SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of December, 2022

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

MATERIAL FACT

CENTRAIS

ELÉTRICAS BRASILEIRAS S/A CNPJ: 00.001.180/0001-26 | NIRE: 533.0000085-9 PUBLICLY-HELD COMPANY

Centrais Elétricas Brasileiras

S/A (“Company” or “Eletrobras”) (B3: ELET3, ELET5 & ELET6; NYSE: EBR & EBR.B; LATIBEX: XELT.O &

XELT.B), pursuant to article 157, §4, of Law No. 6.404, of December 15, 1976 ("Brazilian Corporate Law"), to CVM

Resolution No. 44, of August 23, 2021, and CVM Resolution No. 78, of March 29, 2022 ("CVM Resolution 78"), referring

to the material fact disclosed on November 28, 2022, informs that the Company's Board of Directors has decided to submit to

the shareholders of the Company's common shares the Management Proposal for the 185th Extraordinary General Meeting, to be

held on January 05, 2023 ("EGM").

The agenda of the EGM, as summarized below,

aims to achieve Eletrobras' objectives of simplifying and rationalizing its shareholder structure and carrying out the merger of shares

of its Subsidiaries (as defined below) to achieve synergy and operational gains, as well as simplifying and improving the organizational

and governance structures of the companies involved, with the consequent improvement in its market positioning.

Redemption of all Class A Preferred

Shares

Due to the low liquidity of the "Class

A" preferred shares ("Class A Preferred Shares") - representing 0.006384% of the Company's capital stock - the management

proposes the redemption of all the Class A Preferred Shares, pursuant to article 16 of the Company’s Bylaws and article 44, paragraph 1,

of the Brazilian Corporate Law, at the amount of BRL 48.4502 per Class A Preferred Share (“Redemption Price”) and the

consequent cancellation of the redeemed Class A Preferred Shares, without reduction of the capital stock ("Redemption of Class

A Preferred Shares").

The Company's management clarifies that

the decision for the Redemption of Class A Preferred Shares was based on the authorization provided for in the Company’s Bylaws

and aims at rationalizing and simplifying its shareholder structure, as well as the reduction of regulatory compliance costs.

Merger of Shares

Additionally, the management submitted for

the shareholders the resolution on the merger of shares of the following subsidiaries: (i) Companhia Hidro Elétrica do São

Francisco ("CHESF"); (ii) Companhia de Geração e Transmissão de Energia Elétrica do

Sul do Brasil ("CGT Eletrosul"); (iii) Furnas - Centrais Elétricas S. A. ("Furnas"); and

(iv) Centrais Elétricas do Norte do Brasil S.A. ("Eletronorte" and, together with CHESF, CGT Eletrosul and

Furnas, the "Subsidiaries").

In compliance with Annex A of CVM Resolution

78 the Company presents the following information:

| 1. | Identification of the companies involved in the operation and brief description

of the activities performed by them |

Centrais Elétricas Brasileiras

S/A: Eletrobras was established by Law No. 3.890-A, of June 15, 1962, in the form of a corporation, having as its corporate purpose

promoting studies, construction projects and the operation of electrical energy generation plants, transmission and distribution lines,

as well as carrying out commercial acts arising from these activities, such as the marketing of electrical energy, which led Eletrobras

to make a decisive contribution to the expansion of the supply of electrical energy and to the development of the country. Eletrobras

is active in the generation, transmission and commercialization of electrical energy in the country and contributes to making the Brazilian

energy matrix one of the cleanest and most renewable in the world.

Companhia Hidro Elétrica do

São Francisco: CHESF is a publicly-held corporation, established by Decree-Law No. 8.031/45, with operations initiated

on March 15, 1948. CHESF's main activities are the generation and transmission of electrical energy, operating all over Brazil, and its

main buyers are currently the Southeast and Northeast regions. CHESF's operations in the generation of electrical energy include 12 hydroelectric

power plants and 14 wind power plants, totaling an installed capacity of 10,460.4 MW on September 30, 2022, and, in the activity

of energy transmission, the system is composed of 139 power substations and 21,969.4 km of high voltage lines on September 30, 2022. In

addition to its own generation park and transmission systems, the company participates, in partnership with other companies, in the construction

and operation of hydroelectric power plants and wind power plants with installed capacities, as of September 30, 2022, of 15,646MW and

93.0MW, respectively, and of transmission undertakings composed, as of September 30, 2022, of 6,125.0km of high voltage lines.

Companhia de Geração

e Transmissão de Energia Elétrica do Sul do Brasil: CGT Eletrosul is a private company founded on July 28, 1997.

CGT Eletrosul started its activities mainly in thermal power generation in the state of Rio Grande do Sul. On January 2, 2020, after the

merger of Eletrosul Centrais Elétricas S.A., the company’s corporate purpose included carrying out studies, projects, construction,

operation and maintenance of power plants, substations, transmission and distribution lines, in accordance with the legislation in force.

Furnas – Centrais Elétricas

S.A.: Furnas is a private company engaged in the generation, transmission, and sale of electric power in the region comprising

the Federal District and the states of São Paulo, Minas Gerais, Rio de Janeiro, Espírito Santo, Rio Grande do Sul, Santa

Catarina, Goiás, Mato Grosso, Mato Grosso do Sul, Pará, Tocantins, Rondônia, Ceará and Bahia. Its energy is

commercialized with energy distribution companies, traders and free consumers all over the national territory. Furnas holds several public

service concessions in the electricity generation and transmission segments.

Centrais Elétricas do Norte

do Brasil S.A.: Eletronorte is a private company authorized to operate by Decree No. 77,548/73, as a concessionaire of public

electric power services. The main corporate purpose of Eletronorte is, among other activities (a) to carry out studies, projects,

construction, operation and maintenance of power plants, substations, power transmission and distribution lines, energy commercialization,

as well as the execution of corporate acts arising from these activities; and (b) to associate itself, upon prior and express authorization

from the Eletrobras’ Board of Directors, to form business consortiums or to participate in companies, with or without controlling

power, in Brazil or abroad, which are intended, directly or indirectly, to explore the production or transmission of electrical energy

under a concession, authorization or permission regime. Eletronorte holds equity interest in five specific purpose companies (SPC) for

the generation and transmission of electric power.

| 2. | Description and purpose of the transaction |

The merger of shares is a form of corporate

reorganization with express provision in the Brazilian Corporate Law, used by economic groups in search of synergies, operational gains,

cost reduction, simplification of corporate structures, greater speed in the decision-making process and expansion of the competitiveness

and efficiency of the group against competitors. Thus, the main objective of the transaction is to ensure that the parent company becomes

a sole shareholder of its subsidiaries, converting them into wholly-owned subsidiaries, giving minority shareholders of the latter the

choice of migrating to the shareholder base of the former. In the specific case of Eletrobras, this transaction is justified as being

in the interest of all parties concerned, since its subsidiaries CHESF, Furnas, CGT Eletrosul and Eletronorte have today in their corporate

chart a group of minority shareholders who hold a small portion of the voting capital of these companies.

In this sense, from the standpoint of the

minority shareholders of these controlled companies, it is logical and rational to migrate to the Eletrobras

shareholding base, which is built upon the format of a publicly-held company with dispersed capital in a true corporation model. In this

sense, by becoming Eletrobras’ shareholders, such minorities will have greater liquidity and political power, since they will no

longer be minority shareholders in companies with a defined control and, for the most part, private companies. The only publicly-held

subsidiary is CHESF, which is registered under Category A with CVM; but although CHESF is a publicly-held company, its shares are not

admitted for trading (listed) on B3 (the Brazilian stock exchange) and therefore it lacks liquidity, so its shareholders will also benefit

from the merger of shares.

From the standpoint of Eletrobras' shareholders,

this transaction is equally relevant and justified, as it unlocks extremely relevant value levers associated with the management and organization

of these subsidiaries, which will ultimately be reflected in the expected future appreciation and profitability of Eletrobras itself.

| 3. | Main benefits, costs and risks of the transaction |

Benefits of the Merger of Shares.

The operation is justified as being in the interest of all stakeholders, considering that the Subsidiaries currently have in their corporate

chart a group of minority shareholders who hold a small portion of the voting capital of these companies. The restructuring of the Subsidiaries

in order to allow them to have a sole shareholder will then allow the scope of action of these companies to be reviewed and rethought,

with a view to: (i) the complete restructuring and simplification of their governance systems, focusing on smaller local administrations

with an operational management profile; (ii) centralization and standardization of macro processes and structures, with the elimination

of redundancies and efficiency gains in the operation of assets and execution of investment projects; (iii) strengthening of Eletrobras'

role in the strategic direction of its subsidiaries and in defining the best management model; and (iv) greater legal security in

the decision-making process, given the absence of potential conflicting interests normally associated with a plurality of shareholder

base scenario. Therefore, one notices that the main advantages of converting a standard subsidiary into a wholly-owned subsidiary lie

on the moment after the transaction, due to the remodeling of its scope of action, management and governance.

Costs of the Merger of Shares. The

Company's management estimates that the costs of carrying out the merger of shares will be approximately BRL 3,841,744.00, including expenses

with publications, auditors, appraisers, lawyers and other professionals hired to advise in this case.

Risks of the Merger of Shares. The

Company's management does not identify any relevant risks in the implementation of the merger of shares.

| 4. | Exchange of shares ratio and criteria for fixing the exchange ratio |

The shares issued by the Subsidiaries not

yet held by the Company will be subject to exchange by common shares issued by the Company. The respective share exchange ratio will be

equivalent to the net book value of the shares of the companies involved, as of June 30, 2022, as calculated in appraisal reports prepared

by the independent appraisal firm Taticca Auditores Independentes S.S. (which hiring will be subject to approval by the Company's shareholders

at the EGM), as follows:

(i) 7.9948

Eletrobras’ common shares for each CHESF’s preferred share (it should be noted that minority shareholders do not hold CHESF’s

common shares);

(ii) 0.0082

Eletrobras’ common share for each Furnas’ common or preferred share;

(iii) 0.00037

Eletrobras’ common share for each CGT Eletrosul’s share; and

(iv) 2.8155

Eletrobras’ common shares for each Eletronorte’s share.

| 5. | If the transaction was or will be submitted to the approval of Brazilian

or foreign authorities |

The merger of shares does not depend on

the submission to, or approval by, any Brazilian or foreign authority.

| 6. | In transactions involving controlling companies, controlled companies

or companies under common control, the share exchange ratio calculated pursuant to article 264 of the Brazilian Corporate Law |

With regard to a merger of shares of a company

into its respective controlling company (as it is the case of the proposed merger of shares), article 264, §3 of the Brazilian Corporate

Law establishes that should the share exchange ratio of the acquired company for shares of the acquiring company be less favorable than

that indicated in the appraisal report prepared for purposes of article 264 of the Brazilian Corporate Law, the dissenting shareholders'

withdrawal right, provided they request it in due time, shall be calculated based on the value indicated in the appraisal report in question.

Such appraisal report was hired by the Company from Ernst & Young Assessoria Empresarial Ltda. (EY), and such hiring will be subject

to ratification by the Company's shareholders at the EGM.

It should be noted that the exchange ratio

of CHESF’s and Furnas’ shares for Eletrobras’ shares in the context of the mergers of shares calculated based on the

appraisal reports prepared for the purposes of the abovementioned article 264 is more advantageous to the shareholders of these subsidiaries

than the exchange ratio proposed in the respective Protocols and Justification, i.e., that calculated based on the appraisal reports

of the net book value of the respective shares.

Thus, the provisions of article 264, §3,

of the Brazilian Corporate Law will be applied to the dissenting shareholders of CHESF and Furnas, so that they may choose between having

their possible withdrawal right calculated based on the provisions of article 45 of the Brazilian Corporate Law, that is, (i.a) in

regards to CHESF, BRL 369.36 per preferred share (as all the common shares are held by the Company) and; (i.b) in regards to Furnas,

BRL 0.3968 per common or preferred share; or (ii) the amount calculated in the article 264 appraisal report of the respective Subsidiary,

that is, (ii.a) in regards to CHESF, BRL 439.7032 per preferred share (as all the common shares are held by the Company); (ii.b) in

regards to Furnas, BRL 0.6337 per common or preferred share.

It should also be noted that the exchange

ratio of CGT Eletrosul’s and Eletronorte’s shares for Eletrobras’ shares in the context of the merger of shares calculated

on the basis of the article 264 appraisal reports is considered not to be as advantageous for the shareholders of the Subsidiaries as

the exchange ratio proposed in the Protocols and Justification, i.e., the one calculated based on the appraisal reports of the net book

value of the respective shares.

Therefore, the provisions of article 264,

§3, of the Brazilian Corporate Law are not applicable to the dissenting shareholders of CGT Eletrosul and Eletronorte, so that the

withdrawal right of such shareholders will be equivalent to the value of the net book equity contained in the financial statements of

the respective Subsidiary as of December 31, 2021, approved at the last ordinary general shareholders’ meeting of CGT Eletrosul

and Eletronorte, that is (i) with respect to CGT Eletrosul, BRL 0.0182 per share; and (ii) with respect to Eletronorte, BRL 127.2152

per share.

With regard to the Company, as will be better

explained below, holders of Class A Preferred Shares have withdrawal rights as a result of the proposed merger of shares, if the Redemption

of Class A Shares is not approved at the EGM. As consideration for the exercise of the right of withdrawal by such shareholders, they

will receive the value of their shares, calculated pursuant to article 45, §1, of the Brazilian Corporate Law. In this sense, the

reimbursement amount will correspond to the net book value per Class A Preferred Share calculated based on the net equity indicated in

the Company's Consolidated Financial Statements as of December 31, 2021, approved at the Company's ordinary general shareholders’

meeting held on April 22, 2022 - that is, BRL 48.5179

per Class A Preferred Share.

Pursuant to the procedure set forth in article

137, IV, of the Brazilian Corporate Law, for purposes of the exercise of the withdrawal right, the applicable shareholders shall express

their opinion within 30 days from the publication of the minutes of the meeting, including the dissenting shareholders of CHESF and Furnas,

indicating their option for the withdrawal right calculated based on article 45 or §3 of article 264 of the Brazilian Corporate

Law, as indicated above.

| 7. | Applicability of the withdrawal right and reimbursement amount |

In the merger of companies, the dissenting

shareholders of the merged company may withdraw from the company by reimbursing the value of their shares, as provided for in article

136, item IV, and article 137 of the Brazilian Corporate Law.

Article 252 of the Brazilian Corporate Law

extends this right of withdrawal to the dissenting shareholders of the acquiring and acquired company in a merger of shares.

However, we point out that, under the terms

of article 137, II, of the Brazilian Corporate Law - which is also referred to in §§2 and 3 of article 252 and, therefore, also

applies to mergers of shares - "the holder of a share of a type or class that has liquidity and dispersion in the market shall

not have withdrawal rights”.

The Company's shareholders, except for the

holders of Class A Preferred Shares, do not have withdrawal rights as a result of the mergers of shares, to the extent that the shares

held by them have liquidity, since they are included in B3 indexes, and have dispersion, since the Company does not have a controlling

shareholder and, therefore, no shareholder holds more than half of the shares of any kind or class.

The only shareholders of the Company that

have withdrawal rights as a result of the operation are the holders of Class A Preferred Shares, since these shares do not have liquidity.

It should be noted that if the Redemption of Class A Preferred Shares is approved at the EGM, there will be no withdrawal rights for holders

of such shares, since the delisting and cancellation of this class of shares would be approved prior to the resolution of the merger of

shares, and therefore, in a prejudicial way to the withdrawal right.

As for the Subsidiaries, since they are

privately held companies (except for CHESF), they are not part of any stock exchange trading index and therefore do not have liquidity.

In regards to CHESF, although it is a publicly-held company, its shares are not admitted for trading (listing) on B3 and, therefore, they

also lack liquidity. Thus, all dissenting shareholders of the Subsidiaries will have withdrawal rights as a result of the merger of shares

of the Subsidiaries by Eletrobras.

Pursuant to article 137, §3, of the

Brazilian Corporate Law, in the 10 days following the end of the period for the exercise of the withdrawal right, if the Company's management

understands that the payment of the reimbursement amount of the shares to dissenting shareholders who exercised their withdrawal right

will put at risk the Company's financial stability, they may call a shareholders' meeting to ratify or reconsider the resolution. Nevertheless,

the merger of shares is effective from the date of the EGM, under the terms of §3 of article 252 of the Brazilian Corporate Law.

The payment of the reimbursement amount

to the dissenting shareholders who exercised their withdrawal right may only be demanded after the 10-day period mentioned above (if the

reconsideration meeting has not been convened) or after the ratification of the resolution by the general meeting (if it has been convened

within that period). If the meeting reconsiders the resolution, the mergers of shares will no longer be implemented and there will be

no withdrawal or reimbursement.

Also, the reimbursement of shares may be

paid to the account of profits or reserves, except the legal reserve, and in this case the reimbursed shares will remain in treasury,

as established in article 45, §5, of the Brazilian Corporate Law.

| 8. | Other relevant information |

The list of documents required for the exercise

of voting rights at the EGM, which will resolve on the Redemption of Class A Preferred Shares and the Merger of Shares, are available

to the Company's shareholders as of this date at the Company's headquarters and on the website of the Company (https://ri.eletrobras.com/),

CVM (https://www.gov.br/cvm/pt-br) and B3 (www.b3.com.br), and may be consulted by the Company's shareholders, in accordance with the

applicable regulations.

The Company will keep its shareholders and

the market in general duly informed about the development of the matters that are the object of this relevant fact.

Rio de Janeiro, December 05, 2022

Elvira Cavalcanti Presta

CFO and Investor Relations Officer

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: December 05, 2022

| CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS |

| |

|

|

| By: |

/S/ Elvira

Baracuhy Cavalcanti Presta

|

|

| |

Elvira Baracuhy Cavalcanti Presta

CFO and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

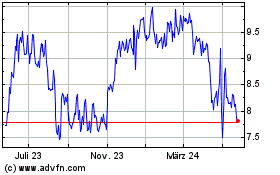

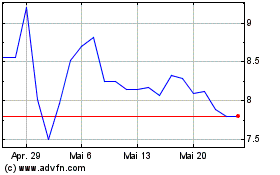

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024