0000019745falseNovember 7, 2024falseNYSE00000197452024-11-072024-11-07

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): November 7, 2024

CHESAPEAKE UTILITIES CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-11590 | | 51-0064146 |

| (State or other jurisdiction of | | (Commission | | (I.R.S. Employer |

| incorporation or organization) | | File Number) | | Identification No.) |

500 Energy Lane, Dover, DE 19901

(Address of principal executive offices, including Zip Code)

(302) 734-6799

(Registrant's Telephone Number, including Area Code)

(Former name, former address and former fiscal year, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

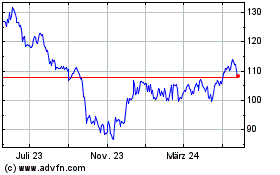

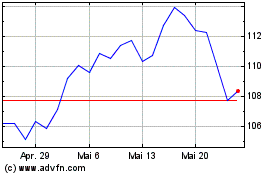

| Common Stock - par value per share $0.4867 | CPK | New York Stock Exchange, Inc. |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Item 2.02. Results of Operations and Financial Condition.

On November 7, 2024, Chesapeake Utilities Corporation issued a press release announcing its financial results for the quarter and for the nine months ended September 30, 2024. A copy of the press release is attached as Exhibit 99.1 hereto and is incorporated by reference herein.

Item 7.01 Regulation FD Disclosure.

On November 7, 2024, Chesapeake Utilities Corporation posted a presentation that will be used during its conference call on November 8, 2024, to discuss the Company’s financial results for the quarter and the nine months ended September 30, 2024, on its website (www.chpk.com) under the “Investors” section. This presentation is being furnished as Exhibit 99.2 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

Exhibit 99.1 - Press Release of Chesapeake Utilities Corporation, dated November 7, 2024. Exhibit 99.2 - Third Quarter 2024 Earnings Call Presentation

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

|

CHESAPEAKE UTILITIES CORPORATION |

|

| /s/ Beth W. Cooper |

| Beth W. Cooper |

| Executive Vice President, Chief Financial Officer, Treasurer, and Assistant Corporate Secretary |

|

| Date: November 7, 2024 |

FOR IMMEDIATE RELEASE

November 7, 2024

NYSE Symbol: CPK

CHESAPEAKE UTILITIES CORPORATION REPORTS THIRD QUARTER

2024 RESULTS

•Net income and earnings per share ("EPS")* were $17.5 million and $0.78, respectively, for the third quarter of 2024, and $81.9 million and $3.66, respectively, for the nine months ended September 30, 2024

•Adjusted net income and Adjusted EPS**, which exclude transaction and transition-related expenses attributable to the acquisition and integration of Florida City Gas ("FCG"), were $18.1 million and $0.80, respectively, for the third quarter of 2024 and $84.2 million and $3.76, respectively, for the nine months ended September 30, 2024

•Adjusted gross margin** growth of $89.3 million during the first nine months of 2024 driven by contributions from FCG, regulatory initiatives and infrastructure programs, natural gas organic growth, continued pipeline expansion projects, and additional customer consumption

•Results continue to track in line with Management's expectations, and the Company continues to affirm 2024 EPS and capital guidance

Dover, Delaware — Chesapeake Utilities Corporation (NYSE: CPK) (“Chesapeake Utilities” or the “Company”) today announced financial results for the three and nine months ended September 30, 2024.

Net income for the third quarter of 2024 was $17.5 million ($0.78 per share) compared to $9.4 million ($0.53 per share) in the third quarter of 2023. Excluding transaction and transition-related expenses associated with the fourth quarter 2023 acquisition of FCG, adjusted net income was $18.1 million ($0.80 per share) or approximately 16 percent higher per share compared to the prior-year period.

The higher results for the third quarter of 2024 were largely attributable to incremental contributions from FCG, additional margin from regulated infrastructure programs, continued pipeline expansion projects to support distribution growth, growth in the Company's natural gas distribution businesses and increased levels of virtual pipeline services. The financing impacts of the FCG acquisition, including increased interest expense related to debt issued and additional shares outstanding, partially offset the increases.

During the first nine months of 2024, net income was $81.9 million ($3.66 per share) compared to $61.9 million ($3.47 per share) in the prior-year period. Excluding the transaction and transition-related expenses, adjusted net income was $84.2 million ($3.76 per share) compared to $64.8 million ($3.63 per share) for the same period in 2023.

Year-to-date earnings for 2024 were primarily impacted by the factors discussed for the third quarter as well as additional adjusted gross margin from increased customer consumption experienced earlier in the year and contributions from the Company's unregulated businesses.

"Chesapeake Utilities delivered strong financial performance and sustained operational excellence in the third quarter as we continued to execute on the three pillars that drive long-term earnings growth and shareholder value: prudently deploying record levels of capital, proactively advancing our regulatory

agenda and continually executing on business transformation,” said Jeff Householder, chair, president and CEO. “In the third quarter alone, we invested nearly $100 million in capital expenditures, filed for rate increases in Delaware and in Florida for our electric operations and successfully implemented our new enterprise-wide customer billing system."

“In the third quarter of 2024, adjusted earnings per share was up 16 percent relative to the same period in 2023, attributable to adjusted gross margin growth of close to 30 percent and continued cost management driven by our business transformation efforts and focus on a “one company” approach. Some of the larger margin drivers include the addition of FCG, which we continue to effectively integrate, strong customer growth of approximately 4 percent in both Delmarva and Florida, incremental margin related to transmission expansions and increased virtual pipeline services and depreciation savings related to regulatory initiatives,” continued Householder. “I’m proud of our teammates’ consistent dedication to prioritizing service and safety to deliver performance in line with our expectations. This commitment enables us to affirm our full-year 2024 adjusted EPS and capital guidance."

Earnings and Capital Investment Guidance

The Company continues to affirm its 2024 EPS guidance of $5.33 to $5.45 in adjusted earnings per share given the incremental margin opportunities present across the Company’s businesses, investment opportunities within and surrounding FCG, regulatory initiatives and operating synergies.

The Company also affirms its previously-announced 2024 capital expenditure guidance of $300 million to $360 million, as well as the capital expenditure guidance for the five-year period ended 2028 that will range from $1.5 billion to $1.8 billion. This investment forecast is projected to result in a 2025 EPS guidance range of $6.15 to $6.35, as well as a 2028 EPS guidance range of $7.75 to $8.00. This implies an EPS growth rate of approximately 8 percent from the 2025 EPS guidance range.

*Unless otherwise noted, EPS and Adjusted EPS information are presented on a diluted basis.

Non-GAAP Financial Measures

**This press release including the tables herein, include references to both Generally Accepted Accounting Principles ("GAAP") and non-GAAP financial measures, including Adjusted Gross Margin, Adjusted Net Income and Adjusted EPS. A "non-GAAP financial measure" is generally defined as a numerical measure of a company's historical or future performance that includes or excludes amounts, or that is subject to adjustments, so as to be different from the most directly comparable measure calculated or presented in accordance with GAAP. Our management believes certain non-GAAP financial measures, when considered together with GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any particular period.

The Company calculates Adjusted Gross Margin by deducting the purchased cost of natural gas, propane and electricity and the cost of labor spent on direct revenue-producing activities from operating revenues. The costs included in Adjusted Gross Margin exclude depreciation and amortization and certain costs presented in operations and maintenance expenses in accordance with regulatory requirements. The Company calculates Adjusted Net Income and Adjusted EPS by deducting costs and expenses associated with significant acquisitions that may affect the comparison of period-over-period results. These non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures. The Company believes that these non-GAAP measures are useful and meaningful to investors as a basis for making investment decisions, and provide investors with information that demonstrates the profitability achieved by the Company under allowed rates for regulated energy operations and under the Company's competitive pricing structures for unregulated energy operations. The Company's management uses these non-GAAP financial measures in assessing a business unit and Company performance. Other companies may calculate these non-GAAP financial measures in a different manner.

The following tables reconcile Gross Margin, Net Income, and EPS, all as defined under GAAP, to our non-GAAP measures of Adjusted Gross Margin, Adjusted Net Income and Adjusted EPS for each of the periods presented.

Adjusted Gross Margin

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended September 30, 2024 |

| (in thousands) | | Regulated Energy | | Unregulated Energy | | Other and Eliminations | | Total |

| Operating Revenues | | $ | 130,633 | | | $ | 35,567 | | | $ | (6,062) | | | $ | 160,138 | |

| Cost of Sales: | | | | | | | | |

| Natural gas, propane and electric costs | | (28,366) | | | (15,868) | | | 6,033 | | | (38,201) | |

| Depreciation & amortization | | (12,301) | | | (4,553) | | | 3 | | | (16,851) | |

Operations & maintenance expenses (1) | | (10,722) | | | (8,058) | | | — | | | (18,780) | |

| Gross Margin (GAAP) | | 79,244 | | | 7,088 | | | (26) | | | 86,306 | |

Operations & maintenance expenses (1) | | 10,722 | | | 8,058 | | | — | | | 18,780 | |

| Depreciation & amortization | | 12,301 | | | 4,553 | | | (3) | | | 16,851 | |

| Adjusted Gross Margin (Non-GAAP) | | $ | 102,267 | | | $ | 19,699 | | | $ | (29) | | | $ | 121,937 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Three Months Ended September 30, 2023 |

| (in thousands) | | Regulated Energy | | Unregulated Energy | | Other and Eliminations | | Total |

| Operating Revenues | | $ | 102,411 | | | $ | 34,970 | | | $ | (5,834) | | | $ | 131,547 | |

| Cost of Sales: | | | | | | | | |

| Natural gas, propane and electric costs | | (26,518) | | | (16,381) | | | 5,805 | | | (37,094) | |

| Depreciation & amortization | | (13,192) | | | (4,420) | | | 2 | | | (17,610) | |

Operations & maintenance expenses (1) | | (4,819) | | | (7,532) | | | (382) | | | (12,733) | |

| Gross Margin (GAAP) | | 57,882 | | | 6,637 | | | (409) | | | 64,110 | |

Operations & maintenance expenses (1) | | 4,819 | | | 7,532 | | | 382 | | | 12,733 | |

| Depreciation & amortization | | 13,192 | | | 4,420 | | | (2) | | | 17,610 | |

| Adjusted Gross Margin (Non-GAAP) | | $ | 75,893 | | | $ | 18,589 | | | $ | (29) | | | $ | 94,453 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Nine Months Ended September 30, 2024 |

| (in thousands) | | Regulated Energy | | Unregulated Energy | | Other and Eliminations | | Total |

| Operating Revenues | | $ | 429,684 | | | $ | 160,089 | | | $ | (17,619) | | | $ | 572,154 | |

| Cost of Sales: | | | | | | | | |

| Natural gas, propane and electric costs | | (105,662) | | | (70,928) | | | 17,532 | | | (159,058) | |

| Depreciation & amortization | | (39,495) | | | (12,257) | | | 8 | | | (51,744) | |

Operations & maintenance expenses (1) | | (35,713) | | | (24,373) | | | 1 | | | (60,085) | |

| Gross Margin (GAAP) | | 248,814 | | | 52,531 | | | (78) | | | 301,267 | |

Operations & maintenance expenses (1) | | 35,713 | | | 24,373 | | | (1) | | | 60,085 | |

| Depreciation & amortization | | 39,495 | | | 12,257 | | | (8) | | | 51,744 | |

| Adjusted Gross Margin (Non-GAAP) | | $ | 324,022 | | | $ | 89,161 | | | $ | (87) | | | $ | 413,096 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | For the Nine Months Ended September 30, 2023 |

| (in thousands) | | Regulated Energy | | Unregulated Energy | | Other and Eliminations | | Total |

| Operating Revenues | | $ | 345,822 | | | $ | 158,886 | | | $ | (19,439) | | | $ | 485,269 | |

| Cost of Sales: | | | | | | | | |

| Natural gas, propane and electric costs | | (105,692) | | | (75,068) | | | 19,282 | | | (161,478) | |

| Depreciation & amortization | | (39,179) | | | (12,923) | | | 6 | | | (52,096) | |

Operations & maintenance expenses (1) | | (23,346) | | | (23,528) | | | (377) | | | (47,251) | |

| Gross Margin (GAAP) | | 177,605 | | | 47,367 | | | (528) | | | 224,444 | |

Operations & maintenance expenses (1) | | 23,346 | | | 23,528 | | | 377 | | | 47,251 | |

| Depreciation & amortization | | 39,179 | | | 12,923 | | | (6) | | | 52,096 | |

| Adjusted Gross Margin (Non-GAAP) | | $ | 240,130 | | | $ | 83,818 | | | $ | (157) | | | $ | 323,791 | |

(1) Operations & maintenance expenses within the condensed consolidated statements of income are presented in accordance with regulatory requirements and to provide comparability within the industry. Operations & maintenance expenses which are deemed to be directly attributable to revenue producing activities have been separately presented above in order to calculate Gross Margin as defined under US GAAP.

Adjusted Net Income and Adjusted EPS

| | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | |

| | September 30, | | |

| (in thousands, except per share data) | | 2024 | | 2023 | | | | |

| Net Income (GAAP) | | $ | 17,507 | | | $ | 9,407 | | | | | |

FCG transaction and transition-related expenses, net (1) | | 593 | | | 2,804 | | | | | |

| Adjusted Net Income (Non-GAAP) | | $ | 18,100 | | | $ | 12,211 | | | | | |

| | | | | | | | |

Weighted average common shares outstanding - diluted (2) | | 22,564 | | | 17,858 | | | | | |

| | | | | | | | |

| Earnings Per Share - Diluted (GAAP) | | $ | 0.78 | | | $ | 0.53 | | | | | |

FCG transaction and transition-related expenses, net (1) | | 0.02 | | | 0.16 | | | | | |

| Adjusted Earnings Per Share - Diluted (Non-GAAP) | | $ | 0.80 | | | $ | 0.69 | | | | | |

| | | | | | | | | | | | | | | | | | |

| | Nine Months Ended | | |

| | September 30, | | |

| (in thousands, except per share data) | | 2024 | | 2023 | | | | |

| Net Income (GAAP) | | $ | 81,946 | | | $ | 61,884 | | | | | |

FCG transaction and transition-related expenses, net (1) | | 2,276 | | | 2,898 | | | | | |

| Adjusted Net Income (Non-GAAP) | | $ | 84,222 | | | $ | 64,782 | | | | | |

| | | | | | | | |

Weighted average common shares outstanding - diluted (2) | | 22,402 | | | 17,847 | | | | | |

| | | | | | | | |

| Earnings Per Share - Diluted (GAAP) | | $ | 3.66 | | | $ | 3.47 | | | | | |

FCG transaction and transition-related expenses, net (1) | | 0.10 | | | 0.16 | | | | | |

| Adjusted Earnings Per Share - Diluted (Non-GAAP) | | $ | 3.76 | | | $ | 3.63 | | | | | |

(1) Transaction and transition-related expenses represent costs incurred attributable to the acquisition and integration of FCG including, but not limited to, transaction costs, transition services, consulting, system integration, rebranding and legal fees.

(2) Weighted average shares for the three and nine months ended September 30, 2024 reflect the impact of 4.4 million common shares issued in November 2023 in connection with the acquisition of FCG.

Operating Results for the Quarters Ended September 30, 2024 and 2023

Consolidated Results

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | |

| September 30, | | | | |

| (in thousands) | 2024 | | 2023 | | Change | | Percent Change |

| Adjusted gross margin** | $ | 121,937 | | | $ | 94,453 | | | $ | 27,484 | | | 29.1 | % |

| Depreciation, amortization and property taxes | 24,998 | | | 23,800 | | | 1,198 | | | 5.0 | % |

| FCG transaction and transition-related expenses | 819 | | | 3,899 | | | (3,080) | | | (79.0) | % |

| Other operating expenses | 55,202 | | | 46,526 | | | 8,676 | | | 18.6 | % |

| Operating income | $ | 40,918 | | | $ | 20,228 | | | $ | 20,690 | | | 102.3 | % |

Operating income for the third quarter of 2024 was $40.9 million, an increase of $20.7 million compared to the same period in 2023. Excluding transaction and transition-related expenses associated with the acquisition and integration of FCG, operating income increased $17.6 million or 73.0 percent compared to the prior-year period. An increase in adjusted gross margin in the third quarter of 2024 was driven by contributions from the acquisition of FCG, incremental margin from regulated infrastructure programs, continued pipeline expansion projects, increased demand for virtual pipeline services and natural gas organic growth. Higher operating expenses were driven largely by the operating expenses of FCG and increased payroll, benefits and other employee-related expenses compared to the prior-year period. Increases in depreciation, amortization and property taxes attributable to growth projects and FCG were partially offset by a $3.2 million reserve surplus amortization mechanism ("RSAM") adjustment from FCG and lower depreciation from our electric operations and Maryland natural gas division due to revised rates from approved depreciation studies.

Regulated Energy Segment

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | |

| September 30, | | | | |

| (in thousands) | 2024 | | 2023 | | Change | | Percent Change |

| Adjusted gross margin** | $ | 102,267 | | | $ | 75,893 | | | $ | 26,374 | | | 34.8 | % |

| Depreciation, amortization and property taxes | 19,853 | | | 18,891 | | | 962 | | | 5.1 | % |

| FCG transaction and transition-related expenses | 819 | | | 3,899 | | | (3,080) | | | (79.0) | % |

| Other operating expenses | 37,660 | | | 28,191 | | | 9,469 | | | 33.6 | % |

| Operating income | $ | 43,935 | | | $ | 24,912 | | | $ | 19,023 | | | 76.4 | % |

The key components of the increase in adjusted gross margin** are shown below:

| | | | | |

| (in thousands) | |

| Contribution from FCG | $ | 23,399 | |

| Margin from regulated infrastructure programs | 1,806 | |

| Natural gas transmission service expansions, including interim services | 1,548 | |

| Natural gas growth including conversions (excluding service expansions) | 1,013 | |

| |

| Changes in customer consumption | (361) | |

| |

| Other variances | (1,031) | |

| Quarter-over-quarter increase in adjusted gross margin** | $ | 26,374 | |

The major components of the increase in other operating expenses are as follows: | | | | | |

| (in thousands) | |

| FCG operating expenses | $ | 7,476 | |

| Payroll, benefits and other employee-related expenses | 1,223 | |

| Insurance related costs | 222 | |

| Other variances | 548 | |

| Quarter-over-quarter increase in other operating expenses | $ | 9,469 | |

Unregulated Energy Segment

| | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended September 30, | | | | |

| (in thousands) | 2024 | | 2023 | | Change | | Percent Change |

| Adjusted gross margin** | $ | 19,699 | | | $ | 18,589 | | | $ | 1,110 | | | 6.0 | % |

| Depreciation, amortization and property taxes | 5,144 | | | 4,902 | | | 242 | | | 4.9 | % |

| Other operating expenses | 17,616 | | | 18,410 | | | (794) | | | (4.3) | % |

| Operating loss | $ | (3,061) | | | $ | (4,723) | | | $ | 1,662 | | | 35.2 | % |

Operating results for the second and third quarters historically have been lower due to reduced customer demand during warmer periods of the year. The impact to operating income may not align with the seasonal variations in adjusted gross margin as many of the operating expenses are recognized ratably over the course of the year.

The major components of the increase in adjusted gross margin** are shown below:

| | | | | | | | |

| (in thousands) | | |

| Propane Operations | | |

| Contributions from acquisition | | $ | 135 | |

| | |

| | |

| CNG/RNG/LNG Transportation and Infrastructure | | |

| Increased level of virtual pipeline services | | 1,098 | |

| | |

| | |

| Other variances | | (123) | |

| Quarter-over-quarter increase in adjusted gross margin** | | $ | 1,110 | |

The major components of the decrease in other operating expenses are as follows:

| | | | | | | | |

| (in thousands) | | |

| Payroll, benefits and other employee-related expenses | | $ | (515) | |

| | |

| | |

| Other variances | | (279) | |

| Quarter-over-quarter decrease in other operating expenses | | $ | (794) | |

Operating Results for the Nine Months Ended September 30, 2024 and 2023

Consolidated Results

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended | | | | |

| September 30, | | | | |

| (in thousands) | 2024 | | 2023 | | Change | | Percent Change |

| Adjusted gross margin** | $ | 413,096 | | | $ | 323,791 | | | $ | 89,305 | | | 27.6 | % |

| Depreciation, amortization and property taxes | 77,811 | | | 70,918 | | | 6,893 | | | 9.7 | % |

| FCG transaction and transition-related expenses | 3,114 | | | 3,899 | | | (785) | | | (20.1) | % |

| Other operating expenses | 170,878 | | | 145,486 | | | 25,392 | | | 17.5 | % |

| Operating income | $ | 161,293 | | | $ | 103,488 | | | $ | 57,805 | | | 55.9 | % |

Operating income for the first nine months of 2024 was $161.3 million, an increase of $57.8 million compared to the same period in 2023. Excluding transaction and transition-related expenses associated with the acquisition and integration of FCG, operating income increased $57.0 million or 53.1 percent compared to the prior-year period. An increase in adjusted gross margin in the first nine months of 2024 was driven by contributions from the acquisition of FCG, incremental margin from regulatory initiatives, natural gas organic growth and continued pipeline expansion projects, higher customer consumption and increased margins from the Company's unregulated businesses. Higher operating expenses during the current period were driven largely by the operating expenses of FCG and increased insurance costs. These increases were partially offset by lower payroll, benefits and other employee-related expenses compared to the prior-year period. Increases in depreciation, amortization and property taxes attributable to growth projects and FCG were partially offset by an $8.9 million RSAM adjustment from FCG and lower depreciation from our electric operations and Maryland natural gas division due to revised rates from approved depreciation studies.

Regulated Energy Segment

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended | | | | |

| September 30, | | | | |

| (in thousands) | 2024 | | 2023 | | Change | | Percent Change |

| Adjusted gross margin** | $ | 324,022 | | | $ | 240,130 | | | $ | 83,892 | | | 34.9 | % |

| Depreciation, amortization and property taxes | 63,671 | | | 56,415 | | | 7,256 | | | 12.9 | % |

| FCG transaction and transition-related expenses | 3,114 | | | 3,899 | | | (785) | | | (20.1) | % |

| Other operating expenses | 114,688 | | | 87,988 | | | 26,700 | | | 30.3 | % |

| Operating income | $ | 142,549 | | | $ | 91,828 | | | $ | 50,721 | | | 55.2 | % |

The key components of the increase in adjusted gross margin** are shown below:

| | | | | |

| (in thousands) | |

| Contribution from FCG | $ | 71,725 | |

| Margin from regulated infrastructure programs | 4,424 | |

| Natural gas growth including conversions (excluding service expansions) | 4,182 | |

| Natural gas transmission service expansions, including interim services | 3,702 | |

Rate changes associated with the Florida natural gas base rate proceeding (1) | 1,630 | |

| Eastern Shore contracted rate adjustments | (238) | |

| |

| Other variances | (1,533) | |

| Period-over-period increase in adjusted gross margin** | $ | 83,892 | |

(1) Includes adjusted gross margin contributions from permanent base rates that became effective in March 2023.

The major components of the increase in other operating expenses are as follows: | | | | | |

| (in thousands) | |

| FCG operating expenses | $ | 25,363 | |

| Facilities, maintenance costs and outside services | 677 | |

| Insurance related costs | 651 | |

| |

| Other variances | 9 | |

| Period-over-period increase in other operating expenses | $ | 26,700 | |

Unregulated Energy Segment

| | | | | | | | | | | | | | | | | | | | | | | |

| Nine Months Ended

September 30, | | | | |

| (in thousands) | 2024 | | 2023 | | Change | | Percent Change |

| Adjusted gross margin** | $ | 89,161 | | | $ | 83,818 | | | $ | 5,343 | | | 6.4 | % |

| Depreciation, amortization and property taxes | 14,142 | | | 14,500 | | | (358) | | | (2.5) | % |

| Other operating expenses | 56,413 | | | 57,789 | | | (1,376) | | | (2.4) | % |

| Operating income | $ | 18,606 | | | $ | 11,529 | | | $ | 7,077 | | | 61.4 | % |

The major components of the change in adjusted gross margin** are shown below:

| | | | | | | | |

| (in thousands) | | |

| Propane Operations | | |

| Increased propane customer consumption | | $ | 1,261 | |

| Contributions from acquisition | | 733 | |

| Increased propane margins and service fees | | 521 | |

| CNG/RNG/LNG Transportation and Infrastructure | | |

| Increased level of virtual pipeline services | | 1,585 | |

| Aspire Energy | | |

| Increased margins - rate changes and gathering fees | | 1,267 | |

| | |

| Other variances | | (24) | |

| Period-over-period increase in adjusted gross margin** | | $ | 5,343 | |

The major components of the decrease in other operating expenses are as follows:

| | | | | | | | |

| (in thousands) | | |

| | |

| Vehicle expenses | | $ | 575 | |

| Insurance related costs | | 456 | |

| Payroll, benefits and other employee-related expenses | | (1,598) | |

| Facilities, maintenance costs, and outside services | | (631) | |

| Other variances | | (178) | |

| Period-over-period decrease in other operating expenses | | $ | (1,376) | |

Forward-Looking Statements

Matters included in this release may include forward-looking statements that involve risks and uncertainties. Actual results may differ materially from those in the forward-looking statements. Please refer to the Safe Harbor for Forward-Looking Statements in the Company’s 2023 Annual Report on Form 10-K and Quarterly Report on Form 10-Q for the third quarter of 2024 for further information on the risks and uncertainties related to the Company’s forward-looking statements.

Conference Call

Chesapeake Utilities (NYSE: CPK) will host a conference call on Friday, November 8, 2024 at 8:30 a.m. Eastern Time to discuss the Company’s financial results for the three and nine months ended September 30, 2024. To listen to the Company’s conference call via live webcast, please visit the Events & Presentations section of the Investors page on www.chpk.com. For investors and analysts that wish to participate by phone for the question and answer portion of the call, please use the following dial-in information:

Toll-free: 800.245.3074

International: 203.518.9765

Conference ID: CPKQ324

A replay of the presentation will be made available on the previously noted website following the conclusion of the call.

About Chesapeake Utilities Corporation

Chesapeake Utilities Corporation is a diversified energy delivery company, listed on the New York Stock Exchange. Chesapeake Utilities Corporation offers sustainable energy solutions through its natural gas transmission and distribution, electricity generation and distribution, propane gas distribution, mobile compressed natural gas utility services and solutions, and other businesses.

Please note that Chesapeake Utilities Corporation is not affiliated with Chesapeake Energy, an oil and natural gas exploration company headquartered in Oklahoma City, Oklahoma.

For more information, contact:

Beth W. Cooper

Executive Vice President, Chief Financial Officer, Treasurer and Assistant Corporate Secretary

302.734.6022

Michael D. Galtman

Senior Vice President and Chief Accounting Officer

302.217.7036

Lucia M. Dempsey

Head of Investor Relations

347.804.9067

Financial Summary

(in thousands, except per-share data)

| | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | Nine Months Ended | | |

| September 30, | | September 30, | | |

| 2024 | | 2023 | | 2024 | | 2023 | | | | |

| Adjusted Gross Margin | | | | | | | | | | | |

| Regulated Energy segment | $ | 102,267 | | | $ | 75,893 | | | $ | 324,022 | | | $ | 240,130 | | | | | |

| Unregulated Energy segment | 19,699 | | | 18,589 | | | 89,161 | | | 83,818 | | | | | |

| Other businesses and eliminations | (29) | | | (29) | | | (87) | | | (157) | | | | | |

| Total Adjusted Gross Margin** | $ | 121,937 | | | $ | 94,453 | | | $ | 413,096 | | | $ | 323,791 | | | | | |

| | | | | | | | | | | |

| Operating Income (Loss) | | | | | | | | | | | |

| Regulated Energy segment | $ | 43,935 | | | $ | 24,912 | | | $ | 142,549 | | | $ | 91,828 | | | | | |

| Unregulated Energy segment | (3,061) | | | (4,723) | | | 18,606 | | | 11,529 | | | | | |

| Other businesses and eliminations | 44 | | | 39 | | | 138 | | | 131 | | | | | |

| Total Operating Income | 40,918 | | | 20,228 | | | 161,293 | | | 103,488 | | | | | |

| Other income (expense), net | 400 | | | (72) | | | 1,705 | | | 1,036 | | | | | |

| Interest charges | 17,022 | | | 7,076 | | | 50,861 | | | 21,272 | | | | | |

| Income Before Income Taxes | 24,296 | | | 13,080 | | | 112,137 | | | 83,252 | | | | | |

| Income taxes | 6,789 | | | 3,673 | | | 30,191 | | | 21,368 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Net Income | $ | 17,507 | | | $ | 9,407 | | | $ | 81,946 | | | $ | 61,884 | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

Weighted Average Common Shares Outstanding: (1) | | | | | | | | | | | |

| Basic | 22,501 | | | 17,797 | | | 22,346 | | | 17,784 | | | | | |

| Diluted | 22,564 | | | 17,858 | | | 22,402 | | | 17,847 | | | | | |

| | | | | | | | | | | |

Earnings Per Share of Common Stock | | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Basic | $ | 0.78 | | $ | 0.53 | | $ | 3.67 | | $ | 3.48 | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Diluted | $ | 0.78 | | $ | 0.53 | | $ | 3.66 | | $ | 3.47 | | | | |

| | | | | | | | | | | |

| Adjusted Net Income and Adjusted Earnings Per Share | | | | | | | | | | | |

| Net Income (GAAP) | $ | 17,507 | | | $ | 9,407 | | | $ | 81,946 | | | $ | 61,884 | | | | | |

FCG transaction and transition-related-expenses, net (2) | 593 | | | 2,804 | | | 2,276 | | | 2,898 | | | | | |

| Adjusted Net Income (Non-GAAP)** | $ | 18,100 | | | $ | 12,211 | | | $ | 84,222 | | | $ | 64,782 | | | | | |

| | | | | | | | | | | |

| Earnings Per Share - Diluted (GAAP) | $ | 0.78 | | | $ | 0.53 | | | $ | 3.66 | | | $ | 3.47 | | | | | |

FCG transaction and transition-related-expenses, net (2) | 0.02 | | | 0.16 | | | 0.10 | | | 0.16 | | | | | |

| Adjusted Earnings Per Share - Diluted (Non-GAAP)** | $ | 0.80 | | | $ | 0.69 | | | $ | 3.76 | | | $ | 3.63 | | | | | |

(1) Weighted average shares for the three and nine months ended September 30, 2024 reflect the impact of 4.4 million common shares issued in November 2023 in connection with the acquisition of FCG.

(2) Transaction and transition-related expenses represent costs incurred attributable to the acquisition and integration of FCG including, but not limited to, transaction costs, transition services, consulting, system integration, rebranding and legal fees.

Financial Summary Highlights

Key variances between the third quarter of 2023 and 2024 included:

| | | | | | | | | | | | | | | | | | | | |

| (in thousands, except per share data) | | Pre-tax

Income | | Net

Income | | Earnings

Per Share |

Third Quarter of 2023 Adjusted Results** | | $ | 16,979 | | | $ | 12,211 | | | $ | 0.69 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Increased Adjusted Gross Margins: | | | | | | |

| Contributions from acquisitions | | 23,534 | | | 16,958 | | | 0.75 | |

| Margin from regulated infrastructure programs* | | 1,806 | | | 1,301 | | | 0.06 | |

| Natural gas transmission service expansions, including interim services* | | 1,548 | | | 1,115 | | | 0.05 | |

| Increased level of virtual pipeline services | | 1,098 | | | 791 | | | 0.04 | |

| Natural gas growth including conversions (excluding service expansions) | | 1,013 | | | 730 | | | 0.03 | |

| Changes in customer consumption | | (651) | | | (469) | | | (0.02) | |

| | 28,348 | | | 20,426 | | | 0.91 | |

| | | | | | |

| Increased Operating Expenses (Excluding Natural Gas, Propane, and Electric Costs): | | | | | | |

| FCG operating expenses | | (8,680) | | | (6,255) | | | (0.28) | |

| Payroll, benefits and other employee-related expenses | | (708) | | | (510) | | | (0.02) | |

| | (9,388) | | | (6,765) | | | (0.30) | |

| | | | | | |

| Interest charges | | (9,946) | | | (7,167) | | | (0.32) | |

| Increase in shares outstanding due to 2023 and 2024 equity offerings*** | | — | | | — | | | (0.14) | |

| Net other changes | | (878) | | | (605) | | | (0.04) | |

| | (10,824) | | | (7,772) | | | (0.50) | |

Third Quarter of 2024 Adjusted Results** | | $ | 25,115 | | | $ | 18,100 | | | $ | 0.80 | |

* Refer to Major Projects and Initiatives Table for additional information.

** Transaction and transition-related expenses attributable to the acquisition and integration of FCG have been excluded from the Company’s non GAAP measures of adjusted net income and adjusted EPS. See reconciliations above for a detailed comparison to the related GAAP measures.

*** Reflects the impact of 4.4 million common shares issued in November 2023 in connection with the acquisition of FCG and shares also issued in 2024.

Key variances between the nine months ended September 30, 2023 and September 30, 2024 included:

| | | | | | | | | | | | | | | | | | | | |

| (in thousands, except per share data) | | Pre-tax

Income | | Net

Income | | Earnings

Per Share |

Nine months ended September 30, 2023 Adjusted Results** | | $ | 87,151 | | | $ | 64,782 | | | $ | 3.63 | |

| | | | | | |

| Non-recurring Items: | | | | | | |

| Absence of benefit associated with a reduction in the PA state tax rate | | — | | | (1,284) | | | (0.06) | |

| | — | | | (1,284) | | | (0.06) | |

| | | | | | |

| Increased Adjusted Gross Margins: | | | | | | |

| Contributions from acquisitions | | 72,458 | | | 52,952 | | | 2.36 | |

| Margin from regulated infrastructure programs* | | 4,424 | | | 3,233 | | | 0.14 | |

| Natural gas growth including conversions (excluding service expansions) | | 4,182 | | | 3,056 | | | 0.14 | |

| Natural gas transmission service expansions, including interim services* | | 3,702 | | | 2,706 | | | 0.12 | |

| Rate changes associated with the Florida natural gas base rate proceeding* | | 1,630 | | | 1,191 | | | 0.05 | |

| Increased level of virtual pipeline services | | 1,585 | | | 1,158 | | | 0.05 | |

| Improved Aspire Energy performance - rate changes and gathering fees | | 1,267 | | | 926 | | | 0.04 | |

| Changes in customer consumption | | 1,191 | | | 870 | | | 0.04 | |

| Increased propane margins and fees | | 521 | | | 381 | | | 0.02 | |

| | 90,960 | | | 66,473 | | | 2.96 | |

| | | | | | |

| (Increased) Decreased Operating Expenses (Excluding Natural Gas, Propane, and Electric Costs): | | | | | | |

| FCG operating expenses | | (28,813) | | | (21,057) | | | (0.94) | |

| Depreciation, amortization and property tax costs (includes FCG) | | (3,441) | | | (2,515) | | | (0.11) | |

| Insurance related costs | | (1,107) | | | (809) | | | (0.04) | |

| Payroll, benefits and other employee-related expenses | | 1,484 | | | 1,084 | | | 0.05 | |

| | (31,877) | | | (23,297) | | | (1.04) | |

| | | | | | |

| Interest charges | | (29,589) | | | (21,623) | | | (0.97) | |

| Increase in shares outstanding due to 2023 and 2024 equity offerings*** | | — | | | — | | | (0.74) | |

| Net other changes | | (1,394) | | | (829) | | | (0.02) | |

| | (30,983) | | | (22,452) | | | (1.73) | |

Nine months ended September 30, 2024 Adjusted Results** | | $ | 115,251 | | | $ | 84,222 | | | $ | 3.76 | |

* Refer to Major Projects and Initiatives Table for additional information.

** Transaction and transition-related expenses attributable to the acquisition and integration of FCG have been excluded from the Company’s non GAAP measures of adjusted net income and adjusted EPS. See reconciliations above for a detailed comparison to the related GAAP measures.

*** Reflects the impact of 4.4 million common shares issued in November 2023 in connection with the acquisition of FCG and shares also issued in 2024.

Recently Completed and Ongoing Major Projects and Initiatives

The Company continuously pursues and develops additional projects and initiatives to serve existing and new customers, further grow its businesses and earnings, and increase shareholder value. The following table includes all major projects and initiatives that are currently underway or recently completed. The Company's practice is to add incremental margin associated with new projects and initiatives to this table once negotiations or details are substantially final and/or the associated earnings can be estimated. Major projects and initiatives that have generated consistent year-over-year adjusted gross margin contributions are removed from the table at the beginning of the next calendar year.

The related descriptions of projects and initiatives that accompany the table include only new items and/or items where there have been significant developments, as compared to the Company's prior quarterly filings. A comprehensive discussion of all projects and initiatives reflected in the table below can be found in the Company's third quarter 2024 Quarterly Report on Form 10-Q.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Gross Margin |

| Three Months Ended | | Nine Months Ended | | Year Ended | | Estimate for |

| September 30, | | September 30, | | December 31, | | Fiscal |

| (in thousands) | 2024 | | 2023 | | 2024 | | 2023 | | 2023 | | 2024 | | 2025 |

| Pipeline Expansions: | | | | | | | | | | | | | |

| Southern Expansion | $ | 586 | | | $ | 100 | | | $ | 1,758 | | | $ | 586 | | | $ | 586 | | | $ | 2,344 | | | $ | 2,344 | |

| Beachside Pipeline Expansion | 603 | | | 603 | | | 1,809 | | | 1,206 | | | 1,810 | | | 2,451 | | | 2,414 | |

| St. Cloud / Twin Lakes Expansion | 146 | | | 118 | | | 438 | | | 118 | | | 264 | | | 584 | | | 2,752 | |

| Wildlight | 566 | | | 178 | | | 970 | | | 271 | | | 471 | | | 1,423 | | | 2,996 | |

| Lake Wales | 114 | | | 114 | | | 342 | | | 152 | | | 265 | | | 454 | | | 454 | |

| Newberry | 646 | | | — | | | 718 | | | — | | | — | | | 1,364 | | | 2,585 | |

| Boynton Beach | — | | | — | | | — | | | — | | | — | | | — | | | 3,342 | |

| New Smyrna Beach | — | | | — | | | — | | | — | | | — | | | — | | | 1,710 | |

| Central Florida Reinforcement | — | | | — | | | — | | | — | | | — | | | 98 | | | 1,959 | |

| Warwick | — | | | — | | | — | | | — | | | — | | | 258 | | | 1,858 | |

| Renewable Natural Gas Supply Projects | — | | | — | | | — | | | — | | | — | | | — | | | 5,460 | |

| Total Pipeline Expansions | 2,661 | | | 1,113 | | | 6,035 | | | 2,333 | | | 3,396 | | | 8,976 | | | 27,874 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | |

| CNG/RNG/LNG Transportation and Infrastructure | 3,498 | | | 2,385 | | | 10,438 | | | 8,811 | | | 11,181 | | | 14,000 | | | 15,000 | |

| | | | | | | | | | | | | |

| Regulatory Initiatives: | | | | | | | | | | | | | |

| Florida GUARD program | 982 | | | 90 | | | 2,436 | | | 90 | | | 353 | | | 3,566 | | | 6,333 | |

| FCG SAFE Program | 1,051 | | | — | | | 2,152 | | | — | | | — | | | 3,337 | | | 6,534 | |

| Capital Cost Surcharge Programs | 765 | | | 687 | | | 2,373 | | | 2,110 | | | 2,829 | | | 3,167 | | | 4,374 | |

Florida Rate Case Proceeding (1) | 3,991 | | | 3,991 | | | 13,591 | | | 11,961 | | | 15,835 | | | 17,153 | | | 17,153 | |

Maryland Rate Case (2) | — | | | — | | | — | | | — | | | — | | | TBD | | TBD |

Delaware Rate Case (3) | — | | | — | | | — | | | — | | | — | | | TBD | | TBD |

Electric Rate Case (4) | — | | | — | | | — | | | — | | | — | | | TBD | | TBD |

| Electric Storm Protection Plan | 717 | | | 298 | | | 2,024 | | | 940 | | | 1,326 | | | 3,133 | | | 5,581 | |

| Total Regulatory Initiatives | 7,506 | | | 5,066 | | | 22,576 | | | 15,101 | | | 20,343 | | | 30,356 | | | 39,975 | |

| | | | | | | | | | | | | |

| Total | $ | 13,665 | | | $ | 8,564 | | | $ | 39,049 | | | $ | 26,245 | | | $ | 34,920 | | | $ | 53,332 | | | $ | 82,849 | |

(1) Includes adjusted gross margin during 2023 comprised of both interim rates and permanent base rates which became effective in March 2023.

(2) Rate case application and depreciation study filed with the Maryland PSC in January 2024. See additional information provided below.

(3) Rate case application and depreciation study filed with the Delaware PSC in August 2024. See additional information provided below.

(4) Rate case application filed with the Florida PSC in August 2024. See additional information provided below.

Detailed Discussion of Major Projects and Initiatives

Pipeline Expansions

St. Cloud / Twin Lakes Expansion

In February 2024, Peninsula Pipeline filed a petition with the Florida Public Service Commission ("PSC") for approval of an amendment to its Transportation Service Agreement with FPU for an additional 10,000 Dts/day of firm service in the St. Cloud, Florida area. Peninsula Pipeline will construct pipeline expansions that will allow FPU to serve the future communities that are expected in that area. The Florida PSC approved the project in May 2024, and it is expected to be complete in the fourth quarter of 2025.

Newberry Expansion

In April 2023, Peninsula Pipeline filed a petition with the Florida PSC for approval of its Transportation Service Agreement with FPU for an additional 8,000 Dts/day of firm service in the Newberry, Florida area. The petition was approved by the Florida PSC in the third quarter of 2023. Peninsula Pipeline will construct a pipeline extension, which will be used by FPU to support the development of a natural gas distribution system to provide gas service to the City of Newberry. A filing to address the acquisition and conversion of existing Company owned propane community gas systems in Newberry was made in November 2023. The Florida PSC approved it in April 2024, and conversions of the community gas systems began in the second quarter of 2024.

East Coast Reinforcement Projects

In December 2023, Peninsula Pipeline filed a petition with the Florida PSC for approval of its Transportation Service Agreements with FPU for projects that will support additional supply to communities on the East Coast of Florida. The projects are driven by the need for increased supply to coastal portions of the state that are experiencing significant population growth. Peninsula Pipeline will construct several pipeline extensions which will support FPU’s distribution system in the areas of Boynton Beach and New Smyrna Beach with an additional 15,000 Dts/day and 3,400 Dts/day, respectively. The Florida PSC approved the projects in March 2024. Construction is projected to be complete in the first and second quarters of 2025 for Boynton Beach and New Smyrna Beach, respectively.

Central Florida Reinforcement Projects

In February 2024, Peninsula Pipeline filed a petition with the Florida PSC for approval of its Transportation Service Agreements with FPU for projects that will support additional supply to communities located in Central Florida. The projects are driven by the need for increased supply to communities in central Florida that are experiencing significant population growth. Peninsula Pipeline will construct several pipeline extensions which will support FPU’s distribution system around the Plant City and Lake Mattie areas of Florida with an additional 5,000 Dts/day and 8,700 Dts/day, respectively. The Florida PSC approved the projects in May 2024. Completion of the projects is projected for the fourth quarter of 2024 for Plant City and the fourth quarter of 2025 for Lake Mattie.

Warwick

In July 2024, the Company announced plans to extend Eastern Shore's transmission deliverability by constructing an additional 4.4 miles of six inch steel pipeline. The project will reinforce the supply and growth for our Delaware division distribution system and expand natural gas service further into Maryland for anticipated future growth. The project is estimated to be in service during the fourth quarter of 2024.

Pioneer Supply Header Pipeline Project

In March 2024, Peninsula Pipeline filed a petition with the Florida PSC for its approval of Firm Transportation Service Agreements with both FCG and FPU for a project that will support greater supply growth of natural gas service in southeast Florida. The project consists of the transfer of a pipeline asset from FCG to Peninsula Pipeline. Peninsula Pipeline will proceed to provide transportation service to both

FCG and FPU using the pipeline asset, which supports continued customer growth and system reinforcement of these distribution systems. The Florida PSC approved the petition in July 2024.

Renewable Natural Gas Supply Projects

In February 2024, Peninsula Pipeline filed a petition with the Florida PSC for approval of Transportation Service Agreements with FCG for projects that will support the transportation of additional renewable energy supply to FCG. The projects, located in Florida’s Brevard, Indian River and Miami-Dade counties, will bring renewable natural gas produced from local landfills into FCG’s natural gas distribution system. Peninsula Pipeline will construct several pipeline extensions which will support FCG's distribution system in Brevard County, Indian River County, and Miami-Dade County. Benefits of these projects include increased gas supply to serve expected FCG growth, strengthened system reliability and additional system flexibility. The Florida PSC approved the petition at its July 2024 meeting with the projects estimated to be completed in the first half of 2025.

Regulatory Initiatives

Maryland Natural Gas Rate Case

In January 2024, the Company's natural gas distribution businesses in Maryland, CUC-Maryland Division, Sandpiper Energy, Inc., and Elkton Gas Company (collectively, “Maryland natural gas distribution businesses”) filed a joint application for a natural gas rate case with the Maryland PSC. In connection with the application, the Company is seeking approval of the following: (i) permanent rate relief of approximately $6.9 million with a return on equity ("ROE") of 11.5 percent; (ii) authorization to make certain changes to tariffs to include a unified rate structure and to consolidate the Maryland natural gas distribution businesses which is anticipated to be called Chesapeake Utilities of Maryland, Inc.; and (iii) authorization to establish a rider for recovery of the costs associated with the Company's new technology systems. In August 2024, the Maryland natural gas distribution businesses, the Maryland Office of Peoples' Counsel ("OPC") and PSC Staff reached a settlement agreement which provided for, among other things, an increase in annual base rates of $2.6 million. In September 2024, the Maryland Public Utility Judge issued an order approving the settlement agreement in part. The $2.6 million increase in annual base rates was approved and the Company will file a Phase II filing to determine rate design across the Maryland natural gas distribution businesses, consolidation of the applicable tariffs and recovery of technology costs. The outcome of the application is subject to review and approval by the Maryland PSC.

Maryland Natural Gas Depreciation Study

In January 2024, the Company's Maryland natural gas distribution businesses filed a joint petition for approval of its proposed unified depreciation rates with the Maryland PSC. A settlement agreement between the Company, PSC staff and the Maryland OPC Counsel was reached and the final order approving the settlement agreement went into effect in July 2024, with new depreciation rates effective as of January 1, 2023. The approved depreciation rates will result in an annual reduction in depreciation expense of approximately $1.2 million.

FCG SAFE Program

In April 2024, FCG filed a petition with the Florida PSC to more closely align the SAFE Program with FPU's GUARD program. Specifically, the requested modifications will enable FCG to accelerate remediation related to problematic pipe and facilities consisting of obsolete and exposed pipe. These modifications will require an estimated additional $50.0 million in capital expenditures associated with the SAFE Program, which would increase the total projected capital expenditures to approximately $255.0 million over a 10-year period. The Florida PSC approved the modifications in September 2024.

Delaware Natural Gas Rate Case

In August 2024, the Company's Delaware natural gas division filed an application for a natural gas rate case with the Delaware PSC. In connection with the application, the Company is seeking approval of the following: (i) permanent rate relief of approximately $12.1 million with a ROE of 11.5 percent; (ii) proposed changes to depreciation rates which were part of a depreciation study also submitted with the filing; and (iii) authorization to make certain changes to the existing tariffs. In September 2024, interim rates were approved by the Delaware PSC in the amount of $2.5 million on an annualized basis effective in October 2024. The discovery process has commenced and hearing for the proceeding has been scheduled for May 2025. The outcome of the application is subject to review and approval by the Delaware PSC.

FPU Electric Rate Case

In August 2024, the Company's Florida Electric division filed a petition with the Florida PSC seeking a general base rate increase of $12.6 million with a ROE of 11.3 percent based on a 2025 projected test year. The outcome of the application will be subject to review and approval by the Florida PSC. In October 2024, annualized interim rates of approximately $1.8 million were approved with an effective date of November 1, 2024.

Other Major Factors Influencing Adjusted Gross Margin

Weather and Consumption

Weather was not a significant factor to adjusted gross margin in the third quarter of 2024 compared to the same period in 2023.

For the nine months ended September 30, 2024, higher consumption which includes the effects of colder weather conditions compared to the prior-year period resulted in a $1.2 million increase in adjusted gross margin. While temperatures through September 30, 2024 were colder than the prior-year period, they were approximately 13.2 percent and 13.1 percent warmer, respectively, compared to normal temperatures in our Delmarva and Ohio service territories.

The following table summarizes HDD and CDD variances from the 10-year average HDD/CDD ("Normal") for the three and nine months ended September 30, 2024 and 2023.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Three Months Ended | | | | Nine Months Ended | | |

| September 30, | | | | September 30, | | |

| 2024 | | 2023 | | Variance | | 2024 | | 2023 | | Variance |

| Delmarva | | | | | | | | | | | |

| Actual HDD | 6 | | | 19 | | | (13) | | | 2,287 | | | 2,069 | | | 218 | |

| 10-Year Average HDD ("Normal") | 27 | | | 38 | | | (11) | | | 2,635 | | | 2,731 | | | (96) | |

| Variance from Normal | (21) | | | (19) | | | | | (348) | | | (662) | | | |

| | | | | | | | | | | |

Florida | | | | | | | | | | | |

| Actual HDD | — | | | 1 | | | (1) | | | 511 | | | 371 | | | 140 | |

| 10-Year Average HDD ("Normal") | 1 | | | 1 | | | — | | | 512 | | | 550 | | | (38) | |

| Variance from Normal | (1) | | | — | | | | | (1) | | | (179) | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| | | | | | | | | | | |

| Ohio | | | | | | | | | | | |

| Actual HDD | 43 | | | 86 | | | (43) | | | 3,180 | | | 3,148 | | | 32 | |

| 10-Year Average HDD ("Normal") | 65 | | | 65 | | | — | | | 3,661 | | | 3,661 | | | — | |

| Variance from Normal | (22) | | | 21 | | | | | (481) | | | (513) | | | |

| | | | | | | | | | | |

Florida | | | | | | | | | | | |

| Actual CDD | 1,528 | | | 1,533 | | | (5) | | | 2,824 | | | 2,793 | | | 31 | |

| 10-Year Average CDD ("Normal") | 1,420 | | | 1,391 | | | 29 | | | 2,615 | | | 2,535 | | | 80 | |

| Variance from Normal | 108 | | | 142 | | | | | 209 | | | 258 | | | |

Natural Gas Distribution Growth

The average number of residential customers served on the Delmarva Peninsula increased by approximately 3.9 percent for the three and nine months ended September 30, 2024 while our legacy Florida Natural Gas distribution business increased by approximately 3.9 percent and 3.7 percent, respectively, during the same periods.

The details of the adjusted gross margin increase are provided in the following table:

| | | | | | | | | | | | | | | | | | | | | | | |

| Adjusted Gross Margin** |

| Three Months Ended | | Nine Months Ended |

| September 30, 2024 | | September 30, 2024 |

| (in thousands) | Delmarva Peninsula | | Florida | | Delmarva Peninsula | | Florida |

| Customer growth: | | | | | | | |

| Residential | $ | 276 | | | $ | 470 | | | $ | 1,118 | | | $ | 1,997 | |

| Commercial and industrial | 172 | | | 95 | | | 452 | | | 615 | |

Total customer growth (1) | $ | 448 | | | $ | 565 | | | $ | 1,570 | | | $ | 2,612 | |

(1) Customer growth amounts for the legacy Florida operations include the effects of revised rates associated with the Company's natural gas base rate proceeding, but exclude the effects of FCG.

Capital Investment Growth and Capital Structure Updates

The Company's capital expenditures were $256.8 million for the nine months ended September 30, 2024. The following table shows a range of the forecasted 2024 capital expenditures by segment and by business line:

| | | | | | | | | | | |

| 2024 |

| (in thousands) | Low | | High |

| Regulated Energy: | | | |

| Natural gas distribution | $ | 160,000 | | | $ | 190,000 | |

| Natural gas transmission | 75,000 | | | 90,000 | |

| Electric distribution | 30,000 | | | 38,000 | |

| Total Regulated Energy | 265,000 | | | 318,000 | |

| Unregulated Energy: | | | |

| Propane distribution | 13,000 | | | 15,000 | |

| Energy transmission | 5,000 | | | 6,000 | |

| Other unregulated energy | 13,000 | | | 15,000 | |

| Total Unregulated Energy | 31,000 | | | 36,000 | |

| Other: | | | |

| Corporate and other businesses | 4,000 | | | 6,000 | |

| Total 2024 Forecasted Capital Expenditures | $ | 300,000 | | | $ | 360,000 | |

The capital expenditure projection is subject to continuous review and modification. Actual capital requirements may vary from the above estimates due to a number of factors, including changing economic conditions, supply chain disruptions, capital delays that are greater than currently anticipated, customer growth in existing areas, regulation, new growth or acquisition opportunities and availability of capital.

The Company's target ratio of equity to total capitalization, including short-term borrowings, is between 50 and 60 percent. The Company's equity to total capitalization ratio, including short-term borrowings, was approximately 49 percent as of September 30, 2024.

Chesapeake Utilities Corporation and Subsidiaries

Condensed Consolidated Statements of Income (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended | | Nine Months Ended | | |

| | September 30, | | September 30, | | |

| | 2024 | | 2023 | | 2024 | | 2023 | | | | |

| (in thousands, except per share data) | | | | | | | | | | | | |

| Operating Revenues | | | | | | | | | | | | |

| Regulated Energy | | $ | 130,633 | | | $ | 102,411 | | | $ | 429,684 | | | $ | 345,822 | | | | | |

| Unregulated Energy | | 35,567 | | | 34,970 | | | 160,089 | | | 158,886 | | | | | |

| Other businesses and eliminations | | (6,062) | | | (5,834) | | | (17,619) | | | (19,439) | | | | | |

| Total Operating Revenues | | 160,138 | | | 131,547 | | | 572,154 | | | 485,269 | | | | | |

| Operating Expenses | | | | | | | | | | | | |

| Natural gas and electricity costs | | 28,366 | | | 26,518 | | | 105,662 | | | 105,692 | | | | | |

| Propane and natural gas costs | | 9,835 | | | 10,576 | | | 53,396 | | | 55,786 | | | | | |

| Operations | | 49,519 | | | 41,217 | | | 153,418 | | | 128,147 | | | | | |

| FCG transaction and transition-related expenses | | 819 | | | 3,899 | | | 3,114 | | | 3,899 | | | | | |

| Maintenance | | 5,062 | | | 5,125 | | | 16,526 | | | 15,487 | | | | | |

| Depreciation and amortization | | 16,851 | | | 17,610 | | | 51,744 | | | 52,096 | | | | | |

| Other taxes | | 8,768 | | | 6,374 | | | 27,001 | | | 20,674 | | | | | |

| Total operating expenses | | 119,220 | | | 111,319 | | | 410,861 | | | 381,781 | | | | | |

| Operating Income | | 40,918 | | | 20,228 | | | 161,293 | | | 103,488 | | | | | |

| Other income (expense), net | | 400 | | | (72) | | | 1,705 | | | 1,036 | | | | | |

| Interest charges | | 17,022 | | | 7,076 | | | 50,861 | | | 21,272 | | | | | |

| Income Before Income Taxes | | 24,296 | | | 13,080 | | | 112,137 | | | 83,252 | | | | | |

| Income taxes | | 6,789 | | | 3,673 | | | 30,191 | | | 21,368 | | | | | |

| Net Income | | $ | 17,507 | | | $ | 9,407 | | | $ | 81,946 | | | $ | 61,884 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Weighted Average Common Shares Outstanding: | | | | | | | | | | | | |

| Basic | | 22,501 | | | 17,797 | | | 22,346 | | | 17,784 | | | | | |

| Diluted | | 22,564 | | | 17,858 | | | 22,402 | | | 17,847 | | | | | |

| | | | | | | | | | | | |

| Earnings Per Share of Common Stock: | | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Basic | | $ | 0.78 | | | $ | 0.53 | | | $ | 3.67 | | | $ | 3.48 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Diluted | | $ | 0.78 | | | $ | 0.53 | | | $ | 3.66 | | | $ | 3.47 | | | | | |

| | | | | | | | | | | | |

| Adjusted Net Income and Adjusted Earnings Per Share | | | | | | | | | | | | |

| Net Income (GAAP) | | $ | 17,507 | | | $ | 9,407 | | | $ | 81,946 | | | $ | 61,884 | | | | | |

FCG transaction and transition-related expenses, net (1) | | 593 | | | 2,804 | | | 2,276 | | | 2,898 | | | | | |

| Adjusted Net Income (Non-GAAP)** | | $ | 18,100 | | | $ | 12,211 | | | $ | 84,222 | | | $ | 64,782 | | | | | |

| | | | | | | | | | | | |

| Earnings Per Share - Diluted (GAAP) | | $ | 0.78 | | | $ | 0.53 | | | $ | 3.66 | | | $ | 3.47 | | | | | |

FCG transaction and transition-related expenses, net (1) | | 0.02 | | | 0.16 | | | 0.10 | | | 0.16 | | | | | |

| Adjusted Earnings Per Share - Diluted (Non-GAAP)** | | $ | 0.80 | | | $ | 0.69 | | | $ | 3.76 | | | $ | 3.63 | | | | | |

(1) Transaction and transition-related expenses represent costs incurred attributable to the acquisition and integration of FCG including, but not limited to, transaction costs, transition services, consulting, system integration, rebranding and legal fees.

Chesapeake Utilities Corporation and Subsidiaries

Consolidated Balance Sheets (Unaudited)

| | | | | | | | | | | | | | |

| Assets | | September 30,

2024 | | December 31,

2023 |

| (in thousands, except per share data) | | | | |

| Property, Plant and Equipment | | | | |

| Regulated Energy | | $ | 2,600,087 | | | $ | 2,418,494 | |

| Unregulated Energy | | 426,127 | | | 410,807 | |

| Other businesses and eliminations | | 32,136 | | | 30,310 | |

| Total property, plant and equipment | | 3,058,350 | | | 2,859,611 | |

| Less: Accumulated depreciation and amortization | | (556,421) | | | (516,429) | |

| Plus: Construction work in progress | | 156,180 | | | 113,192 | |

| Net property, plant and equipment | | 2,658,109 | | | 2,456,374 | |

| Current Assets | | | | |

| Cash and cash equivalents | | 1,609 | | | 4,904 | |

| Trade and other receivables | | 57,113 | | | 74,485 | |

| Less: Allowance for credit losses | | (2,739) | | | (2,699) | |

| Trade and other receivables, net | | 54,374 | | | 71,786 | |

| Accrued revenue | | 23,634 | | | 32,597 | |

| Propane inventory, at average cost | | 6,781 | | | 9,313 | |

| Other inventory, at average cost | | 21,139 | | | 19,912 | |

| Regulatory assets | | 20,446 | | | 19,506 | |

| Storage gas prepayments | | 4,339 | | | 4,695 | |

| Income taxes receivable | | 12,563 | | | 3,829 | |

| Prepaid expenses | | 18,965 | | | 15,407 | |

| Derivative assets, at fair value | | 405 | | | 1,027 | |

| Other current assets | | 2,232 | | | 2,723 | |

| Total current assets | | 166,487 | | | 185,699 | |

| Deferred Charges and Other Assets | | | | |

| Goodwill | | 507,852 | | | 508,174 | |

| Other intangible assets, net | | 15,475 | | | 16,865 | |

| Investments, at fair value | | 14,156 | | | 12,282 | |

| Derivative assets, at fair value | | 122 | | | 40 | |

| Operating lease right-of-use assets | | 10,945 | | | 12,426 | |

| Regulatory assets | | 81,899 | | | 96,396 | |

| Receivables and other deferred charges | | 12,147 | | | 16,448 | |

| Total deferred charges and other assets | | 642,596 | | | 662,631 | |

| Total Assets | | $ | 3,467,192 | | | $ | 3,304,704 | |

Chesapeake Utilities Corporation and Subsidiaries

Consolidated Balance Sheets (Unaudited) | | | | | | | | | | | | | | |

| Capitalization and Liabilities | | September 30,

2024 | | December 31,

2023 |

| (in thousands, except per share data) | | | | |

| Capitalization | | | | |

| Stockholders’ equity | | | | |

| Preferred stock, par value $0.01 per share (authorized 2,000 shares), no shares issued and outstanding | | $ | — | | | $ | — | |

| Common stock, par value $0.4867 per share (authorized 50,000 shares) | | 11,085 | | | 10,823 | |

| Additional paid-in capital | | 812,896 | | | 749,356 | |

| Retained earnings | | 528,426 | | | 488,663 | |

| Accumulated other comprehensive loss | | (4,135) | | | (2,738) | |

| Deferred compensation obligation | | 9,775 | | | 9,050 | |

| Treasury stock | | (9,775) | | | (9,050) | |

| Total stockholders’ equity | | 1,348,272 | | | 1,246,104 | |

| Long-term debt, net of current maturities | | 1,172,956 | | | 1,187,075 | |

| Total capitalization | | 2,521,228 | | | 2,433,179 | |

| Current Liabilities | | | | |

| Current portion of long-term debt | | 18,522 | | | 18,505 | |

| Short-term borrowing | | 214,753 | | | 179,853 | |

| Accounts payable | | 70,138 | | | 77,481 | |

| Customer deposits and refunds | | 47,408 | | | 46,427 | |

| Accrued interest | | 13,776 | | | 7,020 | |

| Dividends payable | | 14,492 | | | 13,119 | |

| Accrued compensation | | 14,495 | | | 16,544 | |

| Regulatory liabilities | | 14,762 | | | 13,719 | |

| | | | |

| Derivative liabilities, at fair value | | 633 | | | 354 | |

| Other accrued liabilities | | 25,832 | | | 13,362 | |

| Total current liabilities | | 434,811 | | | 386,384 | |

| Deferred Credits and Other Liabilities | | | | |

| Deferred income taxes | | 289,208 | | | 259,082 | |

| Regulatory liabilities | | 190,512 | | | 195,279 | |

| Environmental liabilities | | 2,441 | | | 2,607 | |

| Other pension and benefit costs | | 16,327 | | | 15,330 | |

| Derivative liabilities, at fair value | | 2,030 | | | 927 | |

| Operating lease - liabilities | | 9,157 | | | 10,550 | |

| Deferred investment tax credits and other liabilities | | 1,478 | | | 1,366 | |

| Total deferred credits and other liabilities | | 511,153 | | | 485,141 | |

Environmental and other commitments and contingencies (1) | | | | |

| Total Capitalization and Liabilities | | $ | 3,467,192 | | | $ | 3,304,704 | |

(1) Refer to Note 6 and 7 in the Company's Quarterly Report on Form 10-Q for further information.

Chesapeake Utilities Corporation and Subsidiaries

Distribution Utility Statistical Data (Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Three Months Ended September 30, 2024 | | For the Three Months Ended September 30, 2023 |

| Delmarva NG Distribution | | Florida Natural Gas Distribution | | Florida City Gas Distribution | | FPU Electric Distribution | | Delmarva NG Distribution | | Florida Natural Gas Distribution | | FPU Electric Distribution |

Operating Revenues

(in thousands) | | | | | | | | | | | | | |

| Residential | $ | 8,277 | | | $ | 9,583 | | | $ | 12,026 | | | $ | 16,053 | | | $ | 8,663 | | | $ | 9,862 | | | $ | 16,967 | |

| Commercial and Industrial | 7,119 | | | 22,873 | | | 15,713 | | | 14,368 | | | 9,119 | | | 26,020 | | | 15,920 | |

Other (1) | 2,375 | | | 4,485 | | | 5,710 | | | (565) | | | 217 | | | 2,441 | | | (204) | |

| Total Operating Revenues | $ | 17,771 | | | $ | 36,941 | | | $ | 33,449 | | | $ | 29,856 | | | $ | 17,999 | | | $ | 38,323 | | | $ | 32,683 | |

| | | | | | | | | | | | | |

| Volumes (in Dts for natural gas and MWHs for electric) | | | | | | | | | | | | | |

| Residential | 237,744 | | | 347,995 | | | 341,010 | | | 100,207 | | | 245,612 | | | 325,445 | | | 102,699 | |

| Commercial and Industrial | 1,913,091 | | | 9,070,258 | | | 2,686,804 | | | 118,214 | | | 1,915,125 | | | 10,684,539 | | | 96,716 | |

| Other | 59,512 | | | 659,557 | | | 1,496,698 | | | — | | | 62,277 | | | — | | | — | |

| Total | 2,210,347 | | | 10,077,810 | | | 4,524,512 | | | 218,421 | | | 2,223,014 | | | 11,009,984 | | | 199,415 | |

| | | | | | | | | | | | | |

| Average Customers | | | | | | | | | | | | | |

| Residential | 101,635 | | | 92,125 | | | 114,200 | | | 25,776 | | | 97,847 | | | 88,640 | | | 25,782 | |

| Commercial and Industrial | 8,322 | | | 8,494 | | | 8,567 | | | 7,354 | | | 8,208 | | | 8,411 | | | 7,382 | |

| Other | 27 | | | — | | | 118 | | | — | | | 24 | | | 6 | | | — | |

| Total | 109,984 | | | 100,619 | | | 122,885 | | | 33,130 | | | 106,079 | | | 97,057 | | | 33,164 | |

| | | | | | | | | | | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Nine Months Ended September 30, 2024 | | For the Nine Months Ended September 30, 2023 |

| Delmarva NG Distribution | | Florida Natural Gas Distribution | | Florida City Gas Distribution | | FPU Electric Distribution | | Delmarva NG Distribution | | Florida Natural Gas Distribution | | FPU Electric Distribution |

Operating Revenues

(in thousands) | | | | | | | | | | | | | |

| Residential | $ | 60,003 | | | $ | 36,201 | | | $ | 39,975 | | | $ | 38,704 | | | $ | 67,562 | | | $ | 38,546 | | | $ | 39,347 | |

| Commercial and Industrial | 35,009 | | | 80,647 | | | 52,115 | | | 37,285 | | | 41,637 | | | 80,499 | | | 39,913 | |

Other (1) | (2,262) | | | 7,966 | | | 9,730 | | | (3,623) | | | (6,696) | | | 6,401 | | | (805) | |

| Total Operating Revenues | $ | 92,750 | | | $ | 124,814 | | | $ | 101,820 | | | $ | 72,366 | | | $ | 102,503 | | | $ | 125,446 | | | $ | 78,455 | |

| | | | | | | | | | | | | |

| Volumes (in Dts for natural gas and MWHs for electric) | | | | | | | | | | | | | |

| Residential | 3,499,276 | | | 1,714,914 | | | 1,367,409 | | | 243,454 | | | 3,302,125 | | | 1,551,348 | | | 238,051 | |

| Commercial and Industrial | 7,588,547 | | | 29,318,803 | | | 8,455,727 | | | 301,687 | | | 7,523,061 | | | 31,047,013 | | | 239,505 | |

| Other | 207,213 | | | 1,962,689 | | | 4,566,210 | | | — | | | 213,600 | | | 627,934 | | | — | |

| Total | 11,295,036 | | | 32,996,406 | | | 14,389,346 | | | 545,141 | | | 11,038,786 | | | 33,226,295 | | | 477,556 | |

| | | | | | | | | | | | | |

| Average Customers | | | | | | | | | | | | | |

| Residential | 101,045 | | | 91,345 | | | 113,633 | | | 25,747 | | | 97,230 | | | 88,051 | | | 25,718 | |

| Commercial and Industrial | 8,361 | | | 8,484 | | | 8,545 | | | 7,361 | | | 8,242 | | | 8,408 | | | 7,373 | |

| Other | 26 | | | — | | | 109 | | | — | | | 23 | | | 6 | | | — | |

| Total | 109,432 | | | 99,829 | | | 122,287 | | | 33,108 | | | 105,495 | | | 96,465 | | | 33,091 | |

| | | | | | | | | | | | | |

(1) Operating Revenues from "Other" sources include unbilled revenue, under (over) recoveries of fuel cost, conservation revenue, other miscellaneous charges, fees for billing services provided to third parties and adjustments for pass-through taxes.

1 Third Quarter 2024 Earnings Call Presentation November 8, 2024 scan here for an electronic copy

2 Safe Harbor for Forward-Looking Statements Safe Harbor Statement Some of the statements in this presentation are “forward-looking statements” within the meaning of the Private Securities Litigation Reform Act of 1995 and other applicable law. Such forward-looking statements may be identified by the use of words, such as “project,” “believe,” “expect,” “anticipate,” “intend,” “plan,” “estimate,” “continue,” “potential,” “forecast” or other similar words, or future or conditional verbs such as “may,” “will,” “should,” “would” or “could.” These statements represent our intentions, plans, expectations, assumptions and beliefs about our future financial performance, business strategy, projected plans and objectives. These statements are subject to many risks and uncertainties and actual results may materially differ from those expressed in these forward-looking statements. Please refer to Chesapeake Utilities Annual Report on Form 10-K for the year ended December 31, 2023 filed with the SEC and other SEC filings concerning factors that could cause those results to be different than contemplated in this presentation. Non-GAAP Financial Information This presentation includes non-GAAP financial measures including Adjusted Gross Margin, Adjusted Net Income and Adjusted Earnings Per Share (“EPS*”). A "non-GAAP financial measure" is generally defined as a numerical measure of a company's historical or future performance that includes or excludes amounts, or that is subject to adjustments, so as to be different from the most directly comparable measure calculated or presented in accordance with GAAP. Our management believes certain non- GAAP financial measures, when considered together with GAAP financial measures, provide information that is useful to investors in understanding period-over-period operating results separate and apart from items that may, or could, have a disproportionately positive or negative impact on results in any particular period. The Company calculates Adjusted Gross Margin by deducting the purchased cost of natural gas, propane and electricity and the cost of labor spent on direct revenue- producing activities from operating revenues. The costs included in Adjusted Gross Margin exclude depreciation and amortization and certain costs presented in operations and maintenance expenses in accordance with regulatory requirements. The Company calculates Adjusted Net Income and Adjusted EPS by deducting costs and expenses associated with significant acquisitions that may affect the comparison of period-over-period results. These non-GAAP financial measures are not in accordance with, or an alternative to, GAAP and should be considered in addition to, and not as a substitute for, the comparable GAAP measures. The Company believes that these non-GAAP measures are useful and meaningful to investors as a basis for making investment decisions and provide investors with information that demonstrates the profitability achieved by the Company under allowed rates for regulated energy operations and under the Company's competitive pricing structures for unregulated energy operations. The Company's management uses these non-GAAP financial measures in assessing a business unit and Company performance. Other companies may calculate these non-GAAP financial measures in a different manner. See Appendix for a reconciliation of Gross Margin, Net Income and EPS, all as defined under GAAP, to our non-GAAP measures of Adjusted Gross Margin, Adjusted Net Income, and Adjusted EPS for each of the periods presented. *Unless otherwise noted, EPS and Adjusted EPS information is presented on a diluted basis.

3 • As seasons change, check / update fluids, windshield wipers & roadside emergency supplies • Be aware of lower visibility as the time change shifts sunrise and sunset • Leave extra room between your car and others to account for wet, slippery roads • Avoid using cruise control when driving on any slippery surface, such as ice or snow • Leave extra time to manage traffic and less-experienced drivers around holidays • Treat exhaustion and intoxication as equally deadly while driving Safety Moment: Safe Driving Habits for Fall & Winter

4 Today’s Presenters Jeff Householder Chair of the Board, President & Chief Executive Officer Beth Cooper Executive Vice President, Chief Financial Officer, Treasurer & Asst. Corporate Secretary Lucia Dempsey Head of Investor Relations Jim Moriarty Executive Vice President, General Counsel, Corporate Secretary & Chief Policy and Risk Officer