Form NPORT-P - Monthly Portfolio Investments Report on Form N-PORT (Public)

28 November 2023 - 10:22PM

Edgar (US Regulatory)

Nuveen

Dow

30

SM

Dynamic

Overwrite

Fund

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Shares

Description

(a)

Value

LONG-TERM

INVESTMENTS

-

99.9%

X

–

COMMON

STOCKS

-

99

.1

%

X

545,665,893

Banks

-

2.8%

107,330

JPMorgan

Chase

&

Co

$

15,564,997

Total

Banks

15,564,997

Capital

Goods

-

14.5%

107,330

3M

Co

10,048,235

107,330

(b)

Boeing

Co/The

20,573,014

107,329

Caterpillar

Inc

29,300,817

107,330

Honeywell

International

Inc

19,828,144

Total

Capital

Goods

79,750,210

Consumer

Discretionary

Distribution

&

Retail

-

5.9%

107,330

Home

Depot

Inc/The

32,430,833

Total

Consumer

Discretionary

Distribution

&

Retail

32,430,833

Consumer

Durables

&

Apparel

-

1.9%

107,330

NIKE

Inc,

Class

B

10,262,895

Total

Consumer

Durables

&

Apparel

10,262,895

Consumer

Services

-

5.1%

107,330

McDonald's

Corp

28,275,015

Total

Consumer

Services

28,275,015

Consumer

Staples

Distribution

&

Retail

-

3.6%

107,330

Walgreens

Boots

Alliance

Inc

2,387,019

107,330

Walmart

Inc

17,165,287

Total

Consumer

Staples

Distribution

&

Retail

19,552,306

Energy

-

3.3%

107,330

Chevron

Corp

18,097,985

Total

Energy

18,097,985

Financial

Services

-

13.7%

107,330

American

Express

Co

16,012,563

107,330

(c)

Goldman

Sachs

Group

Inc/The

34,728,768

107,330

Visa

Inc,

Class

A

24,686,973

Total

Financial

Services

75,428,304

Food,

Beverage

&

Tobacco

-

1.1%

107,330

Coca-Cola

Co/The

6,008,333

Total

Food,

Beverage

&

Tobacco

6,008,333

Health

Care

Equipment

&

Services

-

9.8%

107,330

UnitedHealth

Group

Inc

54,114,713

Total

Health

Care

Equipment

&

Services

54,114,713

Household

&

Personal

Products

-

2.8%

107,329

Procter

&

Gamble

Co/The

15,655,008

Total

Household

&

Personal

Products

15,655,008

Insurance

-

3.2%

107,330

Travelers

Cos

Inc/The

17,528,062

Total

Insurance

17,528,062

Nuveen

Dow

30SM

Dynamic

Overwrite

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Shares

Description

(a)

Value

Materials

-

1.0%

107,329

Dow

Inc

$

5,533,883

Total

Materials

5,533,883

Media

&

Entertainment

-

1.6%

107,330

(b)

Walt

Disney

Co/The

8,699,096

Total

Media

&

Entertainment

8,699,096

Pharmaceuticals,

Biotechnology

&

Life

Sciences

-

10.3%

107,330

(c)

Amgen

Inc

28,846,011

107,329

Johnson

&

Johnson

16,716,492

107,329

Merck

&

Co

Inc

11,049,520

Total

Pharmaceuticals,

Biotechnology

&

Life

Sciences

56,612,023

Semiconductors

&

Semiconductor

Equipment

-

0.7%

107,330

Intel

Corp

3,815,582

Total

Semiconductors

&

Semiconductor

Equipment

3,815,582

Software

&

Services

-

12.8%

107,330

International

Business

Machines

Corp

15,058,399

107,330

Microsoft

Corp

33,889,448

107,330

(b)

Salesforce

Inc

21,764,377

Total

Software

&

Services

70,712,224

Technology

Hardware

&

Equipment

-

4.4%

107,329

(c)

Apple

Inc

18,375,798

107,330

Cisco

Systems

Inc

5,770,061

Total

Technology

Hardware

&

Equipment

24,145,859

Telecommunication

Services

-

0.6%

107,330

Verizon

Communications

Inc

3,478,565

Total

Telecommunication

Services

3,478,565

Total

Common

Stocks

(cost

$222,672,878)

545,665,893

Shares

Description

(a)

Value

X

–

EXCHANGE-TRADED

FUNDS

-

0

.8

%

X

4,248,200

20,000

Vanguard

Total

Stock

Market

ETF

$

4,248,200

Total

Exchange-Traded

Funds

(cost

$3,981,085)

4,248,200

Investments

in

Derivatives

Part

F

of

Form

N-PORT

was

prepared

in

accordance

with

U.S.

generally

accepted

accounting

principles

(“U.S.

GAAP”)

and

in

conformity

with

the

applicable

rules

and

regulations

of

the

U.S.

Securities

and

Exchange

Commission

(“SEC”)

related

to

interim

filings.

Part

F

of

Form

N-PORT

does

not

include

all

information

and

footnotes

required

by

U.S.

GAAP

for

complete

financial

statements.

Certain

footnote

disclosures

normally

included

in

financial

statements

prepared

in

accordance

with

U.S.

GAAP

have

been

condensed

or

omitted

from

this

report

pursuant

to

the

rules

of

the

SEC.

For

a

full

set

of

the

Fund’s

notes

to

financial

statements,

please

refer

to

the

Fund’s

most

recently

filed

annual

or

semi-annual

report.

Fair

Value

Measurements

The

Fund’s

investments

in

securities

are

recorded

at

their

estimated

fair

value

utilizing

valuation

methods

approved

by

the

Board

of

Directors/

Trustees.

Fair

value

is

defined

as

the

price

that

would

be

received

upon

selling

an

investment

or

transferring

a

liability

in

an

orderly

transaction

to

an

independent

buyer

in

the

principal

or

most

advantageous

market

for

the

investment.

U.S.

GAAP

establishes

the

three-tier

hierarchy

which

is

used

to

maximize

the

use

of

observable

market

data

and

minimize

the

use

of

unobservable

inputs

and

to

establish

classification

of

fair

value

measurements

for

disclosure

purposes.

Observable

inputs

reflect

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Observable

inputs

are

based

on

market

data

obtained

from

sources

independent

of

the

reporting

entity.

Unobservable

inputs

reflect

management’s

assumptions

about

the

assumptions

market

participants

would

use

in

pricing

the

asset

or

liability.

Unobservable

inputs

are

based

on

the

best

information

available

in

the

circumstances.

The

following

is

a

summary

of

the

three-tiered

hierarchy

of

valuation

input

levels.

Level

1

–

Inputs

are

unadjusted

and

prices

are

determined

using

quoted

prices

in

active

markets

for

identical

securities.

Level

2

–

Prices

are

determined

using

other

significant

observable

inputs

(including

quoted

prices

for

similar

securities,

interest

rates,

credit

spreads,

etc.).

Type

Description

Number

of

Contracts

Notional

Amount

(d)

Exercise

Price

Expiration

Date

Value

OPTIONS

PURCHASED

-

0

.0

%

X

–

Put

Consumer

Discretionary

Select

Sector

SPDR

Fund

65

$

975,000

$

150

10/20/23

$

5,850

Call

General

Mills

Inc

60

450,000

75

10/20/23

450

Call

S&P

500

Index

50

23,250,000

4650

10/20/23

875

Total

Options

Purchased

(cost

$18,289)

175

$

24,675,000

7,175

Total

Long-Term

Investments

(cost

$226,672,252)

549,921,268

Principal

Amount

(000)

Description

(a)

Coupon

Maturity

Value

SHORT-TERM

INVESTMENTS

-

2.1%

X

–

REPURCHASE

AGREEMENTS

-

2

.1

%

X

11,667,797

$

11,668

Repurchase

Agreement

with

Fixed

Income

Clearing

Corporation,

dated

09/29/23,

repurchase

price

$11,669,352,

collateralized

by

$16,545,600,

U.S.

Treasury

Bond,

2.875%,

due

05/15/52,

value

$11,901,198

1.600%

10/02/23

$

11,667,797

Total

Repurchase

Agreements

(cost

$11,667,797)

11,667,797

Total

Short-Term

Investments

(cost

$11,667,797)

11,667,797

Total

Investments

(cost

$

238,340,049

)

-

102

.0

%

561,589,065

Other

Assets

&

Liabilities,

Net

- (2.0)%

(

10,874,316

)

Net

Assets

Applicable

to

Common

Shares

-

100%

$

550,714,749

Options

Written

Type

Description

Number

of

Contracts

Notional

Amount

(d)

Exercise

Price

Expiration

Date

Value

Call

S&P

500

Index

(370)

$

(

165,205,000

)

$

4,465

10/20/23

$

(

238,650

)

Call

S&P

500

Index

(50)

(

23,000,000

)

4,600

10/20/23

(

2,000

)

Call

S&P

500

Index

(50)

(

23,250,000

)

4,650

10/20/23

(

875

)

Call

S&P

500

Index

(70)

(

32,025,000

)

4,575

11/17/23

(

62,650

)

Call

S&P

500

Index

(70)

(

32,200,000

)

4,600

11/17/23

(

45,500

)

Total

Options

Written

(premiums

received

$2,879,276)

(610)

$(275,680,000)

$(349,675)

Nuveen

Dow

30SM

Dynamic

Overwrite

Fund

(continued)

Portfolio

of

Investments

September

30,

2023

(Unaudited)

Level

3

–

Prices

are

determined

using

significant

unobservable

inputs

(including

management’s

assumptions

in

determining

the

fair

value

of

investments).

The

following

table

summarizes

the

market

value

of

the

Fund's

investments

as

of

the

end

of

the

reporting

period,

based

on

the

inputs

used

to

value

them:

Level

1

Level

2

Level

3

Total

Long-Term

Investments:

Common

Stocks

$

545,665,893

$

–

$

–

$

545,665,893

Exchange-Traded

Funds

4,248,200

–

–

4,248,200

Options

Purchased

7,175

–

–

7,175

Short-Term

Investments:

Repurchase

Agreements

–

11,667,797

–

11,667,797

Investments

in

Derivatives:

Options

Written

(349,675)

–

–

(349,675)

Total

$

549,571,593

$

11,667,797

$

–

$

561,239,390

For

Fund

portfolio

compliance

purposes,

the

Fund’s

industry

classifications

refer

to

any

one

or

more

of

the

industry

sub-classifications

used

by

one

or

more

widely

recognized

market

indexes

or

ratings

group

indexes,

and/or

as

defined

by

Fund

management.

This

definition

may

not

apply

for

purposes

of

this

report,

which

may

combine

industry

sub-classifications

into

sectors

for

reporting

ease.

(a)

All

percentages

shown

in

the

Portfolio

of

Investments

are

based

on

net

assets

applicable

to

common

shares

unless

otherwise

noted.

(b)

Non-income

producing;

issuer

has

not

declared

an

ex-dividend

date

within

the

past

twelve

months.

(c)

Investment,

or

portion

of

investment,

has

been

pledged

to

collateralize

the

net

payment

obligations

for

investments

in

derivatives.

(d)

For

disclosure

purposes,

Notional

Amount

is

calculated

by

multiplying

the

Number

of

Contracts

by

the

Exercise

Price

by

100.

ETF

Exchange-Traded

Fund

S&P

Standard

&

Poor's

SPDR

Standard

&

Poor's

Depositary

Receipt

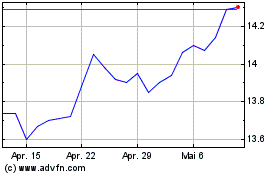

Nuveen Dow 30SM Dynamic ... (NYSE:DIAX)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Nuveen Dow 30SM Dynamic ... (NYSE:DIAX)

Historical Stock Chart

Von Mai 2023 bis Mai 2024