10/27/20230000945764false00009457642023-10-272023-10-27

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, DC 20549

FORM 8-K

CURRENT REPORT PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of Report (Date of earliest event reported): October 27, 2023

DENBURY INC.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 1-12935 | | 20-0467835 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| 5851 Legacy Circle | | | | | | | |

| Plano, | Texas | | | | 75024 | | | (972) | 673-2000 |

| (Address of principal executive offices) | | | (Zip code) | | | (Registrant’s telephone number, including area code) |

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | | | | |

| ☑ | | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | | | | |

| ☐ | | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | | | | |

| ☐ | | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Exchange Act:

| | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol | | Name of each exchange on which registered |

| Common Stock, par value $.001 per share | | DEN | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Section 1 – Registrant’s Business and Operations

Item 1.01 – Entry into a Material Definitive Agreement

On October 27, 2023, Denbury Inc. (the “Company”) entered into a Fourth Amendment (the “Amendment”) to its September 18, 2020 senior secured revolving credit facility with JPMorgan Chase Bank, N.A., as administrative agent, and other lenders party thereto to accommodate certain provisions in connection with the pending acquisition of the Company by Exxon Mobil Corporation (“ExxonMobil”). The full text of the Amendment is filed as Exhibit 10.1 hereto and incorporated by reference in this Current Report on Form 8-K.

Important Information about the Transaction and Where to Find It

In connection with the proposed transaction between the Company and ExxonMobil, the Company and ExxonMobil have filed and will file relevant materials with the Securities and Exchange Commission (the “SEC”). On August 29, 2023, ExxonMobil filed with the SEC a registration statement on Form S-4, as amended (No. 333-274252) to register the shares of the common stock of ExxonMobil to be issued in connection with the proposed transaction. The registration statement, which was declared effective by the SEC on September 29, 2023, includes a definitive proxy statement of the Company that also constitutes a prospectus of ExxonMobil (the “definitive proxy statement/prospectus”). The definitive proxy statement/prospectus was mailed to the stockholders of the Company on September 29, 2023. This communication is not a substitute for the registration statement, definitive proxy statement or prospectus or any other document that ExxonMobil or the Company (as applicable) has filed or may file with the SEC in connection with the proposed transaction. BEFORE MAKING ANY VOTING OR INVESTMENT DECISION, INVESTORS AND SECURITY HOLDERS OF EXXONMOBIL AND THE COMPANY ARE URGED TO READ THE REGISTRATION STATEMENT AND THE DEFINITIVE PROXY STATEMENT/PROSPECTUS FILED WITH THE SEC AND ANY OTHER RELEVANT DOCUMENTS THAT ARE FILED OR WILL BE FILED WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY WHEN THEY BECOME AVAILABLE BECAUSE THEY CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND RELATED MATTERS. Investors and security holders may obtain free copies of the registration statement and the definitive proxy statement/prospectus, as well as other filings containing important information about ExxonMobil or the Company, without charge at the SEC’s Internet website (http://www.sec.gov). Copies of the documents filed with the SEC by ExxonMobil are and will be available free of charge on ExxonMobil’s internet website at www.exxonmobil.com under the tab “investors” and then under the tab “SEC Filings” or by contacting ExxonMobil’s Investor Relations Department at investor.relations@exxonmobil.com. Copies of the documents filed with the SEC by the Company are and will be available free of charge on the Company’s internet website at https://investors.denbury.com/investors/financial-information/sec-filings/, by directing a request to Denbury Inc., ATTN: Investor Relations, 5851 Legacy Circle, Suite 1200, Plano, TX 75024, Tel. No. (972) 673-2000 or by contacting the Company’s Investor Relations Department at IR@denbury.com. The information included on, or accessible through, ExxonMobil’s or the Company’s website is not incorporated by reference into this communication.

Participants in the Solicitation

ExxonMobil, the Company, their respective directors and certain of their respective executive officers may be deemed to be participants in the solicitation of proxies in respect of the proposed transaction. Information about the directors and executive officers of the Company is set forth in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on April 18, 2023, and in its Form 10-K for the year ended December 31, 2022, which was filed with the SEC on February 23, 2023. Information about the directors and executive officers of ExxonMobil is set forth in its proxy statement for its 2023 annual meeting of stockholders, which was filed with the SEC on April 13, 2023, and in its Form 10-K for the year ended December 31, 2022, which was filed with the SEC on February 22, 2023. Additional information regarding the participants in the proxy solicitations and a description of their direct or indirect interests, by security holdings or otherwise, are contained in the definitive proxy statement/prospectus and will be contained in other relevant materials filed with the SEC when they become available.

No Offer or Solicitation

This communication is for informational purposes and is not intended to, and shall not, constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation of any vote or approval, nor shall there be any offer, solicitation or sale of securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or

qualification under the securities laws of any such jurisdiction. No offering of securities shall be made except by means of a prospectus meeting the requirements of Section 10 of the U.S. Securities Act of 1933, as amended.

Forward-Looking Statements

This communication contains “forward-looking statements” within the meaning of the federal securities laws, including Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. In this context, forward-looking statements often address future business and financial events, conditions, expectations, plans or ambitions, and often contain words such as “expect,” “anticipate,” “intend,” “plan,” “believe,” “seek,” “see,” “will,” “would,” “target,” similar expressions, and variations or negatives of these words, but not all forward-looking statements include such words. Forward-looking statements by their nature address matters that are, to different degrees, uncertain, such as statements about the consummation of the proposed transaction and the anticipated benefits thereof. All such forward-looking statements are based upon current plans, estimates, expectations and ambitions that are subject to risks, uncertainties and assumptions, many of which are beyond the control of ExxonMobil and the Company, that could cause actual results to differ materially from those expressed in such forward-looking statements. Important risk factors that may cause such a difference include, but are not limited to: the completion of the proposed transaction on anticipated terms and timing, or at all, including obtaining regulatory approvals that may be required on anticipated terms and Company stockholder approval; anticipated tax treatment, unforeseen liabilities, future capital expenditures, revenues, expenses, earnings, synergies, economic performance, indebtedness, financial condition, losses, future prospects, business and management strategies for the management, expansion and growth of the combined company’s operations and other conditions to the completion of the merger, including the possibility that any of the anticipated benefits of the proposed transaction will not be realized or will not be realized within the expected time period; the ability of ExxonMobil and the Company to integrate the business successfully and to achieve anticipated synergies and value creation; potential litigation relating to the proposed transaction that could be instituted against ExxonMobil, the Company or their respective directors; the risk that disruptions from the proposed transaction will harm ExxonMobil’s or the Company’s business, including current plans and operations and that management’s time and attention will be diverted on transaction-related issues; potential adverse reactions or changes to business relationships resulting from the announcement or completion of the merger; rating agency actions and ExxonMobil and the Company’s ability to access short- and long-term debt markets on a timely and affordable basis; legislative, regulatory and economic developments, including regulatory implementation of the Inflation Reduction Act, timely and attractive permitting for carbon capture and storage by applicable federal and state regulators, and other regulatory actions targeting public companies in the oil and gas industry and changes in local, national, or international laws, regulations, and policies affecting ExxonMobil and the Company including with respect to the environment; potential business uncertainty, including the outcome of commercial negotiations and changes to existing business relationships during the pendency of the merger that could affect ExxonMobil’s and/or the Company’s financial performance and operating results; certain restrictions during the pendency of the merger that may impact the Company’s ability to pursue certain business opportunities or strategic transactions or otherwise operate its business; acts of terrorism or outbreak of war, hostilities, civil unrest, attacks against ExxonMobil or the Company, and other political or security disturbances; dilution caused by ExxonMobil’s issuance of additional shares of its common stock in connection with the proposed transaction; the possibility that the transaction may be more expensive to complete than anticipated, including as a result of unexpected factors or events; changes in policy and consumer support for emission-reduction products and technology; the impacts of pandemics or other public health crises, including the effects of government responses on people and economies; global or regional changes in the supply and demand for oil, natural gas, petrochemicals, and feedstocks and other market or economic conditions that impact demand, prices and differentials, including reservoir performance; changes in technical or operating conditions, including unforeseen technical difficulties; those risks described in Item 1A of ExxonMobil’s Annual Report on Form 10-K, filed with the SEC on February 22, 2023, and subsequent reports on Forms 10-Q and 8-K, as well as under the heading “Factors Affecting Future Results” on the Investors page of ExxonMobil’s website at www.exxonmobil.com (information included on or accessible through ExxonMobil’s website is not incorporated by reference into this communication); those risks described in Item 1A of the Company’s Annual Report on Form 10-K, filed with the SEC on February 23, 2023, and subsequent reports on Forms 10-Q and 8-K; and those risks described in the registration statement on Form S-4 and accompanying definitive proxy statement/prospectus available from the sources indicated above. References to resources or other quantities of oil or natural gas may include amounts that ExxonMobil or the Company believe will ultimately be produced, but that are not yet classified as “proved reserves” under SEC definitions.

These risks, as well as other risks associated with the proposed transaction, are more fully discussed in the definitive proxy statement/prospectus included in the registration statement on Form S-4 filed with the SEC and mailed to the Company’s stockholders in connection with the proposed transaction. While the list of factors presented here and the list of factors presented in the registration statement on Form S-4 and the definitive proxy statement/prospectus are considered representative, no such list should be considered to be a complete statement of all potential risks and uncertainties. Unlisted factors may

present significant additional obstacles to the realization of forward-looking statements. We caution you not to place undue reliance on any of these forward-looking statements as they are not guarantees of future performance or outcomes and that actual performance and outcomes, including, without limitation, our actual results of operations, financial condition and liquidity, and the development of new markets or market segments in which we operate, may differ materially from those made in or suggested by the forward-looking statements contained in this communication. Neither ExxonMobil nor the Company assumes any obligation to publicly provide revisions or updates to any forward-looking statements, whether as a result of new information, future developments or otherwise, should circumstances change, except as otherwise required by securities and other applicable laws. Neither future distribution of this communication nor the continued availability of this communication in archive form on ExxonMobil’s or the Company’s website should be deemed to constitute an update or re-affirmation of these statements as of any future date.

Item 9.01 – Financial Statements and Exhibits

(d)Exhibits.

The following exhibits are furnished in accordance with the provisions of Item 601 of Regulation S-K:

| | | | | | | | |

| Exhibit Number | | Description |

| 10.1* | |

|

| 104 | | The cover page has been formatted in Inline XBRL.

|

* Included herewith.

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | |

| | Denbury Inc. (Registrant) |

| Date: October 30, 2023 | By: | /s/ James S. Matthews |

| | | James S. Matthews |

| | | Executive Vice President, Chief Administrative Officer,

General Counsel and Secretary |

Exhibit 10.1

FOURTH AMENDMENT TO CREDIT AGREEMENT

This FOURTH AMENDMENT TO CREDIT AGREEMENT (this “Fourth Amendment”) is entered into as of October 27, 2023 (the “Fourth Amendment Effective Date”), by and among DENBURY Inc., a Delaware corporation (the “Borrower”), the Guarantors party hereto, JPMORGAN CHASE BANK, N.A., as administrative agent (in such capacity, the “Administrative Agent”), and the Lenders party hereto.

RECITALS

WHEREAS, the Borrower, the Administrative Agent and certain Lenders are parties to that certain Credit Agreement dated as of September 18, 2020 (as amended, supplemented or otherwise modified prior to the date hereof, the “Credit Agreement”; unless otherwise defined herein, all terms used herein with their initial letter capitalized shall have the meaning given such terms in the Credit Agreement, including, to the extent applicable, after giving effect to the amendments set forth in Section 1 of this Fourth Amendment);

WHEREAS, pursuant to the Credit Agreement, certain Lenders have extended credit in the form of Loans to the Borrower and provided certain other credit accommodations to the Borrower; and

WHEREAS, the Borrower has requested that Lenders amend certain provisions contained in the Credit Agreement as more specifically provided for herein.

NOW THEREFORE, for and in consideration of the mutual covenants and agreements herein contained and other good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged and confessed, the Borrower, the Administrative Agent and the Lenders party hereto hereby agree as follows:

Section 1. Amendments to Credit Agreement. In reliance on the representations, warranties, covenants and agreements contained in this Fourth Amendment, and subject to the satisfaction or waiver of the condition precedent set forth in Section 2 hereof, the Credit Agreement shall be amended effective as of the Fourth Amendment Effective Date in the manner provided in this Section 1.

1.1 Additional Definitions. Section 1.1 of the Credit Agreement shall be amended to add thereto in alphabetical order the following definitions, which shall read in full as follows:

“Fourth Amendment” shall mean that certain Fourth Amendment to Credit Agreement dated as of the Fourth Amendment Effective Date, among the Borrower, the Guarantors, the Administrative Agent and the Lenders party thereto.

“Fourth Amendment Effective Date” means October 27, 2023.

1.2 Restatement of Definitions. The following definitions contained in Section 1.1 of the Credit Agreement are hereby amended and restated in their respective entireties to read in full as follows:

“Credit Documents” shall mean this Agreement, the First Amendment, the Second Amendment, the Third Amendment, the Fourth Amendment, the Guarantee, the Security Documents and any promissory notes issued by the Borrower under this Agreement and any other agreements executed by Credit Parties in connection with this Agreement and expressly identified as “Credit Documents” therein.

“Consolidated Cash Balance Threshold” shall mean, (a) solely for purposes of Section 2.3(a), Section 7.1(d)(ii) and any Notice of Borrowing, as of any date of determination, (i) for the period from and after the Fourth Amendment Effective Date until, and including, October 31, 2023, an amount equal to $225,000,000 and (ii) at any other time, an amount equal to the greater of (A) $75,000,000 and (B) ten percent (10%) of the Borrowing Base then in effect (which amount shall not exceed $100,000,000) and (b) solely for purposes of Section 5.2(e), as of any date of determination, (i) for the period from and after the Fourth Amendment Effective Date until, and including, November 3, 2023, an amount equal to $225,000,000 and (ii) at any other time, an amount equal to the greater of (A) $75,000,000 and (B) ten percent (10%) of the Borrowing Base then in effect (which amount shall not exceed $100,000,000).

Section 2. Conditions Precedent to Fourth Amendment. The amendments to the Credit Agreement contained in Section 1 hereof shall be effective on the Fourth Amendment Effective Date subject to the following:

2.1 Counterparts. The Administrative Agent shall have received counterparts of this Fourth Amendment duly executed by (a) an Authorized Officer of the Borrower and the Guarantors and (b) the Lenders constituting the Majority Lenders.

2.2 Fees and Expenses. The Administrative Agent shall have received all fees and other amounts due and payable on or prior to the Fourth Amendment Effective Date, including reimbursement or payment of all documented out-of-pocket expenses required to be reimbursed or paid by the Borrower under the Credit Agreement.

Each Lender, by delivering its signature page to this Fourth Amendment, shall be deemed to have acknowledged receipt of, and consented to and approved, this Fourth Amendment and each other document, agreement and/or instrument or other matter required to be approved by Lenders on the Fourth Amendment Effective Date. The Administrative Agent is hereby authorized and directed to declare the amendments in Section 1 hereof to be effective on the date it confirms to the Borrower in writing that the foregoing conditions have been met to the reasonable satisfaction of the Administrative Agent (or the waiver of such conditions as permitted hereby). Such declaration shall be final, conclusive and binding upon the Lenders and all other parties to the Credit Agreement for all purposes.

Section 3. Representations and Warranties. To induce the Lenders and the Administrative Agent to enter into this Fourth Amendment, each Credit Party hereby represents and warrants to the Lenders and the Administrative Agent as follows as of the Fourth Amendment Effective Date:

3.1 Reaffirm Existing Representations and Warranties. Each representation and warranty of such Credit Party contained in the Credit Agreement and the other Credit Documents to which it is a party is true and correct in all material respects (unless such representations and warranties are already qualified by materiality, Material Adverse Effect or a similar qualification in which case such representations and warranties shall be true and correct in all respects) with the same effect as though each such representation and warranty had been made on and as of the Fourth Amendment Effective Date (except where any such representation and warranty expressly relates to an earlier date, in which case each such representation and warranty shall have been true and correct in all material respects as of such earlier date).

3.2 Due Authorization. The execution, delivery and performance by such Credit Party of this Fourth Amendment are within such Credit Party’s corporate, limited liability, limited partnership or other organizational powers, have been duly authorized by all necessary action, and require no action by or in respect of, or filing with, any governmental body, agency or official.

3.3 Validity and Enforceability. This Fourth Amendment constitutes the valid and binding obligation of such Credit Party enforceable in accordance with its terms, except as (a) the enforceability thereof may be limited by bankruptcy, insolvency or similar laws affecting creditor’s rights generally, and (b) the availability of equitable remedies may be limited by equitable principles of general application.

3.4 No Default or Event of Default. After giving effect to this Fourth Amendment, no Default or Event of Default has occurred or is continuing.

3.5 No Defense. (a) The Borrower acknowledges that the Borrower has no defense to the Borrower’s obligation to pay the Obligations when due, and (b) each Credit Party acknowledges that such Credit Party has no defense to the validity, enforceability or binding effect against such Credit Party of any of the Credit Documents to which it is a party or any Liens intended to be created thereby.

Section 4. Miscellaneous.

4.1 No Waivers. No failure or delay on the part of the Administrative Agent or the Lenders to exercise any right or remedy under the Credit Agreement, any other Credit Documents or applicable law shall operate as a waiver thereof, nor shall any single or partial exercise of any right or remedy preclude any other or further exercise of any right or remedy, all of which are cumulative and may be exercised without notice except to the extent notice is expressly required (and has not been waived) under the Credit Agreement, the other Credit Documents and applicable law.

4.2 Reaffirmation of Credit Documents. Any and all of the terms and provisions of the Credit Agreement and the other Credit Documents shall remain in full force and effect as amended and modified hereby. The amendments contemplated hereby shall not limit or impair any Liens securing the Obligations nor limit or impair any guarantees of any Guarantor under the Credit Documents, each of which are hereby ratified, affirmed and extended to secure the Obligations.

4.3 Legal Expenses. The Borrower hereby agrees to pay on demand all reasonable fees and expenses of counsel to the Administrative Agent incurred by the Administrative Agent in connection with the preparation, negotiation and execution of this Fourth Amendment and all related documents.

4.4 Parties in Interest. All of the terms and provisions of this Fourth Amendment shall bind and inure to the benefit of the parties to the Credit Agreement and the other Credit Documents and their respective successors and assigns.

4.5 Counterparts. This Fourth Amendment may be executed in counterparts, and all parties need not execute the same counterpart. Facsimiles and counterparts executed by electronic signature (e.g., .pdf) shall be effective as originals. The execution and delivery of this Fourth Amendment shall be deemed to include electronic signatures on electronic platforms approved by the Administrative Agent, which shall be of the same legal effect, validity or enforceability as delivery of a manually executed signature, to the extent and as provided for in any applicable law, including the Federal Electronic Signatures in Global and National Commerce Act, the New York State Electronic Signatures and Records Act, or any other similar state laws based on the Uniform Electronic Transactions Act; provided that, upon the request of any party hereto, such electronic signature shall be promptly followed by the original thereof.

4.6 Complete Agreement. THIS FOURTH AMENDMENT, THE CREDIT AGREEMENT AND THE OTHER CREDIT DOCUMENTS REPRESENT THE FINAL AGREEMENT BETWEEN THE PARTIES AND MAY NOT BE CONTRADICTED BY EVIDENCE OF PRIOR, CONTEMPORANEOUS OR ORAL AGREEMENTS OF THE PARTIES. THERE ARE NO UNWRITTEN ORAL AGREEMENTS BETWEEN OR AMONG THE PARTIES.

4.7 Headings. The headings, captions and arrangements used in this Fourth Amendment are, unless specified otherwise, for convenience only and shall not be deemed to limit, amplify or modify the terms of this Fourth Amendment, nor affect the meaning thereof.

4.8 Governing Law. THIS FOURTH AMENDMENT SHALL BE GOVERNED BY, AND CONSTRUED IN ACCORDANCE WITH, THE LAWS OF THE STATE OF NEW YORK.

4.9 Severability. Any provision of this Fourth Amendment which is prohibited or unenforceable in any jurisdiction shall, as to such jurisdiction, be ineffective to the extent of such prohibition or unenforceability without invalidating the remaining provisions hereof, and any such prohibition or unenforceability in any jurisdiction shall not invalidate or render unenforceable such provision in any other jurisdiction.

[Signature pages follow.]

IN WITNESS WHEREOF, the parties hereto have caused this Fourth Amendment to be duly executed by their respective authorized officers effective as of the Fourth Amendment Effective Date.

| | | | | | | | |

| BORROWER: |

| |

| DENBURY INC., |

| a Delaware corporation |

| | |

| By: | /s/ Mark C. Allen |

| Name: | Mark C. Allen |

| Title: | Executive Vice President, Chief

Financial Officer, Treasurer and

Assistant Secretary |

[SIGNATURE PAGE TO FOURTH AMENDMENT TO CREDIT AGREEMENT – DENBURY INC.]

Each of the undersigned Guarantors (a) consent and agree to this Fourth Amendment, and (b) agree that the Credit Documents to which it is a party shall remain in full force and effect and shall continue to be the legal, valid and binding obligation of such Person, enforceable against it in accordance with its terms.

| | | | | | | | |

| GUARANTORS: |

| | |

| DENBURY HOLDINGS, INC. |

| DENBURY OPERATING COMPANY |

| DENBURY ONSHORE, LLC |

| DENBURY PIPELINE HOLDINGS, LLC |

| DENBURY GREEN PIPELINE-TEXAS, LLC |

| DENBURY GULF COAST PIPELINES, LLC |

| GREENCORE PIPELINE COMPANY LLC |

| DENBURY GREEN PIPELINE-MONTANA, LLC |

| DENBURY GREEN PIPELINE-RILEY RIDGE, LLC |

| DENBURY THOMPSON PIPELINE, LLC |

| DENBURY BROOKHAVEN PIPELINE, LLC |

| DENBURY GREEN PIPELINE-NORTH DAKOTA, LLC |

| DENBURY CARBON SOLUTIONS, LLC |

| | |

| By: | /s/ Mark C. Allen |

| Name: | Mark C. Allen |

| Title: | Executive Vice President, Chief Financial

Officer, Treasurer and Assistant Secretary |

| | |

| DENBURY BROOKHAVEN PIPELINE

PARTNERSHIP, LP |

| | |

| By: | Denbury Brookhaven Pipeline, LLC,

its general partner |

| | |

| By: | /s/ Mark C. Allen |

| Name: | Mark C. Allen |

| Title: | Executive Vice President, Chief Financial

Officer, Treasurer and Assistant Secretary |

[SIGNATURE PAGE TO FOURTH AMENDMENT TO CREDIT AGREEMENT – DENBURY INC.]

| | | | | | | | |

| |

| |

| JPMORGAN CHASE BANK, N.A., |

| as the Administrative Agent and a Lender |

| | |

| By: | /s/ Anca Loghin |

| Name: | Anca Loghin |

| Title: | Authorized Officer |

[SIGNATURE PAGE TO FOURTH AMENDMENT TO CREDIT AGREEMENT – DENBURY INC.]

| | | | | | | | |

| |

| |

| BANK OF AMERICA, N.A., |

| as a Lender |

| | |

| By: | /s/ Megan Baqui |

| Name: | Megan Baqui |

| Title: | Director |

[SIGNATURE PAGE TO FOURTH AMENDMENT TO CREDIT AGREEMENT – DENBURY INC.]

| | | | | | | | |

| |

| |

| WELLS FARGO BANK, NATIONAL ASSOCIATION, |

| as a Lender |

| | |

| By: | /s/ Erin Grasty |

| Name: | Erin Grasty |

| Title: | Vice President |

[SIGNATURE PAGE TO FOURTH AMENDMENT TO CREDIT AGREEMENT – DENBURY INC.]

| | | | | | | | |

| |

| |

| CAPITAL ONE, NATIONAL ASSOCIATION, |

| as a Lender |

| | |

| By: | /s/ David Lee Garza |

| Name: | David Lee Garza |

| Title: | Vice President |

[SIGNATURE PAGE TO FOURTH AMENDMENT TO CREDIT AGREEMENT – DENBURY INC.]

| | | | | | | | |

| |

| |

| TRUIST BANK, |

| as a Lender |

| | |

| By: | /s/ Greg Krablin |

| Name: | Greg Krablin |

| Title: | Director |

[SIGNATURE PAGE TO FOURTH AMENDMENT TO CREDIT AGREEMENT – DENBURY INC.]

| | | | | | | | |

| |

| |

| U.S. BANK NATIONAL ASSOCIATION, |

| as a Lender |

| | |

| By: | /s/ Beth Johnson |

| Name: | Beth Johnson |

| Title: | Senior Vice President |

[SIGNATURE PAGE TO FOURTH AMENDMENT TO CREDIT AGREEMENT – DENBURY INC.]

| | | | | | | | |

| |

| |

| MIZUHO BANK, LTD., |

| as a Lender |

| | |

| By: | /s/ Edward Sacks |

| Name: | Edward Sacks |

| Title: | Executive Director |

[SIGNATURE PAGE TO FOURTH AMENDMENT TO CREDIT AGREEMENT – DENBURY INC.]

| | | | | | | | |

| |

| |

| FIFTH THIRD BANK, NATIONAL ASSOCIATION, |

| as a Lender |

| | |

| By: | /s/ Thomas Kleiderer |

| Name: | Thomas Kleiderer |

| Title: | Managing Director |

[SIGNATURE PAGE TO FOURTH AMENDMENT TO CREDIT AGREEMENT – DENBURY INC.]

| | | | | | | | |

| |

| |

| ROYAL BANK OF CANADA, |

| as a Lender |

| | |

| By: | /s/ Jay T. Sartain |

| Name: | Jay T. Sartain |

| Title: | Authorized Signatory |

[SIGNATURE PAGE TO FOURTH AMENDMENT TO CREDIT AGREEMENT – DENBURY INC.]

| | | | | | | | |

| |

| |

| CANADIAN BANK OF COMMERCE, |

| NEW YORK BRANCH, |

| as a Lender |

| | |

| By: | /s/ Jacob W. Lewis |

| Name: | Jacob W. Lewis |

| Title: | Authorized Signatory |

| | |

| | |

| By: | /s/ Donovan C. Broussard |

| Name: | Donovan C. Broussard |

| Title: | Authorized Signatory |

[SIGNATURE PAGE TO FOURTH AMENDMENT TO CREDIT AGREEMENT – DENBURY INC.]

| | | | | | | | |

| |

| |

| KEYBANK NATIONAL ASSOCIATION, |

| as a Lender |

| | |

| By: | /s/ George McKean |

| Name: | George McKean |

| Title: | Senior Vice President |

[SIGNATURE PAGE TO FOURTH AMENDMENT TO CREDIT AGREEMENT – DENBURY INC.]

| | | | | | | | |

| |

| |

| COMERICA BANK, |

| as a Lender |

| | |

| By: | /s/ Cassandra Lucas |

| Name: | Cassandra Lucas |

| Title: | Vice President |

[SIGNATURE PAGE TO FOURTH AMENDMENT TO CREDIT AGREEMENT – DENBURY INC.]

| | | | | | | | |

| |

| |

| GOLDMAN SACHS BANK, USA |

| as a Lender |

| | |

| | |

| By: | /s/ Dan Martis |

| Name: | Dan Martis |

| Title: | Authorized Signatory |

[SIGNATURE PAGE TO FOURTH AMENDMENT TO CREDIT AGREEMENT – DENBURY INC.]

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

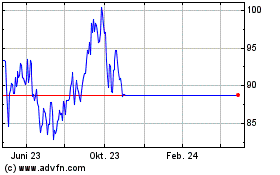

Denbury (NYSE:DEN)

Historical Stock Chart

Von Apr 2024 bis Mai 2024

Denbury (NYSE:DEN)

Historical Stock Chart

Von Mai 2023 bis Mai 2024