0001835378False00018353782023-07-032023-07-030001835378us-gaap:CommonStockMember2023-07-032023-07-030001835378us-gaap:WarrantMember2023-07-032023-07-03

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): July 3, 2023

Innovid Corp.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Delaware | | 001-40048 | | 87-3769599 |

(State or other jurisdiction

of incorporation or organization) | | (Commission

File Number) | | (I.R.S. Employer

Identification No.) |

30 Irving Place, 12th Floor

New York, NY 10003

(Address of principal executive offices) (Zip Code)

(212) 966-7555

(Registrant’s telephone number, include area code)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | | | | | | | | | | | | | |

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| Securities registered pursuant to Section 12(b) of the Act: |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

Common stock, par value $0.0001 per share | | CTV | | New York Stock Exchange |

| Warrants to purchase one share of common stock, each at an exercise price of $11.50 per share | | CTVWS | | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 8.01. Other Events.

On July 3, 2023, Innovid Corp. (the “Company”) received written notice (the “Compliance Notice”) from the New York Stock Exchange (the “NYSE”) informing the Company that it has regained compliance with the continued listing standard set forth in Section 802.01C of the NYSE Listed Company Manual, which requires that companies listed on the NYSE maintain a minimum average closing price of the Company’s common stock above $1.00 per share over a consecutive 30 trading-day period.

The Company regained compliance under Section 802.01C on June 30, 2023 after the Company’s common stock had a closing share price of at least $1.00 and had maintained an average closing share price of at least $1.00 over the 30 trading-day period ending on that date.

On July 5, 2023, the Company issued a press release announcing the Company has regained compliance with the NYSE’s continued listing standards. A copy of the press release is attached as Exhibit 99.1 and is incorporated herein by reference.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No | | Description |

| 99.1 | | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | | | | | | | |

| | INNOVID CORP. |

| | | | |

| Date: July 5, 2023 | | By: | | /s/ Tanya Andreev-Kaspin |

| | Name: | | Tanya Andreev-Kaspin |

| | Title: | | Chief Financial Officer |

Innovid Regains Compliance with NYSE Continued Listing Standards

NEW YORK, July 5, 2023 -- Innovid Corp. (NYSE:CTV) (the "Company"), an independent advertising platform for delivery, personalization, and measurement of converged TV across linear, connected TV (CTV) and digital, today announced that, based on a notification letter the Company received from the New York Stock Exchange (the "NYSE") on July 3, 2023, the Company has regained compliance with the NYSE's continued listing standards for minimum share price under Section 802.01C of the NYSE Listing Company Manual.

On May 18, 2023, NYSE had notified Innovid that it was not in compliance with the NYSE's continued listing standards because the average closing price of the Company’s common stock was less than $1.00 per share over a 30 trading-day period.

On July 3, 2023, the Company received a confirmation from the NYSE that, as of June 30, 2023, the Company’s average stock price had a closing share price of at least $1.00 and had maintained an average closing share price of at least $1.00 over the 30 trading-day period ending on that date. Accordingly, the Company’s shares are no longer considered to be below the minimum share price requirement of Section 802.01C and, a result, the Company has regained compliance with the NYSE continued listing standards and will continue to be traded on the NYSE.

About Innovid

Innovid (NYSE: CTV) powers advertising delivery, personalization, measurement, and outcomes across linear, connected TV (CTV) and digital for the world's largest brands. Through a global infrastructure that enables cross-platform ad serving, data-driven creative, and measurement, Innovid offers its clients always-on intelligence to optimize advertising investment across channels, platforms, screens, and devices. Innovid is an independent platform that leads the market in converged TV innovation, through proprietary technology and exclusive partnerships designed to reimagine TV advertising. Headquartered in New York City, Innovid serves a global client base through offices across the Americas, Europe, and Asia Pacific.

To learn more, visit innovid.com or follow us on LinkedIn or Twitter.

Forward Looking Statements

This press release includes "forward-looking statements" within the meaning of the "safe harbor" provisions of the Private Securities Litigation Reform Act of 1996. The Company's actual results may differ from its expectations, estimates and projections and consequently, you should not rely on these forward-looking statements as predictions of future events. Words such as "expect," "estimate," "project," "budget," "forecast," "anticipate," "intend," "plan," "may," "will," "could," "should," "believes," "predicts," "potential," "continue," "aim," and similar expressions are intended to identify such forward-looking statements. These forward-looking statements include, without limitation, the Company's expectations regarding its future financial results and

expected growth. These forward-looking statements involve significant risks and uncertainties that could cause the actual results to differ materially from the expected results, including Innovid's ability to raise financing in the future, success in retaining or recruiting officers, key employees or directors, changes in applicable laws or regulations, Innovid's ability to maintain and expand relationships with advertisers, decreases and/or changes in CTV audience viewership behavior, Innovid's ability to make the right investment decisions and to innovate and develop new solutions, the accuracy of Innovid's estimates of market opportunity, forecasts of market growth and projections of future financial performance, the extent of investment required in Innovid's sales and marketing efforts, Innovid's ability to effectively manage its growth, the impact of the Covid19 pandemic, the risk of continued inflation and other macroeconomic events, acquisition related risks, and other important factors discussed under the caption "Risk Factors" in Innovid's Annual Report on Form 10-K filed with the SEC on March 18, 2022, as such factors may be updated from time to time in its other filings with the SEC, accessible on the SEC's website at www.sec.gov and the Investors Relations section of Innovid's website at investors.innovid.com. Most of these factors are outside the Company's control and are difficult to predict. The Company cautions not to place undue reliance upon any forward looking statements, including projections, which speak only as of the date made. The Company does not undertake or accept any obligation to release publicly any updates or revisions to any forward-looking statements to reflect any change in its expectations or any change in events, conditions or circumstances on which any such statement is based.

Contacts

Investors:

IR@innovid.com

Media:

Caroline Yodice

cyodice@daddibrand.com

v3.23.2

Cover

|

Jul. 03, 2023 |

| Document Information [Line Items] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 03, 2023

|

| Entity Registrant Name |

Innovid Corp.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-40048

|

| Entity Tax Identification Number |

87-3769599

|

| Entity Address, Address Line One |

30 Irving Place

|

| Entity Address, Address Line Two |

12th Floor

|

| Entity Address, City or Town |

New York

|

| Entity Address, State or Province |

NY

|

| Entity Address, Postal Zip Code |

10003

|

| City Area Code |

212

|

| Local Phone Number |

966-7555

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

true

|

| Entity Ex Transition Period |

false

|

| Entity Central Index Key |

0001835378

|

| Amendment Flag |

false

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common stock, par value $0.0001 per share

|

| Trading Symbol |

CTV

|

| Security Exchange Name |

NYSE

|

| Warrant |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Warrants to purchase one share of common stock, each at an exercise price of $11.50 per share

|

| Trading Symbol |

CTVWS

|

| Security Exchange Name |

NYSE

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_WarrantMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

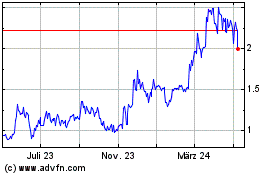

Innovid (NYSE:CTV)

Historical Stock Chart

Von Mär 2024 bis Apr 2024

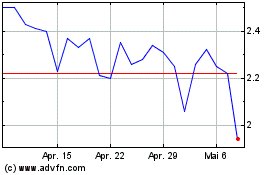

Innovid (NYSE:CTV)

Historical Stock Chart

Von Apr 2023 bis Apr 2024