Dril-Quip, Inc. (NYSE:DRQ) ("Dril-Quip") and Innovex Downhole

Solutions, Inc. ("Innovex") today announced that the parties have

agreed to waive the condition to the consummation of Dril-Quip’s

proposed merger with Innovex requiring the approval of the

amendment of Dril-Quip's restated certificate of incorporation (the

“charter amendment”).

In addition, Dril-Quip and Innovex have agreed to withdraw the

submission of the charter amendment proposal (Proposal No. 2) and

the related non-binding governance proposals (Proposal Nos. 3A – F)

to Dril-Quip stockholders at the special meeting of Dril-Quip’s

stockholders to be held on September 5, 2024. These actions

eliminate the requirement that stockholders approve the charter

amendment, which provided for certain post-closing governance

related matters, as a condition to the closing of the merger.

Accordingly, Dril-Quip's stockholders will no longer be asked to

vote to approve Proposals 2 and 3, relating to the charter

amendment, as set forth in Dril-Quip’s proxy statement/prospectus

dated August 6, 2024 in connection with the upcoming stockholder

meeting to be held on September 5, 2024.

John V. Lovoi, Dril-Quip’s Chairman of the Board, said: “We have

engaged in extensive discussions with our stockholders over the

past several weeks. Based on feedback from our investors, we have

heard a clear recognition of the strategic rationale and

anticipated benefits of our proposed merger with Innovex. However,

certain of our stockholders have also expressed concerns regarding

some of the governance provisions included in the charter amendment

proposal. In response to this feedback, we have worked closely with

Innovex and its controlling stockholder to remove these governance

provisions in order to address these concerns. This decision

reflects our responsiveness to shareholder input and commitment to

strong corporate governance practices. We remain confident that

this merger will create significant value for all stakeholders, and

we look forward to continuing to work towards a successful

close.”

The proposed merger remains on track, and Dril-Quip and Innovex

are committed to completing the merger.

The Dril-Quip Board unanimously recommends that Dril-Quip

stockholders vote “FOR” each of the remaining proposals to be

considered at the special meeting, which will be held on Thursday,

September 5, 2024, at 9:30 a.m. Central Time. Dril-Quip

stockholders who have any questions concerning the merger or the

proxy statement/prospectus or would like additional copies or need

help voting their shares of Dril-Quip common stock, please contact

Dril-Quip’s proxy solicitor:

Morrow Sodali LLC 333 Ludlow Street, 5th Floor, South

Tower Stamford, Connecticut 06902 Stockholders may call toll-free:

(800) 662-5200 Banks and brokers may call collect: (203)

658-9400

About Dril-Quip

Dril-Quip is a leading developer, manufacturer and provider of

highly engineered equipment and services for the global offshore

and onshore oil and gas industry.

About Innovex Downhole Solutions, Inc.

Innovex designs, manufactures, and installs mission-critical

drilling & deployment, well construction, completion,

production, and fishing & intervention solutions to support

upstream onshore and offshore activities worldwide.

Cautionary Statement Regarding Forward-Looking

Statements

Statements contained herein relating to future operations and

financial results or that are otherwise not limited to historical

facts are forward-looking statements within the meaning of the

Securities Act of 1933, as amended (the “Securities Act”), and the

Securities Exchange Act of 1934, as amended, including, but not

limited to, those related to projections as to the anticipated

benefits of the proposed transaction, the impact of the proposed

transaction on Dril-Quip’s and Innovex’s businesses and future

financial and operating results are based on management’s

estimates, assumptions and projections, and are subject to

significant uncertainties and other factors, many of which are

beyond Dril-Quip’s and Innovex’s control. These factors and risks

include, but are not limited to: the impact of actions taken by the

Organization of Petroleum Exporting Countries (OPEC) and non-OPEC

nations to adjust their production levels, risks related to the

proposed transaction, including, the prompt and effective

integration of Dril-Quip’s and Innovex’s businesses and the ability

to achieve the anticipated synergies and value-creation

contemplated by the proposed transaction; the risk associated with

Dril-Quip’s ability to obtain the approval of the proposed

transaction by its stockholders required to consummate the proposed

transaction and the timing of the closing of the proposed

transaction, including the risk that the conditions to the

transaction are not satisfied on a timely basis or at all and the

failure of the transaction to close for any other reason;

unanticipated difficulties or expenditures relating to the

transaction, the response of business partners and retention as a

result of the announcement and pendency of the transaction; and the

diversion of management time on transaction related issues, the

impact of general economic conditions, including inflation, on

economic activity and on Dril-Quip’s and Innovex’s operations, the

general volatility of oil and natural gas prices and cyclicality of

the oil and gas industry, declines in investor and lender sentiment

with respect to, and new capital investments in, the oil and gas

industry, project terminations, suspensions or scope adjustments to

contracts, uncertainties regarding the effects of new governmental

regulations, Dril-Quip’s and Innovex’s international operations,

operating risks, the impact of our customers and the global energy

sector shifting some of their asset allocation from fossil fuel

production to renewable energy resources, and other factors

detailed in Dril-Quip’s public filings with the Securities and

Exchange Commission (the “SEC”). Investors are cautioned that any

such statements are not guarantees of future performance and actual

outcomes may vary materially from those indicated.

Important Information for Stockholders

In connection with the proposed merger of Dril-Quip and Innovex,

Dril-Quip filed with the SEC a registration statement on Form S-4

(as amended, the “Registration Statement”) on May 1, 2024 that

included a proxy statement/prospectus (the “Proxy

Statement/Prospectus”). The Registration Statement was declared

effective by the SEC on August 6, 2024. Dril-Quip filed the

definitive proxy statement/prospectus with the SEC on August 6,

2024, and it was first mailed to Dril-Quip’s stockholders on August

6, 2024. Dril-Quip has filed other relevant documents with the SEC

regarding the proposed merger. This document is not a substitute

for the Proxy Statement/Prospectus or Registration Statement or any

other document that Dril-Quip has filed with the SEC. STOCKHOLDERS

ARE URGED TO CAREFULLY READ THE REGISTRATION STATEMENT, PROXY

STATEMENT/PROSPECTUS (INCLUDING ALL AMENDMENTS AND SUPPLEMENTS

THERETO) AND OTHER RELEVANT DOCUMENTS THAT HAVE BEEN FILED BY

DRIL-QUIP WITH THE SEC IN THEIR ENTIRETY BECAUSE THEY CONTAIN

IMPORTANT INFORMATION ABOUT THE PROPOSED MERGER. Such stockholders

can obtain free copies of the Registration Statement and Proxy

Statement/Prospectus and other documents containing important

information about Dril-Quip, Innovex and the proposed merger

through the website maintained by the SEC at http://www.sec.gov.

Additional information is available on Dril-Quip’s website,

www.dril-quip.com.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20240825948944/en/

Investor Relations: Erin Fazio, Director of Corporate Finance

erin_fazio@dril-quip.com

Dril-Quip Media Relations: Sydney Isaacs / Chuck Dohrenwend

Sydney.Isaacs@h-advisors.global /

Chuck.Dohrenwend@h-advisors.global H/Advisors Abernathy

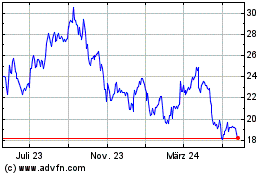

Dril Quip (NYSE:DRQ)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

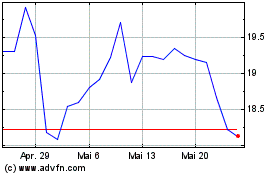

Dril Quip (NYSE:DRQ)

Historical Stock Chart

Von Jan 2024 bis Jan 2025