0000019745falseNovember 22, 2024falseNYSE00000197452024-11-222024-11-22

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): December 31, 2023

CHESAPEAKE UTILITIES CORPORATION

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| | | | |

| Delaware | | 001-11590 | | 51-0064146 |

| (State or other jurisdiction of | | (Commission | | (I.R.S. Employer |

| incorporation or organization) | | File Number) | | Identification No.) |

500 Energy Lane, Dover, DE 19901

(Address of principal executive offices, including Zip Code)

(302) 734-6799

(Registrant's Telephone Number, including Area Code)

(Former name, former address and former fiscal year, if changed since last report.)

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange on which registered |

| Common Stock - par value per share $0.4867 | CPK | New York Stock Exchange, Inc. |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

| | | | | |

| ☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| | | | | |

| ☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| | | | | |

| ☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

☐

Explanatory Note

Item 8.01 Other Events

As previously disclosed in its Current Report on Form 8-K filed with the Securities and Exchange Commission (the “SEC”) on December 1, 2023 (the “Closing 8-K”), and the amendment to the Closing 8-K filed on its current report on Form 8-K/A with the SEC on February 13, 2024, Chesapeake Utilities Corporation, a Delaware corporation (the “Company”), completed the acquisition of Pivotal Utility Holdings, Inc., a wholly owned subsidiary of Florida Power & Light Company doing business as Florida City Gas on November 30, 2023, pursuant to the previously disclosed Stock Purchase Agreement, dated as of September 26, 2023, by and among the Company and Florida Power & Light Company, a Florida corporation.

This Current Report on Form 8-K is being filed to provide the pro forma financial information required by Article 11 of Regulation S-X which is filed as an exhibit hereto and incorporated herein by reference.

Item 9.01 Financial Statements and Exhibits.

(b) Pro forma financial information

The unaudited proforma condensed combined financial information of Chesapeake Utilities Corporation, comprised of the statement of income for the year ended December 31, 2023, and the related notes, are attached hereto as Exhibit 99.1.

(d) Exhibits

99.1 Unaudited pro forma condensed combined financial information of Chesapeake Utilities Corporation for the year ended December 31, 2023.

104 Cover Page Data File (embedded within the Inline XBRL document).

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the Registrant has duly caused this Report to be signed on its behalf by the undersigned hereunto duly authorized.

| | |

|

CHESAPEAKE UTILITIES CORPORATION |

|

| /s/ Beth W. Cooper |

| Beth W. Cooper |

| Executive Vice President, Chief Financial Officer, Treasurer, and Assistant Corporate Secretary |

|

| Date: November 22, 2024 |

SELECTED UNAUDITED PRO FORMA CONDENSED COMBINED

FINANCIAL INFORMATION

The selected unaudited pro forma condensed combined financial information of Chesapeake Utilities Corporation (“Chesapeake Utilities”, or the “Company”) consists of a condensed combined statement of income for the year ended December 31, 2023 which reflects the Company’s acquisition of Pivotal Utility Holdings, Inc., doing business as Florida City Gas (“FCG”), which was completed on November 30, 2023 (the “Acquisition”) pursuant to the previously disclosed Stock Purchase Agreement (the “Purchase Agreement”), dated as of September 26, 2023, by and among the Company and Florida Power & Light Company (“FPL”), a Florida Corporation. The unaudited pro forma condensed combined statement of income included herein has been derived from the following historical financial statements:

•the audited financial statements of Chesapeake Utilities as of and for the year ended December 31, 2023; and

•the unaudited interim financial statements of FCG for the eleven months ended November 30, 2023.

Chesapeake Utilities consolidated balance sheet as of December 31, 2023, as included in the Company’s Annual Report on Form 10-K for the period then ended, includes the assets acquired and liabilities assumed from FCG. As such, an unaudited pro forma combined consolidated balance sheet and the related unaudited pro forma condensed combined consolidated balance sheet information are not included in this Current Report on Form 8-K.

The pro forma adjustments have been prepared as if the acquisition of FCG occurred on January 1, 2023 in the case of the unaudited pro forma condensed combined statements of income for the year ended ended December 31, 2023. The unaudited pro forma condensed combined statements of income should be read in conjunction with the related notes, which are included herein, the financial statements and notes included in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023, as filed February 21, 2024, and the financial statements and notes of FCG referenced herein and included as Exhibits 99.1 and 99.2 in the Company’s Current Report on Form 8-K filed by the Company on November 9, 2023 and the related Form 8-K/A filed on February 13, 2024. The unaudited pro forma condensed combined statement of income is presented for illustrative purposes only and does not necessarily reflect what the combined financial condition and results of operations would have reflected had the Acquisition occurred on the dates indicated. They also may not be useful in predicting the future financial condition and results of the operations of the combined company. The actual financial position and results of operations may differ significantly from the pro forma amounts reflected herein due to a variety of factors, including those discussed in the Company’s Annual Report on Form 10-K for the year ended December 31, 2023 under Item 1A, “Risk Factors.”

CHESAPEAKE UTILITIES CORPORATION

UNAUDITED PRO FORMA CONDENSED COMBINED STATEMENT OF INCOME

FOR THE YEAR ENDED DECEMBER 31, 2023

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | Chesapeake Utilities | | Florida City Gas | | Transaction Adjustments | | Pro Forma Combined | | | | |

| (in thousands, except per share data) | | | | | | | | | | | | |

| Operating Revenues | | | | | | | | | | | | |

| Regulated Energy | | $ | 473,595 | | | $ | 120,161 | | | $ | (1,053) | | [a] | $ | 591,511 | | | | | |

| (1,192) | | [b] | | | | |

| Unregulated Energy | | 223,148 | | | — | | | — | | | 223,148 | | | | | |

| Other businesses and eliminations | | (26,139) | | | — | | | — | | | (26,139) | | | | | |

| Total Operating Revenues | | 670,604 | | | 120,161 | | | (2,245) | | | 788,520 | | | | | |

| Operating Expenses | | | | | | | | | | | | |

| Natural gas and electric costs | | 140,008 | | | 27,532 | | | — | | | 167,540 | | | | | |

| Propane and natural gas costs | | 76,474 | | | — | | | | | 76,474 | | | | | |

| Operations | | 178,437 | | | 35,598 | | | (595) | | [c] | 213,440 | | | | | |

| FCG transaction and transition-related expenses | | 10,355 | | | — | | | — | | | 10,355 | | | | | |

| Maintenance | | 20,401 | | | — | | | — | | | 20,401 | | | | | |

| Depreciation and amortization | | 65,501 | | | 12,427 | | | (895) | | [d] | 75,841 | | | | | |

| | | (1,192) | | [b] | | | | |

| Other taxes | | 28,625 | | | 11,071 | | | — | | | 39,696 | | | | | |

| Total Operating Expenses | | 519,801 | | | 86,628 | | | (2,682) | | | 603,747 | | | | | |

| Operating Income | | 150,803 | | | 33,533 | | | 437 | | | 184,773 | | | | | |

| Other income, net | | 1,438 | | | 570 | | | — | | | 2,008 | | | | | |

| Interest charges | | 36,951 | | | 7,983 | | | 32,973 | | [e] | 71,129 | | | | | |

| 924 | | [f] | | | | |

| (6,649) | | [g] | | | | |

| (1,053) | | [a] | | | | |

| | | | | |

| Income Before Income Taxes | | 115,290 | | | 26,120 | | | (25,758) | | | 115,652 | | | | | |

| Income taxes | | 28,078 | | | 6,448 | | | (6,611) | | [h] | 27,915 | | | | | |

| Net Income | | $ | 87,212 | | | $ | 19,672 | | | $ | (19,147) | | | $ | 87,737 | | | | | |

| | | | | | | | | | | | |

| Weighted Average Common Shares Outstanding: | | | | | | | | | | | | |

| Basic | | 18,371 | | | | | 3,884 | | [i] | 22,255 | | | | | |

| Diluted | | 18,435 | | | | | 3,884 | | [i] | 22,319 | | | | | |

| Earnings Per Share of Common Stock: | | | | | | | | | | | | |

| Basic | | $ | 4.75 | | | | | | | $ | 3.94 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

| Diluted | | $ | 4.73 | | | | | | | $ | 3.93 | | | | | |

| | | | | | | | | | | | |

| | | | | | | | | | | | |

NOTE 1. BASIS OF PRESENTATION

The unaudited pro forma condensed combined statement of income included herein has been prepared in accordance with U.S. generally accepted accounting principles and Article 11 of Regulation S-X, and has been derived from the following historical financial statements:

•the audited financial statements of Chesapeake Utilities as of and for the year ended December 31, 2023;

•the unaudited interim financial statements of FCG as of and for the eleven months ended November 30, 2023.

On November 30, 2023, the Company completed the Acquisition of Pivotal Utility Holdings, Inc., doing business as FCG, pursuant to the previously disclosed Purchase Agreement, dated as of September 26, 2023, by and among the Company and FPL, for $922.8 million in cash.

The Acquisition was accounted for in the unaudited pro forma condensed combined financial statements as an acquisition of all of the outstanding common shares of FCG using the acquisition method of accounting for business combinations. The assets acquired and liabilities assumed were measured at estimated fair value, which is defined as the price that would be received to sell an asset or paid to transfer a liability in an orderly transaction between market participants as of the measurement date. The Company has elected to apply the provision of section 338(h)(10) of the Internal Revenue Code, which recharacterizes the stock purchase as an asset purchase for federal tax purposes. The Company received a tax basis in the acquired assets equal to the purchase price, and will depreciate such basis over a 15-year period.

The accompanying unaudited pro forma condensed combined statement of income is not necessarily indicative of the results that would have been achieved if the transactions reflected herein had been completed on the dates indicated or the results which may be obtained in the future. While the underlying pro forma adjustments are intended to provide a reasonable basis for presenting the significant financial effects directly attributable to the Acquisition, they are preliminary and are based on currently available financial information and certain estimates and assumptions which we believe to be reasonable.

NOTE 2. SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

The accounting policies followed in preparing the unaudited pro forma condensed combined financial statements are those used by Chesapeake Utilities as set forth in the audited historical financial statements and notes of the Company included in its Annual Report on Form 10-K for the year ended December 31, 2023, as filed February 21, 2024. The unaudited pro forma condensed combined financial statements reflect any adjustments known to conform FCG’s historical financial information to the Company’s significant accounting policies based on the Company’s review of FCG’s summary of significant accounting policies, as disclosed in the FCG historical financial statements referenced herein and included as Exhibits 99.1 and 99.2 in the Current Report on Form 8-K filed by the Company on November 9, 2023, and discussions with FCG’s management.

NOTE 3. PRO FORMA ADJUSTMENTS AND ASSUMPTIONS

The following pro forma adjustments were based on the historical financial information and preliminary estimates and assumptions, both as described above and which are subject to change as additional information is obtained:

a.Represents $1.1 million of interest expense associated with long-term transportation service agreements between FCG and Peninsula Pipeline Company, Inc. (“PPC”), a wholly owned subsidiary of the Company. Upon closing of the Acquisition, these agreements have been classified as affiliate transactions and the associated revenues and expenses are being eliminated in the Company’s consolidated results.

b.Represents $1.2 million of depreciation expense associated with long-term transportation service agreements between FCG and PPC. Upon closing of the Acquisition, these agreements have been classified

as affiliate transactions and the associated revenues and expenses are being eliminated in the Company’s consolidated results.

c.Reflects $0.6 million of pension expenses related to benefit plan obligations that were excluded from the Acquisition.

d.Reflects $0.9 million of depreciation expense related to software that was excluded from the Acquisition and retained by FPL.

e.Reflects a $33.0 million net increase to interest expense resulting from the Company’s issuance of long-term debt to finance the Acquisition. The Company issued $550.0 million in new long-term notes in November 2023 at an average interest rate of 6.54 percent.

f.Reflects a $0.9 million increase in interest expense resulting from incremental borrowings under the Company’s $375.0 million unsecured revolving credit facility with certain lenders at an interest rate of 6.17 percent. Such incremental borrowings were used to finance the Acquisition and pay certain transaction-related expenses in connection with the Acquisition and related financing activities.

g.Reflects $6.6 million of interest expense related to outstanding debt of FCG that was settled prior to the Acquisition.

h.Reflects the income tax effects of pro forma adjustments based on the Company’s blended federal and state effective tax rate for the nine months ended September 30, 2023.

i.Reflects a weighted average 3.9 million shares of the Company’s common stock issued in November 2023 to finance the Acquisition.

v3.24.3

Document And Entity Information

|

Nov. 22, 2024 |

| Cover [Abstract] |

|

| Title of 12(b) Security |

Common Stock - par value per share $0.4867

|

| Document Type |

8-K

|

| Document Period End Date |

Nov. 22, 2024

|

| Entity Registrant Name |

CHESAPEAKE UTILITIES CORPORATION

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-11590

|

| Entity Tax Identification Number |

51-0064146

|

| Entity Address, Address Line One |

500 Energy Lane

|

| Entity Address, City or Town |

Dover

|

| Entity Address, State or Province |

DE

|

| Entity Address, Postal Zip Code |

19901

|

| City Area Code |

(302)

|

| Local Phone Number |

734-6799

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Central Index Key |

0000019745

|

| Amendment Flag |

false

|

| Entity Emerging Growth Company |

false

|

| Trading Symbol |

CPK

|

| Security Exchange Name |

NYSE

|

| Document Information [Line Items] |

|

| Entity Central Index Key |

0000019745

|

| Amendment Flag |

false

|

| Document Period End Date |

Nov. 22, 2024

|

| Entity Emerging Growth Company |

false

|

| Security Exchange Name |

NYSE

|

| Entity Registrant Name |

CHESAPEAKE UTILITIES CORPORATION

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-11590

|

| Entity Tax Identification Number |

51-0064146

|

| Entity Address, City or Town |

Dover

|

| Entity Address, Address Line One |

500 Energy Lane

|

| Entity Address, State or Province |

DE

|

| Entity Address, Postal Zip Code |

19901

|

| City Area Code |

(302)

|

| Local Phone Number |

734-6799

|

| Title of 12(b) Security |

Common Stock - par value per share $0.4867

|

| Trading Symbol |

CPK

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Document Type |

8-K

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14a

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

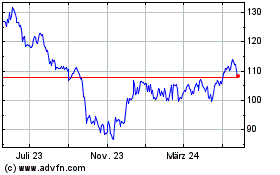

Chesapeake Utilities (NYSE:CPK)

Historical Stock Chart

Von Jan 2025 bis Feb 2025

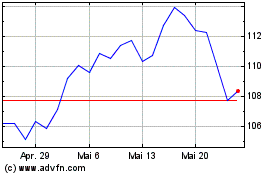

Chesapeake Utilities (NYSE:CPK)

Historical Stock Chart

Von Feb 2024 bis Feb 2025