SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

Report of Foreign Private Issuer

Pursuant to Rule 13a-16 or 15d-16 of the

Securities Exchange Act of 1934

For the month of June, 2022

Commission File Number 1-34129

CENTRAIS ELÉTRICAS BRASILEIRAS S.A.

- ELETROBRÁS

(Exact name of registrant as specified in its

charter)

BRAZILIAN ELECTRIC POWER COMPANY

(Translation of Registrant's name into English)

Rua da Quitanda, 196 – 24th floor,

Centro, CEP 20091-005,

Rio de Janeiro, RJ, Brazil

(Address of principal executive office)

Indicate by check mark whether the registrant

files or will file annual reports under cover Form 20-F or Form 40-F.

Form 20-F ___X___ Form 40-F _______

Indicate by check mark whether the registrant

by furnishing the information contained in this Form is also thereby furnishing the information to the Commission pursuant to Rule

12g3-2(b) under the Securities Exchange Act of 1934.

Yes _______ No___X____

| CA Rua da Quitanda, No. 196, 25th floor 22210-030 Rio de Janeiro – RJ1 DEL statement-070/2022 RCA 935, of June 9, 2022 |

| | |

CERTIFICATION

MINUTES OF THE NINE HUNDRED THIRTY-FIFTH MEETING OF THE BOARD

OF DIRECTORS OF "CENTRAIS ELÉTRICAS BRASILEIRAS S.A. – ELETROBRAS"

CNPJ/ME No. 00001180/0001-26

NIRE 53.3.00000859

On June 9, 2022, at 11:30 p.m. the Board of Directors

of "Centrais Elétricas Brasileiras S.A. – Eletrobras” ("Company"), with headquarters located

at Rua da Quitanda, No. 126, 25th floor, Centro, Rio de Janeiro-RJ, held its 935th meeting by videoconference in an exclusively

remote environment - Cisco Webex Meetings, with an end time of 11:50 p.m. on the same day. The summons of the meeting was made

by order of the Chairman of the Board of Directors, by means of electronic mail, on May 2, 2022, pursuant to paragraph 5, article 28,

of the Company's Bylaws. Councilor RUY FLAKS SCHNEIDER (RFS) assumed the presidency of the meeting. Board members ANA CAROLINA TANNURI

LAFERTE MARINHO (ALM), JERÔNIMO ANTUNES (JEA), BRUNO EUSTÁQUIO FERREIRA CASTRO DE CARVALHO (BEC), MARCELO DE SIQUEIRA FREITAS

(MSF), FELIPE VILLELA DIAS (FVD), DANIEL ALVES FERREIRA (DAF) e ANA SILVIA CORSO MATTE (ASM) attended the meeting. Board member CARLOS

EDUARDO RODRIGUES PEREIRA (CRP) was absent, with justification. The Secretary of Governance, BRUNO KLAPPER LOPES (BKL), also participated

in the meeting, together with the Advisor to the Board of Directors, FERNANDO KHOURY FRANCISCO JUNIOR (FKJ).

Agenda: Eletrobras' Executive Board, through

Resolution RES-270/2022 dated June 9, 2022, pursuant to the authorization granted by the 181st Extraordinary General Meeting

held on February 22, 2022 and the resolutions passed by its Board of Directors at the 933rd Board Meeting held on May

27, 2022, and in compliance with the provisions of the Investment Partnership Program Council Resolution ("CPPI")

No. 203, of October 19, 2021, as amended ("CPPI Resolution 203") and as approved by the Federal Court of Accounts on

May 18, 2022, formalized a proposed resolution with the purpose of approving:

| (1) | the price per common share issued by the

Company under the public offering for the primary distribution ("Primary Offering") and secondary distribution of common

shares issued by the Company ("Common Shares"), approved at the 181st Extraordinary General Meeting held on

May 22, 2022 and the 933rd Meeting of the Board of Directors held on May 27, 2022 ("Global Offering"). |

| (2) | the accounting destination of the funds

obtained by the Company with the Global Offering. |

| (3) | the Company's capital increase, within

the limit of authorized capital, through the issuance of Common Shares, excluding the preemptive rights of the Company's current shareholders,

under the terms of article 172, item I, of Law No. 6,404 of December 15, 1976, as amended ("Corporation Law"),

and the sole paragraph of article 8 of the Company's bylaws. |

| (4) | the verification of the subscription of

the Common Shares issued in the Global Offering and approval of the Company's new capital stock. |

| (5) | the updating, ad referendum of

the next general shareholders' meeting of the Company, of the capital stock reflected in the caput of article 8 of the Company's

bylaws. |

| (6) | the full content of certain documents

prepared within the scope of the Global Offering. |

| (7) | the confirmation of the

authorization for the Company's officers to perform all regular management acts that may be necessary to carry out the Global

Offering, including, but not limited to, (i) negotiation of the

terms, conditions and documents of the Global Offering; and (ii) execution

of all agreements and documents necessary for the Global Offering. |

| CA Rua da Quitanda, No. 196, 25th floor 22210-030 Rio de Janeiro – RJ1 DEL statement-070/2022 RCA 935, of June 9, 2022 |

| | |

| (8) | the authorization for the Company's Chief

Governance, Risk and Compliance Officer to formalize the validation of the final versions of the documentation for the Global Offering

by the Company to the working group of the Global Offering, including (i) the completion of information arising from the setting

of the Price per Share, pursuant to item(1) above; and (ii) the correction of inconsistencies and/or adjustments of information identified

by the independent auditors, the Company's financial advisors and the legal advisors hired for the Global Offering due to the validation

and finalization of the review of the Global Offering Documents. |

Deliberation: DEL 070/2022. The following was

approved, without reservations and restrictions, by unanimity of the Board of Directors present, and with the prior advice of the Company's

competent governance bodies, as applicable:

| (1) | the issue price of R$42.00 per Common

Share ("Price per Share"), including in the form of American Depositary Shares ("ADS"), within

the scope of the Global Offering, which was established following the proposal by the coordinators of the Global Offering to the Company

and the selling shareholder, and after verification that the Price per Share is not less than the minimum price established by the CPPI

and informed to the Company on this date on a reserved basis, pursuant to Resolution No. CPPI 203, considering the conclusion of

the investment intention book building process conducted by the coordinators of the Brazilian Offering, in Brazil, pursuant to article

23, paragraph 1, and article 44 of CVM Instruction 400, and by the coordinators of the International Offering, abroad ("Bookbuilding

Process"), and had as a parameter (i) the quotation of the common shares issued by the Company at "B3 S.A."

- Brasil, Bolsa, Balcão ("B3"); (ii) the quotation of the ADS on the New York Stock Exchange ("NYSE");

and (iii) the indications of interest in terms of quality and quantity of demand (by volume and price) collected from institutional investors

during the Bookbuilding Process. Under the International Offering, the Price per Share in the form of ADSs was set at US$8.63 ("Price

per ADS"), considering that each ADS corresponds to one common share issued by the Company and that the United States dollar

(US$) exchange rate (PTAX) disclosed by the Central Bank of Brazil on June 9 , 2022 was R$4.8951. Since the Company's

capital increase resulting from the Global Offering is fixed in Brazilian Reais (R$) and the Price per ADS is fixed in United States Dollars

(US$), eventual exchange variations occurring until the effective payment will be accounted for as financial results. |

| (2) | the destination of the totality of the

funds obtained by the Company with the Global Offering to the Company's capital stock account. |

| (3) | after hearing the prior opinion of the

Company's fiscal council, the Company's capital increase, within the limit of authorized capital provided for in the sole paragraph of

article 8 of the Company's bylaws, through the issuance of 627.675.340 common, nominative, book-entry shares with no par value, without

observing the current proportion between common shares and preferred shares issued by the Company, but observing the maximum proportion

between preferred shares and common shares as set forth in paragraph 2 of article 11 of its bylaws, and in item III of paragraph 1 of

article 8 of Law No. 10.303, of October 31, 2001, as amended, excluding the preemptive right, but granting the Shareholders the right

of priority for subscription of the Common Shares of the Primary Offering, including the maximum amount of the supplementary lot of Common

Shares, in an amount equivalent to up to the proportional subscription limit of the respective Shareholder set forth in the Initiation

Announcement and in the Definitive Prospectus, of the shareholders holding Common Shares and Preferred Shares issued by the Company on

May 27, 2022 ("First Cut-off Date") , pursuant to item I of article 172 of the Brazilian Corporation Law and article

8 of the Company's Bylaws, in conformity with the provisions of Law No. 14,182, of July 12, 2021, as amended, at a unit issue price

corresponding to the Price per Share, totaling the amount of

R$26,362,364,280.00, thus increasing the Company's capital stock from

R$39,057,271,546.52 (thirty-nine billion fifty-seven million two hundred seventy-one thousand five hundred forty-six reais and fifty-two

cents) to RS65,419,635,826.52. |

| CA Rua da Quitanda, No. 196, 25th floor 22210-030 Rio de Janeiro – RJ1 DEL statement-070/2022 RCA 935, of June 9, 2022 |

| | |

For purposes of these minutes, "Shareholders"

means all common and preferred shareholders of the Company on the First Cut-off Date, with due regard for the fact that, pursuant to paragraph

3 of article 3 of CPPI Resolution 203, the Global Offering will not admit the participation of (a) organs and entities belonging

to the direct, indirect or foundational federal public administration; (b) funds in which the federal government ("Union")

holds, directly or indirectly, a majority of the shares; and (c) any of the branches of government;

| (4) | the verification of the subscription of

627,675,340 common shares issued by the Company in the Global Offering and the approval of the Company's new capital stock, which now

amounts to R$65,419,635,826.52, divided into 1,916,517,936 common shares, 146,920 (one hundred forty-six thousand, nine hundred and twenty)

preferred class “A” shares and 279,941,394 (two hundred seventy-nine million, nine hundred forty-one thousand, three hundred

and ninety-four) preferred class “B” shares, all nominative, registered and without par value. The Common Shares and the ADSs

issued as a result of the capital increase approved pursuant to item (2) above above shall confer upon their respective holders,

as of the date of settlement of the Global Offering, the same rights, advantages obligations and restrictions attributed respectively

to the holders of common shares issued by the Company and ADSs backed by common shares issued by the Company currently outstanding, pursuant

to the Company’s bylaws, the Brazilian Corporation Law, the Level 1 Regulation of B3 and, as the case may be, the Second Amended

and Restated Deposit Agreement entered into on August 18, 2017 between the Company and Citibank N. A., as amended by Amendment

No 1 to the Second Amended and Restated Deposit Agreement. The new Ordinary Shares and ADS will also entitle their holders to receive

dividends in full and any other earnings of any nature that may be declared as of the date of publication of the Commencement Announcement.

|

| (5) | in view of the ratification of the capital

increase subject to the resolution in item (3) above above, approve, ad referendum of the next general shareholders’

meeting of the Company, the update of the capital stock reflected in the caput of article 8 of the Company’s bylaws to reflect

the Company’s capital increase, which will take effect with the following wording: |

Art. 8° - The capital stock is

65,419,635,826.52 (sixty-five billion, four hundred and nineteen million, six hundred and thirty-five thousand, eight hundred and twenty-six

reais and fifty-two cents), divided into 1,916,517,936 (one billion, nine hundred and sixteen million, five hundred and seventeen thousand,

nine hundred and thirty-six) common shares, 146,920 (one hundred forty-six thousand, nine hundred and twenty) preferred class "A"

shares and 279,941,394 (two hundred seventy-nine million, nine hundred forty-one thousand, three hundred and ninety-four) preferred class

"B" shares, all nominative, registered and without par value.

| (6) | the full content of certain documents

prepared within the scope of the Global Offering: |

| |

(i) |

Private Instrument of Coordination Agreement, Placement and Firm Guarantee

of Settlement of Common Shares Issued by "Centrais Elétricas Brasileiras S.A. - Eletrobras" ("Brazilian Offering

Distribution Agreement"); |

| |

(ii) |

draft of the Adhesion Instrument to the Private Instrument of Coordination,

Placement and Firm Guarantee of Settlement of Common Shares Issued by Centrais Elétricas Brasileiras S.A. - Eletrobras; |

| CA Rua da Quitanda, No. 196, 25th floor 22210-030 Rio de Janeiro – RJ1 DEL statement-070/2022 RCA 935, of June 9, 2022 |

| | |

| |

(iii) |

Private Instrument of Service Provision Agreement for Price Stabilization

of Common Shares Issued by "Centrais Elétricas Brasileiras S.A. - Eletrobras" ("Stabilization Agreement"); |

| |

(iv) |

Private Instrument of Service Provision Agreement for Price Stabilization

of Common Shares Issued by "Centrais Elétricas Brasileiras S.A. - Eletrobras" ("Stabilization Agreement"); |

| |

(v) |

announcement of the beginning of the Global Offering; |

| |

(vi) |

draft of the Global Offering closing announcement; |

| |

(vii) |

Definitive Prospectus of the Public Offering of Primary and Secondary

Distribution of Common Shares Issued by "Centrais Elétricas Brasileiras S.A. Eletrobras", including the documents

attached hereto and incorporated by reference ("Definitive Prospectus"); |

| |

(viii) |

Service Rendering Agreement for the Operational Viability of Public Offerings

for Distribution of Securities; |

| |

(ix) |

International Underwriting and Placement Facilitation Agreement ("Contrato

de Distribuição da Oferta Internacional"); |

| (x) | draft of the restriction agreements on

the sale of Common Shares to be entered into with the Company's management and the selling shareholder in connection with the Global Offering

("Lock-up Agreements"); |

| |

(xi) |

Form 6-K, relating to the filing of the International Offering

Distribution Agreement, and its attachments; |

| (xii) | Form 6-K, relative to the publication

of the Material Fact about the setting of the Price per Share; |

| (xiii) | Final Prospectus Supplement, and

its appendices; |

| (xiv) | Officers' certificate to be signed

by the Company; |

| (xv) | PricewaterhouseCoopers arrangement letter;

|

| (xvi) | NYSE Supplement Listing Application;

and |

| (xvii) | Declaration for Purposes of the Public

Offering of Primary and Secondary Distribution of Common Shares Issued by Centrais Elétricas Brasileiras S.A. - Eletrobras - Certificates

and Back-up; and |

| (xviii) | Section 312.03 Confirmation Letter. |

| (7) | the confirmation of the authorization

for the Company's officers to perform all regular management acts that may be necessary to carry out the Global Offering, including, but

not limited to, (i) negotiation of the terms, conditions and documents of the Global Offering; and (ii) execution of all agreements

and documents necessary for the Global Offering, including the Distribution Agreement of the Brazilian Offering, the Distribution Agreement

of the International Offering, the Stabilization Agreement, the Loan Agreement, and the Lock-up Agreements. |

| (8) | the authorization for the Company's Chief

Governance, Risk and Compliance Officer to formalize the validation of the final versions of the Global Offering documents by the Company

to the Global Offering working group, including (i) the completion of information arising from the setting of the Price per Share,

pursuant to item (1) above; and (ii) the correction of inconsistencies and/or adjustments of information identified by the independent

auditors, the Company's financial advisors and the legal advisors hired for the Global Offering due to the validation and finalization

of the review of the Global Offering Documents; and (iii) adjust the Company's Reference

Form to reflect the changes required as a result of the Global Offering and to correct immaterial inconsistencies. |

| CA Rua da Quitanda, No. 196, 25th floor 22210-030 Rio de Janeiro – RJ1 DEL statement-070/2022 RCA 935, of June 9, 2022 |

| | |

Closure and recording: There being no further business

to discuss on DEL070/2022, the Chairman of the Board of Directors declared the meeting finalized and ordered the Secretary of Governance

to draw up this Certificate which, after being read and approved, was signed by the Chairman of the Board of Directors. The other matters

discussed at this meeting have been omitted from this certificate, since they concern merely internal interests of the Company, a legitimate

precaution supported by the duty of confidentiality of the Management, pursuant to the "caput" of article 155 of the Corporation

Law, and therefore fall outside the scope of the rule contained in paragraph 1 of article 142 of the aforementioned Law. It is recorded

that the material pertinent to the items deliberated at the present Board of Directors Meeting is filed at the Company's headquarters.

The deliberation portrayed in this certificate is a true copy of the decision taken in the minutes of the meeting referred to and contained

in the proper book kept at the Company's headquarters. Present at the meeting and signatories of the minutes: Chairman; The Board Members:

Councilor RUY FLAKS SCHNEIDER (RFS); Board Members ANA CAROLINA TANNURI LAFERTE MARINHO (ALM), JERÔNIMO ANTUNES (JEA), BRUNO EUSTÁQUIO

FERREIRA CASTRO DE CARVALHO (BEC), MARCELO DE SIQUEIRA FREITAS (MSF), FELIPE VILLELA DIAS (FVD), DANIEL ALVES FERREIRA (DAF), and ANA

SILVIA CORSO MATTE (ASM); Secretary of Governance BRUNO KLAPPER LOPES (BKL); and the Advisor to the Board of Directors, FERNANDO KHOURY

FRANCISCO JUNIOR (FKJ).

Rio de Janeiro, June 9, 2022.

_________________________________

RUY FLAKS SCHNEIDER

Chairman of the Board of Directors

SIGNATURE

Pursuant to the requirements of the

Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto

duly authorized.

Date: June 10, 2022

| CENTRAIS ELÉTRICAS BRASILEIRAS S.A. - ELETROBRÁS |

| |

|

|

| By: |

/S/ Elvira

Baracuhy Cavalcanti Presta

|

|

| |

Elvira Baracuhy Cavalcanti Presta

CFO and Investor Relations Officer |

|

FORWARD-LOOKING STATEMENTS

This press release may contain forward-looking statements.

These statements are statements that are not historical facts, and are based on management's current view and estimates offuture

economic circumstances, industry conditions, company performance and financial results. The words "anticipates", "believes",

"estimates", "expects", "plans" and similar expressions, as they relate to the company, are intended

to identify forward-looking statements. Statements regarding the declaration or payment of dividends, the implementation of principal

operating and financing strategies and capital expenditure plans, the direction of future operations and the factors or trends

affecting financial condition, liquidity or results of operations are examples of forward-looking statements. Such statements reflect

the current views of management and are subject to a number of risks and uncertainties. There is no guarantee that the expected

events, trends or results will actually occur. The statements are based on many assumptions and factors, including general economic

and market conditions, industry conditions, and operating factors. Any changes in such assumptions or factors could cause actual

results to differ materially from current expectations.

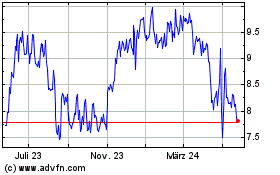

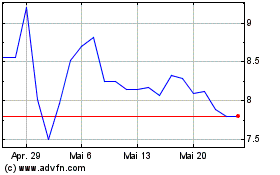

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

Centrais Eletricas Brasi... (NYSE:EBR.B)

Historical Stock Chart

Von Jul 2023 bis Jul 2024