Corning Completes Swap to Exit Dow Corning

01 Juni 2016 - 3:14PM

Dow Jones News

By Austen Hufford

Corning Inc. said it had successfully exchanged shares of

silicone company Dow Corning for cash and an interest in a

semiconductor company, ending a 73-year joint venture with Dow

Chemical Co.

Corning said it swapped its 50% stake in Dow Corning for $4.8

billion and a 40% stake in Hemlock Semiconductor Group, which makes

semiconductors for the solar-panel industry. Dow Chemical now fully

owns Dow Corning and will also keep a stake in Hemlock.

The deal comes as the solar industry faces challenges from low

energy prices, expiring tax credits and pushback from local

electric utilities.

"Our position in Hemlock allows us to capture the potential

upside from a rebound in the solar market," Corning Chief Executive

Wendell Weeks said.

The deal closed after it received a positive tax ruling from the

Internal Revenue Service.

The swap was announced in December on the same day as Dow

Chemical agreed to merge with DuPont Co., creating a chemical giant

with a market value of about $130 billion. That pending deal, which

is currently undergoing regulatory review, will combine two of the

oldest companies in the U.S. into a chemical giant called

DowDuPont. The combined company is planning to split itself into

three separately-traded companies focused on agricultural products,

material sciences, and specialty products about 18 to 24 months

after the merger closes.

Write to Austen Hufford at austen.hufford@wsj.com

(END) Dow Jones Newswires

June 01, 2016 08:59 ET (12:59 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

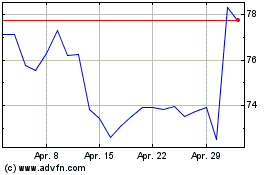

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024