2,454) | |

| Net income | — | | — | | — | | | — | | | — | | | — | | | 7,686 | | | 7,686 | |

| Balance at March 31, 2024 | 121,941 | | (18,485) | | 12,194 | | 358,827 | | 426 | | (77,566) | | 178,709 | | 472,590 |

| Shares issued - stock-based compensation | 364 | | — | | 36 | | | (36) | | | — | | | — | | | — | | | — | |

| Stock-based compensation expense | — | | — | | — | | | 1,012 | | | — | | | — | | | — | | | 1,012 | |

| Treasury stock | — | | (76) | | — | | | — | | | — | | | (458) | | | — | | | (458) | |

| Dividend distributions | — | | — | | — | | | — | | | — | | | — | | | (6,579) | | | (6,579) | |

| Other comprehensive loss | — | | — | | — | | | — | | | (1,068) | | | — | | | — | | | (1,068) | |

| Net income | — | | — | | — | | | — | | | — | | | — | | | 28,151 | | | 28,151 | |

| Balance at June 30, 2024 | 122,305 | | | (18,561) | | | 12,230 | | | 359,803 | | | (642) | | | (78,024) | | | 200,281 | | | 493,648 | |

| Shares issued - stock-based compensation | — | | — | | — | | | — | | | — | | | — | | | — | | | — | |

| Stock-based compensation expense | — | | — | | — | | | 1,344 | | | — | | | — | | | — | | | 1,344 | |

| Treasury stock | — | | — | | — | | | — | | | — | | | — | | | — | | | — | |

| Dividend distributions | — | | — | | — | | | — | | | — | | | — | | | (6,605) | | | (6,605) | |

| Other comprehensive loss | — | | — | | — | | | — | | | 1,655 | | | — | | | — | | | 1,655 | |

| Net income | — | | — | | — | | | — | | | — | | | — | | | 10,990 | | | 10,990 | |

| Balance at September 30, 2024 | 122,305 | | (18,561) | | $ | 12,230 | | | $ | 361,147 | | | $ | 1,013 | | | $ | (78,024) | | | $ | 204,666 | | | $ | 501,032 | |

See notes to unaudited condensed consolidated financial statements.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Common Shares

Issued | | Treasury Shares | | Common Stock | | Additional Paid-In

Capital | | Accumulated Other

Comprehensive Loss | | Treasury Stock | | Retained Earnings | | Total |

| (in thousands) |

| Balance at January 1, 2023 | 119,483 | | (11,630) | | $ | 11,948 | | | $ | 353,606 | | | $ | 1,179 | | | $ | (47,652) | | | $ | 147,024 | | | $ | 466,105 | |

| Shares issued - stock-based compensation | 633 | | (187) | | 64 | | | 210 | | | — | | | — | | | — | | | 274 | |

| Stock-based compensation expense | — | | — | | — | | | 683 | | | — | | | — | | | — | | | 683 | |

| Treasury stock | — | | (981) | | — | | | — | | | — | | | (5,377) | | | — | | | (5,377) | |

| Dividend distributions | — | | — | | — | | | — | | | — | | | — | | | (6,735) | | | (6,735) | |

| Cumulative effect of adjustment upon adoption of ASU 2016-13 on January 1, 2023 | — | | — | | — | | | — | | | — | | | — | | | (3,120) | | | (3,120) | |

| Other comprehensive loss | — | | — | | — | | | — | | | (125) | | | — | | | — | | | (125) | |

| Net income | — | | — | | — | | | — | | | — | | | — | | | 3,470 | | | 3,470 | |

| Balance at March 31, 2023 | 120,116 | | (12,798) | | 12,012 | | 354,499 | | 1,054 | | (53,029) | | 140,639 | | 455,175 |

| Shares issued - stock-based compensation | 1,090 | | (249) | | 109 | | | (1) | | | — | | | — | | | — | | | 108 | |

| Stock-based compensation expense | — | | — | | — | | | 708 | | | — | | | — | | | — | | | 708 | |

| Treasury stock | — | | (1,161) | | — | | | — | | | — | | | (6,026) | | | — | | | (6,026) | |

| Dividend Distribution | — | | — | | — | | | — | | | — | | | — | | | (6,717) | | | (6,717) | |

| Other comprehensive loss | — | | — | | — | | | — | | | 2,006 | | | — | | | — | | | 2,006 | |

| Net income | — | | — | | — | | | — | | | — | | | — | | | 6,752 | | | 6,752 | |

| Balance at June 30, 2023 | 121,206 | | (14,208) | | 12,121 | | 355,206 | | 3,060 | | (59,055) | | 140,674 | | 452,006 |

| Shares issued - stock-based compensation | 135 | | (16) | | 13 | | | 198 | | | — | | | — | | | — | | | 211 | |

| Stock-based compensation expense | — | | — | | — | | | 1,020 | | | — | | | — | | | — | | | 1,020 | |

| Treasury stock | — | | (1,403) | | — | | | — | | | — | | | (6,090) | | | — | | | (6,090) | |

| Dividend Distribution | — | | — | | — | | | — | | | — | | | — | | | (6,701) | | | (6,701) | |

| Other comprehensive loss | — | | — | | — | | | — | | | (2,216) | | | — | | | — | | | (2,216) | |

| Net income | — | | — | | — | | | — | | | — | | | — | | | 6,141 | | | 6,141 | |

| Balance at September 30, 2023 | 121,341 | | (15,627) | | $ | 12,134 | | | $ | 356,424 | | | $ | 844 | | | $ | (65,145) | | | $ | 140,114 | | | $ | 444,371 | |

See notes to unaudited condensed consolidated financial statements.

VAALCO ENERGY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS (Unaudited)

| | | | | | | | | | | | |

| Nine Months Ended September 30, | |

| 2024 | | 2023 | |

| (in thousands) | |

| CASH FLOWS FROM OPERATING ACTIVITIES: | | | | |

| Net income | $ | 46,827 | | | $ | 16,363 | | |

| Adjustments to reconcile net income to net cash provided by operating activities: | | | | |

| Depreciation, depletion and amortization | 105,987 | | | 94,958 | | |

| Bargain purchase gain | (19,898) | | | 1,412 | | |

| Exploration expense | 48 | | | 1,194 | | |

| Deferred taxes | (7,762) | | | (2,305) | | |

| Unrealized foreign exchange loss | (613) | | | 932 | | |

| Stock-based compensation | 3,362 | | | 2,332 | | |

| Cash settlements paid on exercised stock appreciation rights | (154) | | | (282) | | |

| Derivative instruments (gain) loss, net | 209 | | | 2,268 | | |

| Cash settlements paid on matured derivative contracts, net | (15) | | | (62) | | |

| Cash settlements paid on asset retirement obligations | (315) | | | (4,796) | | |

| Credit losses and other | 5,222 | | | 2,437 | | |

| Other operating loss, net | 34 | | | 317 | | |

| Equipment and other expensed in operations | 1,589 | | | 2,560 | | |

| Change in operating assets and liabilities: | | | | |

| Trade, net | (39,456) | | | 29,364 | | |

| Accounts with joint venture owners, net | (4,739) | | | 15,090 | | |

| Egypt receivables and other, net | (394) | | | 694 | | |

| Crude oil inventory | 12,153 | | | (5,952) | | |

| Prepayments and other | (1,847) | | | 1,198 | | |

| Value added tax and other receivables | (5,713) | | | (3,719) | | |

| Other long-term assets | 1,808 | | | 2,942 | | |

| Accounts payable | (9,034) | | | (10,083) | | |

| Foreign income taxes receivable/(payable) | 24,327 | | | 36,025 | | |

| | | | |

| Accrued liabilities and other | (42,441) | | | (11,076) | | |

| Net cash provided by (used in) operating activities | 69,185 | | | 171,811 | | |

| CASH FLOWS FROM INVESTING ACTIVITIES: | | | | |

| Property and equipment expenditures | (61,530) | | | (77,365) | | |

| Cash paid in business combination, net of cash acquired | 412 | | | — | | |

| Net cash provided by (used in) investing activities | (61,118) | | | (77,365) | | |

| CASH FLOWS FROM FINANCING ACTIVITIES: | | | | |

| Proceeds from the issuances of common stock | 447 | | | 593 | | |

| Dividend distribution | (19,647) | | | (20,153) | | |

| Treasury shares | (6,803) | | | (17,493) | | |

| Deferred financing costs | — | | | (83) | | |

| Payments of finance lease | (6,261) | | | (5,246) | | |

| Net cash provided by (used in) in financing activities | (32,264) | | | (42,382) | | |

| Effects of exchange rate changes on cash | (4) | | | (321) | | |

| NET CHANGE IN CASH, CASH EQUIVALENTS AND RESTRICTED CASH | (24,201) | | | 51,743 | | |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT BEGINNING OF PERIOD | 129,178 | | | 59,776 | | |

| CASH, CASH EQUIVALENTS AND RESTRICTED CASH AT END OF PERIOD | $ | 104,977 | | | $ | 111,519 | | |

See notes to unaudited condensed consolidated financial statements.

VAALCO ENERGY, INC. AND SUBSIDIARIES

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS SUPPLEMENTAL DISCLOSURES (Unaudited)

| | | | | | | | | | | |

| Nine Months Ended September 30, |

| 2024 | | 2023 |

| (in thousands) |

| Supplemental disclosure of cash flow information: | | | |

| Interest paid, net of amounts capitalized | $ | 4,900 | | | $ | 6,622 | |

| Supplemental disclosure of non-cash investing and financing activities: | | | |

| Property and equipment additions incurred but not paid at end of period | $ | 8,894 | | | $ | 23,820 | |

| Recognition of right-of-use operating lease assets and liabilities | $ | 2,035 | | | $ | 2,582 | |

| Recognition of right-of-use finance lease assets and liabilities | $ | — | | | $ | 3,273 | |

| Asset retirement obligations | $ | 15,796 | | | $ | 2,487 | |

See notes to unaudited condensed consolidated financial statements.

VAALCO ENERGY, INC. AND SUBSIDIARIES

NOTES TO THE UNAUDITED CONDENSED CONSOLIDATED FINANCIAL STATEMENTS

1. ORGANIZATION AND ACCOUNTING POLICIES

VAALCO Energy, Inc. (together with its consolidated subsidiaries “we”, “us”, “our”, “VAALCO” or the “Company”) is a Houston, Texas-based independent energy company engaged in the acquisition, exploration, development and production of crude oil, natural gas and natural gas liquids (“NGLs”) properties. As operator, the Company has production operations and conducts exploration activities in Gabon and Canada and holds interests in two production sharing contracts (“PSCs”) in Egypt and holds a non-operator interest in Cote d’Ivoire. The Company has opportunities to participate in development and exploration activities in Equatorial Guinea, West Africa and Nigeria.

These unaudited condensed consolidated financial statements (“Financial Statements”) reflect the opinion of management and all adjustments necessary for a fair presentation of results for the interim periods presented. All adjustments are of a normal recurring nature unless disclosed otherwise. Interim period results are not necessarily indicative of results expected for the full year.

These unaudited interim condensed consolidated financial statements have been prepared in accordance with rules of the Securities and Exchange Commission (“SEC”) and do not include all the information and disclosures required by accounting principles generally accepted in the United States (“GAAP”) for complete financial statements. They should be read in conjunction with the audited consolidated financial statements and notes thereto included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, which includes a summary of the significant accounting policies.

Allowance for credit losses and other – The Company estimates the current expected credit losses based primarily using either an aging analysis or discounted cash flow methodology that incorporates consideration of current and future conditions that could impact its counterparties’ credit quality and liquidity. Uncollectible receivables are written off when a settlement is reached for an amount that is less than the outstanding historical balance or when the Company has determined that the balance will not be collected.

The following table provides an analysis of the change of the aggregate credit loss allowance and other allowances.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in thousands) |

| Allowance for credit losses and other | | | | | | | |

| Balance at beginning of period | $ | (12,604) | | | $ | (13,519) | | | $ | (6,029) | | | $ | (8,704) | |

| Credit loss charges and other, net of receipts | (69) | | | (822) | | | (5,222) | | | (2,437) | |

| Cumulative effect of adjustment upon adoption of ASU 2016-13 on January 1, 2023 | — | | | — | | | — | | | (3,120) | |

Reversal of allowance resulting from the

settlement of the related receivable | 11,200 | | | — | | | 11,200 | | | — | |

| Foreign currency gain (loss) | (425) | | | 238 | | | (1,847) | | | 158 | |

| Balance at end of period | $ | (1,898) | | | $ | (14,103) | | | $ | (1,898) | | | $ | (14,103) | |

Fair value of financial instruments

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | As of September 30, 2024 |

| Balance Sheet Line | | Level 1 | | Level 2 | | Level 3 | | Total |

| | | (in thousands) |

| Assets | | | | | | | | | |

| Derivative asset | Prepayments and other | | $ | — | | | $ | 244 | | | $ | — | | | $ | 244 | |

| | | $ | — | | | $ | 244 | | | $ | — | | | $ | 244 | |

| Liabilities | | | | | | | | | |

| Derivative liability | Accrued liabilities and other | | $ | — | | | $ | 35 | | | $ | — | | | $ | 35 | |

| | | $ | — | | | $ | 35 | | | $ | — | | | $ | 35 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | As of December 31, 2023 |

| Balance Sheet Line | | Level 1 | | Level 2 | | Level 3 | | Total |

| | | (in thousands) |

| Assets | | | | | | | | | |

| Derivative asset | Prepayments and other | | $ | — | | | $ | 403 | | | $ | — | | | $ | 403 | |

| | | $ | — | | | $ | 403 | | | $ | — | | | $ | 403 | |

| Liabilities | | | | | | | | | |

| SARs liability | Accrued liabilities and other | | $ | — | | | $ | 163 | | | $ | — | | | $ | 163 | |

| | | | $ | — | | | $ | 163 | | | $ | — | | | $ | 163 | |

2. NEW ACCOUNTING STANDARDS

Not Yet Adopted

In August 2023, the Financial Accounting Standards Board (“FASB”) issued new guidance to provide specific guidance on how a joint venture, upon formation, should recognize and initially measure assets contributed to and liabilities assumed by such joint venture. The rules become effective prospectively for all joint venture formations occurring on or after January 1, 2025. VAALCO is currently assessing the impact of this guidance on the consolidated financial statements.

In November 2023, FASB issued new guidance to improve reportable segment disclosure requirements, primarily through enhanced disclosures about significant segment expenses. The rules become effective for annual periods beginning after December 15, 2023, and for interim periods within fiscal years beginning after December 15, 2024. The standard requires additional disclosures about operating segments. VAALCO is currently evaluating the impact of adopting this guidance on the consolidated financial statements.

In December 2023, FASB issued new guidance to improve income tax disclosures to provide information to assess how an entity’s operations and related tax risks and tax planning and operational opportunities affect its tax rate and prospects for future cash flows. The rules become effective for annual periods beginning after December 15, 2024. The standard modifies required income tax disclosures. VAALCO is currently evaluating the impact of adopting this guidance on the consolidated financial statements.

In November 2024, the FASB issued ASU 2024-03, Accounting Standards Update 2024-03, Income Statement-Reporting Comprehensive Income-Expense Disaggregation Disclosures (Subtopic 220-40): Disaggregation of Income Statement Expenses to improve financial reporting by requiring that public business entities disclose additional information about specific expense categories in the notes to financial statements at interim and annual reporting periods. This ASU is effective for annual reporting periods beginning after December 15, 2026, and interim reporting periods beginning after December 15, 2027. Early adoption is permitted. VAALCO is currently evaluating the impact of adopting this ASU to our notes to the consolidated financial statements and processes.

3. ACQUISITION

On February 29, 2024, the Company entered into a Share Purchase Agreement (the “Share Purchase Agreement”) to purchase all of the issued shares in the capital of Svenska Petroleum Exploration Aktiebolag, a company incorporated in Sweden (“Svenska”) for $66.5 million in cash (the “Purchase Price”), subject to certain adjustment as described in the Share Purchase Agreement (the “Svenska Acquisition”). The Company subsequently closed the Svenska Acquisition for

the net purchase price of $40.2 million, on April 30, 2024 after certain regulatory and government approvals were received. The Purchase Price was funded with $40.2 million of VAALCO’s cash-on-hand. Cash acquired in the business combination included $31.8 million of cash and cash equivalents as well as restricted cash of $8.8 million which nets to $0.4 million cash received on the business combination as disclosed within the unaudited condensed consolidated statements of cash flows.

| | | | | | | | | |

| | | | | |

| | | | | |

| April 30, 2024 | | | | |

| (in thousands) | | | | |

| Purchase Consideration | | | | | |

| Cash | $ | 40,166 | | | | | |

| Total purchase consideration | $ | 40,166 | | | | | |

| | | | | |

| April 30, 2024 | | | | |

| (in thousands) | | | | |

| Assets acquired: | | | | | |

| Cash and cash equivalents | $ | 31,789 | | | | | |

| Other receivables, net | 830 | | | | | |

| Crude oil inventory | 14,981 | | | | | |

| Prepayments and other | 409 | | | | | |

| Crude oil, natural gas and NGLs properties and equipment, net | 100,188 | | | | | |

| Restricted cash | 8,788 | | | | | |

| Other LT receivables | 33 | | | | | |

| Deferred tax asset | 28,153 | | | | | |

| Total assets acquired | 185,171 | | | | | |

| Liabilities assumed: | | | | | |

| Accounts payable | (2,506) | | | | | |

| State oil liability | (19,447) | | | | | |

| Accrued tax settlement | (8,788) | | | | | |

| Accrued accounts payable invoices | (21,692) | | | | | |

| Accrued liabilities and other | (19,083) | | | | | |

| Asset retirement obligations | (15,694) | | | | | |

| Deferred tax liability | (37,897) | | | | | |

| Total liabilities acquired | (125,107) | | | | | |

| Bargain purchase gain | (19,898) | | | | | |

| Total purchase price | $ | 40,166 | | | | | |

All assets and liabilities associated with Svenska’s interest in the producing Baobab field as well as the non-producing discovery located offshore of Nigeria, including crude oil and natural gas properties, asset retirement obligations and working capital items, were recorded at their estimated fair value. The Company used estimated future crude oil prices as of the closing date, April 30, 2024, to apply to the estimated reserve quantities acquired and market participant assumptions to the estimated future operating and development costs to arrive at the estimates of future net revenues. The future net revenues were discounted using the Company’s weighted average cost of capital to determine the fair value at closing. The valuations to derive the purchase price included the use of both proved and unproved categories of reserves, expectation for timing and amount of future development and operating costs, projections of future rates of production, expected recovery rates, and risk adjusted discount rates. Other estimates were used by the Company to determine the fair value of certain assets and liabilities. The fair value of the acquired identifiable assets and liabilities is provisional pending the final valuations for crude oil, natural gas and NGLs properties and equipment, net, asset retirement obligations, accrued liabilities and other and deferred tax assets and liabilities. Svenska is subject to the legal and regulatory requirements, including but not limited to those related to environmental matters and taxation, in each of the jurisdictions in countries in which it operates.

VAALCO has conducted a preliminary assessment of liabilities arising from these matters in each of these jurisdictions and has recognized provisional amounts in its initial accounting for the Svenska Acquisition for all identified liabilities in

accordance with the requirements of Accounting Standards Codification (“ASC”) Topic 805. However, VAALCO is continuing its review of these matters during the measurement period, and if new information obtained about facts and circumstances that existed at the acquisition date identifies adjustments to the assets and liabilities initially recognized, as well as any additional assets and liabilities that existed at the acquisition date, the acquisition accounting will be revised to reflect the resulting adjustments to the provisional amounts initially recognized. As a result of comparing the purchase price to the fair value of the assets acquired and liabilities assumed, a $19.9 million bargain purchase gain was recognized and is included in “Bargain purchase gain” under “Other income (expense)” in the unaudited condensed consolidated statements of operations and comprehensive income. The bargain purchase gain is primarily attributable to a stronger forward pricing curve for oil reserves than was used for the purposes of calculating the price paid for the business.

Post-Acquisition Operating Results. The table below summarizes amounts contributed by the Cote d’Ivoire assets acquired in the Svenska Acquisition to the Company's consolidated results for the period from April 30, 2024 through September 30, 2024.

| | | | | |

| April 30, 2024 through September 30, 2024 |

| (in thousands) |

| Crude oil, natural gas and natural gas liquids sales | $ | 67,035 | |

| |

| Net income | $ | 5,589 | |

The unaudited pro forma results presented below have been prepared to give effect to the Svenska Acquisition discussed above on the Company’s results of operations for the three and nine months ended September 30, 2024 and 2023, as if the acquisition had been consummated on January 1, 2023. The unaudited pro forma results do not purport to represent what the Company’s actual results of operations would have been if the Svenska Acquisition had been completed on such date or to project the Company’s results of operations for any future date or period.

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| | | | | | | |

| (in thousands) | | (in thousands) |

| Pro forma (unaudited) | | | | | | | |

| Crude oil, natural gas and natural gas liquids sales | $ | 140,334 | | | $ | 167,634 | | | $ | 388,792 | | | $ | 437,181 | |

| Operating income | $ | 44,083 | | | $ | 54,759 | | | $ | 82,174 | | | $ | 139,595 | |

Net income (loss) (a) | $ | 10,990 | | | $ | 10,976 | | | $ | 20,306 | | | $ | 43,158 | |

| | | | | | | | |

| Basic net income (loss) per share: | | | | | | | |

| Income (loss) from continuing operations | $ | 10,990 | | | $ | 10,976 | | | $ | 20,306 | | | $ | 43,158 | |

| Net income (loss) per share | $ | 0.11 | | | $ | 0.10 | | | $ | 0.20 | | | $ | 0.40 | |

| Basic weighted average shares outstanding | $ | 103,743 | | | $ | 106,289 | | | $ | 103,644 | | | $ | 106,876 | |

| Diluted net income (loss) per share: | | | | | | | |

| Income (loss) from continuing operations | $ | 10,990 | | | $ | 10,976 | | | $ | 20,306 | | | $ | 43,158 | |

| Net income (loss) per share | $ | 0.11 | | | $ | 0.10 | | | $ | 0.20 | | | $ | 0.40 | |

| Diluted weighted average shares outstanding | $ | 103,842 | | | $ | 106,433 | | | $ | 103,728 | | | $ | 107,072 | |

(a)The unaudited pro forma net income (loss) for the nine months ended September 30, 2024 excludes a nonrecurring pro forma adjustment directly attributable to the Svenska Acquisition, consisting of a bargain purchase gain of $19.9 million.

4. SEGMENT INFORMATION

The Company’s operations are based in Gabon, Egypt, Canada, Equatorial Guinea and Cote d'Ivoire. Each of the reportable operating segments are organized and managed based upon geographic location. The Company’s Chief Executive Officer,

who is the chief operating decision maker, evaluates the operational results of each geographic segment separately, primarily based on operating income (loss). The operations of all segments include exploration for and production of hydrocarbons where commercial reserves have been found and developed. Revenues are based on the location of hydrocarbon production. Corporate and Other category is primarily corporate and operations support costs that are not allocated to the reportable operating segments.

Segment activity of continuing operations for the three and nine months ended September 30, 2024 and 2023 as well as long-lived assets and segment assets at September 30, 2024 and December 31, 2023 are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, 2024 |

| (in thousands) | Gabon | | Egypt | | Canada | | Equatorial Guinea | | Cote d'Ivoire | | Corporate and Other | | Total |

| Revenues: | | | | | | | | | | | | | |

| Crude oil, natural gas and natural gas liquids sales | $ | 47,608 | | | $ | 34,544 | | | $ | 8,387 | | | $ | — | | | $ | 49,795 | | | $ | — | | | $ | 140,334 | |

| Operating costs and expenses: | | | | | | | | | | | | | |

| Production expense | 13,932 | | | 12,477 | | | 3,015 | | | 195 | | | 12,701 | | | 4 | | | 42,324 | |

| Exploration expense | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Depreciation, depletion and amortization | 12,796 | | | 8,729 | | | 6,106 | | | — | | | 19,184 | | | 216 | | | 47,031 | |

| General and administrative expense | 241 | | | (79) | | | (4) | | | 62 | | | 1,061 | | | 5,648 | | | 6,929 | |

| Credit losses and other | — | | | — | | | — | | | 69 | | | — | | | — | | | 69 | |

| Total operating costs and expenses | 26,969 | | | 21,127 | | | 9,117 | | | 326 | | | 32,946 | | | 5,868 | | | 96,353 | |

| Other operating income (expense), net | — | | | — | | | 102 | | | — | | | — | | | — | | | 102 | |

| Operating income (loss) | 20,639 | | | 13,417 | | | (628) | | | (326) | | | 16,849 | | | (5,868) | | | 44,083 | |

| Other income (expense): | | | | | | | | | | | | | |

| Derivative instruments gain(loss), net | — | | | — | | | — | | | — | | | (169) | | | 379 | | | 210 | |

| Interest (expense) income, net | (964) | | | (360) | | | — | | | — | | | 2,029 | | | (1,293) | | | (588) | |

| Bargain purchase gain | — | | | — | | | — | | | — | | | — | | | — | | | — | |

| Other (expense) income, net | (72) | | | (101) | | | 669 | | | (4) | | | (37) | | | (597) | | | (141) | |

| Total other expense, net | (1,036) | | | (461) | | | 670 | | | (4) | | | 1,823 | | | (1,511) | | | (519) | |

| Income (loss) before income taxes | 19,603 | | | 12,956 | | | 42 | | | (330) | | | 18,672 | | | (7,379) | | | 43,564 | |

| Income tax (benefit) expense | 12,932 | | | 3,613 | | | — | | | — | | | 8,454 | | | 7,575 | | | 32,574 | |

| Net income (loss) | $ | 6,671 | | | $ | 9,343 | | | $ | 42 | | | $ | (330) | | | $ | 10,218 | | | $ | (14,953) | | | $ | 10,990 | |

| Consolidated capital expenditures | $ | 8,859 | | | $ | 1,698 | | | $ | 3,014 | | | $ | 38 | | | $ | 11,158 | | | $ | 1,839 | | | $ | 26,606 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2024 |

| (in thousands) | Gabon | | Egypt | | Canada | | Equatorial Guinea | | Cote d'Ivoire | | Corporate and Other | | Total |

| Revenues: | | | | | | | | | | | | | |

| Crude oil, natural gas and natural gas liquids sales | $ | 158,786 | | | $ | 106,986 | | | $ | 24,460 | | | $ | — | | | $ | 67,035 | | | $ | — | | | $ | 357,267 | |

| Operating costs and expenses: | | | | | | | | | | | | | |

| Production expense | 49,131 | | | 38,652 | | | 8,753 | | | 712 | | | 29,606 | | | 5 | | | 126,859 | |

| Exploration expense | — | | | 48 | | | — | | | — | | | — | | | — | | | 48 | |

| Depreciation, depletion and amortization | 39,591 | | | 25,481 | | | 15,297 | | | — | | | 25,233 | | | 385 | | | 105,987 | |

| General and administrative expense | 1,194 | | | 297 | | | (119) | | | 233 | | | 1,185 | | | 18,440 | | | 21,230 | |

| Credit losses and other | 20 | | | 4,812 | | | — | | | 390 | | | — | | | — | | | 5,222 | |

| Total operating costs and expenses | 89,936 | | | 69,290 | | | 23,931 | | | 1,335 | | | 56,024 | | | 18,830 | | | 259,346 | |

| Other operating income (expense), net | (34) | | | — | | | 102 | | | — | | | — | | | — | | | 68 | |

| Operating income (loss) | 68,816 | | | 37,696 | | | 631 | | | (1,335) | | | 11,011 | | | (18,830) | | | 97,989 | |

| Other income (expense): | | | | | | | | | | | | | |

| Derivative instruments gain, net | — | | | — | | | — | | | — | | | (169) | | | (211) | | | (380) | |

| Interest (expense) income, net | (3,439) | | | (1,120) | | | 38 | | | — | | | 489 | | | 1,392 | | | (2,640) | |

| Bargain purchase gain | — | | | — | | | — | | | — | | | — | | | 19,898 | | | 19,898 | |

| Other income (expense), net | (303) | | | (101) | | | 674 | | | (2) | | | (338) | | | (3,856) | | | (3,925) | |

| Total other expense, net | (3,742) | | | (1,221) | | | 713 | | | (2) | | | (18) | | | 17,223 | | | 12,953 | |

| Income (loss) before income taxes | 65,074 | | | 36,475 | | | 1,344 | | | (1,337) | | | 10,993 | | | (1,608) | | | 110,942 | |

| Income tax expense (benefit) | 38,956 | | | 19,395 | | | — | | | — | | | 5,404 | | | 360 | | | 64,115 | |

| Net income (loss) | $ | 26,118 | | | $ | 17,080 | | | $ | 1,344 | | | $ | (1,337) | | | $ | 5,589 | | | $ | (1,967) | | | $ | 46,827 | |

| Consolidated capital expenditures | $ | 20,248 | | | $ | 7,894 | | | $ | 22,728 | | | $ | 38 | | | $ | 18,310 | | | $ | 3,840 | | | $ | 73,058 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, 2023 |

| (in thousands) | Gabon | | Egypt | | Canada | | Equatorial Guinea | | | | Corporate and Other | | Total |

| Revenues: | | | | | | | | | | | | | |

| Crude oil, natural gas and natural gas liquids sales | $ | 57,275 | | | $ | 50,307 | | | $ | 8,687 | | | $ | — | | | | | $ | — | | | $ | 116,269 | |

| Operating costs and expenses: | | | | | | | | | | | | | |

| Production expense | 20,731 | | | 16,040 | | | 2,627 | | | 259 | | | | | 299 | | | 39,956 | |

| FPSO demobilization and other costs | — | | | — | | | — | | | — | | | | | — | | | — | |

| Exploration expense | — | | | 1,194 | | | — | | | — | | | | | — | | | 1,194 | |

| Depreciation, depletion and amortization | 14,583 | | | 12,967 | | | 4,948 | | | — | | | | | 40 | | | 32,538 | |

| General and administrative expense | 348 | | | 54 | | | — | | | 94 | | | | | 5,720 | | | 6,216 | |

| Credit losses and other | 684 | | | — | | | — | | | 138 | | | | | — | | | 822 | |

| Total operating costs and expenses | 36,346 | | | 30,255 | | | 7,575 | | | 491 | | | | | 6,059 | | | 80,726 | |

| Other operating income, net | 5 | | | — | | | — | | | — | | | | | — | | | 5 | |

| Operating income (loss) | 20,934 | | | 20,052 | | | 1,112 | | | (491) | | | | | (6,059) | | | 35,548 | |

| Other income (expense): | | | | | | | | | | | | | |

| Derivative instruments loss, net | — | | | — | | | — | | | — | | | | | (2,320) | | | (2,320) | |

| Interest income (expense), net | (1,371) | | | (270) | | | — | | | — | | | | | 215 | | | (1,426) | |

| Other income (expense), net | 111 | | | — | | | — | | | (3) | | | | | 75 | | | 183 | |

| Total other expense, net | (1,260) | | | (270) | | | — | | | (3) | | | | | (2,030) | | | (3,563) | |

| Income (loss) before income taxes | 19,674 | | | 19,782 | | | 1,112 | | | (494) | | | | | (8,089) | | | 31,985 | |

| Income tax expense | 13,173 | | | 888 | | | — | | | — | | | | | 11,783 | | | 25,844 | |

| Net income (loss) | $ | 6,501 | | | $ | 18,894 | | | $ | 1,112 | | | $ | (494) | | | | | $ | (19,872) | | | $ | 6,141 | |

| Consolidated capital expenditures | $ | 10,109 | | | $ | 11,987 | | | $ | 3,870 | | | $ | — | | | | | $ | — | | | $ | 25,966 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended September 30, 2023 |

| (in thousands) | Gabon | | Egypt | | Canada | | Equatorial Guinea | | | | Corporate and Other | | Total |

| Revenues: | | | | | | | | | | | | | |

| Crude oil, natural gas and natural gas liquids sales | $ | 171,936 | | | $ | 106,399 | | | $ | 27,577 | | | $ | — | | | | | $ | — | | | $ | 305,912 | |

| Operating costs and expenses: | | | | | | | | | | | | | |

| Production expense | 59,077 | | | 38,239 | | | 8,136 | | | 1,007 | | | | | 301 | | | 106,760 | |

| FPSO demobilization and other costs | 5,647 | | | — | | | — | | | — | | | | | — | | | 5,647 | |

| Exploration expense | 51 | | | 1,208 | | | — | | | — | | | | | — | | | 1,259 | |

| Depreciation, depletion and amortization | 43,885 | | | 37,519 | | | 13,406 | | | — | | | | | 148 | | | 94,958 | |

| General and administrative expense | 1,284 | | | 435 | | | — | | | 310 | | | | | 14,806 | | | 16,835 | |

| Credit losses and other | 2,137 | | | — | | | — | | | 300 | | | | | — | | | 2,437 | |

| Total operating costs and expenses | 112,081 | | | 77,401 | | | 21,542 | | | 1,617 | | | | | 15,255 | | | 227,896 | |

| Other operating income (loss), net | (57) | | | (241) | | | — | | | — | | | | | — | | | (298) | |

| Operating income (loss) | 59,798 | | | 28,757 | | | 6,035 | | | (1,617) | | | | | (15,255) | | | 77,718 | |

| Other income (expense): | | | | | | | | | | | | | |

| Derivative instruments loss, net | — | | | — | | | — | | | — | | | | | (2,268) | | | (2,268) | |

| Interest income (expense), net | (4,254) | | | (1,581) | | | (4) | | | — | | | | | 464 | | | (5,375) | |

| Bargain purchase gain | — | | | — | | | — | | | — | | | | | (1,412) | | | (1,412) | |

| Other income (expense), net | 9 | | | — | | | 1 | | | (4) | | | | | (103) | | | (97) | |

| Total other expense, net | (4,245) | | | (1,581) | | | (3) | | | (4) | | | | | (3,319) | | | (9,152) | |

| Income (loss) before income taxes | 55,553 | | | 27,176 | | | 6,032 | | | (1,621) | | | | | (18,574) | | | 68,566 | |

| Income tax expense | 36,002 | | | 10,141 | | | — | | | — | | | | | 6,060 | | | 52,203 | |

| Net income (loss) | $ | 19,551 | | | $ | 17,035 | | | $ | 6,032 | | | $ | (1,621) | | | | | $ | (24,634) | | | $ | 16,363 | |

| Consolidated capital expenditures | $ | 15,173 | | | $ | 32,084 | | | $ | 16,008 | | | $ | — | | | | | $ | 36 | | | $ | 63,301 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | Gabon | | Egypt | | Canada | | Equatorial Guinea | | Cote d'Ivoire | | Corporate and Other | | Total |

| Long-lived assets: | | | | | | | | | | | | | | |

| As of September 30, 2024 | | $ | 158,256 | | | $ | 153,636 | | | $ | 110,474 | | | $ | 10,038 | | | $ | 94,387 | | | $ | 4,798 | | | $ | 531,589 | |

| As of December 31, 2023 | | $ | 171,787 | | | $ | 171,224 | | | $ | 105,189 | | | $ | 10,000 | | | $ | — | | | $ | 1,586 | | | $ | 459,786 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| (in thousands) | | Gabon | | Egypt | | Canada | | Equatorial Guinea | | Cote d'Ivoire | | Corporate and Other | | Total |

| Total assets: | | | | | | | | | | | | | | |

| As of September 30, 2024 | | $ | 205,649 | | | $ | 319,955 | | | $ | 116,455 | | | $ | 14,689 | | | $ | 157,357 | | | $ | 123,798 | | | $ | 937,903 | |

| As of December 31, 2023 | | $ | 309,394 | | | $ | 263,015 | | | $ | 114,215 | | | $ | 11,327 | | | $ | — | | | $ | 125,265 | | | $ | 823,216 | |

5. EARNINGS PER SHARE

Basic earnings per share (“EPS”) is calculated using the average number of shares of common stock outstanding during each period. For the calculation of diluted shares, the Company assumes that restricted stock is outstanding on the date of

vesting, and the Company assumes the issuance of shares from the exercise of stock options using the treasury stock method.

A reconciliation of reported net income to net income used in calculating EPS as well as a reconciliation from basic to diluted shares follows:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| (in thousands) |

| Net income (loss) (numerator): | | | | | | | |

| Net Income | $ | 10,990 | | | $ | 6,141 | | | $ | 46,827 | | | $ | 16,363 | |

| Income attributable to unvested shares | (145) | | | (66) | | | (491) | | | (122) | |

| Numerator for basic | 10,845 | | | 6,075 | | | 46,336 | | | 16,241 | |

| Loss attributable to unvested shares | — | | | (8) | | | — | | | (49) | |

| Numerator for dilutive | $ | 10,845 | | | $ | 6,067 | | | $ | 46,336 | | | $ | 16,192 | |

| | | | | | | |

| Weighted average shares (denominator): | | | | | | | |

| Basic weighted average shares outstanding | 103,743 | | 106,289 | | 103,644 | | 106,876 |

| Effect of dilutive securities | 99 | | 144 | | 84 | | 196 |

| Diluted weighted average shares outstanding | 103,842 | | 106,433 | | 103,728 | | 107,072 |

| Stock options and unvested restricted stock grants excluded from dilutive calculation because they would be anti-dilutive | 734 | | 530 | | 437 | | 336 |

6. REVENUE

Gabon

The Company currently sells crude oil production from Gabon under term crude oil sales and purchase agreements (“COSPA” or “COSPAs”) or crude oil sales and marketing agreements ("COSMA” or “COSMAs"). The following table presents revenues from contracts with customers as well as revenues associated with the obligations under the Etame PSC. | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues from customer contracts: | (in thousands) |

| Sales under the COSPA or COSMA | $ | 54,933 | | | $ | 64,100 | | | $ | 182,048 | | | $ | 194,179 | |

| Other items reported in revenue not associated with customer contracts: | | | | | | | |

| Carried interest recoupment | 652 | | | 1,378 | | | 1,826 | | | 3,590 | |

| Royalties | (7,977) | | | (8,203) | | | (25,088) | | | (25,833) | |

| Net revenues | $ | 47,608 | | | $ | 57,275 | | | $ | 158,786 | | | $ | 171,936 | |

With respect to the government’s share of Profit Oil, the Etame PSC provides that corporate income tax is satisfied through the payment of Profit Oil. In the unaudited consolidated statements of operations and comprehensive income, the government’s share of revenues from Profit Oil is reported in revenues with a corresponding amount reflected in the current provision for income tax expense. Payments of the income tax expense are reported in the period that the government takes its Profit Oil in-kind, which is the period in which it lifts the crude oil. As of September 30, 2024 and December 31, 2023, the Company had a $35.7 million and $18.9 million, respectively, of foreign income tax payable, respectively.

Egypt

The following table presents revenues in Egypt from contracts with customers:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues from customer contracts: | (in thousands) |

| Gross sales | $ | 63,432 | | | $ | 88,748 | | | $ | 191,938 | | | $ | 193,570 | |

| Royalties | (28,714) | | | (37,944) | | | (84,550) | | | (86,176) | |

| Selling costs | (174) | | | (497) | | | (402) | | | (995) | |

| Net revenues | $ | 34,544 | | | $ | 50,307 | | | $ | 106,986 | | | $ | 106,399 | |

Canada

The following table presents revenues in Canada from contracts with customers:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues from customer contracts: | (in thousands) |

| Oil revenue | $ | 8,039 | | | $ | 7,832 | | | 21,739 | | | $ | 22,811 | |

| Gas revenue | 224 | | | 988 | | | 1,429 | | | 2,649 | |

| NGL revenue | 2,008 | | | 2,073 | | | 5,905 | | | 6,421 | |

| Royalties | (1,533) | | | (2,206) | | | (3,801) | | | (4,304) | |

| Selling costs | (351) | | | — | | | (812) | | | — | |

| Net revenues | $ | 8,387 | | | $ | 8,687 | | | 24,460 | | | $ | 27,577 | |

Cote d'Ivoire

The following table presents revenues in Cote d'Ivoire from contracts with customers:

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | Nine Months Ended September 30, |

| 2024 | | 2023 | | 2024 | | 2023 |

| Revenues from customer contracts: | (in thousands) |

| Revenues | $ | 49,795 | | | $ | — | | | $ | 67,035 | | | $ | — | |

Information about the Company’s most significant customers

For the three months ended September 30, 2024, the Company had one customer each that comprised 100% of its sales for Gabon, Egypt and Cote d'Ivoire. In Canada, three separate customers made up approximately 59%, 22% and 16% of its sales.

For the nine months ended September 30, 2024, the Company had one customer each that comprised 100% of its sales for Gabon, Egypt and Cote d'Ivoire. In Canada, three separate customers made up approximately 44%, 30% and 21% of its sales.

7. CRUDE OIL, NATURAL GAS AND NGLS PROPERTIES AND EQUIPMENT

The Company’s crude oil, natural gas and NGLs properties and equipment is comprised of the following:

| | | | | | | | | | | |

| | As of September 30, 2024 | | As of December 31, 2023 |

| | (in thousands) |

| Crude oil, natural gas and NGLs properties and equipment - successful efforts method: | | | |

| Wells, platforms and other production facilities | $ | 1,606,047 | | | $ | 1,468,542 | |

| Work-in-progress | 12,242 | | | 4,183 | |

| Undeveloped acreage | 53,780 | | | 52,109 | |

| Equipment and other | 67,239 | | | 47,794 | |

| Total crude oil, natural gas and NGLs properties, equipment and other | 1,739,308 | | | 1,572,628 | |

| Accumulated depreciation, depletion, amortization and impairment | (1,207,719) | | | (1,112,842) | |

| Net crude oil, natural gas and NGLs properties, equipment and other | $ | 531,589 | | | $ | 459,786 | |

8. DERIVATIVES AND FAIR VALUE

The Company uses derivative financial instruments from time to time to achieve a more predictable cash flow from crude oil and gas production by reducing the Company’s exposure to price fluctuations. See the table below for the list of outstanding contracts as of September 30, 2024:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Settlement Period | | Type of Contract | | Index | | Average Monthly Volumes | | Weighted Average Put Price |

| | | | | | | (Bbls)a | | (per Bbl) |

| October 2024 - December 2024 | | Put Options | | Dated Brent | | 125,000 | | $ | 65.00 | |

a)The premium for these options was $4.01 per barrel and was paid in October 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| Settlement Period | | Type of Contract | | Index | | Average Monthly Volumes | | Weighted Average SWAP Price in CAD |

| | | | | | | (GJ)b | | (per GJ) |

| November 2024 - March 2025 | | Swap | | AECO (7A) | | 67,000 | | $ | 2.80 | |

b)One gigajoule (GJ) equals one billion joules (J). A gigajoule of natural gas is about 25.5 cubic metres at standard conditions.

The following table sets forth the gain (loss) on derivative instruments on the Company’s unaudited condensed consolidated statements of operations and comprehensive income:

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | Three Months Ended September 30, | | Nine Months Ended September 30, |

| Derivative Item | | Statements of Operations Line | | 2024 | | 2023 | | 2024 | | 2023 |

| | | | | (in thousands) | | (in thousands) |

| Commodity derivatives | | Cash settlements paid on matured derivative contracts, net | | $ | 18 | | | $ | 1 | | | $ | (15) | | | $ | (62) | |

| | | Unrealized gain (loss) | | 192 | | | (2,321) | | | (365) | | | (2,206) | |

| | | Derivative instruments gain (loss), net | | $ | 210 | | | $ | (2,320) | | | $ | (380) | | | $ | (2,268) | |

9. CURRENT ACCRUED LIABILITIES AND OTHER

Accrued liabilities and other balances were comprised of the following:

| | | | | | | | | | | |

| As of September 30, 2024 | | As of December 31, 2023 |

| (in thousands) |

| Accrued accounts payable invoices | $ | 38,720 | | | $ | 21,225 | |

| Gabon contractual obligations | 8,081 | | | 15,794 | |

| | | |

| State oil liability | 22,145 | | | — | |

| Capital expenditures | 8,551 | | | 10,136 | |

| Egypt modernization payments | 9,742 | | | 9,933 | |

| Accrued wages and other compensation | 6,725 | | | 3,746 | |

| Seismic data | 2,455 | | | — | |

| Other | 7,429 | | | 6,763 | |

| Total accrued liabilities and other | $ | 103,848 | | | $ | 67,597 | |

10. COMMITMENTS AND CONTINGENCIES

Abandonment funding

Under the terms of the Etame PSC, the Company has a cash funding arrangement for the eventual abandonment of all offshore wells, platforms and facilities on the Etame Marin block. At September 30, 2024, $10.7 million ($6.3 million, net to VAALCO) of the abandonment fund has been funded on an undiscounted basis. The annual payments will be adjusted based on revisions in the abandonment estimate. This cash funding is reflected under “Other noncurrent assets” in the “Abandonment funding” line item of the unaudited condensed consolidated balance sheets. Future changes to the anticipated abandonment cost estimate could change the asset retirement obligation and the amount of future abandonment funding payments.

Share Buyback Program

On November 1, 2022, the Company announced that the Company’s board of directors formally ratified and approved a share buyback program. The board of directors also directed management to implement a Rule 10b5-1 trading plan (the “10b5-1 Plan”) to facilitate share purchases through open market purchases, privately negotiated transactions, or otherwise in compliance with Rule 10b-18 under the Securities Exchange Act of 1934. The 10b5-1 Plan provided for an aggregate purchase of currently outstanding common stock up to $30 million over a maximum period of 20 months. Payment for shares repurchased under the share buyback program were funded using the Company's cash on hand and cash flow from operations. The share buyback program was completed on March 12, 2024. Under the share buyback program, we purchased a total of 6,797,711 shares at an average price of $4.41 per share.

Merged Concession Agreement

The Company is a party to the Merged Concession Agreement with the Egyptian General Petroleum Corporation (“EGPC”). In accordance with the Merged Concession Agreement, the Company is required to make a $10.0 million annual modernization payment to EGPC each year through February 1, 2026. The $10.0 million modernization payment due February 1, 2024 was offset against receivables owed to the Company from EGPC. On the unaudited condensed consolidated balance sheet as of September 30, 2024, $9.7 million of the remaining modernization payment liability was recorded in the line item “Accrued liabilities and other” and $9.0 million was recorded in “Other long-term liabilities.”

The Company also has minimum financial work commitments of $50.0 million per each five-year period of the primary development term, commencing on February 1, 2020 for a total of $150 million over the 15-year license contract term. Through September 30, 2024, the Company's financial work commitments have exceeded the five-year minimum $50 million threshold and any excess carries forward to offset against subsequent five-year commitments.

As the Merged Concession Agreement was signed in January 2022 and became effective as of February 1, 2020 (the “Merged Concession Effective Date”), there was an effective date adjustment owed to the Company for the difference in the historic commercial terms and the revised commercial terms applied against the production since the Merged Concession Effective Date. The Company recognized a receivable in connection with the Merged Concession Effective Date adjustment of $67.5 million as of October 13, 2022, based on historical realized prices (the "Backdated Receivable"). Subsequent to the determination of the Merged Concession Effective Date adjustment, VAALCO and EGPC have agreed to offset outstanding payables owed to EGPC against the Backdated Receivable balance. In June 2024, EGPC confirmed the final settlement amount of $40.5 million owed to the Company. The remaining net receivable is recorded in the “Egypt receivables and other” line item in the unaudited condensed consolidated balance sheet as of September 30, 2024.

11. DEBT

As of September 30, 2024 and December 31, 2023, the Company had no outstanding debt.

RBL Facility

On May 16, 2022, the Company entered into an agreement with Glencore Energy UK Ltd. (“Glencore”), and other lenders, to provide a senior secured reserve-based revolving credit facility (the “RBL Facility”) for a maximum principal amount of up to $50.0 million. Beginning October 1, 2023 and thereafter on April 1 and October 1 of each year during the term of the RBL Facility, the $50 million initial commitment, will be reduced by $6.3 million. At September 30, 2024, the amount available to be drawn under the RBL Facility was $37.5 million.

The RBL Facility agreement contains certain debt covenants, including that, as of the last day of each calendar quarter, (i) the ratio of Consolidated Total Net Debt to EBITDAX (as each term is defined in the RBL Facility agreement) for the trailing 12 months shall not exceed 3.0x and (ii) consolidated cash and cash equivalents shall not be lower than $10.0 million at any time. The amount the Company can borrow with respect to the borrowing base is subject to compliance with the financial covenants and other provisions of the RBL Facility agreement. Regarding the requirements, the Company must deliver its annual financial statements to Glencore within 90 days of the end of each fiscal year. At September 30, 2024, the Company was in compliance with all debt covenants and had no outstanding borrowings under the RBL Facility.

12. INCOME TAXES