Discover Financial Services (NYSE: DFS) (the “Company”) today

announced, as required under the New York Stock Exchange (the

“NYSE”) Listed Company Manual, that it received a notice (the “NYSE

Notice”) from the NYSE on November 19, 2024 that the Company is not

in compliance with Section 802.01E of the NYSE Listed Company

Manual as a result of its failure to timely file its Quarterly

Report on Form 10-Q for the fiscal quarter ended September 30, 2024

with the U.S. Securities and Exchange Commission (the “SEC”) prior

to November 18, 2024, the end of the extension period provided by

Rule 12b-25 under the Securities Exchange Act of 1934, as amended.

The NYSE Notice has no immediate effect on the listing of the

Company’s common stock on the NYSE.

On July 19, 2023, the Company disclosed that beginning around

mid-2007, the Company incorrectly classified certain credit card

accounts into its highest merchant and merchant acquirer pricing

tier (the “card product misclassification”). Based on information

available as of June 30, 2023, the Company recognized a liability

of $365 million that was accounted for as the correction of an

error. The Company determined that the revenue impact was not

material to the consolidated financial statements of the Company

for any of the impacted periods. While it was therefore determined

that it was not necessary for the Company to restate any previously

issued interim or annual financial statements, the cumulative

misstatement was deemed material to the three and six months ended

June 30, 2023 condensed consolidated financial statements, and

therefore the Company determined that adjustment of the full $365

million only through 2023 earnings was not appropriate. Therefore,

the $365 million liability (the “Initial Liability”) was recorded

as of June 30, 2023 with offsetting adjustments to merchant

discount and interchange revenue and retained earnings, along with

consequential impacts to deferred tax accruals. Comparable

corrections were made for all prior periods presented in the

Company’s Quarterly Reports on Form 10-Q for the fiscal quarters

ended June 30, 2023 and September 30, 2023 and subsequently in the

Company’s Annual Report on Form 10-K for the fiscal year ended

December 31, 2023.

On February 19, 2024, Discover and Capital One Financial

Corporation (“Capital One”) jointly announced that they entered

into an agreement and plan of merger pursuant to which the

companies will combine in an all-stock transaction (the

“Merger”).

In the Company’s Quarterly Report on Form 10-Q for the fiscal

quarter ended March 31, 2024, the Company disclosed that it had

determined to increase its liability to $1.2 billion (the

“Liability Increase”) through a charge to other expense for the

three months ended March 31, 2024, to reflect the total amount the

Company then expected was probable to be disbursed in relation to

the card product misclassification. The Company determined the

Liability Increase was appropriate based on its experience through

that date with remediation efforts, discussions through the first

quarter of 2024 with its regulators, Board of Directors and other

stakeholders, the pending Merger, which was approved by the

Company’s Board of Directors during the quarter, and a desire to

advance resolution of the matter more quickly to mitigate further

risk.

As part of the review of the Company’s historical financial

statements by the Staff of the SEC (the “Staff”) undertaken in

connection with the Staff’s review of the Registration Statement on

Form S-4 filed by Capital One in connection with the Merger (and

the preliminary joint proxy statement/prospectus contained therein)

(the “Registration Statement”), the Staff provided comments to the

Company relating to the Company’s accounting approach for the card

product misclassification. The Company has responded to these

comments and has engaged in several verbal discussions with the

Staff. The Staff has indicated that it disagrees with the Company’s

application of revenue recognition guidance issued by the Financial

Accounting Standards Board in connection with the Company’s

recording of the Initial Liability.

The Staff has, however, indicated that it would not object to an

approach whereby the Company determined the cumulative revenue

error related to the card product misclassification to be the

maximum amount agreed to be paid by the Company in restitution in

respect of the card product misclassification (excluding interest

and legal expenses) (the “Alternative Approach”). This amount is

approximately $1,047 million.

On November 25, 2024, the Audit Committee of the Board of

Directors of the Company (the “Audit Committee”), acting on the

recommendation of management, and after discussion with Deloitte

& Touche LLP (“Deloitte”), the Company’s independent registered

public accounting firm, concluded that (i) the Company’s audited

financial statements as of December 31, 2023 and 2022 and for each

of the three years in the period ended December 31, 2023 included

in the Company’s Annual Report on Form 10-K filed with the SEC for

the fiscal year ended December 31, 2023 and (ii) the Company’s

unaudited condensed consolidated financial statements included in

the Company's Quarterly Reports on Form 10-Q previously filed with

the SEC for the fiscal quarters ended March 31, 2023, June 30,

2023, September 30, 2023, March 31, 2024 and June 30, 2024

(collectively, the “Prior Periods”), should no longer be relied

upon and should be restated to reflect the Alternative Approach. In

addition, the Audit Committee concluded that management’s report on

the effectiveness of internal control over financial reporting as

of December 31, 2023 and Deloitte’s report on the consolidated

financial statements as of December 31, 2023 and 2022 and for each

of the three years in the period ended December 31, 2023 as well as

Deloitte’s report on the effectiveness of internal control over

financial reporting as of December 31, 2023, should no longer be

relied upon.

In order to implement the Alternative Approach in the Restated

Financial Statements (as defined below), approximately $600 million

of the Liability Increase will be reallocated from being recorded

as other expense in the fiscal quarter ended March 31, 2024 to a

revenue error correction in prior periods. In addition, $124

million of the Liability Increase representing interest that the

Company committed to pay as part of its counterparty restitution

plan will also be reallocated from the fiscal quarter ended March

31, 2024 to the third and fourth quarters of 2023. Cumulative

historical earnings, capital and the aggregate amount of the

counterparty restitution liability will not be affected by

application of the Alternative Approach. However, separate work

being done to validate the remediation methodology with a

third-party consultant has resulted in the identification of

approximately $60 million of incremental overcharges, which will be

reflected in the Restated Financial Statements.

As a result, the Company expects the Restated Financial

Statements to reflect the following approximate impacts: as of

December 31, 2023, (i) an increase in assets of $190 million, (ii)

an increase in accrued expenses and other liabilities of $783

million, and (iii) a decrease in retained earnings of $593 million.

For the years ended December 31, 2023 and 2022, pre-tax income

would be reduced by approximately $190 million to $3,636 million

and $77 million to $5,641 million, respectively. For the third

quarter of 2024, pre-tax income would decrease by approximately $6

million to $1,282 million while pre-tax income for the nine months

ended September 30, 2024 would increase by approximately $700

million to $4,462 million (as compared to the pre-tax income

reported in the financial information with respect to the quarter

ended September 30, 2024 in the exhibits furnished with the

Company’s Current Report on Form 8-K filed with the SEC on October

16, 2024).

Amendments to the Company’s Annual Report on Form 10-K for the

fiscal year ended December 31, 2023 (the “Form 10-K/A”), and the

Company’s Quarterly Reports on Form 10-Q for the fiscal quarters

ended March 31, 2024 and June 30, 2024 (the “Form 10-Q/As” and

together with the Form 10-K/A, the “Restated Financial

Statements”), are expected to be filed prior to or concurrently

with the filing of the Company’s Quarterly Report on Form 10-Q for

the fiscal quarter ended September 30, 2024 in order to reflect the

Alternative Approach and the other modifications described above to

the Prior Periods.

The Company is working expeditiously to file the Restated

Financial Statements as soon as reasonably practicable. The Company

currently expects to complete the filings prior to year-end,

however there can be no assurance of the actual timing.

The Company expects that Capital One will file a pre-effective

amendment to the Registration Statement promptly following the

Company’s filing of the Restated Financial Statements, and that as

soon as practicable following the effectiveness of the Registration

Statement and the mailing of the definitive joint proxy

statement/prospectus contained therein to each company’s

stockholders, each company will hold its respective special meeting

of stockholders for purposes of obtaining the requisite stockholder

approvals of the Merger.

About Discover

Discover Financial Services (NYSE: DFS) is a digital banking and

payment services company with one of the most recognized brands in

U.S. financial services. Since its inception in 1986, the company

has become one of the largest card issuers in the United States.

The Company issues the Discover® card, America's cash rewards

pioneer, and offers personal loans, home loans, checking and

savings accounts and certificates of deposit through its banking

business. It operates the Discover Global Network® comprised of

Discover Network, with millions of merchants and cash access

locations; PULSE®, one of the nation's leading ATM/debit networks;

and Diners Club International®, a global payments network with

acceptance around the world. For more information, visit

www.discover.com/company.

Cautionary Note Regarding Forward Looking Statements:

This communication contains forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Such statements, which speak to our expected business and

financial performance, among other matters, contain words such as

"believe," "expect," "anticipate," "intend," "plan," "aim," "will,"

"may," "should," "could," "would," "likely," "forecast," and

similar expressions. Other forward-looking statements may include,

without limitation, statements with respect to the restatement of

the Company’s financial statements. Such statements are based on

the current beliefs and expectations of the Company’s management

and are subject to significant risks and uncertainties. Actual

results may differ materially from those set forth in the

forward-looking statements. These forward-looking statements speak

only as of the date of this communication and there is no

undertaking to update or revise them as more information becomes

available. Actual future events could also differ materially due to

numerous factors that involve substantial known and unknown risks

and uncertainties including, among other things, risks relating to

the final impact of the restatements on the Company’s financial

statements; the impact of the restatements on the Company’s

evaluation of the effectiveness of its internal control over

financial reporting and disclosure controls and procedures; delays

in the preparation of the consolidated financial statements and/or

the declaration of effectiveness of the Registration Statement; the

risk that additional information will come to light that alters the

scope or magnitude of the restatement; the risks and uncertainties

set forth under “Risk Factors” and elsewhere in the Company’s

reports on Form 10-K and Form 10-Q; and the other risks and

uncertainties discussed in any subsequent reports that the Company

files with the SEC from time to time. Although the Company has

attempted to identify those material factors that could cause

actual results or events to differ from those described in such

forward-looking statements, there may be other factors that could

cause actual results or events to differ from those anticipated,

estimated or intended. Given these uncertainties, investors are

cautioned not to place undue reliance on forward-looking

statements.

Important Information About the Merger and Where to Find

It

Capital One has filed the Registration Statement with the SEC to

register the shares of Capital One’s common stock that will be

issued to the Company’s stockholders in connection with the Merger.

The Registration Statement includes a preliminary joint proxy

statement of Capital One and the Company that also constitutes a

preliminary prospectus of Capital One. The definitive joint proxy

statement/prospectus will be sent to the stockholders of each of

the Company and Capital One in connection with the Merger.

INVESTORS AND SECURITY HOLDERS ARE URGED TO READ THE

REGISTRATION STATEMENT AND JOINT PROXY STATEMENT/PROSPECTUS WHEN

THEY BECOME AVAILABLE (AND ANY OTHER DOCUMENTS FILED WITH THE SEC

IN CONNECTION WITH THE MERGER OR INCORPORATED BY REFERENCE INTO THE

JOINT PROXY STATEMENT/PROSPECTUS) BECAUSE SUCH DOCUMENTS WILL

CONTAIN IMPORTANT INFORMATION REGARDING THE MERGER AND RELATED

MATTERS. Investors and security holders may obtain free copies

of these documents and other documents filed with the SEC by the

Company or Capital One through the website maintained by the SEC at

http://www.sec.gov or by contacting the investor relations

department of the Company or Capital One at:

Discover Financial

Services

Capital One

Financial Corporation

2500 Lake Cook Road

1680 Capital One Drive

Riverwoods, IL 60015

McLean, VA 22102

Attention: Investor Relations

Attention: Investor Relations

investorrelations@discover.com

investorrelations@capitalone.com

(224) 405-4555

(703) 720-1000

Before making any voting or investment decision, investors

and security holders of the Company and Capital One are urged to

read carefully the entire Registration Statement and joint proxy

statement/prospectus, including any amendments thereto, because

they contain important information about the Merger. Free copies of

these documents may be obtained as described above.

Participants in Solicitation

The Company, Capital One and certain of their directors and

executive officers may be deemed participants in the solicitation

of proxies from the stockholders of each of the Company and Capital

One in connection with the Merger. Information regarding the

directors and executive officers of the Company and Capital One and

other persons who may be deemed participants in the solicitation of

the stockholders of the Company or of Capital One in connection

with the Merger will be included in the joint proxy

statement/prospectus related to the Merger, which will be filed by

Capital One with the SEC. Information about the directors and

executive officers of the Company and their ownership of the

Company common stock can also be found in the Company’s definitive

proxy statement in connection with its 2024 annual meeting of

stockholders, as filed with the SEC on March 15, 2024, as

supplemented by the Company’s proxy statement supplement, as filed

with the SEC on April 2, 2024, and other documents subsequently

filed by the Company with the SEC. Information about the directors

and executive officers of Capital One and their ownership of

Capital One common stock can also be found in Capital One’s

definitive proxy statement in connection with its 2024 annual

meeting of stockholders, as filed with the SEC on March 20, 2024,

and other documents subsequently filed by Capital One with the SEC.

Additional information regarding the interests of such participants

will be included in the joint proxy statement/prospectus and other

relevant documents regarding the Merger filed with the SEC when

they become available.

View source

version on businesswire.com: https://www.businesswire.com/news/home/20241125018559/en/

Investor Contact: Erin Stieber, 224-405-4555

investorrelations@discover.com

Media Contact: Matthew Towson, 224-405-5649

matthewtowson@discover.com

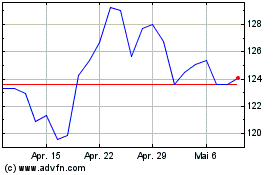

Discover Financial Servi... (NYSE:DFS)

Historical Stock Chart

Von Nov 2024 bis Dez 2024

Discover Financial Servi... (NYSE:DFS)

Historical Stock Chart

Von Dez 2023 bis Dez 2024