Form 6-K - Report of foreign issuer [Rules 13a-16 and 15d-16]

17 Januar 2025 - 1:36PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 6-K

REPORT OF FOREIGN PRIVATE ISSUER

PURSUANT TO RULE 13a-16 OR 15d-16 UNDER THE

SECURITIES EXCHANGE ACT OF 1934

For the month of January 2025

Commission File Number: 001-34602

DAQO NEW ENERGY CORP.

Unit 29D, Huadu Mansion, 838 Zhangyang Road,

Shanghai, 200122

The People’s Republic of China

(+86-21) 5075-2918

(Address of principal

executive office)

Indicate by check mark whether the registrant files or will file annual

reports under cover of Form 20-F or Form 40-F.

EXHIBIT INDEX

SIGNATURES

Pursuant to the requirements of the Securities

Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized.

| |

DAQO NEW ENERGY CORP. |

| |

|

| |

By: |

/s/ Xiang Xu |

| |

Name: |

Xiang Xu |

| |

Title: |

Chairman of the Board of Directors and Chief Executive Officer |

| |

|

|

| Date: January 17, 2025 |

|

Exhibit 99.1

Daqo New Energy’s Subsidiary Xinjiang

Daqo Provides Preliminary Estimate of Net Loss for FY2024

Shanghai, China—January 17, 2025—Daqo

New Energy Corp. (NYSE: DQ) ("Daqo New Energy", the "Company" or “we”), a leading manufacturer of high-purity

polysilicon for the global solar PV industry, today announced that its subsidiary Xinjiang Daqo New Energy (“Xinjiang Daqo”)

has provided an estimate of its net loss for the fiscal year ended December 31, 2024 to the Shanghai Stock Exchange.

Xinjiang Daqo estimates that under PRC GAAP,

its net loss attributable to Xinjiang Daqo’s shareholders in FY2024 would be in the range of RMB2.6~3.1 billion, compared to net

profit attributable to Xinjiang Daqo’s shareholders of RMB5.8 billion in FY2023. This estimate includes losses related to provisions

for inventory impairment and fixed asset impairment.

Daqo New Energy currently beneficially owns approximately

72.4% of Xinjiang Daqo’s equity interest, and the majority of the Company's revenue and net income are contributed by Xinjiang

Daqo. The estimated net loss described in this press release was prepared solely for Xinjiang Daqo in RMB in accordance with PRC GAAP

and is subject to change upon completion of Xinjiang Daqo's internal financial closing and reporting process. In contrast, the Company's

consolidated financial results are reported in U.S. dollars in accordance with U.S. GAAP.

The estimated net loss described in this press

release is based solely on the information currently available to Xinjiang Daqo’s management. Its actual result could vary materially

from this preliminary estimate. Consequently, investors should exercise caution in relying on this preliminary estimate and should not

draw any inferences from it regarding financial or operating data not provided. The estimated net loss should not be viewed as a substitute

for full financial statements of Xinjiang Daqo prepared in accordance with PRC GAAP. In addition, the estimated net loss is not necessarily

indicative of the results to be achieved by Xinjiang Daqo in any future period.

About Daqo New Energy Corp.

Daqo New Energy Corp. (NYSE: DQ) ("Daqo"

or the "Company") is a leading manufacturer of high-purity polysilicon for the global solar PV industry. Founded in 2007, the

Company manufactures and sells high-purity polysilicon to photovoltaic product manufacturers, who further process the polysilicon into

ingots, wafers, cells and modules for solar power solutions. The Company has a total polysilicon nameplate capacity of 305,000 metric

tons and is one of the world's lowest cost producers of high-purity polysilicon.

For additional information, please contact:

Daqo New Energy Corp.

Investor Relations

Email: ir@daqo.com

Christensen

In China

Mr. Rene Vanguestaine

Phone: +86-178-1749-0483

Email: rene.vanguestaine@christensencomms.com

In the U.S.

Ms. Linda Bergkamp

Phone: +1-480-614-3004

Email: lbergkamp@christensencomms.com

Safe Harbor Statement

This announcement contains forward-looking statements.

These statements are made under the “safe harbor” provisions of the U.S. Private Securities Litigation Reform Act of 1995.

These forward-looking statements can be identified by terminology such as “will,” “expects,” “anticipates,”

“future,” “intends,” “plans,” “believes,” “estimates,” “might,”

“guidance” and similar statements. Among other things, the estimated net loss for the year of 2024 contains forward-looking

statements. The Company may also make written or oral forward-looking statements in its reports filed or furnished to the U.S. Securities

and Exchange Commission, in its annual reports to shareholders, in press releases and other written materials and in oral statements

made by its officers, directors or employees to third parties. Statements that are not historical facts, including statements about the

Company’s beliefs and expectations, are forward-looking statements. Forward-looking statements involve inherent risks and uncertainties,

all of which are difficult or impossible to predict accurately and many of which are beyond the Company’s control. A number of

factors could cause actual results to differ materially from those contained in any forward-looking statement, including but not limited

to the following: the demand for photovoltaic products and the development of photovoltaic technologies; global supply and demand for

polysilicon; alternative technologies in cell manufacturing; the Company’s ability to significantly expand its polysilicon production

capacity and output; the reduction in or elimination of government subsidies and economic incentives for solar energy applications; the

Company’s ability to lower its production costs; and changes in the regulatory environment. Further information regarding these

and other risks is included in the reports or documents that the Company has filed with, or furnished to, the U.S. Securities and Exchange

Commission. All information provided in this press release is as of the date hereof, and the Company undertakes no duty to update such

information or any forward-looking statement, except as required under applicable law.

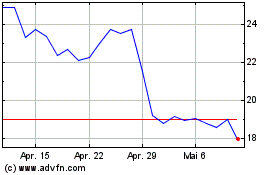

Daqo New Energy (NYSE:DQ)

Historical Stock Chart

Von Dez 2024 bis Jan 2025

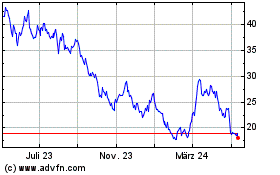

Daqo New Energy (NYSE:DQ)

Historical Stock Chart

Von Jan 2024 bis Jan 2025