SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

SCHEDULE 13D

(Rule 13d-101)

INFORMATION TO BE INCLUDED IN STATEMENTS

FILED PURSUANT

TO §240.13d-1(a) AND AMENDMENTS THERETO FILED PURSUANT TO

§ 240.13d-2(a)

(Amendment No. 6)

DIGITAL

MEDIA SOLUTIONS, INC.

(Name of Issuer)

CLASS

A COMMON STOCK

(Title of Class of Securities)

25401G106

(CUSIP Number)

Prism Data, LLC

Joseph Marinucci, Manager

c/o Digital Media Solutions Holdings, LLC

4800 140th Avenue, Suite 101

Clearwater, FL 33762

Telephone: (727) 287-0428

(Name, Address and Telephone Number of Person

Authorized to Receive Notices and Communications)

March 5, 2024

Date of Event Which Requires Filing of this

Statement

If the filing person

has previously filed a statement on Schedule 13G to report the acquisition that is the subject of this Schedule 13D, and is filing

this schedule because of §§ 240.13d-1(e), 240.13d-1(f) or 240.13d-1(g), check the following

box: o

Note: Schedules

filed in paper format shall include a signed original and five copies of the schedule, including all exhibits. See Rule 13d-7 for

other parties to whom copies are to be sent.

| * |

The remainder of this cover page shall be filled out for a reporting person’s initial filing on this form with respect to the subject class of securities, and for any subsequent amendment containing information which would alter disclosures provided in a prior cover page. |

The information required

on the remainder of this cover page shall not be deemed to be “filed” for the purpose of Section 18 of the Securities

Exchange Act of 1934 (“Act”) or otherwise subject to the liabilities of that section of the Act but shall be subject

to all other provisions of the Act (however, see the Notes).

(Continued on following pages)

Page 1 of 5

|

1

|

NAMES OF REPORTING PERSONS

Prism Data, LLC

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF

A GROUP

(see instructions)

(a) o

(b) o

|

|

3

|

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS* (see instructions)

OO (See Item 3)

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

Delaware

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7

|

SOLE VOTING POWER

0 shares

|

|

8

|

SHARED VOTING POWER

0 shares

|

|

9

|

SOLE DISPOSITIVE POWER

0 shares

|

|

10

|

SHARED DISPOSITIVE POWER

0 shares

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON

0 shares

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES (see instructions)

o

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW 11

0%

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

OO

|

Page 2 of 5

|

1

|

NAMES OF REPORTING PERSONS

Joseph Marinucci

|

|

2

|

CHECK THE APPROPRIATE BOX IF A MEMBER OF

A GROUP

(see instructions)

(a) o

(b) o

|

|

3

|

SEC USE ONLY

|

| 4 |

SOURCE OF FUNDS* (see instructions)

OO (See Item 3)

|

| 5 |

CHECK BOX IF DISCLOSURE OF LEGAL PROCEEDINGS

IS REQUIRED PURSUANT TO ITEM 2(d) OR 2(e)

o

|

|

6

|

CITIZENSHIP OR PLACE OF ORGANIZATION

United States

|

Number of

Shares

Beneficially

Owned By

Each

Reporting

Person

With |

7

|

SOLE VOTING POWER

444,567 shares (see Item 5 infra)

|

|

8

|

SHARED VOTING POWER

0 shares (see Item 5 infra)

|

|

9

|

SOLE DISPOSITIVE POWER

444,567 shares (see Item 5 infra)

|

|

10

|

SHARED DISPOSITIVE POWER

0 shares (see Item 5 infra)

|

|

11

|

AGGREGATE AMOUNT BENEFICIALLY OWNED BY

EACH REPORTING PERSON

444,567 shares (see Item 5 infra)

|

|

12

|

CHECK BOX IF THE AGGREGATE AMOUNT IN ROW (11)

EXCLUDES CERTAIN SHARES (see instructions)

o

|

|

13

|

PERCENT OF CLASS REPRESENTED BY AMOUNT

IN ROW 11

9.9% (see Item 5 infra)

|

|

14

|

TYPE OF REPORTING PERSON (SEE INSTRUCTIONS)

IN

|

Page 3 of 5

Explanatory Note:

This Amendment No. 6

(this “Amendment”) to the Statement of Beneficial Ownership on Schedule 13D amends the Schedule 13D

filed on July 27, 2020 (as subsequently amended) (the “Schedule 13D”) by Prism Data, LLC (“Prism”)

and Joseph Marinucci (together, the “Reporting Persons”) with respect to the Class A common stock, par value

$0.0001 per share (the “Common Stock” or “Class A Common Stock”) of Digital Media Solutions,

Inc., a Delaware corporation (the “Issuer”). Capitalized terms used but not defined in this Amendment have the

meaning set forth in the Schedule 13D. Disclosure items set forth in the Schedule 13D shall remain in effect, except to the extent

expressly amended or superseded by this Amendment.

| Item 3. |

Source and Amount of Funds or Other Consideration. |

On March 5, 2024, Prism

Data, LLC distributed shares of Common Stock to its members (the “Distribution”). The Reporting Person, as a

member of Prism, received 486,970 shares of Common Stock in connection with the Distribution.

| Item 5. |

Interests in Securities of the Issuer. |

Item 5 is hereby amended

and restated in its entirety with the following:

(a) and (b)

All percentages of shares

of Common Stock outstanding contained herein are based on 4,286,712 shares of

Common Stock outstanding as of November 17, 2023 (which consists of (i) 2,765,764 shares of Common Stock as reported on the Issuer’s

Form 10-Q for the quarter ended September 30, 2023, filed on November 14, 2023, and (ii) 1,520,948 shares of Common Stock issued

to Prism Data, LLC on November 17, 2023 in connection with the redemption of the 1,520,948 units of Digital Media Solutions Holdings,

LLC, an indirect subsidiary of the Issuer, held by Prism).

In addition to the shares

of Common Stock owned by Mr. Marinucci (for which he has sole voting and dispositive power), Mr. Marinucci has the sole power to

vote and dispose of (i) 69,552 shares of Common Stock underlying the same number of warrants to purchase shares of Common Stock

owned by him, (ii) 9,386 shares of Common Stock underlying the same number of options to purchase shares of Common Stock owned

by him, and (ii) 114,784 shares of Common Stock issuable upon conversion of shares of Series B Convertible Preferred Stock owned

by Bayonne Holdings LLC, an entity owned and controlled by Mr. Marinucci.

(c) The

Reporting Persons have not engaged in any transaction involving shares of Common Stock during the 60 days prior to the filing of

this Amendment, except for (i) the Distribution, and (ii) immediately following the Distribution, Mr. Marinucci transferred 250,845

shares of Common Stock, warrants to purchase 17,964 shares of Common Stock, and options to purchase 9,386 shares of Common Stock

to his ex-spouse pursuant to a domestic relations order.

(d) No

person is known by the Reporting Persons to have the right to receive or the power to direct the receipt of dividends from, or

the proceeds from the sale of, any Common Stock beneficially owned by the Reporting Persons and described in this Item 5.

(e) On

March 5, 2024, Prism Data, LLC ceased to be the beneficial owner of more than five percent of the Common Stock.

Page 4 of 5

SIGNATURE

After reasonable inquiry

and to the best of their knowledge and belief, each of the undersigned hereby certifies that the information set forth in this

statement is true, complete and correct.

Dated: March 5, 2024

| |

Prism Data LLC |

| |

|

| |

By:/s/ Joseph Marinucci |

| |

Joseph Marinucci, Manager |

| |

|

| |

/s/ Joseph Marinucci |

| |

Joseph Marinucci |

| Attention: | Intentional misstatements or omissions of fact constitute Federal criminal violations (See 18

U.S.C. 1001). |

Page 5 of 5

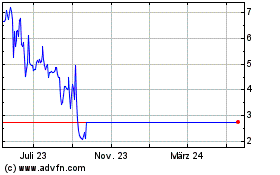

Digital Media Solutions (NYSE:DMS)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

Digital Media Solutions (NYSE:DMS)

Historical Stock Chart

Von Apr 2023 bis Apr 2024