By David Benoit

Dow Chemical Co. and DuPont Co. announced plans to merge Friday

in a transaction that combines two longtime rivals and heralds the

arrival of a new era of activist investing.

Dow and DuPont said they would combine into a chemical giant

worth more than $120 billion before splitting up into three

separate companies. While the plan was hatched by the companies'

chief executives, they worked alongside activist investor Nelson

Peltz, who played a central role in helping plan and execute the

deal, according to those involved.

As the merger plan came together in recent weeks, Mr. Peltz and

his colleague Ed Garden of Trian Fund Management LP worked behind

the scenes with Dow Chief Executive Andrew Liveris and DuPont's

Edward Breen.

That campaign kicked off when Messrs. Peltz and Garden were

invited in October to meet with DuPont's board in Baltimore. At the

meeting, the men encouraged the board to pursue a tie-up with

Dow--a move that, unbeknown to them, was recently under way.

The involvement of Trian is the latest sign of the growing clout

of activists. While they have become increasingly powerful in

recent years, forcing companies to do everything from buying back

stock to selling assets, their ability to help bring about such a

monumental deal represents a new high.

Once viewed as fighters from the fringe who would be kept far

from deal talks of two iconic companies, activist investors have

won acceptance from some executives and boards, who now sometimes

court their detailed analysis and thinking on decision making. That

has placed them at the center of some recent deals, such as the

ongoing role of William Ackman of Pershing Square Capital

Management LP in trying to merge railroads Canadian Pacific Railway

Ltd. and Norfolk Southern Corp.

Another activist, Daniel Loeb's Third Point LLC, also played a

role in the DowDuPont deal, albeit an indirect one. Mr. Loeb had

pressured Dow to break itself up last year and had criticized Mr.

Liveris, but had settled a pending proxy fight in exchange for two

directors. As part of that pact, Mr. Loeb was barred from public

comments on Dow for a year, but had privately kept his own pressure

on Dow's board and Mr. Liveris.

He wasn't involved in the deal talks and wasn't made aware

before The Wall Street Journal reported on the talks earlier this

week. But his standstill expires this weekend, meaning he could

have started a new fight soon, a possibility that was known during

the deliberations.

The following account is based on interviews with numerous

people close to the negotiations.

Mr. Liveris called Mr. Breen as soon as he was named interim CEO

at DuPont in October. Mr. Breen knew what the call was about before

he even picked up the phone, he said in an interview.

Messrs. Liveris and Breen, who had never met, agreed to get

together the following Sunday for brunch at a Philadelphia hotel.

They spent the afternoon discussing the benefits of bringing the

companies together and then breaking them into new entities. Mr.

Liveris pressed to move quickly, hinting that he had other

options.

Mr. Breen asked for a few days, and called back quickly, ready

to press forward on a deal.

The timing was right for both sides. Commodity prices continued

to sink and the U.S. dollar grew stronger, denting revenue for both

companies. Meanwhile, the companies' stock-market values were just

about the same, making a merger of equals easier to strike. Then,

Mr. Breen, a known deal maker, was given the reins with a mandate

to change the 213-year-old company.

Messrs. Breen and Liveris then met numerous times at various

hotels and sketched out the broad details of an agreement, handing

back and forth a roughly seven-page document. Advisers reminded

them that mergers-of-equals often founder when details aren't

agreed upon early.

A couple of weeks later, Messrs. Peltz and Garden were invited

to meet the entire DuPont board. It was the first meeting with the

whole board since they had begun a campaign for change at the

company more than two years earlier.

In the Four Seasons Hotel in Baltimore, the Trian duo sat at a

small table facing a large U-shaped table where the board of

Wilmington, Del.-based DuPont sat and listened. The directors said

little.

Trian didn't hold back, chastising the board for disappointing

results at the company and a spinoff they considered poorly

executed. The activists, representing DuPont's fifth-largest

shareholder with a roughly 3% stake, said they would support Mr.

Breen being named permanent CEO but wanted to see one of three

things happen: A breakup of DuPont; a deal between its agriculture

business and Syngenta AG; or a merger with Dow. They made clear the

deal with Midland, Mich.-based Dow was their preferred option.

Mr. Peltz had already learned from a lunch with Mr. Liveris in

late 2014 that Dow could be interested in a deal, and the two

discussed how one could be structured. Mr. Liveris, had long

desired the deal and previously worked out a plan with help from

his banker Michael Klein, founder of Klein & Co. But on this

day he demurred: The timing wasn't right.

At the Baltimore meeting, Mr. Breen gave no hint to the

investors he was already along the path toward a deal.

But after becoming permanent CEO in November, Mr. Breen arrived

at Trian's office in New York the week of Thanksgiving with Roger

Altman, the banker and former deputy treasury secretary, with a

nondisclosure agreement for Trian officials to sign. Once they had

done so, they let the activists in on the secret: Dow and DuPont

were in talks for a deal and a subsequent breakup.

Both Dow and DuPont wanted Trian's input on how to execute the

breakup, tapping its extensive history in separating industrial

conglomerates. Trian leapt into action and signed a separate

nondisclosure agreement with Dow. But it gave the sides only 30

days to strike a deal.

Mr. Peltz invited Mr. Liveris and his chief operating officer,

James Fitterling, to his sprawling mansion in Palm Beach, Fla., the

Monday after Thanksgiving for an all-day discussion on which

businesses belonged where.

The group painstakingly went through each business's customers,

raw materials, costs and sales forces. Trian reported back to Mr.

Breen on how they thought the split should work.

Once the sides agreed on the structure, Dow and DuPont gathered

hundreds of advisers, including bankers from Lazard Ltd., Morgan

Stanley and Goldman Sachs Group Inc., in the General Motors

building overlooking Central Park in New York.

They dug in, looking at where the combined company could find

savings. For a week, the teams discussed how they would build the

company from scratch in the most efficient way.

When they were done, they had identified more than $3 billion in

costs they could eliminate. Executives Friday touted the 4,000

hours poured into the math, assuring that the so-called synergy

figure is a real one they expect to beat.

As a merger of equals, each side's shareholders will get roughly

50% of the combined company, and the board will be split 50/50. Mr.

Liveris will be executive chairman and Mr. Breen, chief executive.

Mr. Liveris said Friday that he and Mr. Breen had "checked their

egos at the door."

Yet a diverging future for the two chief executives also

appeared to emerge Friday.

Mr. Liveris described the accord as the end of a long road and

hinted he may be retiring before long.

"I do want to eventually go to the place where the future of the

company is not just beholden to my presence," he said on a

conference call.

Seven months ago, DuPont had beaten Trian in a proxy fight, a

victory some thought could mark a pushback on activism's rise. Now,

Trian looks vindicated, says Chris Davis, a lawyer who advises

activists at Kleinberg, Kaplan, Wolff & Cohen P.C.

"America's corporate landscape is being permanently reshaped

under the influence of two of its pre-eminent activists," Mr. Davis

said. "Public directors may want to rethink the DuPont

narrative."

Jacob Bunge contributed to this article.

(END) Dow Jones Newswires

December 11, 2015 20:21 ET (01:21 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

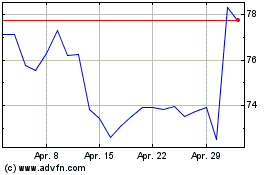

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jun 2024 bis Jul 2024

DuPont de Nemours (NYSE:DD)

Historical Stock Chart

Von Jul 2023 bis Jul 2024